I recently attended the FEIFA Annual Adviser Conference in London and wanted to share a brief summary of the latest market insights, along with how advisers are continuing to evolve their approach to best serve clients in today’s environment.

FEIFA Annual Adviser Conference

By Peter Brooke

This article is published on: 30th May 2025

The Federation of European Independent Financial Advisers (FEIFA) – not to be confused with the football governing body! – was founded 16 years ago by a group of experienced IFA firms across Europe. They saw the need for an organisation that could uphold professional standards and represent the interests of advisers and their clients with both industry bodies and regulators across the continent. Spectrum is proud to be one of the original founding members, and we continue to support and build on those standards through our ongoing involvement.

The annual conference brings together FEIFA members and leading industry voices to discuss the unique challenges of advising cross-border clients. As Head of the Spectrum Investment Committee, it remains a valuable and important event in my calendar.

Staying the Course Through Market Volatility

Richard Flood (RBC Brewin Dolphin) reminded us that global events—whether pandemics, wars, or political wrangling —are a constant. Despite this, markets rise over time. The key is to focus on long-term fundamentals rather than react to short-term noise.

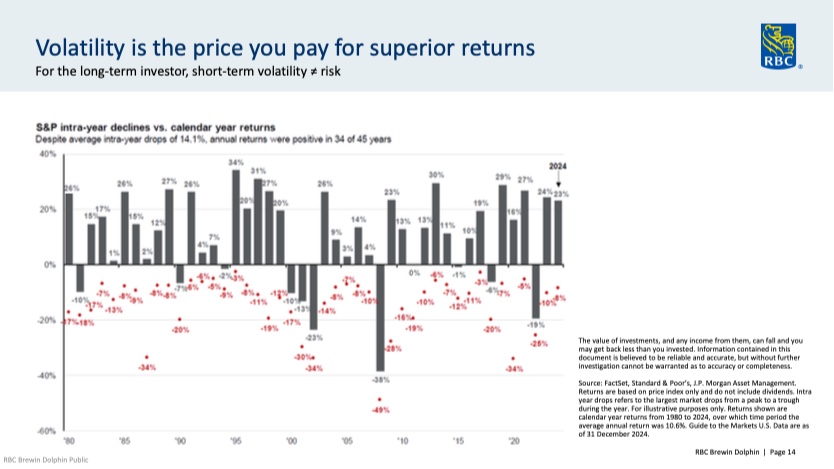

Volatility, he stressed, is a normal part of investing and “the price you pay for superior returns.”

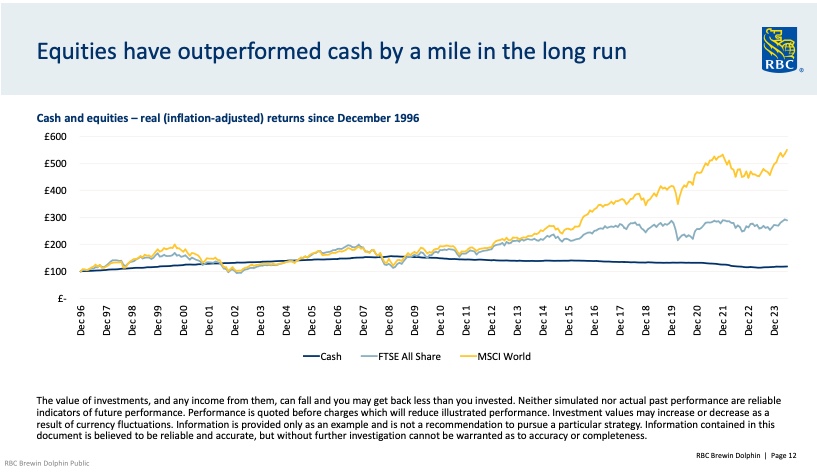

Avoiding volatility by sitting in cash is not a good idea either as Inflation diminishes the purchasing power of cash – as illustrated in this Equities v’s Cash ‘inflation adjusted’ performance chart.

Navigating an Uncertain 2025

David Coombs (Rathbones) highlighted the ongoing impact of geopolitical events like Trump’s executive orders and Tariffs on trade and compared them to other countries ‘protectionist policies’ like unbalanced tax rates (eg Ireland), agricultural subsidies (eg France).

He also stressed the unconsidered challenges that passive investments (eg ETFs) pose to market stability due to being “forced sellers & and forced buyers” therefore adding to volatility.

Active management, in his view, remains vital, especially in 2025, and he shared a wonderful example of how active he has been in the last year:

The below chart is the Shopify share price, a share he has held for some time, the red dots are where he sold some shares (trimmed) and the yellow dots are where he added money – this shows that active management is much more than strategically choosing which companies to own or not own, but how to add value through tactical decisions.

The Passive Investing Paradox

Henry Wilson (LGT Wealth Management) discussed the risks of over-reliance on passive funds, including the concentration risk in a few large companies (eg MAG 7). Because of this concentration of returns (and risk) to fewer, larger companies he believes that true diversification is under threat, valuations are higher, future returns are compromised…

… BUT as Harry Markowitz, the architect of Modern Portfolio Theory & Efficient Frontier said “Diversification is the only free lunch to investing”.

Therefore while passive investing remains a useful tool, LGT and Spectrum advocate for highly diversified, actively managed portfolios to help manage risk and improve long-term returns.

If you are going to own passive investments you have to be active with them.

Model Portfolios & Adviser Alpha

Matthew Lamb (Pacific Asset Management) explored the evolution of model portfolios and the increasing role of technology. With many portfolios becoming similar, the real value lies in the advice given—not just the investments chosen.

This fits strongly with my recent newsletter about risk (click here) – If most ‘Balanced’ portfolios are similar to each other and most ‘Growth’ portfolios are similar to each other then the outcome for you, as my client, is not in picking between two balanced funds or two growth funds… it’s ensuring we choose correctly between Balanced or Growth in the first place!!

Good risk profiling conversations make sure we start in the right place.

Planning for the Summer

After almost 13 years, we’re finally heading to Australia for a long-overdue family holiday. We’ll be visiting my wife’s side of the family, who all live in Queensland. She’s been able to make a few trips in that time, but between school schedules, travel costs and a global pandemic, the children and I haven’t been back since 2013. We’ll be away for five weeks from the end of June and are really looking forward to the trip.

I’ll still be checking emails and messages periodically, but if you’d like to catch up — whether by phone, Zoom or in person before we go — please do get in touch or book something in the calendar before Friday 27th June.

All being well, I’ll be back at my desk (with a fair dose of jet lag) on Wednesday 6th August.

Lions V’s Australia

Of course, seeing family and friends is the main priority — but I’d be lying if I said there wasn’t something else I’m particularly excited about.

As a lifelong rugby fan, getting the chance to see the British & Irish Lions take on Australia in both the 1st and 3rd Test Matches — plus the Queensland Reds in early July — is nothing short of a bucket list experience for me.

As always, if there’s anything you’d like to go over before I head off, just let me know. And if anything comes up while I’m away, I’ll do my best to ensure it’s handled smoothly.

Contact me if you have any questions via the below channels, or the booking system – always drop me a quick message if you need a time slot outside of those available.

Mobile & Whatsapp: +33 6 87 13 68 71

Email: peter.brooke@spectrum-ifa.com

Calendly booking system: https://calendly.com/peterbrooke/30min

Financial Market Update April 2025

By Peter Brooke

This article is published on: 8th April 2025

Uncertainty leads to Volatility

Quite understandably my inbox has been full of messages from concerned clients and musings from commentators and investment managers about how to respond to the current market reaction to President Trump’s raft of tariffs.

