September is a gorgeous month in France and this year has been no exception. For me September often goes by in a whirl – with the children back at school there are still after school activities to organise and parent-teacher meetings to attend.

Financial update in France October 2023

By Katriona Murray-Platon

This article is published on: 4th October 2023

However, for those who are not affected by the back to school mayhem September is a great time to enjoy the warmer weather and the beauty spots of France once the summer tourists have left.

Further to what I wrote in my last Ezine, the interest rate on the Livret A and Livret de Développement Durable et Solidaire (LDDS), which was expected to rise to 4%, shall instead remain at 3% and the French government has committed to keeping it at this rate until 2025. However, an appeal against this decision has been brought before the Conseil d’Etat. The interest rate of the Livret d’Epargne Populaire (LEP) has already dropped slightly from 6.1% to 6%.

If you realise you have forgotten to declare something on your 2022 tax return or you wish to correct an amount, you can, since the 1st August, amend your return on your online space on the impots.gouv.fr website. This service will be available until 11.59pm on 6th December. You should have already received your tax statement for the declaration you did in May and you should pay the amounts requested on this statement but if you do decide to amend your tax return, a new statement will be issued and any overdue amounts will be adjusted or repaid.

The tax authorities should already have your bank details that you provided to take any overdue tax from your account or pay any reimbursements. If this is not the case and if you have less that €300 to pay, you have to pay this by 30th September using the online service. If you have more than €300 to pay on your 2022 tax bill, these amounts will be taken on 26th September and around the 25th of October and November with the last quarter of the payment being taken out of your account on 27th December.

October is the month for the taxe foncière which is due by 16th October or 23rd October if you pay online or with your telephone or tablet. If you have already received your statement, you may have noticed an increase in the amount. The taxe foncière increased by 3.4% in 2022 but it has increased by 7.1% in 2023. This is an average and does not include any increases that the local councils may have voted. The sharp increase is due in part to the annual review of the rental value of the property which takes into account the Consumer Price Index which itself is determined by inflation.

Not everyone has to pay the taxe foncière. There are exemptions for those on pension benefits (ASPA) or disability allowance (ASI and AAH) as well as for those who were 75 and over on 1st January 2023 if your taxable income (RFR) for 2022 was less than €11,855 for one person or €18,233 for a couple. If one partner is over 75 and the other isn’t they can still be exempt. If a person is in a retirement home, their former home, provided it is not rented, is also exempt. New constructions, extensions or changes to buildings (a barn conversion for example) may be partially or totally exempt from taxe foncière for the first 2 years unless the local council has decided otherwise.

Although 2022 was a difficult year financially, this has not stopped the French from investing in Assurance Vie policies. According to the data published in the Le Particulier magazine in September (no 1208), 144.4 billion euros was invested in assurance vies in 2022, only slightly down from 2021 when 148.6 billion euros was invested. Most of this was in Euro Funds which, in spite of their steady decline over the past ten years, saw a slight increase in 2022 to 2% which is however less than the rates on the Livret A and LDDS.

In other news in September, I had the very great privilege of being invited to the GREAT event, organised by the British Embassy, in honour of the King and Queen’s visit to Bordeaux in September. Around 1500 people, French and British, were invited to this special event at the historic Place de la Bourse where we mingled with other members of the Bordeaux British community, bilingual professionals and business owners; sampled British foods, wines and sparkling wine and enjoyed music by local British artists. In addition to seeing the King and Queen, who arrived by tram to this event, Paddington Bear also made an appearance and the Fiji Rugby Team were also there and sang a beautiful song to the King as he was leaving. It was a very special and enjoyable day!

Is cash king?

By Gareth Horsfall

This article is published on: 3rd October 2023

It’s been a horrible 2 years (almost) in investment markets. Let’s just be honest. If markets don’t pick up in Quarter 4 of 2023 then we will have been in for 2 pretty rubbish years. It’s tough to say it from someone (me) who is invested in ‘investing’ and using the markets to protect money from inflation.

