I have held off this subject for a while because in the finance industry we have been waiting for some figures to confirm what has to date been expected, but as yet could not be verified: slowing inflation figures.

Cash or invest?

By Gareth Horsfall

This article is published on: 26th November 2023

This has now been demonstrated in 2 countries: The USA and the UK (and it is likely that the EU will follow suit)

On November 1st the Fed announced that inflation had slowed in the States slowing from 3.8% in August to 3.7% in November. This is a good signal that interest rate rises in the USA have had the desired effect on inflation and so they decided to keep policy rates on hold at 5.25-5.5%

The UK also announced more dramatic falls in inflation, from 6.7% in September to 4.6% in October. That’s quite the fall, and resulted in the same action from the Bank of England: interest rates will be kept on hold.

Not a lot of time left for savers and higher interest rates

As a result, anyone who is looking to pick up the best interest rates on their cash will more than likely need to act fast now. It is highly likely that we have reached the peak interest rate in the cycle and so the direction will more than likely be down from here. Remember that Central Banks have a 2% inflation target and whilst there is little chance of that happening (in my humble opinion!) for some time to come yet, they will quickly want to reduce interest rates to stimulate the home buying sector, making it cheaper for new borrowers and also to alleviate the pressure on existing borrowers with higher repayments, hence stimulating overall spending and avoiding deep recession.

That doesn’t bode well for savers who have been eyeing the delicious Burrata-esque interest rates on cash in the last year. The banks will very likely be ahead of the trend and start lowering their fixed term offers before the central bank rate falls. In fact we are already seeing that a number of fixed rate offers are being withdrawn.

Therefore, is it time to Invest rather than sitting on cash?

I think this has been the second most asked question of me in 2023.

