I have a few things I would like to write about in this Ezine. In the last month or so a number of questions have arisen from clients and people who have contacted me, re tax and investment markets, AI, the UK property and much more. So, I thought I would try and address a few of these in this Ezine.

Italian tax and finance update | November 2025

By Gareth Horsfall

This article is published on: 20th November 2025

However, before I do that I thought I would give you the quick update on the new house and I say ‘new’ house but we moved in on August 7th 2024 and so it’s now been over a year and the house itself is largely done, save for some bits and pieces to do but which can be done when we have the time and energy and money to do so.

The thing that I am still very much learning is the management of the land :2025 was the first summer when I saw the full cycle of the fruit trees. I was explaining to someone recently that I didn’t actually buy any fruit from the fruttivendolo from about April until about 2 weeks ago because it has been a continuous fruiting, one after the other. Now, I just have some of the last cachi (persimmons) hanging off the tree but that’s it and learning the cycle of what grows and when they flower, fruit and when to harvest is quite interesting. I remember that the nespola (medlar) tree and almond tree flowered very early last year, in February if memory serves me correctly (I think I may need to start a diary!) and so given both of those trees need a good trim this winter (I never got round to them last year), the question is when to do it? My hunch is anytime now given we are in the ‘riposo vegetale‘ phase for plants, but anyway these are the kinds of decisions which haunt my dreams. LOL !!

With the recent spurt of rain and then the return of the good weather, the grass has had another growth spurt and I will need to give that another trim before the winter hibernation, more than likely. I should also mention that I harvested my first bietola (chard) last night. At the end of September, I popped to the local garden centre and bought a variety of seedlings and at last light of the day, around 7 pm dug a few channels in the land and planted my first ‘orto’ or as I like to call it the ‘orticino’. (See the photo below). Hardly very exciting, but I thought I would give it a go.

If you are interested in the crops, the list is as follows: porro (leek), winter lettuce (2 types), rapa, finocchio, broccoletti, carciofi (artichokes) and bietola and it was pretty much experimental for me and as you can see is quite messy in fact I haven’t had time to do any fancy bordering or anything like that because it’s in the middle of a patch of land where I haven’t even got around to cutting the grass from summer yet. Anyway, it’s all good fun and nice to have fresh bio veg available although slugs and snails are having a field day and most of it is pottered with hole ….but I am working on that!

Otherwise, I have understood that the summer period, May to September, is mainly for watching everything grow…quickly! Particularly, those things that you pruned in the period from October to April with the hope that this year’s crop will be better than last year’s, but never really knowing what nature will bring it’s like gambling and not knowing the odds. Writing it down it sounds a ridiculous waste of energy, but seeing the literal ‘ fruits’ of your labour is somewhat deeply satisfying…

Not wanting to turn this Ezine into a country side Q&A newsletter, I will move swiftly on from life in rural Italy and onto money matters.

As I said there are a few things which I wanted to mention in this E-zine and the first of which is one of my favourite subjects: The Agenzia delle Entrate.

I have been contacted by a number of people since September who have received letters from the AdE, this would not normally picque much interest for me because the AdE send regular letters out to try and weed out potential errors or omissions from your tax return in fact I have had a few myself over the years.

However this letter was of particular interest because it broached the subject of residency and non declaration of assets, at all, ever.

Over the years I have seen many times where someone has made a tax declaration, but where errors have been made and / or omissions, and the AdE have eventually caught up with the error and the individual concerned has had to correct the error, pay the back taxes and penalties. Fair enough mistakes happen and often through bad advice on the part of the commercialista but one category of people who seems to have evaded the oversight of the AdE were those people who are resident in Italy, and for one reason or another have never made a tax return here. The main reason is because they were badly advised by a commercialista to not ‘enter the system’ or that they were declaring in another country thinking that it wasn’t necessary to do so in Italy.

However, it may look like that particular issue has been uncovered by the AdE, in fact, in a short period of about 5 weeks, I had 6 people contact me, all with very similar situations, relating to not having filed for taxes in Italy and subsequently receiving a letter from the AdE asking them to visit their local AdE office and explain the anomaly.

Whether this is an awakening for the AdE for merely just a blip is anyone’s guess but I suspect they have finally got the right hand speaking with the left hand and they will weed more of these issues out in the near future. It all corresponds nicely with the change in definition of residency from Jan 1st 2024 and so is probably the start of a wider push to make sure that everyone is doing what they should be, whether they know it or not.

