I am back in the office after Le Tour de Finance dates last week in Abruzzo and Marche…..and I learned something interesting from the people that came along!

Le Tour de Finance visits Italy

By Gareth Horsfall

This article is published on: 30th October 2023

It was great to be getting out of the office again and going and touring the country with our financial experts. I have to admit that the organisation of the events is a bit stressful: finding and negotiating with the venue, finding the right people to come and speak and then dealing with the logistics over the 2 days. But, in the end, it is not just good for work, but I really enjoy being able to be to be out and about, visit new parts of Italy and meet new people and speak with old, alike.

These Le Tour de Finance events were all about the ladies!

I had deliberately invited only female speakers to get another perspective on the world of finance this time and although I can’t exactly put my finger on what was different, the atmosphere was different in some way. Exactly what I can’t say, but something for sure. So, I will put that down as a success!

I did mention above that I learned something from the people that came along. There was a difference in the focus of people’s attention this time. Normally it has been primarily focussed on Italian taxation and the financial planning in Italy, but this time the majority of the questions and queries during the talk and after over lunch, were centered around the investment markets and the future outlook for investors. I guess that shouldn’t have taken me by surprise given the state of world geopolitics, but it was interesting to note and helps me to focus in these E-zines and my other articles.

However, this E.zine is not designed to provide you with a long interpretation of what was said on the day. Instead I managed to find the time to interview the speakers and here are the videos, in full.

If you also have questions about financial markets, investing and how world geopolitical events affect your money then you might find the interview with Joy Callender and Lorraine Reddaway from RBC Brewin Dolphin very interesting. We have inserted some slides into the videos which provide visual aids to what we are saying.

First interview with RBC Brewin Dolphin asset managers.

Second interview with Stefania Falcone at Currencies Direct where we have a chat about exchanging currencies and the difference between them and Wise.

And the last video with Judith Ruddock of Studio del Gaizo Picchioni where we talk about the Agenzia delle Entrate, common tax mistakes for residents of Italy and what to watch out for.

Women & finance

By Portugal team

This article is published on: 30th October 2023

It seems strange to think that gender differences can not only affect the way in which we think about managing our finances but the practical needs and requirements too. But with 60% of the UK’s wealth estimated to be in the hands of women by 2025 (a trend seen throughout most countries) being cognisant of these differences will put you – or the women in your life – a step ahead.

What are the issues?

Even today, studies show that despite 85% of women running household finances, over half of women defer to partners to manage and make long term financial decisions. There are several reasons for this, but a lack of confidence saw women shying away from taking a more active role. With 3/4 of women aged 60 either single, widowed or divorced, relying heavily on a partner can leave them disadvantaged.

Women live longer than men and their finances must therefore last longer. Recent ONS statistics predicted a lifespan of 83.1 years for women, and where planning has not been put in place, or put in place with a male’s longevity in mind, women may find themselves struggling in later years.

Women are naturally more cautious and conservative, but over the long term, such investments have lower growth potnential. A YouGov study showed that 55% of women had never held an investment vs. 35% of men.

80% of companies are paying women less than men. A 2021 study by NEST showed that the average working woman could have a pay gap of £70,000 at retirement. Similarly, women are more likely to have taken time out of employment or reduce hours to care of children and/or elderly parents and relatives. These career breaks not only directly affect income, but can affect promotion or progression opportunities. This has a knock on effect on finances and women are seen to have approx. 51% less in retirement savings than their male counter parts.

These factors mean that women must take a different approach to men when thinking about their finances. This is something investment providers are recognising. For example BlackRock, the world’s largest fund manger, has recently launched investment funds geared at women and aimed at addressing and incorporating the issues women face.

What can you do?

Develop your understanding and relationship with money. Ask yourself why you have certain feelings or views around money. What makes you uncomfortable? When do you feel this? Why? Identifying your strengths and weaknesses will help you on your financial journey.

Make time to set goals and develop your financial plan. Your plan should be specific and realistic otherwise you are setting yourself up for failure.

If you are still working, know your worth. Women negotiate less than men when it comes to pay – 33% of women vs. 43% of men. Do your research, demonstrate your value and remember, if you don’t ask you won’t get!

Invest your money. Saving money is one thing, but how do you build wealth for the long term? The single most detrimental impact on savings is inflation. As things get more expensive, your income and savings must also grow to keep up, and cash or bank deposits are not a good inflation hedge. Whilst investing does carry risk, it provides the best opportunity for inflation beating returns in the long run – an opportunity for women to use their longevity in their favour!

Don’t be afraid of investing and use professionals to help you get it right. Statistics show that women make better investors, often achieving better returns than men. A study by Hargreaves Lansdown showed women’s returns outperforming men by 0.81% over 3 years (over 30 years this would result in a portfolio value of 25% more).

If you are already investing ensure that you review things regularly and pay close attention to your investments. It is not uncommon to see portfolios that have not moved in many years due to high fees or poor performance.

Take control and build your financial confidence. This maybe through education or working with professionals, but it will allow you to identify and take advantage of opportunities, achieve financial independence and peace of mind.

Tax changes in Italy

By Gareth Horsfall

This article is published on: 29th October 2023

I am rushing this E-zine out to you after travelling for the last 2 weeks, because there are some important developments in La Legge di Bilancio 2024 which may affect you.

Not since 2014 and the new tax laws introduced by Mario Monti have I seen such big changes in the tax system in Italy. Georgia Meloni’s government have clearly taken a leaf from that book and have introduced a raft of new tax law changes which have recently been announced in La Legge di Bilancio 2024. (These have not been passed yet, but it is highly likely that they will be voted on before year end!).

THE MOST IMPORTANT OF WHICH, FOR MY CLIENTS, IS AN INCREASE ON THE WEALTH TAX ON OVERSEAS PROPERTY!!!

Below I explain a few of the changes and which groups of people they might affect.

“Those who plan do better than those who do not plan, even should they rarely stick to their plan!”

1. Wealth tax on overseas property will increase from 0.76% to 1.06%.pa

On an average overseas property taxable value of GBP300,000 or USD300,000, the tax will rise by 900 a year!

2. Affitti Brevi – cedolare secca – tax to increase from 21% to 26%

If you rent out a property in Italy for short terms rentals (less than 30 days), and you are not registered as a company, then you have the option of applying the ‘cedolare secca’, which is a sort of preferential forfeit rate of tax (expenses non deductible) of 21%. This will rise to 26% from January 2024.

3. Proposed Tax Band changes for 2024

| 2023 | |

|---|---|

| €0 - €15,000 | 23% |

| €15,000 - €50,000 | 27% |

| €50,000 + | 43% |

| 2024 | |

| €0 - €28,000 | 23% |

| €28,000 - €50,000 | 35% |

| €50,000 + | 43% |

4. Non-EU citizens resident in Italy! will have to pay an annual contribution of €2000 to access the Italian health service.

(The contribution will not have to be paid for foreign students with a permesso di soggiorno or similar)

This is a huge development, because any non-EU citizen resident in Italy (US persons and now Brit’s) who is currently paying for access to the Italian health service is assessed based on a certain level of ‘reddito complessivo’ (total income).

You can access that info from the Minstero della Salute website on the link below:

https://www.salute.gov.it/imgs/C_17_pagineAree_2522_listaFile_itemName_0_file.pdf

If you are a non-EU citizen living in Italy, and maybe paying the minimum of €387,34 a year, then this could be a significant rise of nearly €1600 a year!

(Interestingly if you have a high income level and are assessed on the maximum under the current criteria, then €2000 a year would be a quite sizeable discount – assuming the reddito complessivo calculation is no longer valid).

Here are the categories of people who would need to pay.

