Let’s talk about CASH

Since my last quarterly update in August the mood in markets has been a little confused.

By Peter Brooke

This article is published on: 13th October 2023

Let’s talk about CASH

Since my last quarterly update in August the mood in markets has been a little confused.

After the more optimistic start to the year when stock markets, especially in the US, showed resilience and the roots of recovery from a horrendous 2022, the summer was much more mixed. The Bank of England and the US Federal Reserve didn’t raise interest rates in September, though the ECB did but from a lower level.

August was much more volatile than expected with investors trying to work out if inflation had peaked and if central banks were done with their unprecedented interest rate hikes, and when they might start thinking about cutting rates.

The oil price has also settled at a higher-than-expected level, which might be a sign of increased economic activity, but it doesn’t help to get rid of sticky inflation.

Interest rates are a means of dealing with inflation. Central banks raise rates to increase costs and reduce spending power with the aim of lowering demand and squeezing prices. This is an art rather than a science. Central banks need to find the right balance of weakening demand, while avoiding a recession. This has proved fiendishly difficult and tackling inflation has seldom been achieved without some economic pain.

We are currently in the eye of the storm. Over the past 18 months, global interest rates have moved from near zero to over 5% in some places. Inflation is coming down and interest rates may have peaked, but monetary policy operates with an unpredictable lag. It is difficult to know how much of these interest rate rises have fed into the economy and whether a recession is just round the corner.

Investors will have to start getting used to these elevated levels of interest rates for longer as the consensus opinion is now that interest rate cuts won’t come quickly and won’t be significant until inflation is firmly under control. We are still very much in a holding pattern.

Of course, one of the few benefits of these hikes in interest rates is that you can now achieve some positive return on cash, which hasn’t been possible for around 15 years!!

I am having a lot of conversations with people asking why they should consider investing rather than leaving money in the bank.

This is a very good question… equity and bond investors have had very little, if any, positive returns since January 2022 so why invest now when I know I can now get returns on cash?

For someone with a very short-term time horizon, and therefore a very low risk profile, then cash earning around 5% will look attractive. Clearly tax is an issue, which will diminish this return but still it is at least a certainty.

What about those with longer time horizons – should they stay in cash given the high returns relative to recent history?

There are several considerations here:

