Spectrum Client Charter – what you can expect from us

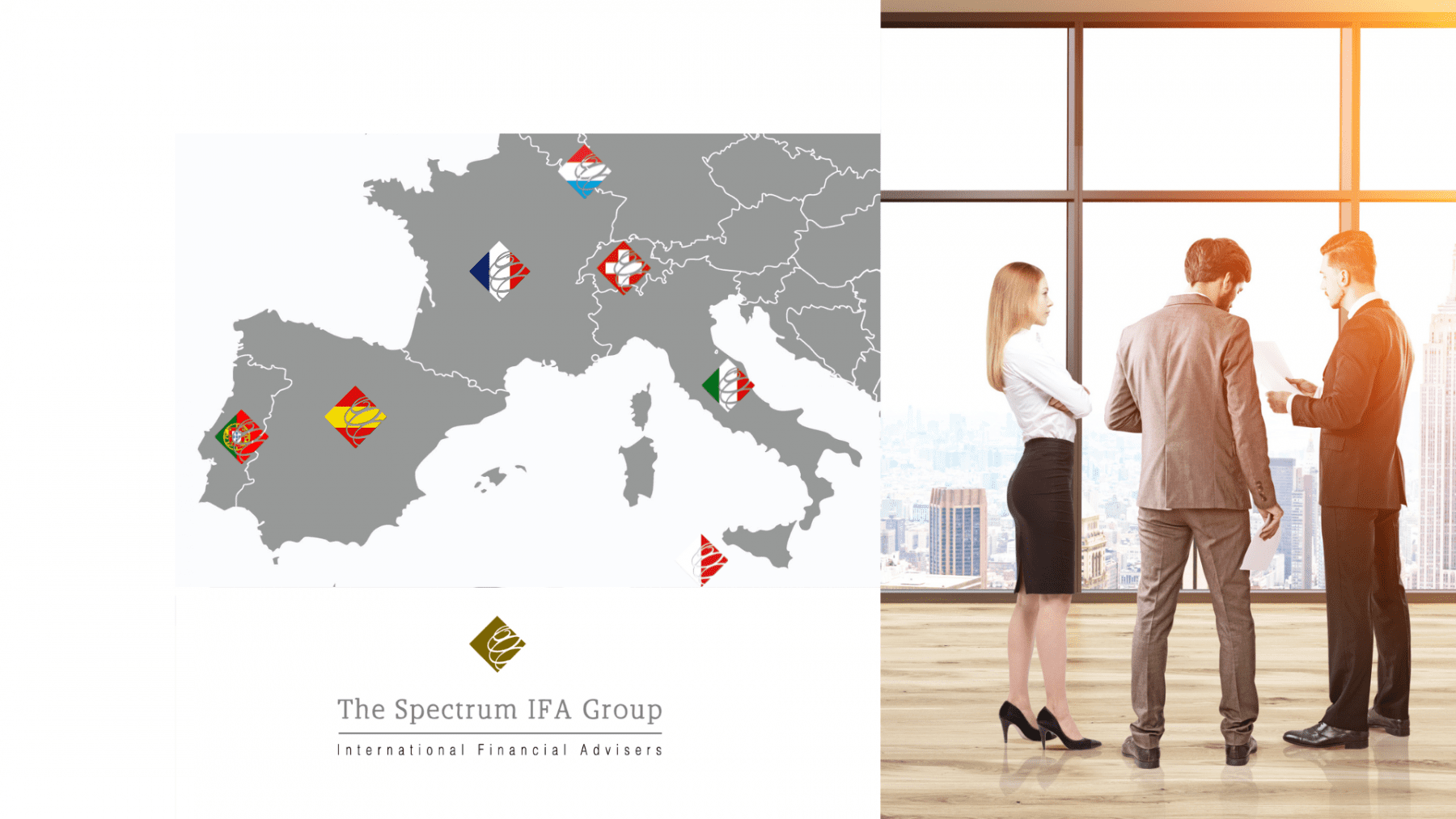

The Spectrum IFA Group is a European trademark under which a number of companies are working, including TSG Insurance Services SARL. This document details the association between Spectrum, Spectrum advisers and their clients. The term ‘Spectrum’ refers to those companies and advisers that form part of The Spectrum IFA Group.

1. Ownership stability: The Spectrum IFA Group has been continuously owned by its founders since operations began in 2003. No financial institutions or other third parties have shareholdings in any part of the group. We are legally obliged to highlight those companies with whom we place more than 10% of our business: Prudential International and Utmost PanEurope are key participants in our market. Details of other product providers are available on request

2. Financial planning: Spectrum offers a no obligation, no fee financial review and planning service. This allows prospective clients to fully understand our advice process and recommendations before choosing to become a client.

During this process we complete a comprehensive ‘know your client’ financial fact-find in order to understand your immediate circumstances as well as longer term plans, needs and objectives. We also complete a due diligence exercise in line with global anti-money-laundering regulations and assess your attitude to risk, professional financial experience and investment preferences, including in relation to Environmental, Social and Governance (ESG) factors.

3. Reasons why: Prior to completion of application documents, Spectrum will explain to you the type of product being recommended and supply a brochure (and any technical guide or other relevant material) for you to review and retain for future reference. Spectrum will take time to explain the product’s key features including charges and any potential cancellation penalties.

4. Your money: Spectrum doesn’t handle client money. All transactions are completed directly between you and the financial institution responsible for your investment.

5. Remuneration: Spectrum doesn’t receive fees directly from clients. For insurance advice we are remunerated by insurance company commissions. For investment advice we are remunerated by fees paid from investment service providers. As stated above, there is no fee payable for our financial planning service. If an investment fund within an insurance policy pays an additional initial commission, we undertake to rebate this to you in full by way of increased allocation. In the unlikely event that a fund is subject to a potential exit penalty, we will highlight details to you in writing. Where we take on the servicing of an existing contract, originally recommended by another advisory firm, we may arrange a servicing charge (deducted from the product), in which case it would be discussed and agreed with you in advance.

Details of Spectrum’s regulatory status, financial services licences, professional insurance, complaints procedure and general data protection information follow in this document.

Statutory corporate and regulatory information

This document is an essential element of the relationship between us. It contains a summary of the legal information that Spectrum must communicate to you prior to entering into a professional relationship.