The uncertainty around how these tariffs will play out has led to large falls in stock markets, especially the US.

As discussed in my last newsletter Lets Talk About Risk, volatility is an important and unavoidable part of investing and will be negated by time in the market and can provide great opportunities. The key is to ‘stay the course’ and try and ‘see through the noise’.

However, I did want to get something out to you with some current thoughts about what is happening, what might happen in the near future and why ‘staying the course’ is the best option.

We’ve Been Here Before

When markets turn volatile, perspective is everything.

The past week feels pretty tumultuous but, of course, we’ve been here before.

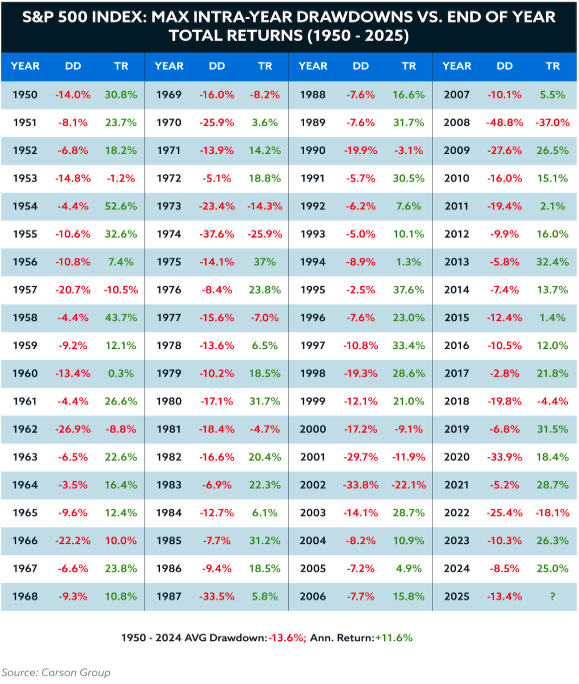

The table below shows the maximum intra-year drawdowns (DD) and end-of-year total returns (TR) for the S&P 500 from 1950 to 2025.

It reveals that after severe drawdowns, the market has often recovered the full decline and finished the year strongly positive.

Years to Note:

- 1970: Market fell -26% from peak to trough… yet ended +3.6%

- 1975: Dropped -14.1%, but closed the year up +37%

- 1987 (Black Monday): Down -33.5% mid-year, still finished +5.8%

- 2009: Deep in the Global Financial Crisis, dropped -27.6%, yet ended +26.5%

- 2020: COVID crash brought a -33.9% drawdown… ended +18.4%

On each occasion, the best course of action would have been to avoid the noise and stay invested.

“History doesn’t repeat itself, but it often rhymes.”

I hope that the above shows that though periods of volatility will always happen and always be temporary it is best to stay the course and try and avoid the noise;

I do appreciate that it is difficult with today’s ‘news’ channels adding to the feeling of panic on an hourly basis so I have shared below some links from firms much closer to the markets to share more detail about what is happening and what investors should consider in these temporarily volatile times.

Traversing Trump tariffs by Daniel Casali, Chief Investment Strategist at Evelyn Partners

Trump’s tariffs: how should investors respond? From Rathbones Investment Management

I would like, once again, to thank these expert commentators and the team at New Horizon Asset Management for their quick and important updates to a challenging situation.

Talk to me

As always, please remember that financial decisions should be made with careful consideration of individual circumstances and professional advice, I am here to support you.

If you have missed any previous news and updates these can all be found on the archive page here.

If you have any questions please use the the below channels, or the booking system – always drop me a quick message if you need a time slot outside of those available.

Mobile & Whatsapp: +33 6 87 13 68 71

Email: peter.brooke@spectrum-ifa.com

Facebook: Peter Brooke – Financial Advice

Calendly: https://calendly.com/peterbrooke/30min

Understanding Investment Risk

By Peter Brooke

This article is published on: 30th March 2025

“Risk” is an unavoidable, and sometimes welcome, part of investing so having a better understanding of the different forms of risk can help investors make informed decisions that align with their financial goals. In this (quite long) article, we explore key types of “risks” and how they impact financial planning.

What is RISK?

Definition: The possibility of something bad happening!!

What is INVESTMENT RISK?

Definition: The degree of uncertainty and/or potential financial loss inherent in an investment decision.

So we need to frame our conversations about “RISK” by trying to understand the ‘something bad’ in every decision we make.

Inflation Risk: The risk of doing nothing!

A.K.A. – The Erosion of Purchasing Power

Inflation risk occurs when the value of money declines over time, reducing its purchasing power.

For example, if inflation averages 2.5% per year, €100 will only buy €53.10 of goods in 25 years’ time.

To counteract inflation risk, investors should turn to non-cash assets like shares and bonds, which have historically always outpaced inflation over the long term.

What’s the something bad? – The risk of doing nothing and leaving money in a bank account will guarantee a financial loss over the long term.

Permanent and Total Loss of Capital

Companies can and do ‘go bust’ and for an investor in those company’s shares this would mean a total and permanent loss of capital – the share price falling to zero.

Therefore understanding how a company is managed and investing across a diversified group of high quality companies will minimise this risk.

Outsourcing to a fund manager to diversify this risk is a great way to ‘avoid the losers’ even if you don’t always ‘own all the winners’.

What’s the something bad? – Investing in just one or a few companies and not understanding the ‘fundamentals’ of each investment.

Volatility: Fluctuations in Values

Volatility is often ‘defined’ as RISK with respect to investments.

Volatility refers to short-term fluctuations in the price of an investment; for example a share price.

While dramatic drops can be unsettling, history shows that volatility is entirely normal and markets always recover over time.

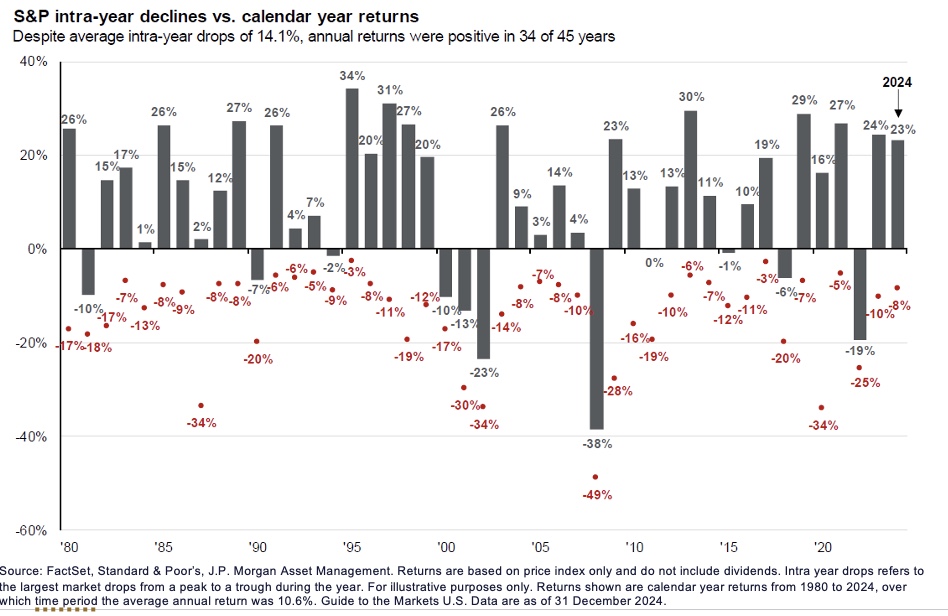

For example, look at the chart below; since 1980, the US stock market (S&P 500) has experienced declines averaging 14.1% during each year, yet annual returns were positive in 34 of those 45 years (75%).