1. Sticky Inflation

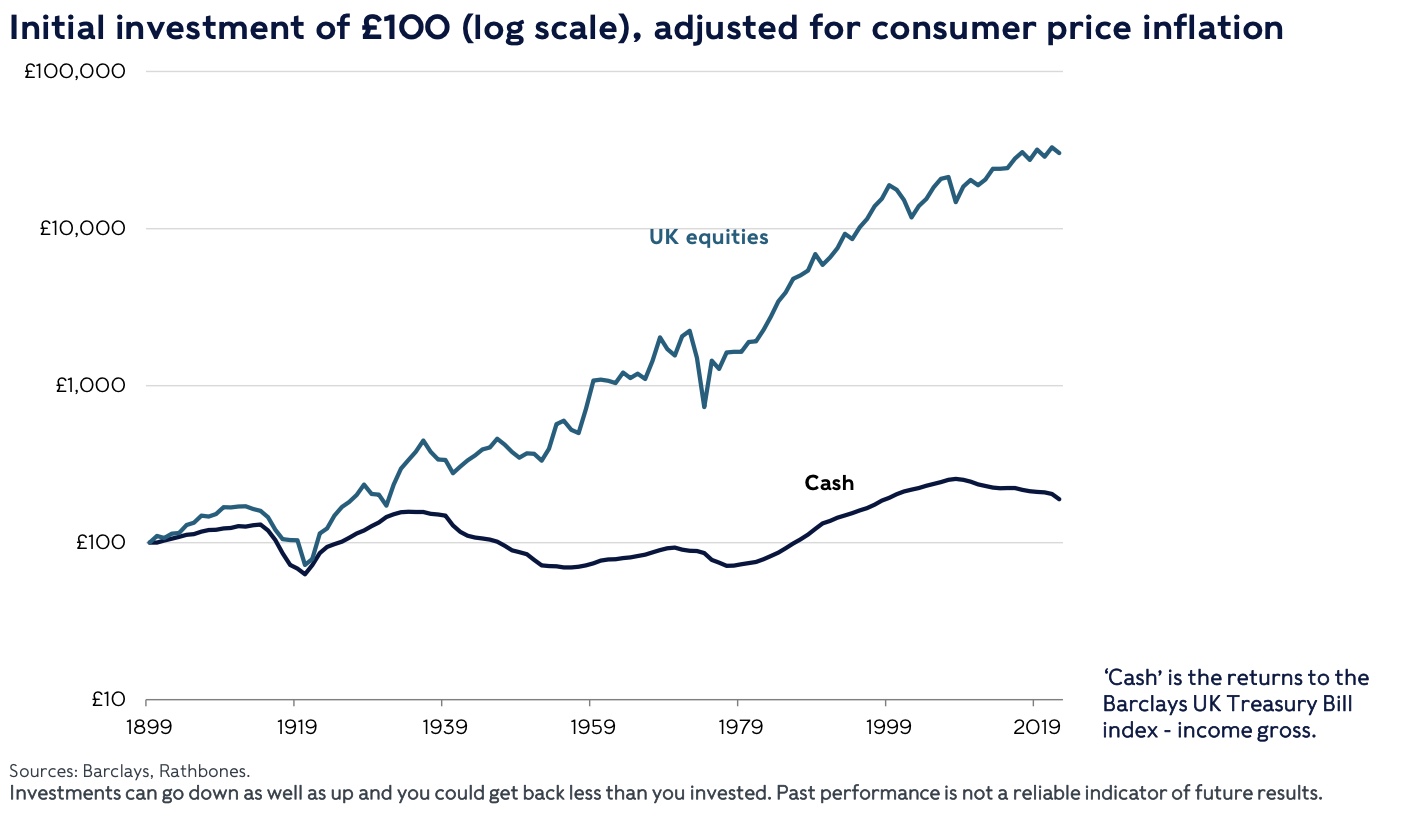

If base level inflation is to remain higher for longer then we still need to consider the NET return you will be getting on your cash.

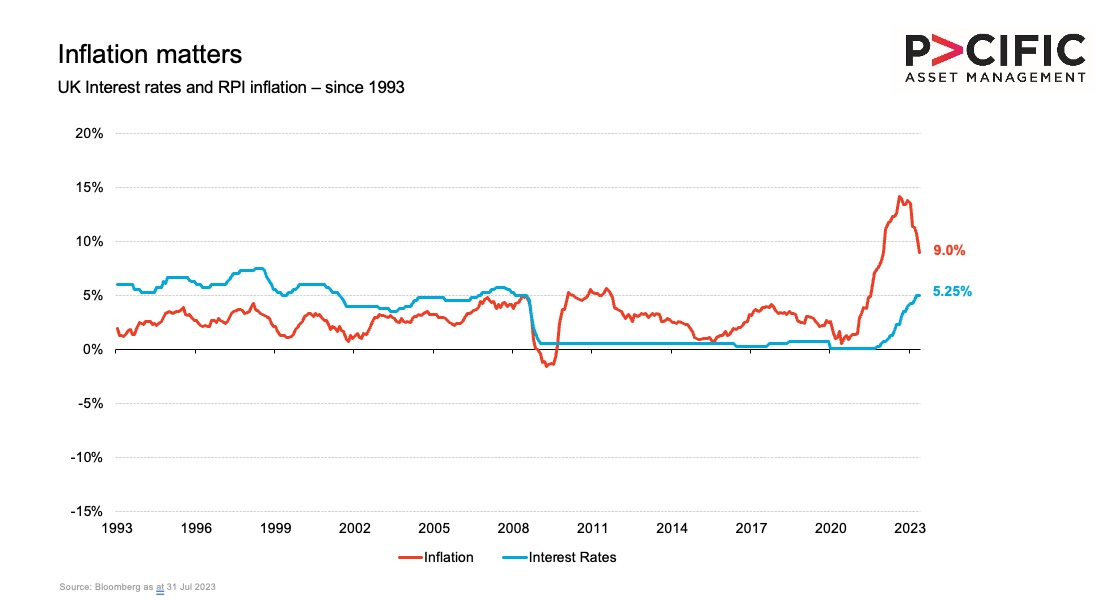

Here is a chart showing UK Inflation and UK interest rates over the last 30 years – even today inflation, though falling, is still above base rates:

