Before I get into things I thought I would share a picture of my olive oil container (fusto), all 50 ltrs of it! The raccolta, which I did at the start of October with the help of some locals, produced approx 150 ltrs of oil, of which we split 3 ways.

Finance in Italy – November 2024

By Gareth Horsfall

This article is published on: 1st December 2024

It seemed only fair given I had no equipment and had no idea what I was doing and this will easily cover our annual consumption and maybe some gifts to friends and family. What a great experience though!

Next year I will get more organised and see what I can arrange. The olive oil may be virgin but my virgin olive oil raccolta days are now finally over! I am now starting to really earn that Italian citizenship!

On the property front we are finally getting to the end of the things to be done….at least for now.

After a disastrous first kitchen fitting we had to order another one and will receive that in the coming weeks. We have been cooking and eating in an out house for the last 4 months, but as the colder weather is now settling in it’s becoming more difficult to say the least!!

All the other little bits, which take time and effort, are getting completed meanwhile I am still loving the surroundings, olive trees and watching autumn turn to winter and the changing landscape. I am also finding that on our ‘terreno’ we have a whole load of wild plant foods growing: cicoria, wild finocchio, asparagus, and numerous other edible plants.

I would never have known if it wasn’t for the ex-owner who came around and pointed them all out and advised to do some foraging rather than keeping the grass short everywhere. I will see how that pans out, but it could be interesting and I am keen to try and use the land rather than just curate it (mainly because cutting grass every 2 weeks is hard work) and so I have lots more to learn. A fresh organic larder on the ‘terreno’ might just be the thing; in the areas that I have let grow wild to date the insects and birds seem to be having a ball anyway and some interesting wild orchid type plants have popped up as well.

Anyway, moving swiftly onto financial matters because I imagine you are more interested in that than my explorations of country life…

I refrained from writing an E.zine directly after the US election because everyone seems to have their own opinion of Donald Trump so it matters not what I think. In the end what does matters, for our purposes, are the financial markets and how they react to such events.

If you hadn’t noticed the immediate reaction was very healthy indeed and stock markets rose on the back of the news. Trump is a self confessed businessman after all !!

I saw him doing an interview the other day in which he said that he had spoken to lots of business people since his last time in the Oval Office and had asked what was more beneficial for them: reducing taxes or reducing regulation and bureaucracy. He explained that every one of them said that reducing over-burdensome regulation and bureaucracy was more important by far. So, it might be reasonable to assume that should he be able to follow through with this aim that he can provide a healthy landscape for US companies to flourish.

Certainly the indicators are good! He also has his Department of Government Efficiency head – Mr Elon Musk, rationalising the US government agencies so that should be something interesting to watch if his firing of employees when he took over Twitter is anything to go by.

I myself can confirm that over-burdensome regulation affects our business tremendously these days; there seems to be more and more paperwork than ever before, and much of it could be eliminated or reduced significantly. However, I don’t see that happening any time soon especially from the direction of EU, who set the rules, so we will continue to deal with it. Tech now plays an important part for us in gathering and dealing with client information and it saves you and I a lot of time.

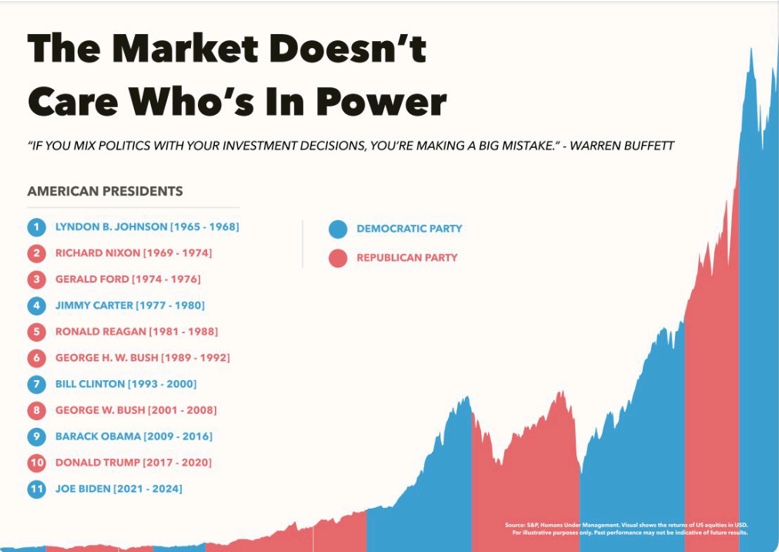

But regardless of all of this, we have to consider how financial markets will continue to react and, at the time of the election someone shared on LinkedIn a graph which I will share with you below:

As you can see, the stock market doesn’t care who is in power, we can all have our own views on Donald Trump and his effect on the world, but in the end it doesn’t matter one tiny bit; but there are 2 takeaways from this graph:

1. The market rises over time

2. In every period there is market volatility and there will be moving forward.

The stock market may have risen since the election and Bitcoin is equally flying, but be under no illusion, at some point markets will correct.

The best thing to do is be invested in solid companies and diversify your portfolio. Match it to your risk profile and decide how much of those ups and downs you can stomach. Patience will take care of the rest for you.

Your financial enemy is not Donald Trump nor anyone who will come after it is simply inflation! The rise in the cost of goods and services over time. Keep your eye on that and not on the daily swings in markets.

On the subject of inflation, it continues its rise – I can’t believe how much things cost in relation to the new house we bought. I asked for a quote from a local gardening firm to cut a long hedge, which is quite overgrown, and when I got it back my eyes started to water. So, like a good Yorkshire man I went out and bought a chainsaw for €180 and thought I would just do it myself, piano piano. In the process I saved myself a whole load of money! Equally, the daily rate for builders, electricians, plumbers etc is now so high! Obviously their cost of work has increased and that is being passed onto us.

