The Great Moderation & The Next Decade.

Is it really different this time?

The finance industry is often guilty of a very short term view. I read at least two emails every day that focus solely on the last 24 hours, which is probably not particularly healthy. It is also ironic that my industry then tells all its clients to only judge performance over the medium to long term … whatever that means.

Finance Update Q1 2023

By Peter Brooke

This article is published on: 27th March 2023

Of course, understanding how daily events can affect performance is important, but from time to time we really must put this into the context of the long term, and sometimes the VERY long term.

Our friends at Evelyn Partners have created a terrific piece of research considering the last 40 years (yes, 40) and then looking forward at the next decade, where they feel there really is something different happening. Here I will summarise their musings – I hope you find it interesting.

The Great Moderation 1980 to 2020

The economic impact of China’s emergence over the last 40 years has contributed to lower inflation and lower interest rates this impact is particularly characterised by

- Favourable Demographics

- Movement of workers

- Globalisation

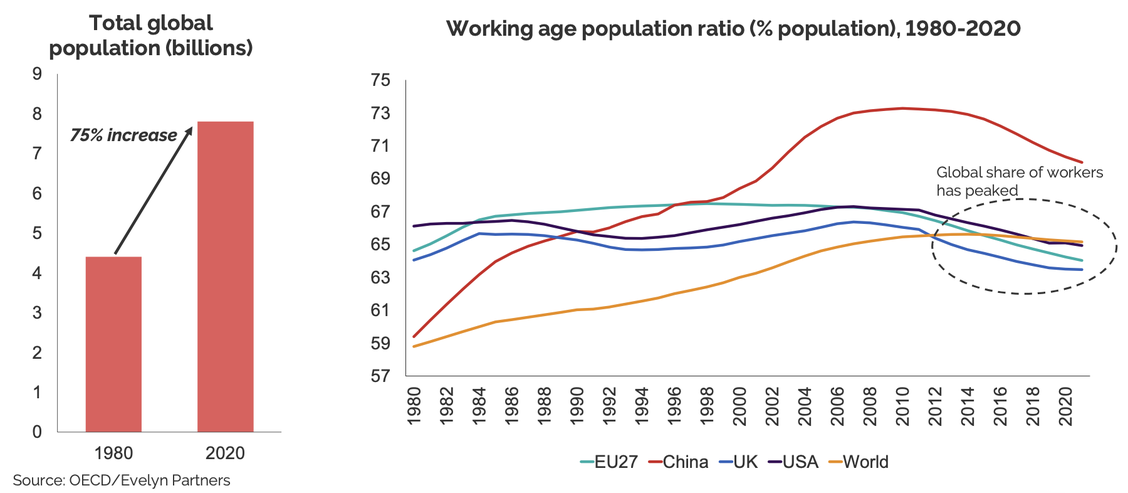

1. Favourable Demographics – massive growth in global population AND in the numbers of ‘working age people.

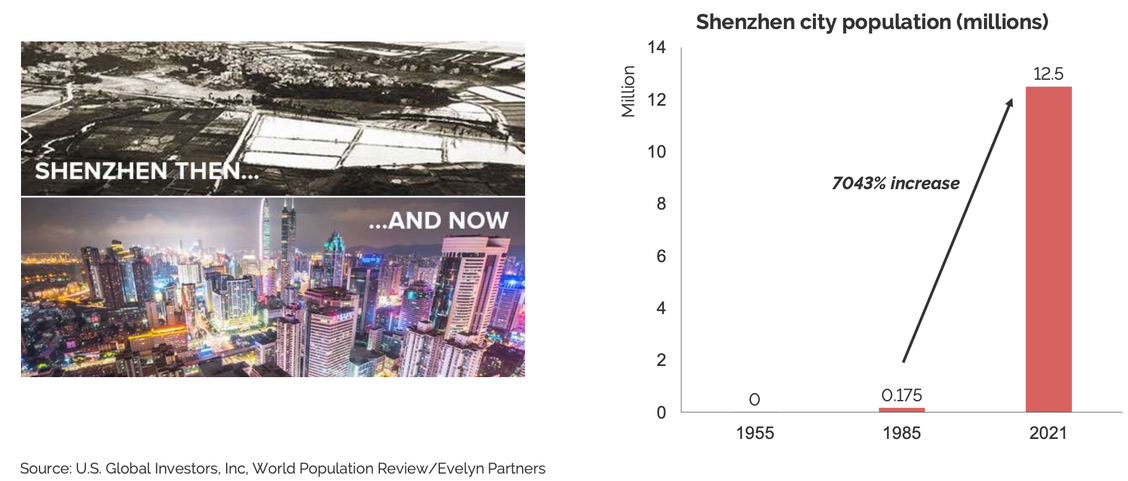

2. Massive movement of workers from rural regions into new cities facilitated rapid growth in manufacturing and economic output.

