The new year is a great time for setting goals and making resolutions. I read that, according to a recent survey, saving money was the most popular resolution (after losing weight)!

Financial Update France January 2024

By Katriona Murray-Platon

This article is published on: 8th January 2024

Saving money is a very important habit to have throughout your life. The great thing is that it is never too late or early to start saving and you don’t need to put aside a lot. Just like it is not a good idea to do fad diets but more to make manageable improvements to your lifestyle, it is better not to make too ambitious savings plans but to put aside small regular amounts that build up over time.

The French standard savings accounts are currently earning 3% which will remain as such until the beginning of 2025. You are allowed to put €22,950 of capital into a Livret A and €12,000 into a LDDS. Once you have reached these limits you cannot put any more into it but the interest compounded over the years can be added to these amounts. The LEP is the highest remunerated savings account, currently at 6%, however if you are eligible for this account you should take advantage of this rate as soon as you can as it may drop to 4.2% on 1st February. If you are eligible you can have 2 LEP accounts per household and can put up to €10,000 of capital into it. To be eligible one person alone must not have earned more than €21,393 in 2022 as declared in 2023. Your bank will not automatically suggest that you open this account so it is for you to check whether you are eligible and request to open a LEP. There are other savings accounts and term accounts that the banks may offer but the rates on these are around 3% and unlike the above mentioned accounts, they will be subject to tax and social charges.

Whilst we don’t know how the market will react to various events and political developments in 2024, fixed income assets could continue to provide good earnings this year. Our investment providers have seen good steady returns in 2023 in their more cautious funds. Whilst savings and fixed interest assets are good to have, it is also important to have some equity based investments. According to a Credit Suisse study published in February 2023, the actual annualised return (after inflation) on the savings accounts in France was -0.8% per year between 1923 and 2022, compared with +6.1% from shares.

On the 15th January, if you have had home help expenses (cleaner, gardener etc) you will get 60% of this tax credit paid to you. The remainder will be taken off your taxes in September.

I will be attending our annual conference in Budapest from 22nd to 26th of January and will have lots of information to pass onto you when I hear the presentations from our product providers. Also coming in my February Ezine will be the news from the adopted French Finance law for 2024.

It is never too late or too early to financial planning so do get in touch and recommend your friends to get in touch with me for a free financial consultation.

Happy New Year 2054

By Richard McCreery

This article is published on: 4th January 2024

A tongue in cheek look at the world

three decades from now

The year is 2054. The Trump family presidency is about to enter its fourth decade of ruling power, with Ivanka in charge ever since her father abolished the 22nd amendment of the US constitution that limits anyone to two terms.

Today, the government has a 99% approval rating, according to the state-sponsored broadcaster Fox News, and the Trump family continue to win each election in a landslide, having introduced new rules to make the voting system fair and honest following the collapse of the Biden regime.

However, America is not the technological superpower it once was, having stubbornly doubled down on the use of oil, coal and gas whilst the rest of the modern world switched to clean, abundant renewable energy and electric cars. The technology-hating president Donald Trump eventually decided that the Big Tech billionaires such as Bezos, Zuckerberg and Musk were getting too big for their boots and nationalised their companies, declaring that it was his duty to the people to use his talent for business to run them himself. This move ushered in a new kind of capitalism as their huge profits were directed to fund the collapsing social security system, the construction of border walls sealing off America from Canada and Mexico, and enabling the Trump White House to install gold-plated toilets in every room, making it the envy of African dictators and footballers wives.

The US national debt has climbed to $340 trillion, a tenfold increase since The Donald regained power in 2024, but the Fed has kept interest rates at zero for most of the past three decades. The US Treasury has been able to fund the debt by creating a series of $1 trillion digital coins and by selling NFT trading cards. As a result, the ‘Trump’, the new name for the US Dollar, is one of the weakest currencies in the world – you currently get 250 Trumps to the Euro. The Trump administration has managed to stave off financial collapse by regularly threatening to ‘renegotiate’ America’s sovereign debt with its creditors, a scenario that everyone wants to avoid.

Whilst America has begun to resemble a strange version of Cuba or North Korea, Europe has enjoyed a surprising renaissance, thanks to its early adoption of artificial intelligence as a key element of government. For once, the hype turned out to be real (albeit 15 years after the first AI stock market bubble had popped) and AI advanced rapidly as it was entrusted to take over from politicians. A new law in 2035 stating that anyone who expressed a desire to go into politics would immediately be banned from going into politics meant that a new way to govern had to be found. By harnessing AI for the common good, rather than allowing it to be controlled by a few large companies or rich individuals, Europe has been able to rebuild its infrastructure, increase the leisure time of its working population with the introduction of the 3-day week and overtake the US and Asia in the development of new virtual reality worlds where most retired people now spend their final years – it has become possible to see the world, live out your dreams and fulfil your fantasies, all without leaving the comfort of your armchair.

Norway has become the most admired nation in the world, an example of good resource management and social equality. It’s oil fields were eventually depleted but, unlike other oil-rich nations like Saudi Arabia and Russia, Norway had invested its wealth for future generations into thousands of companies around the world. As the only country to have virtually no debt, Norway’s Krone has since taken the place of the US Dollar as the world’s reserve currency.

The Krone has gold-like limited supply, is backed by real wealth and an economy powered by an abundance of clean thermal and hydro electricity. In 2031, Norway became the first country in the world to have an all-electric transport system, having waved goodbye to petrol engines long before anyone else. It’s cooler climate has also made it one of the world’s most popular holiday destinations now that parts of the Mediterranean region have become too hot to support life outdoors during the summer months.

Technological advances in the early 2040’s mean that global poverty, water shortages and hunger around the world may soon become a thing of the past. The spread of AI-powered nanobots throughout industry and agriculture has increased productivity by thousands of degrees of efficiency. No longer is output restricted by physical human strength, labour laws, poor education, the need for holidays or sick leave. Tiny machines that are able to reproduce as the work requires are now populating factories and fields in vast numbers, freeing humans from the slavery of the daily struggle to feed themselves or earn a living. This new workforce has massively increased our efficiency when using finite natural resources, it has created a recycling movement that ensures nothing is wasted and has generated an abundance of goods and services.

Education is now available to anyone who is connected to the world wide web, which these days is everyone. Society’s best teachers no longer stand in a lecture hall in Cambridge or Harvard, educating only a few privileged students. Today, they are treated like rock stars as they broadcast their lessons around the world to millions of people at a time, giving students everywhere the chance to be taught by the best in their field. However, despite a leap in global education levels, AI has not been able to come up with a way to genetically eliminate stupidity, even if it is now recognised as a medical condition for insurance purposes.

Instead, advanced neuroscience technology, first brought to the mass market by Elon Musk, allows a person to switch between their original brain and a Tesla artificial brain that is installed alongside. The new technology is prone to make mistakes and somewhat fails to live up to the hype but it is very popular thanks to its ability to allow the user to function in ‘self driving’ mode and switch off their real brain.

War has largely been eliminated in 2054. The spread of the internet to every part of the globe helped people of all nations and religions to bond and empathise with each other. For the first time in history, people were able to see and really understand how other people lived. They might not all agree with each other but the urge to kill has been reduced dramatically (except in America) and the need to occupy more territory has been negated by expansion into new digital universes and, soon, into space. The end of corruption in politics also meant that the world’s largest arms companies suddenly found themselves facing a demand shortage as government budgets were directed elsewhere, so they naturally directed their skills towards space exploration.

War isn’t the only thing that has been eliminated – so has smoking, alcohol, red meat, close human contact (unless you have a license), telling off children, boxing, speeding, fast food and swearing. The proliferation of cameras everywhere ensures the population remains polite and well behaved, much like Japan. Only the Clarksonites remain in defiance, an underground movement dedicated to preserving what they describe as the lost arts of fun, debauchery and common sense.