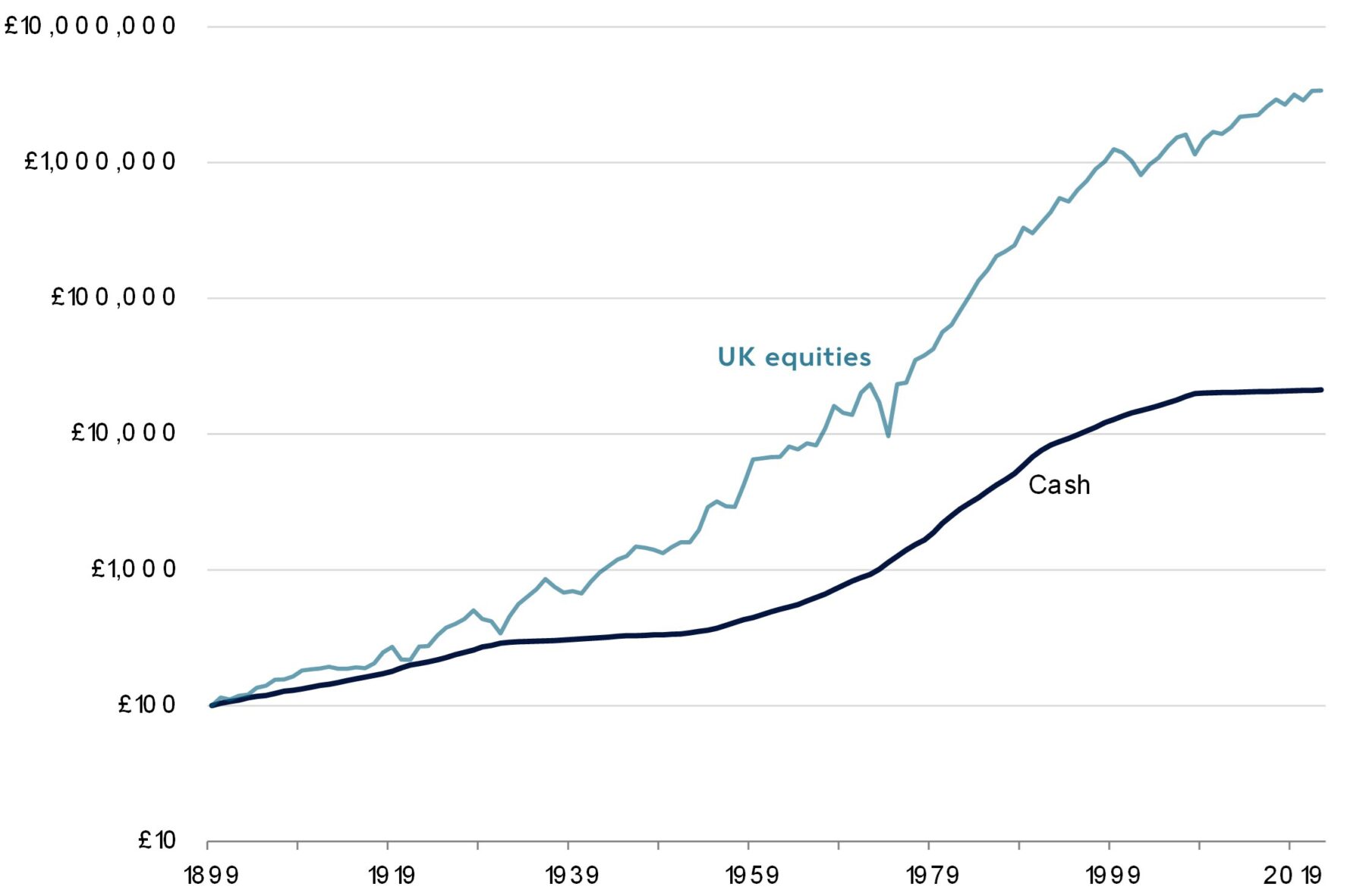

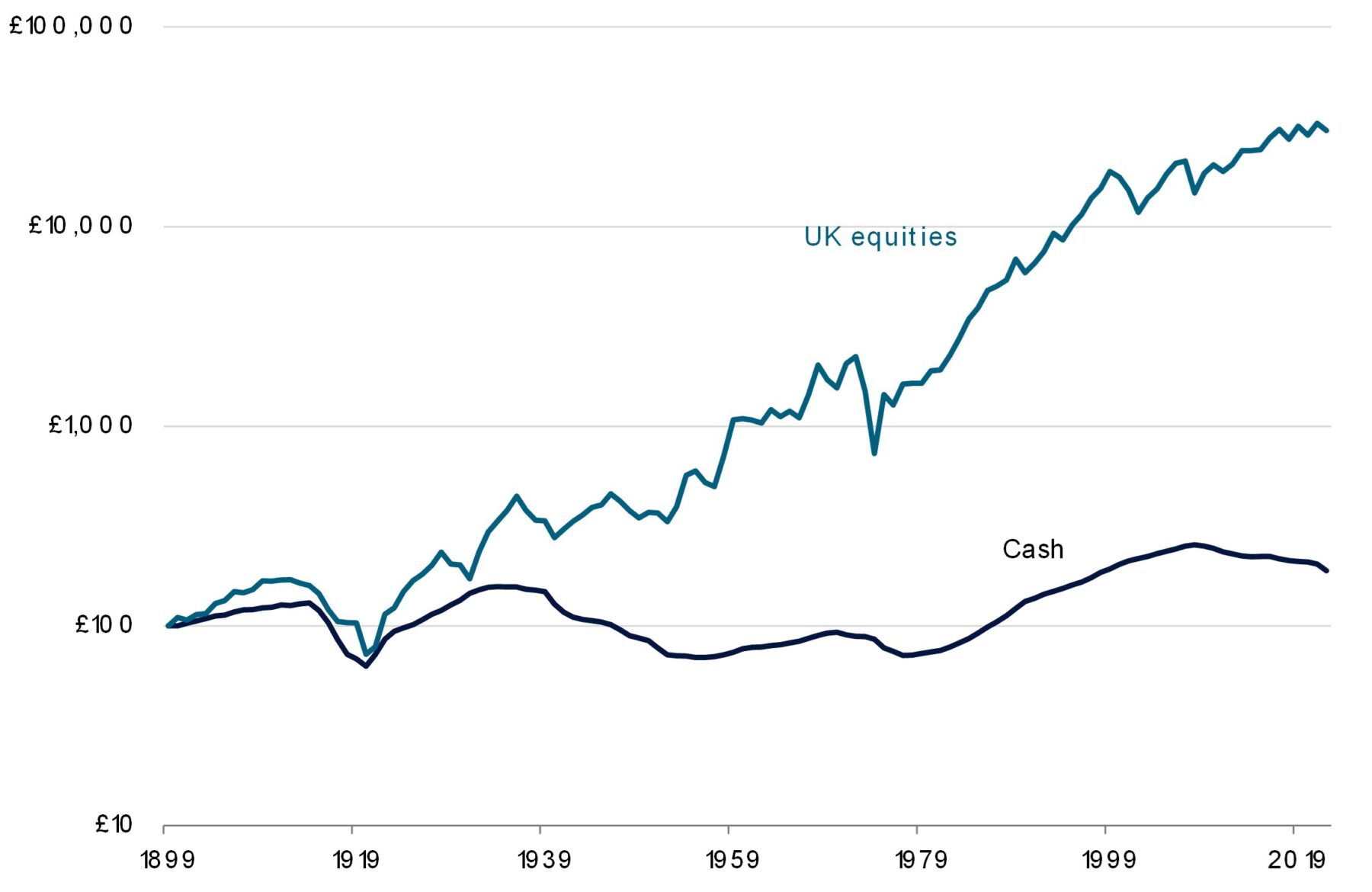

I imagine that you think that my answer has always been to invest, given that this is the main service that I offer clients. However, you would be wrong! I have, on a number of occasions advised clients to seek out better deposit rates on cash. It all depends on circumstances. In general, anyone needing cash in the short term (1-2 years) would be advised to keep the required amount in cash to cover any bigger one-off expenses and the same would apply whether interest rates are at zero or 5%. However, my advice is, and has always been, that if you have a longer term horizon i.e you intend on living on a return from capital over the next 10 or 20 years, or even longer, then investing is the better option. Why? Because quite simply cash is a terrible way to hold capital long term and trying to time entry into the markets is an impossible task.

But I repeat this mantra often, so let me show you some great slides that I have received from Rathbones Investment managers recently which go a bit deeper into the understanding of why cash is a bad medium to long term option.

