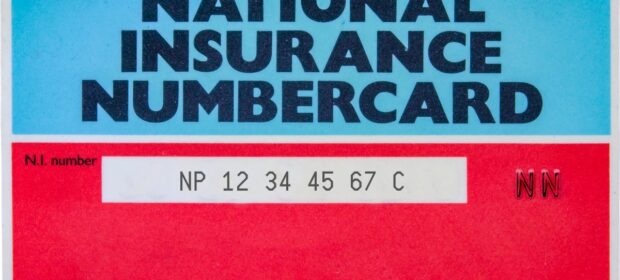

If you have lived and worked in the UK and have paid National Insurance Contributions (NICS) you may be able to buy top-up years for missed years from 2006 onwards. It will depend on where you are currently living, but it can be beneficial to secure all or a portion of the UK State Pension, which is currently £221 per week.

The Value in UK National Insurance Contributions

By Chris Eaborn

This article is published on: 4th June 2024

To qualify for a minimum UK State Pension you must have 10 qualifying years. For example, if you worked in the UK for five years, you would not qualify for a pension but you can buy five years of contributions (or for an even higher pension entitlement, the full eighteen years’ worth since 2006!) and you will receive a minimum State Pension which is currently £63 per week.

The numbers could be compelling as if you have to pay Class 2 voluntary contributions you would pay a one-off £819 (5 x £163.80) to take you to ten years of contributions and receive an indefinite pension in your retirement of what today is £63/week (£3,276 per year) compared to nothing at all! And even if you have to pay the higher Class 3 contributions you would pay £4,121 as a one-off to receive (at today’s levels) an annual pension of £3,276 per year for life from UK State Retirement Age.

You can check your National Insurance record here:

https://www.gov.uk/check-national-insurance-record

To qualify for a full pension depends on various factors that the HMRC will calculate for you.

You should urgently complete a form CF83 as there is a significant backlog for the response from HMRC with your calculations, and the deadline for making voluntary payments is 5th April 2025.

Form CF83 can be found here: https://assets.publishing.service.gov.uk/media/65a4e2117eb42e000dceb7ab/CF83.pdf

If you have any problems completing it, the telephone number for HMRC is +44 191 203 7010 and after the prompt you should say “International Case Worker” for the correct department.

The form gives you a choice of whether it is to request information about only buying back missing years, or only paying voluntary contributions in future years, or both. I was advised by the officer I spoke to that the maximum contribution required for a full pension varies (and you will be advised) but is typically 35 years.

There is no benefit to overpaying. For example, a young person working overseas who plans to move back to the UK and pick up paying NICS again, may not need to contribute for missing years if the time overseas is relatively short and they are likely to contribute at least the number of years to qualify for a maximum UK State Pension in the future.

Form CF83 must be physically posted to HMRC so we recommend registered mail of an international courier service such as DHL, FedEx, etc.

The cost of the additional contributions depends on whether you have to pay Class 2 or Class 3 contributions. Class 2 contributions are £163.80 per year and Class 3 are £824.20 per year. The HMRC report will tell you the cost and the resulting benefits and you can decide if you think the benefits outweigh the costs.

Clearly, there is no perfect calculation because you don’t know how long you will live after reaching UK State Retirement Age, but if the cost of topping yourself up looks reasonable it could be a helpful part of your retirement planning, especially if you live long into retirement as this will boost your “guaranteed” income.

**Finally, please note that this article is for information only and is subject to change. Please relay on the calculations by HMRC. Information as of 29th May 2024.

If would like to discuss your retirement planning with one of our experienced advisers, please do not hesitate to get in touch.

Spectrum IFA sponsors Freddie for a Day

By Chris Eaborn

This article is published on: 4th May 2016

This September would have been the 70th birthday of Freddie Mercury, legendary lead singer of the rock band Queen.

His final recordings were made at Queen’s Mountain Studios in Montreux, where Freddie also lived.