The red figures show the largest market drop in value for each year and the grey bars show the total return for that same year… for example 2024 shows a drawdown of 8% but the S&P 500 finished the year 23% up.

Volatility is NORMAL and does NOT mean a capital loss for the long term investor.

Volatility risk is mitigated by TIME in the market

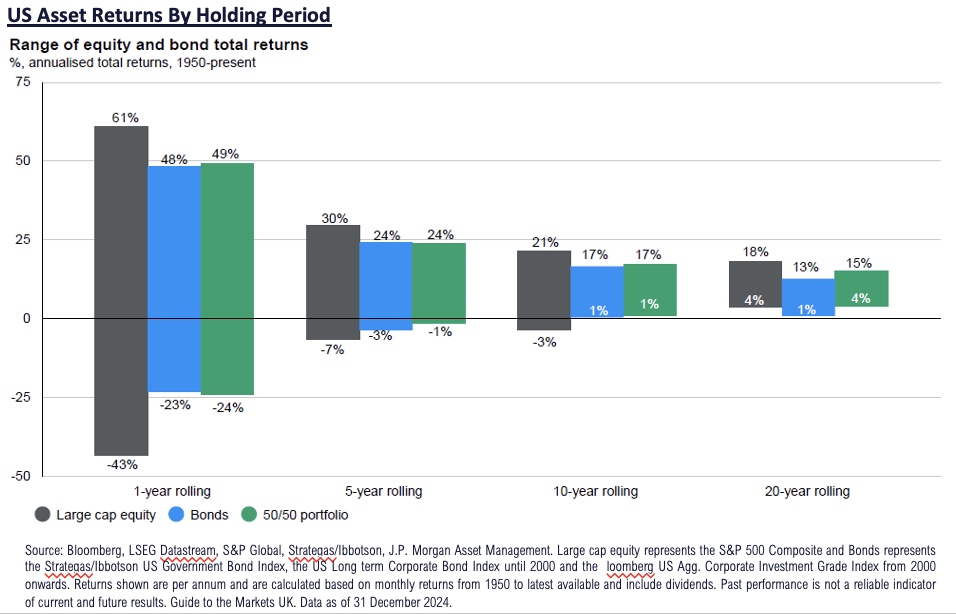

Volatility is part and parcel of investing, and your investment time horizon almost without exception determines the likelihood of investment success. This chart shows the annualised returns over four different time frames (1, 5, 10 and 20 years) using data from 1950 to today.

A 50/50 portfolio of shares and bonds (the green bar) shows that in the last 75 years you could lose up to 24% or gain up to 49% in any given one year period.

However, over every 10 year rolling period in that same 75 years, your worst possible return would be 1% p.a, (ie. no loss) and the best would be 17% p.a.

The longer the investment term, the less relevant volatility becomes, and crucially, the longer the investment term, the greater the likelihood of investment success.

What’s the something bad? – Not maintaining a long-term perspective and reacting impulsively to market swings.

Longevity Risk: Outliving Your Wealth

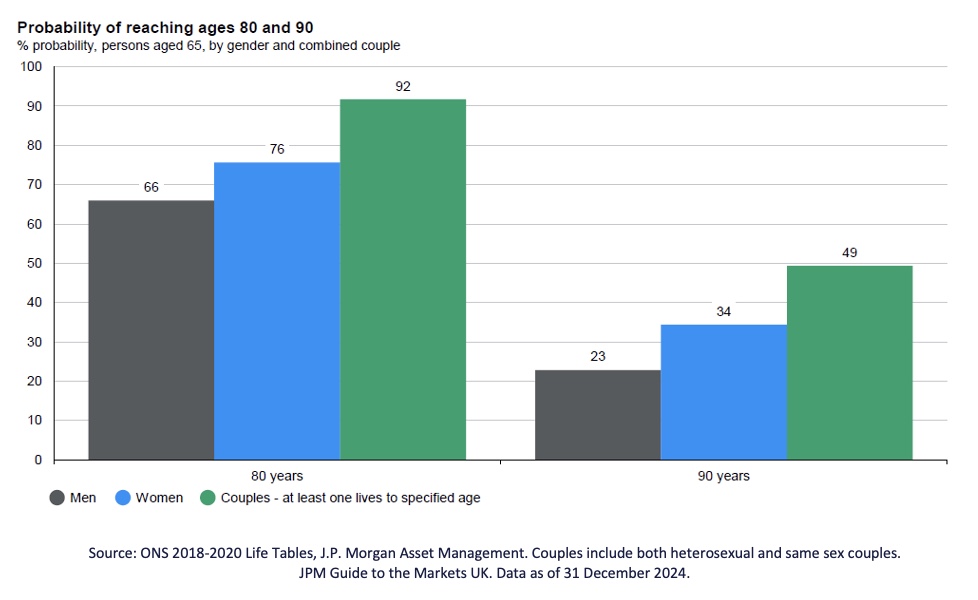

With increasing life expectancy, investors must consider the risk of outliving their assets.

For a couple aged 65 today there is a 92% chance that one of them will live to 80 and a 49% chance one will live to 90.

Planning for a longer retirement by investing must now include more exposure to growth-oriented assets.

Sequencing Risk/ The Timing of Returns Matters

For retirees or those drawing an income from investments, sequencing risk— the order in which returns occur— can significantly impact portfolio longevity.

A market downturn early in retirement can lead to a faster depletion of funds compared to a downturn later in retirement.

Strategies like maintaining a cash reserve, actively managing portfolio risk as you approach retirement and diversifying investment assets will help.

What’s the something bad? – A market correction just at the point of retirement can significantly impact the quality of that retirement.

ROMO – The Risk Of Missing Out: The Cost of Not Investing

As well as the risk of not keeping up with inflation, there is also a significant risk (and great financial cost) in staying out of the market.

The ‘magic of compounding’ delivers substantial rewards for the patient, long term investor.

The 8 – 4 – 3 Rule

- The first 8 years is a period where money grows steadily

- The next 4 years is where it accelerates

- The next 3 years is where the snowball effect takes place

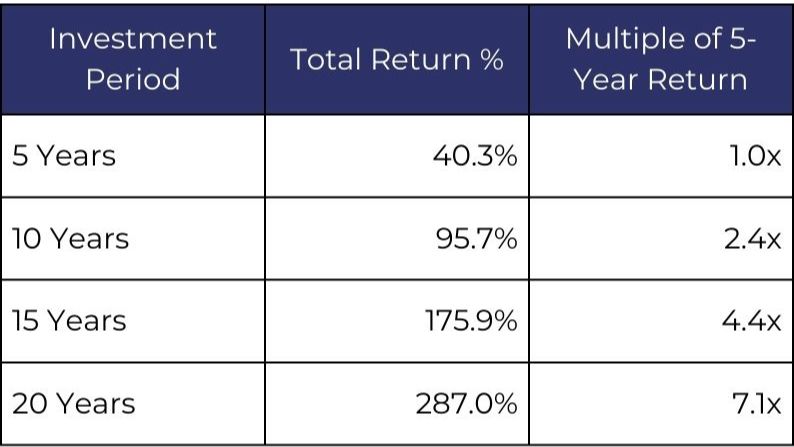

Here is a table showing the compounding effect of a 7% annual return:

What’s the something bad? – The risk of doing nothing and not benefiting from compounding returns.

Currency Risk

Expatriates often have assets in one currency but expenditure in another; for example a Pension in British Pounds and outgoings in Euros.

As global investors there will always be some form of underlying currency risk but mitigating the practicalities of moving money around from one currency to another is possible with careful planning.