1. Students or equivalent who are in Italy for a period of less than 3 months.

2. Holders of the permesso di soggiorno for ‘residenza elettiva‘ !!! who don’t have any form of work.

3. Persons of religious institutions.

4. Diplomatic and consular personnel of foreign representations in Italy. (excluding staff with an Italian work contract)

5. Employees of International organisations operating in Italy. (presumably United Nations et al)

6. Foreigners who work for International organisations operating in Italy. (not on Italian contracts)

7. Foreigners who participate in voluntary programmes

8. Parents, over 65 years old, who have or will move to Italy to be with family members, after 5th November 2008.

9. All other excluded categories.

*** Notable is the category of anyone applying for ‘residenza elettiva’. This will affect alot of UK and US citizens who may currently be applying to become resident in Italy under the residenza elettiva category.***

*****Interesting exclusion from the list. *****

One notable category of people missing from the list is Brit’s who were registered in Italy before Brexit and therefore have acquired EU rights as per the EU/UK withdrawal agreement, also retired Brit’s with the right to reciprocal healthcare in Italy under the S1 arrangement. It remains to be seen whether they would be expected to pay or not. (I would think not!) My suspicion is that no one has even thought about this category of individuals and so, like many pieces of Italian legislation, it is first introduced then clarified over time. My thinking is that this one will have to be taken up by the British Embassy and the remaining UK citizen rights lobby groups, for clarification.

And lastly……………………..

Changes to the meaning of residence and domicile!!

(very important for anyone who has residenza in Italy but is claiming ‘fiscal’ residency in another country)

The new text relating to the definition of residency and domicile is as follows:

“Il comma 2 dell’articolo 2 del Testo Unico delle Imposte sui redditi, approvato con decreto del Presidente della Repubblica del 22 dicembre 1986, n. 917 è sostituito dal seguente: “2. Ai fini delle imposte sui redditi si considerano residenti le persone che per la maggior parte del periodo d’imposta, considerando anche le frazioni di giorno, hanno il domicilio o la residenza nel territorio dello Stato ovvero che sono ivi presenti. Ai fini dell’applicazione della presente disposizione, per domicilio si intende il luogo in cui si sviluppano, in via principale, le relazioni personali e familiari della persona. Salvo prova contraria, si presumono altresì residenti le persone iscritte per la maggior parte del periodo di imposta nelle anagrafi della popolazione residente.”

Let’s anlayse the important differences below:

1. Change in the definition of domicile:

In Italian law it currently reads as:

“the place of your principal place of work or interests”

The new definition will be connected to your personal status and read as follows:

“the place where the person’s personal and family relationships mainly develop”

This could be significant for anyone who previously may have claimed working abroad as a criteria for not being resident, whilst their main family relationships were still in Italy.

2. Fractions of days.

If you are someone who has to count your days in and out of the country to maintain non-residency or residency alike, then you will likely need to count fractional days in Italy as well. i.e any time spent in the country in any one day will be counted as a full day for residency purposes.

3. Assumed residenza for anyone registered at the anagrafe for the majority of the fiscal period (calendar year)

Again, this is an important development for anyone who is registered as resident at the anagrafe, has a carta d’identità and certificati di residenza, but is claiming fiscal residency in another tax jurisdiction.

It is clear from these changes that the Italian government is tightening up the rules around residenza and closing those loopholes which many people have used to get around ‘residenza fiscale’ whilst retaining the benefits of being registered as a resident in the anagrafe,

I have been banging on that drum for a long time now. If you are registered as a resident in Italy for the majority of the calendar year then by definition you are also considered fiscally resident as well. Whilst the definitions allowed for people to get around the law, it seems that this will become much harder.

How all this will be put into action is anyone’s guess, but it might be prudent to think that once the laws are refined, then the authorities can use existing information to further investigate matters that have already come to their attention but they have been unable to act on due to the loopholes in the system.

Therefore, the advice is simple:

If you think that anything above might affect you then do some financial planning before it is too late!

Are bonds back?

By Portugal team

This article is published on: 27th October 2023

Recent times have been tough for bond prices due to rising interest rates and inflation concerns, but there are signs that the bond market could now offer some interesting opportunities for investors.

The bond market is much larger than the stock market with figures from Morningstar valuing the market at approx. $300 trillion compared with the stock market at approx. $124 trillion, so it is a significant market for investors to understand.

What are bonds?

A bond is simply a loan that an investor makes to a government or company in return for a set interest rate, known as a coupon. For example, if you buy a 10-year 5% US Treasury bond for $100, you are lending $100 to the US government who will pay you $5 each year for 10 years and at the end of the term, you get your original capital of $100 back.

Investors like the predictable income and the relative stability of bond investments. They also complement shares which tend to be more volatile e.g. when share prices fall and investors are nervous, they often flock to the relative safety of bonds, which pushes up the value of bonds to compensate.

There are many bonds to choose from, each with different levels of risk, and therefore return expectations. For example, instead of buying a US treasury bond, you could buy a bond in Apple or BP and because there is more risk in lending to a company than there in lending to the US government, you can expect a higher coupon of say 6% or 7% to compensate for this increased risk.

Recent market issues – an exceptional period

In simple terms, traditionally, the prices of bonds move in an opposite direction to interest rates so when interest rates rise, bond prices fall.

Given that interest rates globally have been steadily increasing for the last couple of years, bond prices have naturally suffered.

One unusual phenomenon we have seen is that stock markets have also performed relatively poorly so we have seen bonds and stocks falling at the same time. This is a very rare event which has only happened three times in the last 45 years and many commentators believe the normal diversification and inverse relationship between bonds and shares will resume going forward.

Last week, we saw that UK 30-year bond yields rose to their highest level since 1998 and similarly, US Treasury yields are at a 16-year high, despite high interest rates. So why is this?

From a UK perspective, the recent mini-budget included tax cuts and increased spending, something that will need to be paid for through increased borrowing. The government does this by selling more bonds. But more government debt without the economic growth to support it spells increased risk for the economy and it is this that triggered a large-scale sell-off of UK bonds, reducing the price and therefore increasing yields.

Looking forward

There are three supporting factors for a positive outlook for bonds:

1. As bond prices have fallen, the yield available to investors has increased substantially which supports bonds and the outlook for prices going forward. As a result, bonds may provide an attractive level of income, and at relatively low risk levels, which has not been seen for many years.

2. Figures from Vanguard, the world’s second-largest fund manager, show that bonds typically outperform cash in the three years following peak rate hikes dating back to 1980. The Federal Reserve, Bank of England and European Central Bank have all signalled interest rates are close to or have peaked already. The consensus is therefore that interest rates and yields should fall over time, and as prices move opposite to interest rates, bond prices should rise.

3. Bonds have historically performed better than shares and cash during recessions. With concerns still lingering about economies entering recessions, bonds could again offer value in a portfolio.

Of course, we always have to point out that history does not always repeat itself and things may happen differently this time, but the alignment of several tailwinds for bonds is a positive signal.

When a bond is not a bond

Please note that there are also tax structures known as “investment bonds” which are not to be confused with the bonds we’ve discussed in this article. Investment bonds are a form of tax wrapper and they are often used by residents of Portugal (as well as being efficient from a UK tax perspective) to hold and manage investment portfolios.

Spectrum supporting Mimosa Matters

By Peter Brooke

This article is published on: 25th October 2023

The Nice to Cannes Relay Marathon

As we gear up for the upcoming Nice to Cannes Relay Marathon on November 5th, I wanted to take a moment to share with you the reason behind my choice to support Mimosa Matters, a charity that holds a special place in my heart.

In a world that often seems to move too quickly, community stands out as a pillar of strength and support. It’s a reminder that we are not alone and that, together, we can make a meaningful impact. The Nice to Cannes Relay Marathon embodies the spirit of community, with individuals coming together to achieve a common goal through teamwork and perseverance, and having a bit of fun together through the aches and pains.