Crypto Investors

Are you an investor in crypto currencies? Well there is some rather alarming news for you moving into 2025, if you are an Italian resident for tax purposes.

From 1st Jan 2025, the capital gains tax rate on crypto currency speculation will increase from the flat standard CGT rate of 26% to a whopping 42%! Not great news for you if you have been investing in crypto and are sat on healthy gains, certainly given the fact that Bitcoin has risen significantly over the last few months, effectively doubling in price.

One way to mitigate the higher tax rate on your historic gains might be to cash out before the end of the year and pay your 26% on historic gains in next years tax return. At the same time you can buy back in and in that way you reset the clock on the purchase price, to the new amount. Clearly this means paying 26% CGT on your gains to date, but if significant then it could be worth it. From there on in it will be 42% on realised gains.

Checking your Italian tax return – it might save you money!

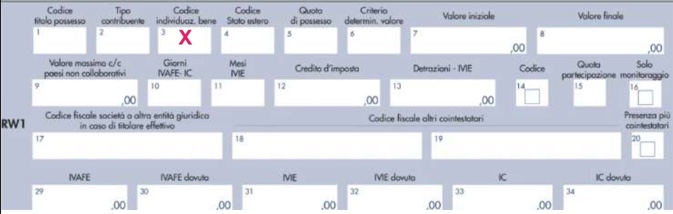

One of the things I help my clients with these days is taking a look at their tax returns and making sure that the section Quadro RW ( declaration of overseas assets) is prepared correctly.

This year I found a number of incorrect entries from commercialisti and got them corrected, saving some clients thousands in tax. However, to be fair to commercialisti they are often bombarded with information which is in English and on statements which they don’t know how to interpret. It is no wonder they sometimes get it wrong and we can’t expect them to understand non-Italian portfolio or cash transaction statements. However, that’s no excuse and either we or they have to be more attentive.

So, here’s one tip for checking your own Quadro RW.

You will find in that section that there are lots of little boxes, in which various values need to go. In box No.3 you will find the title.

‘codice individuazione bene’

This is nothing other than the number which you (or your commercialista) must select to identify the type of asset that you hold abroad, but clearly it’s not much good if you don’t have the list of identifier numbers. So, here, below, I have included a list of all the different codes:

| CONTI CORRENTI E DEPOSITI ESTERI | 1 |

| PARTECIPAZIONI AL CAPITALE O AL PATRIMONIO DI SOCIETA NON RESIDENTI | 2 |

| OBBLIGAZIONI ESTERE E TITOLI SIMILARI | 3 |

| TITOLI NON RAPPRESENTATIVI DI MERCE E CERTIFICATI DI MASSA EMESSI DA NON RESIDENTI | 4 |

| VALUTE ESTERE DA DEPOSITI E CONTI CORRENTI | 5 |

| TITOLI PUBBLICI ITALIANI EMESSI ALL'ESTERO | 6 |

| CONTRATTI DI NATURA FINANZIARIA STIPULATI CON CONTROPARTI NON RESIDENTI | 7 |

| POLIZZE DI ASSICURAZIONE SULLA VITA E DI CAPITALIZZAZIONE | 8 |

| CONTRATTI DERIVATI E ALTRI RAPPORTI FINANZIARI CONCLUSI AL DI FUORI DEL TERRITORIO DELLO STATO | 9 |

| METALLI PREZIOSI ALLO STATO GREZZO O MONETATO DETENUTI ALL'ESTERO | 10 |

| PARTECIPAZIONI PATRIMONIO DI TRUST, FONDAZIONI O ALIRE ENTITA GIURIDICHE DIVERSE DALLE SOCIETA | 11 |

| FORME DI PREVIDENZA GESTITE DA SOGGETTI ESTERI | 12 |

| ALTRI STRUMENTI FINANZIARI ANCHE DI NATURA NON PARTECIPATIVA | 13 |

| ALIRE ATTIVITA ESTERE DI NATURA FINANZIARIA E VALUTE VIRTUALI | 14 |

| BENI IMMOBILI | 15 |

| BENI MOBILI REGISTRATI (es. yacht e auto di lusso) | 16 |

| OPERE D'ARTE E GIOIELLI | 17 |

| ALTRI BENI PATRIMONIALI | 18 |

| IMMOBILE ESTERO ADIBITO AD ABITAZIONE PRINCIPALE | 19 |

| CONTO DEPOSITO TITOLI ALL’ESTERO | 20 |

Each number relates to the different type of assets you may hold. No 1 being conto correnti e depositi, which is current accounts and deposit accounts. However, be aware that there are different interpretations because National Savings Certificates or money market accounts, for example, will not fall into this category in Italy even though they may seem as though they should based on our interpretation.

A good start is to get a copy of your Unico tax return and check that the numbers are inserted correctly. You can work the figures out as well, but an asset declared incorrectly i.e bank account instead of stock portfolio, could end up costing you!

Remember, that you can down load a copy of your tax return now on the Agenzia delle Entrate website if you have a SPID or the carta d’identità elettronica which you have linked to the app. We have all the tools, so let’s use them or alternatively, just ask me!

On that note, I will leave you with this shorter E-zine. I will be writing about UK Inheritance tax and the very important changes that have occurred in the 30th October budget in my next E-zine. For once some tax changes could be a huge bonus for anyone looking to live in Italy for the rest of their lives and then pass on as much as possible to their heirs. The rules have been changed to make it much more clear on how you can now escape UK inheritance tax. For the likes of us who live in Italy, where from an inheritance tax point of view the country is like a fiscal paradise, we have a clearer path to taking advantage of Italy’s rules rather than the UK, but like almost everything it will require carefully planning and a full understanding of the changes.

I will certainly get that Ezine to you before Xmas !!