As part of a number of fundraising events, students of SEG, the Swiss Education Group, a leading hospitality education network, is hosting a fundraising weekend on 14th and 15th May in Montreux, entitled Freddie for a Day, to celebrate his life and raise money for the Mercury Phoenix Trust.

The Trust was established after his death and focuses on HIV awareness and prevention with a focus on young people in developing countries.

http://www.mercuryphoenixtrust.com/site/aboutus

Spectrum is a sponsor and one of our Swiss-based advisers Chris Eaborn, will be attending on our behalf.

Making a Will in Switzerland

By Chris Eaborn

This article is published on: 12th September 2014

Wills in Switzerland

Swiss Law

As a general rule, the Estate of anyone residing in Switzerland is governed by Swiss material law, especially by the relevant provisions of the Swiss Civil Code, which definitely apply in the absence of a Will, notwithstanding the deceased’s citizenship, personal status or religion.

Swiss law, which was influenced by the Napoleonic Code, provides for various solutions, either mandatory or optional, and includes the so-called rules of “forced heirship” – according to which some heirs (the spouse, the children and, in some cases, the parents of the deceased) are in any event entitled to a minimum portion of the Estate (similar rules apply in most countries on the continent and in Scotland).

Choice of Law

According to the Swiss Federal Law on Private International Law, foreign residents in Switzerland may, by making a Will, direct that their Estate be governed by the law of their country of origin and, thus, avoid all or some of the rules set by Swiss law.

This choice of law (that is not permitted in the event of double citizenship including Swiss citizenship) does not affect the jurisdiction of the Swiss authorities and, depending on the deceased’s Canton of residence, inheritance tax must still be paid in Switzerland (taking into consideration the deceased’s Estate on a worldwide basis).

As regards American citizens, it may be wise to specify the law of the relevant US State (with which they have some connections, e.g. California), while Brits should refer to “English law” (or “Scottish law” for the Scots) rather than UK or British law since it does not exist as such.

Making a Will

If made in Switzerland, the Will must have the form prescribed by Swiss law. As a rule, it must either be entirely handwritten, dated and signed by the “Testator”, or made before a Swiss Notary Public (where the Will is actually drafted by the Notary and signed by the Testator in the presence of two witnesses who are often the Notary’s assistants).

Typed Wills or so-called “joint” Wills (one single Will made by two people) are prohibited and void.

Handwritten Wills may be drafted in any language, while Wills made before a Notary Public are usually in the local official language (i.e. in French in the French-speaking area of Switzerland, such as Geneva or Vaud).

Although it is not legally required in Switzerland, when a handwritten Will may predictably need, at some point, to be proven in the US, it is worth asking two witnesses to certify the Will at the time it is signed by the Testator, as this would be expected by a US probate Court.

Making a Will before a Notary Public is especially advisable when the mental capacity of the person making the Will could later be questioned (due to illness, age, potential influence of other people, etc.).

Usually, Wills made with the assistance of a Notary Public are kept by the latter who must send them to the competent local Court or authority upon the testators’ death. When Wills are made privately, it is wise to leave them in some place where they will be found easily, but they can be lost or destroyed. It goes without saying that any Will may, at the Testator’s discretion, be changed, amended, replaced or cancelled at any time by their authors and mere photocopies are not effective.

Appointment of an Executor

Under Swiss law, when there is no Will, the Estate is usually handled by the heirs (who must act jointly).

An Executor (or more than one) may however be appointed by Will and, upon the Testator’s death, will be required by the competent local Court (the Judge of the Peace in Geneva and Vaud) to accept this mission. The Will may include some specific instructions to the Executor who is generally entitled to deal with the Estate without any restriction.

The appointment of an Executor in a Will (and a possible Successor Executor – contingent in the event of the death or incapacity of the first one) is recommended when some assets are held abroad (especially in the US, in the UK or in other common law jurisdictions), when some of the heirs are under 18 years of age or when the situation may prove complex for some other reasons.