Don’t worry, I am not running the entire Marathon – that would be crazy – I will leave that for those whose fitness levels are way better than mine!

I am running the final 6.4km leg…. some might say the ‘taking-all-the-glory-leg’… for Team Early Birds, a gang of super women who are doing all the hard work over the proceeding 35.6km; if you have a spare euro or two, please do consider empowering our legs to carry us all to the end by helping us raise some funds for the important work that Mimosa undertake.

The fundraising link for our team is here

I was hoping to run a longer leg but a recent bout of bronchitis and a lower back injury have curtailed my training a little but I am back hitting the tarmac again and as I lace up my running shoes for my leg of the Relay Marathon, I am not just running for personal achievement; I am running to try and make a difference.

Mimosa Matters shares this commitment, and by supporting their cause, we can collectively contribute to creating a stronger, more compassionate community.

Your contribution, no matter the size, will help make a positive impact on the lives of those in need. Together, we can run towards a brighter and more connected future. Of course, please don’t feel any pressure to contribute at all… instead perhaps share this email or come and encourage us all on the road a week on Sunday, you won’t miss us, we’ll all be in bright yellow.

Why Mimosa Matters

Spectrum and I have chosen to support Mimosa Matters again because of the incredible work they do in fostering a sense of community and making a positive difference in the lives of others. Mimosa Matters goes beyond traditional charity by actively engaging with local communities and addressing their specific needs in the fight against cancer.

They work closely with local cancer professionals & associations to create and fund projects to increase awareness of the causes of cancer and to channel funds into cancer research and into associations that directly support patients and their families living with cancer in our region.

Sadly, too many of us have been directly affected by this relentless disease and we must stand, walk or run together to try and stop it.

Please follow these links if you would like more information about Mimosa Matters

https://www.mimosamatters.org/

and the Marathon https://www.mimosamatters.org/project/nice-cannes-marathon-2023/

And, in case you missed it, the all important fundraising link again for our team is here

https://www.helloasso.com/associations/mimosa/collectes/team-early-birds-running-for-mimosa

https://www.facebook.com/mimosamatters and https://www.facebook.com/financial.advisors

Thanks for taking your valuable time to read through this, I really appreciate it.

Financial seminars on the Algarve

By Portugal team

This article is published on: 17th October 2023

Even with diligent preparation and thorough planning comes a mild sense of apprehension as the big moment approaches.

How many guests will show up?

It was then with quiet satisfaction, and some relief, that Spectrum’s Debrah Broadfield and Mark Quinn welcomed a steady stream arrivals to their financial planning seminars in the Algarve this week.

At two venues over two consecutive days, 80 guests attended these events for a timely update on recent changes to the investment and tax planning opportunities (currently still) available to expatriates living in Portugal.

With explanations, practical examples, and responses to audience questions, our hosts highlighted how to invest securely, successfully and tax-efficiently, adding that professional guidance is (of course) essential for achieving the most favourable outcomes, and avoiding potentially expensive pitfalls.

Richard Flood and Lorraine Reddaway from RBC Brewin Dolphin complemented these presentations with an insight into investor psychology and the behavioural impact of emotional decisions on investment returns – perhaps unsurprisingly, inexperienced investors are often poor decision-makers when it comes to wealth management.

RBC Brewin Dolphin’s approach to stock selection and portfolio construction provided reassurance on the value of professional asset management.

Both seminars were well attended, with many guests requesting meetings for immediate help and advice.

Our team in Portugal are also running two workshops in November:

8th November 2023

Boavista Golf & Spa,

Quinta da Boavista, 8601-901 Lagos

10am – 1pm (with a coffee break)

9th November 2023

Magnolia Hotel,

Estr. Da Quinta Do Lago, 8135-106, Almancil

10am – 1pm (with a coffee break)

Covering a wide range of topics, our workshops aim to give you the knowledge to make good choices in all areas of financial planning, taxation and organising yourself for life in Portugal.

With an informal round table format, we will be discussing issues such as:

- How different types of pensions are taxed in Portugal

- Where tax should be paid on different types of pension income

- Double taxation and how to avoid it

- Drawdown options and the tax implications

- UK pension changes: LTA abolition, impact on taxation

- Tax planning opportunities: Pre-April 2024 planning window

- QROPS & QNUPS: Do you really need one or should you keep your UK pensions?

- How to pass on your pensions and the implications for your beneficiaries

- Open Q&A throughout

Finance update Q3 2023

By Peter Brooke

This article is published on: 13th October 2023

Let’s talk about CASH

Since my last quarterly update in August the mood in markets has been a little confused.

After the more optimistic start to the year when stock markets, especially in the US, showed resilience and the roots of recovery from a horrendous 2022, the summer was much more mixed. The Bank of England and the US Federal Reserve didn’t raise interest rates in September, though the ECB did but from a lower level.

August was much more volatile than expected with investors trying to work out if inflation had peaked and if central banks were done with their unprecedented interest rate hikes, and when they might start thinking about cutting rates.

The oil price has also settled at a higher-than-expected level, which might be a sign of increased economic activity, but it doesn’t help to get rid of sticky inflation.

Higher for longer

Interest rates are a means of dealing with inflation. Central banks raise rates to increase costs and reduce spending power with the aim of lowering demand and squeezing prices. This is an art rather than a science. Central banks need to find the right balance of weakening demand, while avoiding a recession. This has proved fiendishly difficult and tackling inflation has seldom been achieved without some economic pain.

We are currently in the eye of the storm. Over the past 18 months, global interest rates have moved from near zero to over 5% in some places. Inflation is coming down and interest rates may have peaked, but monetary policy operates with an unpredictable lag. It is difficult to know how much of these interest rate rises have fed into the economy and whether a recession is just round the corner.

Investors will have to start getting used to these elevated levels of interest rates for longer as the consensus opinion is now that interest rate cuts won’t come quickly and won’t be significant until inflation is firmly under control. We are still very much in a holding pattern.

So should I keep my cash in my bank?

Of course, one of the few benefits of these hikes in interest rates is that you can now achieve some positive return on cash, which hasn’t been possible for around 15 years!!

I am having a lot of conversations with people asking why they should consider investing rather than leaving money in the bank.

This is a very good question… equity and bond investors have had very little, if any, positive returns since January 2022 so why invest now when I know I can now get returns on cash?

For someone with a very short-term time horizon, and therefore a very low risk profile, then cash earning around 5% will look attractive. Clearly tax is an issue, which will diminish this return but still it is at least a certainty.

What about those with longer time horizons – should they stay in cash given the high returns relative to recent history?

There are several considerations here:

1. Sticky Inflation

If base level inflation is to remain higher for longer then we still need to consider the NET return you will be getting on your cash.