However, despite the relative sanitisation of humanity, in the year 2054 the future is looking bright. The stock market is up, house prices are up and most people around the world have food on the table and more tv programmes than they can ever watch. The depression years of the late 2020s, a hangover from the locked-down COVID era, have given way to a time of greater optimism, more peaceful co-existence and rising prosperity. Climate change has been arrested thanks to clean-tech, space travel is opening up new frontiers in human exploration and the virtual reality worlds are enabling new lives in the digital universe. It may not be perfect, but it is a lot better than anything the science fiction writers of the late 20th century were predicting.

Financial update France December 2023

By Katriona Murray-Platon

This article is published on: 6th December 2023

Here we are already at the end of the year. 2023 has been a year of highs and lows, not for me personally or professionally, but in the markets. If you look at any of the main markets or indexes you can see that 2023 has been a challenging year for investors. Of course there are still several weeks left in December so it is too early to say how the year will end.

At the end of November the UK chancellor presented the autumn statement. Whilst much of this does not affect those of us in France, Mr Hunt did confirm that the triple lock would be maintained and the pension payment would increase by 8.5% in April 2024. If you are entitled to the new State pension you will get £221.20 a week from April. Those pensioners who qualified for their pensions before April 2016 will also see an increase from £156.20 currently to £169.50 per week. Unlike in the UK the tax bands in France have been increased for 2024 so this means that, subject to the exchange rate, pensioners in France will get more income but pay less taxes next year.

The Bank of England decided in November that it would not increase interest rates and would maintain it at 5.25%. Whilst this is unlikely to change in the medium term, with inflation falling to 4.7% in October, it has been no surprise to me to read in the UK press that many banks are dropping the high interest rate accounts that have been on offer over this past year.

Please remember that most companies and business owners have to pay CFE by 15th December. As the CFE is a local tax and the other local taxes like the taxe d’habiation and taxe foncière increased this year, it should come as no surprise if you find that your CFE has also increased.

As we head towards the end of the year there may still be some things you might want to consider doing to alleviate your tax burden next year. Tis the season for giving so if you haven’t already been making charitable donations monthly during the year or you want to make one off donations at this time of the year, you can deduct between 66% to 75% of the amount donated, depending on the status of the chosen charity, and up to 20% of your annual taxable income. Also, if you have a PER and are in a position to make a contribution to it before the end of the year, this is also deductible from your taxable income.

There was good news for those invested in the Pru as, at the quarterly review of the Expected Growth Rates on 27th November, there was no changes to the EGRs and no Unit Price Adjustments. This was welcome news since there had been three consecutive downward Unit Price Adjustments in the PruFund Growth Sterling fund in previous quarters.

Looking forward, I always like to remain positive and hopeful however I have learnt that it is also important to manage expectations. One of our product provides reminded me that there will be many countries heading to the polls in 2024 and that this is likely to cause turbulence and volatility in the markets.

The OECD predicts that “In the absence of further large shocks to food and energy prices, projected headline inflation is expected to return to levels consistent with central bank targets in most major economies by the end of 2025.” It further stated that whilst “Global growth is projected to be 2.9% in 2023, and weaken to 2.7% in 2024. As inflation abates further and real incomes strengthen, the world economy is projected to grow by 3% in 2025”. Of course, whilst these are based on careful analysis and good information, they are just predictions and as we have seen things often turn out better than most analysts ever predicted.

No matter what happens my job is to be there for my clients, to advise them on their investments and provide them with the proper information to help them make the right financial decisions so please do get in touch if you would like to arrange a phone call, video call or face to face meeting.

I shall be celebrating Christmas here in France and then New Years in the UK. There are still plenty of dates available for meetings before the end of the year but if I don’t speak to you before then I wish you all a very happy holiday season and all the best for the new year!

Financial update France

By Katriona Murray-Platon

This article is published on: 7th November 2023

November is here, the temperatures have dropped and it is cold and rainy outside. So here is some good financial news to warm you up!

Since the 1st January 2023, Taxe d’habitation no longer applies to the main residence. Now it is only those with a second home who have to pay taxe d’habitation on their second property. The tax statements should be on your online account on the impots.gouv.fr website in November. You have until 15th December to pay this tax.

In France, one out of ten houses are considered to be second homes by the tax office. These properties are mainly to be found on the coast (40%) or in the mountains (16%) with the remainder being mainly in the larger towns and cities (12%). These properties are usually smaller than the main home with a quarter of them being less than 40 m².

Contrary to what some newspapers would have you believe, any taxes on second homes largely affect French owners and not foreigners, since only one out of ten second homes are owned by a person living outside France. Among those owned by French residents, two out of three properties are owned by people over 60. This figure increases to three out of four along the coast. 34% of properties are owned by higher income households. https://www.insee.fr/fr/statistiques/5416748.

Make sure that you check your Taxe Foncière statement that you received in October as there could be a mistake on it. According to the French tax office approximately 1.87 billion euros have been overpaid just in 2023 because of mistakes made by the tax office.

The draft finance law has been making its way through parliament. Article 2 of the draft finance law for 2024 has increased the tax brackets by 4.8%. The new proposed tax brackets are as follows:

| Income | Tax rate |

|---|---|

| Up to €11,294 | 0% |

| From €11,294 to €28,797 | 11% |

| From €28,797 to €82,341 | 30% |

| From €82,341 to €177,106 | 41% |

| Over €177,106 | 45% |

If you are in receipt of a French pension through Agirc-Arrco, the additional pension (complémentaire) will increase by 4.9% in November. It increased last November by 5.12%. The French State pension will also increase by 5.2% from 1st January 2024.

If you haven’t already looked into carrying out work on your house to improve your heating or energy efficiency, now may be the time as the amount of the bonus (MaPrimeRenov) has increased on average by €4300.

The maximum amount that you can put into a LEP savings account has increased since 1st October from €7700 to €10,000. The interest rate on this amount remains at 6%. To be eligible to have a LEP, your taxable income (revenue fiscal de reference) for 2022 as stated on your tax return received in Autumn 2023 must be less than €21,393 for a single person, or €32,818 for a couple.

The 30th November is the date by which you must inform your bank if your taxable income (revenu fiscal de reference) in 2021 was less than €25,000 as a single person or €50,000 as a couple, so that they don’t automatically take the 12.8% tax from the interest on your savings in 2024. If you receive dividends, the income thresholds are higher, €50,000 for a single person and €75,000 for a couple. This is particularly important if your income is not taxable or in the 11% tax bracket. These thresholds remain the same as previous years and have not increased with inflation.

November is the month when you can see the most beautiful autumn colours around France. It is also a great time to review your finances and make plans for the year ahead. If you have any questions on the above or any other matters, please do get in touch!

Spectrum supporting Mimosa Matters

By Peter Brooke

This article is published on: 25th October 2023

The Nice to Cannes Relay Marathon

As we gear up for the upcoming Nice to Cannes Relay Marathon on November 5th, I wanted to take a moment to share with you the reason behind my choice to support Mimosa Matters, a charity that holds a special place in my heart.

In a world that often seems to move too quickly, community stands out as a pillar of strength and support. It’s a reminder that we are not alone and that, together, we can make a meaningful impact. The Nice to Cannes Relay Marathon embodies the spirit of community, with individuals coming together to achieve a common goal through teamwork and perseverance, and having a bit of fun together through the aches and pains.

Don’t worry, I am not running the entire Marathon – that would be crazy – I will leave that for those whose fitness levels are way better than mine!

I am running the final 6.4km leg…. some might say the ‘taking-all-the-glory-leg’… for Team Early Birds, a gang of super women who are doing all the hard work over the proceeding 35.6km; if you have a spare euro or two, please do consider empowering our legs to carry us all to the end by helping us raise some funds for the important work that Mimosa undertake.

