Are you an expat living in Spain?

We are hosting an Expert Q & A to offer you the CORRECT answers

to those important questions everyone seems to have,

but can not always obtain.

By Barry Davys

This article is published on: 3rd April 2023

Whether you are thinking of moving to Spain or already living here, tax is a major part of your financial life that needs to be considered and planned for carefully.

1. In the UK, probably the best savings vehicle is an Individual Savings Account (ISA). This is because the income and capital growth is free of income tax and capital gains tax. It is, however, a UK tax scheme and is not recognised in Spain. Selling your ISA whilst you are still a UK tax resident can save you paying tax in Spain both on an ongoing basis and when you sell. There are also options where you can replace the ISA investments with very similar ones in Spain in a tax efficient manner once you have sold your ISA.

2. If you can, take your 25% tax free lump sum from your pension before you come to Spain. Again this is a UK based tax rule and it does not exist in Spain. You may be able to take part of a pension without tax in Spain, but there are rules and conditions. In the UK it is a clear rule and we recommend taking advantage of it. Like the ISA it is possible to reinvest the money with similar investments as you had in your pension on arrival in Spain.

3. You can pay into a UK private pension for up to five years on leaving the UK and continue to receive tax relief on the contributions. You will need to start the pension before you leave the UK. The limit is a maximum of £3,600 per annum but you only pay £2,880. The government will pay your pension company the difference to make it up to £3,600. A husband and wife paying into a pension for five years would qualify for a UK Government “top up” of £7,200. At the end of five years they would have a pension pot of £36,000 which will remain free of income tax and capital gains tax in Spain, until you start taking money from the pot.

4. Do you need to top up your National Insurance Contributions to improve your UK state pension? It is easier to do this before you leave the UK.

5. The sale of a main residence in the UK is free of capital gains tax. In Spain, the rules are different and you may have to pay capital gains tax on the change in value between the purchase price and the selling price of your home. As an example, a £200,000 gain (not at all uncommon if you have had your house for 10 years) could mean a tax bill of £44,800.

6. If you and your family are considering inheritance tax planning, consider making or receiving gifts before you leave the UK. These gifts can be potentially exempt from UK inheritance tax. In Spain, they would be subject to gift tax.

7. Are you eligible for the “Beckham Law”? This is a law that was introduced to encourage skilled workers to Spain. The tax rate is set at just 24% for your employment income for a period of five complete Spanish tax years. This is the part of the scheme that you will see most heavily promoted.

However, the scheme also allows you to receive capital gains and investment income from outside of Spain without paying Spanish tax. Careful structuring of your affairs can lead to a plethora of planning opportunities. Perhaps the biggest opportunity is selling your UK business and paying 0% tax on the sale. For further information please email barry.davys@spectrum-ifa.com

8. If you are approaching retirement or retiring to Spain, it is possible to save tax on the income you receive by planning the source of your income. As a brief example, pension income is generally taxed as employment income and taxed at your highest rate. Drawing funds from an investment can result in tax as little as 2%. From another source there can be 0% tax. To benefit from this planning it is important to have an adviser who understands your situation and requirements at the same time as having a clear understanding of how investments are taxed in Spain.

9. Different investments attract different tax treatments in Spain in the same way as they do in other countries. There are investments in Spain that are taxed more than others. Try to use the lower tax ones where the investment matches your requirements. You can benefit from many years without paying income tax and capital gains tax.

10. In Spain, inheritance tax is based on taxing the person receiving the inheritance rather than taxing the estate of the person who has died. If inheritance tax is a concern, with the right advice you can build a plan which manages the amount of tax due. The bedrock of the plan should be that you are not left short of money in later life. Your plan should then match your personal requirements. Some planning is simple and straightforward, so it is worthwhile looking at inheritance planning before events overtake you.

11. Are you considering returning to the UK? It is also worthwhile thinking about the possibility of an unplanned return to the UK if one partner were to die, for ill health or ill health of a family member in the UK such as a parent. If a return to the UK is a possibility, make sure you have the type of investment which will not tax you in the UK for the time you have spent in Spain.

By Jeremy Ferguson

This article is published on: 28th March 2023

What is wrong with the way some banks work nowadays? It seems to me you can run a poor show, and when things go badly wrong the central banks will bail you out, and then off you and your highly paid colleagues can go again to mismanage your way to the next catastrophe.

The one thing I explain to people time and time again is that when you deposit any of your hard- earned cash in a bank, the bank has it is on ‘their’ balance sheets. They can then use that to go off and lend money or invest in assets where they can make more money. So effectively, they are using your money to make themselves money. The problem is that a lot of what they do may need a long timeline to work, so if people start demanding their money in large numbers (known as a run on the bank), they may not actually be able to meet those requirements, hence they close the doors to withdrawals.

Years ago a run on a bank would take time, with people literally queuing around the block looking to withdraw their money from the person behind the counter. The trouble nowadays is that a run on the bank is so much easier to implement, with all of us having apps on our phones and laptops that mean we can ask for our money in an instant. That was one of the biggest issues contributing to the failure of Silicon Valley Bank in America a couple of weeks ago, and the start of this whole process of fear beginning again. Due to the frenzy of concerns about that bank being whipped up on social media, thousands of clients started to try and withdraw their deposits all at the same time. To say the run on the bank happened quickly would be an understatement.

It is interesting to see what happened by looking more closely at what went wrong there. The bank had a huge amount of funds on deposit, and although they were large lenders, they had a lot of excess cash doing nothing for them. They needed that to be making money for them so, in their view wisely, they bought a large amount of 10 year government bonds. They did this because government bonds are traditionally seen as safe and would earn a small return.

