In this Ezine I will summarise the discussions and news from our annual event which took place in Monaco this year. However, before I do that I must provide a small apology because about 3 weeks have passed since the event itself.

Financial updates – February 2026 – Italy

By Gareth Horsfall

This article is published on: 20th February 2026

As you may know my newsletters are not AI generated and for this reason they take me a little time to summarise the information, and also find the time to do so. I hope that you appreciate the fact that you are not being sent existing information which has been trawled out of the internet-o-sphere, but rather real, new and original content. (AI was a big story on the conference actually, so I will be touching on this a bit further down).

Before I get on to that, I should mention a few house and land things to keep you updated on our continued transition to rural Italian life.

The first thing to admit is that I seem to have lost the winter race to complete all the jobs I wanted to do before the spring arrived and before plant life sprang back into action. The grass being the main culprit. It seems that although the air temps are still a bit chilly on sunny days, the almond tree is now in full bloom and flower buds are starting to emerge on the fruit trees, notably the apricot tree. They are not fully formed yet but I imagine it won’t be long before they flower. I just hope a random storm doesn’t pass this year at the time of flowering and destroy the flowers again. But the grass is starting its quick growth spell with the extra light during the days and I imagine it will only be a matter of time before it’s knee high again. However, the wild flowers are already starting to grow and they are always a pleasure to see.

I am still on with the potatura of the olive trees as my early morning activity. The land is full of olive tree cuttings at the moment and I am thinking I maybe need to call someone to help clear it up. But, I am still enjoying the task and although I kind of think I don’t really fully know what I am doing, I will just see what happens with the olive oil production this year and take it from there.

And so, other than that its’ business as usual. The world of finance keeps moving forward, or backwards, depending on your point of view, and when you check your portfolio valuation.

Interest rate cuts – Tax cuts – Lower energy costs – Deregulation

One interesting thing that occurred before I went on the conference, in fact just a few days before, was that a handful of people contacted me to say that they wanted to sell out of US based assets because they didn’t like the activities of Donald Trump and the current US administration. My advice at this time was:

We need to separate the political from the investment!

It is always good to be reminded that the US stock market is valued (USD 67-69 trillion) at more than the rest of the worlds stockmarkets cumulatively (USD 55 to 60 trillion). So no matter what we think about the politics in the US at the moment, to exclude ourselves from the US stockmarket would be akin to investment suicide. We can make investment choices based on sustainable and ethical choices (and we offer these services as well for our clients) but some of the best research, technological innovation and new creative thinking comes from the US and so it still retains it’s spot as one of the best, if not THE best places for an investor.

To further explain the importance of the US market, it was explained at the conference, that should just 1% of the total value of the US stockmarket be moved at any one time, it would hardly move the markets in the US at all. That same amount would be the equivalent of the entire German stockmarket (which includes all the big names we know such as Volkswagen, Basf, Siemens, SAP, Mercedes Benz and many more) and would have a tremendous impact on the German stockmarket and in Europe, just to give context on how important the US is for our portfolios.

Saying all this, I appreciate that the Trump administration may still be a little too much to bare for some people, and so here is my summary of what is going on there:

DRIVING THE US DOLLAR LOWER

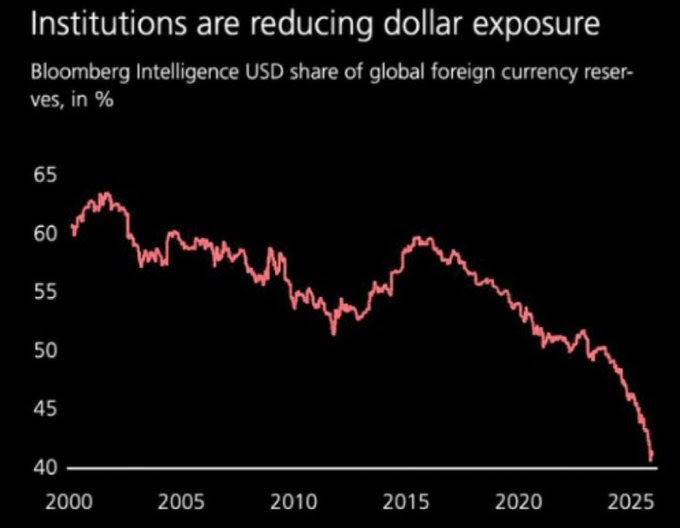

If the U.S. economy is about 30% of global GDP, then should its currency, being that it is the reserve one, account for 35%-40% of global reserves and not 50% or 60%?

It is now pretty evident that the Trump administration is aiming to push the US Dollar lower against other currencies…but why?

The old globalisation game where the US outsourced everything and let China build the factories is effectively over. The idea that cheap imports were free trade and you don’t pay the price for destroying your industrial base is something which needs to be re-addressed as many economists on both the left and right side of politics, agree. To some extent Beijing also started weaponizing supply chains, particularly in rare earths such as lithium, cobalt and graphite, because they have an almost 90% control over these rare earths, both in mining and refining. The Trump administration is aiming to protect US interests and rebuild American industry from the ground up.