The fundraising link for our team is here

I was hoping to run a longer leg but a recent bout of bronchitis and a lower back injury have curtailed my training a little but I am back hitting the tarmac again and as I lace up my running shoes for my leg of the Relay Marathon, I am not just running for personal achievement; I am running to try and make a difference.

Mimosa Matters shares this commitment, and by supporting their cause, we can collectively contribute to creating a stronger, more compassionate community.

Your contribution, no matter the size, will help make a positive impact on the lives of those in need. Together, we can run towards a brighter and more connected future. Of course, please don’t feel any pressure to contribute at all… instead perhaps share this email or come and encourage us all on the road a week on Sunday, you won’t miss us, we’ll all be in bright yellow.

Why Mimosa Matters

Spectrum and I have chosen to support Mimosa Matters again because of the incredible work they do in fostering a sense of community and making a positive difference in the lives of others. Mimosa Matters goes beyond traditional charity by actively engaging with local communities and addressing their specific needs in the fight against cancer.

They work closely with local cancer professionals & associations to create and fund projects to increase awareness of the causes of cancer and to channel funds into cancer research and into associations that directly support patients and their families living with cancer in our region.

Sadly, too many of us have been directly affected by this relentless disease and we must stand, walk or run together to try and stop it.

Please follow these links if you would like more information about Mimosa Matters

https://www.mimosamatters.org/

and the Marathon https://www.mimosamatters.org/project/nice-cannes-marathon-2023/

And, in case you missed it, the all important fundraising link again for our team is here

https://www.helloasso.com/associations/mimosa/collectes/team-early-birds-running-for-mimosa

https://www.facebook.com/mimosamatters and https://www.facebook.com/financial.advisors

Thanks for taking your valuable time to read through this, I really appreciate it.

Finance update Q3 2023

By Peter Brooke

This article is published on: 13th October 2023

Let’s talk about CASH

Since my last quarterly update in August the mood in markets has been a little confused.

After the more optimistic start to the year when stock markets, especially in the US, showed resilience and the roots of recovery from a horrendous 2022, the summer was much more mixed. The Bank of England and the US Federal Reserve didn’t raise interest rates in September, though the ECB did but from a lower level.

August was much more volatile than expected with investors trying to work out if inflation had peaked and if central banks were done with their unprecedented interest rate hikes, and when they might start thinking about cutting rates.

The oil price has also settled at a higher-than-expected level, which might be a sign of increased economic activity, but it doesn’t help to get rid of sticky inflation.

Higher for longer

Interest rates are a means of dealing with inflation. Central banks raise rates to increase costs and reduce spending power with the aim of lowering demand and squeezing prices. This is an art rather than a science. Central banks need to find the right balance of weakening demand, while avoiding a recession. This has proved fiendishly difficult and tackling inflation has seldom been achieved without some economic pain.

We are currently in the eye of the storm. Over the past 18 months, global interest rates have moved from near zero to over 5% in some places. Inflation is coming down and interest rates may have peaked, but monetary policy operates with an unpredictable lag. It is difficult to know how much of these interest rate rises have fed into the economy and whether a recession is just round the corner.

Investors will have to start getting used to these elevated levels of interest rates for longer as the consensus opinion is now that interest rate cuts won’t come quickly and won’t be significant until inflation is firmly under control. We are still very much in a holding pattern.

So should I keep my cash in my bank?

Of course, one of the few benefits of these hikes in interest rates is that you can now achieve some positive return on cash, which hasn’t been possible for around 15 years!!

I am having a lot of conversations with people asking why they should consider investing rather than leaving money in the bank.

This is a very good question… equity and bond investors have had very little, if any, positive returns since January 2022 so why invest now when I know I can now get returns on cash?

For someone with a very short-term time horizon, and therefore a very low risk profile, then cash earning around 5% will look attractive. Clearly tax is an issue, which will diminish this return but still it is at least a certainty.

What about those with longer time horizons – should they stay in cash given the high returns relative to recent history?

There are several considerations here:

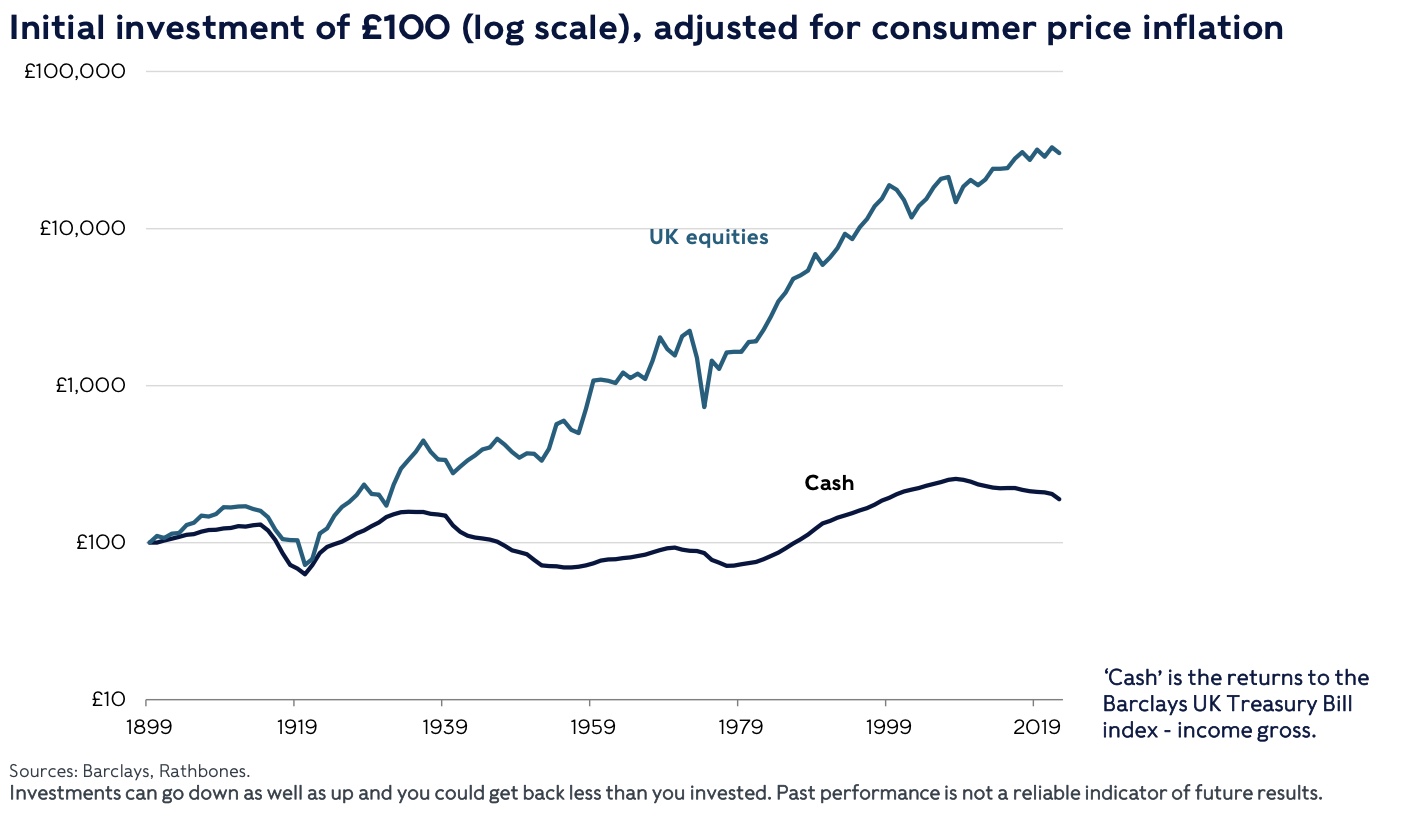

1. Sticky Inflation

If base level inflation is to remain higher for longer then we still need to consider the NET return you will be getting on your cash.