Then the Fed started raising interest rates in a bid to stem inflation. Of course, this then meant the value of the government bonds became more and more stressed the higher the rates went. Effectively the clients’ money was now in the wrong place and couldn’t easily be unwound. In simple terms, a pretty basic error which you would hope someone looking after your money should have been aware of.

As I write, the contagion this whole issue has caused in the banks is causing share prices to tumble again. It’s so frustrating when this sort of thing happens, as very often it’s the baby being thrown out with the bathwater, but unfortunately this is how the stock markets tend to be. Anyway, it never seems to change and the fact that the Fed raising interest rates has led to the banks ´´crumbling´´ is somewhat bizarre in my humble opinion, when they seem to think they know what they are doing!

I speak a great deal with clients about using ‘insurance’ based products to house their investments. The reasons and advantages are many but the most relevant point I like to make, and relevant to what I’ve been talking about, is when you invest your money in these companies it is physically off their balance sheet and held for your benefit only. That’s the polar opposite to leaving your money in the bank. Of course, the risk is then what you do with your money, but it’s a massive point that is regularly overlooked and gives people a high level of comfort.

If you are worried about your money and where it is at the moment please feel free to get in touch and we can see what alternative solutions may be available for you.

By Peter Brooke

This article is published on: 27th March 2023

The Great Moderation & The Next Decade.

Is it really different this time?

The finance industry is often guilty of a very short term view. I read at least two emails every day that focus solely on the last 24 hours, which is probably not particularly healthy. It is also ironic that my industry then tells all its clients to only judge performance over the medium to long term … whatever that means.

Of course, understanding how daily events can affect performance is important, but from time to time we really must put this into the context of the long term, and sometimes the VERY long term.

Our friends at Evelyn Partners have created a terrific piece of research considering the last 40 years (yes, 40) and then looking forward at the next decade, where they feel there really is something different happening. Here I will summarise their musings – I hope you find it interesting.

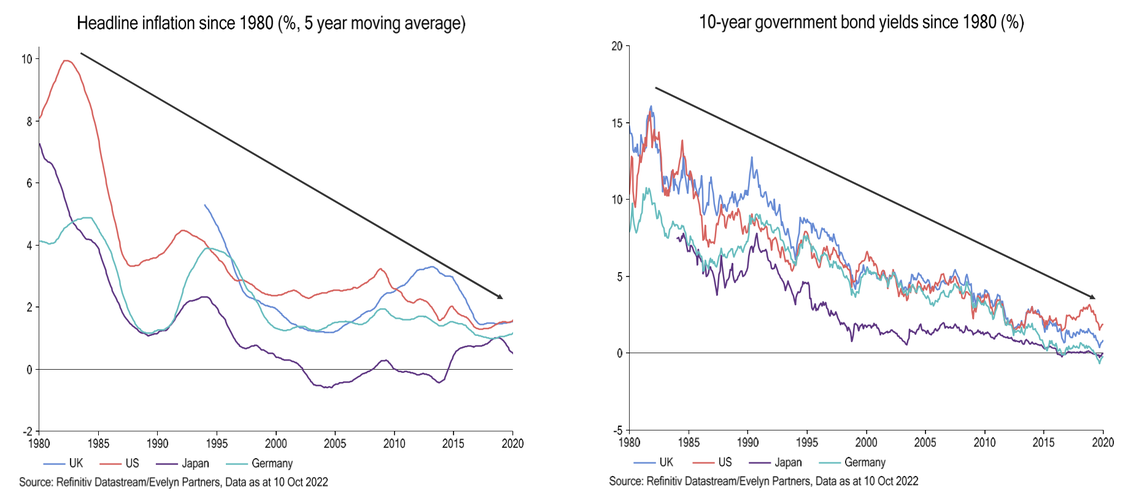

The economic impact of China’s emergence over the last 40 years has contributed to lower inflation and lower interest rates this impact is particularly characterised by

