It’s that time of the year again folks!

I am always given warning that tax time is approaching because a number of clients start to ask for valuations of accounts, interpretation of some documents and also help with organising and sharing some documents with commercialisti.

Tax returns in Italy

By Gareth Horsfall

This article is published on: 2nd May 2025

However, regardless of anyone actually alerting me to the upcoming tax declaration in Italy, I always say that Easter time is a good time as any to nudge yourself into getting your financial documents in order for your ‘dichiarazione’ (if you haven’t done it already).

Never leave it too late! Commercialisti are run off their feet in the summer and can be hard to get hold of during their busiest time of the year, just when you or I are thinking about our holidays!

In this E-zine I am going to do an abbreviated version of the taxes that you may be subject to.

Nothing has really changed much from last year, so if you would like a longer explanation of what they are and why they are charged then you can check out my 2024 E-zine on the same subject, HERE.

(More on Italian country life at the end of this E.-zine if you are so inclined to keep reading on!)

TAX ON INCOME

INCOME TAX RATES FOR 2025 (IRPEF)

In a move to simplify the tax regime in Italy the tax bands have now moved from 4 to 3 in 2024.

| On the first € 28000 | 23% |

| € 28001 to € 50000 | 35% |

| € 50000+ | 43% |

PENSIONS

Most of my clients are in, or planning for, retirement to some degree and so understanding how your pension will be taxed as a resident in Italy is of paramount importance.

PRIVATE PENSIONS AND OCCUPATIONAL PENSIONS (Income tax rates – IRPEF)

Private pension provider income: 401K / IRA’s etc / Occupational pensions / Personal pension income / State pension or social security.

All these types of pension incomes fall into the income tax rates ( IRPEF), they are added together and the rates applied to the progressive bands of income.

GOVERNMENT DERIVED PENSIONS

(tax in country of origin unless Italian citizen!)

The definition according to the Italy / UK / USA double taxation convention 1988 is, paid from:

” a political or an administrative subdivision or a local authority”

The pension awarded is generally taxable only in the state in which it originates and tax is generally deducted at source in that country of origin, unless your are an Italian citizen and then it becomes taxable in Italy as well.

(Check the double taxation treaty from the country in which the pension payments originate)

(This income is not taken into account when calculating the tax on your other income sources in Italy, e.g. rental income, and it is not declared on your tax declaration in Italy)

2025: NO TAX AREA (€8500)

The NO TAX AREA applies to anyone receiving a pension, whilst resident in Italy (“pensioner” is defined as someone who is receiving official state benefits i.e., social security or state pension).

No distinction is made between pensions being paid from abroad or within Italy!

The NO TAX AREA is €8500 per annum.

It is important to understand that this is NOT an allowance but a tax credit system.

If your total income (reddito complessivo) is €8500 or less then all the tax payable on your pension will be provided as a tax credit.

HOWEVER, the more your total income, from all sources, increases over €8500, the more of the tax credit you lose.

If your total income is €50000 or above you would not receive any tax credit.

BANK ACCOUNTS AND DEPOSITS

A very simple to understand and acceptable €34.20 per annum is applied to each conto corrente e libretto di risparmio: current account or deposit account. This would typically include fixed deposits, short terms cash deposits, CD’s etc. The charge is the equivalent of the ‘imposta da bollo’ which is applied to all Italian deposit accounts each year.

(Money market accounts, premium Bonds in the UK and other deposit based instruments will not generally fall in this category and would be subject to wealth tax – see below)

Interest income is taxed at 26%.

INVESTMENT INCOME AND CAPITAL GAINS (26%)

A flat tax rate of 26% is payable on interest and income payments from capital and realised capital gains are also taxed at the same rate of 26%.

(Interest from Italian government bonds and government bonds from ‘white list’ countries are still taxed at 12.5% rather than 26%, as detailed above. This is another quirk of Italian tax law as this means that you pay less tax as a holder of government bonds in Pakistan or Kazakhstan, than a holder of corporate bonds from Italian giants ENI or FIAT).

If you are invested in NON-EU harmonised collective investment vehicles i.e. funds which are listed in a place outside the EU, then the gains and income from these assets are NOT taxed at the flat 26% rate in Italy, but would be added to the rest of your income for the year and taxed at your highest marginal rate of income tax! Funds or ETF’s, for example, which re listed in the UK with a GB ISIN code or in the US with an equivalent US number, would fall into this category.

