I recently attended the FEIFA Annual Adviser Conference in London and wanted to share a brief summary of the latest market insights, along with how advisers are continuing to evolve their approach to best serve clients in today’s environment.

FEIFA Annual Adviser Conference

By Peter Brooke

This article is published on: 30th May 2025

The Federation of European Independent Financial Advisers (FEIFA) – not to be confused with the football governing body! – was founded 16 years ago by a group of experienced IFA firms across Europe. They saw the need for an organisation that could uphold professional standards and represent the interests of advisers and their clients with both industry bodies and regulators across the continent. Spectrum is proud to be one of the original founding members, and we continue to support and build on those standards through our ongoing involvement.

The annual conference brings together FEIFA members and leading industry voices to discuss the unique challenges of advising cross-border clients. As Head of the Spectrum Investment Committee, it remains a valuable and important event in my calendar.

Staying the Course Through Market Volatility

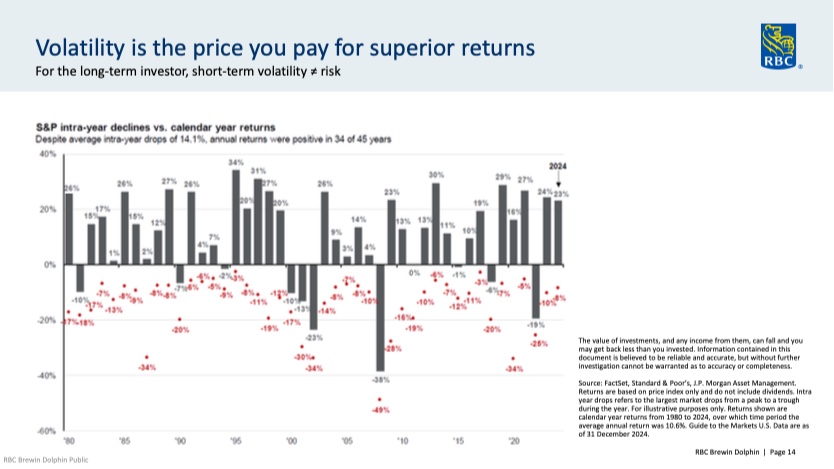

Richard Flood (RBC Brewin Dolphin) reminded us that global events—whether pandemics, wars, or political wrangling —are a constant. Despite this, markets rise over time. The key is to focus on long-term fundamentals rather than react to short-term noise.

Volatility, he stressed, is a normal part of investing and “the price you pay for superior returns.”

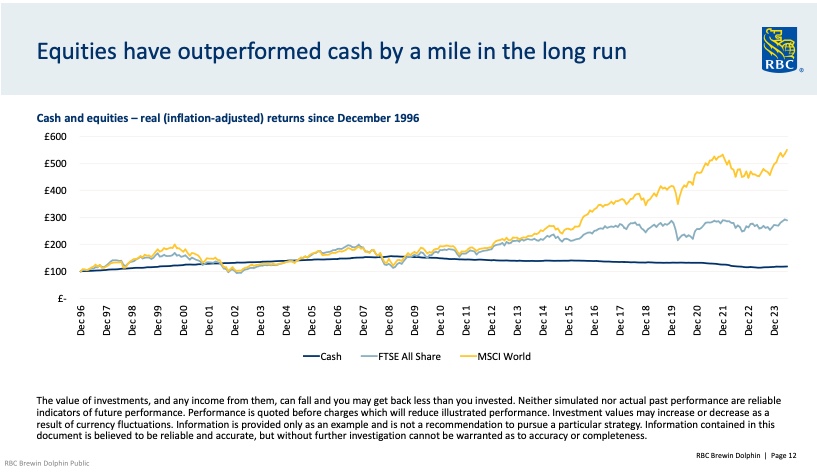

Avoiding volatility by sitting in cash is not a good idea either as Inflation diminishes the purchasing power of cash – as illustrated in this Equities v’s Cash ‘inflation adjusted’ performance chart.

Navigating an Uncertain 2025

David Coombs (Rathbones) highlighted the ongoing impact of geopolitical events like Trump’s executive orders and Tariffs on trade and compared them to other countries ‘protectionist policies’ like unbalanced tax rates (eg Ireland), agricultural subsidies (eg France).

He also stressed the unconsidered challenges that passive investments (eg ETFs) pose to market stability due to being “forced sellers & and forced buyers” therefore adding to volatility.

Active management, in his view, remains vital, especially in 2025, and he shared a wonderful example of how active he has been in the last year:

The below chart is the Shopify share price, a share he has held for some time, the red dots are where he sold some shares (trimmed) and the yellow dots are where he added money – this shows that active management is much more than strategically choosing which companies to own or not own, but how to add value through tactical decisions.

The Passive Investing Paradox

Henry Wilson (LGT Wealth Management) discussed the risks of over-reliance on passive funds, including the concentration risk in a few large companies (eg MAG 7). Because of this concentration of returns (and risk) to fewer, larger companies he believes that true diversification is under threat, valuations are higher, future returns are compromised…

… BUT as Harry Markowitz, the architect of Modern Portfolio Theory & Efficient Frontier said “Diversification is the only free lunch to investing”.

Therefore while passive investing remains a useful tool, LGT and Spectrum advocate for highly diversified, actively managed portfolios to help manage risk and improve long-term returns.

If you are going to own passive investments you have to be active with them.

Model Portfolios & Adviser Alpha

Matthew Lamb (Pacific Asset Management) explored the evolution of model portfolios and the increasing role of technology. With many portfolios becoming similar, the real value lies in the advice given—not just the investments chosen.

This fits strongly with my recent newsletter about risk (click here) – If most ‘Balanced’ portfolios are similar to each other and most ‘Growth’ portfolios are similar to each other then the outcome for you, as my client, is not in picking between two balanced funds or two growth funds… it’s ensuring we choose correctly between Balanced or Growth in the first place!!

Good risk profiling conversations make sure we start in the right place.

Planning for the Summer

After almost 13 years, we’re finally heading to Australia for a long-overdue family holiday. We’ll be visiting my wife’s side of the family, who all live in Queensland. She’s been able to make a few trips in that time, but between school schedules, travel costs and a global pandemic, the children and I haven’t been back since 2013. We’ll be away for five weeks from the end of June and are really looking forward to the trip.

I’ll still be checking emails and messages periodically, but if you’d like to catch up — whether by phone, Zoom or in person before we go — please do get in touch or book something in the calendar before Friday 27th June.

All being well, I’ll be back at my desk (with a fair dose of jet lag) on Wednesday 6th August.

Lions V’s Australia

Of course, seeing family and friends is the main priority — but I’d be lying if I said there wasn’t something else I’m particularly excited about.

As a lifelong rugby fan, getting the chance to see the British & Irish Lions take on Australia in both the 1st and 3rd Test Matches — plus the Queensland Reds in early July — is nothing short of a bucket list experience for me.

As always, if there’s anything you’d like to go over before I head off, just let me know. And if anything comes up while I’m away, I’ll do my best to ensure it’s handled smoothly.

Contact me if you have any questions via the below channels, or the booking system – always drop me a quick message if you need a time slot outside of those available.

Mobile & Whatsapp: +33 6 87 13 68 71

Email: peter.brooke@spectrum-ifa.com

Calendly booking system: https://calendly.com/peterbrooke/30min