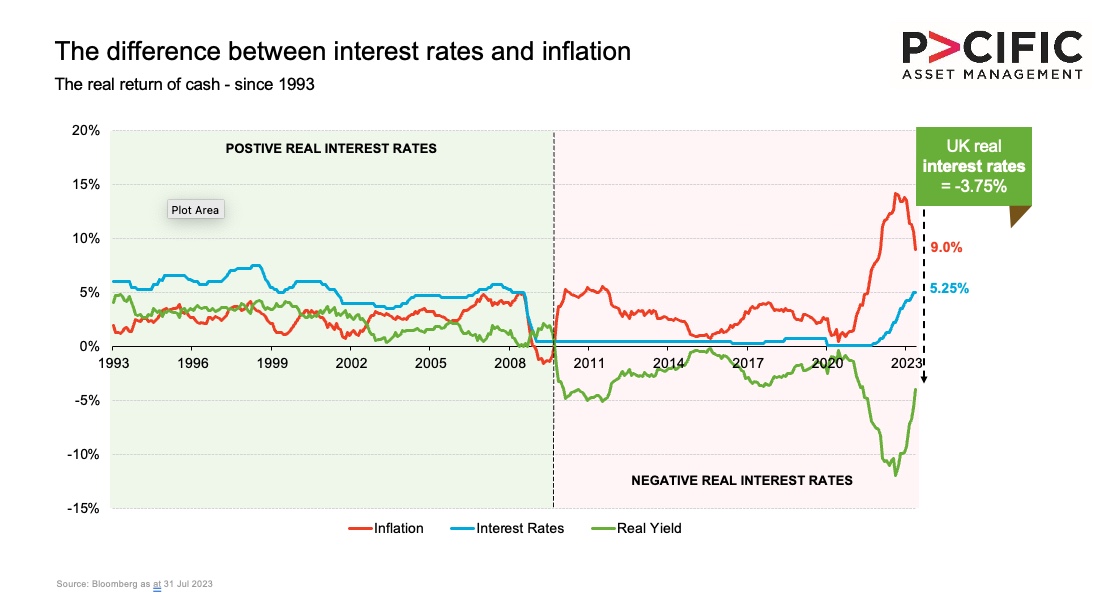

Put another way – if we take one away from the other we can see that the REAL return on cash today is still negative (the green line) – that’s a guaranteed loss of 3.75% over the next 12 months.

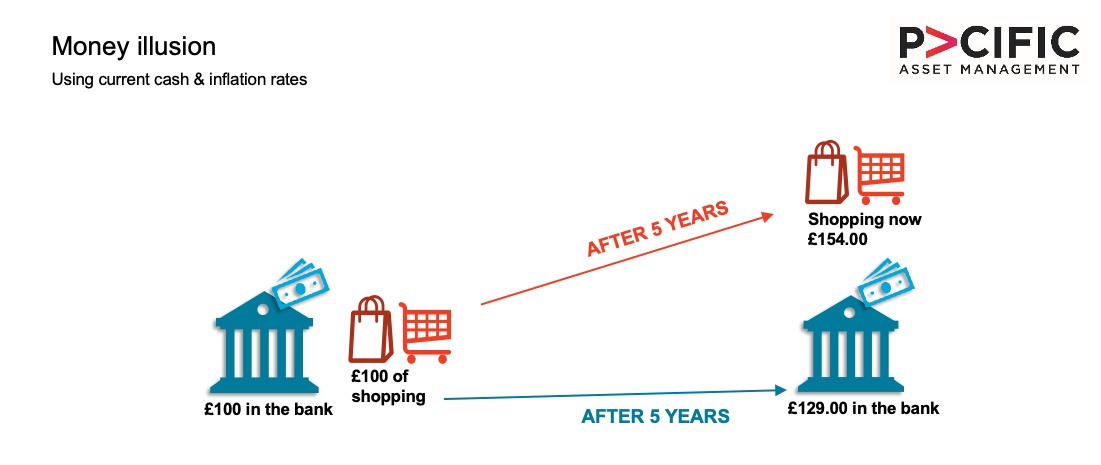

Put another way again… what can you buy in 5 years if things remain as they are today? See below for a real world example of how inflation affects us all:

2. Other investments should do better…

BONDS:

Most investments are valued versus the ‘risk-free’ rate of return (ie cash).

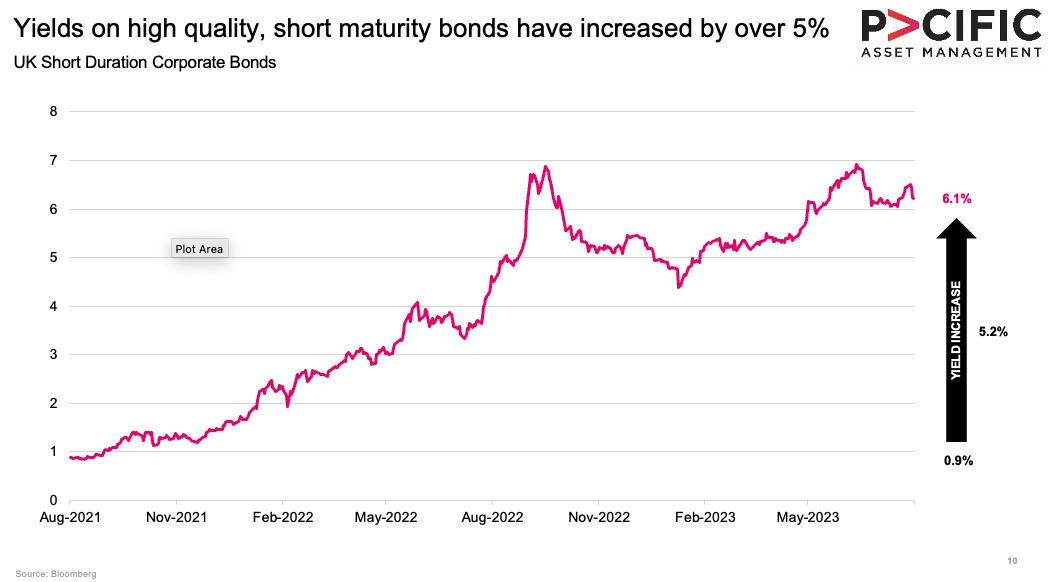

So when cash was paying you 0.1% many investors were happy to accept 1.5% to 2% from high-quality investment grade bonds, even though they come with a little more risk….

… so there is a strong case for buying bonds today yielding 6% to 7% because we are happy to be paid the extra 1.5% to 2% for the extra risk we are taking… this is exactly where bond ‘yields are today’.

SHARES:

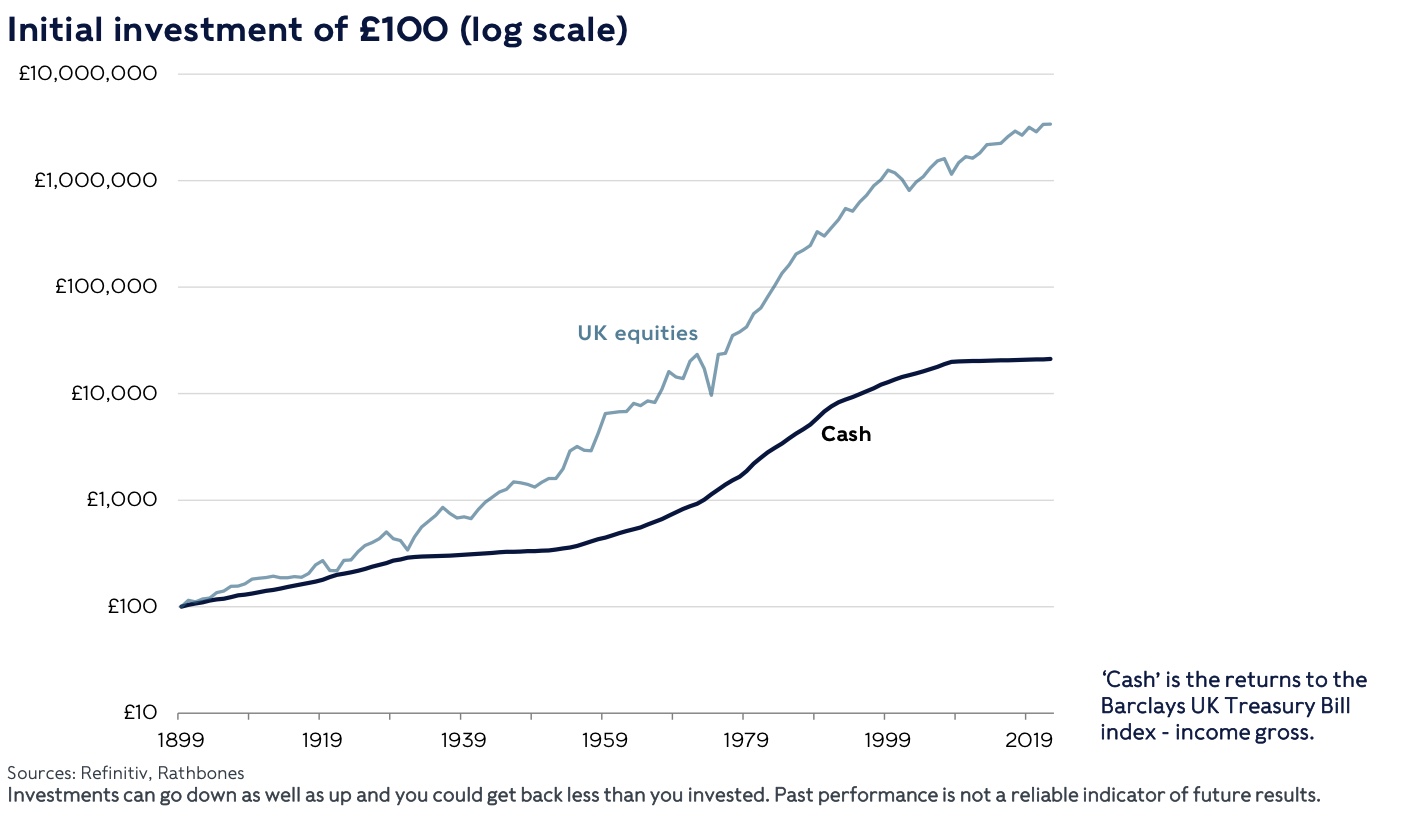

Though more volatile, shares have always outperformed cash AND inflation over the longer term.