This is particularly important for UK and USA domiciled assets. If you have a brokerage account with a group such as Fidelity or Vanguard or one of the many other asset management firms, or you invest through a platform such as Hargreaves Lansdown in the UK/USA, then depending on which assets you invest in could mean you are pushing yourself into a higher tax bracket on taxable gains and income for the year. Your portfolio may need restructuring for life in Italy!

WEALTH TAX ON ASSETS (0.2% PA)

Any financial assets other than property attract an annual wealth tax of 0.2% on the value of the asset as at the 31st December each year.

Here are examples of a few:

GENERAL INVESTMENT ACCOUNTS, ISAS, BROKERAGE ACCOUNTS, PLATFORMS, DISCRETIONARY MANAGED PORTFOLIO, DIRECT INVESTMENT IN FUNDS, STOCKS AND SHARES, COMMODITIES, ART WORK, CLASSIC CARS, ETC.

If the assets are located in one of tax regimes around the world which are considered fiscally privileged by the Italian authorities, then the rate of tax is 0.4% pa. The list can be found at the end of this article HERE

INCOME FROM OVERSEAS PROPERTY (Income tax rates – IRPEF)

Overseas net property income (after allowable expenses in the country in which is located) is added to your other income for the year and taxed at your highest progressive rate of income tax.

THE WEALTH TAX OF 1.06% ON THE VALUE OF THE PROPERY (IVIE)

