It is not the strongest of the species that survives, nor the most intelligent that survives. It is the one that is most adaptable to change

Are you and your investments adapting to change?

By John Hayward

This article is published on: 11th January 2021

I didn’t write that and neither did Charles Darwin, even though many websites state that it is from Darwin´s Origin of Species. In a way, it doesn’t matter who wrote it. What is important is that it is not necessarily the strongest, or the most intelligent, who have survived this coronavirus. Many people have adapted their lives, with guidance, to avoid contracting the virus and/or passing it on in case they have it without knowing.

When lockdown took affect here on Friday 13th March 2020 panic was rife, which manifested itself through stockmarkets crashing across the world. If there is one thing that we have learnt about the human being, it is that he or she is likely to overreact in times of trouble. Toilet rolls, bleach, and selling off stocks and shares were the focus for many in March and April. Months later, it appears that we are not going to the loo so often, houses don´t need cleaning so regularly, and that the business world is in better shape than a lot of people realise.

I return to the “Darwin’s” theory, focusing on adaptation. Some companies were already struggling pre-Covid 19 (21st century companies with 20th century ideas), so the pandemic has accelerated their demise, whereas other companies have taken advantage of the online and digital world, made more prominent because of Covid-19, and have adapted to the demand created by Covid-19.

Brexit has gone (at last!). Boris Johnson has achieved what he wanted. We shall see where that leaves Britain and the consequences for those of us living in an EU country. We knew that there would be changes; deal or no deal. There will be more paperwork, more checks, more headaches, and less freedom. However, those with the desire to adapt, will. This adaptation should bring security, confidence, and an overall feeling of well-being.

So whether it was Darwin, Mrs Miggins from the cake shop, or the bloke down the tavern, who spoke of adaptation all those years ago, the important thing is to look forward, act responsibly, and ignore all the horrible and, at times, unnecessary press reports and local gossip. Not only will all the negatives affect your mental health but they could also impact your wealth. We are not doctors but we can perhaps help your wealth make you healthier.

Should I transfer my UK Pensions if I’m living in France?

By Philip Oxley

This article is published on: 12th October 2020

I live in France but have pensions in the UK. Should I transfer them to a QROPS, an International SIPP or just leave them where they are?

For British Nationals living in France, perhaps the primary decision to be made in relation to long term financial planning is whether or not to take any action with regards to any pension scheme/s they have in the UK.

To deal at the outset with one question I have seen asked, and increasingly so since the Brexit decision, it is important to state that it is not necessary to move your pension if you move to France. Even after Brexit, you will still have access to your pension funds. Concern that you will lose access to your pension fund is not a good reason to move it!

However, there can be good reasons to consider moving your pension once you have relocated to France. This decision should be made only on the basis of a proper analysis having been conducted on your existing schemes.

As a French resident, the primary options in relation to your pension scheme/s are as follows:

i) Leave them where they are

ii) Move them into a QROPS

iii) Move them into an International SIPP

iv) A combination of the above

Click on the sections below to find out more:

Following a professional review, sometimes our recommendation is to leave your pensions schemes in their existing arrangement in the UK. Reasons for doing this include the following:

- you plan to move back to the UK at some point in the near future

- your pension scheme/s are relatively small in value (e.g. less than £100,000)

- you have a cautious stance in relation to investments, your pension scheme is a Defined Benefit scheme (sometimes known as a Final Salary scheme) and this is your only or primary source of income once you retire

One key drawback to this approach is that you will forever receive your pension in GBP, therefore always be subject to exchange rate risk and currency exchange costs. You only have to speak to someone who already receives their pension in GBP (or even read some of the posts on Facebook on this issue) to see that British Nationals have really felt exchange rate pain in recent years, only receiving €1.10 currently for each £ when once it was closer to €1.40. In addition, there is the time spent researching and using currency exchanges to try to obtain the best rate.

For example, drawing a pension of £10,000 per year and converting to Euro would have yielded approximately the following amounts over the past 15 years:

- €15,000 in January 2007

- €10,500 in December 2008

- €14,250 in July 2015 and

- €11,000 currently

These fluctuations are not helpful in your later years when you need to plan your financial affairs and seek a degree of certainty in relation to your income.

A QROPS has been the go-to product for many expats over the years. To be classified as a QROPS the scheme must meet certain requirements, as defined by Her Majesty’s Revenue & Customs (HMRC). Amongst the key benefits are the following:

- The option to consolidate multiple pensions into one administratively simple but diversified portfolio. Consolidating pension pots into a single structure is a more convenient way of tracking your pension growth and provides a far simpler structure when you start to draw your pension

- The currency of the pension can be chosen, not just at outset, but a change in currency can be made whilst holding the pension. Therefore, if you move your pension into a QROPS in GBP initially, if a point arises in the future when the pound significantly increases in value, part of the fund or the entire fund can be moved into Euro

- A QROPS is a pension which is held outside of the UK; therefore, it provides some protection against future legislative changes that might take place impacting pensions based in the UK. Chancellors of the Exchequer have for many years now seen pensions as an easy target for raising tax revenue

- Moving pensions funds into a QROPS is an action that is known as a Benefit Crystallisation Event (BCE) and your pension will be tested against the UK Lifetime Allowance (LTA) at the time of transfer. Should your pension subsequently grow in value in a QROPS beyond the LTA (currently £1,073,000) there will be no further test or tax to pay. Currently, pensions in excess of the LTA can be taxed at up to 55% in the UK, depending on the type of withdrawal (lump sum or drawdown). Although in some cases, you may be able to enhance the LTA limit with different forms of pension protection

- Tax planning opportunities for your nominated beneficiaries on the event of your death. Currently, if you are over 75 when you die (most of us hope this will be the case) then a tax liability exists for your beneficiaries in relation to UK based pensions. This liability could be greatly reduced and often no tax is payable if certain conditions are met

One disadvantage of some QROPS is the level of fees. Because of the structure of a QROPS requiring an offshore investment platform, EU based trustee (typically Malta-based) and sometimes a Discretionary Fund Manager (DFM), costs can in some cases become prohibitive. However, regardless of pension value, there is scope to control both initial and ongoing charges. With proper planning, cost should not be an obstacle to establishing a QROPS.