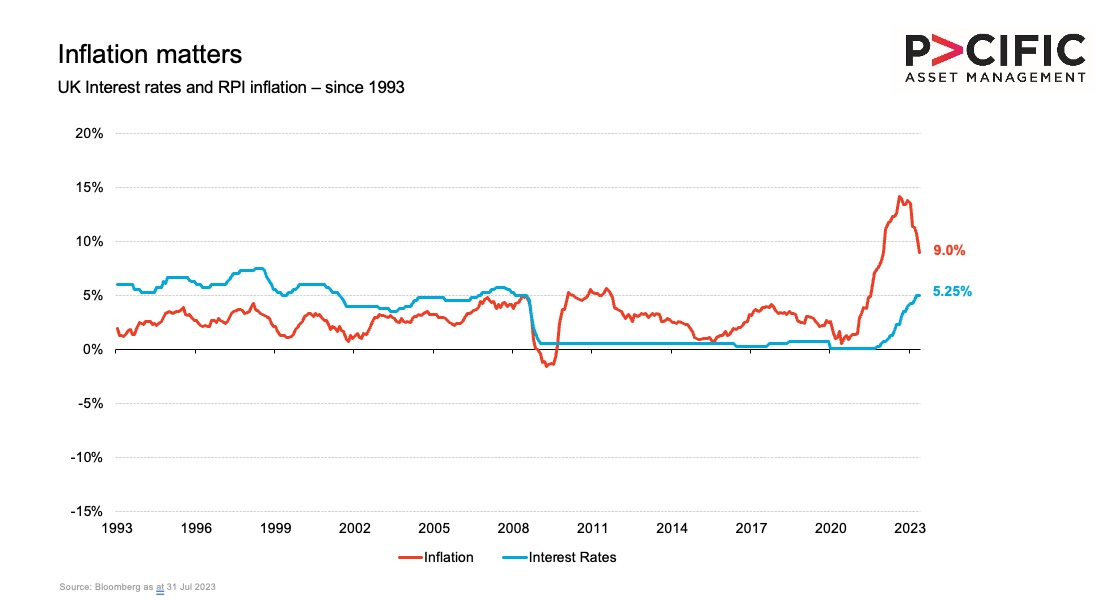

Here is a chart showing UK Inflation and UK interest rates over the last 30 years – even today inflation, though falling, is still above base rates:

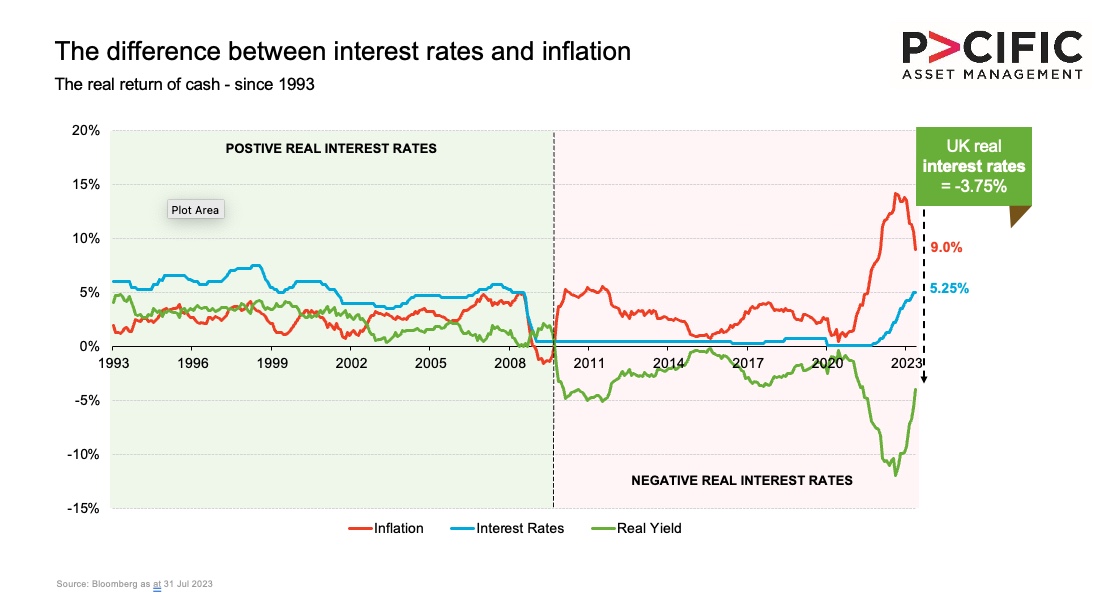

Put another way – if we take one away from the other we can see that the REAL return on cash today is still negative (the green line) – that’s a guaranteed loss of 3.75% over the next 12 months.

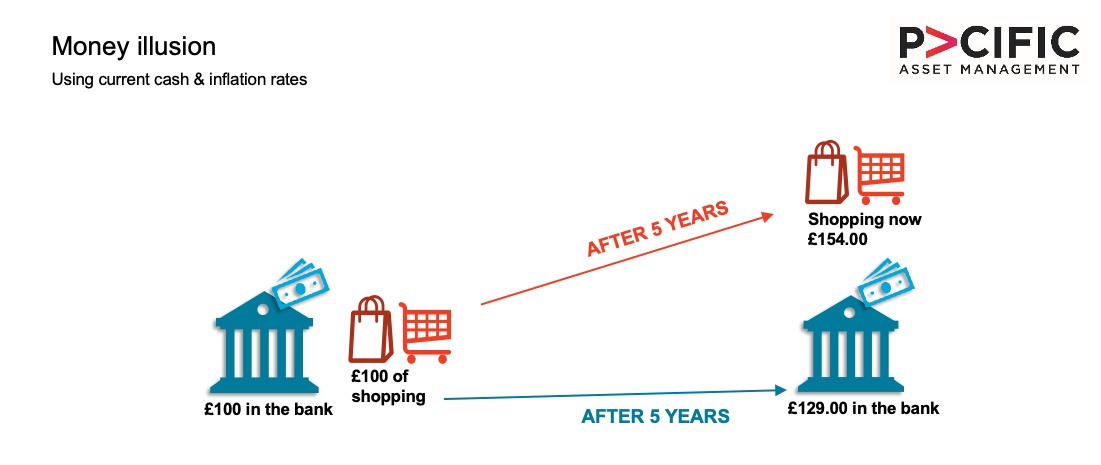

Put another way again… what can you buy in 5 years if things remain as they are today? See below for a real world example of how inflation affects us all:

2. Other investments should do better…

BONDS:

Most investments are valued versus the ‘risk-free’ rate of return (ie cash).

