“Risk” is an unavoidable, and sometimes welcome, part of investing so having a better understanding of the different forms of risk can help investors make informed decisions that align with their financial goals. In this (quite long) article, we explore key types of “risks” and how they impact financial planning.

Understanding Investment Risk

By Peter Brooke

This article is published on: 30th March 2025

What is RISK?

Definition: The possibility of something bad happening!!

What is INVESTMENT RISK?

Definition: The degree of uncertainty and/or potential financial loss inherent in an investment decision.

So we need to frame our conversations about “RISK” by trying to understand the ‘something bad’ in every decision we make.

Inflation Risk: The risk of doing nothing!

A.K.A. – The Erosion of Purchasing Power

Inflation risk occurs when the value of money declines over time, reducing its purchasing power.

For example, if inflation averages 2.5% per year, €100 will only buy €53.10 of goods in 25 years’ time.

To counteract inflation risk, investors should turn to non-cash assets like shares and bonds, which have historically always outpaced inflation over the long term.

What’s the something bad? – The risk of doing nothing and leaving money in a bank account will guarantee a financial loss over the long term.

Permanent and Total Loss of Capital

Companies can and do ‘go bust’ and for an investor in those company’s shares this would mean a total and permanent loss of capital – the share price falling to zero.

Therefore understanding how a company is managed and investing across a diversified group of high quality companies will minimise this risk.

Outsourcing to a fund manager to diversify this risk is a great way to ‘avoid the losers’ even if you don’t always ‘own all the winners’.

What’s the something bad? – Investing in just one or a few companies and not understanding the ‘fundamentals’ of each investment.

Volatility: Fluctuations in Values

Volatility is often ‘defined’ as RISK with respect to investments.

Volatility refers to short-term fluctuations in the price of an investment; for example a share price.

While dramatic drops can be unsettling, history shows that volatility is entirely normal and markets always recover over time.

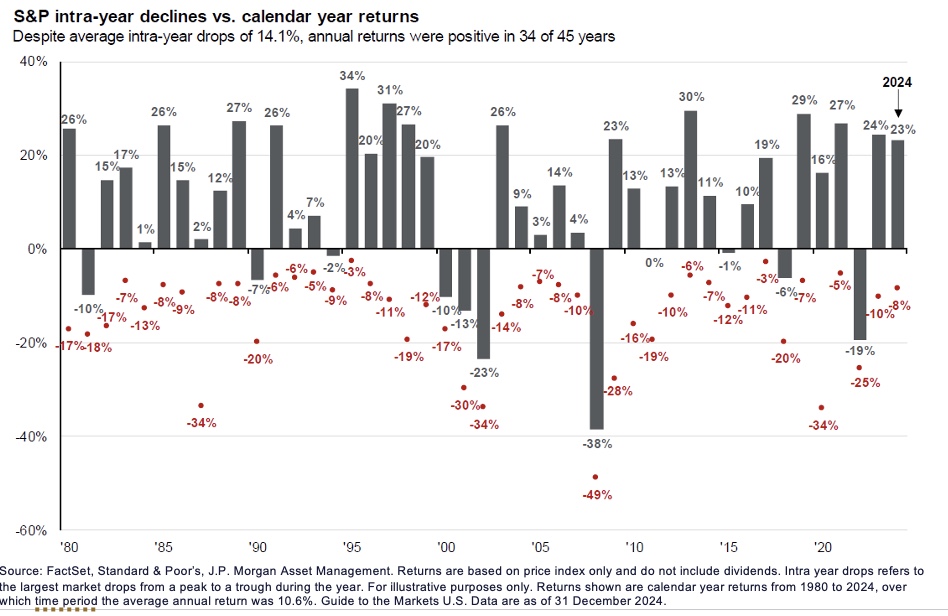

For example, look at the chart below; since 1980, the US stock market (S&P 500) has experienced declines averaging 14.1% during each year, yet annual returns were positive in 34 of those 45 years (75%).

The red figures show the largest market drop in value for each year and the grey bars show the total return for that same year… for example 2024 shows a drawdown of 8% but the S&P 500 finished the year 23% up.

Volatility is NORMAL and does NOT mean a capital loss for the long term investor.