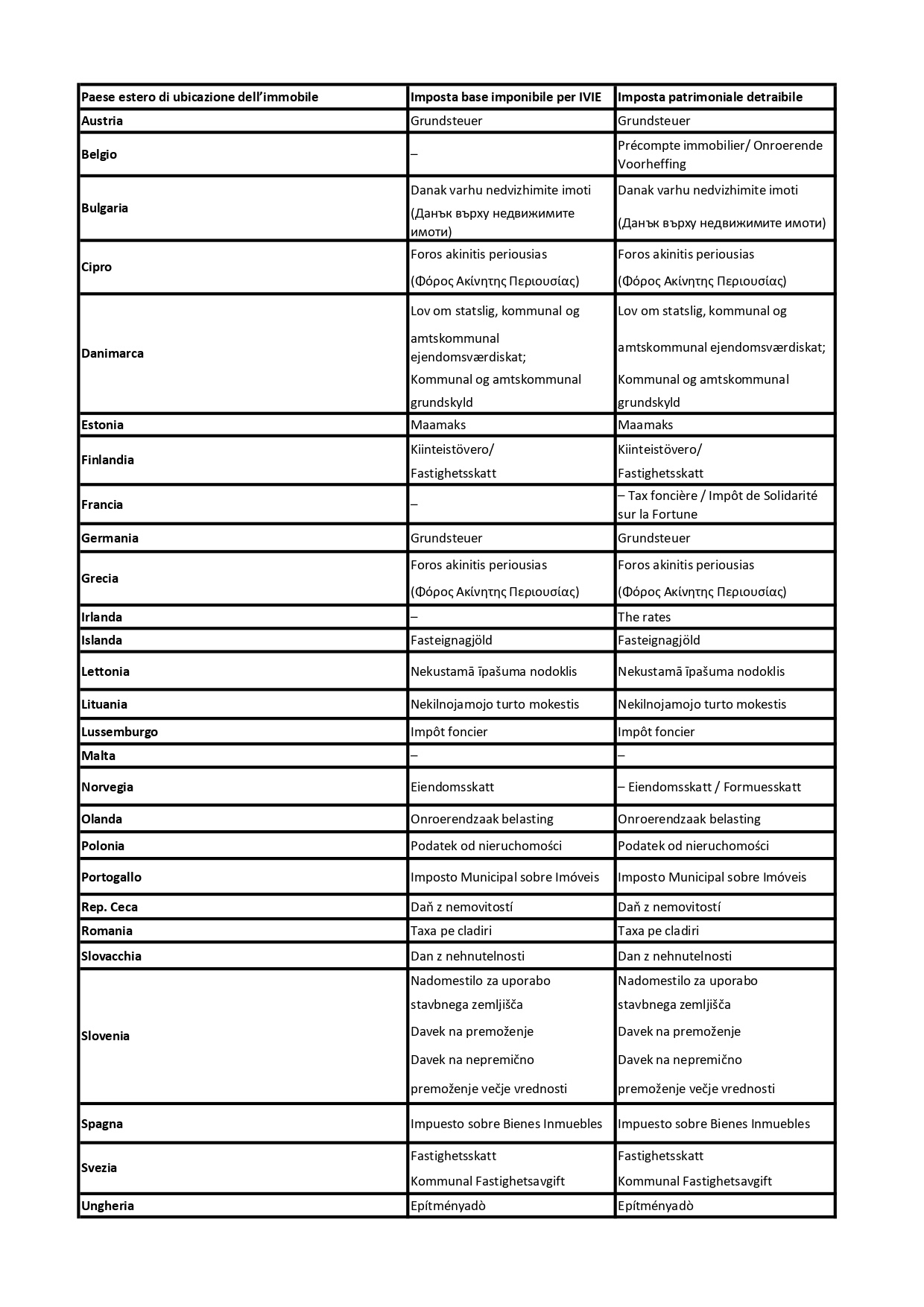

For properties based in the EU, the value on which this tax is based is the Italian cadastral equivalent. You will find that the market value will, in most cases, to be significantly more than the cadastral equivalent value. For a list of the different tax values across Europe see the table below.

For properties located outside the EU (inc the UK/USA/Canada/Australia/NZ etc) the value for tax purposes is defined as the acquisition value (purchase /inherited/acquired) where this can be evidenced, otherwise it is the current market value of the property.

DISPOSAL OF PROPERTY

Disposal of properties both abroad and in Italy (exc prima casa) are not deemed speculative if you have owned the property for more than 5 full tax years and therefore are not capital gains tax liable on the disposal, in Italy.

NOTE: If you gain residency in Italy then by default your previous ‘first home’ or ‘family home’ for the purposes of the Italian tax authorities is now classified as an investment property. By definition, if you have a home in Italy and a property in another country, even if you consider this property your family home, it can no longer be considered your ‘Prima Casa’ for Italian tax purposes.

If you have any questions about any of these taxes and how they might apply to you and your individual financial situation, or if you think that you might be paying more than need to, then do get in touch and I will be happy to see if I can help you with your plans.

I can be contacted on email: gareth.horsfall@spectrum-ifa.com or on cell: +39 333 6492356

A QUICK UPDATE ON COUNTRY LIFE

The country life update seems to be garnering more interest than the financial talk, given the lovely feedback I have from many of you. I know many of you have already trodden this well worn path of moving to Italian rural homes and are involved in differing degrees with your properties and land management.

I am now slowing down a little bit as the spring has arrived and I see that the plants are literally exploding before my eyes. It seems futile to try and manage it too much when its all growing so quickly. However, it is hard to let go and I do find myself getting up in the morning and just having an hour or 2 on the land before work, or even on the weekend, where it rolls easily into 4 or 5 hours to the extent that my wife finally shouts from the window “Are we ever going to see you this weekend?”. At which point I know my day on the land is over, at least for that day.

Anyway, I know I have been telling many of you that I have refrained from cutting the grass under the olive trees to date. There is now good reason to be careful because as you will see below in the pictures, there are some new occupants of the land and I am a little reluctant to start mowing them down. (I have recently staked around them so I can get on with the grass cutting but without destroying the wild orchids).

I did however want to share a funny story. I bought a trattorino ( ride on lawn mower) in the January sales online, and got quite a good deal on it. However, given the weather had been quite cold up until about a month ago, the grass hadn’t really grown that much and so I put it in storage. I decided to start it up about a week ago, just to see how it went and as you might imagine, it didn’t start.

I was left with my trusty motorized lawnmower. ‘Che fatica!‘ as they say !! The trattorino ride on mower has now been fixed, under guarantee, (it was a broken fuse) and what a difference !!! A HUGE labour savings device.

On another note, I am finally starting, after the winter clean up of the land, to start looking at the border areas and wondering how I can tidy them up as well. A lot of trees and woodland needs to be at least trimmed back and will leave me with lots of material to deal with as always, given I need to do some fencing I was thinking about using this material in some way.

Facebook and social media, almost as soon as I started thinking about it, started pumping out lots of ideas from dead hedges, to woven fences and lots more. I am undecided, but might try my hand at some fence building at some point. It should be fun.

Interestingly, on our annual work and investment conference for The Spectrum IFA Group there has been lots of talk about the impact of Artificial Intelligence, on our lives, in the last few years.