So, in short, if you are resident in Italy then it is more than likely that you should be declaring your financial situation for taxes each year, if a commercialista tells you that you shouldn’t or don’t need to file, then you need to question that and not just take their word for it. I would request written, signed confirmation that this is the case. Equally, filing for taxes in another country, thinking that this is sufficient, is generally the wrong thing to do and you may want to explore this further to avoid eventual contact from the AdE.

If you happen to be in this situation and are wondering what steps to take, do not hesitate to get in touch. I have helped many people through this situation in the past, it’s better to address the matter before being picked up by the AdE.

Now, let’s move on to the subject of the UK property market.

“Property is the best investment”

I don’t know how many times I have heard this said to me in my career, which has spanned an era when property investment probably has been one of, if not the best investment to make.

However, everything is cyclical and whilst UK residential property may have been a great investment, that doesn’t mean to say it will be forever. In fact, the UK property market has stalled, at the time of writing, and it remains to be seen whether it is just a pause for breath or part of a longer period of downturn for the UK property market. As I have repeated many times in the past, in times of needs, governments will turn to the real estate market to generate tax revenue because it is has been the go to investment of choice for most people. The UK budget will roll around at the end of this month and we will see what kind of moves Rachel Reeves makes on the UK property market, it is expected that she will tax properties over a certain value, but little is known at this time. (I spoke with an investment manager in London recently who said they are bracing themselves for a ‘brutal’ budget, were his exact words).

However, as usual these are just my musings.

To explain in a bit more detail Rathbones Investment Management recently wrote a great article for a professional publication and I thought to share this with you here.

The UK’s love affair with property investment is apparent across newspapers, daytime TV and social media. An English person’s home may be their castle – they’ve also regarded it as their nest egg (and the same for other Britons). Many have even bought additional castles, such is their ardour for property. Reflecting this, official figures show more than 2.8mn private landlords in the UK.

However, the days of strong returns from residential property are already past. The past decade has seen three pieces of bad news. House price growth has been slower; higher interest rates have squeezed the buy-to-let business model; the regulatory treatment of private landlords has become progressively less favourable.

The economic and policy outlook suggests those headwinds won’t dissipate. From 1980 to 2016, UK house prices rose 6.7% per year in absolute terms, or 3.3% in real terms (after allowing for inflation). Prices in London rose even faster: 8.5% in absolute and 5.0% in real terms. That rate of capital appreciation is considerable – and investors making an income from renting out properties would have made even more.

It’s difficult to compare returns from property exactly with returns from other investments, for various reasons – such as the cost of mending that leaky roof. But taking the crude numbers, the capital appreciation of a portfolio made up of 25% UK equities and 75% international equities would have been only slightly higher at 9.0% per year or 5.5% after inflation.

What drove high house prices?

What lay behind this? One cause is higher wages. As earnings have risen in real terms, households have been able to spend more on housing.

Between 1980 and 1998, the average UK house price rose by 2.6% above inflation per year. So too did the average wage. As result, the house price-to-earnings ratio – the average house price divided by average earnings – was similar in both years, at around 4.3, although it did fluctuate a lot between these two points.

However, since 2000, the ratio has risen to as high as 8 and never fallen below 6. So pay can’t be the whole story behind the price rises.

A fall in interest rates helped sustain higher house prices relative to earnings. Double-digit mortgage rates were the norm in the 1980s and early 1990s. But these dropped to as low as 1–2% by the late 2010s. This shift allowed buyers to borrow a lot more money for any given level of monthly repayment, bidding up house prices.

Other changes to the mortgage market have probably helped push UK house prices higher, by increasing the availability of loans and encouraging property investment. These include the entry of banks into the mortgage market, the introduction of buy-to-let mortgages, and market innovations, such as the government’s Help to Buy scheme.

Moreover, housebuilding has failed to keep pace with population growth over the past fifty years or so. In other words, demand has risen faster than supply.

Productivity, rates and policy

But conditions for house price growth now look much less fertile. After a period of far outstripping inflation, average earnings have grown much more slowly lately. Even if we ignore declining real wages in the early 2010s, they’ve only outpaced inflation by 0.5% a year since 2016. In the long run, real-terms wage growth is closely linked to productivity – companies generally only pay their workers more if they’re getting more from them. But productivity growth has in recent years been low – and we don’t foresee a dramatic improvement anytime soon.