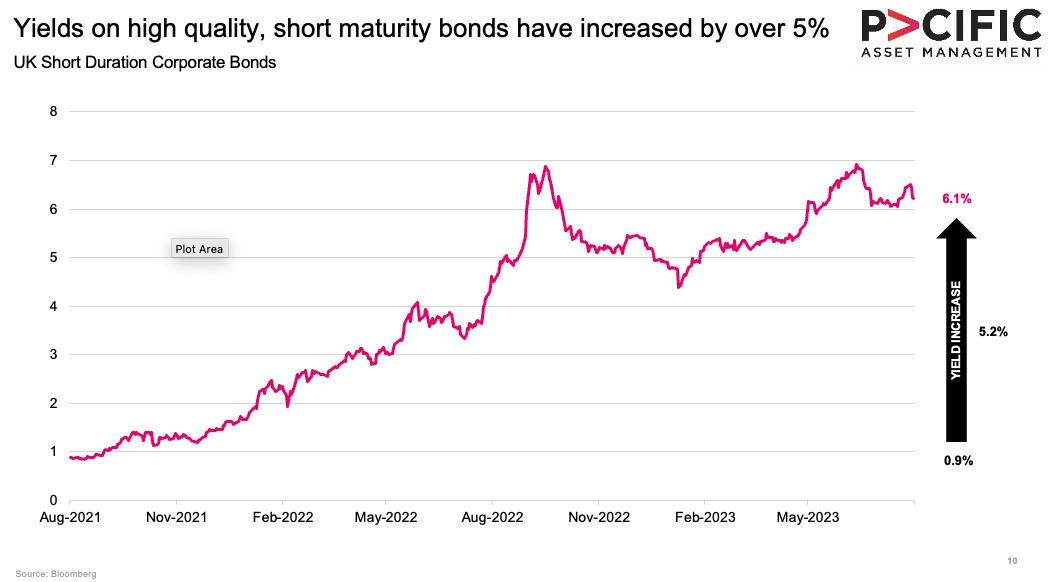

So when cash was paying you 0.1% many investors were happy to accept 1.5% to 2% from high-quality investment grade bonds, even though they come with a little more risk….

… so there is a strong case for buying bonds today yielding 6% to 7% because we are happy to be paid the extra 1.5% to 2% for the extra risk we are taking… this is exactly where bond ‘yields are today’.

SHARES:

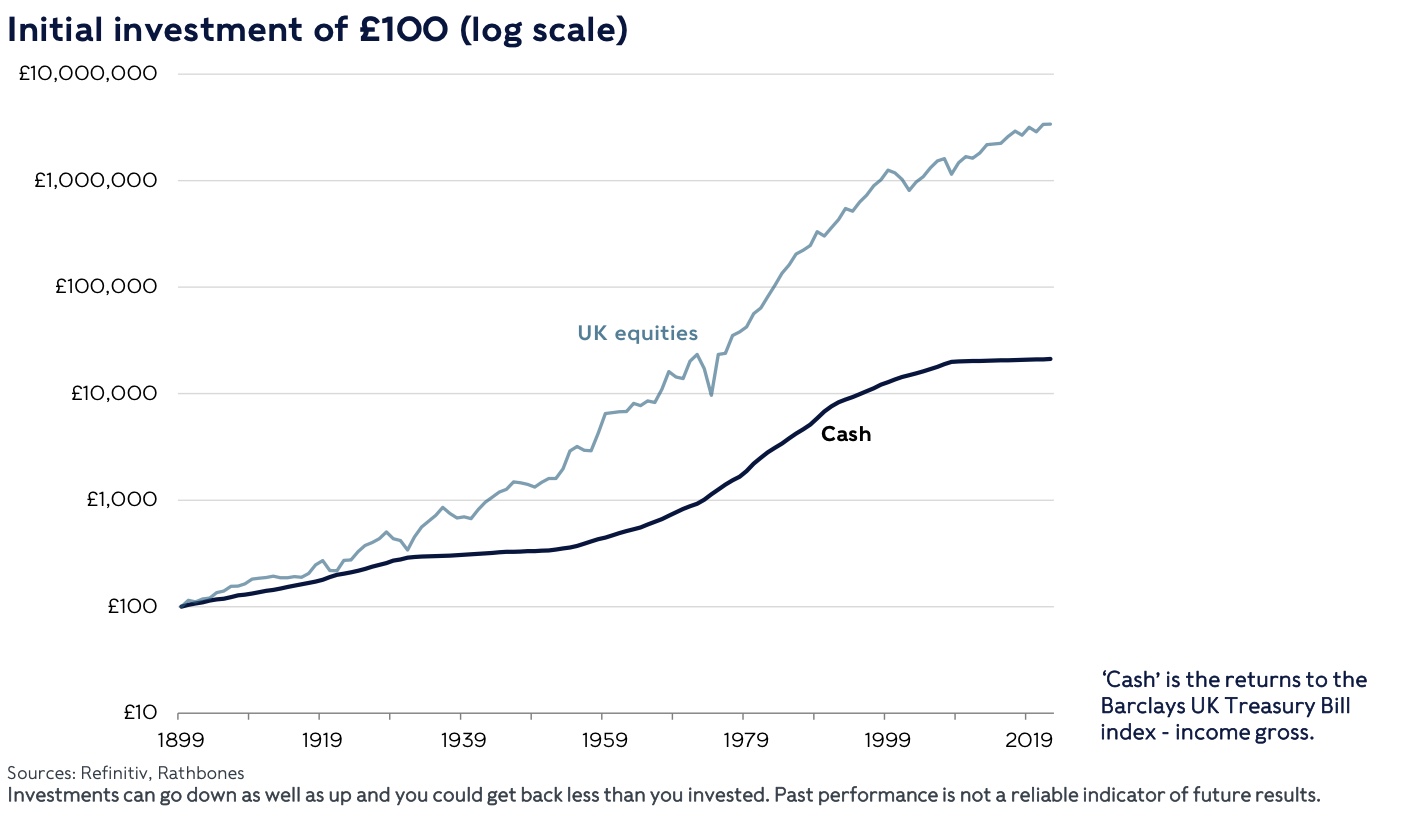

Though more volatile, shares have always outperformed cash AND inflation over the longer term.

