I don’t think I have ever wanted to leave a year behind me as much I did 2022. Well, maybe 2008/2009, but 2022 recorded as one of the most brutal in my career. No matter which direction there only seemed to be bad news. Thankfully we have passed into 2023.

So what does 2023 have in store?

By Gareth Horsfall

This article is published on: 1st February 2023

So what can expect from 2023?

Working with The Spectrum IFA Group means that I am invited each year to their annual conference where we are invited to listen to a number of fund / asset managers who can give us some insight into what has happened and also where things might be heading. This conference was a special one because it was the 20th anniversary of the The Spectrum IFA Group and so the event was held at Gleneagles in Scotland. Apart from the cold (average -2 degree), the conference went well and I managed to scribble some notes from the various speakers, my favourites being David Coombes from Rathbones Asset Managers, Rob Gordon from Dreihaus/VAM Investment funds and Rob Clarry from Evelyn Partners.

(Disclaimer: It should be noted the views expressed here are my own. The information collected has been interpreted by me and can only be taken as such. To protect the names mentioned above none of this article should be taken as advice, recommendations or an offer of solicitation from the fund/asset managers themselves or the companies they represent).

“Heads of State don’t have a clue what they are doing…yet they think they can predict the future”

This was how one asset manager (who shall remain unnamed) started his presentation. The point being that if we are basing our investment ideas and knowledge on economists, central banks or governments themselves, then it is almost certain that you are going to get it wrong.

But don’t just take my word for it, let’s looks at some investment examples that didn’t go well in 2022, and which prove the case:

1. Wind Power is the future…but is it? It produces only when the wind blows, it is significantly more costly than traditional energy sources. The amount of ecological damage to build wind turbines in terms of resources required and to install them probably far outweighs the benefits if you place it against other alternative energy sources. In addition, the blades have a lifespan of approximately 10 years then they need to be replaced and buried somewhere because they cannot be recycled. Yet, faced with all these facts and a sector heavily subsidised by government money, a Danish wind power company: Vestas, which has never turned a sizeable profit was worth more than Apple at one point.

2. Cryptocurrency: There is not a lot to say about Crypto in 2022 other than a complete investment disaster. Bitcoin lost 60% of its value in 2022. A pretty high risk asset if ever there was one. Crypto was also plagued by the collapse of FTX with literal losses ( i.e lost and likely never to be found) assets of $1-2 billion. Hackers also stole $4.3 billion of cryptocurrency in 2022, an increase of 37% from 2021. Yet, governments tell us that government backed crypto-currencies are the future. I will stick with cash, thank you very much!

3. Tesla and Elon: How the darling of the investment world, and government officials alike, has been ousted from his perch. A bit like crypto currency Tesla lost 65% of its value in 2022. You might argue that he is changing the world with his electric vehicles, yet did you know that Volkswagen made more electric vehicles in Europe in 2022 than Tesla? So, who is changing the world? His move to Twitter should also raise eyebrows. A company worth $40bn on the world’s financial markets which has yet to show a profit and one which he also says will ‘change the world’. Remain a sceptic!

4. Inflation is transitionary: Governments also said that when the inflation train left the station in 2020, that, at best, it would be, quote, ‘transitionary’. i.e it would go away once post Covid supply chains returned to normal. I never believed this and wrote about it on a few occasions in the last couple of years. Let me tell you that inflation is here to stay…and would you like some numbers on that? Well David Coombes from Rathbones hazards a guess that inflation will continue at approx 4% in the US, 3-4% in the EU and 5-6% in the UK as an average over the next 3 years. I suspect those are headline ‘government’ declared rates. My guess is that real inflation may be somewhat higher. Protecting those savings and investments has never been more important.

Did you know that inflation needs to only run at 7% per annum for 10 years for the value of your money to halve. 2022 ‘true’ inflation was more like 10-15% across Europe, so that’s 2 of those 10 years taken care of already.

So with all this doom and gloom, what actually did do well in 2022?

Answer: The old, out of favour, industries of the past: BP, Shell, Lockheed, Schlumberger, Caterpillar et al.

Yep, those very same industries which no one wants to invest in any longer. They turned the corner and became the star performers of the investment markets. In fact, anything moderately related to ethical / sustainable / ecological investment had the hardest time in 2022. It was enough to test anyone’s ethical investment values!

However, the truth of the matter is that with interest rates likely to be higher in the next 5 years than they have been in the last 5 years, and the cost of debt being significantly higher, we may just see some of the older, cash rich industries doing quite well, and seeing some of the newer debt heavy companies struggling or even going bust.

Take Netflix. (It has become my go to TV channel!). Netflix’s business model is built on continual expansion of its subscribers and content. However, it has been heavily funded by cheap debt. How might it progress in a world where the debt it needs to make a new series costs 5 times more than before? I suspect it might survive this new world it finds itself in, but could it become a takeover target from a more established and cash rich company, like Disney?

