Retirement options

One of the big differences when you move to Spain are the options available to you for retirement planning. In the UK/Ireland we have ISAs and private/employer pension schemes which both offer good tax savings.

By Chris Burke

This article is published on: 8th February 2023

One of the big differences when you move to Spain are the options available to you for retirement planning. In the UK/Ireland we have ISAs and private/employer pension schemes which both offer good tax savings.

ISAs are not tax free in Spain, and the annual ‘private pension allowance’ is only €1,500 per year per person! In some employer contribution schemes you can save up to €10,000 per year, but these are very uncommon. Compare that to £40,000 per year in the UK, or in Ireland up to €115,000 per person, per year! €1,500 per year is never going to achieve any serious amount of income for retirement.

The main reason for this is that in Spain, culturally people preferred to set up a company structure or accrue properties, passing these from generation to generation. Additionally, there is a lack of incentives from the authorities to entice people to save into retirement schemes.

Pensions have been popular for retirement in the UK/Ireland because of the tax savings and potential employer contributions. Take both of those away and they are not nearly as effective, which is what happens when you move to Spain. So, what can you do if you want to plan for retirement in a tax efficient manner?

For me, retirement is not just about a pension, it’s about a retirement plan. We help clients build that retirement strategy, taking into consideration the amount of income they want, making sure their assets are highly tax efficient (such as moving them away from future income tax positions) and then making sure everything is flexible and portable, because you never know what will happen in life. This is all done by using our client planning portal, where we work together to bring this to life using the following process:

This is all done by planning, where we work together to bring this to life using the following process:

We never know exactly what’s going to happen, but one thing is for sure, with proper informed planning and regular analysis, you will be much better prepared.

By David Hattersley

This article is published on: 17th October 2022

A sense of deja-vu is now apparent as the UK is experiencing a similar situation compared to the 70’s. Drawing comparisons especially for those that lived through that era would be unhelpful. However a minor point worth considering were the restrictions on the flow of capital out of the UK. For those lucky enough to travel abroad then a limit of £25.00 cash per person was the restricted limit under the Exchange Control Act 1947. My wife still has her old passport with form PP/A dated 14.02.73. One of her clients of 100 years still remembers how difficult it was to bring money into Spain to buy a plot of land.

For those that already are living in Europe or plan to in the very near future under the golden visa rules, I am not suggesting a wholesale restriction of capital movement . A difference though between the 70’s and now is the growth in personal wealth, with the primary asset being property. The 2nd biggest asset and perhaps underrated was the growth of money purchase pensions after Mrs Thatcher came to power and for those in their 50’s & 60’s this could be quite considerable. The opportunity to “ distance work “ may have an impact on younger professionals and for those relocating here.

The current government is under extreme pressure, especially the need to raise tax revenue to balance the books, along with the alleged reports of threats to tear up all agreements with Europe.One politically “safe option” and unlikely to cause uproar and outrage by the general public would be to curtail or even stop transfers to a QROP for those lucky to live or move to Europe.

Why would the government do this ? The payment of a pension held in the UK could be taxed at source as are the current Civil Service Pensions, thereby retaining the long-term tax revenue stream. It would mean filing tax returns both in the UK & Spain. The pension commencement lump sum could also come under review. There certainly wouldn’t be a public outcry for those “ lucky” enough to have sizeable pension pots.

The UK Budget Bill normally has to be debated and passed into law which takes about 3 months. In 2015 negative amendments were made to the QROPs rules that took effect immediately on the day after the budget and was quietly “slipped in”. A case of “ the devils always in the detail”! After all the principle of if one can get away with it once, why not try to repeat a similar process again?

There are many advantages in transferring to a QROPs and at The Spectrum IFA Group we offer and recommend a thorough assessment and report of your individual situation by our qualified specialist at no cost to you. An additional benefit is the long-term service provided as UK based advisers can no longer provide this for residents in Spain and the individual can retain control via a local adviser. A transfer to a QROP doesn’t only apply to UK nationals but any European worker that has built up a “pension pot”. I have been heavily involved in the pensions market since 1987 and have a wealth of experience in this field so if you have any concerns or interest please contact me to arrange a no-obligation initial meeting.

e.mail : david.hattersley@spectrum-ifa.com

Telephone or Whats App : 0034 711 051 938

By Chris Burke

This article is published on: 21st September 2022

I hope you are well and had an enjoyable summer. This month we cover the following topics (if there is anything you would like to understand more or wish to see covered in these Newsletters, don’t hesitate to ask):