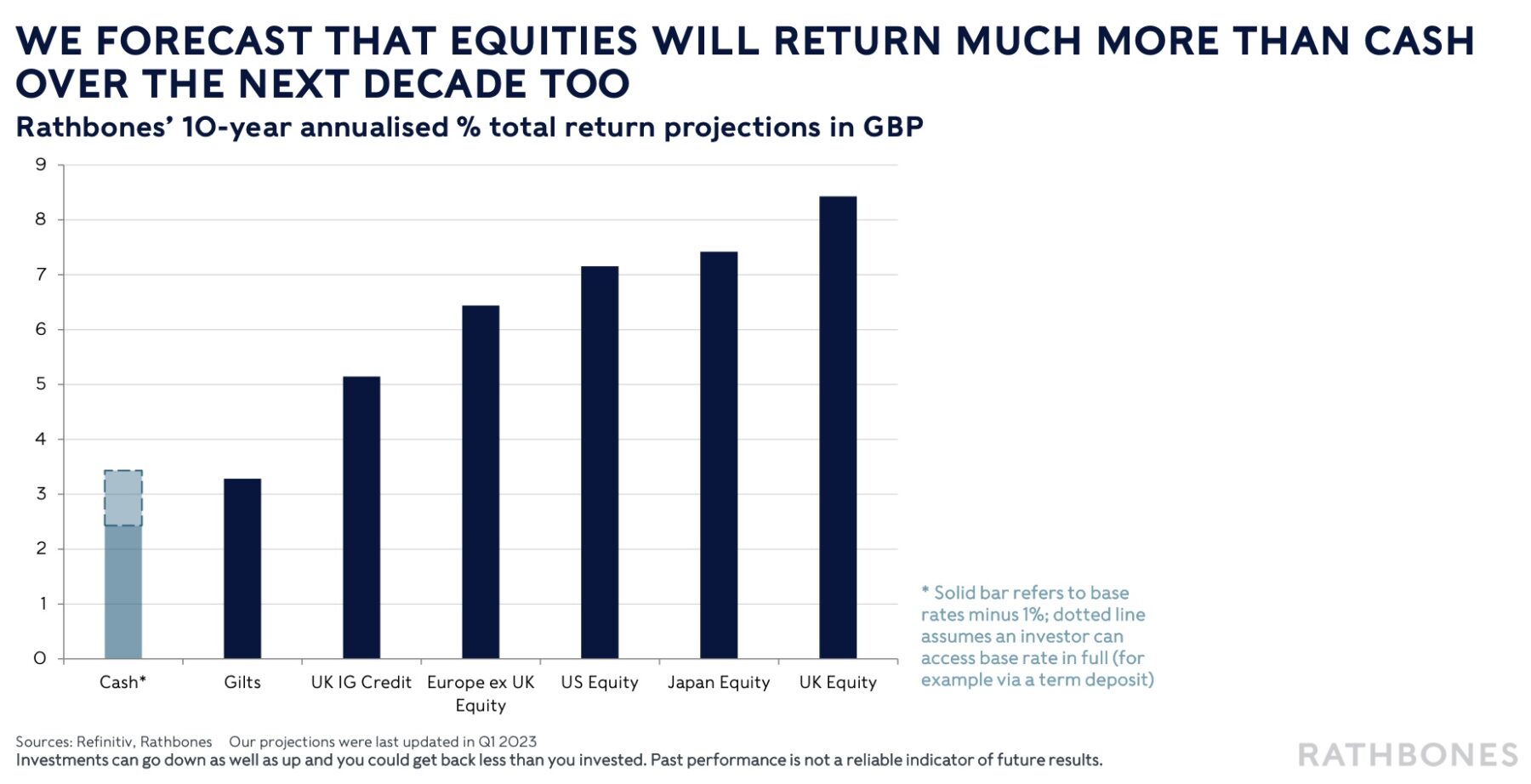

And expectations over the coming years are that shares will continue to outstrip returns on cash:

In Summary

We feel that we are getting closer to understanding a little more about how the future might look. Inflation seems to have peaked but will remain sticky for a while, which will mean interest rates are likely to stay higher too for longer than originally thought.

The chance of global recession is still there but nor lower and the consensus appears to be that it will be soft and short if it emerges at all. This can be good for stock market performance but in the meantime cash and bonds are, for the first time in a very long time, a genuine investment option; though sticky inflation must be taken into account when choosing how much to leave in cash.

Inflation is a financial reality that we all need to navigate. By proactively addressing this challenge and exploring investment opportunities that protect your wealth, we can work together to ensure your financial future remains secure.

If you have capital to invest for longer than the next couple of years then an actively managed multi asset approach should be considered to minimise the effects of inflation on your hard earned funds.

I would very much like to thank the investment teams at Pacific Asset Management, Rathbones Investment Management and Evelyn Partners for their input into this data and summary.

If you would like to dive deeper into these subjects please check out the following links:

3rd Quarter Outlook from Pacific Asset Management

Why do interest rates and inflation matter for investors from Evelyn Partners

Feel free to get in touch if you have any questions via the below channels, or the booking system – always drop me a quick message if you need a time slot outside of those available.

If you have missed any previous emails, click here to access the Archive.

For now, have a great day, speak soon…

Introducing your Client Portal

By Peter Brooke

This article is published on: 5th October 2023

CashCalc

What is the Cash Calc Secure Client Portal?

Cash Calc was launched back in 2014 by a UK IFA who was unimpressed with the digital tools available to our industry. It was initially launched as a Cash Flow Planning Calculator – more on this later, but has developed into a broad suite of great tools for advisers like me and their clients.

“seek first to understand, then to be understood”

In order to best advise my existing and future clients I need a full picture of their current situation and an understanding of their objectives, aspirations and goals – we rather boringly call this ‘fact finding’… though it is not all just facts!

A recent addition to the Cash Calc tools is the ability for my clients to complete or update their own fact find in their own time from the comfort of their own homes via the Client Portal, if they want to. It is totally secure and can be updated as little or as often as necessary.

We can also use the portal for the secure sharing of documents, like investment statements, passports, utility bills etc AND for secure two way messaging.

For those who prefer not to use this service, please don’t worry, I will still use it as a data storage tool but will manage the access and information myself.

Please check out this video for more:

Hop Onboard

If you are already ‘onboarded’ and have your Portal login details please do have another look and send me a quick message (top right corner of the screen) to say hi and confirm it is all working OK.

Some of my existing clients have stated a preference to have their quarterly investment statements shared via the portal as a more secure option than email – please don’t hesitate to let me know if you prefer this too?

If you are not yet ‘onboarded’ please don’t worry, as part of our review process I will be sending you a personalised ‘secure invitation’ to the portal to set it all up; it is very easy.

Of course, if you just can’t wait please drop me a line and I will send your personalised login details immediately.