I know it’s the only way to protect our hard earned capital from the ravages of prices increases, but after 2 years of markets not going anywhere it is a tough job to convince anyone that this is still the best way to protect capital.

Until 2022 you could have almost been forgiven for wondering what inflation was. We hadn’t really seen the effects of inflation for the last 20 years, and now it’s back with a bang. Right at the moment of global political instability and war. The perfect storm!

Since Feb 2022 the markets reacted to the events between Russia and Ukraine and since then, with the onset of price increases for, just about, everything we buy, global stock markets are still trading under their highs of 2021.

Why not cash instead?

If you are someone sitting on cash, you might be cautious about investing and who can blame you? Everything around the world looks unstable and putting money in cash might earn you 5% in US CD’s, 4% in € and potentially 6% in GBP. Even though these interest rates are trailing the real rise in the cost of goods and services, you can’t be blamed for looking for some certainty in an uncertain world.

A woman’s view on the world

It is for this reason that I invited Joy Callendar of Brewin Dolphin (https://www.brewin.ie/our-people/joy-callender) to come and speak at our events in Abruzzo and Marche on the 17th and 18th October, respectively.

I wanted to invite a female Investment Manager this time as women have a different perspective on investing than men. Women are shown in numerous studies to be less aggressive and less impetuous than men in their investment decision making. This is good for me, because I will get time to hear what Joy has to say to you, but also I will get time to speak with her during the time travelling to each place and in the evenings. I myself want to hear how someone, like Joy, is going to help us navigate these rocky waters.

It is without a doubt that Joy will advocate investment as a mean to inflation protect your money and tell us that cash is, long term, a bad way to protect our real long term spending power of our money (because it is). But what about the short to medium term: is it a good idea to invest in cash now and wait until markets start to recover? Or can we invest in areas which are less volatile? Can Brewin Dolphin keep money in high interest bearing funds/investments with minimal risk and time the right moment to get into the markets for us? Can they just move in and out of areas at the right time to maximise returns?

There are so many questions that I want the answers to.

Brewin Dolphin and many other asset management firms want to get out and talk directly to people, rather than being solely based online, as they see the value in talking to people directly. They have a budget for working with companies like us who can provide an audience for them. They have services for residents in Italy and also are SEC licensed for services to US persons living in Italy. (Of course they love a few days out of the office in rural Italy as well) .

I am planning more events around Italy in the spring of 2024 (some with a different theme) and would welcome any recommendations if you think you might know a group of people who might want to listen to investment/tax planning experts for your life in Italy. Don’t hesitate to let me know.

In the meantime, if you want some answers to any investment, currency exchange or tax planning questions then please register to come along to the events below. Oct 17th in Abruzzo and Oct 18th Marche.

These events will NOT be a lecture or usual seminar,but, instead, a PANEL style approach.

The panel of experts will be open to questions and answers from any member/s of the audience and be available to listen to your concerns, worries and comments and hopefully provide some concrete and helpful information.

I am keen to put these experts on the spot and get the answers we want and to really make them work for their money, and I need your help to do that!!

Do I need a financial adviser?

By Susan Worthington

This article is published on: 1st October 2023

Just recently I returned “home” to continue my work under the wing of The Spectrum IFA Group. Two years ago I moved away thinking I could expand the range of services to offer my clients, but sometimes the grass isn’t greener. However, leaving one base for another also creates time for reflection and, sometimes, realisation that where you were was rather good.

Change is always happening around us, but for some it can be unsettling. I am fortunate in that all my clients and contacts have been happy to stay with me on my journey.

It made me appreciate that a client’s commitment to one adviser for the duration of their financial arrangements is fundamental to developing a strong relationship and achieving successful outcomes. It’s what an adviser can help them with that matters, and supporting those requirements over the long-term creates a unique bond. Matching the actual advice and arrangements to a client’s needs should be the highest priority for any adviser.