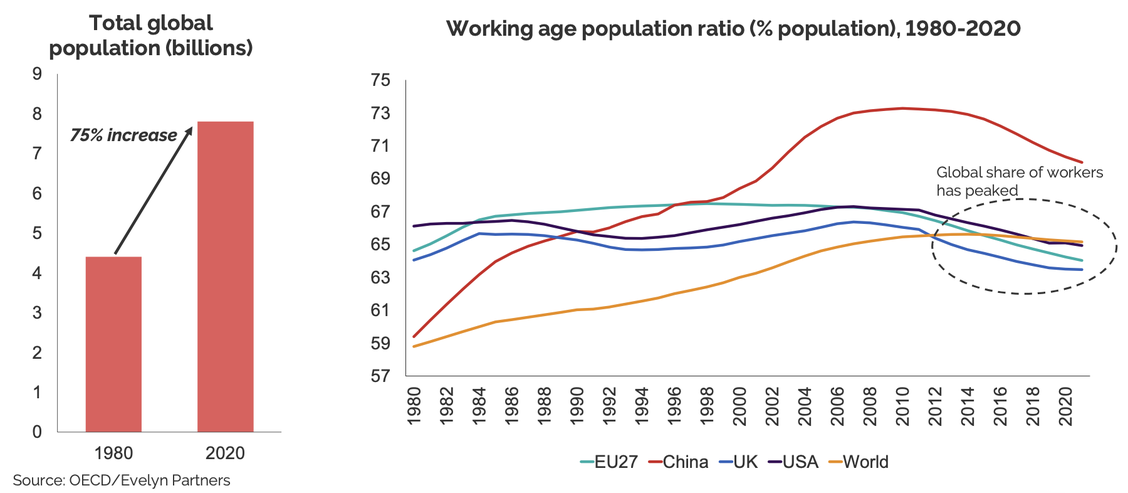

1. Favourable Demographics – massive growth in global population AND in the numbers of ‘working age people.

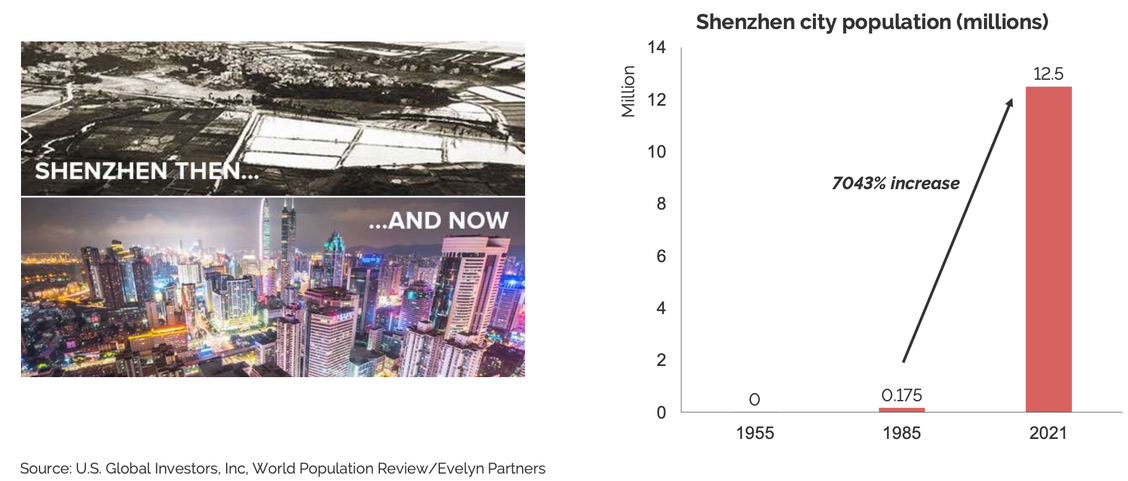

2. Massive movement of workers from rural regions into new cities facilitated rapid growth in manufacturing and economic output.

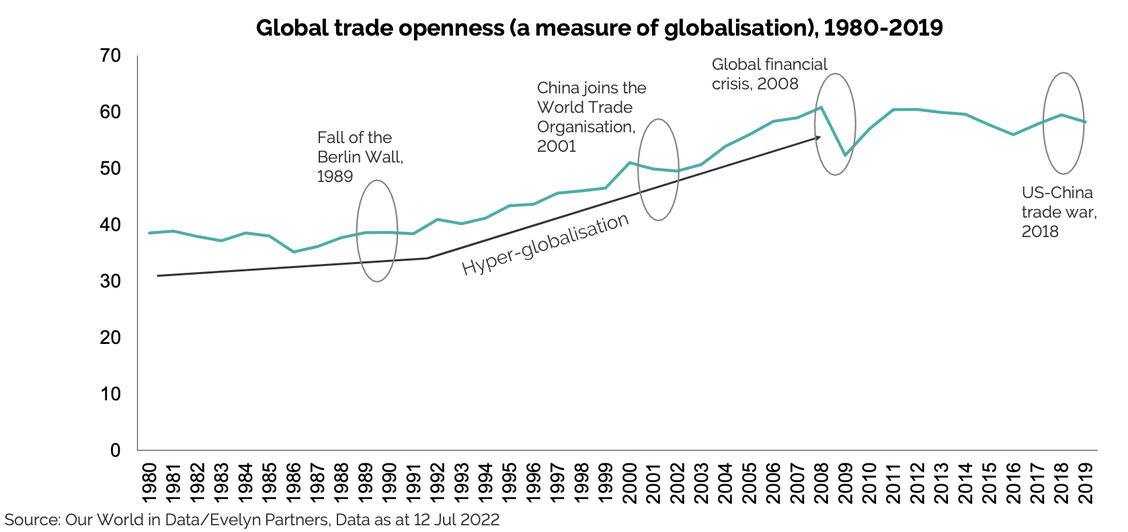

3. Globalisation enabled advanced economies to tap into this pool of cheap labour. But it now seems to be slowing…

The economic impact has been significant: 40 years of falling inflation and interest rates!!

So is it really different this time?

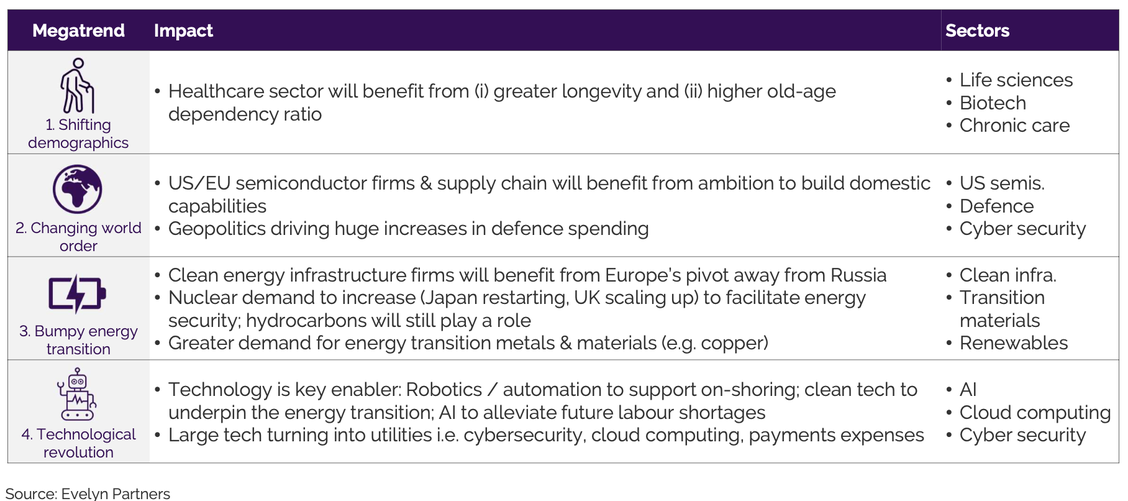

YES – We are at an inflexion point. 4 “Megatrends” will shape markets over the next 10 years – and beyond!