Options could be:

- Take all the currency risk at the start – ie transfer the whole ‘pot’ today to your expenditure currency – a one off risk.

- Take all the currency risk at the end – exchange the money to your expenditure currency when you draw the money out; this might be better as it may spread the risk over time.

- Manage the currency – you could set up your account in your expenditure currency (e.g. Euros) but keep the underlying investments in their original currency (e.g. GBP) and then create a strategy to move the money over time to match the outgoings.

What’s the something bad? – The risk of not correctly matching your assets with your liabilities – a large fluctuation affects your lifestyle.

Assessing Your Attitude to Risk:

All of the above is to help our conversation about ‘RISK’ but in order to best set up and review your investment portfolio we have a 3 part process to determine exactly how much investment risk you can tolerate:

1. Your ATTITUDE to risk – this is a psychometric test, via a questionnaire, to assess your in-built view on risks, volatility and returns.

2. Your CAPACITY to take risk – this is a deeper understanding of your overall situation and therefore your ability to weather ups and downs in portfolio values… i.e. do you have other assets, a large pension or property income; how reliant are you on your portfolio at any given time?

3. Your TIME HORIZON for investing – when do you need to access to this money? Will the access be to draw an income or large lump sums or even, all of the fund in one go? Or is this money just to be invested to pass on to beneficiaries?

The answers to these 3 questions provide us with a ‘score’ and ‘understanding’ of how you will use the money being invested… this allows us to assign a ‘Risk Benchmark’ to your portfolio, from which we will determine its asset allocation and then monitor its performance and volatility for the duration of the investment.

Obviously, your TIMESCALE changes over time and your CAPACITY can change as your life situation changes; even if you maintain the same inherent ATTITUDE to risk we must always review and monitor the overall position of your portfolio and potentially change your benchmark as time passes.

Final Thoughts

Investing always carries ‘risks’, but knowledge and strategy can help manage them effectively. Whether it’s inflation, market fluctuations, or longevity concerns, working with a financial adviser ensures that risk is considered within a well-thought-out plan. Overall doing nothing is the largest risk.

Staying focused on long-term goals, and avoiding emotional reactions to short-term market movements, usually leads to successful financial outcomes.

I would very much like to thank the team at RBC Brewin Dolphin for their kind input and help with this article, I truly hope you found it useful.

If you’d like to discuss your investment strategy and how to manage these risks, feel free to get in touch!

Enhance Your Financial Planning Experience

By Peter Brooke

This article is published on: 7th March 2025

I’m always looking for ways to improve how we can work together, ensuring that your financial planning experience is seamless, efficient, and tailored to your needs. To that end, I am excited to share some recent technology updates that will enhance our communication and collaboration.

These two new enhancements add to the suite of tech tools I am already using to save time, improve communication, improve my efficiency in dealing with follow up tasks and provide you with the best financial planning service possible.

Introducing Our Virtual Office Via Spatial.chat

Spectrum advisers and our clients are spread across Europe and so we have invested into an innovative virtual office via App.Spatial.chat to offer a more interactive and engaging way to meet remotely. This platform allows for an easy to use virtual face-to-face experience, making it easier for us to discuss your financial plans in a comfortable, secure setting – whether you’re at home or on the go.

This tech does not replace face-to-face meetings but offers us another way of meeting. I will be offering this as an invite option via my Calendly Booking system as well as zoom, teams, telephone calls and, of course, face to face meetings.

When you enter the Spectrum Virtual office, as a guest, you will see a brief introduction as to how it works, you can then enter the main office or any of our ‘country’ offices, via the list on the right hand side of the screen.

Our meetings will be conducted in my own personal office which is password protected so we have complete privacy from anyone else who might be online at the time.

I look forward to seeing some of you there over the coming months.

Secure Meeting Documentation with Otter.ai

To ensure I capture every important detail during our discussions, I will now be using Otter.ai to record virtual and even live face to face meetings, with the agreement of my clients.

This tool allows me to create accurate transcripts of our conversations, helping me stay fully aligned with your financial goals and ensuring that nothing is overlooked.

Rest assured, all recordings and transcriptions will be handled securely, I permanently delete each one as soon as I have downloaded the transcribed notes and follow up to task lists, maintaining strict confidentiality in accordance with data protection standards.

Why These Changes Matter to You

- More convenience: Join virtual meetings effortlessly, without the hassle of traditional video conferencing setups.

- Better accuracy: Transcribed notes ensure that no key point is missed.

- Improved collaboration: We can refer back to meeting summaries for clarity and progress tracking.

Successfully Introduced over the last few years

Cash Calc Secure Client Portal for data gathering, expense tracking, document sharing and even secure messaging: https://the-spectrum-ifa-group-1002.cashcalc.co.uk/register?ref=MTIzMTU=

Calendly booking system for easy call and meeting booking linked straight to my diary https://calendly.com/peterbrooke/30min

DocuSign and Adobe Sign – these allow me to send you paperwork to sign digitally and securely to save us all time and the requirement to print and post documents.

The future of finance is undeniably tech-enabled. By embracing AI and support tools like these, we plan to remain competitive, agile, and customer-focused.

Feel free to get in touch if you have any questions via the below channels, or the booking system – always drop me a quick message if you need a time slot outside of those available.

If you have missed any previous emails, click here to access the Archive.

For now, have a great day, speak soon…

‘Play it again ‘Uncle’ Sam’

By Peter Brooke

This article is published on: 4th February 2025

Looking forward to 2025

Another year and another wonderful Spectrum conference. More on that in a moment.

Last year, in Budapest, was my 20th conference with Spectrum after which I offered a fairly cautious outlook for the year to come. You can review my thoughts in The view from the Danube

I have now just returned from a superb four days in Casablanca, hence the name of this piece, which was our first ever conference outside of Europe. We had another great group of experts who shared their views on the key themes likely to shape 2025. From the future of US markets under Trump 2.0 to opportunities in bonds and the transformative power of AI; here’s a summary of the insights most relevant to your investments and financial goals. Overall I feel cautiously optimistic looking forward to 2025.

Market Highlights & Opportunities

US Exceptionalism: Can the Outperformance Continue?

Even with the slightly pessimistic outlook for 2024, the US stock market had an exceptional year, with the S&P500 delivering one of its strongest performances in history, though much of this was led by a small handful of stocks.

As we look to 2025, several factors suggest US markets could remain a standout:

-

Momentum: The US economy grew by 3.2% in 2023 and is forecasted to grow 2.8% in 2024, showing resilience despite high inflation and interest rates.

-

Earnings Growth: US companies are projected to achieve earnings growth of 13.8% in 2025—significantly higher than the 7.4% forecast for European companies.

-

Profitability: The US has long maintained a profitability edge over other developed economies, and Trump’s deregulation efforts could further enhance competitiveness.

-

Structural Advantages: Energy independence, favourable demographics, and leadership in technology (particularly AI) continue to position the US ahead of its global peers.

Trump 2.0: Pro-Growth Policies and Market Implications

With the Republican Party securing a clean sweep in the 2024 elections, President Trump is expected to have more freedom to implement his policies in his second term. Here’s what investors should consider:

- Focus on Stock Market Performance: Trump views stock market performance as a key indicator of his success, aligning his administration’s priorities with investor interests.

- Trade and Tariffs: ‘America first’ tariff policies aimed at encouraging manufacturing in the US could have a mixed impact—potentially limiting inflationary pressures but altering global supply chains.

- Tax Cuts and Deregulation: Further tax cuts and red tape reductions are likely. While tax policy changes may take time to impact the economy, they could provide immediate support to stock markets.