Volatility risk is mitigated by TIME in the market

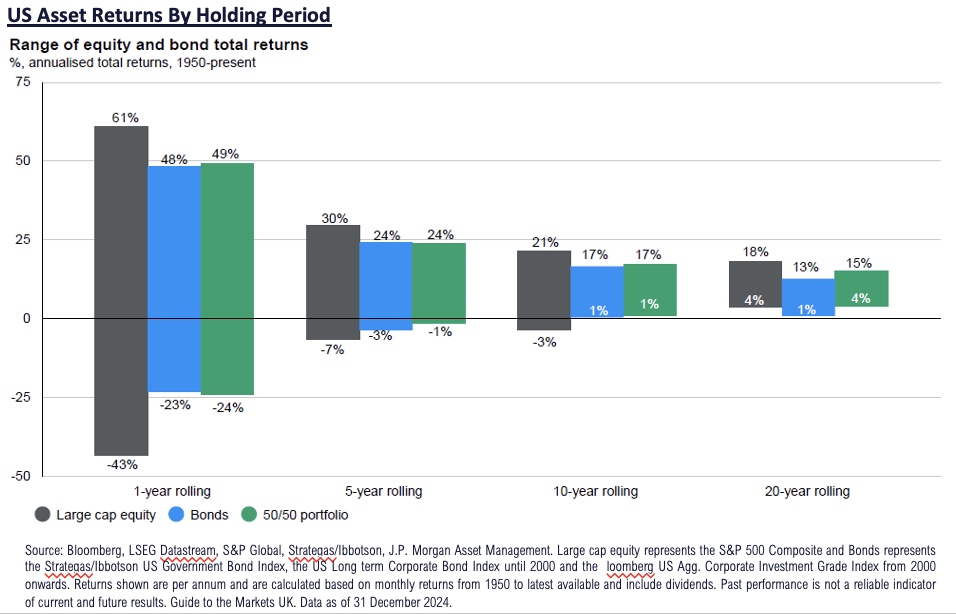

Volatility is part and parcel of investing, and your investment time horizon almost without exception determines the likelihood of investment success. This chart shows the annualised returns over four different time frames (1, 5, 10 and 20 years) using data from 1950 to today.

A 50/50 portfolio of shares and bonds (the green bar) shows that in the last 75 years you could lose up to 24% or gain up to 49% in any given one year period.

However, over every 10 year rolling period in that same 75 years, your worst possible return would be 1% p.a, (ie. no loss) and the best would be 17% p.a.

The longer the investment term, the less relevant volatility becomes, and crucially, the longer the investment term, the greater the likelihood of investment success.

What’s the something bad? – Not maintaining a long-term perspective and reacting impulsively to market swings.

Longevity Risk: Outliving Your Wealth

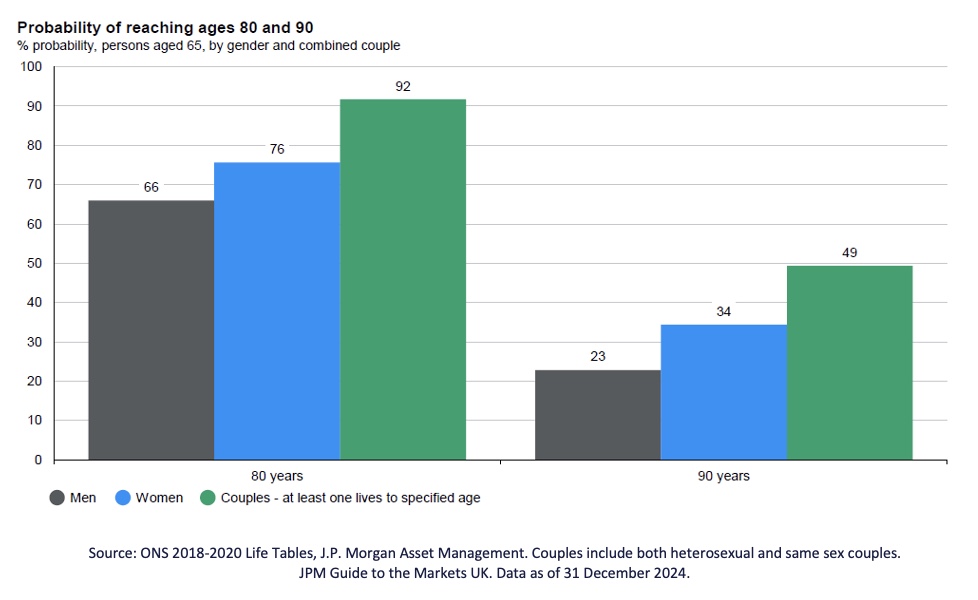

With increasing life expectancy, investors must consider the risk of outliving their assets.

For a couple aged 65 today there is a 92% chance that one of them will live to 80 and a 49% chance one will live to 90.

Planning for a longer retirement by investing must now include more exposure to growth-oriented assets.

Sequencing Risk/ The Timing of Returns Matters

For retirees or those drawing an income from investments, sequencing risk— the order in which returns occur— can significantly impact portfolio longevity.

A market downturn early in retirement can lead to a faster depletion of funds compared to a downturn later in retirement.