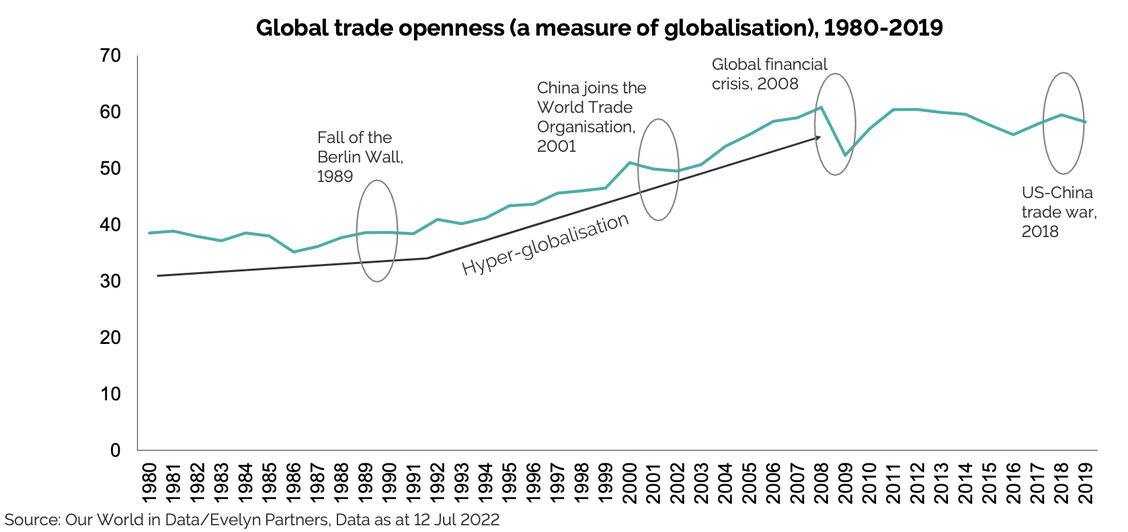

3. Globalisation enabled advanced economies to tap into this pool of cheap labour. But it now seems to be slowing…

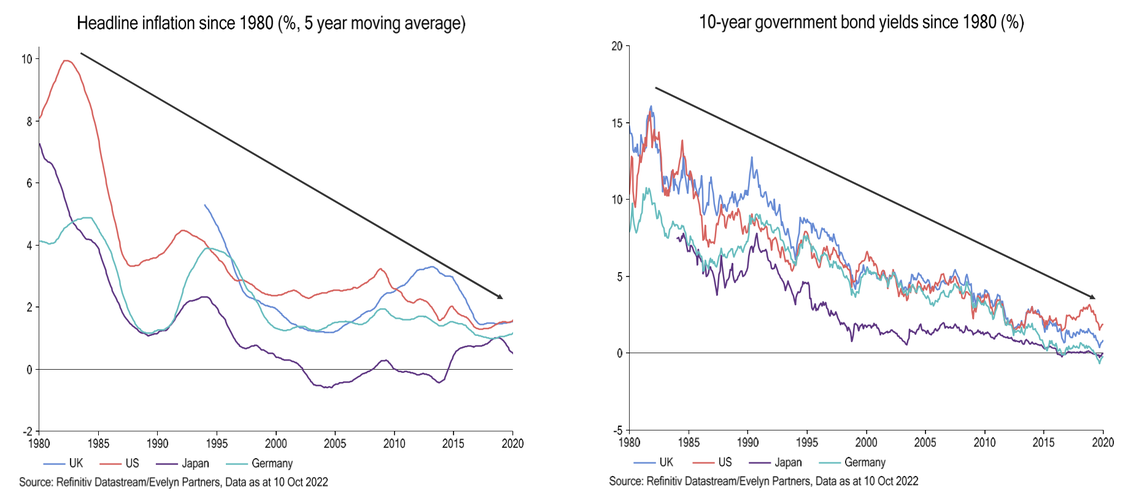

The economic impact has been significant: 40 years of falling inflation and interest rates!!

The Next Decade

So is it really different this time?

