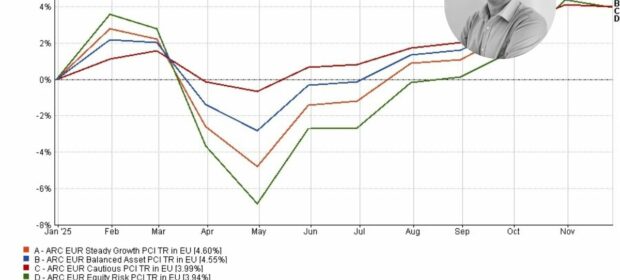

As we come to the end of the year, we wanted to share a brief reflection on what has been a challenging but ultimately rewarding period for investors.

It’s been another unusual year (I think I wrote that in my last Christmas newsletter!!). We began 2025 with talk of a Trump tariff driven recession, interest rate cuts and the end of US dollar dominance. Instead, growth has slowed but not collapsed, interest rates have stayed higher for longer, and after weakening early in the year, the US dollar has strengthened again in the second half of 2025.

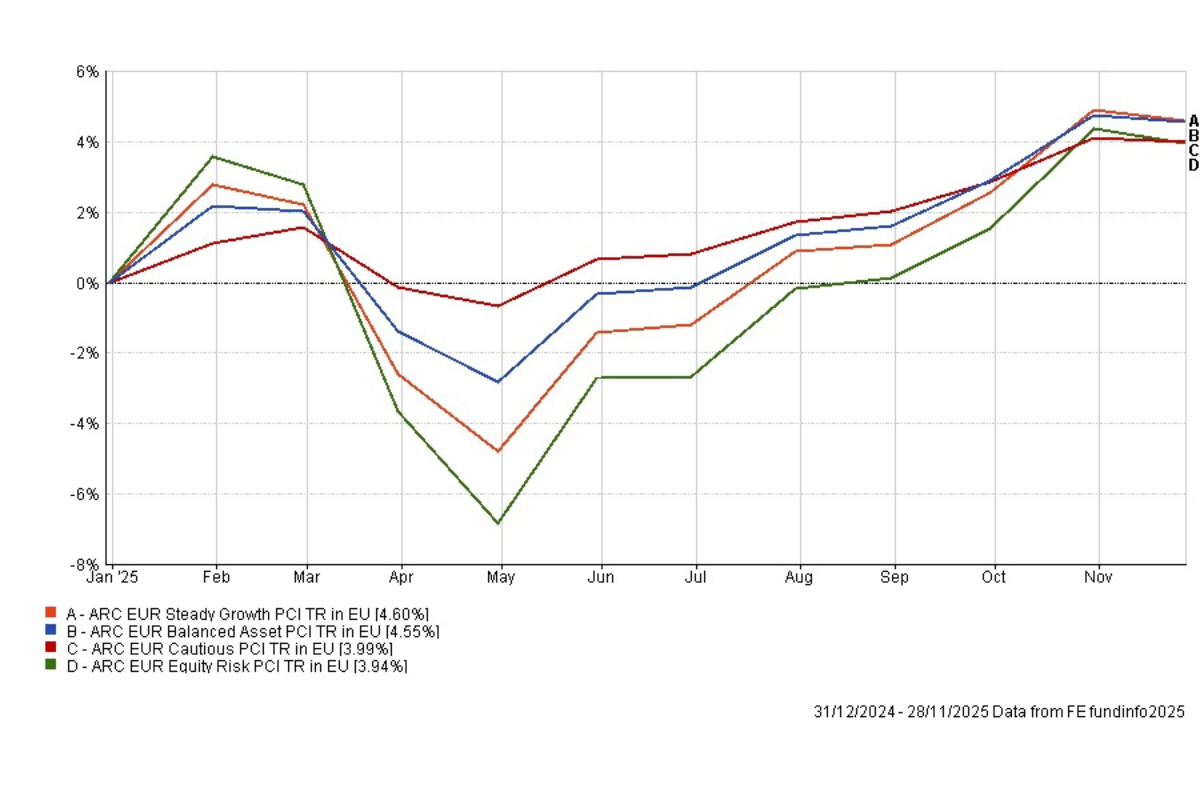

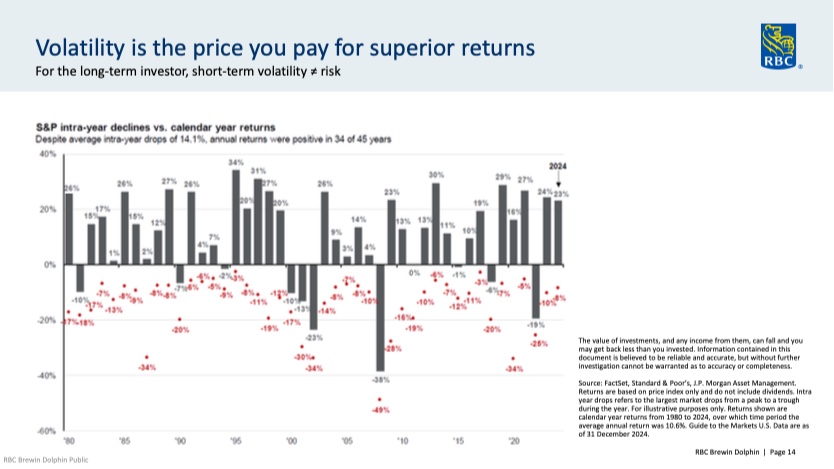

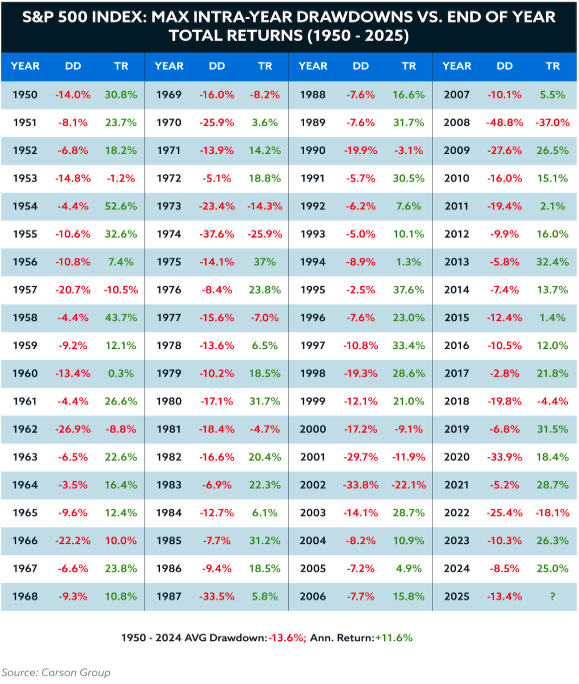

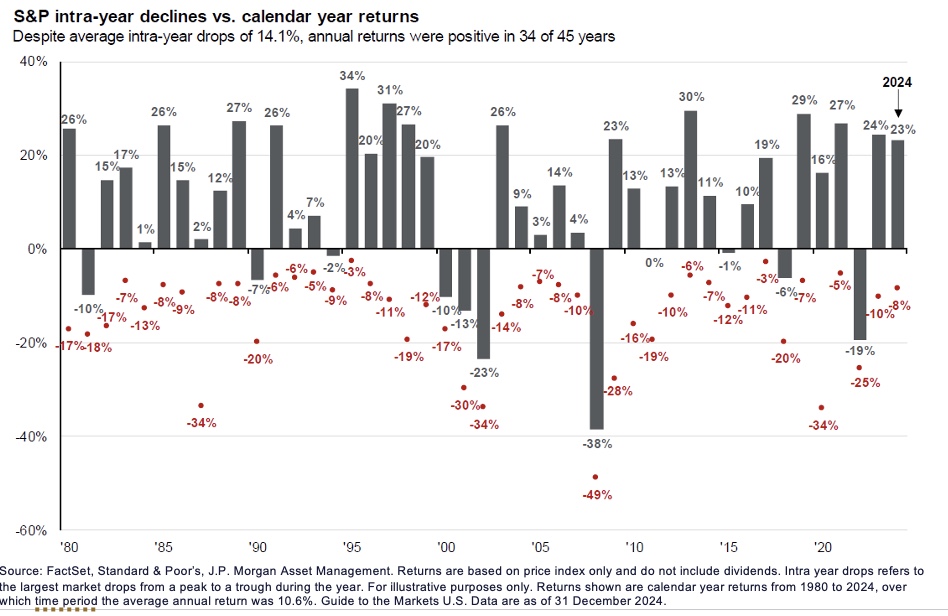

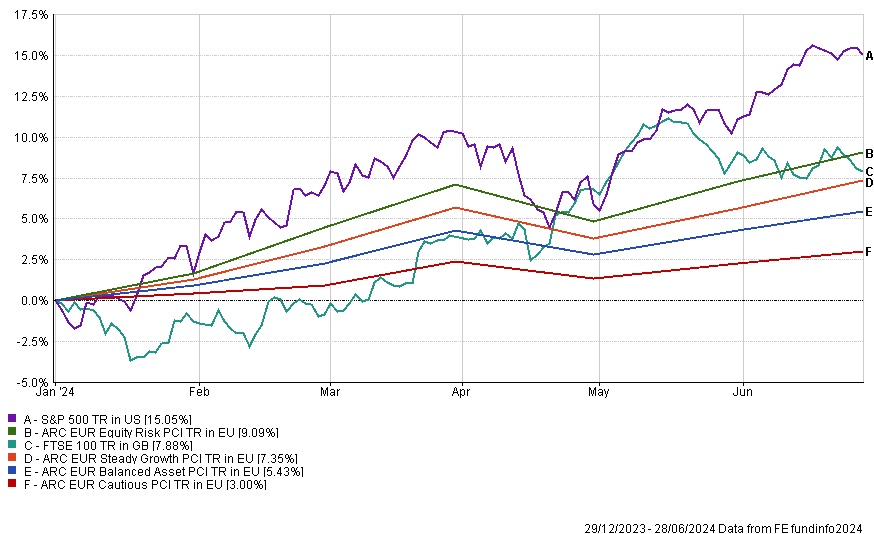

Equities experienced volatility along the way, driven by geopolitics, policy changes and concerns around inflation. Despite this, strong company earnings — particularly in technology and AI — helped global