So what can an adviser provide:

• Helps maintain perspective (and calm) during stock market turbulence. This is particularly relevant at the time of writing!

• Able to explain and problem solve when something goes wrong.

• They provide more accurate news and updates from the real experts, steering clear of the media hype and scaremongering that is everywhere.

• Recommend tax efficient arrangements geared to your lifetime and also very importantly, after it, for your family.

• Have access to investment fund experts who often fare better than self-selected choices.

• Keep you on track as your circumstances change. Nothing ever stays the same, part of life’s rich pattern, so having a hand to hold you through that change can be comforting and supportive.

• Liaise with your tax or legal advisers to ensure your overall interests are protected.

Not everyone chooses to work with a financial adviser. Some people can’t find one they can work with or trust or just simply prefer to manage their own affairs. Many don’t do anything at all.

It made me check some UK statistics. Did you know that:

• 39% of adults (20.3 million) don’t feel confident managing their own money.

• 11.5 million have less than £100 in savings.

• nearly nine million people are in serious debt, and only around a third receive help.

• Brits who took professional financial advice between 2001 and 2006 enjoyed an average increase in their assets of nearly £48,000 after 10 years, compared to those who took no advice.

• Most millionaires likely use some type of financial adviser to grow and protect their wealth.

According to a recent report from Prudential, more than half – 53% – of UK adults say that financial problems and changed circumstances over the last 12 months have caused them to seek financial advice. Of this figure, 33% have already sought financial advice, whilst the remaining 20% are planning to do so.

Most people will benefit from the knowledge and experience of a professional financial adviser, especially if they have a variety of assets. When deciding between working with a financial adviser or doing it yourself, you just need to weigh the benefits against what you could be missing out on. Just a thought…….!

Tax & financial seminars in Portugal

By Portugal team

This article is published on: 21st September 2023

Are you an expatriate living in Portugal and looking to understand

more about your tax and financial situation?

Join us, and our panel of guest speakers, for informed guidance on Portuguese resident tax and financial planning opportunities, commentary on investment markets and to meet like-minded people in your local area.

10th October 2023

Magnolia Hotel

Estr. da Quinta do Lago, 8135-106 Almancil

10am – 1pm

11th October 2023

Boavista Golf & Spa

Quinta da Boavista, 8601-901 Lagos

10am – 1pm

Engage with our chartered financial planners and tax advisers

- Demystifying jargon: Understand key terms like residence, domicile, NHR, visas, day counting, and where and to whom taxes should be paid

- Avoiding costly pitfalls: learn from common mistakes and discover strategies to prevent them

- Real-life case studies: Business and property sales, personal investments, UK ans offshore pensions, inheritance tax, domicile and personal taxation.

- Investment fundamentals: Understand risk and volatility, investor psychology, tips and traps of investing and portfolio building

- Interactive Q&A: Have your questions answered during our open session

Experience a unique opportunity to ‘look over the shoulder’ of a fund manager with RBC Brewin Dolphin

- Find out how they create and build portfolios: the principles, processes, data and tools

- Discussion: current markets, trends and forecasts

- Interactive Q&A: ask anything during the open Q&A

Sign up for the seminars below

Top tips for expat finances – Spain

By Chris Burke

This article is published on: 18th September 2023

Well, thank goodness that heatwave is over and I can venture out during daylight hours again! September and October for me are the absolute best times of the year here in Spain, great comfortable temperatures, less people (tourists) around and the sea has been warmed up over the summer.

This month’s Top Tips are as follows:

- 7P tax exemption rule – do you travel outside of Spain at least two weeks a month?

- Property price forecast UK & Spain for the end of 2023/2024

- Why should I speak to a Financial Adviser (a good one, that is 😊) in one sentence?