A SIPP has some of the advantages of a QROPS in relation to currency flexibility and consolidation, but because it remains a pension structure domiciled in the UK, the tax advantages in relation to the LTA and Death Benefits for heirs do not apply. Also, it remains exposed to any legislative changes made by the UK Government in future budgets.

However, if you plan to move back to the UK or prefer to keep your pension based in the UK, then this is an option that may be suitable.

What I mean by this, is that if you have a good, well-funded Defined Benefit (final salary) scheme and also one or more Defined Contribution (money purchase) pensions schemes, you have the option to move one or more into another structure (e.g. QROPS or International SIPP) and leave some of the schemes in place. For example, you may want to keep the security of a guaranteed pension that a Defined Benefit scheme provides but move your other DC pension schemes into a QROPS or SIPP and secure the benefits that ensue from these structures.

Other considerations

In deciding whether to go ahead and transfer your existing pensions into a different structure, typically the bar should be set at a higher level for a Defined Benefit (final salary) scheme. This type of pension provides a guaranteed income for life, offers some protection from inflation and the risk of funding your retirement does not rest with you (i.e. you are protected from the ups and downs of the stock market).

However, these schemes do lack flexibility and by exchanging the guaranteed annual income from retirement age, you receive instead a cash lump sum (and transfer values have seldom been higher than now) which you can invest and spend how you like with access from age 55 and the ability to pass the full amount onto your beneficiaries (tax-free if you die under the age of 75 and also the potential to be tax-free over the age of 75 if your pension is a QROPS).

Most Defined Benefit schemes only pay half of your pre-commutated pension to your spouse should you die, and usually a minimal amount or nothing to your children if you no longer have a spouse at the time of your death or your spouse who was a beneficiary of your pension subsequently dies. A QROPS for example allows much greater flexibility in relation to the selection of a beneficiary, allowing the funds to pass to any named beneficiary. Also Defined Benefit schemes are not entirely risk free – many are underfunded and some may be unable to meet their obligations (although the Pension Protection Fund exists to provide 90% of the guaranteed income if the scheme becomes insolvent before you reach retirement age, although there are maximum limits of compensation, i.e. £37,315 at age 65. The full amount would be paid if the scheme became insolvent if you were over the scheme retirement age).

There are two primary types of

employment pension schemes in the UK

a) Defined Benefit (or Final Salary)

• Provides guaranteed pension as a proportion of final salary based on i) salary ii) years of service iii) accrual rate (e.g. 1/60th of final salary for each full year of service)

• Payable from Age 65 (if taken earlier penalties apply for each year taken before 65)

• The pension is reduced when taking a lump sum

b) Defined Contribution (or Money Purchase)

• Pension benefits depend on the size of the fund

• Significant flexibility in relation to when to take the pension (currently from Age 55), how much to take and structure used to take the pension (annuity, capped and flexi-access drawdown, UFPLS, Scheme etc.)

• The pension fund size will depend on how and where it has been invested and the performance of those funds

Summary

This is a complex area and it is difficult to cover all relevant details within the parameters of this article. There are other considerations I have not addressed here, and this piece should be considered a high-level overview of some of the factors to consider. Perhaps the best advice I can give is the following:

- Do not just do nothing and leave the pensions where they are because it’s the easiest thing to do

- Do not assume the best option is to move your pension/s offshore into a QROPS just because you live in France and the UK has left the EU

- Act now to have your pension schemes carefully reviewed. Engage with a properly regulated financial adviser and have an analysis conducted as to your options. Only then can you make a well-informed decision about what is best for you and your long-term financial security

A final point to consider is that there is currently a 25% tax applied to pension transfers into a QROPS for British Nationals living outside the EEA. After 31 December 2020, it is possible that this tax will also apply to those living in the EEA (as the UK will no longer be an EU country and the transition period will have expired). This has not yet been confirmed by the UK government but the opportunity to consider a QROPS as a financial planning option may not exist beyond the end of this year. If this is an option you want to explore, I recommend you do this without delay.

How is my UK Pension taxed in Italy?

By Gareth Horsfall

This article is published on: 2nd October 2020

There is nothing like a cold snap to focus the mind and it certainly arrived with a bang this year. In Rome we lost about 20 degrees of temperature in a week. However, I have to confess that I am rather glad that the autumn months are now upon us because the prolonged hot temperatures play havoc with trying to be productive.

In this article, as you will see, there are a number of shorter topics, but ones which I think are relevant for our lives in Italy. During the summer I have been scanning the financial papers and the ‘norme e tributi’ pages of Sole 24 Ore to see what might affect our lives in the future. Fortunately, the Italian government seemed to give us a break this year and I didn’t find much of significant interest. However, a number of other matters have arisen in the last few weeks

UK pensions and tax when living in Italy

Let’s start with one of the more interesting matters that arose during the summer. I was contacted by a client who was enquiring about taking money out of her QROPS pension (a QROPS is a UK pension that has been moved away from the UK but still operates like a UK pension – useful when living abroad!).