IN THE LONG TERM INVESTING IN EQUITIES HAS COMFORTABLY BEATEN CASH

RETURNS FROM CASH HAVE FAILED TO KEEP UP WITH INFLATION FOR LONGER PERIODS

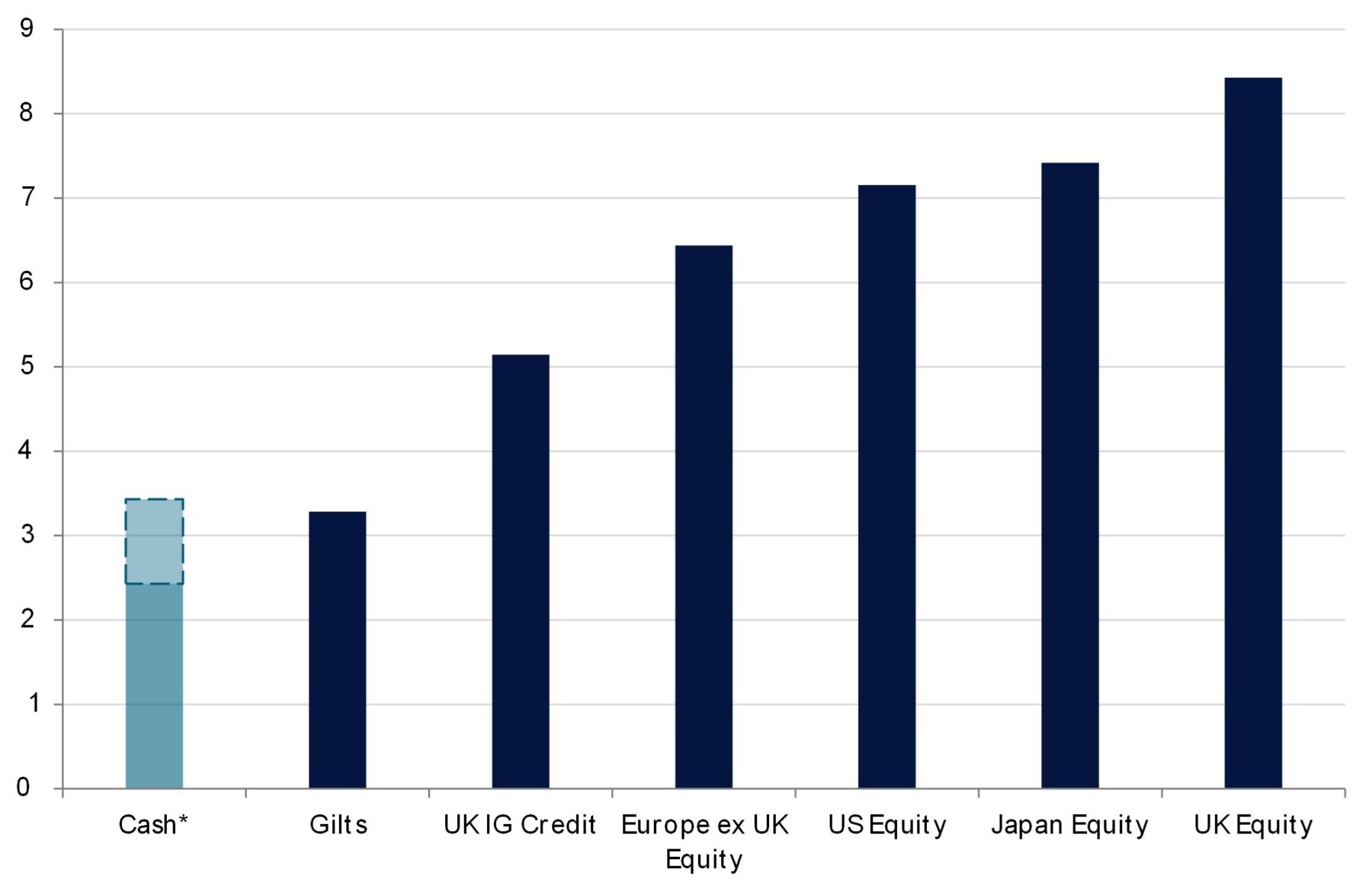

EQUITIES ARE FORECASTED TO RETURN MORE THAN CASH OVER THE NEXT DECADE

In addition, someone I know who is a UK Independent financial advisor (thanks for sending this Chris!) sent me some other useful information which I want to share with you on the same topic.

So, does investing even make sense anymore?

First, it’s worth reminding ourselves that the laws of capitalism haven’t changed:

- Governments must pay higher returns than cash to borrow. Governments NEED to raise money through debt. It’s what keeps pensions paid and the lights on. If cash rates are at 5%, government bonds have to offer people MORE than that to tempt them out of the bank – even more so if they want them to lock it up for 10 years

- Companies must pay more than governments to borrow. Companies NEED to incentivise you to lend to them, rather than to the government … which means paying you more than the government does! If cash is at 5%, and government bonds are at 6% (say)… corporate debt must be higher (otherwise why take the risk?!)

