Summer is well and truly here so it’s time to enjoy everything that brings, especially before it gets too hot! It’s hard to beat Spain when we have so many sunny days – a walk along the seafront or a stroll through the forest to keep cool and listen to the nature.

Top financial tips – Spain July 2024

By Chris Burke

This article is published on: 11th July 2024

From a financial perspective, I am always here to update you on anything new or tips/hints to keep your finances healthy – this month we are focusing on the following:

- Biometric card for entry & exit to Spain – Autumn 2024

- Inheritance tax & gift tax in Spain

- 80+ state pension for UK persons living abroad

Biometric card for entry & exit to Spain

The EES (Entry/Exit System) will be introduced by the EU in Autumn 2024 – this is an automated system for registering travellers from the UK and other non-EU countries each time they cross an EU external border. It will require third country nationals, including UK nationals, visiting the EU to create a digital record and provide their biometric data (fingerprints and facial image) at the border when they enter the EU’s Schengen Zone. It is expected that Spanish Green Certificate holders may face significant delays and difficulties at borders if they do not have a TIE.

The system will register the person’s name, type of travel document, biometric data (ie fingerprints and captured facial images) and the date and place of entry or exit each time they go through a ‘checkpoint’, which will in real terms replace stamping of passports (so those regular travellers to the EU won’t have to worry about running out of passport pages with stamping!).

Whilst hopefully making travelling easier and quicker, it’s also clear to note that there will be a ‘hard electronic’ record of which borders you cross and how many days you are spending in each country, which from a tax perspective could be interesting. Let´s see how long it takes for this to also become common practice at ‘road borders’.

Inheritance tax (IHT) & Gift tax in Spain

One of the great unknowns amongst those who are non-Spanish and tax resident in Spain is how inheritance tax works and what amounts are payable. Particularly if you come from the UK, it’s important to note that Spain does not, (generally), take into consideration the rules of other countries regarding IHT. Inheritance tax in Spain has no ‘double tax treaty’ with the UK, meaning Spain will not take into account any tax paid on this OR rules applicable in that country (for example, if there is no tax to pay in the UK there could be significant tax to pay in Spain).

They purely look at the amount you are inheriting and if you are a Spanish tax resident apply the following to work out how much tax you need to pay them (if any):

- Your relationship to the deceased, (the more distant a relative you are, the more tax)

- The amount being received, (there is a progressive tax upwards with the more you inherit)

- The value of existing assets by the inheritor

- Which region you are tax resident in Spain and where additional ‘local’ laws apply

Inheritance tax starts from zero (allowances) and can reach up to 82% for a distant relative. Therefore, it’s imperative to understand what this number is should the situation arise, enabling you to plan effectively and maximise the remaining monies. It´s only my personal opinion but why would you not want, with proper planning, to maximise those ‘hard earned monies’ your relatives accumulated and left you over their lifetime?

On a side note, if there are relatives in other countries, (perhaps you have siblings), the Will can be set up to make sure you receive the same amount from the estate net of inheritance tax -the executor of the Will can deduct the tax from the ‘pot’ and then distribute accordingly – therefore the tax can be paid from all members receiving the inheritance not just yourself and enabling you to receive the same amount in real terms. This is something I have come across on a few occasions.

Another way is to receive any monies is as a ‘Gift’ whilst the donor is still alive, the tax on these is between 5-9% (again, the closer the relation the less tax you pay, so for a parent making a gift the tax would normally be 5%). Furthermore the location of the assets, (such as property in the UK), will make a difference to the amount paid.

As you can probably appreciate, by understanding these rules you can start to plan how and when best to receive any assets from relatives/parents. This is an area in which we work closely alongside tax advisers/planners almost every day, making sure our clients take sound financial/tax planning advice and a strategy is implemented to make sure the money is:

- Received as tax efficiently as possible

- Managed carefully to provide a tax efficient income for life (and for any other close family members)

- Invested safely and strategically

- Set up in an inheritance friendly manner for future generations

80+ state pension for UK persons those living abroad

If you do not receive the UK basic State Pension or you get less than £101.55 a week, you could get the difference paid up to this amount, as long as you were 80 years old before the 6th April 2016.

Other qualifying criteria are:

- you were resident in the UK for at least 10 years out of 20 (this doesn’t have to be 10 years in a row) – this 20-year period must include the day before you turned 80 or any day after.

- you were ‘normally resident’ in the UK, the Isle of Man or Gibraltar on your 80th birthday, or the date you made the claim for this pension if later.

If you would like to discuss any of the topics above in more detail or you would like to have an initial consultation with Chris to explore your personal situation, you can do so here.

Click here to read independent reviews on Chris and his advice.

If you would like any more information regarding any of the above, or to talk through your situation initially and receive expert, factual based advice, don’t hesitate to get in touch with me.