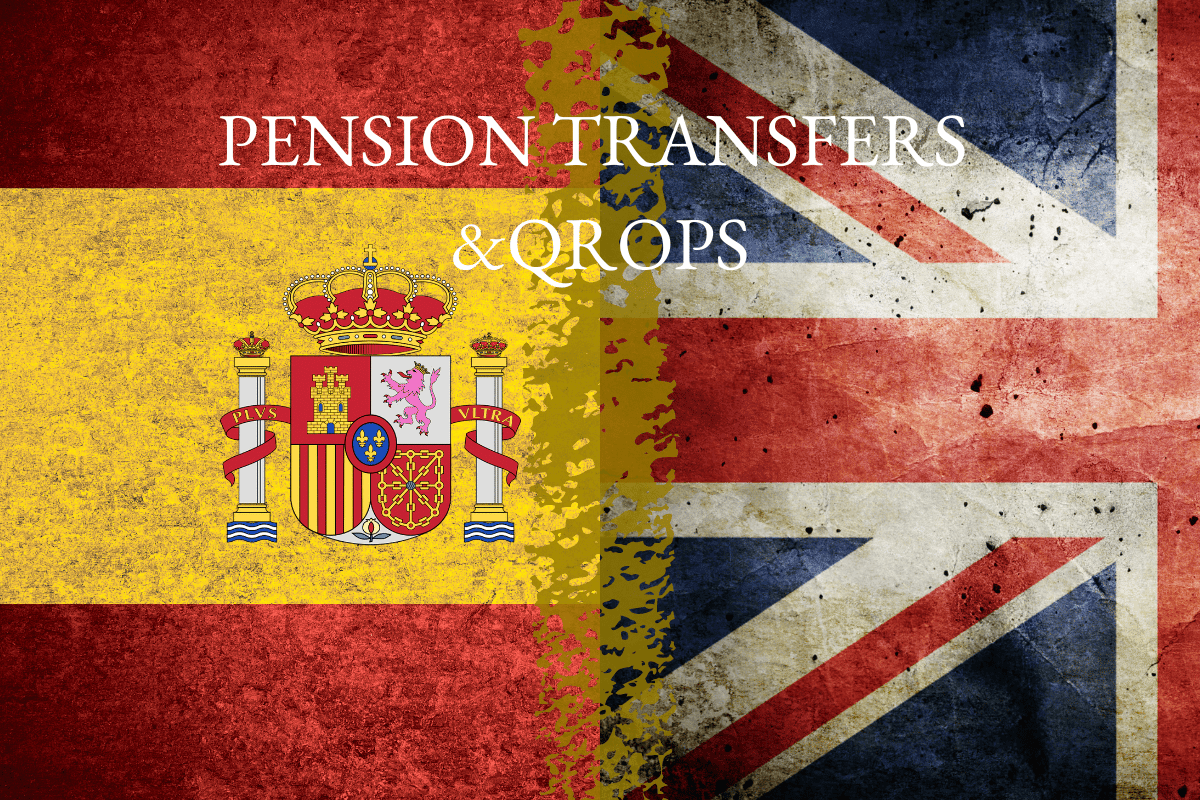

Early Retirement Pensions in Spain

Did you know that in Spain, under certain circumstances, you can take early retirement before the legal retirement age? But what are these circumstances and what requirements must you meet?

What are you entitled to and how can you apply for it?

This can be quite complicated depending on your situation, and we would recommend taking professional advice so that you can be sure of exactly what you are entitled to.

New Cryptocurrency Regulations in Spain

From 2023 onwards, Spanish residents will have to declare cryptocurrency holdings in their tax returns. Currently, cryptocurrency holders are only obliged to declare any profits or losses in their income tax returns. The 2022 tax return has a special section for these assets. However, from 1st January 2023, a new regulation will be implemented meaning that all Cryptocurrency transactions must be declared. This has been regulated by Spain’s new anti-fraud law, which is currently at the public hearing stage. It has been set out in a draft bill incorporating several anti-fraud amendments.

The new tax declaration will have to be submitted using the form Modelo 721. Information will have to be included on those who have held cryptocurrency or have been authorised beneficiaries of cryptocurrency at some point during the year (from 2023 onwards). Furthermore, cryptocurrency holders will have to include information on what their final balances are at the end of the year, as well as information on the types of cryptocurrency and the amount of units that they hold, along with the equivalent amount in Euros. This new regulation further reinforces the need to seek professional tax advice if you are a cryptocurrency holder or thinking of becoming one.