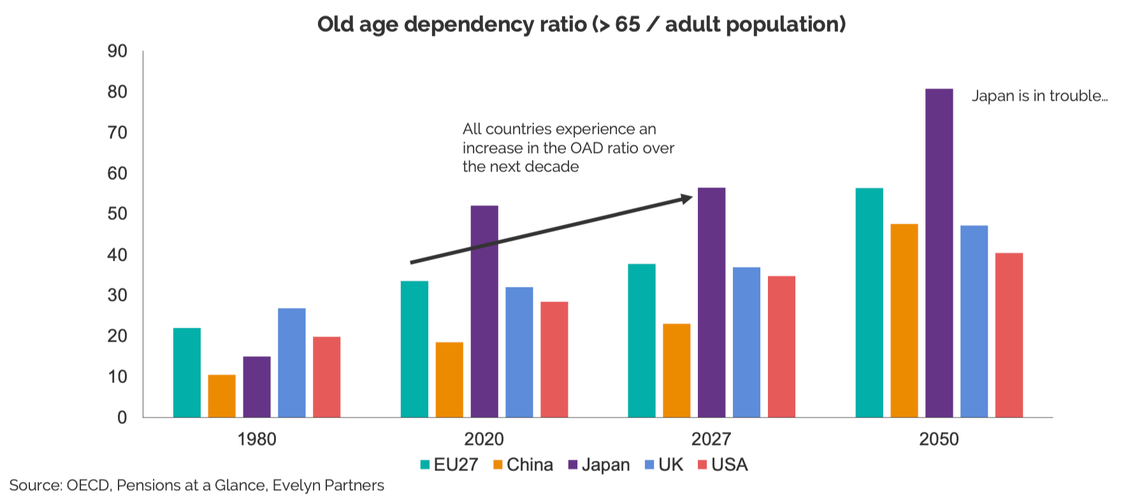

1. Shifting Demographics: The old-age dependency ratio is set to increase sharply & population growth will slow

2. Changing World order: US-China decoupling and the war in Ukraine will result in ‘slowbalisation’.

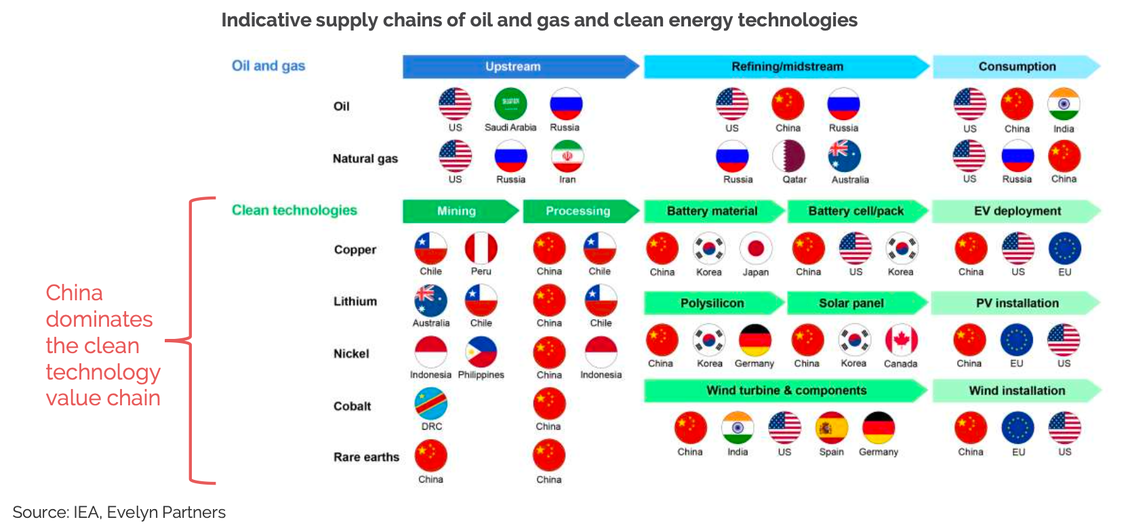

3. Bumpy Energy Transition: The war has undermined energy security & accelerated the energy transition… But the transition is likely to be bumpy. It will bring new energy trade patterns and geopolitical considerations into play…

Who really owns the infrastructure which will help our Energy transition?

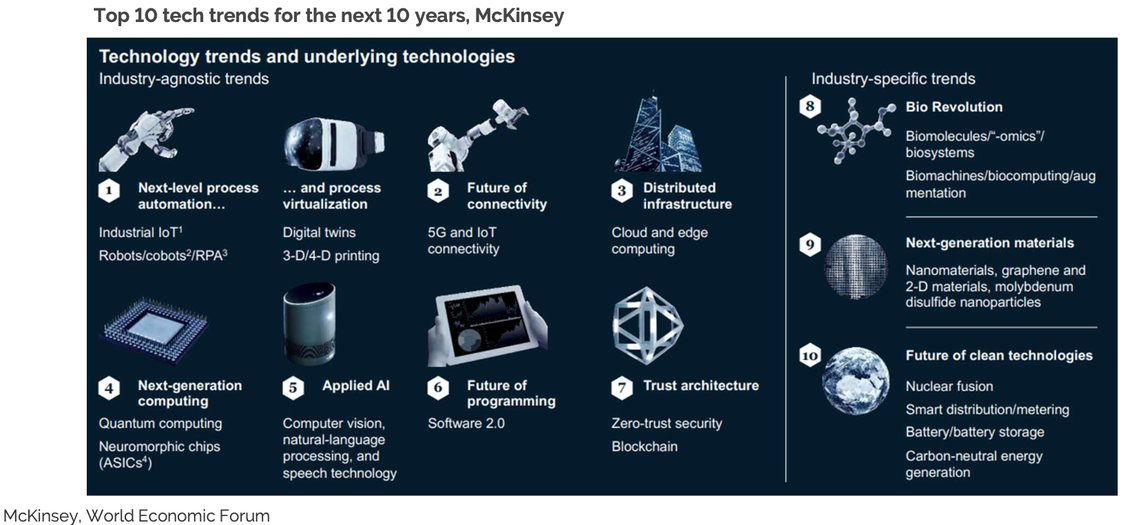

4. Technological Revolution: New technologies will underpin the future of business and most areas of our lives… for example Artificial Intelligence and Automation