Top financial tips in Spain – March 2024

By Chris Burke

This article is published on: 28th March 2024

Spring is well underway and it won’t be long before the wonderful feeling of summer is upon us – I personally can’t wait!

Part of my role is to make sure you are financially/economically smart and keep you up to date with ways to reduce taxes, increase wealth and anything else I feel an expatriate living in Spain should know. This month we focus on the following topics:

- British Passports – additional months rule!

- Inheritance & Wills – important tax tips

- What were the best investments of 2023

British Passports – additional months rule reminder!

If you are planning to travel to an EU country (except Ireland), or Switzerland, Norway, Iceland, Liechtenstein, Andorra, Monaco, San Marino or Vatican City, you must follow the Schengen area passport requirements.

Your passport must be:

- issued less than 10 years before the date you enter the country (check the ‘date of issue’)

- valid for at least 3 months after the day you plan to leave (check the ‘expiry date’)

Check your passport meets these requirements before you travel. If your passport was issued before 1 October 2018, ´´extra months´´ may have been added to its expiry date.

Surely this is obvious Chris you say? Well, since Brexit I am afraid not. Many people have passports which unknowingly have more than the 10 years validity on them and thus they travel to Spain thinking ‘great, my passport expires in October this year, more than 3 months after I arrive back in the UK from my trip to Spain’. However, the problem is Spain ‘doesn’t accept’ the extra 6 months that were added to the length of this passport.

I mention this because someone on my flight only recently was stopped from leaving the UK due to this. There are no alerts or checks from airlines even with online check-in until you get to the departure gate, a VERY painful way to find out. This applies to Spanish residents also!

Check your passport……. if it has the additional months, make sure you renew it before it’s not valid in Europe. New UK adult passports are now only valid for 10 years.

Inheritance & Wills – important tax tips

One of the FIRST things I tell anyone I meet professionally (whether they ask or not) is that the MOST important person to get on your side in Spain is a good tax adviser/accountant, particularly in respect of inheritance planning, and here is the reason why.

Depending on the relationship to the deceased, the value of the inheritor’s current assets, and the amount they receive, there could be a significant amount of tax to pay in Spain. Just by being organised in many circumstances this can be avoided.

Two case scenarios:

- Someone retired dies who has a partner but they aren’t living together/aren’t officially a couple for administrative purposes or married

- Someone dies and leaves money to grandchildren/nieces/nephews

In these scenarios and depending on where they live in Spain, tax could be payable at a rate of up to 72%……………however, this could be avoided by various methods including using gift tax at 5-9% prior to death or changing some administration before the person passes on from this world.

PLEASE make sure you are organised from an inheritance tax perspective if you think this could have an effect on you. Knowing what the potential tax could be will enable you to make important decisions or plan to avoid this.

What were the best investments of 2023?

Hindsight is a wonderful thing.

However its always important to review and understand what has happened, why, and then decide if you need to change your approach towards most strategies in life, including investing.

Amongst many options, thematic investing has become more and more popular over recent years. To explain this approach simply, you are focusing on a trend/area that you believe will give you higher potential growth on your monies than in a more general investment. For example if you believe that Cyber Security is going to be an area that more people will spend money on in the near future and therefore a good area to invest in, you could target investments that focus solely or predominantly on this specific topic. Because you are being more focused and targeted, this attracts higher risk because your money is invested solely in that area. However, if you are correct then the returns/rewards are generally greater because you have channeled your money into that specific area rather than taking a general approach.

In 2023 it is clear that when you review which investment funds worked well, two key areas stand out more than most (I do not take cryptocurrency into consideration because many investment companies will not consider this, due to still being viewed as an unknown entity, and it being largely unregulated).

Strong performers in 2023 were:

- Technology

- US stock markets

However, it’s important to note that the year before this these were both two of the worst performing…….so how do you know what investment funds to pick, how long to hold them and when to make any changes?

Well, by education……by constantly being informed on a range of factors related to these areas, which could include the following:

- Political

- Environmental

- Laws/legislation

- Economic

Alongside this, considering your investment timelines, your goals and your appetite for risk/reward, then you can start to put together a strategy that with regular reviews and ongoing advice, with someone you trust, will give the best chance of success to achieve your savings and investment goals moving forward.

Click here to read independent reviews on Chris and his advice.

If you would like any more information regarding any of the above, or to talk through your situation initially and receive expert, factual based advice, don’t hesitate to get in touch with me.

Are there ISAs in Spain?

By Chris Burke

This article is published on: 14th January 2024

When living in Spain it shouldn’t take too long to discover that personal finances work very differently from many other European countries, particularly the UK. Independent advice is hard to find – most people talk to their bank and are told that their main option is to invest in the bank’s own standard products and solutions, which for many people are not suitable or appropriate.