I have always advised my clients that any withdrawals from a UK personal pension are taxed at income tax rates in Italy, but over the last few years I have come across a number of clients whose commercialista has been declaring the pension as a ‘previdenza complementare’. This is the Italian equivalent of a UK personal pension. The main reason for choosing this route seemed to be a preferential flat tax rate of 15%. My argument has always been that the 2 structures have fundamentally different characteristics and therefore a UK personal pension should be considered an irrevocable trust, hence withdrawals are subject to income tax. In fact as far back as June 2018 I wrote the following in an article:

In a lot of cases I was informed that the commercialista had contacted the local Agenzia delle Entrate and they had confirmed that this is correct. So, who was I to challenge it? However, I still believed that it was incorrect. Of course, no-one challenged it because it also meant the difference between being paying a 15% flat tax rate on that income or progressive income tax rates starting from 23%.

However, during the summer the client I referred to above contacted her commercialista, who did not accept this definition, but in fact presented an ‘interpello’ issued by the Agenzia delle Entrate (an interpello is basically an ‘opinion’ from the Agenzia delle Entrate on a specific case that is presented to them) from May 2020 regarding a UK personal pension holder.

In the interpello (which you can find HERE – the interesting part starts on page 7) it indicates that a UK personal pension should not be considered a ‘previdenza complementare’, but should actually be subject to progressive tax rates in Italy. This is quite an eye-opener because if this is the case, then it flies against the information gained from various commercialisti.

I should add here that the interpello is merely an indicative judgment in this particular case and is by no means a definitive decision for everyone holding a UK personal pension and resident in Italy. However, the fact that the AdE has gone to the trouble to write this gives us a pretty good idea into their thinking, should they choose to follow it up.

What to do?

So what should you do if your commercialista has advised you to declare your UK personal pension as a ‘previdenza complementare’ and you are now benefitting from the 15% flat tax rate? I would take the interpello to them and ask their opinion based on the new evidence. Or you may choose to do nothing. Whatever your choice or the advice from the commercialista, we are now a little more enlightened into the thoughts of the Agenzia delle Entrate on this topic.

Brexit

It is worth noting here that Brexit is almost upon us and whatever your opinion as to how the UK will exit, a messy unfriendly exit may bring a few matters to light. In particular, the interpello also states that pension funds which ‘could’ be deemed to qualify are those which conduct business cross border and meet the pension rules of both EU states in which they are operating. I don’t know of a UK personal pension provider that does this anyway, but the mere fact that the UK is in the EU may gloss over some of these finer points. But then, what will happen once the UK leaves the EU?

Which leads nicely on to the next problem that Brits are now facing in Italy.

Bank account closures for UK citizens living in the EU

By now, I am sure you have read the headlines saying that a number of UK banks are contacting or have contacted their customers living in the EU to close down their UK banks accounts, potentially leaving them without a UK account. To date the main culprits are the Lloyds banking group, which includes Halifax and the Royal Bank of Scotland, Coutts and Barclays.

I am afraid to say that the rumours are true and I know of a number of people who have been contacted already.

The culprit, of course, is Brexit…

These banks have now had to weigh up the benefits of retaining bank account holders in the EU post Brexit, because once they out of the EU market place they will be forced to adhere to individual EU jurisdictional regulations, as well as UK regulations, if they want to continue to service clients in any EU state. Clearly, for a bank which has no intention of developing business in Italy (in our case), nor does it have a sufficiently large client base in Italy already, then they are going to need to look to close down activities in those jurisdictions to ensure they do not fall foul of the regulators.

It is interesting that, in contrast, HSBC Bank has not decided to pull from its EU markets because it has sufficient activities which take place throughout the EU. I have also heard that Nationwide is also not pulling any activities just yet.

For many clients this is going to be a very tough time, as you could lose a bank account in the UK when you may still have bills being paid, or you simply use it when you are in the UK. To make matters worse, because you are no longer a resident in the UK, you can no longer request an account from another UK banking group.

Many of the groups will also offer their international bank account services, of which the majority are based in the Isle of Man. This is not a good idea because the Isle of Man is not in the UK, but is a UK dependant territory and is deemed a fiscal paradise. It is currently on the grey list of ‘could do better’ in global fiscal transparency with the EU. It is anyone’s guess what will happen after the UK leaves the EU, but it is certainly not beyond imagination that the EU will look to impose punitive tax measures for anyone holding accounts in UK offshore jurisdictions. Let’s not forget that it only came off the black list in 2015!

So, without any other options perhaps one of the better solutions is to look at an Italian bank which can provide a GBP account. I have used Fineco for years, and recommend it to many clients. They offer a EUR current account linked to a GBP and USD account and transfers of cash between accounts are made at spot rate, with no fee. It might be a solution, but will be no consolation for losing your UK bank account. Once again, another downside of Brexit for those of us that have chosen to live in the EU.

Why you should never leave more than €100,000 (or currency equivalent) in your bank account

Still on the subject of banking, does the sound of a bad bank sound appealing to you? A bank that is so bad that it can take all the bad from all the other banks and just keep it there and away from us all. It sounds like a great idea in theory.

On the 25th September the EU had a consultation round table event with a number of European bank leaders, asset management groups and government officials to discuss the possibility of creating a European-wide ‘bad bank’ which would take all that bad debt (debt which cannot be paid back for one reason or another) and which is currently sat on the balance sheets of a lot of European banks, particularly Italian ones and other Southern European states. The idea being that this bad debt could be whisked away from the banks, freeing them up from the worry of having to manage this debt and giving them the liberty to start lending once again, supposedly to individuals and businesses which pose a better credit risk and would be more reliable at paying the debt back.

So far so good. I would not argue at this point. It seems like a good idea to help stimulate economies especially after the COVID-19 crisis.

But morally, should we accept this?