- Immigration: A crackdown on illegal immigration could weigh on certain sectors like agriculture, but a scaled-back approach may reduce the economic disruption.

- Geopolitical Stability: Trump’s administration is expected to focus on negotiations over conflict, which may support global market stability.While there are risks—such as high valuations in sectors like Artificial Intelligence (AI), the US markets remain supported by strong fundamentals, making increased exposure to this market a prudent strategy.

UK Bonds: A New Era of Opportunity

Bonds are regaining their appeal:

-

Attractive Yields: UK gilts are offering a 5.5% yield, equivalent to a real return of nearly 3%, presenting an appealing alternative to equities, especially in Europe.

-

Diverse Opportunities: Investors are also finding value in international bonds, including those from Portugal, Romania, and Germany.

-

Volatility Awareness: Bonds have become as volatile as equities, underscoring the need for a well-diversified portfolio.

AI: The Next Growth Engine

The AI revolution is driving innovation and creating new opportunities across industries. It is important to consider those companies who will be enabled by AI and who will earn from “enabling the enabled” as well as those companies supporting the infrastructure of AI.

Key investment areas include:

-

Data Ownership and Infrastructure: Companies like RELX (legal and medical data) and Equinix (data centres) are poised to benefit from the AI boom.

-

Efficiency Gains: Firms such as Rentokil and Waste Management are leveraging AI to optimise operations and drive growth.

-

Cloud Infrastructure: AI can’t happen without the Cloud.

Navigating Risk in 2025

Understanding and managing risk is critical to achieving long-term financial success. I will be writing a newsletter in the coming months focussing solely on ‘risk,’ but for now here are key considerations:

-

Inflation remains sticky: The risk of doing nothing could erode your cash’s value over time.

-

Volatility: Short-term market fluctuations are normal but tend to even out over time, emphasising the importance of staying invested.

-

Longevity: For couples, there’s a 50% chance one partner will live to age 90—making a long-term income strategy essential.

-

Sequencing Risk: Timing withdrawals during retirement requires careful planning to avoid depleting your assets prematurely.

What This Means for Your Portfolio

With markets adapting to new norms, a balanced and diversified approach remains crucial:

-

US Market Focus: While US equities remain a core component, avoiding over-concentration in sectors like AI is vital. Just 7 companies make up 33% of the S&P 500 index and contributed 55% of all the returns of the S&P500 in 2024 – the largest concentration in history.

-

Employ Active Managers: Passive investors have had a great run, especially if invested in US equities but as we have already seen this month the AI Titans have sold off on one piece of news from China. Active managers will control these concentration risks.

-

Global Bonds: High yields make bonds an attractive addition to portfolios, particularly for those seeking income and stability.

-

Alternative Investments: Assets like gold can provide a hedge against geopolitical risks and inflation.

I would very much like to thank the investment management teams at RBC Brewin Dolphin, Rathbones Investment Management, Evelyn Partners, New Horizons, Alquity Investments, VAM Funds and Prudential International for their time and expert views for the content in this update.

Here are some links to other articles supporting this summary if you want to dive deeper into the details:

US Continues to Outperform https://www.evelyn.com/insights-and-events/insights/can-us-outperformance-continue/

A look back on 2024 https://www.evelyn.com/insights-and-events/insights/2024-investment-review-ifa/

Trump 2.0 https://www.lgtwm.com/uk-en/insights/market-views/trump-politics-the-global-order-250934

The excellent monthly Rathbones Sharpe End Podcast https://www.rathbonesam.com/uk/sharpe-end-podcast#podcasts

Nice-Cannes Marathon 2024

By Peter Brooke

This article is published on: 2nd November 2024

Run with Purpose: Peter Brooke and The Spectrum IFA Group Take on the Nice-Cannes Marathon 2024!

On November 3rd, Peter Brooke from The Spectrum IFA Group will proudly run with The Run for Hope Team in the Nice-Cannes Relay Marathon. For years, Peter and Spectrum have embraced this challenge, raising awareness and funds for a cause that deeply resonates with them.

The Run for Hope team, is a partnership between Mimosa and Cancer Support Group 06, brings together a community of runners from beginners to experts, inspiring teamwork and fun to raise funds for cancer support by running in the Nice-Cannes Relay Marathon. Participants enjoy comprehensive training, support and a festive after-party, all contributing to a great cause, the support of cancer patients on the French Riviera.

As experts in financial planning for English speaking expatriates living in Europe, The Spectrum IFA Group provides comprehensive and personalised financial advice, and planning. Peter, who has been with Spectrum for 20 years on the French Riviera understands the complex financial and tax issues his clients face and he and Spectrum are dedicated to helping you navigate these challenges.

By participating in the relay marathon, Peter and Spectrum demonstrate their commitment to the broader community on the Côte d’Azur. Supporting The Run for Hope Team allows them to blend their professional expertise with their passion for making a difference. Cheer on Peter and the whole Mimosa team as they run for hope, showcasing the same dedication they bring to managing your finances.

Together, we can achieve great things—both on the marathon route and in your financial journey!

The Spectrum IFA Group: Running for Hope, Running for You!

2024 Market Update

By Peter Brooke

This article is published on: 28th July 2024

Following my outlook in January I am writing with a quick update on the year so far and a look forward for the rest of the year and into 2025.

One important point I would like to make is that many global issues, especially Politics and the outcome of the many elections we have in 2024, might feel very important to us on a day-to-day basis but might have a very different impact on investment markets and so do please read the following through the lens of investing.

Global equities have been performing well, with US equities gaining 15% in the first half of 2024, led by companies like Nvidia, Microsoft, Alphabet, Amazon, Meta, and Apple, which contributed significantly to market progress.

The economic outlook indicates that the global economy is expected to grow by 2.6% in 2024, with improved growth prospects in the US and China due to factors like loose fiscal policy, immigration, and government stimulus programs.

Market ‘breadth’ has been a concern, with the above five technology stocks driving over half of the returns in the US market; as global growth continues this should lead to opportunities in other sectors like industrials that are connected to the Artificial Intelligence theme; very recently we are starting to see a broadening of market returns.

Market risks related to inflation and interest rates are expected to shift to a positive tailwind in the second half of the year, which should be good for both shares and bonds. Central banks, like the European Central Bank (ECB), are already cutting interest rates and others are likely to follow suit.