Many people from the UK are used to a more sophisticated way of investing, maximising tax efficiency and mitigation through solutions such as ISAs and pensions. These can greatly reduce the tax you pay making a big difference to the amount of money you end up with, in some cases incredibly so.

Is there a Spanish equivalent of a UK ISA?

In short, there is something very similar. It can greatly reduce the tax you pay as your investment grows and can even be set up for your children to benefit independently.

Are there Spanish equivalents of a private pension in Spain?

Yes, there are, however these are vastly different to in the UK. In the UK you can contribute up to £60,000 per year to a private pension. In Spain you can only contribute €1,500 per year. A self-employed person can contribute an additional €4,250 per year. Very few employers in Spain have their own pension schemes and those that do have a limit of €10,000 per year that can be jointly contributed to.

How does the equivalent of the UK ISA in Spain work?

As your money grows any gain you make is not taxable until you receive this money (achieving compound growth). When you access this money, any gain is offset proportionally against the original investment amount, and as such removing this proportion of the gain. For example, if your investment grows by 50%, any partial withdrawals you make have this portion deducted against the gain you have made. Over the years this can make an incredible difference to the tax you pay, particularly as this investment income falls under Capital Gains tax (savings tax) and not income tax, which can become VERY important when paying tax on your monies (pension income falls under income tax).

As a reminder, the tax rates are:

Capital gains tax ranges from 19-26%, income tax from 24-47%.

Many people use this option for their mid-term and retirement planning because they have some flexibility, are portable should you move elsewhere and are also highly tax efficient and compliant in Spain.

Important note on UK ISA’s

Whilst UK ISAs are tax efficient in the UK (all gains are tax exempt), as a Spanish tax resident this is not the case – any gains that arise in your UK ISA must be declared annually and tax paid on these even if you do not access the money. This makes UK ISAs as a Spanish tax resident very inefficient and why many people look for alternatives.

UK ISA Tip when moving to Spain

Before you become a Spanish tax resident, if you encash your UK ISA you realise any gains that would be taxable when you become a Spanish tax resident. This not only includes any annual gain, but more importantly the gain from inception, which as a Spanish tax resident you would be liable for when you encash.

If you would like any more information regarding any of the above, or to talk through your situation initially and receive expert, fact based advice, don’t hesitate to get in touch with Chris.

Click here to read independent reviews on Chris and his advice.

Top tips for expat finances | Spain

By Chris Burke

This article is published on: 10th October 2023

The clocks go back in a few weeks, so enjoy the last of the summer evenings before its time to get the winter wardrobe out and get cosy!

This month’s Top Tips are as follows:

- Wills – Why almost everyone should have one

- How to build a pension in Spain, quick example

- Why have your investment in a tax ‘Wrapper’ rather than an investment platform?

Wills – why almost everyone should have one

If you die whilst living in Spain or owning property/assets here, the expression is known as dying ‘intestate’. To quote why you should not want this to happen (apart from the obvious!) the Law societies words are as follows:

“Dying intestate not only means your final wishes will probably go unheeded, but the financial and emotional mess is left for your loved ones to sort out. This need not be your final legacy.”

So, if are not bothered about the administration you leave behind, the only circumstances under which I would suggest you might not want a Will (I still think you should, but it’s your choice) are if you are single or married with no children.

If you have children under the age of adulthood, in my professional opinion there are no excuses for not having a Will for the following reason: God forbid something should happen to both parents, how would the law know who you would want them to be raised by and how? Those left behind (grandparents for example) may not agree with your wishes but they should respect them. Imagine if you didn’t stipulate and the state decided against your families wishes………………….

Building a pension in Spain, quick example

“Chris, I want to save for retirement but I note the annual amount you can save into a private pension in Spain is €1,500, what options do I have?”

Well, some people tell me they could overpay into the state pension to obtain more, I say good luck with that. One of the ways they now calculate this is the average of the last 25 years of your salary/income, so the days of a great Spanish state pension for most are over.

I could go into great depth here but for ease’s sake, the following saving / investing example could give you an income of approximately €25,000 per year, so along with a full UK state pension that would give you a total income of approximately €38,000 per year and hardly any tax to pay:

- Initial investment of €50,000

- €2,000 per month contribution for 20 years

- Total investment value at the end: €926,247.78

I did say it was quick! This is of course is in tomorrows money (inflation roughly doubles every 24 years). With my clients we go into much more depth and analysis, but it gives you an idea.

Why have your investment in a tax ‘Wrapper’ rather than a platform?

Because of Tax, Tax, Tax!!!!!

Need I say anymore, THE most important aspect to consider as a Spanish tax resident.

When you withdraw money from an investment platform you are taxed on the ‘profit’ you take out. So, for example you start/invest €100,000, it grows to €120,000, you withdraw €10,000, tax is payable on the €10,000 as that is profit.