Another example of one of those new, sustainable, ethical businesses, potential disruptor / game changer was Impossible Meat. For those that are not aware they are producing plant-based meat alternatives. In 2022 they saw their share price fall 96% as consumers turned away from their product. (I tried them myself and can’t say I was too impressed!). An example of governments pushing us towards more plant-based and lab made foods, not to forget bugs. But can they accurately predict the future?

So, the cost of servicing debt is certainly going to reshape the investment world again, yet there is one major theme which will shape the world in years to come: SECURITY and I don’t just mean military security, but also energy and food security.

Energy Security

Energy security is being driven by the war in Ukraine and the end of the reliance on Russian cheap energy. A perfect example of how energy policy is needing to change focus is Giorgia Meloni’s recent trip to Algeria to agree access to their gas fields, and export into Europe. Algeria has the 11th largest reserves in the world and have a gas surplus. Italy is trying to line itself up as an energy hub for Europe given that gas will likely now come in from the global south rather than the north, and Italy, it would seem, is ideally placed as a central Mediterranean country and its access into the EU. The only snag, which is not much talked about, is the fact that Algeria is a Russia ally and currently buys fighter jets from Russia and supports it in the war with Ukraine, so how the Italy/Algeria agreement will work is anyone’s guess.

Military security

Military security for the EU is still going to come from NATO (i.e US led military policy). It could be argued that the Ukraine war is not in the EU’s interests, in particular Germany, but they have to kowtow to NATO/US driven policy because the EU never could agree on building an army of its own to defend itself, and hence self- determination in terms of defence policy. There is no other real option and so the EU will very likely continue to arm Ukraine and stretch out the war if that is what US policy dictates, even when negotiations to end it might be possible. The order books of most armament / defence companies will be very full for some years to come.

Food security

This was an area which provoked more discussion from the fund managers. In particular how the West will need to develop to ensure that food is still delivered to our supermarkets.

A good example of a company that is innovating in the area of food security is John Deere. The agricultural machinery and tractor marker. They have already developed a fleet of unmanned vehicles which can plant, monitor and harvest. These machines are no longer human driven one-purpose vehicles. They are machines with embedded computers, checking soil temperature and microbe levels, adding fertilizer when needed and checking weather signals, determining when to plant, when to harvest etc, and all without any human intervention in the field. The biggest customers will ultimately be the biggest producers, namely the US, Brazil and Ukraine (you may be surprised about Ukraine being in the list, but a benefit of war for large industries is that they can take advantage of disaster capitalism. Large US and International agricultural companies have been able to take advantage of new laws liberalizing the sale of agricultural land in Ukraine. Previously, Ukrainian small farmers were protected and forbidden to sell their land to large agro interests. Now, big companies are moving in to take charge of Ukrainian land. On one hand the farms will benefit from economies of scale, but the small-scale sustainable farming model will struggle to survive).

Agricultural and food production will be a big investment theme in the coming years!

So, with all these themes in mind, the broad outlook for the future and investment, according to Evelyn Partners, will be determined by 4 main Megatrends.

- SHIFTING DEMOGRAPHICS

- CHANGING WORLD ORDER

- BUMPY ENERGY TRANSITION

- TECHNOLOGICAL REVOLUTION

I won’t bore you with details in each area, but here are some points around the subjects discussed:

SHIFTING DEMOGRAPHICS. Ageing populations, more opportunity for pharmaceutical companies and drug development, more use of online doctoring and diagnosis, roll out of robots in our hospitals and clinics (robot cleaners, robot secretaries, robot surgeons, robot beds moving freely from ward to surgery room without the need for people). It’s all coming and given that 80 out of every 100 people will be over the age of 65 by 2050 in Japan, and around 60 in 100 in Europe, it is difficult to see how our world will survive without increased development and innovation in the healthcare sector.

CHANGING WORLD ORDER. The US/China decoupling will continue and accelerate. Instead of globalisation, think ‘slowbalisation’. The war in Ukraine has driven a wedge between those, already weak, alliances. Russia, Iran, China, Saudi Arabia, India, (the BRICs+) and other countries are coming together to find ways to subjugate control over their regions and wrest control away from the US, especially in the use of payment systems in USD. The US will, of course, fight its corner, just look at its policies around the semi-conductor market which you will have read in my last E-zine ( ) What investment opportunities this will throw up is anyone’s guess, but the exportation of the US model of capitalism around the world, will slow and this could throw up new investment opportunities in new companies further afield.