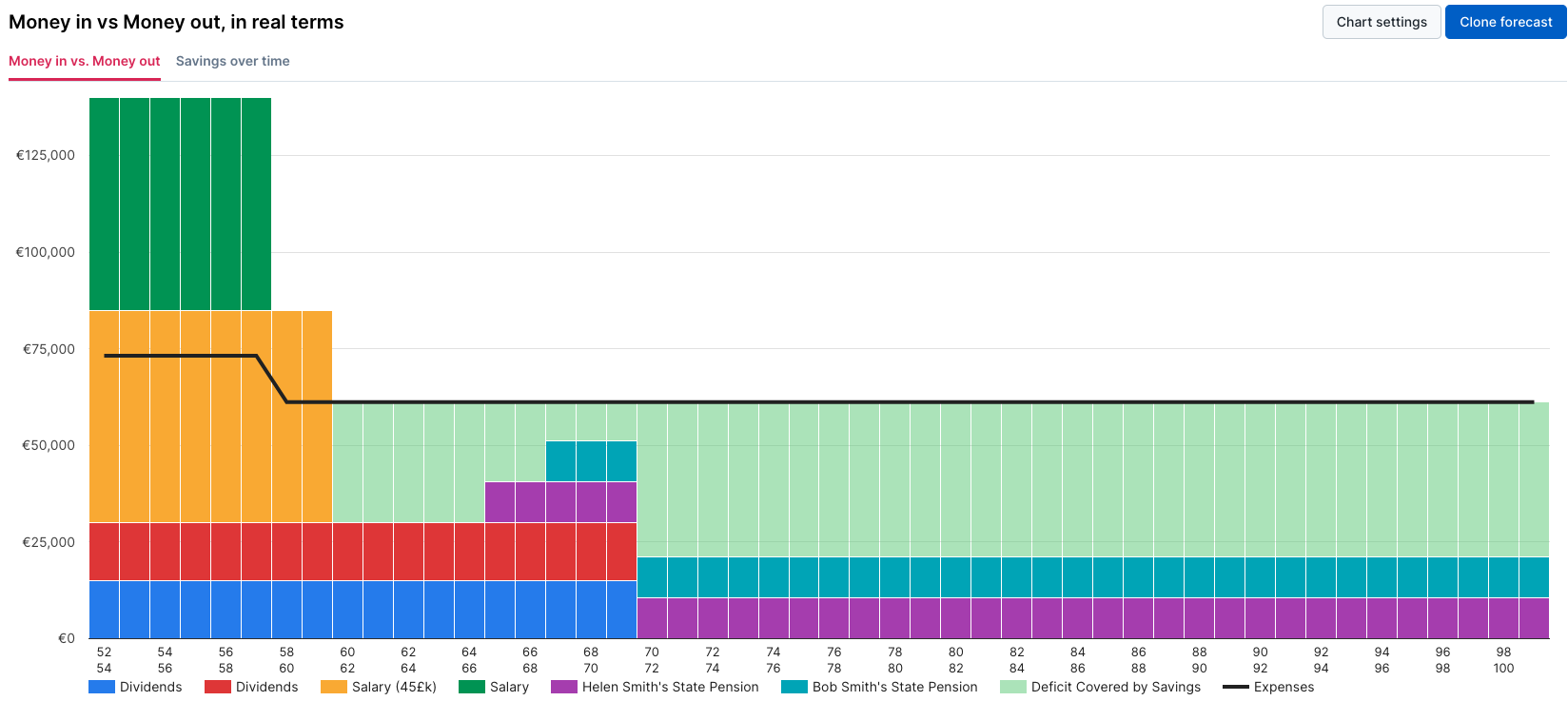

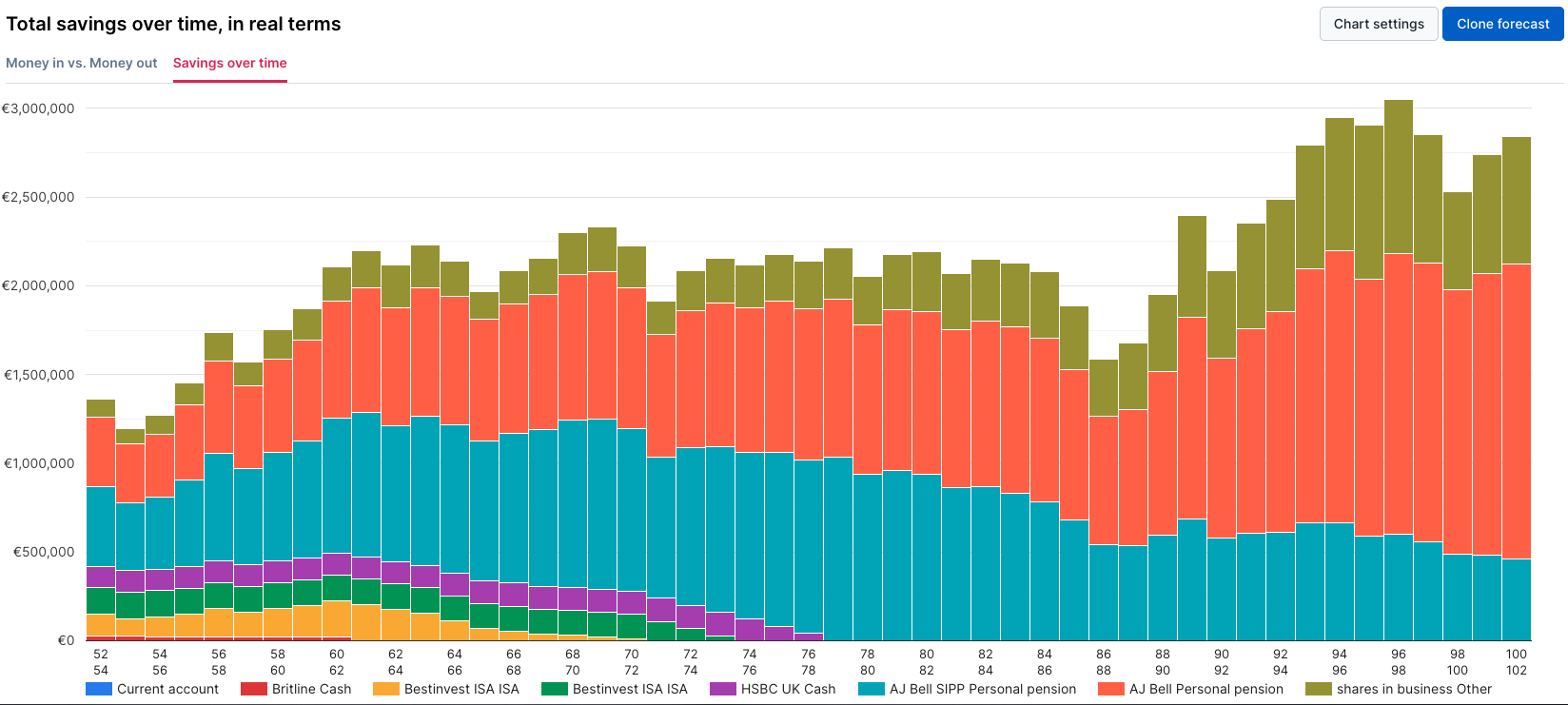

Cash Flow Financial Modelling Tool

As mentioned above Cash Calc started as a ‘Cash Flow Planning Calculator’ and though it is now so much more, this remains one of the most powerful and useful tools for creating truly personalised financial plans.

Using the ‘fact find’ data you provide in the portal I can create multiple bespoke cash flow plans to look at various scenarios and forecast how your financial situation will evolve over time.

“can I afford to retire now?”

“can we pay for our daughter’s wedding?”

“can we fund our Grandchildren’s education?”

We can see graphically where you are today and what changes, tweaks or decisions need to be made to ensure you will be ok long into the future.

Why I love it…

- Its not time critical – you can upload and enter your details in your own time, at your own pace

- Totally Secure – bank level encryption, customised for the Spectrum IFA Group

- Simple interface between us for sharing of documents, messages and, most importantly, for uploading up-to-date financial information

- I am notified as you make changes to your profile

- ‘Virtual’ Modelling tool with scenario based examples

- Very Visual – it’s easy to see how changes will directly impact your situation as we tweak your plans

- Digitally and securely accept and sign-off on a range of documents

- Quarterly Financial statements can also be shared here instead of emailed

….. oh, and it has a load of other great tools we can use too…..

Financial update in France October 2023

By Katriona Murray-Platon

This article is published on: 4th October 2023

September is a gorgeous month in France and this year has been no exception. For me September often goes by in a whirl – with the children back at school there are still after school activities to organise and parent-teacher meetings to attend.

However, for those who are not affected by the back to school mayhem September is a great time to enjoy the warmer weather and the beauty spots of France once the summer tourists have left.

Further to what I wrote in my last Ezine, the interest rate on the Livret A and Livret de Développement Durable et Solidaire (LDDS), which was expected to rise to 4%, shall instead remain at 3% and the French government has committed to keeping it at this rate until 2025. However, an appeal against this decision has been brought before the Conseil d’Etat. The interest rate of the Livret d’Epargne Populaire (LEP) has already dropped slightly from 6.1% to 6%.

If you realise you have forgotten to declare something on your 2022 tax return or you wish to correct an amount, you can, since the 1st August, amend your return on your online space on the impots.gouv.fr website. This service will be available until 11.59pm on 6th December. You should have already received your tax statement for the declaration you did in May and you should pay the amounts requested on this statement but if you do decide to amend your tax return, a new statement will be issued and any overdue amounts will be adjusted or repaid.

The tax authorities should already have your bank details that you provided to take any overdue tax from your account or pay any reimbursements. If this is not the case and if you have less that €300 to pay, you have to pay this by 30th September using the online service. If you have more than €300 to pay on your 2022 tax bill, these amounts will be taken on 26th September and around the 25th of October and November with the last quarter of the payment being taken out of your account on 27th December.

October is the month for the taxe foncière which is due by 16th October or 23rd October if you pay online or with your telephone or tablet. If you have already received your statement, you may have noticed an increase in the amount. The taxe foncière increased by 3.4% in 2022 but it has increased by 7.1% in 2023. This is an average and does not include any increases that the local councils may have voted. The sharp increase is due in part to the annual review of the rental value of the property which takes into account the Consumer Price Index which itself is determined by inflation.

Not everyone has to pay the taxe foncière. There are exemptions for those on pension benefits (ASPA) or disability allowance (ASI and AAH) as well as for those who were 75 and over on 1st January 2023 if your taxable income (RFR) for 2022 was less than €11,855 for one person or €18,233 for a couple. If one partner is over 75 and the other isn’t they can still be exempt. If a person is in a retirement home, their former home, provided it is not rented, is also exempt. New constructions, extensions or changes to buildings (a barn conversion for example) may be partially or totally exempt from taxe foncière for the first 2 years unless the local council has decided otherwise.

Although 2022 was a difficult year financially, this has not stopped the French from investing in Assurance Vie policies. According to the data published in the Le Particulier magazine in September (no 1208), 144.4 billion euros was invested in assurance vies in 2022, only slightly down from 2021 when 148.6 billion euros was invested. Most of this was in Euro Funds which, in spite of their steady decline over the past ten years, saw a slight increase in 2022 to 2% which is however less than the rates on the Livret A and LDDS.