However, with a ‘tax wrapper’ you pay a different tax, Spanish Proportional tax, which is calculated by the following formula:

Initial investment amount, divided by current investment value, multiplied by the amount you are withdrawing.

So, to copy the above example, you start/invest €100,000, it grows to €120,000, you withdraw €10,000, tax is payable on the gain proportionally which is calculated the following way:

€100,000 divided by 120,000 multiplied by €10,000 = €8,333.

This €8,333 is the amount tax exempt, so you are ONLY taxable for €1,666 as opposed to €10,000 for an investment platform gain.

You can also add Children over the age of 14 to Tax Wrappers who benefit from this in the future, as well as partners/spouses. So, the additional cost of the Tax Wrapper can more than outweigh the tax savings over time.

Some of today’s Tips can be quite complex, if you are not sure don’t hesitate to get in touch.

1980’s advert

For those of you who don’t know me that well, I am a bit of an 1980’s fan. I was brought up on prawn cocktail, roast beef with all the trimmings and trifle for pudding. I still even now listen to 1980’s music channels………anyway, I am going to share each month some of my favourite TV commercials from back then until you tell me to stop OR I get inspired with something else!

Looks like we’ve overdone it on the…………

Click here to read independent reviews on Chris and his advice.

If you would like any more information regarding any of the above, or to talk through your situation initially and receive expert, factual based advice, don’t hesitate to get in touch with Chris.

Top tips for expat finances – Spain

By Chris Burke

This article is published on: 18th September 2023

Well, thank goodness that heatwave is over and I can venture out during daylight hours again! September and October for me are the absolute best times of the year here in Spain, great comfortable temperatures, less people (tourists) around and the sea has been warmed up over the summer.

This month’s Top Tips are as follows:

- 7P tax exemption rule – do you travel outside of Spain at least two weeks a month?

- Property price forecast UK & Spain for the end of 2023/2024

- Why should I speak to a Financial Adviser (a good one, that is 😊) in one sentence?

- 90’s nostalgia advert

7P Tax Rule

One of the most common questions people ask me is ‘As I am not on the Beckham Law, how can I reduce my taxes?’ One of the first questions I ask them is ‘how much time do you travel for work outside of Spain?’ If you travel for 2 weeks or more every month, in simple terms you might not to have to pay tax for those days you are away – a significant saving and you may have a tax exemption of up to €60,100 per year.

The key qualification factors are as follows:

- You must be a Spanish tax resident

- The company you are performing the work for must not be Spanish, must be based abroad and not a Spanish entity (but you can be employed by a Spanish company and have been instructed to carry out this work outside of Spain)

- You must physically be outside of Spain when conducting this work

- The country you are working in must have a similar tax system to Spain/have a double tax treaty

If you adhere to all these points then this tax exemption could be applicable for you – please ensure you take professional advice.

Property price forecast for the UK & Spain, for the end of 2023/2024

Property is, in my opinion, a great asset to hold and one that every investment portfolio should have. Just like ‘non-property’ investments, the value can go up and down. It can be more ‘hassle’ to manage taking into account tenants, taxes, issues with the property etc. but long term it has usually been a good investment. Governments are starting to make being a landlord a more expensive venture in the UK now – let’s see if Spain follows suit.

Since covid we have seen that property prices have generally boomed. However, the last 12 months or so things have started to change. New Zealand is in the midst of a property crash, down approximately 18% in a year. Canada is also in a property ‘recession’, down by approximately 15% year on year (most of you probably won’t have heard about these – the news outlets tell you what they want you to hear). Property, just like investment portfolios, does not only go one way, as in up. This year, for the first time in a long time (probably 15 years), I have been advising some clients to sell their UK property investments if they don’t think they will go back there, and it makes sense from a tax perspective. If you are living outside of the UK, at some point you are going to have a decent sized taxable gain/event on that property, (more so in Spain) and even if it is inherited by someone else, it’s unlikely that even then the tax will be avoided/mitigated.

In the UK, properties valued at up to around £600,000 are ‘still moving’, estate agents tell me. Many people over the next year or two will be coming off fixed rate mortgages they took out during covid (when interest rates were low) and their new mortgage repayments will at least double under current rates. They will have the choice to either swallow this extra monthly cost or sell (some will have no choice). Taking all of this into account, forecasters are predicting the UK property market will decline – it is already stumbling at best, with a slow down in sales and asking prices not being achieved generally.

In Spain things are slightly different, and one of the driving factors is that you can fix your mortgage rate for life, meaning you have much more stability of payments moving forward – they can only reduce (if you re-mortgage when rates come down…if and when they do). Research says that the property market is booming in Spain. However, with approximately 15% of the property bought in Spain last year acquired by foreign buyers, taking into account what’s happening elsewhere an economist might say this impact will inevitably have a ripple effect at some point.

Some professions will always be able to be performed from home, however many companies are also starting to ask employees to return to the office. This could put an end to ‘we can work from anywhere, let’s go and live on an island/in the countryside’.