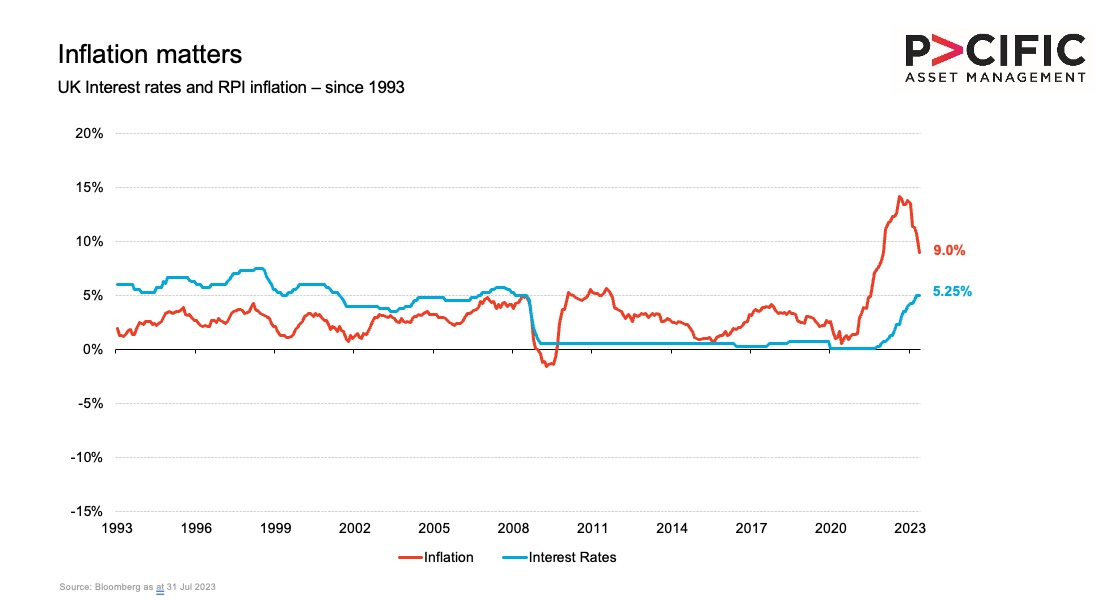

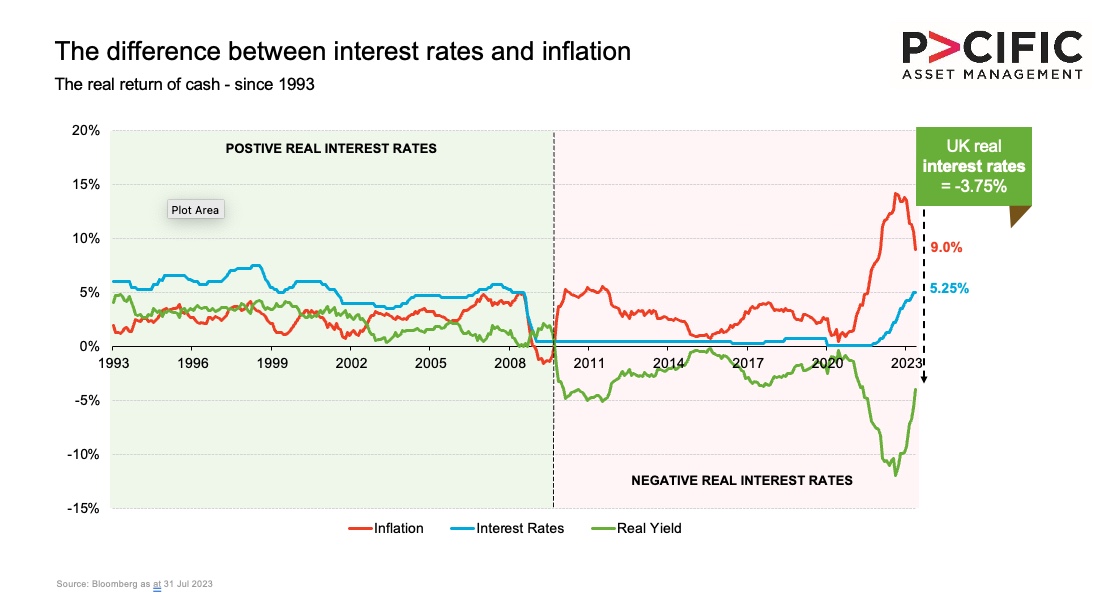

Here is a chart showing UK Inflation and UK interest rates over the last 30 years – even today inflation, though falling, is still above base rates:

Put another way – if we take one away from the other we can see that the REAL return on cash today is still negative (the green line) – that’s a guaranteed loss of 3.75% over the next 12 months.

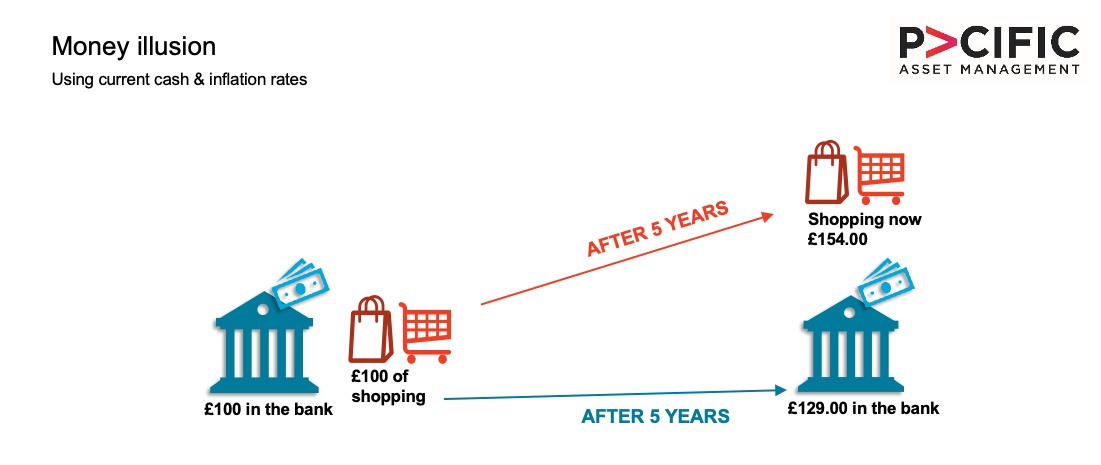

Put another way again… what can you buy in 5 years if things remain as they are today? See below for a real world example of how inflation affects us all:

