Why invest in the financial markets when interest rates are so high?

This is the second part of an article about interest rates and their impact on the financial markets for 2024 and beyond. Click here to read the first part of this article.

By Philip Oxley

This article is published on: 27th March 2024

Why invest in the financial markets when interest rates are so high?

This is the second part of an article about interest rates and their impact on the financial markets for 2024 and beyond. Click here to read the first part of this article.

My article a couple of weeks ago focussed on what has happened over the past couple of years in relation to inflation and interest rates and what is likely to take place next. This article focuses on what all this means for savings and investments. In addition, it will address a key question that was asked of me several times last year – when interest rates are so high and it is possible to obtain a healthy risk-free return, why invest in the roller-coaster that is the financial markets?

Risk & Return

By their very nature, there is always some risk when investing in the financial markets, although it is possible to calibrate a portfolio by the level of risk acceptable to the client. However, over the long term, the risk of your cash diminishing in value is much higher if you leave it in the bank. Certainly, over shorter-term periods the markets can be volatile and at any one point it is possible that the value of your investment will be worth less than the initial value of your premium. This never feels like a good place.

This leads to the question, why take any risk now, when it is possible to benefit from a return of between 3-6% by leaving your money in the bank? Well, in the short term, that’s a reasonable point and especially if your risk profile is low – i.e. you prefer not to take risks with your money, even knowing that this approach is likely to result in a lower return on your funds – then certainly a case can be made for this, at least in the short term.

French Interest-Paying Bank Accounts

In France, the best risk-free returns are to be had utilising the Livret A (maximum deposit of €22,950) and Livret de Développement Durable et Solidaire (LDDS) accounts (maximum deposit of €12,000) which are both paying 3% interest currently, free of tax and social charges. It makes a great deal of sense to place funds in these accounts as they are instant access, and it is important to have funds that you can access easily.

For those on lower incomes, 5% interest can be obtained with a Livret d’Epargne Populaire (LEP), with the maximum amount that can be deposited being €10,000. You will need to provide a copy of last year’s tax return documents (the Avis) to demonstrate that your income level is below the required threshold. Currently this threshold is €22,419 for a one-part and €34,393 for a two-part household – further details in this link https://www.service-public.fr/particuliers/vosdroits/F2367

For those with more significant amounts of funds and/or whose risk profile is higher, these accounts are still well worth using for holding an emergency fund that is easy to access.

For those with bank accounts in the UK, the returns have been even higher, and it has been possible to obtain 5% or even 6% interest, which is certainly appealing.

Risks of Keeping Assets in Cash

However, there is a but – or several buts in fact:

a) If your cash is earning significantly more than 3% (the LEP excepted), the chances are that your funds are in a UK bank account (not French), and you will have to pay tax on this interest in France. Therefore, whatever rate of return you are receiving in the UK, needs to be reduced by nearly one third to arrive at an actual net return.

b) All market commentators believe we are now at peak interest rates – in both the UK and Eurozone – and the next move will be down. Bank rates have been at levels hitherto unseen in decades, but they will surely not remain at this level as we progress through 2024.

c) Benefiting from high interest rates can easily coincide with periods of strong financial market performance – i.e. whilst you are benefitting from one, you could be missing out on the other!

d) Investing in the financial markets has always provided a greater return than cash over the long term.

e) Returns from cash have always failed to keep up with inflation over the long-term.