- 90’s nostalgia advert

7P Tax Rule

One of the most common questions people ask me is ‘As I am not on the Beckham Law, how can I reduce my taxes?’ One of the first questions I ask them is ‘how much time do you travel for work outside of Spain?’ If you travel for 2 weeks or more every month, in simple terms you might not to have to pay tax for those days you are away – a significant saving and you may have a tax exemption of up to €60,100 per year.

The key qualification factors are as follows:

- You must be a Spanish tax resident

- The company you are performing the work for must not be Spanish, must be based abroad and not a Spanish entity (but you can be employed by a Spanish company and have been instructed to carry out this work outside of Spain)

- You must physically be outside of Spain when conducting this work

- The country you are working in must have a similar tax system to Spain/have a double tax treaty

If you adhere to all these points then this tax exemption could be applicable for you – please ensure you take professional advice.

Property price forecast for the UK & Spain, for the end of 2023/2024

Property is, in my opinion, a great asset to hold and one that every investment portfolio should have. Just like ‘non-property’ investments, the value can go up and down. It can be more ‘hassle’ to manage taking into account tenants, taxes, issues with the property etc. but long term it has usually been a good investment. Governments are starting to make being a landlord a more expensive venture in the UK now – let’s see if Spain follows suit.

Since covid we have seen that property prices have generally boomed. However, the last 12 months or so things have started to change. New Zealand is in the midst of a property crash, down approximately 18% in a year. Canada is also in a property ‘recession’, down by approximately 15% year on year (most of you probably won’t have heard about these – the news outlets tell you what they want you to hear). Property, just like investment portfolios, does not only go one way, as in up. This year, for the first time in a long time (probably 15 years), I have been advising some clients to sell their UK property investments if they don’t think they will go back there, and it makes sense from a tax perspective. If you are living outside of the UK, at some point you are going to have a decent sized taxable gain/event on that property, (more so in Spain) and even if it is inherited by someone else, it’s unlikely that even then the tax will be avoided/mitigated.

In the UK, properties valued at up to around £600,000 are ‘still moving’, estate agents tell me. Many people over the next year or two will be coming off fixed rate mortgages they took out during covid (when interest rates were low) and their new mortgage repayments will at least double under current rates. They will have the choice to either swallow this extra monthly cost or sell (some will have no choice). Taking all of this into account, forecasters are predicting the UK property market will decline – it is already stumbling at best, with a slow down in sales and asking prices not being achieved generally.

In Spain things are slightly different, and one of the driving factors is that you can fix your mortgage rate for life, meaning you have much more stability of payments moving forward – they can only reduce (if you re-mortgage when rates come down…if and when they do). Research says that the property market is booming in Spain. However, with approximately 15% of the property bought in Spain last year acquired by foreign buyers, taking into account what’s happening elsewhere an economist might say this impact will inevitably have a ripple effect at some point.

Some professions will always be able to be performed from home, however many companies are also starting to ask employees to return to the office. This could put an end to ‘we can work from anywhere, let’s go and live on an island/in the countryside’.

In summary I would say the Spanish property market is at best coming to a slow down, at worst a decline of some proportion. Of course, if you are holding this property for the long term then this will be of less importance. But considering the prices are the highest now they have ever been, and mortgage rates are much higher than they were, taking on a property now might mean you ‘have’ to hold it for a long time to realise its value.

Why should I speak to a Financial Adviser, in one sentence!?

A good adviser will make you more knowledgeable, financially organised, take the strain away from your finances, make your money work hard for you and always be there for you with sound advice whenever you need it (even if they don’t know all the answers, they will do their best to get them for you), always putting your needs first.

Prudential 90’s advert number 2

Do you remember this timeless, funny classic:

Now you can Identify as a Tree……who would have known back then!

If you would like any more information, or to talk through your situation initially and receive expert, factual advice, don’t hesitate to get in touch with Chris.

Le Tour de Finance in Italy

By Gareth Horsfall

This article is published on: 16th September 2023

I’m going back on the road!

As a resident in Italy, do you make the most of your finances? Join us and our panel of guest speakers, for informed guidance on Italian resident tax and financial planning opportunities, commentary on investment markets and to meet like-minded people in your local area.