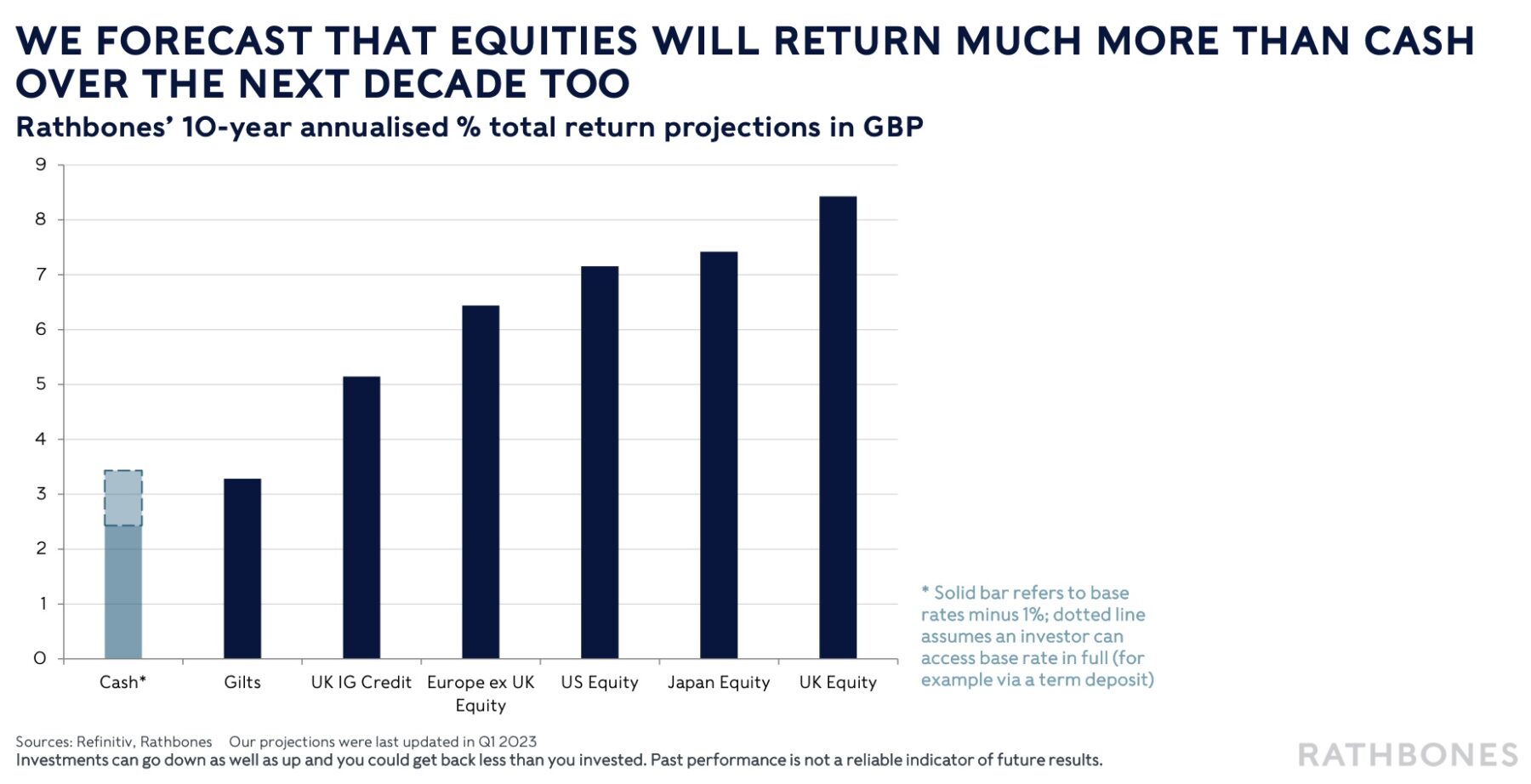

2. Other investments should do better…

BONDS:

Most investments are valued versus the ‘risk-free’ rate of return (ie cash).

So when cash was paying you 0.1% many investors were happy to accept 1.5% to 2% from high-quality investment grade bonds, even though they come with a little more risk….

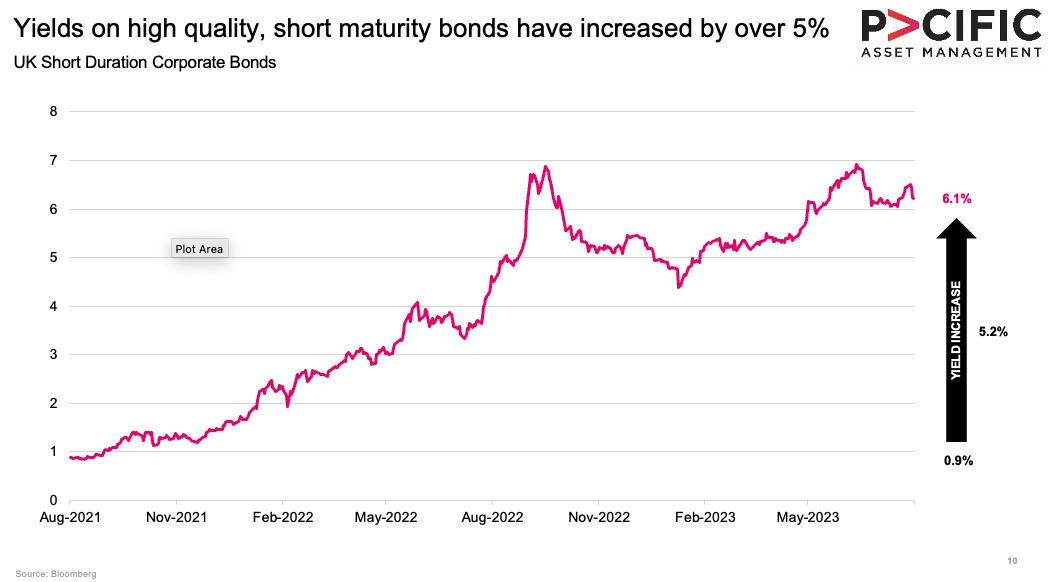

… so there is a strong case for buying bonds today yielding 6% to 7% because we are happy to be paid the extra 1.5% to 2% for the extra risk we are taking… this is exactly where bond ‘yields are today’.

SHARES:

