“If you think you have it tough, read history books.” Bill Maher

I was not particularly interested in history at school, mainly because the history masters (I went to a grammar school where we were taught by masters in moth-eaten gowns and who wore their ties outside their jumpers) would want to teach us about aspects that I had absolutely no interest in.

History: How it can save you money

By John Hayward

This article is published on: 31st May 2023

The Dark Ages, for example. They are called dark ages for a reason. These days I will happily surf the web (can we still say that?) going off-piste (no holding me now) and finding out brilliant historical facts that I am interested in and not what I am told to be interested in. Or maybe I am being told, in this Artificial Intelligence world that we now live in. Having said that, I have not felt any pressure to learn any more about the dark ages.

What is my point here? History is important because it can help us to make decisions. The problem is that, although we have plenty of information to refer to, and perhaps have taken on board, we all too often forget, or even choose to ignore, the “lesson”. In the investment world, it appears that everything that is happening now never occurred before. Or maybe it did but in a dark age when nobody was literate enough to write down what was going on.

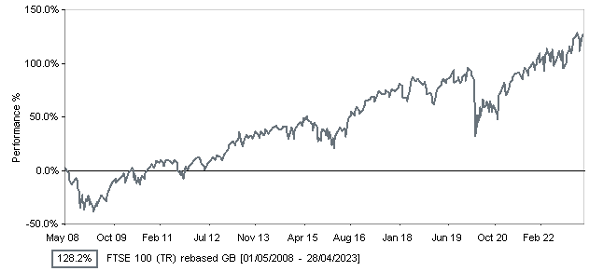

Sell low, buy high. Isn’t that a ridiculous investment strategy? It seems not, to some. I have been in the company of many people over the years who believe that they know when to sell and when to buy back in when “things are better/markets have settled/it is less rainy/the dog has been to the vet”. This strategy has consistently proven itself to be flawed. Although past performance is no guarantee of future performance, history can give us an idea of what could happen in the investment world after different global events. In more recent years, the financial crisis of 2008 and Covid-19 in 2020 have been big tests. After both “incidents”, those who stuck with it have been better off.

Source: Financial Express

Focusing on a stock market index that many British people are familiar with, the FTSE100, in the last 15 years to 1st May 2023, there have been 4 years that have been negative. I apologise for spelling this out but that means 11 years have been positive. 11-4. I like that score. The average annual gain of the index over that period has been almost 13%. Even more interesting is the tendency that a bad year is followed by an outstanding one. This is why, when people sell, they crystallise a loss and then possibly miss the best part of any recovery.

I understand that not everybody is comfortable with sitting out large falls (2008 and 2020). To cater for this, we have solutions within our armoury which limit the downside whilst still providing long-term growth.

To find out how we can help you with your existing investments, and/or provide you with ideas for the future, contact me today at john.hayward@spectrum-ifa.com or on +34 618 204 731 (WhatsApp)

If you are feeling down, pick up a history book. It is certain to take your mind off your woes.