Tuesday 17th October 2023

Castello Semivicoli

Abruzzo

Wednesday 18th October 2023

Villa Anitori

Le Marche

The event starts at 10.00am with a welcome coffee, followed by brief presentations from international experts on a range of topics that could affect you now, or in the future. The morning ends with a complimentary buffet lunch and wine.

For those of you who have known me for sometime, you may remember the days when I was out on the road holding seminars and bringing experts from the world of finance to various places around Italy. After a hiatus, I was about to restart in 2020 and then the dreaded lurgy raised it’s ugly head. Well, now that all seems to behind us, I decided that since my world is more commonly becoming a series of daily video and phone calls, that I wanted to get back out and talk to people in person again.

I miss these events and am really keen to get out and listen to your comments and concerns from a financial planning point of view, for residents in Italy. So, I decided to restart them and and as you can see from the flyer above, I am doing so in Abruzzo and Marche on the 17th and 18th of October, respectively. I would love to see you if you are in the area or would just like to travel and listen to some people from the world of finance and what they have to say on past, present and future events.

In this Tour de Finance, I have organised an all female line-up

(which will make a nice change from the usual panel of men in suits):

Stefania Falcone from Currencies Direct to talk about foreign exchange and the possible direction of currency movements

Lorraine Reddaway, Business Development Manager and Joy Callender, Senior Investment Manager, Dublin from RBC Brewin Dolphin Asset Managers to talk about the risk of investing in the world today and their view on the direction of world markets and asset classes

Judith Ruddock from Studio del Gaizo Picchioni commercialisti

Tax planning around property

By Portugal team

This article is published on: 15th September 2023

Even if you are a Non Habitual Resident (NHR) with preferential tax status, UK and Portuguese property will remain taxable on both income and capital gains. However, there are certain planning opportunities you can tax advantage of in Portugal and the UK.

UK property planning

When selling UK property, you can deduct expenses associated with buying and selling the property, including professional fees and fees incurred on the transfer of property, such as stamp duty. You can also add any expenses incurred in enhancing the property to your base cost.

If the property has ever been your principal private residence (PPR) you can reduce or even eliminate the capital gains tax with main residence relief. This ensures that any period during which the property was your PPR is exempt from tax. For example, if you lived in the property for 5 years out of a total ownership period of 10, then only 50% of any gain would be subject to tax.

The property is also considered your PPR for 9 months after leaving the property so you can increase your tax-free ownership period.

UK allowances available

Even if you have left the UK, as a UK/EEA national you can retain your annual capital gains tax (CGT) allowance to offset any taxable gain, although this is reducing – the current allowance is £6k but falling to £3k from the 2024/25 tax year. If you hold property jointly with your spouse/civil partner, you can combine your CGT allowances (and income tax allowances if letting).

Timing is important

If possible, selling when you have not sold other assets will ensure your full CGT allowance can be set against the property gain.

If you are still UK tax resident you can also:

- time the sale when your income level is low, as your overall income level determines which CGT band will apply (18% for basic rate tax payers and 28% for higher and additional rate), and/or

- higher rate tax payers can potentially lower their tax bands via a pension contribution or donation to charity.

Non-Resident Capital Gains Tax (NRCGT)

If you are a Portuguese tax resident, you are able to benefit from NRCGT which is a UK tax concession which states that only the increase in value of property after April 2015 is taxable e.g. if you purchased a property in 2000, any increase in value between 2000 and 2015 is not taxed. This can substantially reduce your tax bill and wash out gains, and as stated earlier, you can still retain your annual CGT allowance.

If you also qualify for NHR there would be no tax in Portugal, which under normal circumstances would otherwise be taxed at progressive rates.

A further planning angle for those with NHR is that, if properties are held within a company, any dividend taken would be free of tax.