In summary I would say the Spanish property market is at best coming to a slow down, at worst a decline of some proportion. Of course, if you are holding this property for the long term then this will be of less importance. But considering the prices are the highest now they have ever been, and mortgage rates are much higher than they were, taking on a property now might mean you ‘have’ to hold it for a long time to realise its value.

Why should I speak to a Financial Adviser, in one sentence!?

A good adviser will make you more knowledgeable, financially organised, take the strain away from your finances, make your money work hard for you and always be there for you with sound advice whenever you need it (even if they don’t know all the answers, they will do their best to get them for you), always putting your needs first.

Prudential 90’s advert number 2

Do you remember this timeless, funny classic:

Now you can Identify as a Tree……who would have known back then!

If you would like any more information, or to talk through your situation initially and receive expert, factual advice, don’t hesitate to get in touch with Chris.

Investments in Spain

By Chris Burke

This article is published on: 16th August 2023

Savings accounts or investing in Spain – what is right for you?

This is one of the most common questions I am asked, and with interest rates creeping up I thought it prudent to run through how you should decide what’s right for you.

To help with this, firstly we need an explanation of the important differences between the two:

Why would you put money into a savings account?

Saving is putting money aside in a deposit account for the next few years. When interest rates are low, the return you’ll get on your money will be very modest. The risk is that it won’t beat inflation, which is the rate at which the prices of goods and services increase. So, whilst your money is safe (covered up to £85,000 in the UK and €100,000 in Europe), its purchasing power will be eroded over time, meaning you will be able to buy less with your money in the future. When interest rates are high you will get more return on your money, but generally in this type of economic climate it will still be less than inflation. Because of this, money you keep in cash savings accounts should be for short term savings of less than about 5 years.

Why would you invest your money?

Investing is another way of setting aside money for the future, where you invest your money into something with the aim of making a profit in the long run. When you invest, you’re generally exposed to the risk of stock market volatility (although some investments don’t invest entirely or solely in these markets). Your expected returns can fluctuate and you may not get back what you put in, especially in the short term.

You should aim for a minimum of 5 years when investing and start planning ahead with your investment strategy to manage this risk a few years before you want to access your money.

“Save for what’s around the corner and invest for the future”.

Why take any risk with your money?

Firstly, as explained above, inflation will eat into the power of your money over time. This is a problem while you are working, but is particularly important to manage when you are retired and you cannot replace lost buying power with income from your job. Secondly, not all investment risk is equal. The benefit of taking a calculated amount of risk over the long term is that it gives you the potential to make much more money than you would from a savings account, helping to pay for future large expenses and a more comfortable retirement.

What is the trend when interest rates are high compared to investing in the stock markets?

Over a short timeframe, holding cash in a savings account is usually a safe and appropriate option. It is less risky in the short term as it is readily accessible and interest rates are currently attractive relative to the past few years.

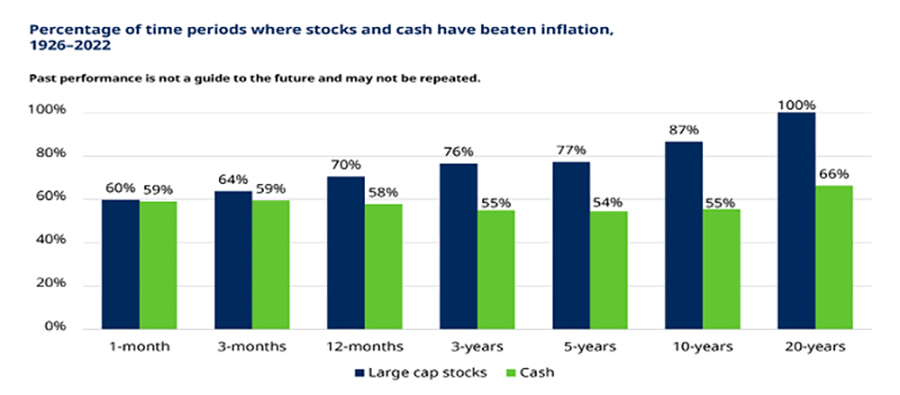

However, time is the critical factor to consider here, as over the longer term cash won’t beat inflation but investing should, as can be seen in the chart below:

Over long periods of time there is a big difference in the returns achieved from saving and investing. In the short-term, investing is riskier than an interest-bearing cash account, however when compared to inflation investing has offered far more certainty and success in the long run.

Prudential 90’s advert

Do you remember this timeless, funny classic: We want to be together!

The principles remain the same even today……

Click here to read independent reviews on Chris and his advice.

If you would like any more information, or to talk through your situation initially and receive expert, factual advice, don’t hesitate to get in touch with Chris.

