“British expats, your financial adviser may well be a bandit!”, this was the title of a 2016 article by Jason Butler in the Financial Times. He painted a depressing picture of the state of the advisory market for expats and some of his key observations still hold today.

So what are some of the issues you need to be thinking about when you are seeking a Financial Adviser in Portugal?

Fees

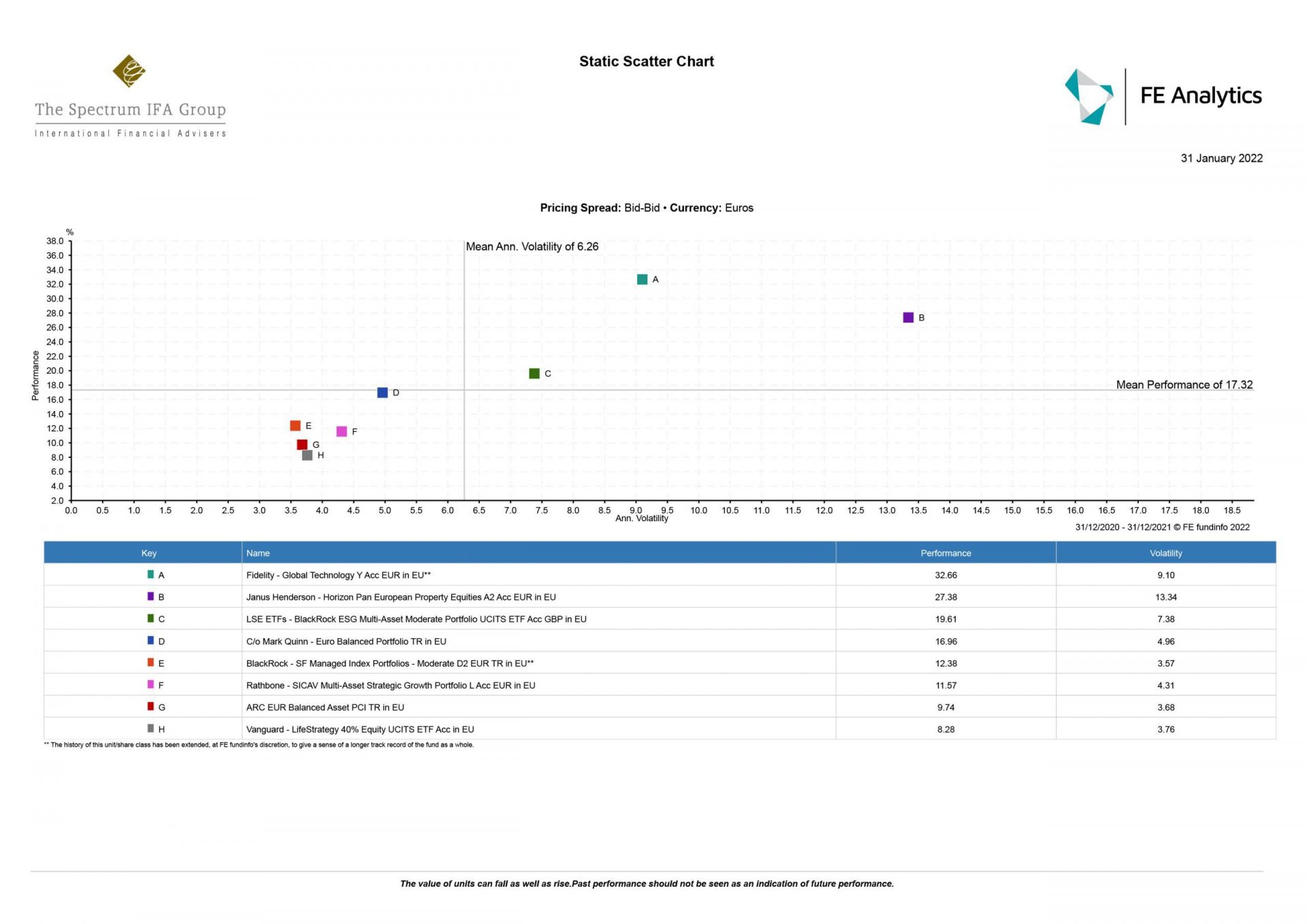

One of the main points from the FT article was the importance of focusing on fees and charges. Butler states that unlike the UK, which abolished commission in 2012, many expat destinations suffer from “eyewatering expensive financial products laced with enormous commission payments”.

It is therefore important to have a clear understanding of what you are being or will be charged, and importantly that these are fully disclosed. This is something not all advisers have done and is fast becoming an issue for them as a result of the MIFID II directive which is forcing them to disclose their charges.

Qualifications

The other area of focus was on qualifications, with Butler citing a lack of qualifications in general. In fact, in Portugal, there is no minimum qualification requirement so in theory, anybody can set themselves up as ‘advisers’.

In the UK, the minimum standard to advise is ‘level 4’ but the gold standard is ‘level 6’, which is Chartered status. These higher qualifications are awarded by the CISI and CII (UK) and the average pass rate for the Chartered status examinations was just 56% in 2020.

You should also seek advisers who are tax qualified, or at the very least work with a firm or individual that is, and who fully understands cross-border issues. This is important given the relatively complex nature of expats’ financial affairs.