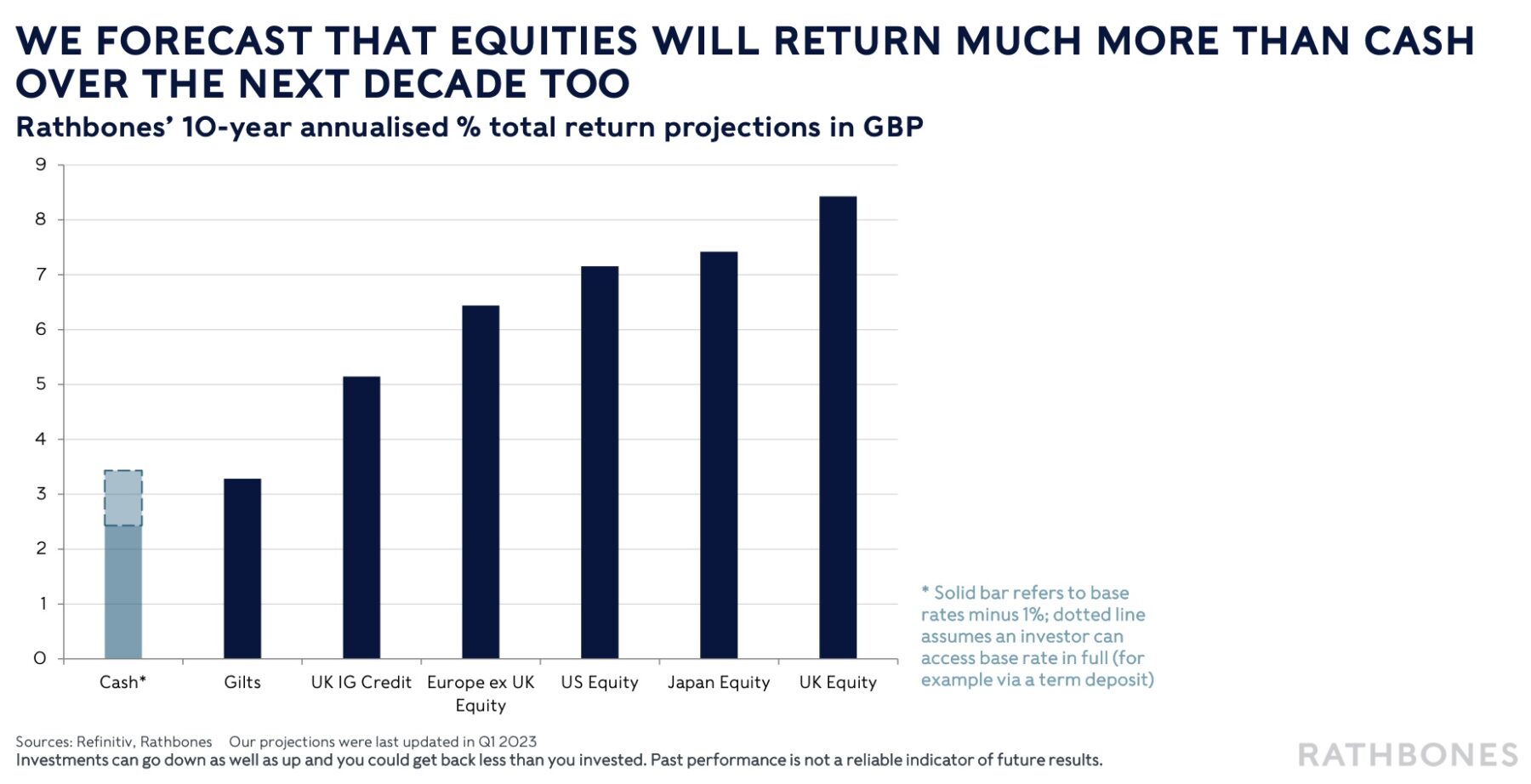

And expectations over the coming years are that shares will continue to outstrip returns on cash:

We feel that we are getting closer to understanding a little more about how the future might look. Inflation seems to have peaked but will remain sticky for a while, which will mean interest rates are likely to stay higher too for longer than originally thought.

The chance of global recession is still there but nor lower and the consensus appears to be that it will be soft and short if it emerges at all. This can be good for stock market performance but in the meantime cash and bonds are, for the first time in a very long time, a genuine investment option; though sticky inflation must be taken into account when choosing how much to leave in cash.

Inflation is a financial reality that we all need to navigate. By proactively addressing this challenge and exploring investment opportunities that protect your wealth, we can work together to ensure your financial future remains secure.

If you have capital to invest for longer than the next couple of years then an actively managed multi asset approach should be considered to minimise the effects of inflation on your hard earned funds.

I would very much like to thank the investment teams at Pacific Asset Management, Rathbones Investment Management and Evelyn Partners for their input into this data and summary.

If you would like to dive deeper into these subjects please check out the following links:

3rd Quarter Outlook from Pacific Asset Management

Why do interest rates and inflation matter for investors from Evelyn Partners

Feel free to get in touch if you have any questions via the below channels, or the booking system – always drop me a quick message if you need a time slot outside of those available.

If you have missed any previous emails, click here to access the Archive.

For now, have a great day, speak soon…