Where no Executor was appointed, the local Court may, under some circumstances, appoint an Administrator to take care of the Estate and to protect the heirs’ interests, especially if they are not all known.

Probate Process

Anyone finding a deceased’s Will in Switzerland must send it to the local authorities. Probate proceedings include the notification of a copy of the Will to all the heirs and beneficiaries and, depending on the circumstances, to any relatives possibly entitled to a portion of the Estate.

If the heirs suspect that the deceased was insolvent, they may reject the inheritance within 90 days. Alternatively, they may, within 30 days, apply with the local Court for a formal inventory to be drawn up (at their own expenses) and only accept the inheritance accordingly.

When the heirs accept (even tacitly) the inheritance, they immediately become the successors of the deceased for all the Estate assets and liabilities. They must act jointly and they are severally responsible for the deceased’s debts and obligations (including outstanding contributions or taxes owed in connection with undeclared assets).

Usually, when the deceased was a foreign national, Swiss Courts require that the heirs submit a formal statement to be issued by a Notary Public, in accordance with information that must be given by two witnesses who have no interest in the Estate and who must confirm the deceased’s family status, along with a list of all relatives who may be entitled to the Estate. In the event of any doubt or if no one is able to provide the requested information, the Court may order that a formal notice be published in the official gazette, allowing any potential heir to challenge the Will within 1 year.

In some cases, the heirs also have to submit a legal opinion confirming the solution resulting from the application of some foreign rules (if selected in the Will) that are sometimes regarded as rather “exotic”.

Once the situation is clarified (and, where applicable, after a fiscal inventory is filed and inheritance tax paid), the Court issues a Certificate of Inheritance naming the heirs and allowing them to fully access the Estate assets and arrange for these to be distributed amongst them.

IN SHORT:

- Non-Swiss can (should) ask for their Estate to be governed by the law of their home country and state the country (i.e. will therefore avoid Napoleonic Code).

- They must clearly state in the Will that this is what they want to do, g. “I direct that my Estate shall be governed by *** law”.

- If it is not made before a Notary Public, the Will must be handwritten and married couple must write a Will each (so-called “joint-wills” are invalid in Switzerland).

- A handwritten Will does not have to be witnessed and it should be kept in a safe place.

- The appointment of an Executor (or more than one) should be considered.

- It is helpful to attach a list of worldwide assets such as the name of the bank, branch and account number in which accounts are held, details of life policies or any other assets, as well as the contact details of people who could inform the heirs (such as Attorney, Financial Advisor or Accountant).

Creating or Updating your Will / Estate Planning – The Right Questions

If you died today, how would your Estate be handled?

- Is there a Will and where is it?

- Which debts should be eliminated?

- Which assets should be sold (such as business or real estate)…

- … and which ones should be kept (such as heirlooms)?

- Who is to receive which assets (financial and sentimental)?

- Are there any distribution clauses (e.g. to give your watch to your son/daughter when they reach age 18)?

- Who is to take legal responsibility for any children under age 18?

- Who is to assist the heirs and to ensure that your instructions will be implemented?

Financial Planning

- Did you know that, if you are a US citizen, Swiss banks can be required to freeze your accounts until all US taxes are declared and paid, thus a joint account could be frozen?

- If a joint account holder passes away, the account can be frozen until Swiss taxes are cleared up, with the surviving spouse only able to present bills for living expenses to be paid.

- If a married couple has children and one of the parents dies without leaving a Will, the child/children are deemed to inherit 50% of the Estate and depending on the Canton, may have to pay Inheritance Tax. In the Canton of Vaud, children may however be “gifted” up to CHF 50’000 per year each – tax free.

Careful individual planning allows to identify and solve a number of issues like these.

We offer a free initial consultation should you wish to discuss these or other financial planning matters and should legal advice be required, we will work in conjunction with excellent English-speaking Attorneys and likewise have access to excellent English-speaking Accountants if pertinent.