This is the argument put forward by a number of EU functionaries who argue that the banks are, once again, getting another bail out at the cost of the taxpayer. You and I.

To remedy this, the ‘Bank recovery and resolution directive’ (BRRD) has proposed that certain parties should also have to meet some of that cost as well as the EU/taxpayer. Those parties have been identified as the shareholders of the bank, holders of the banks bonds and lastly, the one that should interest us all: deposit holders with more than €100,000 or currency equivalent held in any banking group. Does this mean that the EU, to fund the COVID-19 crisis, could make a cash grab on deposit holders with more than €100,000 or currency equivalent in their accounts? At this point it is only a proposal, but I shall be watching this space carefully.

Based on this news, there is probably no better time to look at your financial plans closely, especially if you are holding high levels of cash in any banks around Europe.

NS&I slashes rates!

You might be someone who has been investing in NS&I products in the UK as a diversifier to your other holdings, or maybe just someone who likes to ‘play it safe’ with your money.

National Savings and Investments, NS&I, are backed by the UK government and due to the COVID-19 crisis, the government has now moved to slash rates on all national savings products to the point where you have to ask yourself, ‘are they worth it?’

The rate on the Direct Saver account has been slashed from 1% interest per annum to just 0.15%. Income Bonds, which have for a long time been considered a best buy, have been slashed from 1% interest rate to just 0.01% pa.

Not only that, but the average interest rate on Premium Bonds (with the chance to win the big prize) will fall from 1.4% to just 1% and the amount of prizes issued will be reduced significantly.

If that is not enough, the Bank of England is also toying with the idea of introducing a negative base interest rate. If they apply that to the NS&I products, then you will be effectively paying the government to hold them.

Time to consider alternatives to protect your capital?

Cashback for cashless transactions

Italy has been desperately trying to find ways for the people to start using digital forms of payment instead of cash so that the economy can become more fiscally transparent and they can raise more tax revenue.

By the end of November we will have confirmation on the new push to drive people towards using digital methods of payments in Italy, even for small transactions, such a buying coffee at the bar. The Italian government has come up with an idea to incentivise the drive to digital forms of payment.

Firstly, from next year the maximum spend on contactless forms of payment will rise from €30 to €50.

In addition, they have dreamt up another seemingly difficult to navigate proposal for a refund of expenses paid by card payments. I will have a go at deciphering it here:

1. You will get a 10% reimbursement on expenses paid up to a maximum spend of €3000 per annum (hence a tax refund of max €300 pa).

2. But, to achieve this you must make a minimum of 50 transactions every 6 months (100 every year) and the €3000 is in fact split into a spend of a maximum of €1500 every 6 months. The idea being that you can’t just go and spend on something costing €1500 every 6 months or a series of high value items to reach the limit.

To receive the refund you will need to register on the app and enter your codice fiscale, and your debit/credit card details.

3. Not only are they offering cash back on transactions but they are discussing a ‘super cashback’ prize of €3000 for the first 100,000 people who reach the maximum number of digital transactions in a year, within the limits provided above.

Certainly food for thought. Watch out for confirmation of these offers sometime before the end of November and then start registering to get your cashback. In theory it should be easy, but based on previous experience of Italian government initiatives I fear it may turn out to be more complicated than first glance.

I hoped you have enjoyed this ‘return to normality’ article. I will be sending out more information in the coming weeks and months to keep you up to speed with the goings on in the financial world and how that might impact our lives in Italy.

If any information from this article has interested you and you would like to get in contact, you can reach me on gareth.horsfall@spectrum-ifa.com or on cell phone 333 649 2356 by call, sms or whatsapp.

Tax break for pensioners moving to Italy

By Andrew Lawford

This article is published on: 14th August 2020

Anyone like the sound of living in Italy and paying only 7% tax?

Generally speaking, if you are contemplating the move to Italy you will be thinking about many things, but saving on your tax probably isn’t one of them. So let me give you a nice surprise: if you are in the happy situation of being a pensioner considering moving to Italy, 7% tax on your income is possible, subject to a few rules, for the first 10 years of your residency in the bel paese.

This all came about in 2019’s budget and had the aim of encouraging people to move to underpopulated areas of Italy. Initially, the rules were that you had to take up residency in a town with fewer than 20,000 inhabitants in one of the following regions: Abruzzo, Basilicata, Calabria, Campania, Molise, Puglia, Sardinia or Sicily. Subsequently, the criteria were extended to include towns in the regions of Lazio, Le Marche and Umbria that had suffered earthquake damage and which have fewer than 3,000 inhabitants.

Of course, being Italy, something had to be difficult in all of this, and indeed the law makes reference not to a list of towns but instead tells you to look at ISTAT data (ISTAT is the Italian statistical institute) for the population levels on 1st January in the year prior to when you first exercise the option.

Given the difficulty in finding out exactly which towns would be covered by this rule, I delved into the ISTAT data and also dug out the relevant references to earthquake-struck towns with fewer than 3,000 inhabitants in the other regions mentioned above. I have put all of this in an Excel file which gives a list of towns eligible for the

pensioners’ tax break in Italy divided by region and then further by province, so that you have a rough geographical guide as to the areas you could consider moving to Italy.

As I was sifting through the ISTAT data it suddenly dawned on me that if the cut-off is 20,000 inhabitants, then almost the whole of Southern Italy is eligible for this 7% regime, and you can include in that some truly delightful places such as Vieste in the Gargano (Puglia), or even the island of Pantelleria. This is possible because Italy is divided up into municipal areas that sometimes have more feline than human inhabitants. Obviously, if you are looking for raucous nightlife then you are likely to be disappointed by what is on offer, but if, on the other hand, you like the idea of not having too many people around, then you could do worse than the town of Castelverrino in Molise (population 102) or Carapelle Calvisio in Abruzzo (population 85). Perhaps one day you could even become mayor.