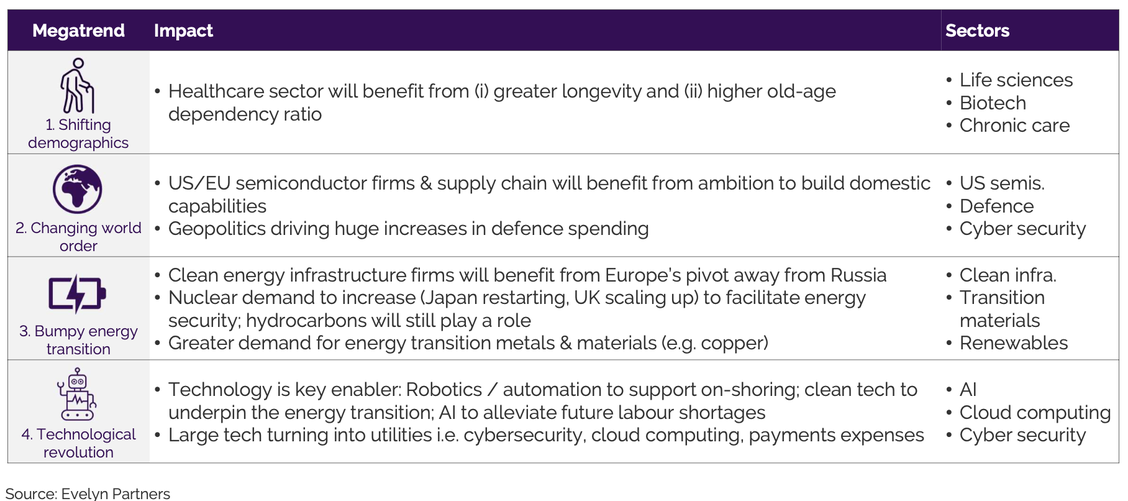

YES – We are at an inflexion point. 4 “Megatrends” will shape markets over the next 10 years – and beyond!

- Shifting Demographics

- Changing World Order

- Bumpy Energy Transition

- Technological Revolution

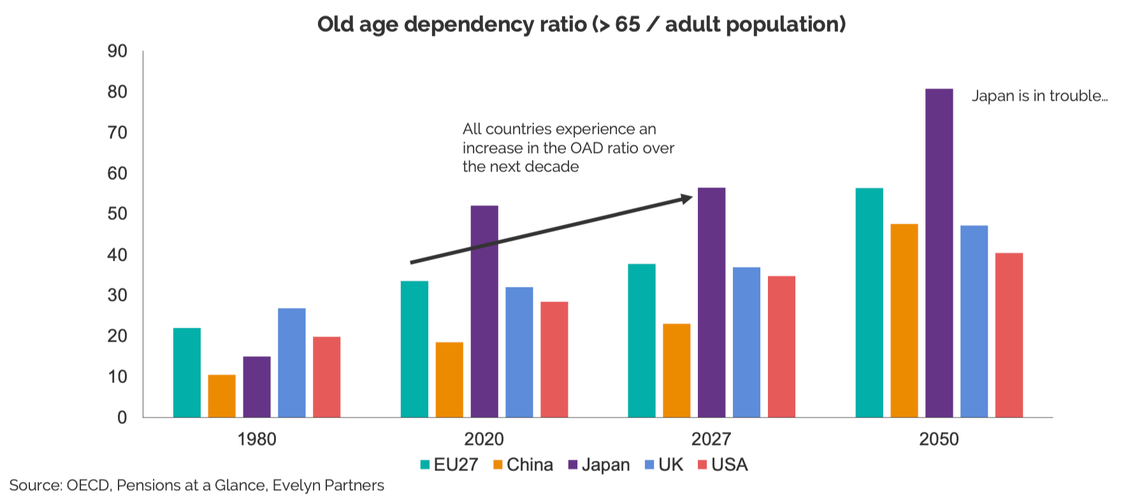

1. Shifting Demographics: The old-age dependency ratio is set to increase sharply & population growth will slow

2. Changing World order: US-China decoupling and the war in Ukraine will result in ‘slowbalisation’.

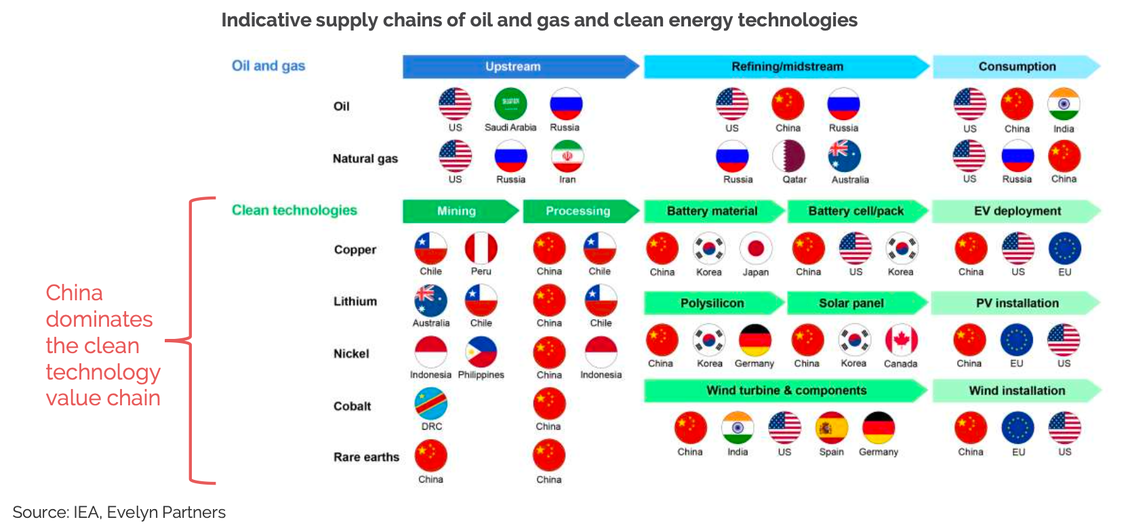

3. Bumpy Energy Transition: The war has undermined energy security & accelerated the energy transition… But the transition is likely to be bumpy. It will bring new energy trade patterns and geopolitical considerations into play…

Who really owns the infrastructure which will help our Energy transition?

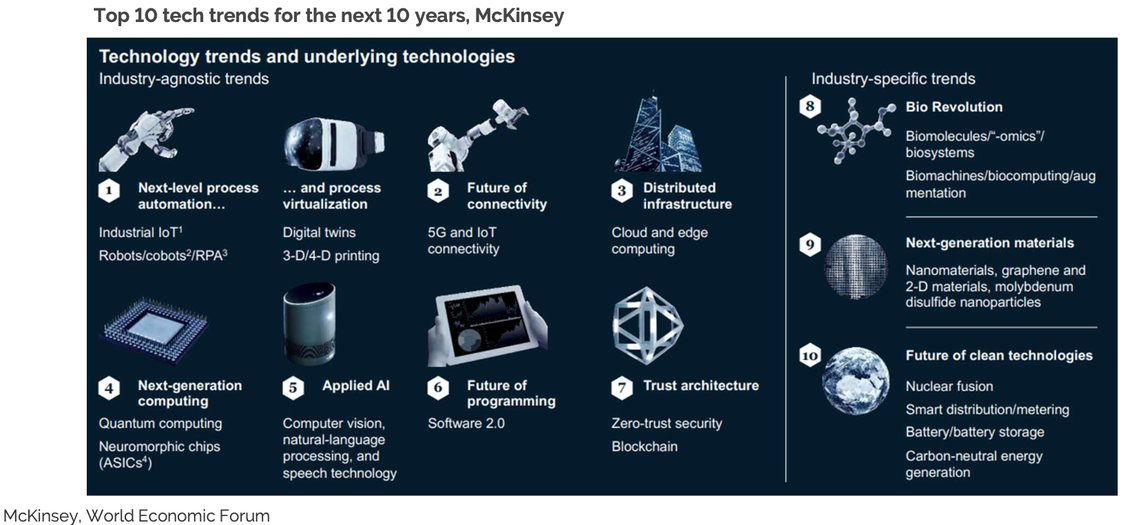

4. Technological Revolution: New technologies will underpin the future of business and most areas of our lives… for example Artificial Intelligence and Automation

So if we really are entering a genuinely different world, how do we manage our money over the next decade and beyond?

All of these factors will present challenges AND opportunities and so it is important to align our approach to benefit as much as possible from these opportunities and minimise the risks of being on the wrong side of the challenges.

Is it time to review your investments?

I hope this ‘longer term’ view has helped you put your existing investment choices into perspective or helped you when choosing new investments.

If you want help with reviewing existing or choosing new funds then don’t hesitate to get in touch.

I want to sincerely thank the team at Evelyn Partners, one of the investment management firms we work closely with, for this excellent piece of research and its refreshingly long term approach.

For more information on this please visit Evelyns Megatrends Hub here www.evelyn.com/good-advice/megatrends/

Make a time to call – it’s good to talk

If we haven’t spoken recently and you want to get in touch via my new booking system then please click on the link to book a quick call.

I have linked my diary to the excellent ‘Calendly app’ which allows us to arrange our next call, zoom or face to face meeting more easily – feel free to forward to family or friends who might need my services.