markets finish the year close to record highs. This was a reminder of the value of staying invested through short-term uncertainty.

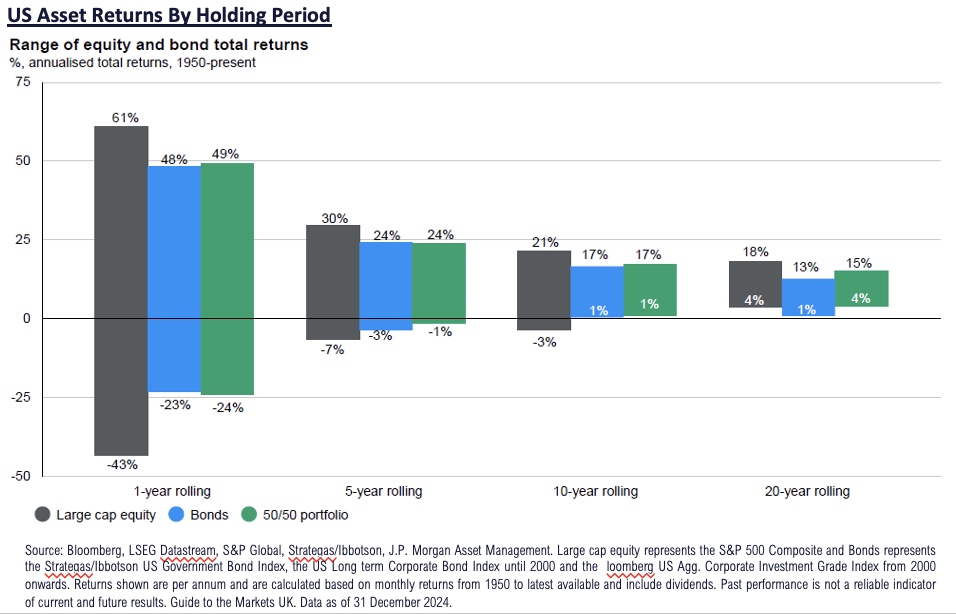

Bonds quietly did their job. While yields rose earlier in the year, they provided attractive income and stability, reinforcing their role as a key diversifier within portfolios.

Gold stood out as a strong performer, offering effective protection against geopolitical and economic uncertainty while contributing positively to returns.