This notice is for information purpose only and does not constitute legal or other professional advice. Any specific queries should be looked at individually with a professional advisor. This document may not be disseminated or published without written authority.

Quick tips when relocating to Switzerland

By Chris Eaborn

This article is published on: 3rd September 2014

House Contents Insurance and Civil Liability Insurance

It is cost-effective to insure your own possessions, as well as the act of damaging someone else’s property or person through a combined “RC Ménage” policy. The liability cover also covers you for accidental damage (not wear and tear, which you are not responsible for) to a rented property which can be helpful as landlords here are VERY strict about any damages when you eventually vacate your property. An average family household costs approximately CHF 300-500frs per year in total for the combined policy of Contents and Liability insurance, although this will differ depending on circumstances. Jewellery should be separately listed.

Fire/Natural Disaster Insurance

This applies only if you live in Canton of Vaud: you have to buy a “fire/natural damages” insurance policy through an agency called the ECA. This cover is not expensive but it is compulsory. Normally, you will be sent a questionnaire in French to complete a few weeks after you move in to your new home. In the interim you are NOT insured, therefore we strongly recommend that you take the initiative to enrol as soon as you move in. We can provide the simple enrolment forms in English for you and a full summary of cover in English. This policy costs approximately CHF 50-100frs a year.

Legal Insurance (“Protection Juridique”)

Attorneys are very expensive and local law is complicated. You can buy a very good insurance policy that pays your legal expenses if you are sued or wish to pursue another person/company (for example, a dispute with a neighbour, or with a service provider, or with your employer). Such a policy costs around CHF 350 per year for a whole family and covers you worldwide, including litigation concerning a driving incident and costs approximately CHF 200 for an individual per year. In addition, and if you prefer, you can exclude driving which makes it even less-expensive still. This insurance is highly recommended as Swiss law is complex, attorneys are expensive and even minor legal disputes, such as defending yourself against a driving offense, can be stressful and distracting if you are trying to handle them by yourself. In the event of major disputes, which could incur a huge cost along with expensive attorney fees, it allows you to choose a lawyer who speaks a language of your choice such as English.

Arriving to/Departing from your Rental Property

When you arrive, make sure you inform the landlord promptly of anything that is not working or that you did not see during the initial inspection or the landlord will expect you to pay for it. When you vacate a property there is a very strict inspection. You will have to have cleaned it to such a degree that they will check for dust in the extractor fans!! It is recommended to get a professional cleaning company to do this or you may have a long wrangle over your deposit and unwanted hassle at the close-out.

Rental Guarantee Insurance: If you do not wish to tie up, typically three months’ rent, you can have this released by taking out a rental deposit insurance. It costs around 5% of the rental deposit amount, per year, so for a CHF 10’000 deposit, you instead pay about 500frs per year.

In Case You Ever Have a Fire or Burglary – Video/Photo your possessions!

We strongly recommend you take a video of your house contents to act as an aide-memoire in case of a fire/burglary. If you were unfortunate enough to have a fire and a total loss of everything, imagine how difficult it would be to sit down and list “everything” right down to the smallest items. This video would also be hugely helpful to an insurance company as it would show that you did own all of the items you listed, even though you would not be expected to have receipts for absolutely everything you own (you could also include a scan of any receipts that you have for larger items such as jewellery/furniture). It will probably only take 15 minutes of your time to do this and you could upload the video to a Cloud storage service or place the disk drive in a bank safety deposit box or give it to a family member to store for you off premises from your home.

A home safe is also a great idea for storing financial papers and family photos on disk (it costs a few hundred francs for a good safe- go for as heavy a model as possible, preferably 100kg-200kg).

Driving

Car insurance: Please be aware that Swiss insurers are strict about reducing/dismissing claims for break-ins where something is left visibly in the car. We suggest that you never leave anything in plain view – lock it in the boot/trunk or in the glove-box (preferably with it locked).