So if we really are entering a genuinely different world, how do we manage our money over the next decade and beyond?

All of these factors will present challenges AND opportunities and so it is important to align our approach to benefit as much as possible from these opportunities and minimise the risks of being on the wrong side of the challenges.

I hope this ‘longer term’ view has helped you put your existing investment choices into perspective or helped you when choosing new investments.

If you want help with reviewing existing or choosing new funds then don’t hesitate to get in touch.

I want to sincerely thank the team at Evelyn Partners, one of the investment management firms we work closely with, for this excellent piece of research and its refreshingly long term approach.

For more information on this please visit Evelyns Megatrends Hub here www.evelyn.com/good-advice/megatrends/

If we haven’t spoken recently and you want to get in touch via my new booking system then please click on the link to book a quick call.

I have linked my diary to the excellent ‘Calendly app’ which allows us to arrange our next call, zoom or face to face meeting more easily – feel free to forward to family or friends who might need my services.

By Gareth Horsfall

This article is published on: 22nd March 2023

2023 is the year that I turn 49 years old. Where do the years go? 50 next year and strangely enough I don’t feel as anxious about it as I thought I would. I actually feel quite good about it, and I have made some personal commitments to spend more time in nature and exercise regularly, but not excessively (I suffered glandular fever a few years ago and so can’t workout as hard as I used to).

It was on one of those walks in nature recently that I actually thought that it’s about that time when our commercialisti start asking us to send our financial information for tax calculation and payment. (unless you are one of those people who is well prepared and has done it already).

Of course, we always have to supply a full list of our incomes and assets (Italian and foreign), bank accounts and properties and taxable assets. However, I am not sure about you, but my commercialista doesn’t really give me much information on the corresponding list of deductions and detractions available to offset/reduce some of our tax bill, so I thought I would write this article to provide you with a full list for the financial year 2022. [A reminder to always check your tax return, once filed by your commercialista, to ensure that errors haven’t been made, especially on the foreign assets section Quadro RW . See my article on this for more information Declaring taxes in Italy

Some of these may be relevant to you, others not, but at least you have the list which you can refer to and always share with others, if you think it might help. There are distinct categories ranging from family expenses to renovation/property expenses as well. Also remember that in ALL cases now, to claim an expense you MUST have paid by electronic/traceable means i.e. bonifico (bank transfer) or carta di credito and you MUST have a corresponding scontrino fiscale in the case of things like farmacia expenses. For larger purchases a fattura (invoice) is required. Without the necessary document you will not be able to claim back the tax relief.

So, without further ado, here is the list:

These attract a detraction of 19% of the full value of the expense.

These all attract a 19% detraction:

the full cost of donations to:

Restructuring and renovation costs

For the tax year 2022, the following deductions are available:

Where you have an income up to €120,000 pa the expenses, as described in this article, will be fully allowed. Where your income is over €120,000pa then the detractions will be reduced according to a formula based on your total income.

And that’s it! Everything that you can detract from your income in 2022 to try and reduce your tax bill in Italy. If that doesn’t make a difference, then you may need to have a look at your overall finances to try and plan in different ways.

It should be noted that the Meloni government is currently debating how they can follow through on their election promise to simplify the tax system by reducing the tax bands from 4 to 3, in the coming year, and then hopefully moving to a 2 tax band system. If they manage to pass this then they will likely reduce/remove the system of detractions/deductions by lowering the bottom rate of tax, or maybe introduce a starting rate tax allowance for everyone (unlikely, in my opinion. The talk is that an allowance may be offered to workers [not self-employed] and pensionati) However, they are in first stage negotiations and it may be some time before things come to pass.

The other thing they are currently discussing is simplification of the taxation of investment income and gains. Presently income and gains from certain types of investments cannot be offset against losses from the same investment. A system they called ‘redditi di capitale’ e ‘redditi diversi’. There is talk to remove this, what I consider a rather odd system, and have the same system as everywhere else, income, gains and losses from investment income treated in the same way.

Anyone who has a missing contribution record for UK National Insurance contributions in the UK between April 2006 and April 2016 will still have the opportunity to make up these contributions until the 31st July 2023, which will still give you the chance to increase your state pension entitlement from the UK. The previous deadline was the 5th April 2023.

The reasoning behind this decision from the UK government is that from April 2023 anyone retiring will need to have a national insurance contribution record of 35 years to receive the maximum state pension. Between 2006 and 2016 different maximum contribution periods may have applied and therefore the UK government is giving you the opportunity to maximise your contributions until July 2023. After this time, it will only be possible to repay the missing previous 6 years contributions in your national insurance record. If you want to know more, you can look at the www.gov.uk website.

Bear in mind that the state pension office will likely be overwhelmed with requests at this time, so if you need to make a request for back payments then you may need to do so immediately, otherwise they may not be able to respond to you in time.

If you are unsure of your National Insurance contribution record then you can check it online at www.gov.uk/check-state-pension. You will need your UK national insurance number handy.