Flat Tax Regime

This new flat-tax regime comes amid a move by a number of European countries to attract pensioners to their shores. Portugal offered a period of exemption on income tax for foreigners (the benefits of which they are now reducing) and Greece has recently announced the intention to offer a 7% flat tax on foreign-source income for pensioners (I wonder where they got that idea from?), which is also promised for 10 years. There is some discussion about the fact that the EU is not generally well-disposed towards these preferential tax regimes, which could lead to them being phased out in a relatively short period of time – so for those looking to make the most of them, time could truly be of the essence.

The great thing is that the 7% rule applies not only to your pension income, but can be applied across the board to any foreign-source income and there is also a substantial reduction in the complexity of the tax declarations that must be made. There are further tax-planning opportunities in all of this, because much will depend on whether you are planning on being a short-term or long-term resident of Italy.

As always, the devil is in the detail as far as tax and residency planning is concerned, and the year of transition when you first establish residency in Italy is key to setting yourself up in the most efficient manner.

So if the above sounds interesting, please get in touch and I would be happy to send you the list of eligible towns and discuss how the rules of the regime apply to your situation.

UK State Pension & Voluntary Contributions

By Paul Roberts

This article is published on: 24th July 2020

This guide is compiled to help you find out more about your UK state pension entitlement and explain how you can top-up your entitlement by making voluntary contributions.

Most of the leg-work can be done on-line using the HMRC sites.

The sites are a joy to navigate, so don’t be fearful! Let’s go.

• To get some general information about UK state pension entitlement / the amounts you will receive and how to claim it etc, click onto the following link;

https://www.gov.uk/new-state-pension

• To check when you will be entitled to receive your UK state pension, click onto the following link;

https://www.gov.uk/state-pension-age

• To check how much UK state pension you will get , you need to click onto the following link, https://www.tax.service.gov.uk/check-your-state-pension but before you can get onto that link; you need to open up a “government gateway account” by clicking on this link and following the instructions;

https://www.access.service.gov.uk/registration/email

….and to set up the government gateway above you will need your National insurance number, your mobile phone and your passport to hand. It is a straightforward process. Once you are set-up you will be given a password, a user ID which in conjunction with an access number, given via your mobile phone, allows you to access your HMRC data and check your state pension entitlements by clicking onto;

https://www.tax.service.gov.uk/check-your-state-pension

• If you can’t remember what your National Insurance Number is then click on the following link;

https://www.gov.uk/lost-national-insurance-number

Your UK Pension entitlement depends on how many years of national contributions you have made

To see the exact number of years that you have contributed, click here;

https://www.gov.uk/check-national-insurance-record

If you want to investigate how to fill in the gaps by making voluntary national contributions (and this is the interesting bit) then click onto the following link;

https://www.gov.uk/voluntary-national-insurance-contributions/who-can-pay-voluntary-contributions

You can make top up by paying Class 2 NIC’s very inexpensively; provided you meet the conditions:

If you scroll down on https://www.gov.uk/voluntary-national-insurance-contributions/who-can-pay-voluntary-contributions – to living and working abroad you will see the following information;

If you qualify, this is the one to go for:

You can check out the following (excellent) site for a well written account of what you might get and who might be entitled to get it.

https://www.healthplanspain.com/blog/expat-tips/318-paying-uk-national-insurance-when-living-in-spain.html

To pay Class 2 NIC’s go to the following link and click on PAY NOW and follow the instructions

https://www.gov.uk/pay-class-2-national-insurance

There is a bit of form filling to do but the benefits are well worth the effort, or at least that was very much my case where I was able to backdate my contributions by 7 years at a cost of around 1000 GBP. These 7 years contributions entitle me to around 7/35 of the state pension which is something of the order of 175 GBP a week from the age of 66 in my case. If one assumes that I get there and live to be an average age, then I’ll pass away age 85ish.

So, what will I gain?

Investment 1000 GBP. Average benefits 7/35 x 175 GBP x (85-66) x52= 34,580 GBP. Wow! And that is all indexed linked. AND, apart from backdating you can set up an annual payment and keep making contributions easily and automatically by direct debit. All well worth looking at .

Good luck with it all and let me know how you get on.

Moving to Spain & UK pension contributions

By John Hayward

This article is published on: 29th May 2020

I am moving to Spain and I want to make UK personal pension contributions

Is this permitted and what are the restrictions?

Will I still receive tax relief?

Providing that you are a relevant UK individual (definitions below) then you can continue pension contributions for up to 5 full tax years after the tax year you leave the UK. This means that, even if you have no UK earnings once you leave the UK, you can continue to pay up to £2,880 a year (currently), with a gross pension credit of £3,600, for 5 full tax years after leaving the UK. There are more details on how you qualify to make contributions in the text below taken from HMRC’s Pensions Tax Manual. Importantly, any contributions must be made to a plan taken out prior to leaving the UK. In other words, you cannot open a new UK pension plan having left the UK.

We have solutions for people who have left the UK but continue to work and wish to fund a retirement plan. We also help clients position their existing pension funds in the most tax efficient way, creating flexibility whilst providing access to investment experts to maximise the benefits you will receive.

Relevant UK individuals and active members*

Section 189 Finance Act 2004

An individual is a relevant UK individual for a tax year if they:

- have relevant UK earnings chargeable to income tax for that tax year,

- are resident in the United Kingdom at some time during that tax year,

- were resident in the UK at some time during the five tax years immediately before the tax year in question and they were also resident in the UK when they joined the pension scheme, or

- have for that tax year general earnings from overseas Crown employment subject to UK tax (as defined by section 28 of the Income Tax (Earnings and Pensions) Act 2003), or

- is the spouse or civil partner of an individual who has for the tax year general earnings from overseas Crown employment subject to UK tax (as defined by section 28 of the Income Tax (Earnings and Pensions) Act 2003)

Relevant UK earnings are explained under Earnings that attract tax relief in the above tax manual.