- Equities have to offer the chance of being paid more than corporate bonds. Companies ALSO need to generate money for their shareholders (who are taking even more risk than their bondholders). Because if their shareholders could do better leaving their money in the bank … soon there’d be no shareholders. And the decision maker at a company knows that. Any new project requiring a cash investment will be judged against the bank rate. If a new project doesn’t have the potential to beat what the bank’s offering, why do it?

The bottom line is that cash sets the bar. Everything else then needs to jump over it.

Of course, it’s tempting to believe that today’s investment circumstances are unique. “This time it’s different!”. Inflation is high. Government debt levels have soared. Geopolitical hotspots are flaring up in Ukraine, the Middle East and Taiwan. Add to that the transformational developments in AI and the increasingly savage impact of climate change. But is it really different this time?

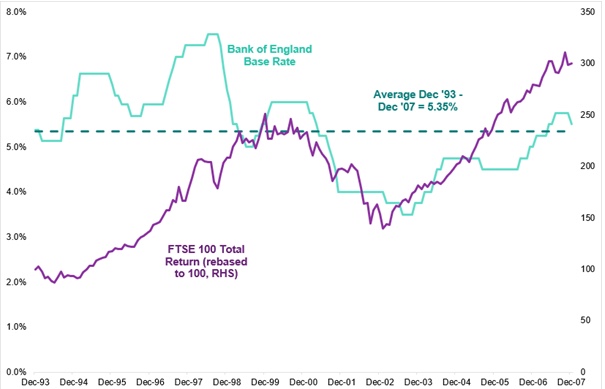

Look at the below chart. Between 1993 and 2007, interest rates averaged 5.35%. Government debt levels were rising sharply*. Geopolitical hotspots were flaring up in Yugoslavia, the Middle East and Russia. The internet was revolutionising society. In the face of all that, surely just staying in cash, at 5.25%, was best?

ABSOLUTELY NOT!

That higher cash bar created better jumpers. The FTSE 100 (with dividends reinvested) returned 8.1% annualised over that period.

The world continued to jump over the bar… and it will do in the next economic cycle too.

Markets are a forward looking mechanism

I will have a brief final word on this matter. I want to tell you a personal story.

In 2008 / 2009 my wife and I had some capital to invest, around €40,000. We had not had a lump sum of this nature to invest in our whole lives. We had mainly saved from income. At the time I had just finished Warren Buffets book ‘The snowball: Warren Buffet and the business of life’. I wanted to learn more from the great investors and understand what decisions they took to help them in their investing decisions so that I could be a better adviser for you, my clients. We just happened to have this capital now, which I knew needed investing for me and my family.

You may remember than 2008 /2009 was the height of the Financial Crisis and the financial markets and general global financial system were teetering on the brink of total collapse. It didn’t appear to be a good time to be investing. However, I knew what I needed to do.

I can only tell you that selecting the funds I wanted to purchase and then actually doing it was one of the hardest things I have ever done with money. It totally went against every grain of common sense in my body, given the state of the financial system at the time. (I was party to just how bad it was through our internal communications from fund managers and financial experts alike) Why invest when the world is in such bad shape? But, I didn’t let my heart rule out and instead went with my head.

What happened over the coming months was that the portfolio I had selected went down 20% in the next month and it left me wondering whether I had done the right thing or not. (and before you ask, I never told my wife about this until about 6 months later!) . But I stuck with the plan and 3 months after that the portfolio had bounced back and was in positive territory again.

Lessons learned

I learned 2 very important lessons from that experience:

1. You can’t time markets. So don’t even try. If you happen to have capital that you need to invest around the time when markets have fallen then it is going to be more or less the best time to get in. The valuations may go lower in the short term but in the medium to long term you are going to get the best valuations.

2. Markets will bounce back before the economy does. At the time I had invested, and the valuations had increased, we were in the worst of that economic period. The bounce came from some political decisions to stimulate the economy, but those decisions would take years before the results fed through to the general economy.

If you would like to discuss anything about this article with me, then please do get in touch on gareth.horsfall@spectrum-ifa.com or message/call me on +39 3336492356