By Jozef Spiteri

This article is published on: 21st March 2023

Following the previous article where we saw how investing can be used to increase levels of savings in retirement, we will now focus on how invested funds can be of added benefit when it comes to drawing an income in retirement.

We shall be making use of the same three scenarios we saw in the last article, where John had to choose between keeping all savings in cash, investing in a balanced risk portfolio or investing in a more adventurous portfolio.

In the first scenario John was left with cash reserves of €911,186 at retirement.

In retirement John aims to maintain his lifestyle whilst also taking two big trips annually with his partner. An estimated drawdown of €50,000 per year should allow this. In this case, cash reserves would last John 18 years. Considering that people nowadays are living longer, John will have some tough decisions to make. This may involve reducing the withdrawals made each year in order to stretch the funds as much as possible. Therefore, John will find it very difficult to maintain the retirement he wanted.

Looking at scenario 2, John will have an investment pot of €1,375,757 at retirement growing at 4% per year. If he were to withdraw €50,000 a year, this would represent a 3.6% annual withdrawal. This would mean that he would be taking out most of the average growth being achieved annually, which will more or less have his portfolio increasing by 0.4% per year net of drawdown. This will mean that John will not only be able to lead the life he wishes but also have a valuable cushion to protect against unexpected expenses which could arise in future.

The potential cushion with scenario 3 could be even greater with a savings pot of € 1,845,763 at retirement and an investment growing at an average 6% per year. John will be making an annual withdrawal of 2.7% of his portfolio leaving a net growth of 3.3% per year after drawdown. It’s often the case however that a more ‘balanced’ risk approach is taken in retirement.

This example illustrates the power of investment not only before, but during, retirement – compound returns within a properly planned investment strategy will often contribute towards achieving a secure and comfortable retirement.

The above are simplified examples and for illustrative purposes only. For a more detailed outline of how we implement successful investment strategies, please contact us to arrange an introductory discussion.

By Amanda Johnson

This article is published on: 21st March 2023

Assurance Vie in France – In most countries, tax-efficient savings and investment schemes exist with the aim of encouraging people to save for the medium and long-term so they don’t become a burden on the state.

However, when we become resident in France the tax-efficiency that we enjoyed from our home schemes is usually lost. This is because, as a French resident, you are liable to French taxes on all your worldwide income and gains, except for anything that might be exempted by the terms of a Double Taxation Treaty.

Even if certain income is exempt from French taxes, it is usually the case that this exempt income must still be declared in France and will be included with your other income when calculating your French income tax liability. The fundamental point to note is that including such exempt income has the effect of increasing the rate at which other sources of income are taxed in France, including investment income.

In France, there are several tax-free accounts available for short-term savings such as:

For medium to long-term investments (as opposed to savings), there is one product that stands head and shoulders above the rest and that is an Assurance Vie

An Assurance Vie (AV) is an insurance-based investment product. It can be as simple or as complicated as you wish to make it. Think of it as that old shoe-box that you keep your documents in, or maybe that fireproof metal cabinet for certificates and the like. Old and battered it may be, but an AV has some rather special properties:

Millions of French people use the AV as their standard form of savings and investments and many billions of Euros are invested this way via French banks and insurance companies. In addition, there is a much smaller group of companies that are not French, but have designed French compliant AV products aimed specifically at the expatriate market in France. These companies are typically situated in well-regulated EU financial centres, such as Dublin and Luxembourg. Before choosing such a company, however, it is important to establish that the company has a French fiscal representative, to ensure that you receive the same tax and inheritance advantages as a French equivalent product.

Some of the advantages of an international AV policy compared to French policies are:

How does an Assurance Vie work?

Your single lump sum investment or regular premiums are paid to an insurance company, which then places the money with the investment manager(s) of your choice. These are usually unit- linked types of investments, for example in equity or bond funds, but can also be in deposits or special products on offer from various financial institutions. You can invest in any number of different funds or products and these are all collated together by the insurance company to form a collective bond, which is your AV policy.

If you have chosen your investments wisely (with the help of your financial adviser), over the long-term the value of units you hold in the funds is likely to increase and so too is the value of your AV policy. However, you must be fully aware of and comfortable with the amount of risk that you are taking, since with any type of unit linked investment your fund value can go down as well as up, as a reflection of what is happening in investment markets. Over the long-term, however, the effect of short-term market volatility will usually be reduced.

Can my capital be guaranteed through an Assurance Vie?

A common feature of the French AV is the possibility of investing in Fonds en Euros. This is a special type of fund designed to form a very cautious base to your total investment, since your capital, as well as any interest and year-end bonus added to it, is guaranteed. The fund invests mostly in government and corporate bonds, although there can also be a little exposure to equities and properties with the aim of enhancing returns. During the year, your capital will earn interest and by law the insurance company must allocate most of your share of the return of the fund to your account, in the form of a year-end bonus. The balance of the return of the fund is kept in the insurance company’s reserves, to smooth out future investment returns, for example in times of poor market investment performance.

Due to the nature of the guarantees with Fonds en Euros, the rate of return is typically low, but is usually better than the interest that you might earn from a bank deposit with immediate access. However, this type of fund is regarded by the tax authorities as being so secure that social charges are levied annually on the gain (rather than only at the time that you take a withdrawal as would be the case with other investments within the AV). This effectively reduces the rate of return over the long term. Through some international AV policies there is the possibility to invest in structured bank deposit offerings, where the investment return is linked to the stock market, but with the security of a capital guarantee.

How do I choose what to invest in inside my Assurance Vie?