Tax embargo in Spain for incorrect declaration of taxes

By Chris Burke

This article is published on: 10th July 2023

When moving to Spain you find out pretty quickly that the way things work here, bureaucratically and lawfully, are very different from the rest of the Western world, particularly the UK. One such example is if you are suspected of making an incorrect tax declaration or filing. Even if advised by your accountant/tax adviser to do so, you are liable and not them. In Spain, simply put, you are guilty until proven innocent of any suspected wrong doing.

With that in mind, one major example is of a self-employed person having their taxes filed incorrectly by their accountant and being unaware. At some point in the future the individual is notified that they have not responded to the tax office’s request to query this, and thus immediately have their income ‘embargoed’ and the monies they are suspected to owe are either taken from their Spanish bank account and/or taken at source from their main customers/invoices.

In one particular instance the tax office claimed they had ‘written confirmation’ that the notice of their investigation was delivered 3 times, however this confirmation is a signed document from the post office delivery person saying they were delivered, not the recipient signing to say he or she received them. Then, due to you not responding, the case is now closed and you are guilty by not replying, thus the money they believed you owed, you now owe and must be paid.

I have seen this happen many times over the years and cause considerable pain and suffering to people. Imagine the tax office saying you owed them €40,000 then taking it from your bank account, or deducting it each month as you received invoice payments. How do you then pay your bills? And in all of this, you are the complete innocent due to your accountant wrongly declaring your taxes.

What can you do? Well, the process is threefold:

- Firstly, you have to contest the ruling and see proof of what they are finding you guilty of (e.g., incorrectly filing) and that they actually delivered the documents to you.

- Secondly, if you feel their ruling is incorrect, appeal against it explaining why.

- Thirdly, as the appeal will likely be unsuccessful you then go through an ‘arbitration’ process where your likelihood of winning is approximately 75% and above.

The bad news is this process normally takes between 3-5 years. If you win, you will receive your money back plus some interest. If you lose, the European courts are your last option.

My best advice for anyone to avoid this is:

- Make sure you are confident in the accountant you are using to reduce the chance of this happening.

- Always make sure your address on file at the tax office is up to date.

- Only keep in a Spanish bank account money you need to live on. The tax office cannot legally take money from bank accounts outside of Spain unless they go through a court process.

If this has happened to you feel free to get in touch – I can recommend a law firm/accountant that has experience in this field and has been successful. Alternatively, if you would also like a recommendation for an accountant that won’t make these mistakes (hopefully, in Spain it’s never 100%!) then again feel free to reach out.

Click here to read independent reviews on Chris and his advice.

Financial Top Tips in Spain

By Chris Burke

This article is published on: 11th June 2023

Thanks to everyone for their positive feedback on these newsletters. They are purely to give us ‘foreigners’ the heads up on financial matters that are at best opaque here in Spain. Before I head off to a chiringuito, as it’s that time of year, this month we shall be concentrating on the following important topics:

- National Insurance deadline to backdate/buy years in the UK – act now!

- What pension are you likely to receive as self-employed/autonomo here in Spain?

- How much money do I need to retire (with example) comfortably?

- Legal aid in Spain for British nationals

UK National Insurance deadline approaching

I meet many people who have contributed into the UK state pension (National Insurance contributions) and then move abroad. They may also pay into other countries´ state pensions, but the BIG potential issue is that no one knows for sure if these will be combined and what income in retirement you will receive. Some people say ‘Well they have to, otherwise it’s not fair and that’s how it works now/used to before Brexit’. I tend to focus on as many certainties as possible and always try to have a ‘more guaranteed’ plan instead of relying on what governments do and don’t do, as that doesn’t fill me with confidence.

I have met many people with 5 years’ state contributions here, 10 there and another 5 somewhere else and they don’t actually end up receiving ANY state pension. This is not the situation I want to end up with and that’s why I recommend to anyone who has existing UK NI contributions to continue to contribute to them, aiming to reach the maximum years needed to receive a full UK state pension. As a non-UK resident, if you are paying taxes in Spain it´s normally £12 a month to contribute to the UK system – for me it’s a no brainer.

With that in mind, normally you can ‘backdate’ or buy past years’ contributions to fill in any gaps you may have. However, from the end of July (next month), you will only be able to backdate 6 years, whereas before this deadline you can buy more. So, if you have significant gaps in your UK NI contributions you only have until next month to ‘fill’ a part of them. You can find out more here: National Insurance Gaps

Self-employed/autonomo state pension amounts

I wanted to clarify something that not many people here realise when they contribute into the social system as self-employed. In the UK you pay your contributions and the number of years you have contributed dictates, more often than not, how much you receive. However, this is not the case in Spain.

