This was a question posed to me by a client recently. I was taken aback by the question as most clients (rightly or wrongly) tend to have fixed expectations about what a ‘good’ and ‘bad’ return is. It was an excellent question and I answered by saying that ‘good’ isn’t absolute; it is relative to the economic and financial environment in which we live.

For example, I remember walking into Cheltenham & Gloucester, Manchester in 1997 and opening a savings account and earning 7.5% per annum! Back then, the Bank of England base rate was 7.25%. If at the same time you were achieving a 7.5% pa return by investing in say, shares or gold, this would not be a ‘good’ rate of return because you would be taking much more risk to achieve the same return as that offered by the bank and only a few basis points above the base rate.

So, with the Bank of England interest rate currently sitting at 0.50% and the ECB base rate at a negative figure of -0.50%, a 4% or 5% pa return looks very attractive today, even though it would not have done in 1997.

Another factor we need to consider when assessing what a ‘good’ return means is the level of risk we take to achieve the return.

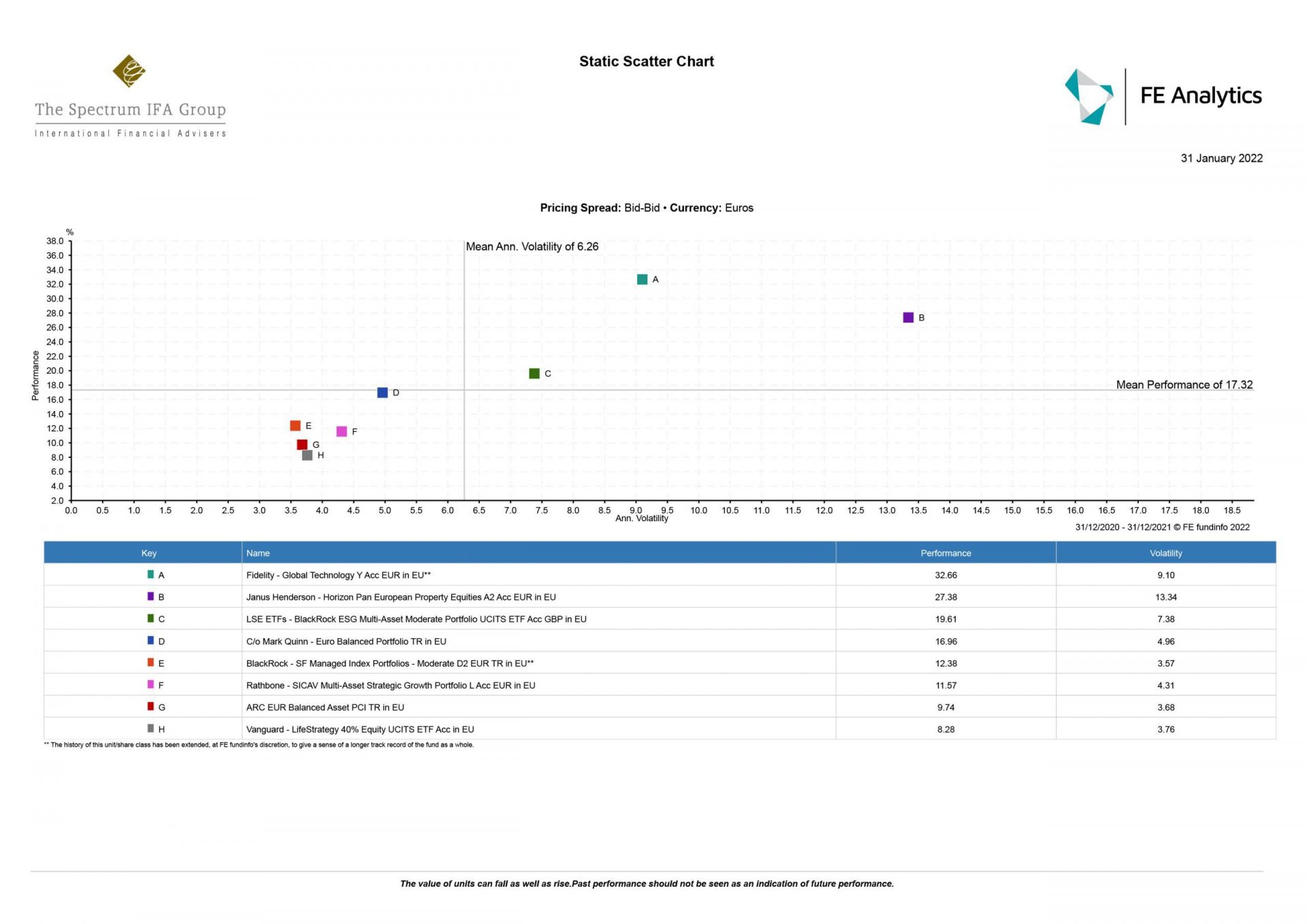

In constructing our portfolios at Spectrum, we always consider performance in the context of risk taken to achieve that return. For example, two funds can both achieve a 5% pa return but one fund may have fallen in value by 20% whereas another fund may be down just 5%. Clearly, the latter is a better fund.

We can analyse this in more detail by considering “scatter diagrams” which is an interesting way of looking beyond headline performance figures.