Are you interested in learning more about Succession and Domicile Planning? Join us at our free to attend educational workshop on 7th November, where our speakers will be discussing the 2024 tax landscape, retirement planning options, investment solutions and tax strategies for expatriates living in Portugal.

Succession and Domicile Planning in Portugal

By Portugal team

This article is published on: 4th November 2024

The workshop will cover:

- Portuguese and UK inheritance taxes: thresholds, rules and allowances

- Succession laws: UK rules, Portugal and forced heirship, Wills and Brussels IV

- IHT mitigation strategies and planning ideas

- Gifting: thresholds, rule and avoiding IHT clawback

- QNUPS: does it really shelter UK IHT in practice

- How to protect family wealth, your beneficiaries and bloodline planning

- How to control family wealth during your lifetime and after your demise

- Open Q&A throughout

Succession and Domicile Planning Workshop

7th November 2024

Date: 7th November

Time: 10am-1pm

Venue: Wyndham Grand Algarve

Quinta do Lago, Av. André Jordan 39, 8135-024 Almancil

Pension Planning and Income Generation Workshop

27th November 2024

Date: 27th November

Time: 10am-1pm

Venue: Wyndham Grand Algarve

Quinta do Lago, Av. André Jordan 39, 8135-024 Almancil

The workshop will cover:

- How different types of pensions are taxed in Portugal

- Where tax should be paid on different types of pension income

- Double taxation and how to avoid it

- Drawdown options and the tax implications

- UK pension changes: LTA abolition, impact on taxation

- Tax planning opportunities: Pre-April 2025 planning window

- QROPS & QNUPS: Do you really need one or should you keep your UK pensions?

- How to pass on your pensions and the implications for your beneficiaries

- Open Q&A throughout

Update on UK pensions when living in Spain

By Barry Davys

This article is published on: 4th November 2024

During the Brexit negotiations, many of us Brits living abroad were concerned about our fate following March 2019. Thankfully, Britain and the EU reached a solid agreement about the rumoured ‘freezing’ of the state pension after Brexit, and the result is very positive indeed – state pensions will continue to increase for those of us living in the EU.

To read the full article please click here www.telegraph.co.uk/pensions-retirement/news/britain-eu-reach-agreement-expats-state-pension-brexit/

Further to the post above about the UK State pension. Here is how helpful this agreement to increase pensions has been. All figures per week

- 2017 – £159.55

- 2018 – £164.35

- 2019 – £168.60

- 2020 – £175.20

- 2021 – £179.60

- 2022 – £185.15

- 2023 – £203.85

- 2024 – £221.20

- 2025 – Budget announcement £230.30 (has to be confirmed by Parliament)

At a time that is convenient for you

Nice-Cannes Marathon 2024

By Peter Brooke

This article is published on: 2nd November 2024

Run with Purpose: Peter Brooke and The Spectrum IFA Group Take on the Nice-Cannes Marathon 2024!

On November 3rd, Peter Brooke from The Spectrum IFA Group will proudly run with The Run for Hope Team in the Nice-Cannes Relay Marathon. For years, Peter and Spectrum have embraced this challenge, raising awareness and funds for a cause that deeply resonates with them.

The Run for Hope team, is a partnership between Mimosa and Cancer Support Group 06, brings together a community of runners from beginners to experts, inspiring teamwork and fun to raise funds for cancer support by running in the Nice-Cannes Relay Marathon. Participants enjoy comprehensive training, support and a festive after-party, all contributing to a great cause, the support of cancer patients on the French Riviera.

As experts in financial planning for English speaking expatriates living in Europe, The Spectrum IFA Group provides comprehensive and personalised financial advice, and planning. Peter, who has been with Spectrum for 20 years on the French Riviera understands the complex financial and tax issues his clients face and he and Spectrum are dedicated to helping you navigate these challenges.

By participating in the relay marathon, Peter and Spectrum demonstrate their commitment to the broader community on the Côte d’Azur. Supporting The Run for Hope Team allows them to blend their professional expertise with their passion for making a difference. Cheer on Peter and the whole Mimosa team as they run for hope, showcasing the same dedication they bring to managing your finances.

Together, we can achieve great things—both on the marathon route and in your financial journey!

The Spectrum IFA Group: Running for Hope, Running for You!

Off The Rails

By Michael Doyle

This article is published on: 1st November 2024

I was travelling back to Brittany by train from Luxembourg on Friday 26 July. A day that may have been remembered for it being the opening ceremony of the Olympics in Paris. I expected some disruption due to the sheer number of people visiting Paris, but I’d no idea what would happen next.

If you don’t know by now the rail network was attacked by vandals who set fire to the fibre optics on the tracks and in doing so put almost 800,000 train services “off the rails”.

What I was impressed by was the network’s response. They had police at most if not all stations affected, they increased the labour rate and what could have been a disaster was handled swiftly and efficiently, with trains back running within two days.

As financial planners, we sometimes have to deal with unforeseen and disruptive events. What happened on the rail network was totally unexpected. As a financial planner, I’ve had to guide my clients through the following over recent years:

- The Brexit referendum and stock-market response that followed

- Donald Trump’s election as US president

- Covid (when stock-markets all but shut down)

- The Russian invasion of Ukraine

- Trump losing to Biden

The main thing my clients were happy with was that I provided reliable guidance on investment repercussions and how to address the events.

This was through either:

- Reviewing and validating their existing investment strategies

- Rebalancing portfolios to ensure still aligned with agreed investment objectives

- Discussing tactical opportunities in response to market conditions

- Proposing suitable investment funds or asset managers

- Reassessing their attitude to risk

So if you had a nervous time with your own financial planning during those uncertain times, or indeed at any time, give me a call and we can work together to ensure you remain “on track” to achieve your financial goals.

The relationship with a financial adviser

By Victoria Lewis

This article is published on: 31st October 2024

The majority of individuals that receive professional financial advice across the UK have remained with the same adviser throughout, a new study by St. James’s Place (SJP) reveals, highlighting the power of longstanding advice relationships. Just under 12,000 UK adults were surveyed this year and the results show financial advice and guidance can benefit immensely.

More than 62% have never switched their financial adviser, rising to nearly 75% for those aged 35 and over.

The study also found that the typical relationship with a financial adviser or advice firm lasts around 7 years, but this increases to over a decade for those aged 55 and over – with nearly 31% of this generation having been with their adviser for 16 years or more.

Trust, understanding and financial satisfaction are the main reasons for never switching financial adviser:

• Trusting their adviser

• Being happy with the advice and financial returns their adviser has delivered

• Their adviser understanding their financial situation

• Having a good relationship with their adviser which has been built over several years

• Their adviser understanding their long-term goals and helping to deliver them

• Their adviser looking after both them and their family

• Their adviser having helped them through big life stages/ moments

SJP said: “Financial advice is about much more than numbers on a page or graphs on a screen.

It’s about building deep, meaningful relationships, and as our research shows these can last many years and span generations.

Whether you’re navigating the early stages of wealth creation, planning for retirement, or managing an unexpected life change, having a trusted adviser by your side can make all the difference.

These were the main reasons cited for working with a financial adviser on an ongoing basis:

• Putting the foundations in place for a stronger financial future

• Helping them to save more money for retirement

• Ensuring they have adequate protection in place if they need it

• Getting on the property ladder

• Navigating difficult periods like divorce or bereavement

• Pass on money to their children or loved ones

• Better manage the cost of raising children

• To provide more financial support to elderly family members

Andy Payne continues: “These goals, moments and milestones may be common to many throughout their lives, but the specific circumstances will always be unique. Having support from an expert financial adviser, with not just the technical expertise but the empathy to deploy it sensitively and with their clients’ needs in mind, can be the difference between a hope dashed and a dream realised.”

If you have already have a financial adviser but doubt if they are the right person for you, perhaps it’s time for a change?

Or perhaps have you been struggling to navigate your financial planning on your own?

I have worked with Spectrum as an International Financial Adviser for over 21 years and still look after my clients who worked with me from the very beginning. I advise the children of my clients now and even other family members too.

The synergy I have with my clients is because we understand each other – our relationship is based on trust and confidence and I know it’s an enjoyable experience because they recommend me to their family and friends. That’s the greatest endorsement I could wish for.

ECB Rate Cuts

By Spectrum IFA

This article is published on: 30th October 2024

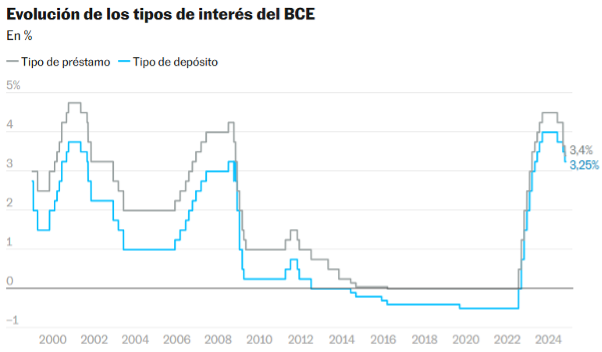

June, September, and now October. The European Central Bank (ECB) has lowered the interest rate by 25 basis points, marking its third rate cut in 2024 and the second consecutive reduction—a sequence not seen in 13 years (see graph).

Inflation is now at 1.7%, its lowest level since April 2021 and below the 2% target.

The ECB’s last meeting of the year will be on December 12th . Monetary analysts predict four more rate cuts by mid-2025, to be followed by a period of stability. According to the ECB’s survey, marginal rate adjustments could occur in 2026, especially in the first half, which would bring rates to around 2% for that year.

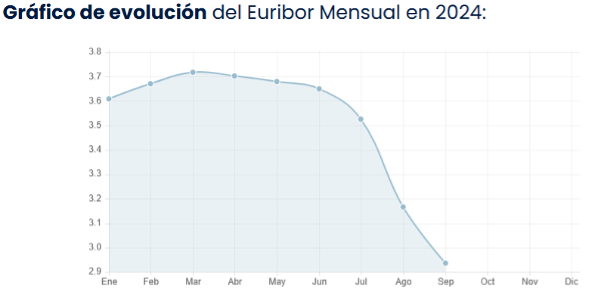

As a result, the Euribor has declined. In October, the monthly Euribor rate stood at 2.711%, a decrease of 0.225 points from the previous month’s 2.936%. Starting 2024 at 3.609%, the Euribor has accumulated a total drop of 0.898 points over the year, as illustrated in the accompanying table and graphs.

As a result, we are starting to see a reaction from the banks. With inflation now at a low and the Euribor experiencing steady declines, further cuts are expected into 2025. This trend has prompted a cautious response from banks, which are gradually reducing interest rates. As the ECB signals possible marginal adjustments by 2026, the Eurozone may enter a phase of rate stability, providing a potentially favourable environment for both borrowers and lenders.

Should you have any inquiries regarding the content of this article, or any other questions relating to mortgages in Spain, please do not hesitate to reach out to us for further information.

Patricia Nadal

spain@spectrum-mortgages.com

Searching for a financial planner

By Michael Doyle

This article is published on: 29th October 2024

It can be a daunting experience!

I started my life in financial planning in Glasgow, Scotland, back in 1998. I moved to Luxembourg in 2008 and began to cover both Luxembourg and Brittany (France) from 2019. I’m not sure where the years have gone, but I am grateful to have worked with some fantastic clients during that time from the likes of KPMG, Champs, The ISL (Luxembourg), UBS, St George’s School, Greenfield Recruitment and the list goes on and on.

I understand that initially my clients sometimes feel nervous when they come to see me as they are probably about to make one of the biggest financial decisions of their lives. I try to put myself in their position to try to fully understand what they need. To help my clients I’ll ask such questions as:

- I understand that you will be looking to work with me or someone like me. Let’s say that we start working together and we’re 12 months ahead of now. What three things did I do that made you happy you employed my services?

- Tell me three things I must always do and three things I should never do.

- What is your golden ticket? By that I mean, when we get to the end of the investment term, what is the goal we are saving for and what does that look like to you?

- If you have used a financial planner in the past what was the best thing about them and what was the worst thing about them?

After I gather all of the hard facts – the basics from name, address, money coming in and money going out, cash and investment holdings, to your immediate and longer-term planning priorities, plus your investment knowledge and attitude to risk – we call an end to the first meeting, and I start researching and preparing a suitable recommendation. This written proposal is carried out at no cost and entirely without obligation.

Why do I not charge for my reports? Simply because I want my clients and prospective clients to see how I work before they commit to using my services. Note that in our initial meeting I also explain fully how I am remunerated and the extent of my service offering, from introductory engagement through to long term reviews and support.

My report is then presented and explained, to allow clients do their homework and cross reference what I am saying with their own research. Then we have a second meeting when I will answer any remaining questions.

At this point the clients are invited to take some time to think over the recommendation and come back to me with any final questions they may have. Only at this point will we move to the final step in the advice process, which is completion of outstanding paperwork to implement the plan and set the investment in place. From here, my commitment to ongoing client service and support is open-ended. My aim in all of this is to grow and protect my clients’ wealth as tax efficiently as possibly whilst developing long-term and productive relationships.

It’s a Classic!

By Michael Doyle

This article is published on: 23rd October 2024

I’m not a big fan of cars. I just never really got interested in them when I was growing up and couldn’t even tell you where to put the windscreen wash when you open the bonnet (hood for our American friends who may be reading this).

However, I can look at a car and think “Oh that’s nice”.

Saying that, a funny thing happened to me the other day while I was out walking in Luxembourg: a classic car passed me on the road and then I passed two others which were parked.

These were all beautiful cars. So much so that I stopped and looked in the window of the third car, which was an old Jaguar. The owner had kept it beautifully – the leather was still top quality and the look inside was fantastic.

Then it struck me. This car is probably expensive to keep and doesn’t have any great features.

There was no place that I could see to charge your mobile and the sound system looked like it couldn’t even play an old tape or CD.

Then I was thinking about why some people come to see me for financial advice and often it’s because they have an investment which is a classic.

These old investments were the only ones available when they took them out but:

- Did not allow for withdrawals until the end of the term

- Had an initial 5%-7% fee for every premium invested

- Had high running costs

- The investment company had little to no contact with the client

Products these days see a minimum of 100% of your investment invested from day one. They offer flexible access without penalty. We can add a specialised fund manager to take care of the investment. Typically, they have much lower running costs.

So, take some time today, gather up all of your old classics and I’ll carry out a full review and can show you if we can move these to a more modern investment where we can add both value and growth.

French Bank Accounts

By Occitanie

This article is published on: 22nd October 2024

Back to basics – an overview of some French bank accounts.

French Interest-Paying Bank Accounts

Whether your level of savings is modest or if your financial circumstances are more comfortable, we recommend that everyone considers using one or more of these accounts available from all banks in France.

These accounts pay interest and there are several available, depending on your circumstances, all providing a modest risk-free return on your savings.

In addition to paying interest on funds deposited, the other benefit common to all these accounts is that the interest payable is exempt from tax and social charges.

Livret A

Eligibility: Open to everyone with a minimum deposit of €10 (only one account per person) and offered by all banks. There are no requirements in relation to age, nationality or tax residence.

Permitted Value: Once the balance of the account reaches €22,950 (whether by deposits or interest or a combination of both), no further deposits can be made but interest can take the balance beyond this maximum.

Current Rate of Interest: 3% per annum

Livret de Développement Durable et Solidaire (LDDS)

Eligibility: Available only to adults who are tax resident in France and offered by all banks. Only one account per adult and no more than two accounts per tax household.

Permitted Value: Once the balance of the account reaches €12,000 (whether by deposits or interest or a combination of both), no further deposits can be made but interest can take the balance beyond this maximum.

Current Rate of Interest: 3% per annum

If you are an adult tax resident in France, it is possible to hold one each of the above. For example, a married couple can hold two Livret A and two LDDS accounts between them with a maximum deposit of €69,900.

Livret d’Epargne Populaire (LEP)

Eligibility: Available at banks, this account is specifically for those on more modest incomes. This account is only for adults and those who are tax resident in France with a limit of two accounts in a tax household.

As this account is focussed on those on modest incomes only, income ceilings apply. If opening an account in 2024, your tax income in 2023 will be referenced. For example, for a 1-part tax household, the ceiling is currently €22,419 and for a 2-part tax household, €34,393.

Permitted Value: Once the balance of the account reaches €10,000 (whether by deposits or interest or a combination of both), no further deposits can be made but interest can take the balance beyond this maximum.

Current Rate of Interest: 4% per annum

Livret Jeune

Eligibility: This account is reserved for young individuals between the ages of 12 and 25 years. An account can be opened with a minimum deposit of €10 with funds freely available from the age of 18 years. Up until the age of 16, minors must obtain the authorisation of their legal representative to make a withdrawal and between 16 and 18 years of age the legal representative has the right to object to a withdrawal request. Only one account is allowed per person.

Permitted Value: Once the balance of the account reaches €1,600 (whether by deposits or interest or a combination of both), no further deposits can be made but interest can take the balance beyond this maximum.

Current Rate of Interest: The current rate of interest can be set freely by the bank but must be no lower than that of the Livret A (currently 3% pa).

The accounts outlined above are always worth using for immediately accessible funds which provide a return which is exempt from tax and social charges, however, the interest rates currently available are the highest for years and will start to decline, with a first reduction likely in January 2025.

Next time

In our next article we will focus on savings/investments where no limits on the investment value exist and where the potential for greater returns is possible. With additional benefits, including tax efficiency and significant inheritance benefits, all roads lead to the Assurance Vie!

If there are any subjects you would like us to cover in one of these articles or if you would like to contact one of our advisers for a financial consultation (no fee), then please get in touch at info@spectrum-ifa.com

The Three Amigos

By Michael Doyle

This article is published on: 21st October 2024

The 1986 movie “The Three Amigo’s” (starring Steve Martin, Chevy Chase and Martin Short) was one of my favourites in my early teens. I laughed so much at that movie and it brings back great memories watching it with my friends in the cinema.

But where does this fit in with financial planning, you’re probably asking yourself.

Well, the three amigos in financial planning are:

• Time

• Knowledge

• Inclination

This is what a financial planner has.

When you are considering your financial situation, ask yourself these questions. Do I have the time, knowledge and inclination to be my own adviser? If you have all three, then you probably won’t have as much need of a financial consultant. If, however, you fall down on one of these, I can quite confidently argue that you need a specialist, and that’s where I come in.

This is my job, and after my family, this is what I’ve committed my life to. So, I have the time to do all of the research on your behalf.

I’ve been in the financial service industry for 25 years so bring a lot of knowledge with me. Not only that, I am backed by a fantastic company in Spectrum who work every day to find better products, better solutions and better advice for our clients. Why does that matter? Well because we have 50 financial advisers across France, Spain, Portugal, Italy, Luxembourg, Malta and Switzerland and have been offering advice since 2003.

Do you really want to be monitoring your portfolio monthly, rebalancing every 6 months or so? If you don’t have the inclination to do this you could see your investment going sideways.

So let’s work together and get the Three Amigos on your side.