BUMPY ENERGY TRANSITION. We are only going one way with energy policy, and that is more towards sustainable energy production; but, if you think we will be switching off the oil taps and shutting down the coal fields overnight, as many Eco groups would wish for, you will be very disappointed. (I will place a bet that in 20 years we are still using the same amount of oil as we are today, but that’s just a personal hunch. A lot of electric cars are going to need a lot of electrical energy from somewhere). A transition will happen but technology and storage of energy will need to improve, solar and wind power will just not make up our energy needs.

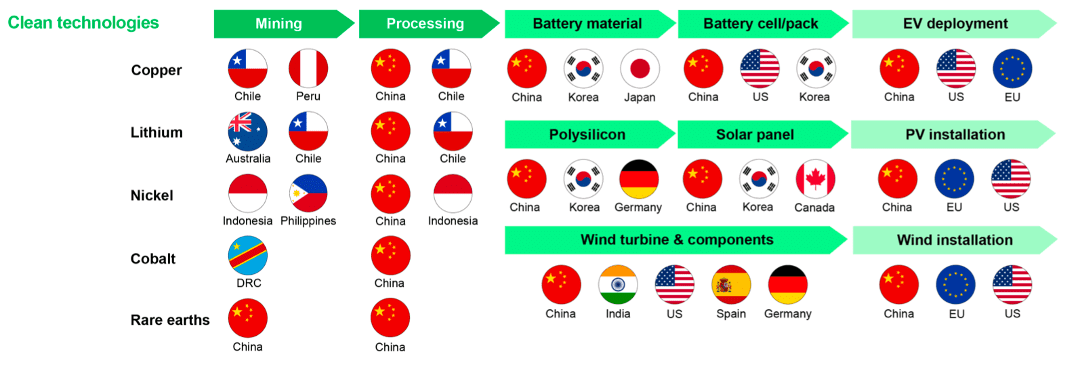

In addition, a little known point about the resources required for a sustainable energy transition: China dominates!

So, whilst the US imposes sanctions on China in the access to and production of semi conductors, China could retaliate with sanctions on the west regarding access to the materials needed to transition to our green economies. Yet, China needs to import 70% of its food from abroad as it is not able to produce enough to feed its population. The US is the biggest producer of agricultural products. So, from a bumpy energy transition we revert back to point 2, The Changing World Order. It will be an interesting time ahead for global politics.

TECHNOLOGICAL REVOLUTION. We have already seen so much revolution in this space since the year of my birth 1974 but the future will accelerate things even more. From next level automation in industry and daily life, 3D and 4D printing will become more the norm (I went to a fayre in Villa Borghese in Rome last Sunday and one stall was 3D printing some items on a wooden work bench) with the launch of 5G we will become even more interconnected, more reliance will be placed on cloud computing and storage of data, next-gen quantum computers, AI and controlled devices, cryptocurrencies, wearable devices…the list goes on.

And if that is not enough to scare you then check out the company recently purchased by Microsoft called ChatGPT. This is a learning AI application which can do just about whatever you want it to do. Think of it as an Alexa x 1milllion! It can provide you with any amount of information you need, ‘write newsletters’ – you just give it a subject and in seconds it will provide you with a written text on a certain subject, do maths, solve problems, write a website for you, some students are even using it to write essays at University. The scary thing is that it learns as it goes. Anyway, you don’t have to worry about my E-zine being written by ChatGPT; I don’t even think the best learned AI could imitate my crazy style.

And more food for thought

Rob Gordon (US citizen) from Dreihaus/VAM Investment funds thinks that Trump will win the Republican nomination again. But he thinks that Jo Biden, at 81 years of age when the election comes around, will win against Trump again.

David Coombes from Rathbones Inv Managers thinks that GBP will drift back into the range of 1.25/1.30 against the Euro within the next 3 to 4 years .

Lessons learned from this conference

This might sound like a sales pitch: something I try to avoid in this E-zines as they are written for information purposes only. However, whilst listening to our various speakers I became overwhelmed at just how complicated the world is becoming from a political, technological, economic and investment perspective. We can no longer ‘pick a stock’ and expect it will do well. Thought and research needs to be behind investment decisions. It’s easy to think that we can invest ourselves, be successful and then years like 2022 come along and there is nowhere to hide: stocks and bonds prices fall together, and then the only safe space is in some highly volatile areas of the commodity sector, which you wouldn’t normally play in. We need professional help and guidance to help us navigate these choppy waters head, but when there are so many changes afoot, it throws up the best investment opportunities. The investment managers and companies we use and talk to regularly are on top of these trends and can help you, our client, to get the best from your investments. The lesson learned from this conference: you are in good hands.

As always, if you have any questions about this E-zine or have any general financial planning concerns as a resident in Italy, or someone who is thinking of moving to Italy, then don’t hesitate to get in touch on email: gareth.horsfall@spectrum-ifa.com or on cell: +39 3336492356