In other news in September, I had the very great privilege of being invited to the GREAT event, organised by the British Embassy, in honour of the King and Queen’s visit to Bordeaux in September. Around 1500 people, French and British, were invited to this special event at the historic Place de la Bourse where we mingled with other members of the Bordeaux British community, bilingual professionals and business owners; sampled British foods, wines and sparkling wine and enjoyed music by local British artists. In addition to seeing the King and Queen, who arrived by tram to this event, Paddington Bear also made an appearance and the Fiji Rugby Team were also there and sang a beautiful song to the King as he was leaving. It was a very special and enjoyable day!

Financial update – France September 2023

By Katriona Murray-Platon

This article is published on: 4th September 2023

I hope you all had a good summer. We spent ten days in Andernos and then enjoyed a much cooler ten days visiting family in the UK. Whilst I was in the UK I saw an advert in the paper for a bank savings account offering around 5% interest on amounts up to £50,000.

However, I noticed that in order to benefit from this rate you would have to commit to leaving the money there for two full years otherwise if you took the money out you would only get around 2% interest. A quick scan of the finance section of the paper showed similar offers. Now, leaving aside the fact that once you are French resident you can’t open a UK bank account, with inflation in July being 6.8% in the UK these rates are still far below inflation. IF you were to have one of these accounts and be a French resident you would need to reduce the interest rate by 30% because that is the French tax that you would have to pay on any gains. Also there is exchange rate risk that needs to be considered.

Some other accounts were brought to my attention in Jersey. However there is no double tax treaty between France and Jersey so any interest earned would be taxable in both countries.

I always advise people to take advantage of the French tax free savings accounts like the LDDS and the Livret A and the LEP if you meet the income threshold BEFORE investing. If you add the CEL account to this list it effectively means you can hold around €50,000 readily available cash earning tax free interest. These rates are reviewed quarterly on 1st of February, May, August and November. You will be pleased to hear that there have been no changes to these rates as at 1st August 2023.

One of the key points about investments is diversification. Not only are the investments we recommend very diversified in terms of geographic location and asset class but if you have invested with us this is usually only a part of your assets.

All investments whether it is your house, your bank accounts, or your other investments, involve some level of risk. You only have to look at the history of the rates on the savings accounts HERE or the current concerns about house prices and mortgage rates in the UK, to see that nothing is guaranteed in the long term. But what we can show you from the past performance of the investments we offer is that over the past three or five years they have performed well. And the longer the investment term, the greater the likelihood of strong, positive returns ahead of the rate of inflation.

Another thing we managed to do at the end of July was to complete our wills and make stipulations about the guardianship of our children. I wrote about guardianship HERE but I admit I never got round to doing anything about it until now. The husband of a French financial adviser that I recently met is the Notaire in an office in our neighbourhood so we were able to make an appointment with him. We hand wrote our wills before the notaire, signed and dated them and then handed them in with a cheque for them to be registered. It was all very easy and I’m glad that it is now sorted.

By now you should have been able to view your tax statements in your online tax account, if you have any questions about the figures please do let me know.

After a long and much needed break, I am excited to be back at work and arrange appointments with my clients and those who have contacted me. If you want to speak to me about something please do let me know.

Looking forward to speaking or hearing from you soon!

Preparing for the inevitable

By Richard McCreery

This article is published on: 4th September 2023

A few tips on how planning ahead, as well as looking back, can make a difficult time much easier on our loved ones. It comes to us all, but we devote relatively little time to thinking about it: death.

Unsurprisingly, most people prefer to avoid thinking about their own mortality, but they are keen to ease the pain for loved ones who are left behind. In this short article I’ll take a look at some tips to make this time a little less hard on your family and I’ll even give you an idea of how you can leave behind a moment of happiness for your closest relatives.

Make ‘The Folder’

My colleague Gareth Horsfall has written about the importance of ensuring your paperwork is in order and stored where your relatives can find everything they’ll need to get through the formalities that inevitably ensue from your passing. The Folder is a central location (digital, physical or both) where you keep a record of all your assets, your bank accounts, your pensions and investments, as well as a copy of all your important documents like birth certificates, marriage certificates, your social security number etc. And, finally, a list of all your internet and device passwords, of which there could be a lot!

Modern life can be extremely complicated whilst we are still alive and it becomes even more so when you have to deal with someone else’s affairs that may not be entirely familiar to you. By collecting all the important paperwork and information in one place, you can ease the inevitable administrative burden and show your loved ones that you were thinking about them. And don’t forget to tell them where they can find The Folder.

Close old overseas accounts and companies

I was once asked to help the wife of a client to deal with some of the inheritance formalities that were required for the settlement of his estate after he died. Wealthy people often have assets in various countries and this can lead to significant extra time and expense when attempting to transfer everything from the deceased’s estate to the beneficiaries.

For example, the ownership of a British Virgin Islands company can’t be transferred to someone else before probate is granted in that jurisdiction, which entails securing the services of a local qualified lawyer. If that company is no longer needed once the deceased is gone then further fees will be incurred in BVI for closing that company. Multiply this scenario across various foreign jurisdictions and it can become quite costly and time consuming in order to settle the full estate.

Conclusion: if you can simplify your affairs by closing underutilized overseas companies or dormant bank accounts, it can save your family a lot of hassle and money later.

Avoid paying more tax than is necessary

Ironically, inheritance tax is a fact of life. It is often only considered when it has to be paid and it can be surprisingly substantial – in France a house can swallow up any allowances you may benefit from, leaving the remainder to be taxed at up to 45% for children and up to 60% for non-family beneficiaries. By using an assurance vie policy as a vehicle for managing some of your wealth you can substantially increase the tax-free sums your loved ones inherit, they may pay a lower tax rate on the amount that is taxed, you can use the beneficiary clause to choose who gets what and the money can grow free of tax during your lifetime if not withdrawn.

Everyone hates paying inheritance tax, so when you know that your children can inherit an extra 152,500€ each tax-free if the money is coming from an assurance vie policy, it quickly becomes apparent how much you can save them (don’t forget: in order to get the maximum benefit, you should start your policy before you turn 70). They say there are only two things that are certain in life: death and taxes. Whilst you can’t avoid the first, your family might avoid the second with a bit of foresight and planning.

Finally, leave them something really personal

You’ve finished tidying up the loose ends of your life, you’ve done all you can to minimize the tax your family will pay and your affairs have been put ‘in order’. You have made every effort to ensure your passing will be as little of a burden on your beneficiaries as is possible, you have made a difficult time less difficult by thinking ahead. There is also a way to use this moment to bring some joy into the lives of those who love you: by thinking back on your life.

A memory journal is a little treasure that helps you to record some of the most precious moments of your life, to be passed on to your children or grandchildren. It is a guided book that contains prompts and questions such as ‘How did you meet my mother?’, ‘What was your favourite subject at school?’, ‘Tell me about the happiest or greatest memories of your life’ or ‘What did you feel when you first saw me after I was born?’ It gives you the opportunity to leave your family the story of your life, your most intimate thoughts and feelings, perhaps alongside a few photos.

Money and paperwork are important, they have to be dealt with. Put everything in order, in advance, and you will be doing your family a big favour. Leave them as much money as you can tax-free and you’ll ensure they will be better off. And finally, a few of your own words left alongside the admin makes this difficult time more bearable. These things are easily put off, you may not even want to think about them, but if you take action sooner rather than later, I promise you will never regret it.

If you would like to speak me about planning ahead and putting your family affairs in order, please get in touch. I’m here to help and happy to answer any questions with no obligation.