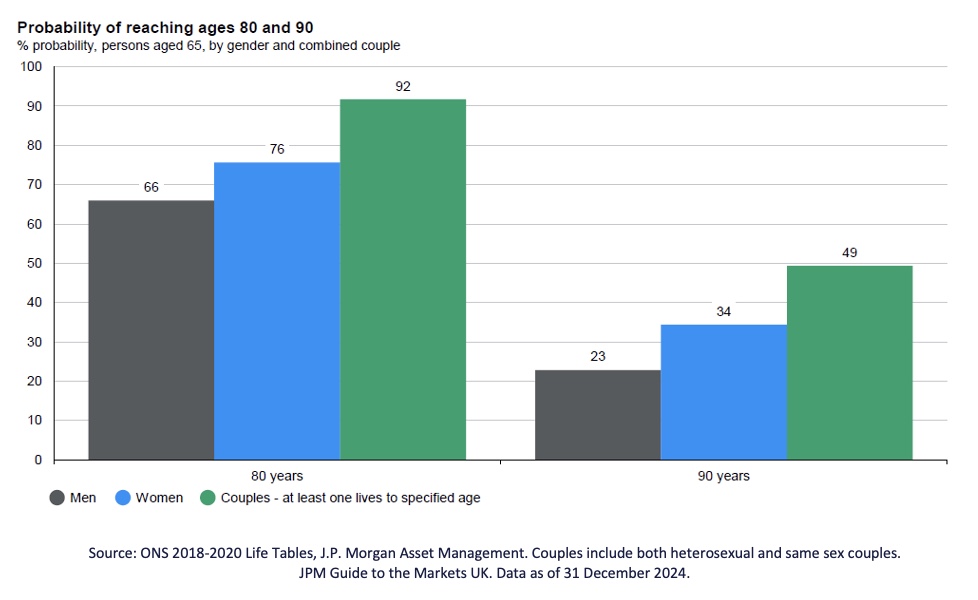

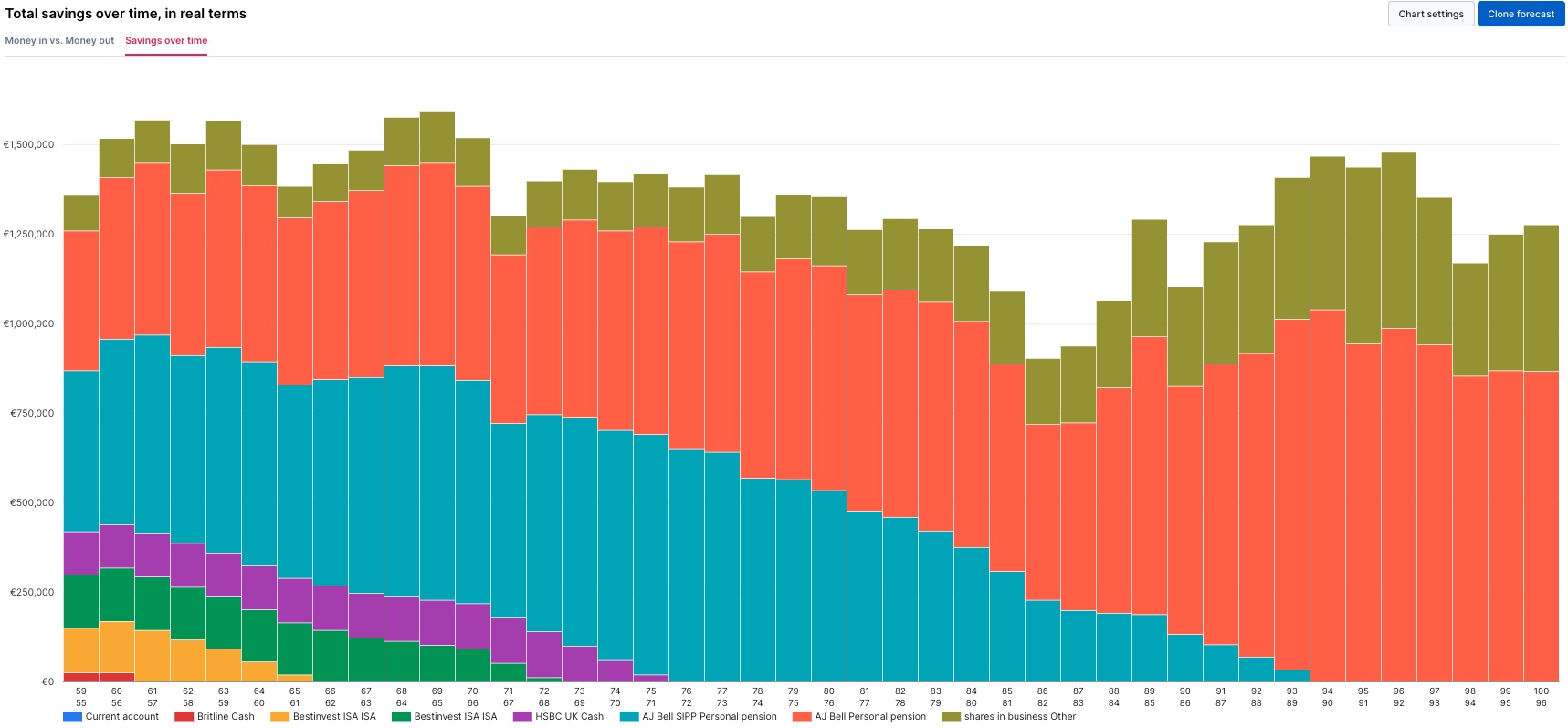

Overall, 2025 reinforced an important lesson: diversified, multi-asset portfolios can help investors navigate uncertainty and capture long-term opportunities — even in unsettled markets.