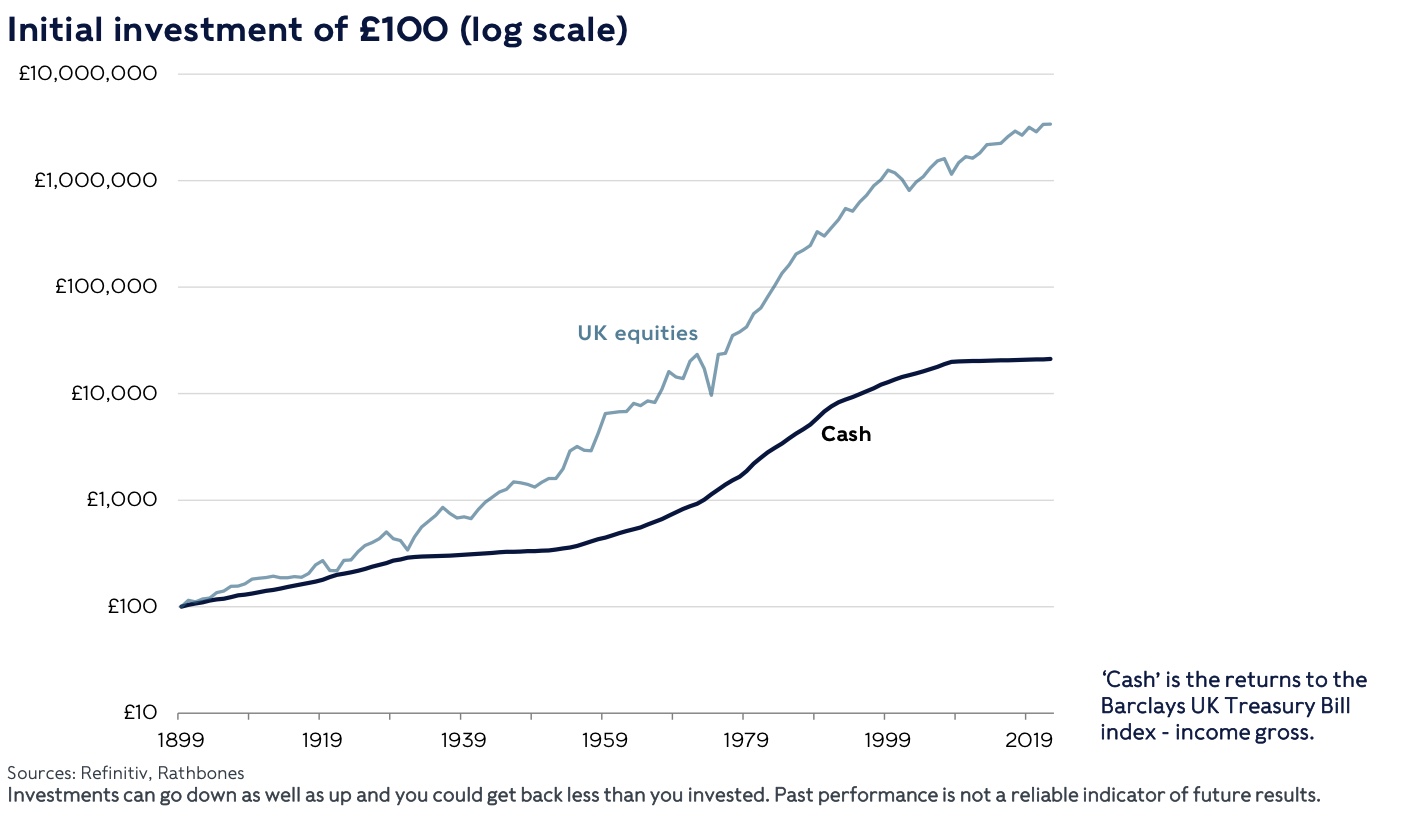

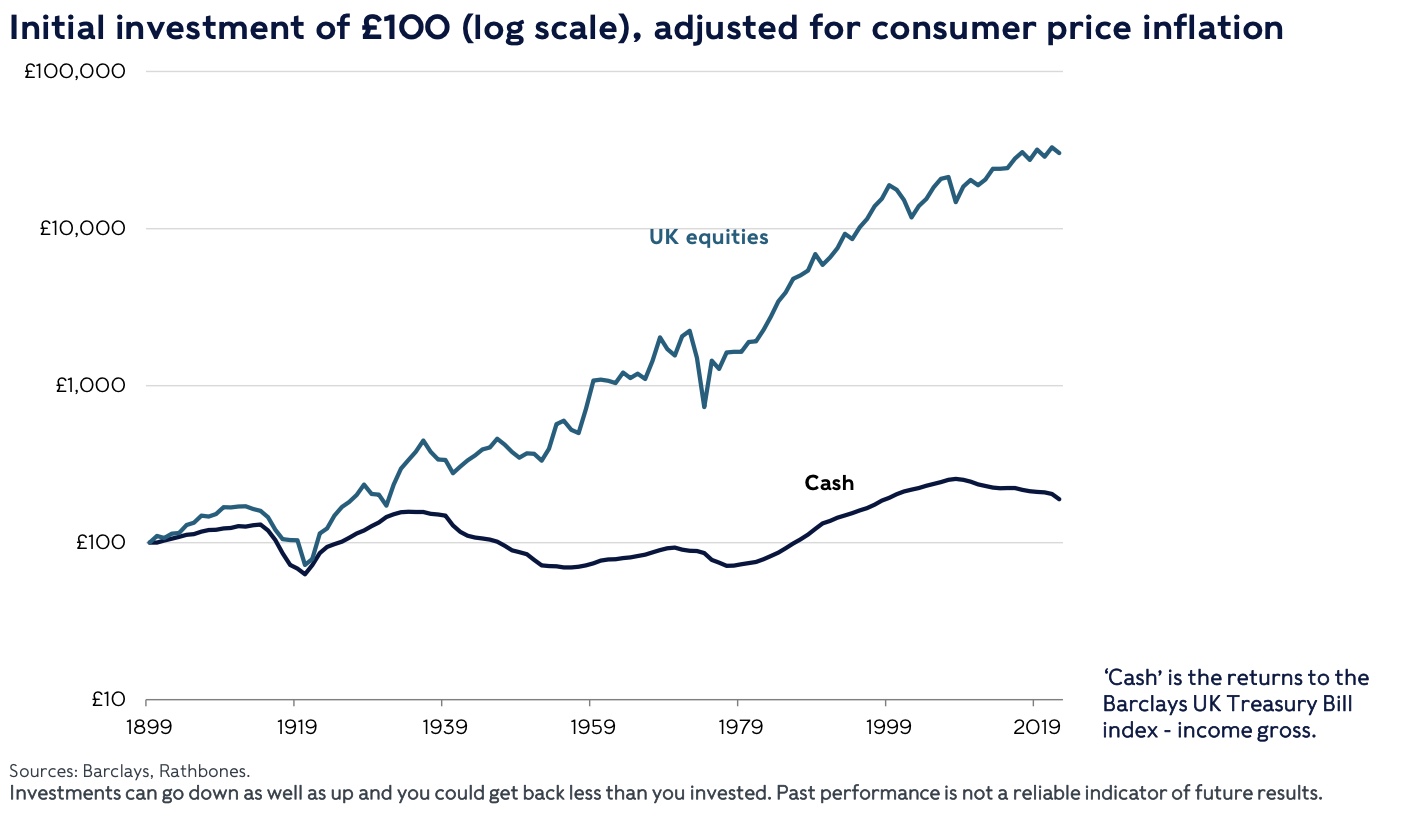

Though more volatile, shares have always outperformed cash AND inflation over the longer term.

And expectations over the coming years are that shares will continue to outstrip returns on cash:

In Summary

We feel that we are getting closer to understanding a little more about how the future might look. Inflation seems to have peaked but will remain sticky for a while, which will mean interest rates are likely to stay higher too for longer than originally thought.

The chance of global recession is still there but nor lower and the consensus appears to be that it will be soft and short if it emerges at all. This can be good for stock market performance but in the meantime cash and bonds are, for the first time in a very long time, a genuine investment option; though sticky inflation must be taken into account when choosing how much to leave in cash.

Inflation is a financial reality that we all need to navigate. By proactively addressing this challenge and exploring investment opportunities that protect your wealth, we can work together to ensure your financial future remains secure.

If you have capital to invest for longer than the next couple of years then an actively managed multi asset approach should be considered to minimise the effects of inflation on your hard earned funds.

I would very much like to thank the investment teams at Pacific Asset Management, Rathbones Investment Management and Evelyn Partners for their input into this data and summary.

If you would like to dive deeper into these subjects please check out the following links:

3rd Quarter Outlook from Pacific Asset Management

Why do interest rates and inflation matter for investors from Evelyn Partners

Feel free to get in touch if you have any questions via the below channels, or the booking system – always drop me a quick message if you need a time slot outside of those available.

If you have missed any previous emails, click here to access the Archive.

For now, have a great day, speak soon…

Top tips for expat finances | Spain

By Chris Burke

This article is published on: 10th October 2023

The clocks go back in a few weeks, so enjoy the last of the summer evenings before its time to get the winter wardrobe out and get cosy!

This month’s Top Tips are as follows:

- Wills – Why almost everyone should have one

- How to build a pension in Spain, quick example

- Why have your investment in a tax ‘Wrapper’ rather than an investment platform?

Wills – why almost everyone should have one

If you die whilst living in Spain or owning property/assets here, the expression is known as dying ‘intestate’. To quote why you should not want this to happen (apart from the obvious!) the Law societies words are as follows:

“Dying intestate not only means your final wishes will probably go unheeded, but the financial and emotional mess is left for your loved ones to sort out. This need not be your final legacy.”

So, if are not bothered about the administration you leave behind, the only circumstances under which I would suggest you might not want a Will (I still think you should, but it’s your choice) are if you are single or married with no children.

If you have children under the age of adulthood, in my professional opinion there are no excuses for not having a Will for the following reason: God forbid something should happen to both parents, how would the law know who you would want them to be raised by and how? Those left behind (grandparents for example) may not agree with your wishes but they should respect them. Imagine if you didn’t stipulate and the state decided against your families wishes………………….

Building a pension in Spain, quick example

“Chris, I want to save for retirement but I note the annual amount you can save into a private pension in Spain is €1,500, what options do I have?”

Well, some people tell me they could overpay into the state pension to obtain more, I say good luck with that. One of the ways they now calculate this is the average of the last 25 years of your salary/income, so the days of a great Spanish state pension for most are over.

I could go into great depth here but for ease’s sake, the following saving / investing example could give you an income of approximately €25,000 per year, so along with a full UK state pension that would give you a total income of approximately €38,000 per year and hardly any tax to pay:

- Initial investment of €50,000

- €2,000 per month contribution for 20 years

- Total investment value at the end: €926,247.78

I did say it was quick! This is of course is in tomorrows money (inflation roughly doubles every 24 years). With my clients we go into much more depth and analysis, but it gives you an idea.

Why have your investment in a tax ‘Wrapper’ rather than a platform?

Because of Tax, Tax, Tax!!!!!