If you would like any more information regarding any of the above, or to talk through your situation initially and receive expert, factual based advice, don’t hesitate to get in touch. You can book an initial consultation via my calendar link below or email/send me a message.

By David Hattersley

This article is published on: 31st August 2022

A sense of deja-vu is now apparent as the UK is experiencing a similar situation compared to the 70’s. Drawing comparisons especially for those that lived through that era would be unhelpful. However a minor point worth considering were the restrictions on the flow of capital out of the UK. For those lucky enough to travel abroad then a limit of £25.00 cash per person was the restricted limit under the Exchange Control Act 1947. My wife still has her old passport with form PP/A dated 14.02.73. One of her clients of 100 years still remembers how difficult it was to bring money into Spain to buy a plot of land.

For those that already are living in Europe or plan to in the very near future under the golden visa rules, I am not suggesting a wholesale restriction of capital movement . A difference though between the 70’s and now is the growth in personal wealth, with the primary asset being property.

The 2nd biggest asset and perhaps underrated was the growth of money purchase pensions after Mrs Thatcher came to power and for those in their 50’s & 60’s this could be quite considerable. The opportunity to “ distance work “ may have an impact on younger professionals and for those relocating here.

The current government is under extreme pressure, especially the need to raise tax revenue to balance the books, along with the alleged reports of threats to tear up all agreements with Europe.

One politically “safe option” and unlikely to cause uproar and outrage by the general public would be to curtail or even stop transfers to a QROP for those lucky to live or move to Europe.

Why would the government do this ? The payment of a pension held in the UK could be taxed at source as are the current Civil Service Pensions, thereby retaining the long-term tax revenue stream. It would mean filing tax returns both in the UK & Spain. The pension commencement lump sum could also come under review. There certainly wouldn’t be a public outcry for those “ lucky” enough to have sizeable pension pots.

The UK Budget Bill normally has to be debated and passed into law which takes about 3 months. In 2015 negative amendments were made to the QROPs rules that took effect immediately on the day after the budget and was quietly “slipped in”. A case of “ the devils always in the detail”! After all the principle of if one can get away with it once, why not try to repeat a similar process again?

There are many advantages in transferring to a QROPs and at The Spectrum IFA Group we offer and recommend a thorough assessment and report of your individual situation by our qualified specialist at no cost to you. An additional benefit is the long-term service provided as UK based advisers can no longer provide this for residents in Spain and the individual can retain control via a local adviser. A transfer to a QROP doesn’t only apply to UK nationals but any European worker that has built up a “pension pot”.I have been heavily involved in the pensions market since 1987 and have a wealth of experience in this field so if you have any concerns or interest please contact me to arrange a no-obligation initial meeting.

By John Hayward

This article is published on: 1st June 2022

Further to the recent article written by my colleague Charles Hutchinson regarding temporary annuities and their taxation of annuities in Spain, I am expanding on the tax treatment of personal pensions generally.

Depending on the type of retirement income that you are receiving, it will either be taxed as regular income, “work” income as the Spanish call it, or savings (passive) income with a different set of tax rates being applying to each type. It is generally understood that the income from pension plans that received tax relief (effectively where the contributions were deducted from income before tax was calculated) will be treated as work income.

The word “annuity” is used in a general sense in the UK as the regular payment which comes from a pension scheme. It is possible to convert a personal pension fund to an annuity, with a view to guaranteeing a fixed income for life albeit waiving the right to the capital value of the pension pot. Whether or not it is advisable to purchase an annuity is another matter. This will depend on personal circumstances.

As far as Spain is concerned, an annuity is a form of income that attracts favourable tax treatment. An annuity in Spain is either temporary or for the whole of life. The annuity is purchased. It is not income drawn from an existing pension fund unless that fund is encashed to buy the annuity. At that point though there is the possibility of a large tax bill on the encashment.

The key points here are that:

Contact me today for more information on how we can help you to protect your assets from unnecessary taxation and make more from your money, protecting your income streams against inflation and low interest rates, to talk about Spanish Tax on Personal Pensions or for any other financial and tax planning information contact me at:

john.hayward@spectrum-ifa.com or call (+34) 618 204 731 (WhatsApp).

By Barry Davys

This article is published on: 23rd May 2022

It is clear from calls and messages to me from people seeking advice there is much confusion regarding taxation when we live in Spain and have income or capital gains in the UK. Sometimes, these calls happen when people have received a letter from the Agencia Tributaria (Hacienda).