Members who move overseas

An individual who is a member of a registered pension scheme and is no longer resident in the UK is a relevant UK individual for a tax year if they were resident in the UK both:

- at some time during the five tax years before that year

- when the individual became a member of the pension scheme

These individuals may also qualify for tax relief on contributions up to the ‘basic amount’ of £3,600.

*Source UK government

To find out if you qualify and an explanation of all your pension options, including pension transfers, SIPPs, QROPS, and income drawdown, tax treatment of pensions in Spain, and to find out how you could make more from your money, protecting your income streams against inflation and low interest rates, or for any other financial and tax planning information, contact me today at john.hayward@spectrum-ifa.com or call or WhatsApp (+34) 618 204 731.

State Pension Benefits

By John Lansley

This article is published on: 22nd May 2020

If you have moved from one country to another, while it may be comparatively easy to obtain tax advice in order to help you plan your finances, it can be very difficult to find out how your State Retirement Pension will be affected, and this has become more uncertain as a result of Brexit. This article aims to shed some light on the issue

This article aims to shed some light on the issue.

I retired in the UK and moved abroad

Let’s start with something easy – if you have already retired and moved to Spain, France or another EU country, the chances are your only State Pension will be from the UK. With Brexit in mind, as long as you were legally resident in your new home country by the end of 2020, nothing will change, and you will be entitled to the annual pension uplift indefinitely.

Coupled to this is your entitlement to healthcare, in that you will have a form S1 from the UK, which ensures you benefit from full care on an ongoing basis, and which in effect will be paid for by the UK Government.

If you have already left the UK but have not yet reached formal retirement age, as long as you were ‘legal’ in your adopted home before the end of 2020, you will receive the UK State Pension at retirement age and qualify for annual increases. You will also be entitled to a form S1.

Note that, if you have not regularised your situation in your adopted home by the end of 2020, the situation is uncertain, to say the least. You will be entitled to claim the UK State Pension when you reach retirement age, but the uplifts are only due for 3 years and, most importantly, form S1 will not be available.

I left the UK 5 years ago at the age of 55 and have been self-employed in Spain for the last 5 years

Have you been making voluntary contributions to the UK scheme? Are you making contributions in Spain? If you haven’t already done so, obtain a pension forecast from HMRC – use the gov.uk website, sign up for the Government Gateway access service, and check your National Insurance Contribution records, as well as your UK tax records. You’ll have to apply to contribute, using form CF83 attached to the booklet NI38, Social Security Abroad.

You will then be told what pension you can expect at your retirement age, and you can also see how many incomplete contribution years you have. It is generally good advice to continue to make voluntary contributions after leaving the UK (currently £795.60pa), but if you are currently self-employed, you will only have to pay at the Class 2 rate, which is £158.60pa for the current year.

You’ll receive details of how to make up the shortfall, by bank transfer or cheque for past years, and by direct debit for the future if you wish to see payments taken automatically. Importantly, you can also call to obtain advice concerning whether it would be worthwhile doing this, and how additional payments will increase your pension entitlement – it might take a while to get through, especially due to the current Coronavirus lockdown, as it appears they are only dealing with those on the point of retiring, but you should find the staff helpful when you do.

Also, make sure you understand what your Spanish contributions entitle you to and try to obtain a projection of your future pension in Spain. This might prove difficult at present, with offices closed or providing limited services.

Having worked in the UK, Italy and now in Spain, I want to claim my State Pension

The first thing to understand is that you should retire formally in the country you are currently living in, unless you haven’t made any pension

contributions there – in which case you apply to the last country in which you contributed.

So, in this case, you approach the Spanish authorities and will have to provide details of all your employment and self-employment history. Spain will then check with each country concerned (the EU-wide scheme ensures this is possible – work history outside the EU means you may have to apply individually to those countries) and will calculate your entitlement. (But bear in mind that Brexit may have had an impact on this in practice, even though the scheme should not be affected – very much ‘work in progress’).

They will do this by adding together the contribution years of each country and then applying this to their own pension rules. This means that, even if you don’t have the minimum number of years’ contributions in one country, the chances are that the contribution years in other countries will ensure you get a pro rata pension. Don’t forget, official retirement age can vary in different countries, and some state pensions are more generous than others.

Each country will then pay their share directly to you, and if you have continued paying into the UK system it’s likely you’ll end up with a much higher pension than might otherwise have been the case.

How is healthcare affected? Any other issues?

The good news is that receiving your pension locally will mean that your access to the local healthcare system comes with it – no need for a form S1. So, any attempts by the UK to remove themselves from the S1 scheme will not affect you.

Note that, although the UK state pension is paid regardless of your other income, the state pension in Spain is not, in that if you wish to continue to work, Spain will not pay anything to you.

Other financial planning tips?

Despite the UK government’s attempts to water down the ability to ‘export’ your UK private pensions using the QROPS arrangements, this is still possible – but perhaps won’t be for much longer. So, obtain advice about whether such a move would be beneficial, as soon as possible.

Any savings or capital you have should be invested tax-efficiently and with the aim of protecting it against both inflation and exchange rate fluctuations. Stock markets can fluctuate too, sometimes dramatically as we have seen, so be careful you understand the amount of risk your investments are exposed to, and seek help from a suitably qualified professional who will be able to help you over the long term.

How much do I need for a comfortable retirement?