Many people are autonomo here and presume the monthly payment they make to the social security, if made over the necessary number of years, (currently 35), will give them the full Spanish state pension – unfortunately that is incorrect. That is because it’s not JUST the number of years you contribute, but also the amount you pay. Not many accountants will confirm that there is a choice on how much you can pay each month towards your social security – a low, medium or high amount. Therefore, most people pay the low amount for many years and only realise the problem when they start looking closer, usually at retirement age. I hope most people are sitting down when I tell you that if you paid the minimum contributions for the full number of qualifying years in Spain, you would receive around €643 a month, (almost half of the UK amount), whilst the maximum is €2,617.

That is why I recommend to almost everyone that they ensure as far as possible that they are fully contributed into the UK system by retirement.

Here are the links to HMRC to read about and organise this, (please don’t get in touch with me for help as it has to be done by yourself):

- Information on paying National Insurance contributions from abroad – gov.uk/national-insurance-if-you-go-abroad

- The Form to complete to pay Class 2 voluntary contributions at £12 a month – gov.uk/government/publications/social-security-abroad-ni38

You can obtain a state pension forecast here in Spain if you have a digital certificate here

As a local accountant recently told me, and I quote, “My personal opinion is that it is better that you make your own pension, saving the money and investing it directly, and more because each time the pensions are reduced year by year and it is quite sure that in the future they will be reduced most, but this is only my opinion…… This is what I decided to do a long time ago.”

So, my advice? Pay the minimum here, pay your NI in the UK and reach the maximum alongside making your own provision along the way.

How much money do you need for a comfortable retirement?

Now, this is a very difficult forecast to make given everyone’s very different lifestyles, so I must use a few assumptions based on the following:

- Average annual salary – €3,000 per month after tax

- Medium lifestyle choice in retirement

Therefore, one could surmise an income needed in retirement of €4,000 per month before tax could be the average amount required. If we say you receive the full state pension of around €1,000 per month, you need to supplement €3,000 per month.

If you had €300,000 and it gave you 5% return each year this would give you €1,250 per month – so we still need another €1,750 per month. Of course, this means that as you are taking the full interest earned from your money pot it is not keeping up with inflation. Therefore, taking 4% at most is more applicable which gives you €1,000 per month income. However, if this income falls under income tax (such as property income), then from earnings upwards of the current allowance of €6,700 each year at age 65 in Spain you will be taxed. Adding that to the state pension, (which is declarable for income tax in Spain), we probably need to say it’s more likely €800 a month net from this monetary income.

So, we see the problem, what do we need to do? In essence, make your savings/monies and assets work for you over the years with professional management, taking into account tax mitigation. The more money you invest and the longer the time, the more comfortable or higher probability you will achieve your goals.

By the way, the answer to the above question also depends on how you are receiving the income. Tax efficient savings will greatly reduce you tax liability away from income tax to the lower, (and with possible offsetting capability) of capital gains tax. In monetary terms, to be safe I would suggest €800,000 plus a property rented out in retirement, in today’s money, as an income will safely achieve this. Is that the average persons situation?

Legal aid in Spain for British nationals

The UK has just released the following information on legal aid available for those residing in Spain which is perhaps ‘better’ than I would have expected and well worth knowing: Legal Aid Spain

Click here to read independent reviews on Chris and his advice.

If you would like any more information regarding any of the above, or to talk through your situation initially and receive expert, factual based advice, don’t hesitate to get in touch with Chris.

The Top Tips in Spain | May 2023

By Chris Burke

This article is published on: 15th May 2023

Summer is well on its way, lighter evenings and enjoyable temperatures are here for most and we will soon be commenting on how hot it is, I am sure!

For this month we shall be concentrating on the following topics:

- Driving licence swap now active

- UK investments/ISAs compared to Spanish options

- UK tax code changes – beware!

- State pension retirement options in Spain

Driving licence swap now active

From the 16th March 2023 the UK & Spain driving licence exchange, without the need to take a practical or theory driving test, is back at long last for those who are Spanish residents. From this date, as a resident you can legally drive in Spain on your UK driving licence, having 6 months to exchange.

You will also need to book a ‘Psicotecnico’ as I previously mentioned in my Newsletter and here is a link for the participating places to do this: Psicotecnico centres

So get your driving gloves back on and hit the Spanish roads! Be aware, this new exchange deal between the UK and Spain also means they will be sharing information on fines, speeding tickets and other incidents recorded (intoxication for example) so take note.

UK investments/ISAs compared to Spanish options

Many people who live in Spain are unclear or unaware of the difference between holding UK savings and investments compared to Spanish, and also what your options actually are here.

Unless you are on a specialist tax regime such as the Beckham Law, or potentially the new Digital Nomad Visa, Spain views UK savings and investments as non-Spanish compliant and therefore tax declarable/paid on any gains annually, EVEN if you do not access any of these monies. In the UK for example, normally the first advice any financial adviser will give their clients is to ‘max out’ their ISA and private pension contributions annually, as the tax saving alone makes this a great thing to do. However, once you become a Spanish tax resident these are not generally tax efficient and any gain on non pension related investments has to be declared and tax paid annually – therefore in many cases potentially nullifying the benefits of these.