Speed limits are VERY strictly policed here, and if you are caught at 30kph over the limit you face not a civil action but a criminal one – with a 3 months ban PLUS a fine of up to 20% of your salary – PLUS your car insurance premiums will go up. Better to know now as there is no lenience because you “did not know”!

Drink driving– Switzerland has a very low limit, and it is strictly enforced, so it is advisable to avoid alcohol or grab the train.

It is also the law that you drive with your headlights on all of the time.

For motorway driving you have to purchase a “Vignette” from any petrol station or Post Office and display it prominently in your car windscreen. The police enjoy random checks especially in February/March to try and catch people out who don’t have one!

Train

If you use the train more than a few times a year, buy a 50% discount card. The Half-Fare travel-card is available for 1, 2 or 3 years and allows you to buy 1st or 2nd class tickets for half the price.

Order your Half-Fare travel-card at your local station or on the Internet at SBB Ticket Shop.

The Half-Fare travel-card is valid for the entire Swiss public transport network, which covers a total of 26,800 kilometres. The map on their website gives details of the routes and public transport services included.

It costs CHF175 for one year, CHF 330 for 2 years and CHF 450 for 3 years. It also gives discounts on the Metro, buses and ferry-boats.

There is a special offer (as of January 2014) for 16 year olds, for a half-fare card for CHF 98frs.

Local-Amenities Guide In English

There is a great book called “Know It All Passport” which includes everything you need to know, in English, about local services and leisure amenities. This is a great resource to help settle you in, especially if your French is still a “work in progress”! www.knowitall.ch lists the outlets where you can buy it.

Groceries and Wine/Beer- ordered online- delivered to your door

www.leshop.ch is an online grocery order service (English available) for Migros, one of the largest and best supermarkets here. They provide excellent service, deliveries are normally very accurate and arrive in good shape. No more heavy shopping bags and check-out queues! Other grocery stores also offer this service.

Tax Returns

Everybody with income over CHF 120k is required to make an annual tax return. If your company does not provide access to an accounting firm to do this for you, we can introduce you to excellent local accountants who are English-speaking, not too expensive and will take the hassle of this from you.

If you earn less than CHF 120K, you should make a “Simplified Tax Return” as there are personalised deductions you can apply for that can’t have been taken into consideration at payroll level. For example, you can deduct credit/mortgage interest and you can deduct for contributing to the 3rd Pillar (mentioned later)….

Tax-Savings

You may be able to make additional back-payments into your company pension. Currently, this is up to 20% of your salary per year for 5 years, which will be fully tax-deductible. Additionally, in the event that you decide to stay in Switzerland and buy a house, this can be pledged as collateral to the bank, thus reducing the size of deposit that you need. We can help you understand the pros/cons of making back-payments.

“3rd Pillar”- this is a private pension which you control. It is totally separate from the company pension and is portable. You can invest CHF 560 per month (maximum CHF 6’739 per year and the amount increases slightly periodically). If you think you will be here for a while, this is a good idea, as both as a disciplined savings vehicle and to help reduce your taxes – and even possibly assist in buying an apartment/house. There are some very attractive products that offer excellent investment returns potential, with a guaranteed capital along with a minimum return every year, even if the investment markets go down! Plus, you benefit from the markets when they go up. Again, we can help you evaluate the various different options available and “what happens if?” scenarios. Products vary hugely in terms of cost/benefits so a comparison is highly advisable.

Buying a House

This typically requires a 20% deposit but it is now possible for Swiss and certain European nationals to obtain a 90% mortgage. Interest rates are extremely low (roughly 2% if you have a mix of variable and fixed rates) and mortgage interest is tax deductible. We recommend you consider buying only if you plan to be here at least 5 years or would be prepared to leave your capital locked-up and rent out the property if you leave Switzerland. This is simply because there are around 5% fees in buying (“Frais Notaires”) plus, if you sell, there are capital gains taxes and realtor sales commissions to pay. Therefore, it may not be a good investment in the very short term.

You can borrow to finance not only a main residence but also a secondary residence such as a ski chalet.

