September is a gorgeous month in France and this year has been no exception. For me September often goes by in a whirl – with the children back at school there are still after school activities to organise and parent-teacher meetings to attend.

Financial update in France October 2023

By Katriona Murray-Platon

This article is published on: 4th October 2023

However, for those who are not affected by the back to school mayhem September is a great time to enjoy the warmer weather and the beauty spots of France once the summer tourists have left.

Further to what I wrote in my last Ezine, the interest rate on the Livret A and Livret de Développement Durable et Solidaire (LDDS), which was expected to rise to 4%, shall instead remain at 3% and the French government has committed to keeping it at this rate until 2025. However, an appeal against this decision has been brought before the Conseil d’Etat. The interest rate of the Livret d’Epargne Populaire (LEP) has already dropped slightly from 6.1% to 6%.

If you realise you have forgotten to declare something on your 2022 tax return or you wish to correct an amount, you can, since the 1st August, amend your return on your online space on the impots.gouv.fr website. This service will be available until 11.59pm on 6th December. You should have already received your tax statement for the declaration you did in May and you should pay the amounts requested on this statement but if you do decide to amend your tax return, a new statement will be issued and any overdue amounts will be adjusted or repaid.

The tax authorities should already have your bank details that you provided to take any overdue tax from your account or pay any reimbursements. If this is not the case and if you have less that €300 to pay, you have to pay this by 30th September using the online service. If you have more than €300 to pay on your 2022 tax bill, these amounts will be taken on 26th September and around the 25th of October and November with the last quarter of the payment being taken out of your account on 27th December.

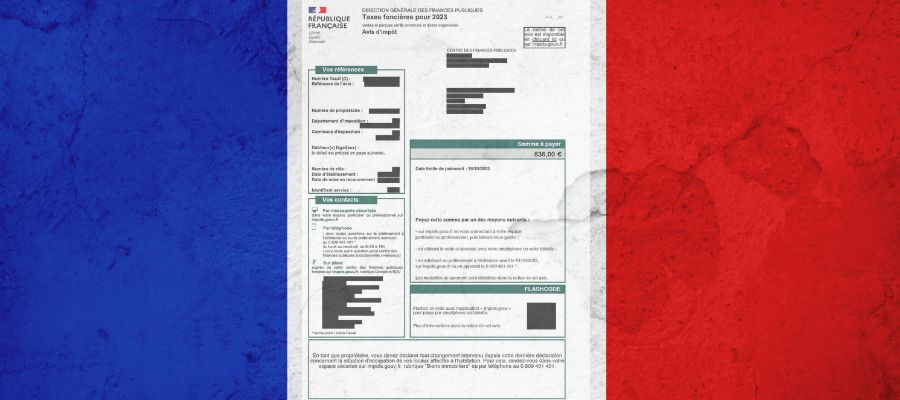

October is the month for the taxe foncière which is due by 16th October or 23rd October if you pay online or with your telephone or tablet. If you have already received your statement, you may have noticed an increase in the amount. The taxe foncière increased by 3.4% in 2022 but it has increased by 7.1% in 2023. This is an average and does not include any increases that the local councils may have voted. The sharp increase is due in part to the annual review of the rental value of the property which takes into account the Consumer Price Index which itself is determined by inflation.

Not everyone has to pay the taxe foncière. There are exemptions for those on pension benefits (ASPA) or disability allowance (ASI and AAH) as well as for those who were 75 and over on 1st January 2023 if your taxable income (RFR) for 2022 was less than €11,855 for one person or €18,233 for a couple. If one partner is over 75 and the other isn’t they can still be exempt. If a person is in a retirement home, their former home, provided it is not rented, is also exempt. New constructions, extensions or changes to buildings (a barn conversion for example) may be partially or totally exempt from taxe foncière for the first 2 years unless the local council has decided otherwise.

Although 2022 was a difficult year financially, this has not stopped the French from investing in Assurance Vie policies. According to the data published in the Le Particulier magazine in September (no 1208), 144.4 billion euros was invested in assurance vies in 2022, only slightly down from 2021 when 148.6 billion euros was invested. Most of this was in Euro Funds which, in spite of their steady decline over the past ten years, saw a slight increase in 2022 to 2% which is however less than the rates on the Livret A and LDDS.

In other news in September, I had the very great privilege of being invited to the GREAT event, organised by the British Embassy, in honour of the King and Queen’s visit to Bordeaux in September. Around 1500 people, French and British, were invited to this special event at the historic Place de la Bourse where we mingled with other members of the Bordeaux British community, bilingual professionals and business owners; sampled British foods, wines and sparkling wine and enjoyed music by local British artists. In addition to seeing the King and Queen, who arrived by tram to this event, Paddington Bear also made an appearance and the Fiji Rugby Team were also there and sang a beautiful song to the King as he was leaving. It was a very special and enjoyable day!