You may have strong views on this yourself, or you may have no ideas at all, but in all cases it helps if you have a good financial adviser at hand. His or her job is to help you understand the whole concept of investment and to help you establish your attitude to investment risk. Sadly, there is no realistic chance of a meaningful return on your savings without accepting some degree of risk. We have also seen in recent years that even leaving your savings in a bank can be risky, whether this is because you do not earn a real rate of return or because the bank fails due to poor management.

Your adviser will show you different types of investment options, explain how they work, what their track records are and how much risk is involved. You make the final decision, but his or her help can be invaluable. When the investments have been made, there should be follow-up meetings to review the performance of your investments. Your adviser may well recommend some changes depending upon the evolution of your own circumstances, or perhaps because of fund performance, or may have interesting new funds to introduce to you.

It is also possible to use the services of a Discretionary Fund Manager, with whom you agree an investment mandate (based on your specific investment objectives and risk profile), who then manages your money on a discretionary basis to achieve your financial goals.

How is Assurance Vie taxed?

Only the gain element of any amount that you withdraw is liable to income tax and the rate of tax is determined by the date on which premiums are paid.

Premiums paid before 27th September 2017:

For premiums paid before 27th September 2017, the taxpayer has the option to be taxed at the progressive rates of the barème scale or the Prélèvement Forfaitaire Libératoire (PFL) rates, as follows:

Premiums paid from 27th September 2017:

The Prélèvement Forfaitaire Unique (PFU) – also known as the Flat Tax – was introduced in the Project de Loi de Finances 2018, published on 27th September 2017. From this date the PFU applies to the total amount of interest, dividends and capital gains on the sales of shares received by the taxpayer. It also applies to certain gains on withdrawals from assurance vie contracts.

The Flat Tax rate is 30%, made up as follows:

For premiums to assurance vie contracts paid from 27th September 2017, the tax rate will vary according to the age of the contract, and for contracts older than eight years according to the ‘threshold’ amount of capital remaining in the contract as at 31st December of the year prior to the withdrawal being taken.

The threshold amount is €150,000 per individual person (across all assurance vie policies), which is determined by reference to the amount of the premiums invested, reduced by any capital already withdrawn, and not the value of the contract.

The threshold is not cumulative between persons and therefore couples who are taxed as a household cannot share in each other’s thresholds. Thus, one spouse may reach the threshold level whilst the other does not, for example where one has say €200,000 capital invested and the other only has €80,000 invested.

The PFU applies to assurance vie contracts of less than eight years regardless of the amount of the outstanding capital. Thus, the PFU rate of 30% replaces the pre-27th September 2017 rates detailed above.

Therefore, according to the age of the contract, the following tax rates apply:

* A lower rate of social charges at 7.5% applies if you are resident in France and hold the EU S1 certificate, whereby you are covered by the health system of another EU or EEA country.

Insurers are obliged to deduct the tax of 12.8% or 7.5% (depending on the duration of the contract) plus the social charges. Subsequently, for contracts older than eight years where the taxpayer has exceeded the threshold, any additional tax due is charged through the taxpayer’s annual declaration.

Tax-free allowance on all policies after the eight year holding period:

In addition to this, and in all cases regardless of the ‘premium paid’ date, after holding a policy for eight years a single taxpayer receives an income tax allowance of €4,600 per annum against the gain element of any withdrawals during the tax year. For a couple who are subject to joint taxation, this is increased to €9,200. Hence, providing that the gain element of total withdrawals made during the year does not exceed the allowance, then there is no income tax to pay. This might not sound a lot, but it is a very useful allowance, as can be seen in the following simple example.

Peter and Pam have an AV policy, which they start in January 2018 with an investment of €100,000. They do not make any withdrawals on this investment for the next eight years, and it is then worth €160,000 (hypothetical). A new car is then needed, and they need some cash to help pay for it, so they withdraw €20,000 from their AV. In this case €60,000 of their AV worth €160,000 is profit, and that is 37.5% of the total, so it is logical that the gain element of their withdrawal is €7,500 and €12,500 is their original capital.

The insurance company (assurance vie provider) will deduct income tax and social charges on the gain element when they pay out the withdrawal. Since the policy is over eight years old however, and they are subject to joint taxation, Peter and Pam have a tax-free allowance of €9,200. The gain will then be declared on their next tax return and they will receive a rebate of the income tax charged.

Does an Assurance Vie have other advantages?

Without doubt, the AV is effective for inheritance planning. There are age restrictions, but via an AV policy you can leave up to €152,500 to any number of beneficiaries, each of whom will pay no succession tax. In addition, AV policies are exempt from the strict French succession rules. You can leave your money to whomever you wish. Should you wish to leave more than this amount to any one beneficiary, they will pay tax at a rate of 20% on the next €700,000, and then at 31.25% above that.

Is an Assurance Vie right for me?

An Assurance Vie is a valuable asset, helping you to shelter your capital and income from unnecessary taxation. It can provide protection for you during your lifetime and protection for your loved ones when you are gone. However, everyone’s circumstances are different and it is essential that you take professional financial advice before investing into this type of product.

By Gareth Horsfall

This article is published on: 17th March 2023

Tax time in Italy – when our commercialisti wake up from their winter ‘letargo’ (aka – well-earned down) and start asking us to send our financial information for tax payment, if you haven’t done it already of course.

On top of the information regarding our taxable assets and income there is the list of allowable deductions /detractions to assist in lowering your tax bill.

In this article, I review that list for fiscal tax year 2022.

SPESE FAMIGLIARI – family expenses. These attract a detraction of 19% of the value of the expense.

SPESE PER LE CASE –

SPESE MEDICHE – medical expenses. These all attract a 19% detraction:

LIBERE DONAZIONI – the full cost of donations to:

BONUS EDILIZIE – restructuring and renovation costs

For the tax year 2022, the following detractions are available:

(** the superbonus has been suspended by the Meloni government because they found a hole of €38 billion in the public finances due to fraudulent activity related to the Superbonus. It is unknown when and if any applications made in 2022 will be reimbursed).