So what can you do?

Most people speak to their Spanish bank and aren’t given any financial advice as such in respect of their circumstances and, in many cases, are sold investments that are not really what they are looking for, nor, dare I say, are any good from what my clients tell me!

When they have been put off by this they start looking around for something similar to what they had before they moved to Spain, and that’s when they find and/or are recommended to me. In Spain, we have access to several flexible investment solutions backed by some of the UK’s largest and well-known institutions. These products are EU regulated and highly tax-efficient, in essence similar to a UK ISA. We start by looking at your overall situation, carefully understanding what you are looking to achieve – whether that be a retirement plan, mid-term investment or complete financial planning for the whole family, taking into account university fees, or perhaps FIRE (Financial Independence, Retire Early). As the years go by and your money grows we provide ongoing advice to make sure these are optimised, taking into account life events that occur along the way.

UK tax code changes – beware!

On the 10th April this year UK state pensions were increased to rise with inflation up to £203.85 a week (10.1% increase) as the government restarted the ‘triple lock’ agreement it had suspended for one year. For most people receiving their UK pensions this was very good news, however for some it has created another problem depending on other income and how they are set up for tax purposes.

When leaving the UK as a tax resident it is important to inform HMRC. If you don’t, once your income rises above your personal allowance of £12,570 (with the state pension annually now £10,600) you will be subject to income tax in the UK and taxed accordingly.

Worse than that, this hike in UK state pension income has seen many retired people have their tax code changed, wrongly it would seem, by HMRC. In one case I have seen they were being taxed 40% on their income above the personal allowance. If the tax they are taking doesn’t look right a simple phone call to HMRC seems to solve the problem.

If you have set yourself up correctly as a non UK tax resident, then the only UK income you should be taxed on is property rental income. Most other income should not be taxed in the UK, but declared and tax paid in the country where you are tax resident.

State pension retirement options in Spain

Below I have listed the different options when you retire in Spain claiming a state pension – one notable new change is that to qualify for ‘partial retirement’ (also known as active retirement) you can only use Spanish contributions – previously you could include contributions from the UK.

Ordinary Retirement

Retirement age in Spain starts at 65, however for most it is 66 years and 10 months and by 2027 the number of years of contributions to retirement needed will be 38.5 years.

Flexible Retirement

After you retire, you can combine receiving a part of your pension with part-time work (reducing your full working day down to 50%). Your pension is reduced proportionally.

Partial/Active Retirement

If you have not reached the legal retirement age, you can combine a part-time employment contract with receiving part of your retirement pension.

**Reminder – to qualify for the Spanish state pension in general you must have contributed for 15 years, of which two at least should fall within the 15 years immediately preceding the start of your entitlement.

If you would like any more information regarding any of the above, or to talk through your situation initially and receive expert, factual based advice, don’t hesitate to get in touch with Chris.

Saving for retirement in Spain

By Chris Burke

This article is published on: 8th February 2023

Retirement options

One of the big differences when you move to Spain are the options available to you for retirement planning. In the UK/Ireland we have ISAs and private/employer pension schemes which both offer good tax savings.

ISAs are not tax free in Spain, and the annual ‘private pension allowance’ is only €1,500 per year per person! In some employer contribution schemes you can save up to €10,000 per year, but these are very uncommon. Compare that to £40,000 per year in the UK, or in Ireland up to €115,000 per person, per year! €1,500 per year is never going to achieve any serious amount of income for retirement.

The main reason for this is that in Spain, culturally people preferred to set up a company structure or accrue properties, passing these from generation to generation. Additionally, there is a lack of incentives from the authorities to entice people to save into retirement schemes.

Pensions have been popular for retirement in the UK/Ireland because of the tax savings and potential employer contributions. Take both of those away and they are not nearly as effective, which is what happens when you move to Spain. So, what can you do if you want to plan for retirement in a tax efficient manner?

For me, retirement is not just about a pension, it’s about a retirement plan. We help clients build that retirement strategy, taking into consideration the amount of income they want, making sure their assets are highly tax efficient (such as moving them away from future income tax positions) and then making sure everything is flexible and portable, because you never know what will happen in life. This is all done by using our client planning portal, where we work together to bring this to life using the following process:

This is all done by planning, where we work together to bring this to life using the following process:

- Assess existing assets including ISAs, pensions and other savings/investments

- Understand your objectives and when/where you are looking to retire and with how much

- Understand your current and ongoing financial situation, taking into account future events such as children/grandparents

- Compile this into a strategy where we plan, implement and review

- Review and adapt as the years go by evolving the plan to fit your life

We never know exactly what’s going to happen, but one thing is for sure, with proper informed planning and regular analysis, you will be much better prepared.