In 2024 we were presented with a list of the jobs most at risk of AI, and those least at risk. At the bottom of the list was fence builder! They didn’t mention that this job might be at risk from Gareth, although the likelihood is that I will give it a try and make a mess and need to call a fence builder in the end, but at least I am guaranteed a nice human conversation instead of wondering if I am talking to an AI application.

This country life certainly has its challenges! I recently was sharing these experiences with someone and finished my emails by saying ‘1st world problems, I guess’. It was only on reflection that I thought that it’s probably one of the types of work that we actually have in common with people wherever they are from on the planet.

I won’t bore you with any more country life tales for this E-zine, but if you have any fence building ideas or want to talk about finances / tax, then please do get in touch!

Trump’s 100 days

Lastly, I thought I would leave you with a piece on Pres. Trump given that he is occupying a significant amount of time with conversations with you, at the moment ( and rightly so)

On April 29th he completed his first 100 days in office and his tone has softened, just slightly, in the last few days.

The article below was sent by one of our collaborative fund manager partners, VAM Funds and I thought I would share it as it’s a succinct article which explains what Trump is trying to do and his potential for success and possible hurdles along the way.

This is not one of my opinion piece’s but instead direct from the financial market people.

As Donald Trump approaches his first 100 days in office, a complex economic narrative emerges – challenging traditional approaches while attempting to address long-standing structural challenges. His presidency has introduced uncertainty and volatility, yet the broader economic context remains one of relative strength. This dynamic sets the current period apart from prior episodes of market turmoil.

Economic Context

The US faces critical economic pressures: a $2 trillion annual deficit, $36 trillion in national debt, and a declining manufacturing base. Trump’s approach represents an unconventional attempt to reimagine America’s economic positioning – neither entirely destructive nor completely transformative.

Yet, unlike previous periods of market unease, the economy today shows notable resilience. US unemployment remains near historic lows, corporate earnings continue to post positive growth, and balance sheets are broadly solid. Credit markets, while reflecting some spread widening, remain stable and not excessively leveraged. In many ways, the economy itself is not the root of the current turbulence.

The singular variable creating uncertainty is Trump himself. Markets are reacting less to economic fundamentals and more to political risk.

Against this backdrop, Trump’s strategy can be broken down into three core themes that shape his economic agenda:

| Trade Recalibration | Structural Economic Challenges | Economic Repositioning |

| Challenging existing global supply chain dependencies | Addressing long-term fiscal sustainability | Reviving domestic manufacturing |

| Seeking "fair trade" rather than pure free trade | Acknowledging the limits of current economic models | Reducing over-reliance on specific global partners |

| Attempting to redirect, not eliminate, global economic relationships | Proposing radical, and sometimes necessary, interventions | Balancing potential opportunity with heightened geopolitical risk |

Market Dynamics

Investors are navigating a landscape marked by uncertainty, but underpinned by strength. Unlike past episodes where systemic weakness drove market corrections, this time, economic indicators remain broadly constructive.

The real concern is political instability. Trump’s unpredictable tactics have jolted investor confidence, even though the macroeconomic foundations remain intact. However, his motivations are clear: he is ultimately driven to prove that he can build a robust U.S. economy, contain inflation, and secure strategic wins in the global trade arena.

With the 2026 mid-term election cycle beginning as early as Q1/Q2 next year, Trump cannot afford to alienate voters or lose his party’s slim Congressional majority. This political imperative may lead to quick policy “off ramps,” efforts to de-escalate tensions, and the search for visible wins – moves that could rapidly calm markets.

Indeed, any signs of stabilising rhetoric or resolution to current crises may spark an equally swift rebound in both equity and fixed income markets.

Structure in Chaos

Trump’s economic policy is neither pure economic nationalism nor traditional globalism. It is a hybrid approach – an improvised balancing act between disruption and adaptation characterised by:

· Challenging existing economic orthodoxy

· Acknowledging global economic interdependence

· Pursuing strategic economic repositioning

with the following potential outcomes:

· Possible supply chain diversification

· Increased domestic economic resilience

· Risk of short-term market volatility

· Long-term structural economic recalibration

Conclusion

Trump’s first 100 days signal a high stakes experiment in economic leadership. The market’s turmoil is not a reflection of economic collapse but of political unpredictability. Yet, the core economy remains resilient.

Should Trump pivot towards pragmatism – seeking quick wins, stabilising policy narratives, and presenting a clearer economic roadmap – the same markets that reacted sharply to uncertainty may respond just as swiftly to renewed clarity.