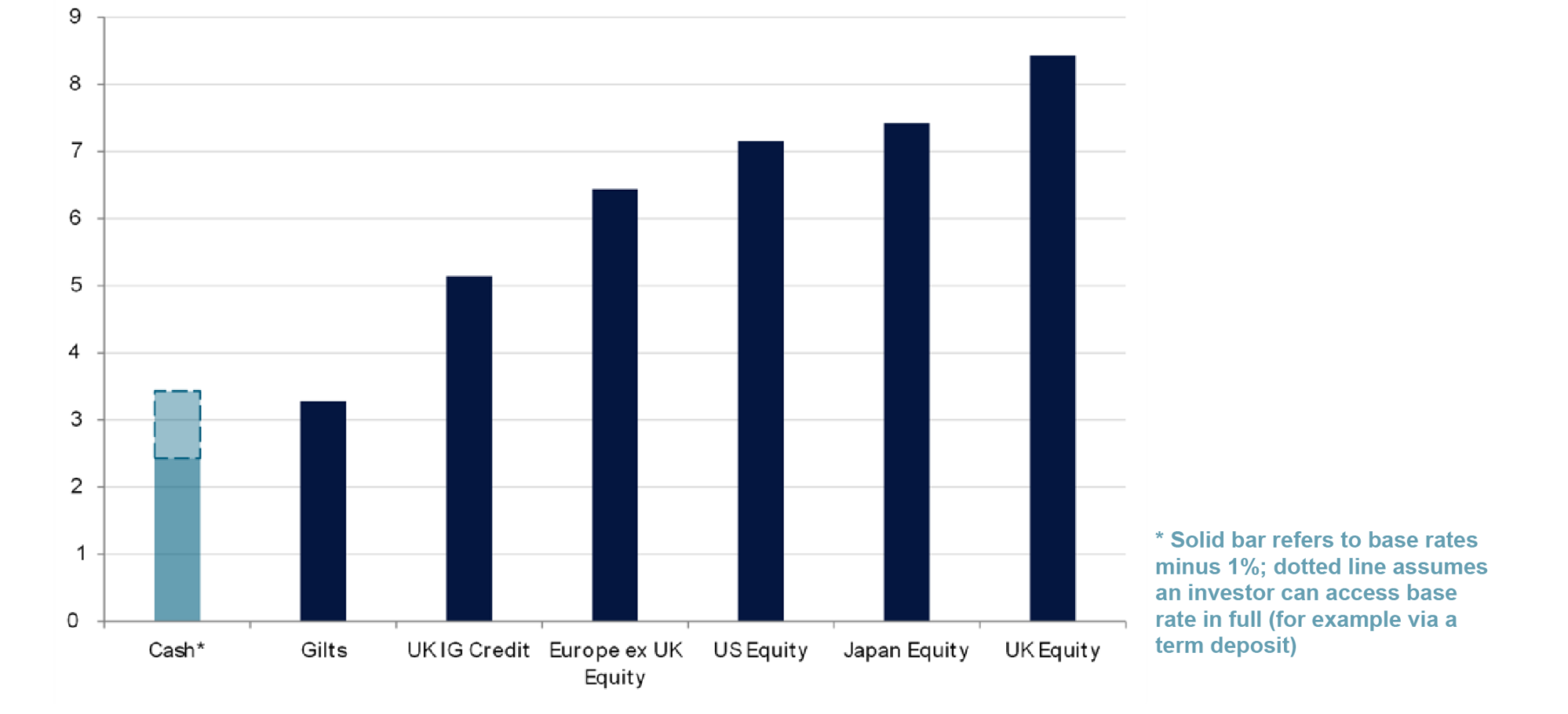

f) Rathbones, one of the UK’s leading investment managers, has forecasted that equities will return significantly more than cash over the forthcoming decade, see below:

We forecast that equities will return much more than cash over the next decade too

One of the best, short articles I have read in relation to the risks of keeping most or all your assets in cash is on Trustnet and quotes from Lindsay James, Investment Strategist at Quilter Investors. I enclose the link to the article below.

Sitting in cash ‘isn’t as risk free as investors think,’ warns Quilter | Trustnet

If you only look at the two graphs, this will illustrate the point clearly:

a) Graph No. 1: The first graph shows what happened to global financial markets in the year following the first interest rate cut (i.e. at the beginning of a rate cutting cycle). There are a few exceptions (most notably during the Global Financial Crisis in 2008/9), but in most cases the financial markets rose strongly. It is too late to wait until this happens and then move funds into the markets, as often the biggest returns can occur over the duration of just a few days, and this leads to the second graph.

b) Graph No. 2: This graph is even more stark, showing the investment returns over a 30-year period of an initial investment of £10,000. Staying invested throughout this period resulted in growth of 1020%. Being absent from the markets for just ten of the best days in the financial markets during this 30-year period, result in a return of half this amount, 469%!

This is why within the world of investing the following saying is so popular – “it’s not about timing the market, but about time in the market” or to put it another way, research has shown that those who remain invested in the markets through the troughs as well as the peaks, generally outperform those who try and time their buy and sell decisions to exit the markets as they fall and buy into the markets as they rise.

The reasons for this are that inevitably, people sell too late (i.e. the markets have already fallen which triggers their decision to exit), and then are too late with their entry back into the markets and miss out on significant gains. Even amongst professionals, it is usually luck not skill (or the benefit of hindsight!) which allows people to call the top or the bottom of the market or get remotely close.

In Summary

Those with limited savings and assets, who cannot afford to lock funds away for several years, should utilise the French interest-paying bank accounts I referred to earlier. Those who are very risk averse and find the prospect of seeing their investments fall in value, stressful and anxiety inducing, should also find the best return they can using risk-free savings accounts, but should also be aware that over the longer term, their savings will inevitably underperform market returns.

However, for everyone else, the evidence clearly demonstrates that investing in the financial markets, irrespective of potential economic or geo-political challenges and even with the current appeal of interest on cash deposits, will, almost without exception, deliver positive long-term financial rewards.

At the risk of oversimplifying – my advice to most people is to set aside sufficient cash for short term needs and unexpected contingencies and invest the rest in a portfolio that is appropriate to your risk profile.

Where should you consider investing any funds? That is for my next article where I will review the best options in France for tax efficient investing.