Tariffs are back—and they’re not going anywhere. They have largely turned out to be a negotiating stick and strategically aimed at specific goods rather than blanket punishment, to protect US domestic producers and force companies to bring manufacturing back to the US. As DT has said: “if you want access to the world’s largest consumer market, build in the US” Produce there and employ Americans.

A WEAKER DOLLAR IS PART OF THE PLAN

Not a collapse, but more than likely a deliberate, controlled depreciation to make U.S. exports competitive again and make imports more expensive. (2026 may see a further USD decline when the new Fed Chairman Kevin Walsh is put in place, and then it could stabilize)

Cheap foreign goods have flooded the US market (and Europe) for decades because the dollar was probably too strong. A weaker dollar rewards domestic production, boosts manufacturing margins, and will hopefully brings jobs back to places that have been forgotten for years! (If this strategy works then you can be assured that Europe wil adopt the same approach, no matter how much they hate to admit it!)

PROJECT VAULT

This could be one of the most significant decisions made by any US administration for decades. Project Vault is a $12 billion strategic plan to stockpile critical minerals, the equivalent of a Petro Reserve for the AI and defense age. The US is building a preferential trading bloc with price floors, adjustable tariffs, and enforceable rules to crush China’s predatory pricing and market flooding.

The winners will be the ones who control the physical economy—the mines, refineries, smelters and processing plants. Critical minerals and rare earth security.

Without them, nothing modern works. Jet engines. Hypersonic missiles. Wind turbines. Electric motors. Drones. Smartphones. AI data centers. Defense systems. EVs. Nothing.

And here are some examples:

Niobium—an irreplaceable steel strengthener. Adds toughness, corrosion resistance, and high-temperature performance to superalloys

(Brazil controls ~90% of global supply. The U.S. imports 100%. Zero domestic production. One mine in Canada which given the fractious nature of current US / Canada relations, the US considers this a national security nightmare)

Neodymium (Nd) and Praseodymium (Pr)—the magnetic rare earths that power permanent magnets, the strongest magnets ever made.

(Essential for EV traction motors, wind turbine generators, missile guidance, radar, precision-guided munitions, and high-performance robotics)

CHINA CONTROLS CIRCA 90% OF REFINING AND 93% OF MAGNET PRODUCTION AND 60% OF THE REFINED SILVER MARKET.

IF RELATIONS SOUR FURTHER, THEN BEIJING WITH JUST ONE PHONE CALL, COULD PARALYZE WESTERN DEFENSE AND CLEAN ENERGY SUPPLY CHAINS

And so, in a nutshell, that is what the Trump administration would appear to be doing geopolitically. (I won’t mention any US domestic issues that are….well….. questionable).

My hunch is that you will see Europe follow suit. Europe appears to have woken up (c/o D.T) to the fact that it needs to protect itself and can no longer rely on the US Military Industrial Complex. Re-arming Europe seems to be the EU leaders first objective, but if they then see progress with this economically nationalistic kind of behaviour in the US then I would say that they will start to walk a similar path, even though the EU is quite protectionist by nature anyway. It may mean that you need to stock up on TEMU goods now, whilst the prices are still low!

I have probably dedicated more time here to the Trump administration than I had wanted to, but it is clearly on alot of minds and so was worthy of a few lines.

However, on our conference we did discuss other investment matters, which arguably are not quite as important as what is happening in the US administration, but also warrant some time being spent on them.

THE GREENLAND DEBATE

These conferences are always interesting to get perspective on certain matters and the issue of Greenland was brought to light as follows:

From 1951 to 2004 the US had the right to place US bases in Greenland without any permission required.

From 2004 this power was taken away when Greenland gained sovereignty and fell under the supervision of Denmark.

Now, the pre-1951 agreement is being re-negotiated, and although not a ‘free to do what you wish’, the US will certainly have the possibility to expand its military presence. Was the whole ‘buying Greenland fiasco’ just a ruse to restablish this agreement?

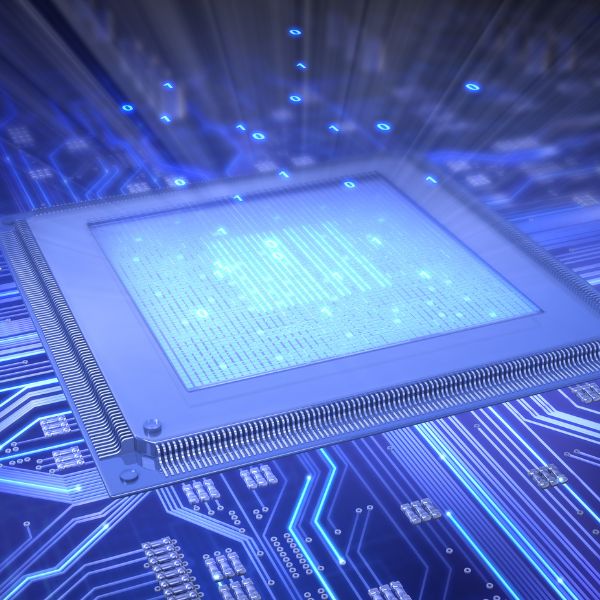

THE AI BUBBLE

At the 2025 conference alot was made of AI and how it would be changing the world, putting people out of work and taking over our world. Just one year on and the view from the asset managers was almost completely the opposite, but also that it is not going anywhere soon.