Moreover, mortgage rates have risen in the past few years. The average 2-year fixed-rate 75% loan-to-value mortgage rate has climbed from 1.2% in 2021 to above 4% since 2022, according to the Bank of England. This has pushed up first-time buyers’ repayments. We don’t see a return to the abnormally low interest rate environment of the 2010s.

On top of higher interest rates, unfavourable tax changes and tighter regulation have added to costs. For example, stamp duty on additional properties was hiked in 2016 and again in 2024.

Moreover, the housing supply pipeline is flowing better. Although the government has fallen short of its housebuilding targets for years, the annual net increase in dwellings has crept back up since 2015, returning to above 200,000. On this measure, the housing stock is growing at the fastest rate since the 1960s.

End of the affair

With those fading tailwinds in mind, it’s little surprise that UK house prices have risen by a much more pedestrian 3.7% per year, in absolute terms, since 2016. That’s only about the same as inflation. Over the same period, the portfolio of UK and international equities we mentioned earlier rose by 7.2% a year.

We think this trend will continue. In our view, it may be time for the British to break off their love affair with the housing market and embark on a new one, with a diversified portfolio of financial assets. After all, 10- year UK government bonds offer yields above 4% and there’s a wide selection of high-quality names across the world’s stock markets. It might not be the most romantic of trysts, but we think it’s likely to offer them a better return in the long term.

Are we in an A.I and tech stock bubble?

For those of you who can remember as far back as the year 2000, as an investor, you may remember the investors favoured around the possibilities of the introduction of the internet (I think we were still working on dial-up connection at the time and my phone was probably a Nokia 3310. The world of today’s smart phones was about another 8 years away, when the iPhone first launched). I remember being at a business meeting in Geneva in 2005 and there was talk of being able to call over the internet from your phone in the near future and being able to answer emails more easily on your phone.

Little did we know how far we would come so quickly ! In the year 2000 there was much hype about this future and that fuelled what is now called the ‘tech boom’ in dot com stocks. Inevitably, this created a bubble in dot com stocks and a subsequent crash in the markets when investors realised a lot of the hype was largely based on fresh air and not much substance.

I have been asked quite a few times in the last month or 2, about the possibility of something similar happening in AI and tech stocks today.

It must be said that the circumstances are quite different this time round. Companies are actually profitable in 2025, and A.I will create problems in the employment market, but also deliver productivity gains.

(Interestingly, I saw an article the other day saying that Italian companies who had laid off employees to benefit from cost and productivity gains from the introduction of AI systems, were doing an about face and re-hiring those same workers because they realised that AI was not going to deliver all those gains which they had been promised).

Anyway, rather than writing a long discourse on the topic I asked Chris Saunders of New Horizon Asset Management what he thought, on this short video with my question and his answer. I hope you find it interesting.

IRPEF (income tax) rates set to drop again!

As part of Giorgia Meloni’ s government’s promise to the Italian people, IRPEF ( income tax) rates would be simplified and even reduced with their long term goal of having a much more simplified tax system ( good luck with that Giorgia !).

In the Legge di Bilancio 2026, which is currently being debated in parliament, they have proposed to reduce the second progressive rate of income tax, which currently sits at 35% for gross income between €28001 and €50000pa, to 33%.

Now, as I have often been heard saying, they are just playing around the margins and this kind of tax reduction will hardly have any real impact for most people who might be struggling with higher prices of the last few years and facing a continued erosion of their income. However, it is still something and in line with the promises made by the current sitting government. (At time of writing it does look like this will be approved and implemented from 2026).

Possible increased tax on rental properties?

This is the one that is creating the greatest political friction at the moment and, so what is it?

The proposal is to increase the cedolare secca tax on rental properties from 21% to 26% from 2026.

Cedolare secca 21% is the tax that is paid on rental property income, where selected, and is a kind of forfeit rate. The income from cedolare secca is not taken into account when calculating your other total income subject to income tax (IRPEF) and so is quite attractive for most. There are some disadvantages, which I won’t go into here because in the main the 21% tax rate is the go to option for most. However, it is proposed to bring this up to 26% on rental income (for private renters, rental agencies and rental agencies online).