Where you have an income up to €120,000 pa the expenses, as described in this article, will be fully allowed. Where you income is over €120,000pa then the detractions will be reduced according to a formula based on your total income.

And that’s it. Everything that you can detract from your income in 2022 to try and reduce your tax bill in Italy. If that doesn’t make a difference, then you may need to have a look at your overall finances to try and plan in different ways.

It should also be noted that the Meloni government is currently debating how they can simplify this whole system by reducing the tax bands from four to three in the coming year, and then hopefully moving to a two tax band system. If they manage to pass this, then they will likely reduce/remove this system of detractions/deductions by lowering the bottom rate of tax, or maybe introducing a starting rate tax allowance for everyone (unlikely). However, they are in first stage negotiations and it may be some time before things come to pass.

By Portugal team

This article is published on: 17th March 2023

One of the most confusing aspects for expats is establishing where they should be paying tax after they have left the UK. Many just assume that there is no UK liability after they have left.

UK property

Tax on income and gains from UK property is always taxed in the UK, even if you live in Portugal with or without NHR status. You do still have your UK annual personal allowance and capital gains tax allowance to offset against any taxable income or gains as a non-UK resident.

You must also declare this in Portugal and will receive a tax credit for the tax paid in the UK to offset any Portuguese tax liability.

UK government pension income

The taxing right remains with the UK in respect of former government service pension income, and you have your UK personal allowance to offset against this.

Government service pension schemes are not the same as the UK State Pension. The State Pension is not taxable in the UK, can be paid out to you gross and is taxable in Portugal.

UK private pension schemes

Private pension schemes are taxable in Portugal. Again, the income can be paid out to you gross by your pension provider. However, in practice, some people still find themselves having tax deducted at source on UK pension income and must reclaim it. If you complete a DT/individual form, available from HMRC’s website, and follow the submission process you will be able to receive your pension free from UK tax at source.

UK dividend & interest trap!

The UK has the right to tax UK-sourced dividends and interest under the treaty rules between the UK and Portugal but an interesting quirk of the rules is that when you submit your UK tax return HMRC will automatically calculate the best outcome for you; either to not tax your UK dividends and interest and in turn, you lose your UK personal allowance (this is called disregarded income treatment) or to tax them and preserve your personal allowance to offset against other income e.g. rental.

Special care must be taken if claiming split-year treatment – this is when you leave the UK partway through the tax year and you are only taxed in the UK from 6th April to the date you leave. A real-life example: an individual who left the UK in July subsequently took a large dividend in the same UK tax year. As a result, the dividend was taxed in the UK (even though they were no longer UK resident) and this resulted in a hefty tax bill. Had they waited until after the following 6th April, HMRC would not have taxed this.

Exceeding your UK day count

Another scenario where you could find yourself a UK tax resident, even though you have moved abroad, is when the relevant day count allowance is exceeded. The UK Statutory Residence test clearly sets out the rules and the allowable number of days to avoid getting yourself into this grey area. The day count can be as little as 16 days and as much as 182 days depending on the number of ties and connections you have.

UK Inheritance Tax

Another context when you can still have a UK liability is in respect of succession and inheritance tax. This is a complicated area, and we will dedicate next week’s article to exploring this topic.

By Portugal team

This article is published on: 14th March 2023

Many British business owners may not have considered selling their UK business as a Portuguese tax resident, and whilst the UK rules for selling business are generous, we have seen several business owners enjoy better outcomes here in Portugal.

Opportunity

Non-Habitual Residence (NHR) status allows those in receipt of foreign-sourced dividends to receive them free of tax. This has proven to be a great opportunity for UK business owners who can enjoy the luxury of running their businesses at arm’s length.

But most owners do not want to run their businesses forever, and what many may not have realised is that selling their business whilst Portuguese tax resident could be highly tax efficient and, in some cases, provide a better result than the UK.

Real-life example

We recently worked with a business owner who had agreed to sell their UK-based business, but the sale would take some time to complete.

They knew what their tax liability on the sale would be in the UK but were keen to move to Portugal quickly, rather than wait for the sale to complete whilst they were resident in the UK. They were understandably disappointed to learn that the potential tax liability in Portugal would be markedly higher, at 28%.

However, on reviewing the structure of the business and how the sale was arranged, we were able to advise on a position where the couple could move to Portugal immediately with a resulting zero tax liability. Additionally, working with a local accountant, it was possible to create an accounting loss for them to use against future gains in Portugal.

In addition, we presented a highly diversified and managed risk solution to preserve and grow their wealth, whilst also future-proofing them for the end of their NHR status and a possible return to the UK.

The position turned out to be better for them selling as Portuguese tax residents, rather than UK tax residents, and they got to get on with their new life in the sun sooner than originally planned.

Replacing business income

The most important step following a sale or after drawing large dividends is finding an appropriate new home for the cash – you do not want it sitting in the bank being eroded by inflation, invested in inappropriate structures, or held tax-inefficiently going forward.

Whether you want to replace the income you once enjoyed, or preserve wealth for future generations, the key is structuring correctly for your goals. This must take into account several factors, such as where you and your ultimate beneficiaries are resident and the associated tax implications, flexibility in access and appropriate investment strategies, to name just a few.

Explore your options

We regularly work with business owners’ UK accountants, tax advisers and other trusted parties to explore restructuring and selling options. We are also on hand for clients to ensure that the advice is coherent, viable and implemented correctly from a cross-border perspective.

We also work with clients to put longer-term plans in place to ensure ongoing tax efficiency, compliance, and wealth preservation here in Portugal. If you would like to explore your options, please contact us for an initial discussion.