Need I say anymore, THE most important aspect to consider as a Spanish tax resident.

When you withdraw money from an investment platform you are taxed on the ‘profit’ you take out. So, for example you start/invest €100,000, it grows to €120,000, you withdraw €10,000, tax is payable on the €10,000 as that is profit.

However, with a ‘tax wrapper’ you pay a different tax, Spanish Proportional tax, which is calculated by the following formula:

Initial investment amount, divided by current investment value, multiplied by the amount you are withdrawing.

So, to copy the above example, you start/invest €100,000, it grows to €120,000, you withdraw €10,000, tax is payable on the gain proportionally which is calculated the following way:

€100,000 divided by 120,000 multiplied by €10,000 = €8,333.

This €8,333 is the amount tax exempt, so you are ONLY taxable for €1,666 as opposed to €10,000 for an investment platform gain.

You can also add Children over the age of 14 to Tax Wrappers who benefit from this in the future, as well as partners/spouses. So, the additional cost of the Tax Wrapper can more than outweigh the tax savings over time.

Some of today’s Tips can be quite complex, if you are not sure don’t hesitate to get in touch.

1980’s advert

For those of you who don’t know me that well, I am a bit of an 1980’s fan. I was brought up on prawn cocktail, roast beef with all the trimmings and trifle for pudding. I still even now listen to 1980’s music channels………anyway, I am going to share each month some of my favourite TV commercials from back then until you tell me to stop OR I get inspired with something else!

Looks like we’ve overdone it on the…………

Click here to read independent reviews on Chris and his advice.

If you would like any more information regarding any of the above, or to talk through your situation initially and receive expert, factual based advice, don’t hesitate to get in touch with Chris.

Let’s deal with the facts

By Paul Roberts

This article is published on: 9th October 2023

Over the summer I read a fascinating book called ‘Checklist Manifesto’ by Atul Gawande. It’s a book about how the systematic use of checklists can help improve outcomes in a wide range of activities.

Gawande, a surgeon, explored the use of checklists in medical procedures and found that developing and complying with detailed checklists has an extraordinarily positive effect on medical outcomes. His book is well worth a read – some of the sections that describe how problems arise and are dealt with when things go wrong in an operating theatre or a cockpit on a passenger flight are truly incredible.

It is an unlikely page-turner, with a lot of practical examples of how adopting good working practices can have a hugely positive effect on outcomes. Here is one example;

In 2001, Peter Pronovost, an intensive care specialist at John Hopkins Hospital, was frustrated with the incidence of central line infection in intensive care. He created a simple checklist of the steps that needed to be taken to prevent infection.

As simple as the steps look, the ICU nurses noted that doctors were often in such a hurry that they ignored a step or two. With this information, Pronovost persuaded the hospital administration to allow nurses to prevent doctors from putting in central lines if they ignored a checklist step.

The nurses were also encouraged to ask doctors every day if they could remove the patients’ lines so they would not stay longer than necessary.

This step reduced the likelihood of untreated pain from 41% to 3%. Pronovost was described as a “genius” by his colleagues because he had the idea of integrating a task list or a checklist into the daily routine of everyone working in the ICU.

It has been interesting to reflect on the power of checklists and very reassuring to note that at Spectrum we have our own set of checklists that ensure we are disciplined and methodical about how we work. This approach, which we apply as part of our standard business practice, helps to secure positive financial outcomes for our clients.

Let me explain how this works with a couple of simple examples;

All potential clients do a fact-find with us as a first step in our financial planning process. The fact find is our checklist of questions that allow us to see where the person is, financially of course, but also in terms of life-stage, planning priorities, tax situation, etc. We build up a comprehensive picture of individual circumstances, what assets they have and what they are looking to do, well BEFORE we offer any advice.

With Client A, we had spoken at length about what he wanted to do and had agreed on a plan of action. When we got together some time later, I followed our Spectrum checklist and asked him if anything had changed with his situation since we had last spoken and the conversation that ensued filled me with concern. He had been contacted by a boiler room operation that had targeted him and who were in the process of getting him to transfer a high five figure sum into an offshore bank account. It was a scam. I was able to stop this before it went any further. He never made the transfer and he still has the money. I was so pleased that I’d followed the checklist and had done my job properly.

Client B is a young family member who is saving up to buy a house. He and his girlfriend have around 85000€ saved up. I asked him what return he was getting on that money. Answer – zilch. I was able to encourage him to explore the options at their bank on the basis that 2-3% was probably there for the taking, explaining that spending a few hours looking into it and taking some action will be the easiest couple of thousand euros they will earn this year.

These are two simple examples of the value that can be created in my business by following a reliable and clearly defined advice process. At Spectrum we are of course appropriately experienced and authorised for the financial planning services on offer. Beyond that, we care about doing a good job. We always offer a no fee, no obligation, face-to-face fact find meeting to anyone who is prepared to invest a couple of hours in finding out more about the planning opportunities available to them. If prospects go on to become clients, we also arrange at least annual review meetings (again at no cost), to revisit the fact finding exercise and to ensure that our original advice recommendations remain suitable, or where necessary to revise arrangements in response to changes in your circumstances.

As an aside, we know that banks generally don’t call their customer to suggest that surplus cash be placed in interest bearing deposit accounts. They just don’t do this sort of thing, because bank employees work for the bank. At Spectrum we work for our clients.

Please feel free to book an introductory appointment with a financial planner at Spectrum and see where it takes you.

Introducing your Client Portal

By Peter Brooke

This article is published on: 5th October 2023

CashCalc

What is the Cash Calc Secure Client Portal?

Cash Calc was launched back in 2014 by a UK IFA who was unimpressed with the digital tools available to our industry. It was initially launched as a Cash Flow Planning Calculator – more on this later, but has developed into a broad suite of great tools for advisers like me and their clients.

“seek first to understand, then to be understood”

In order to best advise my existing and future clients I need a full picture of their current situation and an understanding of their objectives, aspirations and goals – we rather boringly call this ‘fact finding’… though it is not all just facts!

A recent addition to the Cash Calc tools is the ability for my clients to complete or update their own fact find in their own time from the comfort of their own homes via the Client Portal, if they want to. It is totally secure and can be updated as little or as often as necessary.

We can also use the portal for the secure sharing of documents, like investment statements, passports, utility bills etc AND for secure two way messaging.

For those who prefer not to use this service, please don’t worry, I will still use it as a data storage tool but will manage the access and information myself.

Please check out this video for more:

Hop Onboard

If you are already ‘onboarded’ and have your Portal login details please do have another look and send me a quick message (top right corner of the screen) to say hi and confirm it is all working OK.

Some of my existing clients have stated a preference to have their quarterly investment statements shared via the portal as a more secure option than email – please don’t hesitate to let me know if you prefer this too?

If you are not yet ‘onboarded’ please don’t worry, as part of our review process I will be sending you a personalised ‘secure invitation’ to the portal to set it all up; it is very easy.

Of course, if you just can’t wait please drop me a line and I will send your personalised login details immediately.