However, an AI bubble (like the tech bubble of 2000), it would not seem to be. AI is already helping businesses to improve productivity but not by firing staff. There is no evidence of this and the companies running AI models themselves, are already profitable. In addition the Big tech companies are cash rich. It is more likely that AI integration will more of a messy technological shift, than a huge damaging effect and it’s very unlikely that AI stocks will be the cause of a global recession, or mass unemployment no matter what you read online.

Net income from Tech + comms services companies has grown from 23.1% in the year 2000 to 35.3% in 2025

HOWEVER, AI IS NOT LIVING UP TO EXPECTATIONS

A term was used: ‘Crap in – Crap out’.

What is being found is that the AI we know: ChatGPT, Google Gemini etc cannot be relied upon for accurate results.

Search results are based on the data that is out in the internet-o sphere. If that data is flawed then it has no way of knowing how to fact check it and hence it will produce inaccurate results. (In fact caught out ChatGPT on 3 occasions, when I knew its results were incorrect. I now use Google Gemini, which appears to be better). There is also a HUGE amount of internet fraud and scam and the culprits are using the internet to deliberately put out content which furthers their devious means. So, how can we rely on such a system? Markets are worried about the inability to overcome this problem and about a lack of innovation in AI. If we are all fishing in the same pool of information and being provided the same results then innovation and creativity grinds to a halt, and that is not good for businesses who are looking to find an competitive edge and / or increase productivity.

THE STRENGTH OF AI

But, AI probably has a more focussed strength in it’s ability to gather, organise and analyse large data sets. Private data is the real gem! It’s what you can’t see rather than already public data. I may have mentioned in my Ezine last year the example of the Lancet medical publication in the UK, which has archives going back 203 years. It is almost unimaginable that human beings would be able to reference a tiny fraction of that information, whereas they are already using AI tools to organise data and information in their business and to make it available to a much wider and much more targeted audience. Data is the new gold! Loyalty card data would be a perfect example of data which can be privately exploited by companies looking to gain a competitive edge with the use of AI tools.

AI POWER

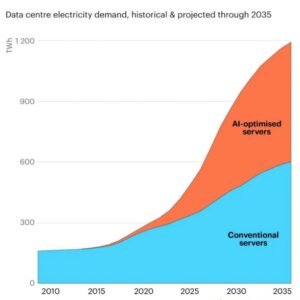

The strange thing with AI is that the people who are probably going to make money from it are not the people directly running AI tools, but more likely the periphery businesses that are needed to keep it running: energy providers and data centres being good examples: see images below to give you an idea of just how many resources are going to have to go into running and maintaining these centres.

Could nuclear and renewables be the winners long term?

TWO MORE ITEMS

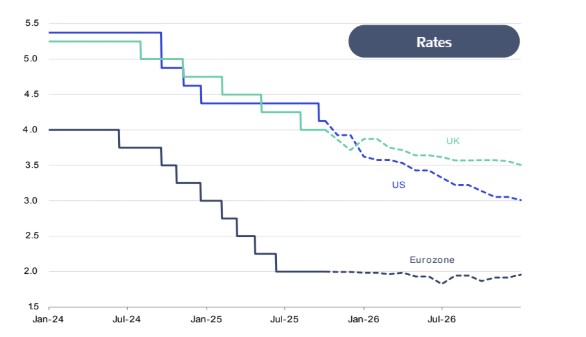

INTEREST RATES: don’t expect rates on your cash to be rising anytime soon. If you are sat with the majority of your assets in cash, then you should really be thinking about the long term implications of inflation on these monies. This is exactly the scenario that governments wanted to see. Low interest rates (which keep government benefit payments down and debt repayments low) but an inflationary economy. They pay their debts down quicker amd erode them away, and we feel the pinch. You can see the interest rate trend in the chart below.

OIL

Given the US’s influence over the world’s major oil producers (Venezuela, Saudia Arabia, Iran and Canada) , it is likely that there will be a glut of oil in the next 5 years. This will most likely push prices down. This is certainly what the D.T administration wants. Energy prices and inflation should fall which could be good for US stocks in particular. The wider US market could benefit greatly.

I hope you have enjoyed this content! Once again apologies for the time taken to get it you. Unfortunately I don’t even think AI is sophisticated enough…yet…to decipher my scribbles and handwriting when note taking.

As always, if you have any questions, or would just like to send me some comments on what you have read here, then feel free to do so. I am always interested to hear your thoughts on these matters.

Equally, if you would like to follow up individually on anything then you can do so on gareth.horsfall@spectrum-ifa.com or message / call me on +39 333 649 2356