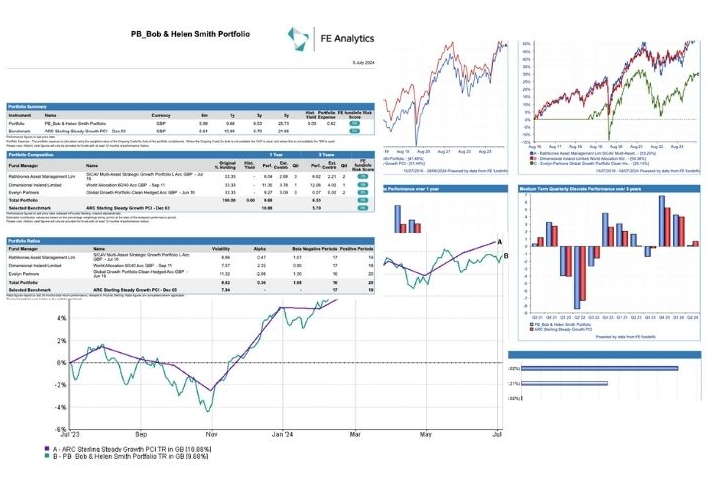

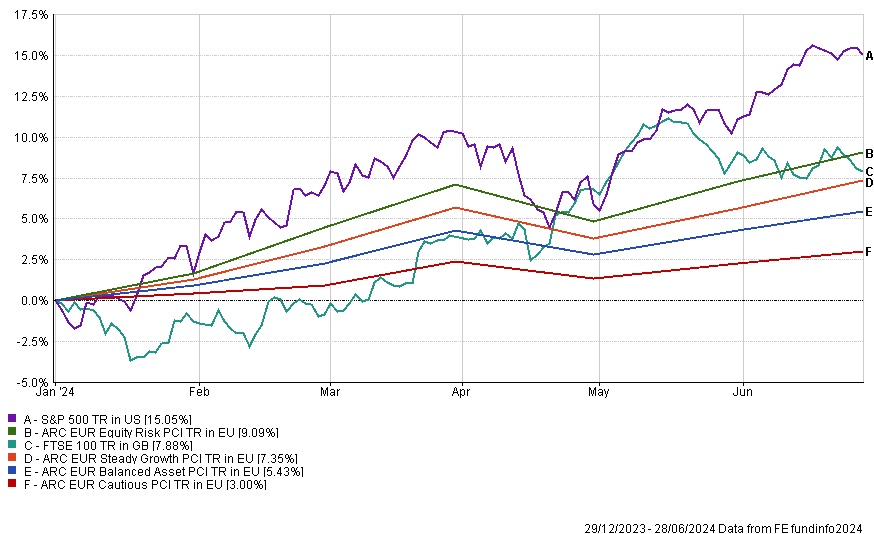

Here is a chart of four different Risk Benchmarks and the main UK and US Stock markets so far in 2024; steady, but the US continues to serge ahead… for now.

Inflation

Inflation hasn’t yet returned to pre-covid levels and is unlikely to drop back this much any time soon. Goods, energy and food inflation have all fallen but services inflation is still high, though this has started to fall slightly in recent weeks. ‘Services’ includes ‘shelter’ e.g. rent and other services such as hospitality.

Interest rate cut forecasts from the ‘experts’ have see-sawed so far this year but the current consensus view is that the first US interest rate cut should now be expected in September. The ECB has already started cutting rates, very slowly, and UK rate cuts might be pushed out into 2025 as services inflation in the UK remains ‘stickier’ than elsewhere.

Elections

Elections do pose sporadic risks to markets, though normally election results don’t truly matter in the longer term; but with the huge volume of elections this year and the swings from left to right (and back again) the volatility caused by the outcomes of elections will probably have much greater short-term impacts than normal.

US – The upcoming election is a key risk, with potential market volatility depending on the election result, especially following the attempted assassination of Donald Trump and the withdrawal of Joe Biden.

If Kamala Harris is selected as the Democratic candidate then Democratic party policies are likely to remain unchanged and so volatility in markets could be short lived, but if they enter the time consuming process of selecting a different candidate (increasingly improbable at the time of writing) then the inevitable political uncertainty could drive US share and bond volatility for longer.

According to the polls and bookmakers the Republicans are now more likely to win, but what might that mean for investors? Potential tax cuts, more deregulation, more protectionism and more oil drilling could be good for US corporate profits and might help bring down inflation. This might not be great for the planet and society but could be good for business.

In addition tariffs on goods entering US from China (and the rest of the world) could add to the short term inflation problem.

Europe – there has been a backlash against various EU led initiatives, like climate change policy and immigration leading to a swing towards the right in many countries.

France – President Macron called a snap election as the Far Right were gaining traction in EU elections; several left wing, centrist and right wing alliances formed as tactical voting led to a deadlock. The major coalition is now on the left of the house which is probably negative for French investment returns but any law changes are very unlikely for at least 12 months when another round of elections is expected.

UK – the new Labour majority government was not a big surprise with ‘time for change’ as a leading driver; but will they be able to do what they said they would do? So far they remain quite centrist and don’t appear to be planning on drifting back to the ‘old labour’ way. They are likely to be more fiscally responsible and will target growth BUT can they actually do it as the challenges are significant and the budget is tight – for example the demands on the NHS and the hot potato of immigration.

There might, however, be a big shift with the relationship with Europe, which must be positive for both sides, especially with respect to defence, cybersecurity and trade and even more so if the US becomes more self protectionist under Trump.

Currency

Here are some thoughts from our friends at Moneycorp:

As many predicted the Labour Party secured a strong majority, and the FX markets remained relatively stable. We’ve seen GBP strength, with GBP/USD rising by 1.7% and GBP/EUR up by 0.8%.

The French election results, however, were unexpected. We had anticipated significant market movements, but the outcome has been a 3-way hung parliament, with all other parties joining forces to prevent the far-right Rassemblement National (RN) from gaining power. This situation suggests potential political turmoil in France for at least the next 12 months until another election can be called. This is not a favourable outcome for President Macron or Europe as a whole. Despite this, the FX markets have remained stable, as the EUR had already weakened prior to the election.

Inflation data and interest rates continue to be the primary drivers of the FX markets.

Here is a Forecast Snapshot of where the banks think FX markets will be at the end of Q3 (30th September).

GBP/USD

Current 1.2840

Barclays 1.28

UniCredit 1.26

Wells Fargo 1.26

BNP Paribas 1.27

GBP/EUR

Current 1.1860

Barclays 1.22

UniCredit 1.16

Wells Fargo 1.19

BNP Paribas 1.20

EUR/USD

Current 1.0825

Barclays 1.05

UniCredit 1.08

Wells Fargo 1.06

BNP Paribas 1.05

I am, once again, very grateful to the teams at Evelyn Partners, Rathbones, New Horrizons and Moneycorp for their help in putting this summary together and hope it is useful in framing where we are today and how we got here.

Here are some further links to supporting views on the above:

https://www.evelyn.com/insights-and-events/insights/investment-outlook-july-2024/

https://www.rathbonesam.com/knowledge-and-insight/review-week-biden-bows-out

https://www.rathbonesam.com/blog/guess-whos-back

If you listen to podcasts I can highly recommend the Sharp End Podcast from David Coombs at Rathbones Asset Management

Talk to me

As always, please remember that financial decisions should be made with careful consideration of individual circumstances and professional advice, I am here to support you.

If you have missed any previous news and updates these can all be found on the archive page here.

I am away on holidays until 5th August but if you have any questions or need further assistance, please feel free to reach out via the below channels, or the booking system – always drop me a quick message if you need a time slot outside of those available.

For now, have a great day, and a wonderful summer

Best regards

Peter Brooke

The Financial Review Process

By Peter Brooke

This article is published on: 9th July 2024

… why, what and how …

Whether you are an existing client of mine or not, and following on from my previous article on ‘The Value of Seeking Financial Advice’, I wanted to take this opportunity to go through the steps in our ‘Client Financial Review Process’.

WHY?

Firstly, and most importantly, it’s crucial to regularly check in on your financial journey, ensuring that we’re on track to meet your goals.

Secondly, we have a regulatory obligation to conduct a review at least once per year for all of our clients, whether this is in person or remotely.

Thirdly, we have a relationship which is built on trust and my understanding of, often, very personal details, so a regular catch up is a great way to nurture this relationship and ensure important issues are raised and discussed; and its a good excuse for a cup of tea and a biscuit [even if via Zoom].

WHAT?

A review won’t just be looking at what has happened over the last year but is designed to identify potential financial planning adjustments we might want to make if your circumstances are changing.

The review should, and will, include the following:

- An update of your situation – incomes, bank balances, asset values, expenditures.

- Changes to your situation – retirement, moving house, changing jobs, school fees etc.