Strategies like maintaining a cash reserve, actively managing portfolio risk as you approach retirement and diversifying investment assets will help.

What’s the something bad? – A market correction just at the point of retirement can significantly impact the quality of that retirement.

ROMO – The Risk Of Missing Out: The Cost of Not Investing

As well as the risk of not keeping up with inflation, there is also a significant risk (and great financial cost) in staying out of the market.

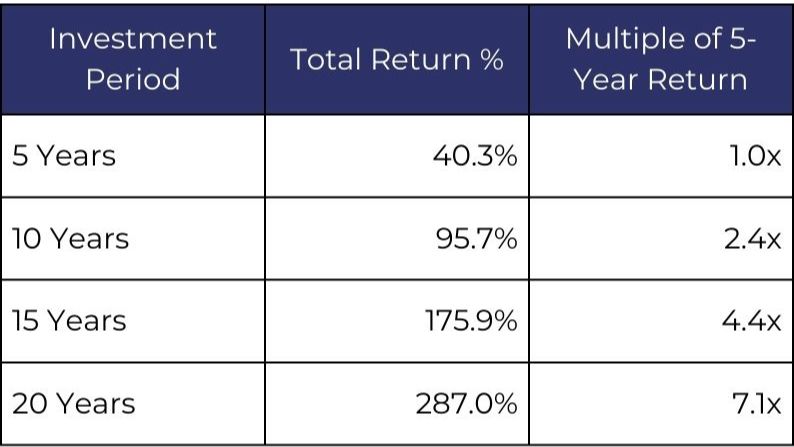

The ‘magic of compounding’ delivers substantial rewards for the patient, long term investor.

The 8 – 4 – 3 Rule

- The first 8 years is a period where money grows steadily

- The next 4 years is where it accelerates

- The next 3 years is where the snowball effect takes place

Here is a table showing the compounding effect of a 7% annual return:

What’s the something bad? – The risk of doing nothing and not benefiting from compounding returns.

Currency Risk

Expatriates often have assets in one currency but expenditure in another; for example a Pension in British Pounds and outgoings in Euros.

As global investors there will always be some form of underlying currency risk but mitigating the practicalities of moving money around from one currency to another is possible with careful planning.

Options could be:

- Take all the currency risk at the start – ie transfer the whole ‘pot’ today to your expenditure currency – a one off risk.

- Take all the currency risk at the end – exchange the money to your expenditure currency when you draw the money out; this might be better as it may spread the risk over time.

- Manage the currency – you could set up your account in your expenditure currency (e.g. Euros) but keep the underlying investments in their original currency (e.g. GBP) and then create a strategy to move the money over time to match the outgoings.

What’s the something bad? – The risk of not correctly matching your assets with your liabilities – a large fluctuation affects your lifestyle.

Assessing Your Attitude to Risk:

All of the above is to help our conversation about ‘RISK’ but in order to best set up and review your investment portfolio we have a 3 part process to determine exactly how much investment risk you can tolerate:

1. Your ATTITUDE to risk – this is a psychometric test, via a questionnaire, to assess your in-built view on risks, volatility and returns.

2. Your CAPACITY to take risk – this is a deeper understanding of your overall situation and therefore your ability to weather ups and downs in portfolio values… i.e. do you have other assets, a large pension or property income; how reliant are you on your portfolio at any given time?

3. Your TIME HORIZON for investing – when do you need to access to this money? Will the access be to draw an income or large lump sums or even, all of the fund in one go? Or is this money just to be invested to pass on to beneficiaries?

The answers to these 3 questions provide us with a ‘score’ and ‘understanding’ of how you will use the money being invested… this allows us to assign a ‘Risk Benchmark’ to your portfolio, from which we will determine its asset allocation and then monitor its performance and volatility for the duration of the investment.

Obviously, your TIMESCALE changes over time and your CAPACITY can change as your life situation changes; even if you maintain the same inherent ATTITUDE to risk we must always review and monitor the overall position of your portfolio and potentially change your benchmark as time passes.

Final Thoughts

Investing always carries ‘risks’, but knowledge and strategy can help manage them effectively. Whether it’s inflation, market fluctuations, or longevity concerns, working with a financial adviser ensures that risk is considered within a well-thought-out plan. Overall doing nothing is the largest risk.

Staying focused on long-term goals, and avoiding emotional reactions to short-term market movements, usually leads to successful financial outcomes.

I would very much like to thank the team at RBC Brewin Dolphin for their kind input and help with this article, I truly hope you found it useful.

If you’d like to discuss your investment strategy and how to manage these risks, feel free to get in touch!

Contact me if you have any questions or the click on the calendar to make an appointment via my booking system.