You may find the HMRC link useful when calculating your likely liability https://www.gov.uk/tax-sell-property/work-out-your-gain

Portugal property planning

Properties purchased after January 1989 are subject to capital gains tax on 50% of the gain. Property purchased before this date is not subject to CGT. Do note, NHR does not have any effect on the taxation of Portuguese property.

Some expenses are deductible, such as the buying and selling costs. In addition, inflation relief is available in Portugal if the property is held for more than two years.

It is possible to mitigate or even eliminate the taxable gain on a Portuguese main home by:

- Reinvesting in another property within the EU;

- Reinvesting in an approved investment structure; or

- A combination of the two e.g. if you sell a property for €1m, you can downsize into a smaller property for €500k and put the balance of €500k into an approved investment structure. This investment structure can then provide a tax-efficient income for life.

The amount that must be reinvested is the net sale proceeds, not just the gain. Any amount not reinvested is taxable under the normal rules.

There are nuances around these rules so please always seek professional advice. There are also complicated scenarios when selling property held by companies and specialist advice and calculations are required.

The dilemma: cash or investment markets?

By Portugal team

This article is published on: 12th September 2023

With rising interest rates, we have seen banks offering interest rates in excess of 4% or even higher with 1-year fixed terms. This coupled with the perceived risk of investment markets and the constant stream of negative news has left many wondering whether staying in cash is best.

Short term goals

Cash certainly has a place as an emergency “buffer” to allow for life’s unexpected events, and it is also sound financial planning to set aside sufficient for your short-term needs. Likewise, holding cash as part of an investment portfolio is important and it can help reduce the effects of volatility often seen in markets.

Cash as a long-term investment

Interest rates offered by banks to customers rarely beat inflation, so using this as a long-term savings strategy is not ideal.

Even with rising interest rates, the returns from cash are still negative when you consider that inflation currently sits at 7.9% in the UK, so investors are not getting any real returns. As an example, the negative effect of a modest 2% inflation on £100,000 over 10 years is £82,035 and £67,297 over 20 years.

However in the longer term, interest rate cuts are likely as the Bank of England is starkly aware that keeping interest rates high risks triggering a recession and destabilising the UK housing market. Central banks globally are also now close to pausing and then reversing recent rate hikes.

Protect yourself against inflation

Investing in high-quality company shares has been shown to offer inflation protection. Looking at long-term figures, Credit Suisse show that over a 123-year period starting in 1900, shares in developed equity markets have generated returns of 5.1% above inflation and emerging equity markets have achieved 3.8% over inflation.

The Credit Suisse figures also show that shares have outperformed cash (and bonds) in every one of the 21 countries its data covers over that 123-year period. This is quite remarkable given this period covers two world wars, two global pandemics, the great depression, the 2000 dot-com bubble, and the 2008 global financial crisis.

Opportunities elsewhere

Falling interest rates will provide opportunities elsewhere. For example, bond prices move in the opposite direction to interest rates so a future fall in interest rates is likely to result in capital gains on bonds, or holding shares allows investors to not only benefit from the increase in share price over time but income from dividends too.

If we look at the top 100 shares in the UK, analysts are expecting a dividend yield of 4.1% this year and 4.4% in 2024 and with the possibility for share buybacks added into the mix, this could be as high as 6% for 2023.

Tax considerations

Always consider the net interest rate you will earn. For example, a relatively attractive rate of 5% becomes a somewhat mediocre return of just 3.6% for a standard Portuguese tax resident who must pay 28% tax.

Also be cognisant that some of the more attractive rates being offered by banks in Guernsey and Jersey will have a higher tax rate applied of 35%, even if you are a Non-Habitual Resident.

The solution – balance

We believe a balanced approach of cash and investments makes most sense. The split however really comes down to your short- and long-term goals.

In short, cash is still king for short-term needs but for meeting longer-term income and growth objectives, stack the odds in your favour by using a sensible and well-diversified portfolio of shares, bonds and property. Coupling this with effective tax planning can lead to even more savings.