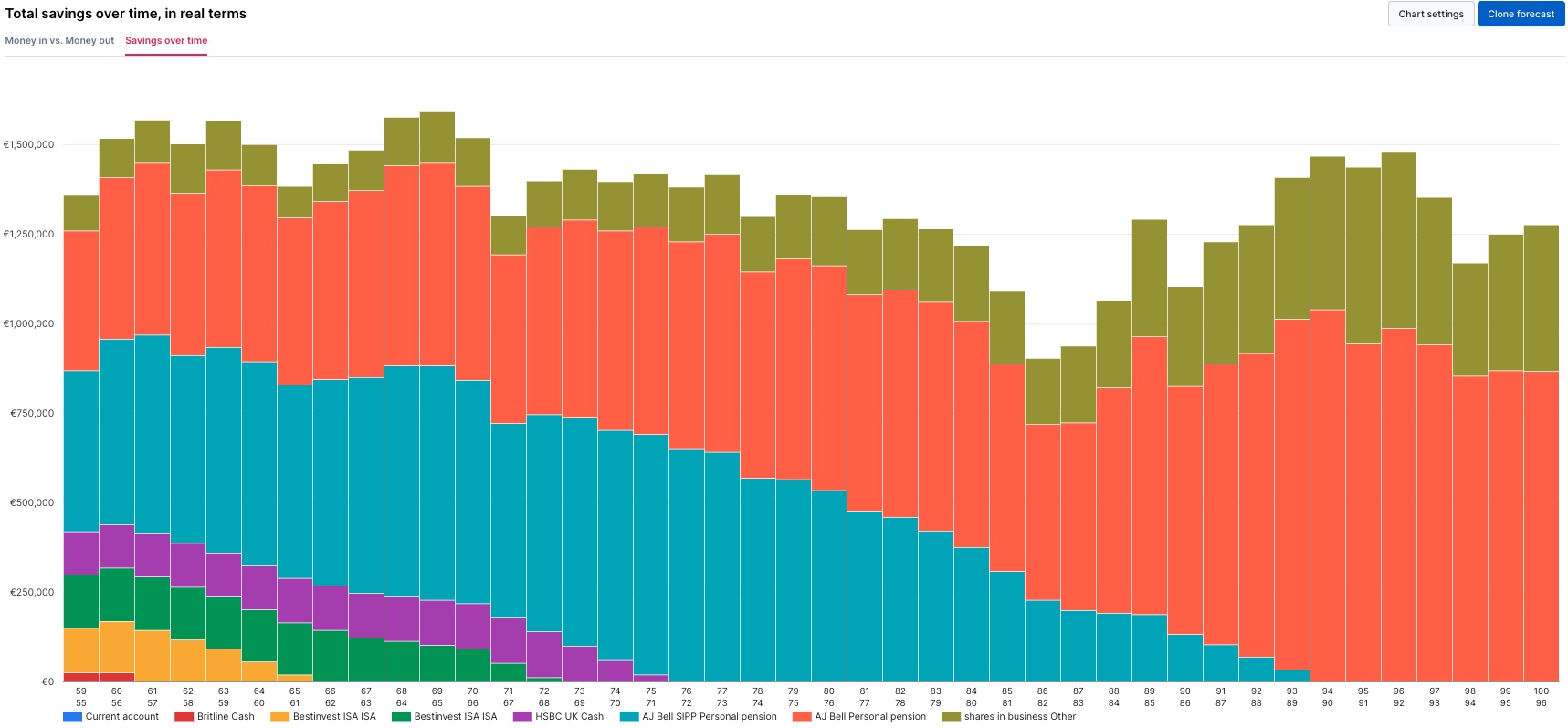

- Cash Flow planning update – are we still on target to meet your goals? … “am i going to be ok, and if not what do I need to do to make sure I am?”

- Investment Portfolio performance update – has it out-performed or under-performed the risk ‘benchmark’ we have allocated? If so, why? Are any changes needed?

HOW?

Many of my clients have been through this review process over the years but I have made a few tweaks and so I wanted to take you through the steps.

The biggest change for us is that I will be asking many of my clients to update their situation directly onto the Secure Cash Calc Portal prior to our review, so I have the most up to date information in advance. This will give me a chance to review your situation before our meeting to ensure we get the most from our time together.

Of course it is not obligatory to use the portal as it is not appropriate for everyone, but if you would like to then do let me know.

The following summary explains each step.

Options for you…

The above summary is focused on the normal Face to Face or Zoom meeting review process, but I can also provide your review as an email or I can even record a video presentation of my update on your portfolio and cash flow plan which you are then free to watch at your leisure; then we can discuss any steps necessary and update any administrative requirements afterwards.

Please do let me know if you prefer to have an email or video review?

As you can see, it’s a collaborative process and financial reviews are a great way to check-in on how things are going and where adjustments need to be made, so if your situation changes, please don’t wait for the next review, get in touch and we can review early.

If you have any questions please use the the below channels, or the booking system – always drop me a quick message if you need a time slot outside of those available.

If you have missed any previous emails, click here to access the Archive.

For now, have a great day,

Buying your dream home in France – webinar

By Peter Brooke

This article is published on: 20th June 2024

WATCH THE WEBINAR HERE

I have worked with many of the panelists for a number of years and their knowledge and experience is valuable to me and my clients; so if you are looking at buying and/or relocating to France then please join us for this live webinar.

Our experienced panelists are here to discuss all nature of topics to do with buying and relocating to France:

Karen Tait – Webinar host

Peter Brooke – Wealth & tax planning from The Spectrum IF Group

Joanna Leggett – French Property Expert from Leggett

Jonathan Watson – Currency Expert from Lumon

Paulette Booth – Banking and insurance expert from AXA

Tracy Leonetti – Visa & paperwork expert from LBS

Sharon Revol – Mortgage expert from Cafpi

The Value of Seeking Financial Advice

By Peter Brooke

This article is published on: 26th March 2024

My name is Peter, and I am a financial adviser!

There, I have said it, and I can own it!

The personal financial advice industry has often been regarded as a home for insurance salesmen in shiny suits or as an out-of-reach luxury for the very wealthy. It hasn’t helped with various mis-selling scandals over the years and high levels of hidden fees, but after 25 years in this industry I wanted to make the case as to why we are not all the same and show what true value can be taken from seeking professional advice.

Fortunately, our industry has changed a lot over those 25 years and transparency, communication and ‘putting the client first’ have now become the values most of us live and work by.

As a little background, I wanted to be a Vet or a Doctor when I was at school, I loved science and maths but didn’t truly focus enough on my A-Levels and was found wanting when it came to getting into Medical School. I ended up studying Molecular Genetics at Sussex University but discovered that I also didn’t want a life in a lab. As a ‘frustrated Doctor’ I ended up in Pharmaceutical Sales… great fun as a young man straight out of Uni but it became a very demoralising job and one which I discovered was really all about making money, not helping people.

I was encouraged by a family friend to look at stockbroking or financial planning as a change of track and started work in 1999 (dot com!!) at an investment advisory business in London. We introduced the UK’s first ‘advisory-discount’ services where we would provide personalised investment recommendations at discounted fees.

Ironically, it took moving to an industry that concentrates solely on money to realise that I could actually help people achieve wellbeing and peace of mind through my abilities to discuss and explain complex issues.

In 2004 I moved to France and started working with The Spectrum IFA Group, helping English speaking expatriates to create and realise their plans for living in France, I have been here ever since. I especially wanted to join a fully regulated company which gave me the independence of my own business and together we have grown to where we are today – 50 advisers operating across Europe, in France, Spain, Portugal, Italy, Luxembourg, Malta and Switzerland.