There are various types of mortgage on the market- if you would like information, again, we can assist you in choosing the right type of mortgage and setting it up with leading partner banks and insurance companies who offer home-loans and help you to set it up in the most tax-optimised way. We can also assist with mortgages in France and in other countries. Please contact me on the phone numbers or email address listed below.

Banking / Private Banking

We can refer you to a local personal banker who speaks English and will take care of “everything” for your everyday banking needs as well as to international banks who specialise in dealing with expatriates.

We have also negotiated exclusive conditions for top-end Private Banking. Again, you can contact me on the numbers and email address listed below.

Making or Updating Your Will (Testament)

If you are not Swiss, you should have a local Will or your Estate is very complicated because local Estate law is similar to France in that it is under the Napoleonic Code (forced-heirship rules), meaning that your money would not necessarily go where you want it to! Non-Swiss nationals have the right to nominate the law of their home country in the administration of their Estate. We can provide you with guidance to write your own Swiss Will, which is relatively simple and does not cost you anything.

Investment Planning

We can help you review any existing investments and pensions and advise you on the impact of your move to Switzerland, as well as about any savings/investment you may wish to make now that you will be Swiss resident. We are Independent and can choose from across the wide choice of institutions on the market. We also have access to structures where you can deal assets yourself, if you wish to.

In particular, we are specialists in finding savings/investment solutions for internationally-orientated clients who may have careers that move them around and who do not simply wish to accumulate small “pots” in each country in which they work.

Foreign Currency Transfers

If you have regular payments, perhaps for funding an overseas mortgage, or you move money to/from Swiss francs, than using your regular bank for this service can be extremely expensive. Margins are undisclosed and, typically, include a spread of 4-5% with even commission on top! This is even if you move money from, for example, a CHF account to a Euro account with the same bank! We can arrange a free account with a leading currency-transfer specialist company through which you can convert currency at institutional rates, saving significantly versus foreign currency transfers through your bank.

Helicopter Rescue Service (Rega)

Helicopter rescue may be covered by your health insurance. However, the service itself is privately funded, receiving no State aid and, if you become a patron (currently CHF 70 a year for a family or CHF 30 a year for an individual), all fees for their services are waived.

Below is a link explaining the benefits in English.

http://www.rega.ch/en/goenner/goennerbestimmungen.aspx

Health Information and Service Providers

The below link is an excellent resource for finding a doctor nearby, as well as general information in English.

http://www.health.ch/english/index.html

Although some of the information may seem a little overwhelming, once initial formalities have been taken care of, living in Switzerland is extremely straightforward. We hope that some of the information contained here is helpful and that you will agree it is a fantastic place to live!

We will be delighted to assist you both now and in the years to come, whether you remain here indefinitely or move around the world!

Please note that this document is intended for general information purposes only for private use. E&OE.

Swiss British Classic Car Show in Morges

By Chris Eaborn

This article is published on: 20th May 2014

On the doorstep of our two Swiss-based advisers, Chris Eaborn and Robbin Davies, is the lakeside town of Morges on Lake Geneva, where for the past 21 years The Swiss Classic British Car Meeting has built to become one of the leading classic car events in Europe.

The brainchild of one man, Keith Wynn, a British expat, it attracts around 1,500 classic and special interest British cars and around 20,000 spectators every year. The event is non-profit, fuelled by Keith and other supporters’ love of some of the most evocative names in automotive history, and the thrill of seeing them driven to the event and displayed along the shorefront for all to enjoy.

The Spectrum IFA Group is a main sponsor and proud to be associated with such a delightful event that brings many visitors to the region and is so popular with the community in which we have many clients.

Entry is free to both drivers and spectators and the location is easily accessed in 20 minutes by train from Geneva Airport.

Maybe you fancy an excuse to visit Switzerland and at the same time visit the show this year on October 4th?

For details of the event, and helpful planning tips such as hotels and transportation, visit www.british-cars.ch