By Chris Webb

This article is published on: 18th March 2020

How much money will I need in retirement?

This is one of the most common questions I hear as a Financial Adviser in Madrid, Spain.

The answer to that question differs from person to person and the numbers I discuss with my clients vary massively. To some, having a quiet retirement with little requirements is the goal; others will want to continue playing golf and attend social events weekly. There is a huge difference in what you will need in your pocket with these different scenarios.

So, what do the experts think?

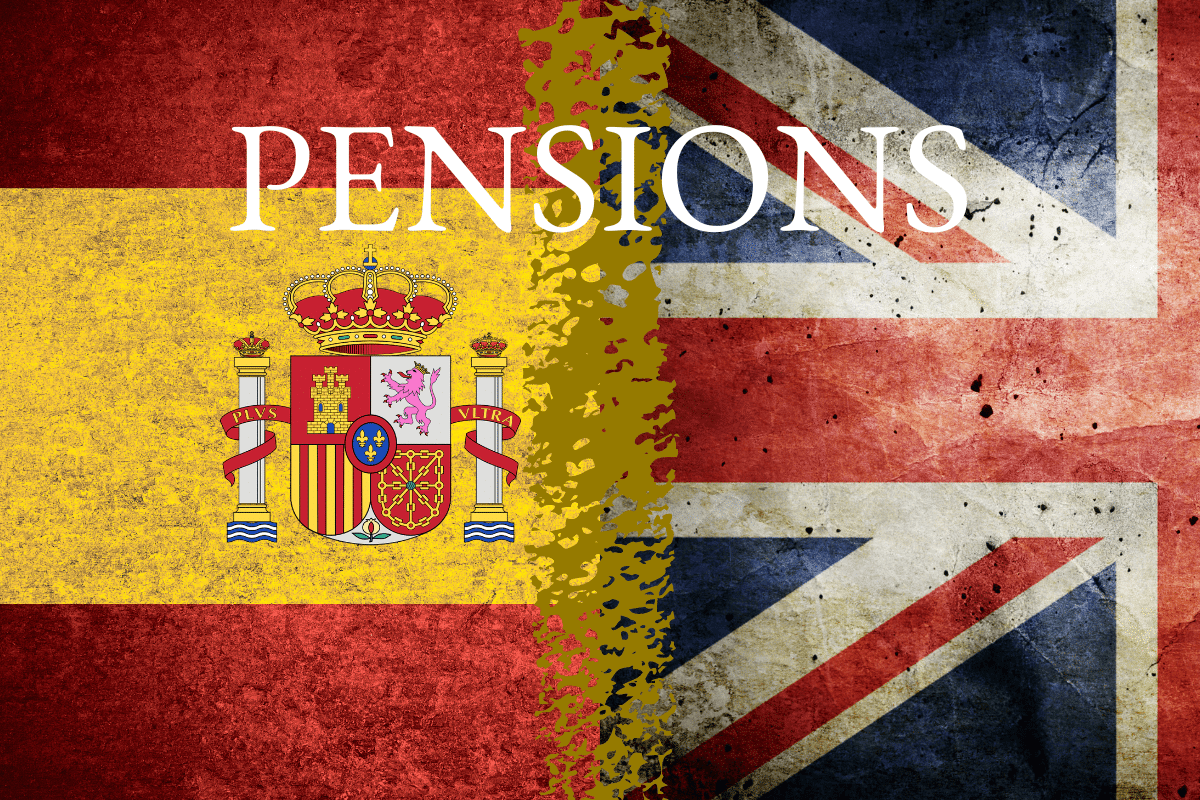

Researchers have calculated how much money a person needs per year in order to enjoy a comfortable retirement. The numbers were calculated by Loughborough’s Centre for Research in Social Policy (CRSP), The Pensions & Lifetime Savings Association (PLSA) and Retirement Living Standards (RLS). A report from Loughborough University and the Pensions and Lifetime Savings Association aims to help people understand how much they will need for a minimum, moderate or comfortable quality of life once they retire.

In the UK a full state pension comes in at just over £8,500, but it’s the other savings you accrue over your working life that will make the difference in people’s post-work years.

Experts found that a single person will need about £10,200 a year to achieve the minimum living standard, £20,200 a year for moderate living standards and £33,000 a year for comfortable living standards. For couples, the minimum standard came in at £15,700, moderate was £29,100 and comfortable worked out as £47,500. The results are based on consultations with members of the public and consider what is needed in retirement for home DIY and maintenance, household and personal goods, holidays, food, transport, clothing and social engagements.

The new Retirement Living Standards describe three different standards of living with associated costs for each – all established by what the public considers realistic and relevant expectations. Associated costs are made up of household bills, food and drink, transport, holidays and leisure, clothing and personal and helping others. The standards cover a range of goods and services that are relevant to most people. These and other costs, such as tax on pension income, may need to be added depending on individual circumstances.

A series of profiles and infographics have been created on the PLSA website to help people calculate their own finances. The research for the Retirement Living Standards was adapted from the approach used to produce the Minimum Income Standard – a calculation of what the public thinks is an acceptable minimum standard of living. The data was gathered through 26 group discussions with around 250 members of the public already retired or approaching retirement, from a wide range of backgrounds. Expert views were taken into account for some areas, such as transport, energy usage and food costs.

The discussions set the parameters for how higher living standards should be described and defined. Through these discussions, three retirement living standards were agreed: minimum, moderate and comfortable.

The standards:

At a cost of £10,200 per year for a single person and £15,700 for a couple, the minimum lifestyle covers all your needs plus enough for some fun – including social participation and social occasions.

The moderate lifestyle (£20,200 a year for singles and £29,100 for couples) provides, in addition to the minimum lifestyle, more financial security and more flexibility.

