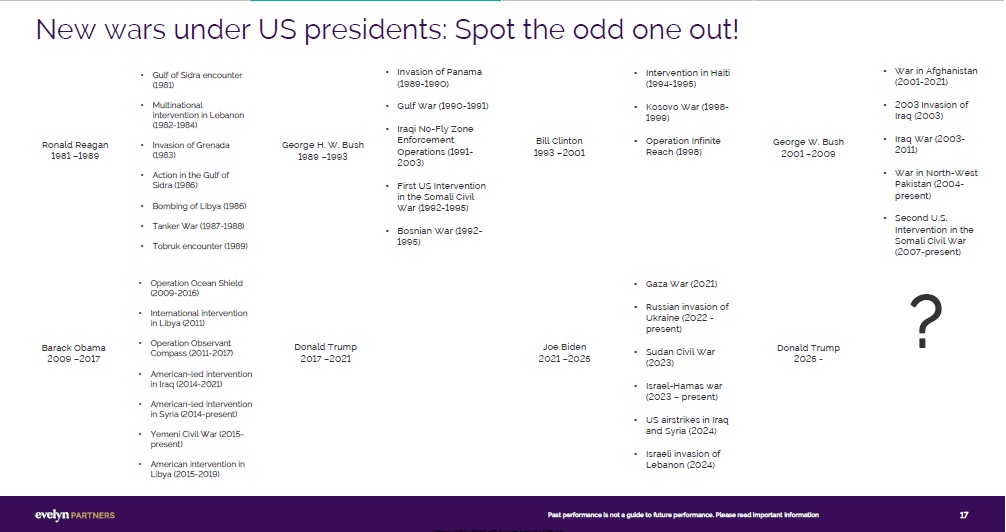

(This slide might be difficult to read, but it’s worth expanding the text to see which US Presidents started the most new wars. A big surprise to me was that Ronald Regan and… Barack Obama! share the record (7 each) – Donald Trump – zero!)

So considering all this, what was the message from the investment managers at the conference?

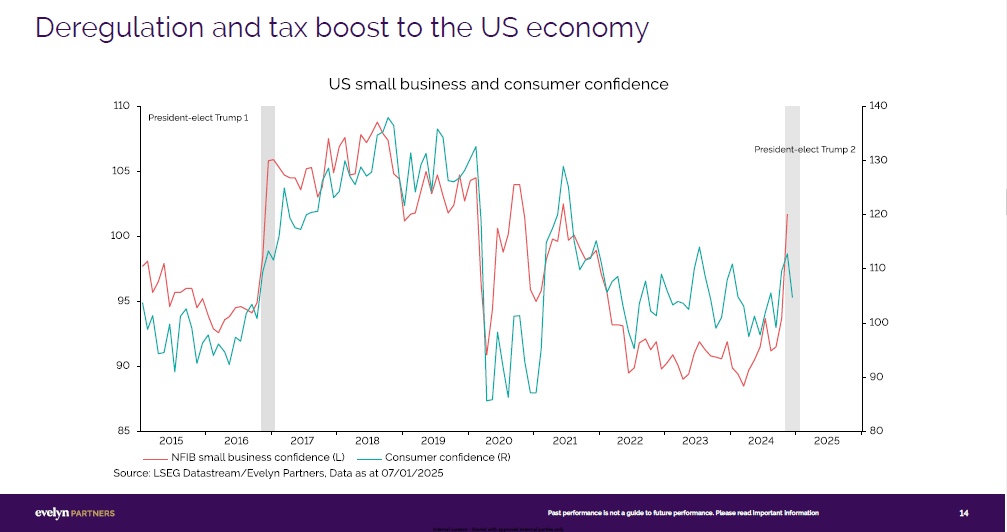

Trump will be good for America, he will stimulate growth in small to mid sized companies in the US. He will bring jobs and businesses back to the US and he will likely be good for your investments where you have exposure to the US stock market. We may also see a bull market in commodities as well.

But it will come at a price and one which we, as investors, must be mindful of.

INCREASED VOLATILITY: More swings in assets prices based on what I stated above:

** Don’t listen to what he says, watch what he does **

Markets will respond to what he says, but as investors we need to keep our eyes on the actions he takes and cut out the noise. It will certainly be an interesting time but could turn out to be a profitable one for those who ride his Presidency out, and, yes, markets will likely fall at some point and we will all feel some pain for a short period, but remember that investing is mid to long term and most of us have been through something similar, if not a lot worse , before…

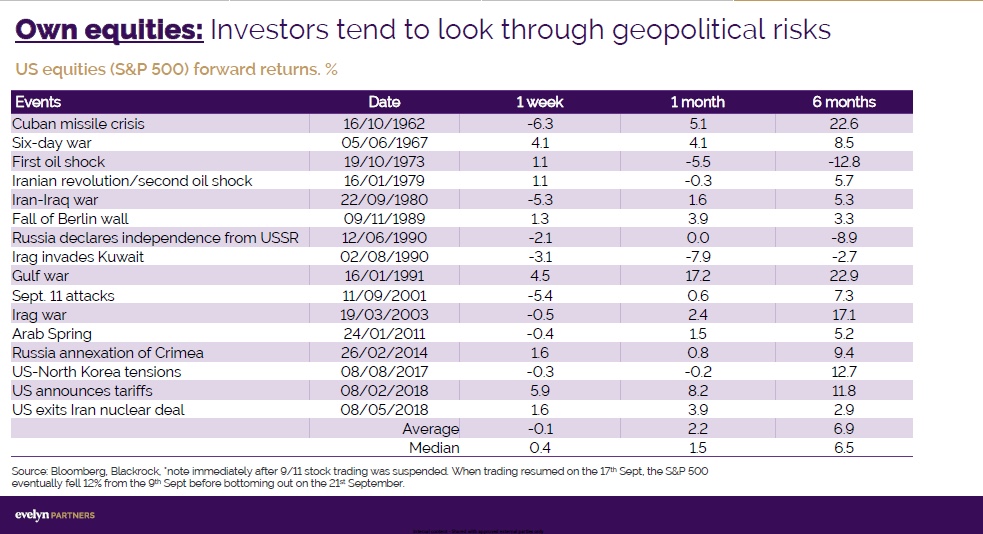

And if you need confirmation of this then check out the following slide: