Financial Markets so far in 2023

So, with this backdrop and a difficult year behind us how have things fared so far in 2023?

Firstly, the gloomy scenario envisaged by many economists at the start of the year has not come to pass. The much-anticipated US recession has been deferred, while financial markets have remained resilient.

The IMF is now predicting a rise in global growth for 2023 though much of this growth won’t becoming from developed economies while emerging markets economies are expected to expand led by China and India.

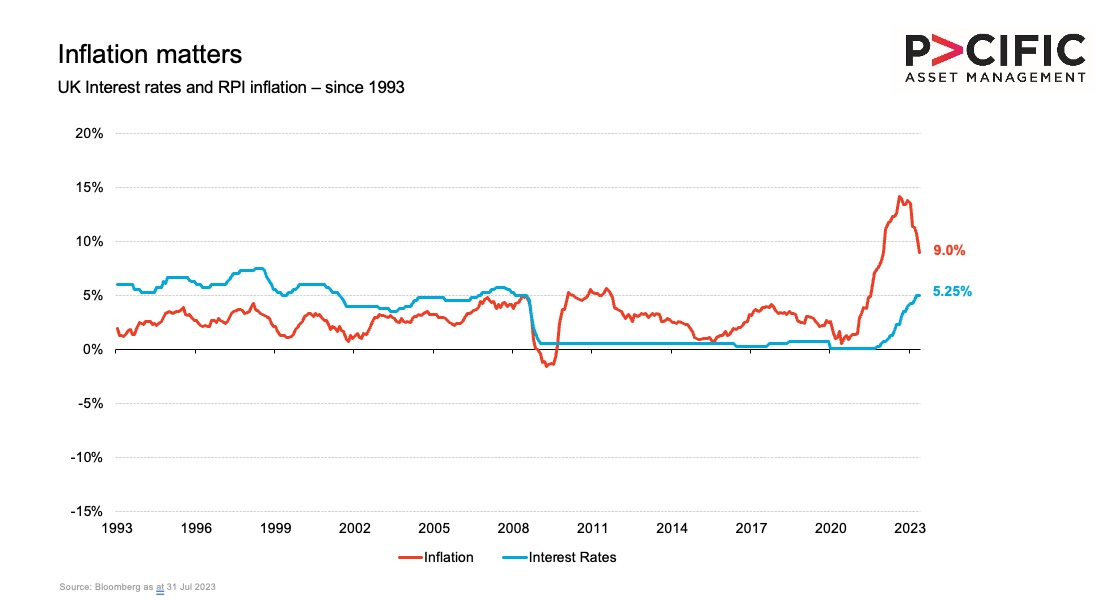

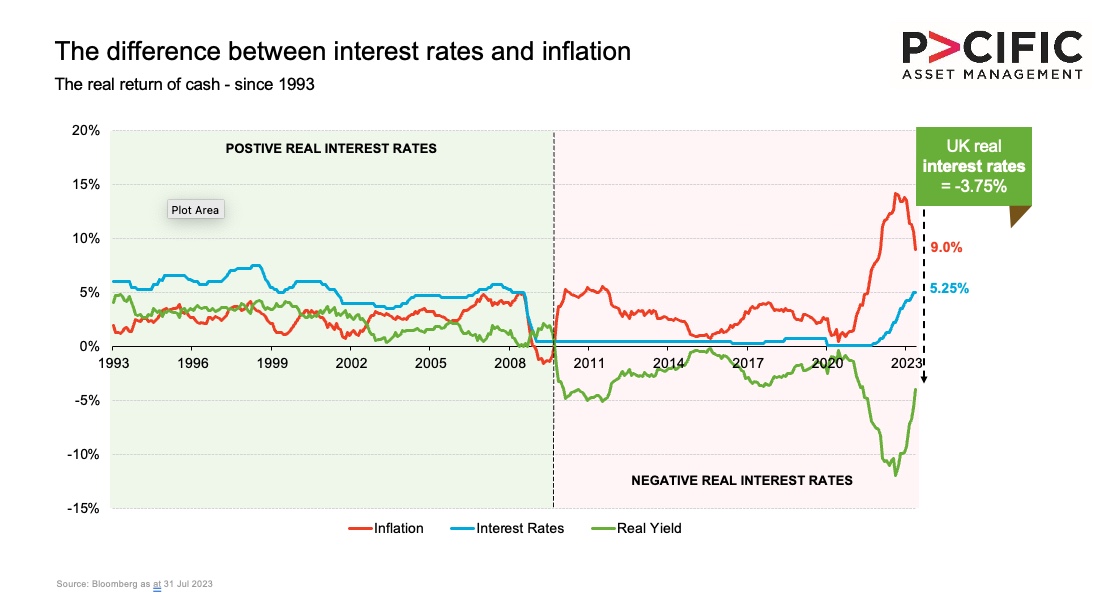

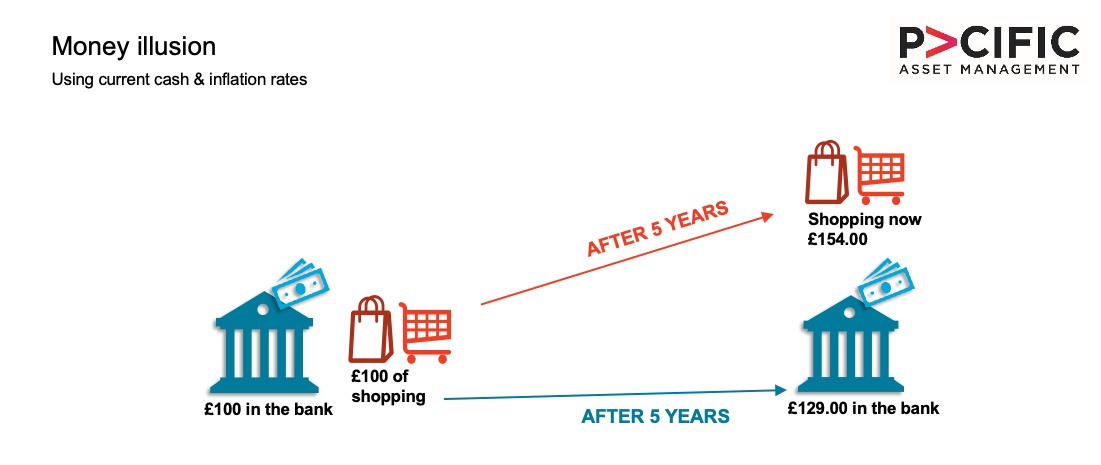

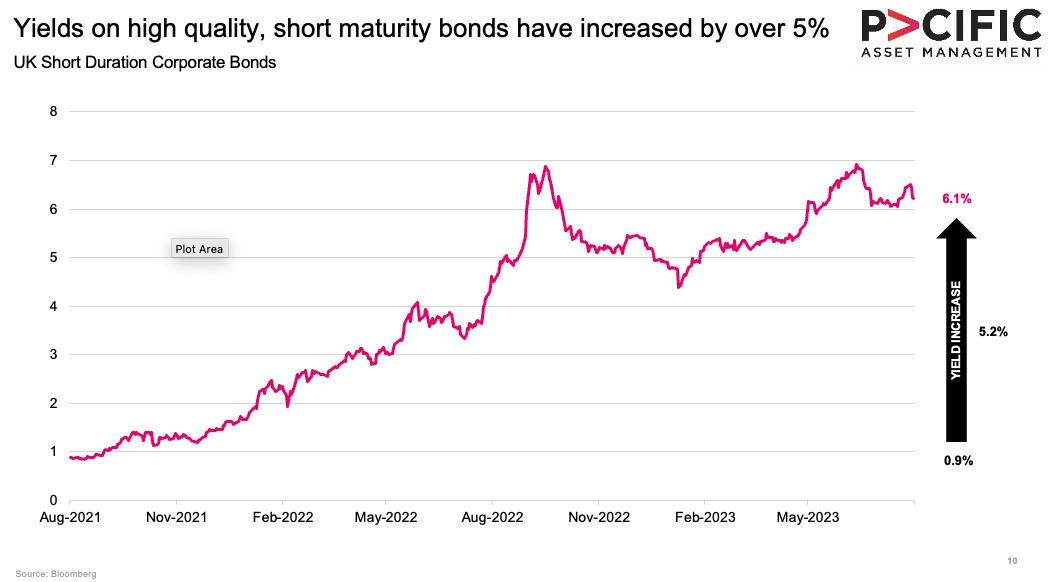

Inflation has come down but has proved far stickier than many expected, with labour markets remaining healthy across most major economies. This has forced central bankers to continue raising interest rates. While the US Federal Reserve appears to have paused with central bank rates of 5.25%, the UK and eurozone central banks are still raising rates and have indicated further rises may lie ahead.

Financial markets have been resilient. The disruption created by the collapse of several banks proved short-lived, with swift action from policymakers and regulators preventing wider problems.

The US stock market has seen a surprising surge from the technology sector. After a grim year in 2022, against expectations, they roared back in 2023. The galvanising force has been generative artificial intelligence, with excitement around Chat GPT creating interest in semiconductor companies such as Nvidia as businesses look to invest in this new technology.

The US economy continues to deliver mixed messages. A buoyant labour market has continued to reduce expectations of a deep recession.The Fed has remained resolute on interest rates, although it paused rate rises in June, it has made it clear that it is willing to raise them again should inflation continue to rise.

Recession appeared an inevitability for the UK economy at the start of the year. As it is, it has not materialised, with falling energy prices, government support and a resilient consumer all acting to shore up growth. Inflation has remained stubbornly high and so the Bank of England has been forced to keep raising interest rates, which are now expected to peak at around 6%.

The UK stock market had a weak start to the year as commodity prices fell and the banking sector was hit by the failures of Credit Suisse in Europe and Silicon Valley Bank in the US. The resurgence of US technology stocks also impacted the UK market as investors swapped from “value” back to “growth” companies.

It was a stronger period for stock markets in Europe as company earnings improved and outstripped the US early in the year. A mild winter and prompt action by governments across the region saw an energy crisis averted. The region was also lifted by the resurgence of China, which is an important export market, particularly for Germany and Spain.

The European Central Bank raised interest rates to 3.5% in June, their highest level in 22 years. Eurozone Consumer price inflation declined steadily from over 10% in October 2022.

The outlook for Asia has been dominated by China. The country’s reopening in October 2022 led hopes of galvanising global economic growth at the start of the year. However, the initial stock market rally petered out as growth has not bounced as many had hoped. Confidence has not yet returned to pre-pandemic levels.

Asian markets have continued to lag their global counterparts as expectations of a swift return to economic growth in China have receded. Nevertheless, there remain plenty of reasons to be optimistic as Chinese stimulus for infrastructure projects is beginning to feed through to the economy.

Japan has been rediscovered by investors in 2023, with veteran investor Warren Buffet making a high-profile investment in the country’s stock markets. The Japanese economy is also starting to improve as reopening gathers pace and wage growth drives consumer spending. As a net importer, it is also benefiting from lower oil prices, which is helping to improve the Government’s fiscal position.

Bonds

The yield (interest paid) on US ten-year government bonds dipped in April, but moved back up as investors started to anticipate more rate rises ahead. Short-dated bonds now have higher yields than longer-dated bonds. This situation is known as an inverted yield curve and means investors expect rates to be cut over the longer term.

This “inversion” is currently common place, with 37 countries now trading with inverted yield curves, including the UK,Germany, France and Canada.