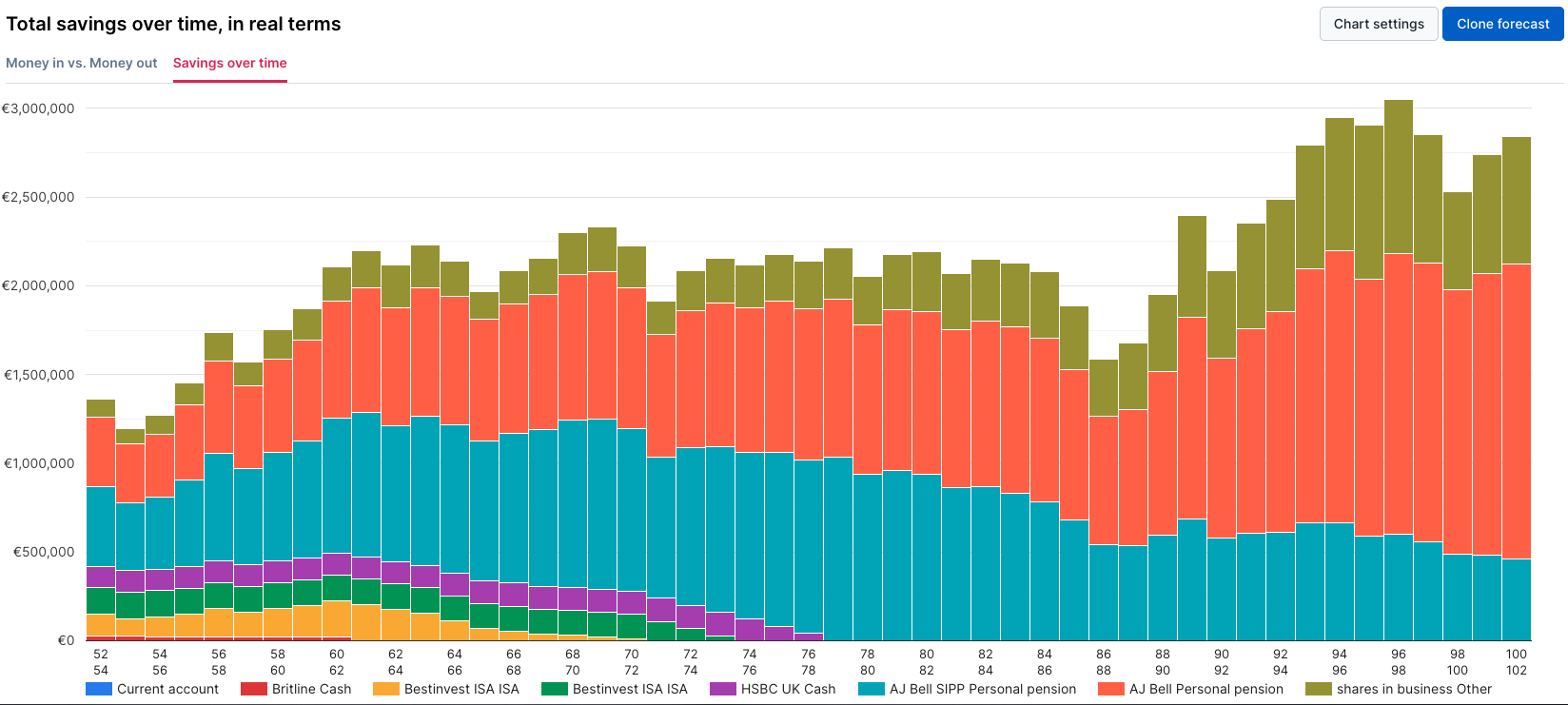

Cash Flow Financial Modelling Tool

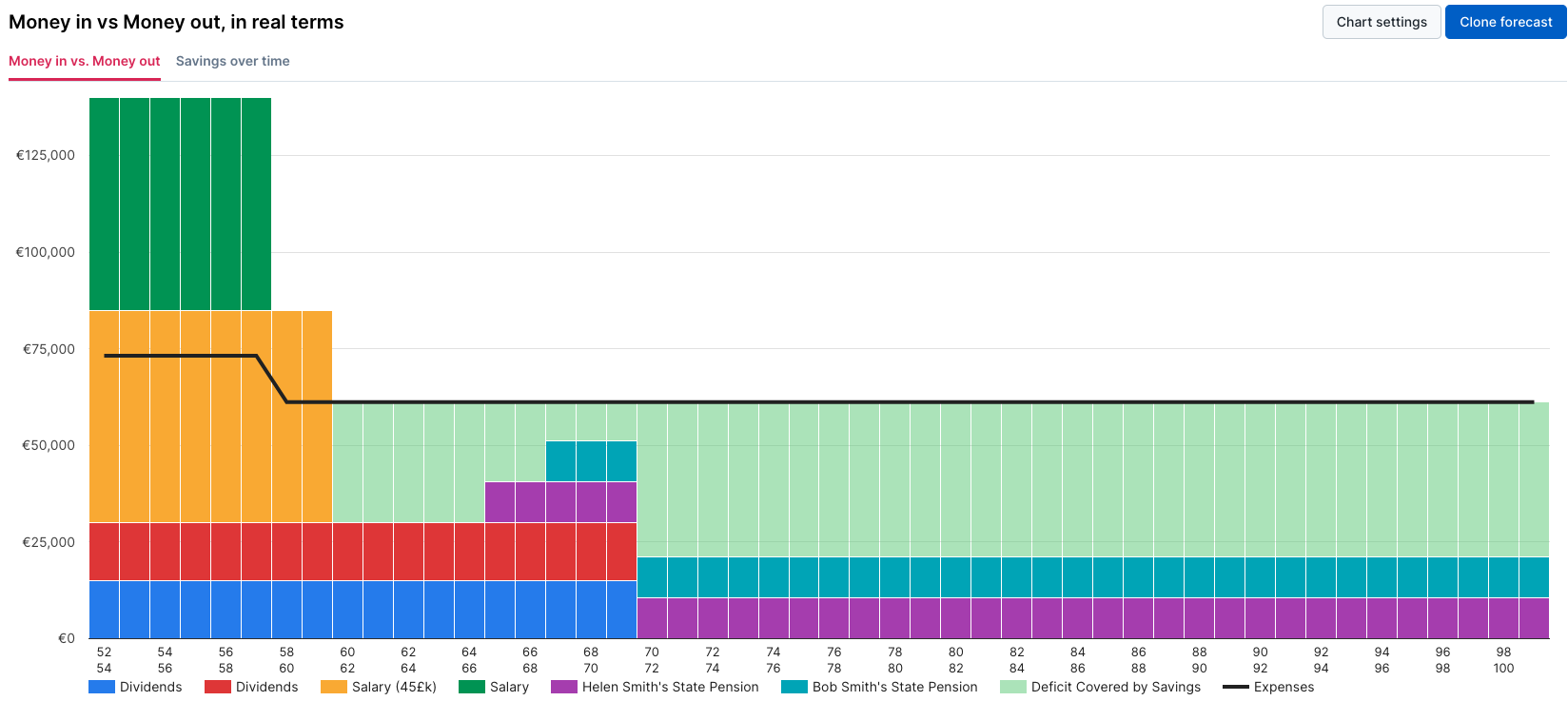

As mentioned above Cash Calc started as a ‘Cash Flow Planning Calculator’ and though it is now so much more, this remains one of the most powerful and useful tools for creating truly personalised financial plans.

Using the ‘fact find’ data you provide in the portal I can create multiple bespoke cash flow plans to look at various scenarios and forecast how your financial situation will evolve over time.

“can I afford to retire now?”

“can we pay for our daughter’s wedding?”

“can we fund our Grandchildren’s education?”

We can see graphically where you are today and what changes, tweaks or decisions need to be made to ensure you will be ok long into the future.

Why I love it…

- Its not time critical – you can upload and enter your details in your own time, at your own pace

- Totally Secure – bank level encryption, customised for the Spectrum IFA Group

- Simple interface between us for sharing of documents, messages and, most importantly, for uploading up-to-date financial information

- I am notified as you make changes to your profile

- ‘Virtual’ Modelling tool with scenario based examples

- Very Visual – it’s easy to see how changes will directly impact your situation as we tweak your plans

- Digitally and securely accept and sign-off on a range of documents

- Quarterly Financial statements can also be shared here instead of emailed

….. oh, and it has a load of other great tools we can use too…..