What should we, as financial advisers, aim to provide to our clients?

I believe our true value lies in helping our clients answer two main questions:

1. Am I going to be ok, financially, and if not, what do I need to do to make sure I am?

2. What have you, as my adviser, done for me?

The first question is the core of a good adviser’s skill set and business strategy – it is all about helping identify and plan for different stages of life. Correctly laying out a ‘roadmap’ for the future and asking the difficult questions; this can truly provide the peace of mind that you, as my client, are on target, and if not what do we need to change or compromise on to ensure you get there.

This roadmap then needs ongoing reviews, especially as life throws various obstacles at us along the way.

The second question is the ‘HOW’ of the first question. Historically we have valued good advice, and what we pay for it, as a percentage measurement of investment performance, which the adviser actually has minimal control over.

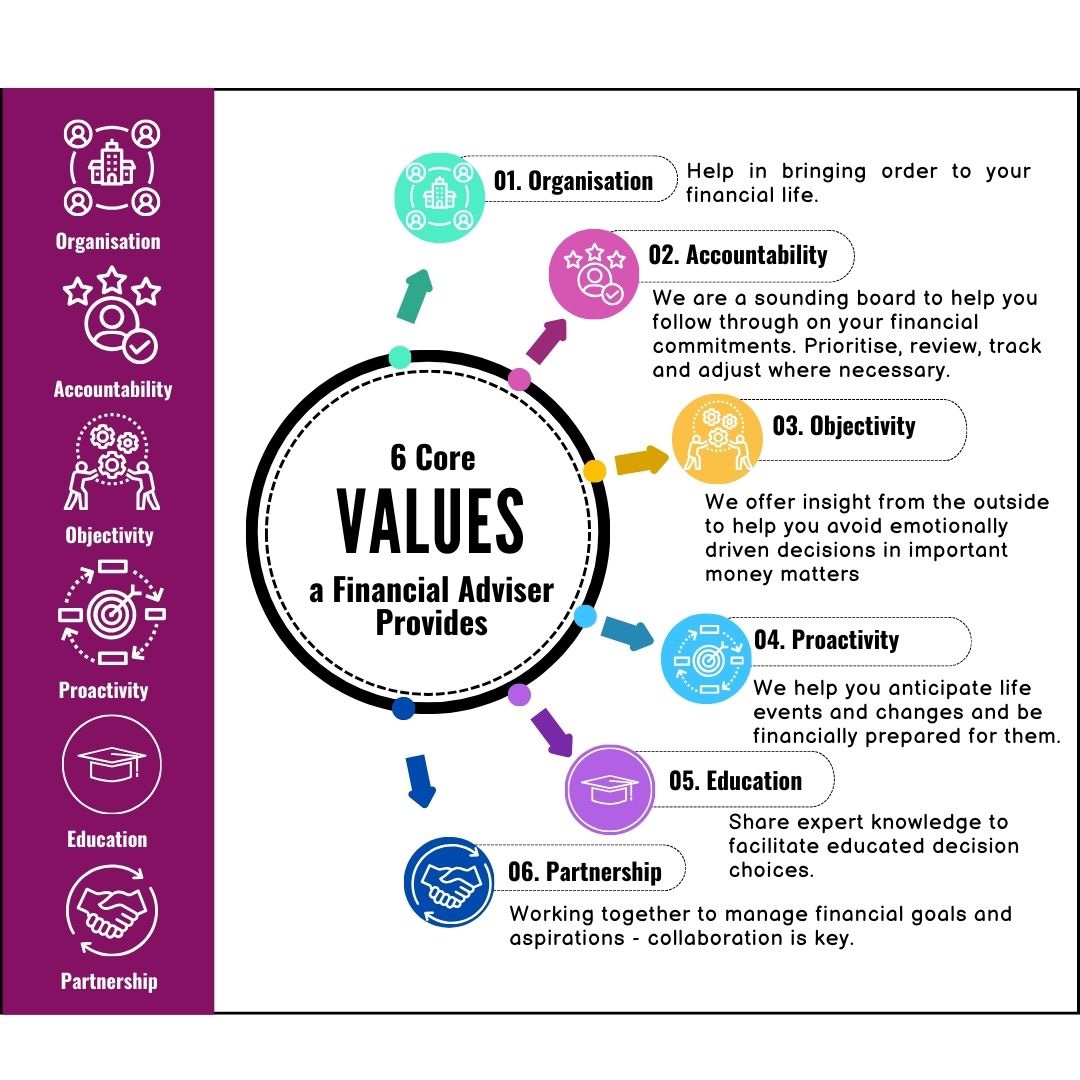

I believe it is more nuanced than this and can be broken down to six key areas in which we can (and should) add value and help answer that first very important question:

We help to bring order to your financial life by assisting setting budgets and cash flow targets as well as overseeing and reviewing investments, insurance, estate plans, taxes, etc.

We are a sounding board to help you follow through on your financial commitments, by identifying and prioritising goals, and then explaining, in plain english, the steps to take, and then regularly reviewing your progress towards them.

We offer insight from the outside to help you avoid emotionally driven decisions in important money matters; we are available to consult with you at key moments of decision-making, providing the necessary research to ensure you have all the information to make the best choices.

We help you anticipate life events and changes and be financially and emotionally prepared for them. We can help in creating, ahead of time, the action plan necessary to address and manage any life transitions that inevitably appear.

We explore what specific knowledge will be needed to succeed in your plans by understanding your situation and then providing the necessary resources to facilitate your decisions, and explaining the options and risks associated with each choice in a clear and simple manner.

We aim to help you achieve the best life possible but will work with you, not just for you, to make this possible. We will take the time to clearly understand your background, philosophy, needs and aspirations and will work collaboratively with you and on your behalf (with your permission, of course).

Upfront about what it costs

For me, helping people is at the centre of my personal values – being paid to do this is a welcome bonus and I have long believed that our jobs find us, not the other way round. I have always been a bit of a ‘planner’ and see ‘the big picture’ in most situations – helping people see that ‘they are going to be ok’, or explaining ‘what they need to do to get there’ is a truly pleasurable challenge for me.

Price is what you pay, Value’s what you get

I firmly believe my clients get value for money. In Europe we are not regulated to handle client money so will never send you a bill for you to pay us directly.

Spectrum is remunerated by the insurance or investment company which provide the final financial solution to you and with whom you have a direct relationship, with us ‘appointed’ as your adviser.

I believe in transparency of all costs and charges so you know exactly what you are paying and to whom. Our charges are competitive, we only use clean share classes of funds so there are no hidden or double fees.

Making the time – ‘How can I help?’

I live and work in a community of English speaking expatiates where referrals and recommendations count for a great deal. I always feel very proud and grateful when an existing client refers me to another family member or friend who might be able to benefit from the services that I offer. So thank you for trusting me with them and I look forward to helping more in the future.

Snapshot of our services

- Financial Planning & Budgeting

- Family protection

- Cash Flow Planning

- Investment Management Advice/Guidance

- Tax optimisation through tax efficient products

- Estate & Inheritance planning

- Risk Management, diversification & asset allocation

- Retirement planning

- Education cost planning

- Long term care planning

- Pension advice including transfer and consolidation

If you know someone who might need our services, feel free to get in touch and forward them this email – the link above can be used to book a 30 minute call with me directly. If I can’t help then I may be able to direct them to someone who can.

If you have any questions or would like a catch up then please use any of the below communication channels or the booking system – always drop me a quick message if you need a time slot outside of those available.

For existing clients the CashCalc secure portal is a great place to update any information, send me documents or even a direct secure message.

If you have missed any previous emails, click here to access the Archive.