As per the UK, see above, real estate is a go to cash cow for governments when they are looking to raise revenue and so this move (although likely to be watered down or removed altogether because Forza Italia are not in agreement and will not vote for the proposed change) is something that we will likely see happen more often.

If, as may be intended, it is being introduced to cool the housing market and, especially in the big cities, cool the rental market itself, I am sceptical that it will have an effect at all. Having lived in Rome for the last 20 years and seeing the explosion in the Airbnb apartment for rent, and the constant stream of tourists to occupy those places then I can’t see that an increase of 5% will hurt that much, other than those who have high debt levels to service.

Anyway, it’s something worth watching, in case you have a rental property, or part of property in Italy which you are generating income from.

London’s attractiveness as an International financial centre.

There has long been talk of London being one of the world’s premier financial centres and for some time, I think, it held the No 1 spot for a period as well, however, that would appear to be changing.

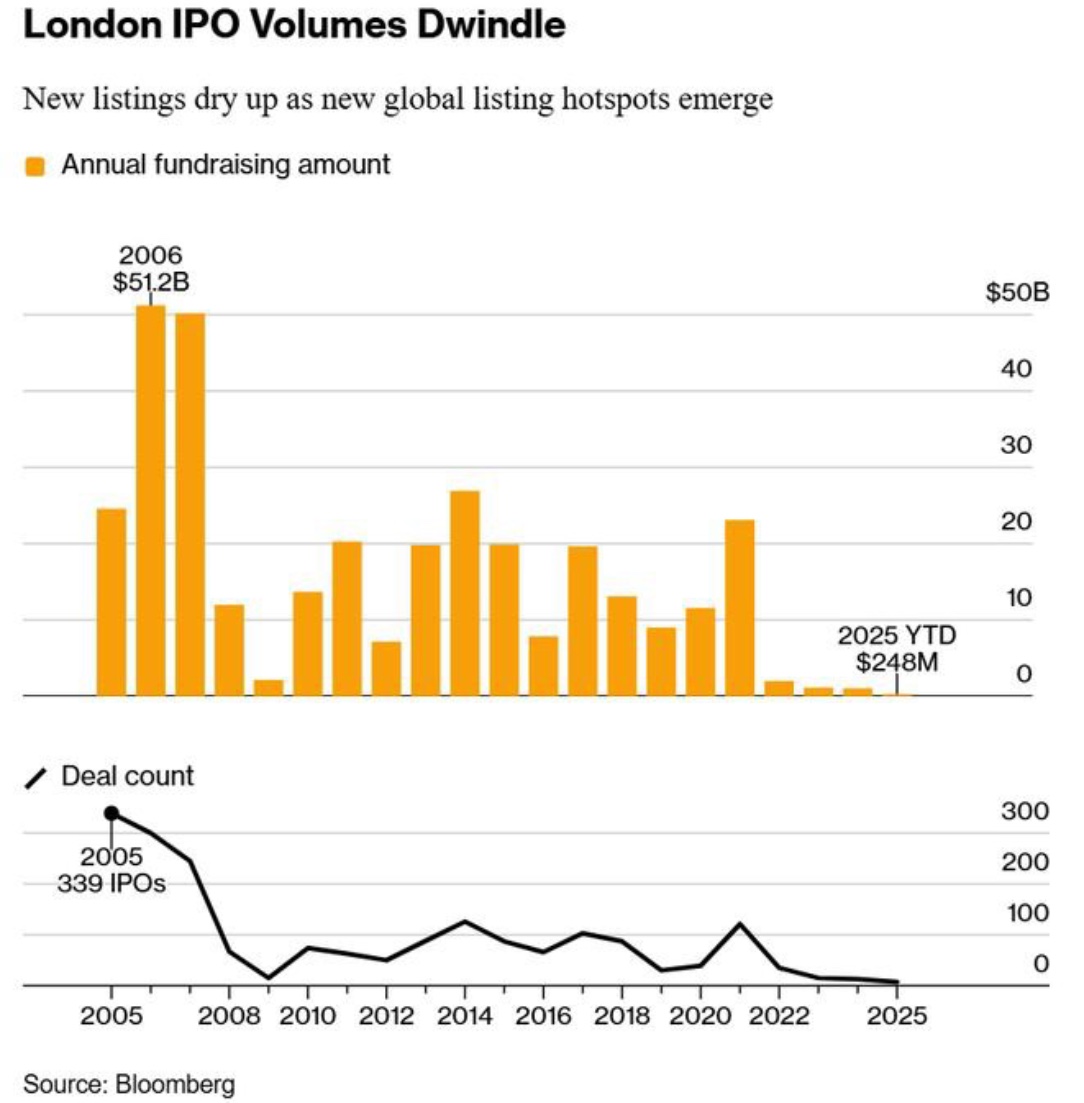

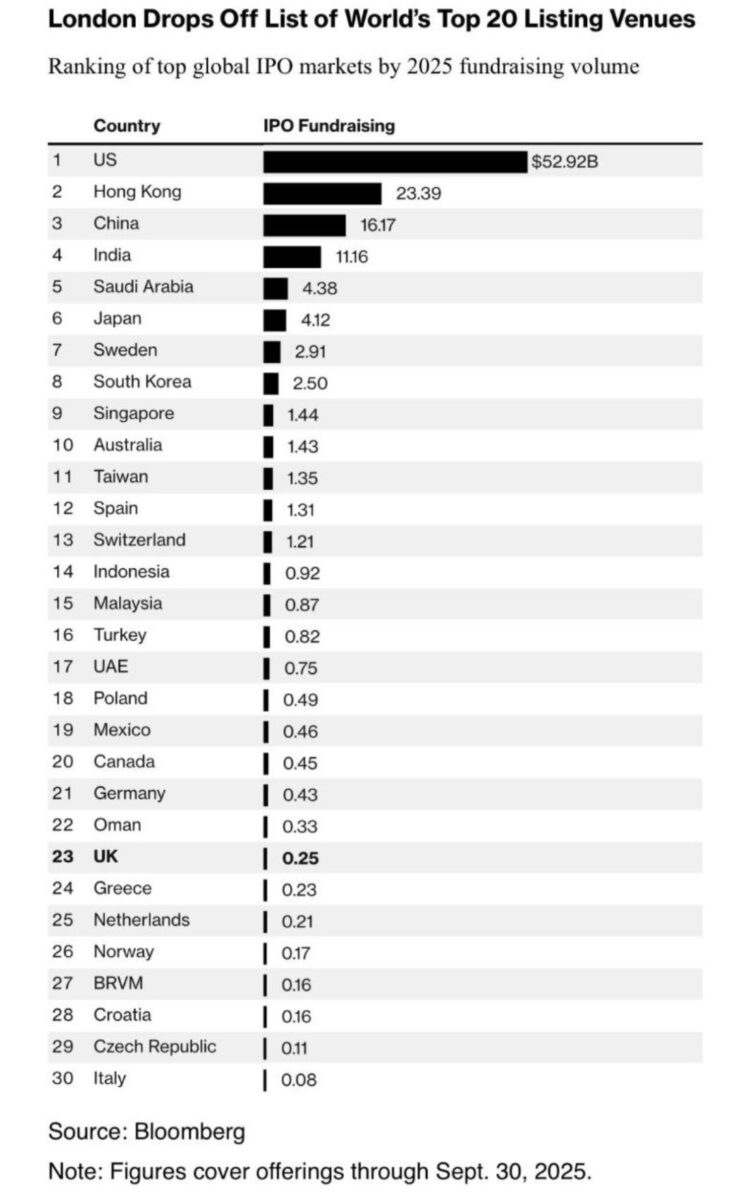

On one of my economist social media feeds, I saw these graphics recently which I thought I would share.

An IPO (Initial Public Offering) is where a private company decides to list on the public stock exchange so that it can raise capital and offer its share to investors. They normally choose to do this when they reach a certain size, as a way of accelerating company growth. In which jurisdiction they do this is important because it can generate a lot of revenue for the financial sector in that country, create jobs and also secures the attractiveness of the financial centre as a place that is deemed safe and secure to list publicly.

London used to be one of the preferred jurisdictions, but as you can see, in 2025, that is no longer the case. London now holds spot No 23 on the list behind some important newer entries, such as Hong Kong, China and India.

What this says about London’s long term future is anyone’s guess but it is interesting information all the same. (Could Brexit have played a part?) . It probably says more about the ever increasing importance of Asian economies and the continued importance of the USA.