Lastly, Warren Buffet’s advice as one of the world’s most successful investors is, “The one thing I will tell you is that the worst investment you can have is cash. Cash is going to become worthless over time but good businesses are going to be worth more over time”.

Are you thinking about moving to Italy?

By Gareth Horsfall

This article is published on: 9th September 2023

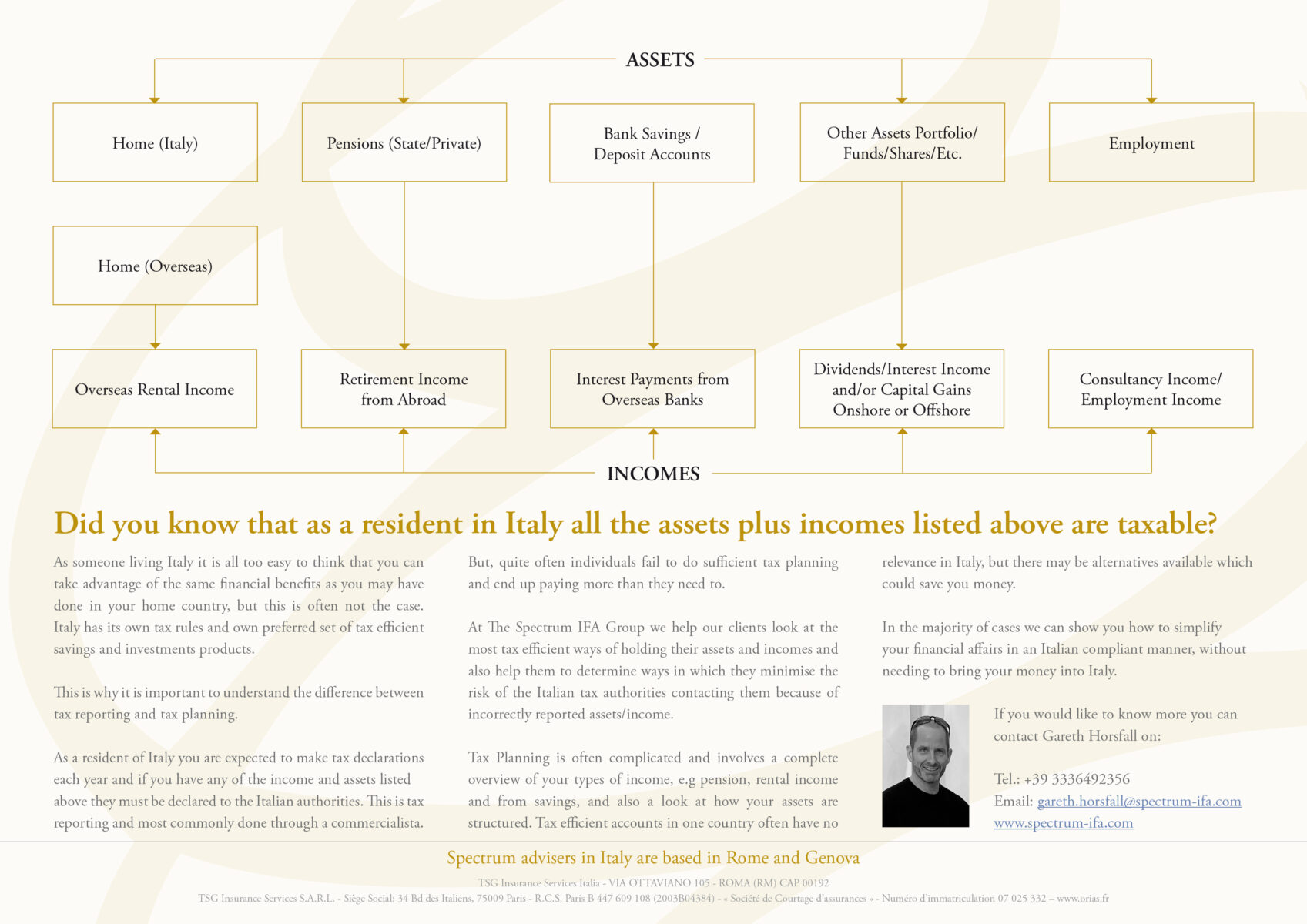

If you are thinking of moving to Italy to become a full time resident, or even a resident for part of the year, then it make sense to understand your tax and other financial liabilities before you make the move.