At the comfortable level (£33,000 a year for singles and £47,500 for couples), retirees could enjoy some luxuries like regular beauty treatments, theatre trips and three weeks in Europe a year.

*Table from https://www.retirementlivingstandards.org.uk/

Breaking down the RLS:

House: Household utility bills, decorating and maintenance, furniture, cleaning supplies, lightbulbs, cooking utensils, appliances (e.g. fridge, washing machine), garden supplies, towels, bedding, gardener/cleaner/window cleaner & funeral plan.

Food and Drink: Household food shopping, eating out, beer & wine.

Transport: Car running costs, railcard/train travel & taxis.

Holidays and Leisure: TV, DVD player, laptop, printer, speakers, CDs, stationery supplies, TV license and subscriptions, internet, activities & holidays.

Clothing and Personal: Clothing, footwear, cosmetics, toothbrush, toothpaste, shaving supplies, hair styling, beauty treatments, dentist, opticians, podiatry & minor first aid supplies.

Helping Others: Gifts, helping others (if applicable) & charitable donations

Planning early is key to getting your retirement plans in order. You can look up another of my articles here on this subject titled “It Is Never Too Early”

Don’t delay your financial plans. For planning, yesterday is better than today, which is better than tomorrow. Contact me, Chris webb on 639 118 185 or chris.webb@spectrum-ifa.com if you want to discuss your own circumstances.

Sources:

Loughborough’s Centre for Research in Social Policy (CRSP).

Pensions and Lifetime Savings Association (PLSA)

Retirement Living Standards (RLS)

Being prepared for BREXIT in France

By Katriona Murray-Platon

This article is published on: 11th March 2020

On 31st January 2020, the UK left the EU. However, the real effects of Brexit, for those of us living in France, will not properly be felt until after the 31st December 2020 (what an interesting New Year’s Eve that will be!) and thereafter. Hopefully, by that time we will have a clearer idea of what our rights and responsibilities are. Until then there will still be much speculation and media noise, which may be just as confusing as it has been over the past four years.

One thing Brexit has established, from the very beginning, is that British citizens living in France, or planning to settle in France, need to get their affairs in order and decide where they would like to live for the foreseeable future. As British citizens we can always return to the UK if we so choose, but if we want to continue to live in France we must show that we have lived here continuously for the last five years or that we intend to continue living here in future.

The next few months are going to be very interesting and it is more than ever important for British citizens to consider some important financial changes.

Pensions after Brexit

In 2006, the UK introduced a law making it possible for UK private pension benefits to be transferred to a Qualifying Recognised Overseas Pension Scheme (QROPS), provided that the overseas scheme meets certain qualifying conditions.

For those pensions that can be transferred there are many benefits including:

- No obligation to purchase an insurance company annuity, at any time

- The potential to pass on the member’s remaining pension assets to nominated beneficiaries on death with minimal or no death duty payable. By comparison, currently a tax charge at the beneficiary’s marginal rate can be applied in the UK, where the member is over age 75 at death

- A wider choice of acceptable investments offered, compared to UK pension plans

- The underlying investments and income payments can be denominated in a choice of currencies, which can potentially reduce exchange rate risk

- Potential to receive a larger amount of Pension Commencement Lump Sum compared to UK schemes

- Depending upon the jurisdiction where the QROPS is set up, income payments may be made without the deduction of local taxes, meaning that income will only be taxed in accordance with the law of the jurisdiction where the member is resident

In 2017 the UK government announced its intention to introduce a new 25% Overseas Transfer Charge (OTC) on QROPS transfers taking place on or after 9th March 2017. This charge does not, however, apply where the QROPS is in the European Union (EU) or EEA and the member is also resident in an EU or EEA country (not necessarily the same EU or EEA country) and remains EU or EEA resident for the next five full UK tax years.

Many of those who work in the industry believe that after the transition period, it may no longer be possible for British citizens to transfer their pensions into an EU QROPS without incurring the 25% charge.

QROPS may not be suitable for everyone and much will depend upon the nature of the UK pension benefits being considered for transfer, as well as the person’s attitude to investment risk. Transferring a pension to a QROPS is not a decision that should be taken lightly nor in haste and proper financial advice with an experienced adviser is essential. Even when the decision has been made to transfer the pension it may take a good few months to complete, which is why, if you are even considering this possibility, it is important to contact a local adviser to explore what your options are.

Taxes after Brexit

As tax between the UK and France is determined by the Double Tax Treaty, this will not be affected by the fact that the UK has left the EU. However, whilst not directly taxed, a lot of UK income, such as UK rental income, is added to the taxable base and increases the tax margin of the French taxpayer. If you intend to live in France, you may want to consider whether it is really in your interest to hold onto UK assets.

It is possible to protect your capital investments in France and ensure that they can grow in a tax efficient environment by way of an Assurance Vie policy. French Assurance Vies or French approved foreign Assurance Vies offer valuable benefits when it comes to income tax, inheritance tax and estate planning. Foreign portfolios and bonds are not treated as Assurance Vies and any gain is subject to tax and social charges irrespective of whether this income is taken or whether it is brought into France. If you are French tax resident, you are taxable on your worldwide income in France. Proving that you are French tax resident will be an important factor for establishing the Right to Remain in France.

Being resident in France does not necessarily mean that all your assets have to be in France or have to be in euros. There are many opportunities for holding sterling based diversified portfolios in a tax efficient manner.

For anyone intending to live in France for the foreseeable future, be aware that today’s valuable financial planning opportunities are unlikely to remain beyond the short term (31st December 2020 could be an important date in this respect). Contact me, Katriona Murray, and I will be happy to arrange a meeting.