My wish is to clarify the situation so that there are no back taxes, fines nor interest to pay in Spain.

This framework will clarify the position and I include specifics regarding pensions. Tax can be, well taxing, so this framework is to help with understanding the overall situation, not to provide specific advice for your situation.

Who’s this for?

This article is for all British people who live in Spain.

Overview

A framework to help explain how do we pay tax on pensions from the UK when living in Spain?

Why to read this article?

This article is written in response to a very sad situation where a pensioner here has been hit by fines, back tax and interest from four years ago because of a mis-understanding on how to organise his tax on his UK pension. It is likely that further fines will follow for other years. The total amount of fines and interest could amount to €21,000

Your commitment

Taking the time to read the article and requesting an initial telephone or Zoom meeting below, if you want help for your specific situation.

Your Tax Framework

Top of the framework is to understand that when we have taxable events in more than one country, the country of our residency is the “controlling tax authority”. They have the final say on what tax must be paid.

If you live in Spain more than 183 days in a calendar year your controlling tax authority is Spain. It does not matter if you also pay tax in the UK.

How this works is as follows:

If you live outside the UK and provide a certificate of tax residency in Spain you can claim dividends, bank interest and even private pensions without paying UK tax (because you will pay tax in Spain).

Pensions, however, are a great source of confusion. The UK retains the right to tax state pensions, military pensions, civil service pensions and a number of others. Previously these did not have to be reported in Spain. They do now!

Tips on pension tax

In my profession as a financial adviser for international people living in Spain I have a clear understanding of tax rules and recommend that you employ a good local tax adviser. This article is not tax advice as it may not reflect your personal circumstances. It is merely a framework to help with your understanding. I hope this article provides more clarity on the issue and helps when you do go to a tax adviser.

By Charles Hutchinson

This article is published on: 19th May 2022

Over the last few years, there have been some well-known IFAs here in Spain advising their clients that they can save up to 88% on their income tax in Spain by stating that their pensions are temporary annuities. In some cases, this has caused serious problems for pensioners. There is no way the Hacienda would offer such benefits unless these annuities were such from outset. It would seem logical if this was to be set up as such from outset, the schemes would have to be domiciled here in Spain for the tax reasons I go on to explain. Similarly, the annuity status could not be applied to foreign pension schemes being exported by expatriates from their previous country of residence when they come to live here.

For example, I have come across clients who have transferred their pension abroad under QROPS rules, they then instruct their trustees to pay them a set income for, say, 5 years. In some cases, the trustees would give them a certificate confirming that this income is a temporary annuity. Ironically this not only potentially makes the trustees as culpable as the pensioner but so too the gestor or accountant drawing up that tax return.

An annuity is something you buy from a financial institution (usually a life assurance company) for a certain sum. In return, the company will pay you an income for life or a fixed period. Once purchased, that money is no longer yours and it is irreversible.

However, the money in a pension scheme (although legally owned by the trustees) is for your benefit in your lifetime and can be passed to your beneficiaries or spouse, depending on the scheme T & Cs. The income can be stopped, restarted, raised, lowered, or even taken in lump sums (again depending on the scheme particulars). The capital remains at your disposal. Therefore it cannot be regarded in any way as an annuity, let alone a temporary one.

Those who promote these “loopholes” are tapping into one’s natural desire to lower one’s taxes. They are exploiting genuine tax benefits offered to those who have already paid income tax on their savings with which they purchase an annuity for a fixed period. The special low tax rates which go with these annuities are by way of partial compensation for having your tax-paid capital repaid to you. Whereas pension income is always taxed at your marginal rate, mainly because there is tax relief on monies you put into your pension scheme, with both money purchase and occupational pensions. Furthermore, pension “pots” are invested and will attract, if properly invested, investment growth.

Those companies who advise people to do this and those who file a tax return claiming their pension is an annuity (when it clearly is not) are committing tax fraud. And there are very heavy fines for doing such a thing. A tax audit can go back up to 5 years and the tax shortfalls can involve sizeable sums especially when the fines are included. At pension age, this can be very distressing and a very nasty shock to an elderly person.

Spectrum can help you avoid this situation by reviewing any previous advice given and offering an unbiased opinion. We research our products and taxation thoroughly before advising our clients. If you have any doubts about your pension and the advice you have already received, then please contact me for an initial meeting which carries no fee. We want you to have peace of mind so that you can tell others about us. Spectrum is not in the risk business but very much here to protect your wealth.