When you buy a house in Italy, you will very likely receive competent and complete advice regarding the cost of buying and renovating a house. The agent may also explain the difference between the cost of buying as a resident in Italy and a non resident. But, the buying process should be accompanied by a clear and concise longer term financial plan to minimise tax liabilities.

Italy has its own tax code and its own preferred set of tax efficient savings and investments products and whilst you may think that you can take advantage of the same financial benefits as you have done in your home country they may not represent the best and most efficient ways to hold your incomes and assets, whilst living in Italy. Tax efficient accounts in one country often have no relevance in Italy. But there are alternatives available which could save you money.

Sadly, and all too often, expats fail to do sufficient tax and ongoing planning for living in a country which has a very different set of rules to their own and as a result end up paying more than they need to, getting fined for simple and honest mistakes and in the worst case scenarios needing to return home.

At The Spectrum IFA Group (Italy) we can help you to not just look at the initial financial aspects of moving to Italy, but also to help you look at the longer term consequences and avoid any inevitable surprises once you have made the decision to purchase property in the country. We want to ensure that your dream move continues to be a dream.

We can help you look at the most tax efficient ways of holding your assets and incomes taking into consideration both Italian tax law and that of your home country and ultimately help you to minimise your tax liabilities.

Cross border Tax Planning involves a complete overview of your types of income, e.g pension, rental income and interest from savings, and also a look at how your assets are structured.

In the majority of cases we can show you how to simplify your financial affairs in an Italian compliant manner without needing to bring your money into Italy.

The end of succession tax in Valencia

By John Hayward

This article is published on: 6th September 2023

On 28th May 2023, Carlos Mazón was elected president of the regional government of Valencia as leader of the Partido Popular. On 21st July 2023 he announced that his government had approved the initiation of a bill to reduce succession and gift tax (ISD – Impuesto de sucesiones y donaciones – Inheritance Tax to the UK reader).

The draft bill was placed on the urgent pile with Les Corts on 3rd August 2023 and it awaits absolute approval.

Mazón’s reasoning was that the income from ISD represents around 1% of the region’s total revenue and that charging tax on money that has been taxed before was not fair. He wants to reduce the tax burden to prevent an inheritance from becoming a “serious economic loss for many families, who have to face its payment, without the inheritance entailing any economic benefit or real increase in their assets.” This seems a very refreshing attitude although his opposition have argued that the wealthy will avoid tax that would generate around €400 million a year. This assumes that the timing of deaths and gifts matches their statistics.

There are conditions to this bonificación in that only close family members and spouses will benefit but that is the same with the existing reduction. The improvement is that, for the majority of spouses and close family members, they will receive a reduction of 99% on the tax bill. Currently it is only 50%.

All this being said, there is still room for inheritance tax, and gift tax, planning. We experience many complicated situations where, for example, couples are not married or there are children from different marriages. Keeping assets away from the inheritance and gift tax net in Spain, in a legal way, is key, especially for beneficiaries who do not live in Spain.

We await absolute approval of the bill but, and although this may sound a little insensitive, any deaths, and gifts made, since 28th May 2023 will be eligible for this new law.

And like buses… Abolition of Wealth Tax in Valencia?

One at a time, please!

More to follow…

To find out how Spanish inheritance and gift tax will affect you and your beneficiaries, as well how we can help you with your existing investments and tax planning, and provide you with ideas for the future, contact me today at john.hayward@spectrum-ifa.com or on +34 618 204 731 (WhatsApp)