I’m Scottish and I live between France and Luxembourg. I moved to Luxembourg in 2008 and then France around 2015 and have commuted between both for a lot of my time with Spectrum. Needless to say my French has improved over time (as long as people speak to me as if I’m 6 year old child).

Basic Investment Terms Explained

By Michael Doyle

This article is published on: 22nd May 2025

One of the things though that I still struggle with is some of the terms they use, eg Pédaler dans la semoule which seemingly means going around in circles. I always wondered why people were pedalling around in semolina.

It got me to thinking that I often assume people know all of the terms we use in financial planning, so here I’ve decided to try and break down the barriers.

What is a stock?

A stock represents partial ownership in a company. When you own a stock, you own a slice of that business — known as a “share” — and have a claim on its assets and earnings. Stocks are traded on public exchanges, and their value fluctuates based on the company’s performance, investor sentiment, and broader market conditions. Investors often buy stocks to participate in a company’s growth and, potentially, receive dividends.

What is a share?

A share is a single unit of ownership in a company, essentially your piece of the total stock issued. If a company issues 1 million shares and you own 10,000 of them, you own 1% of the company. Shares entitle the holder to a portion of the company’s profits (via dividends) and voting rights in some corporate decisions. Shares can rise or fall in value depending on market demand and the underlying company’s performance.

What is a bond?

A bond is a type of loan that investors give to governments, municipalities, or corporations. In return, the issuer agrees to pay back the principal amount on a set date and provide regular interest payments over the life of the bond. Bonds are considered fixed-income investments and are often used to provide portfolio stability and predictable income, especially in contrast to more volatile assets like stocks.

What is an ETF?

An ETF, or Exchange-Traded Fund, is a pooled investment vehicle that holds a diversified basket of assets — such as stocks, bonds, or commodities — and trades on a stock exchange like a regular share. ETFs allow investors to gain broad market exposure, often at a lower cost and with greater flexibility than mutual funds. They are popular for their diversification, transparency, and ease of access for both beginners and seasoned investors.

Let’s have a conversation. Your future wealth might just thank you for acting today.

You can now book a 30 minute zoom meeting with me (at your convenience) by clicking here.

Why Should I have an Assurance Vie?

By Michael Doyle

This article is published on: 20th May 2025

I wrote an article back in 2021 which you can read here. I just wanted to offer a reminder of the 10 most important reasons why you should consider having an Assurance Vie whilst living in France:

- Tax Efficiency: Assurance vie allows for tax-deferred growth on income and gains while the funds remain within the policy.

- Flexible Investment Options: With my help and planning you can choose from a variety of funds, including equity, bond, and special products, allowing for a diversified investment strategy.

- Access to Capital: You have full access to your capital at all times, with the option to take regular income withdrawals (possibly subject to an early exit penalty in the early years).

- Inheritance Planning: Assurance vie is highly effective for inheritance planning, allowing policyholders to designate beneficiaries and providing significant tax-free allowances.

- Long-Term Savings: It serves as a viable alternative to traditional pension plans, offering flexibility in saving for retirement.

- Potential for Higher Returns: By investing in unit-linked funds, there is potential for higher returns compared to traditional savings accounts.

- Social Charges on Gains: Only the gain element of withdrawals is subject to social charges, which can be advantageous compared to other investment vehicles.

- International Options: International assurance vie policies offer additional benefits, such as investment in multiple currencies and broader investment choices. We offer these at Spectrum meaning if you move country your Assurance Vie is often portable.

- Adaptability to Risk Tolerance: We offer regular reviews so can switch funds as your circumstances or attitudes toward investment risk change.

- Tax-Free Allowance After Eight Years: After eight years, gains can be offset against a tax-free allowance of €9,200 for couples or €4,600 for singles, enhancing tax efficiency.

You can now book a 30 minute zoom meeting with me (at your convenience) by clicking here.

Top financial tips Spain May 2025

By Chris Burke

This article is published on: 8th May 2025

Happy (Almost) Summer, everyone!

So far this year, the weather has been very unusual, to say the least. Hopefully, things will start to feel a bit more normal soon – which brings me nicely to the financial world, which has been anything but normal! Sometimes it feels like many of us are just pawns in the game that very powerful people play.

In my world, however, many of these ‘games’ are understandable from a financial perspective, and we don’t panic. Instead, we factor in all scenarios and focus on the medium- to long-term goals for our clients.

This month, I’ve put myself in my readers’ shoes and asked:

“What financial planning should I be doing while living in Spain?”

Whether you’re new to Spain (generally considered to be less than three years) or well-established, it’s important to stay financially organised and understand what actions you need to take.

Living abroad as an expatriate requires thoughtful financial planning to navigate both Spanish and international financial systems. Here are the key areas to consider:

1. Understand Tax Residency and Obligations

In Spain, spending over 183 days within a calendar year establishes you as a tax resident, meaning your worldwide income and assets may be subject to Spanish taxation. It’s crucial to understand the rules around tax residency to avoid unexpected liabilities.

2. Strategise Property Sales and Investments

If you own property in your home country, consider carefully when to sell. Selling property in the same tax year you become a Spanish resident can lead to significant capital gains taxes. Planning the sale before relocating may help mitigate this issue.

3. Establish a Comprehensive Estate Plan

Creating a Will that covers both your home country and Spain is essential to ensure your assets are distributed according to your wishes. It’s wise to consult with advisers experienced in cross-border estate planning to navigate the complexities.

4. Optimise Currency Management

Managing currency exchange efficiently can help minimise losses due to fluctuating exchange rates. Consider using multi-currency accounts or international banking services to provide greater flexibility and cost savings.

5. Savings, Investments & Pension Planning

Ensure these are structured to reduce future tax liabilities—whether that’s for withdrawals, passing assets to your spouse or children, or aligning with your investment expectations (e.g., risk/reward balance). Most importantly, work with someone you trust to help manage these assets.

6. Consult with Experts

Whatever your budget, make sure you work with a recommended lawyer, tax adviser, accountant, and financial adviser. In Spain, you are considered guilty until proven innocent, and it can take years to resolve legal issues—during which your bank accounts or assets may be frozen. Many expats are unaware of this, especially if they come from countries where the opposite presumption applies.

7. Use Your Life Experience

When choosing the right advisers, trust your gut—or your “spider senses,” as I like to call them. You’ve built up intuition through life experience, and more often than not, it’s spot on.

Engaging with financial advisers who specialise in expatriate services can provide tailored guidance on investment strategy, tax planning, and navigating financial matters in both Spain and your home country.

By proactively addressing these areas, you can establish a solid financial foundation for your life in Spain – ensuring both compliance with local regulations and alignment with your long-term goals.

I’m here to help you get organised and take those financial worries away. If you’d like to discuss any of the topics above in more detail, or would like an initial consultation to explore your personal situation, you can do so here.

Click here to read independent reviews on Chris and his advice.

Navigating Market Volatility

By Tom Worthington

This article is published on: 5th May 2025

How It’s Impacting Investors and What’s Driving It

In today’s economic rollercoaster, market volatility has become a feature, not a bug. Thanks to inflation, interest rates, and politicians who change their stance more often than they change their ties, investors are left riding waves of uncertainty

What Is Market Volatility?

Market volatility refers to how wildly asset prices swing around. It’s measured with stats like standard deviation or the VIX—aka the “fear index.” When VIX is high, it means traders are about as calm as a cat in a bathtub.

Think of volatility like a political debate: a lot of shouting, some overreactions, and nobody quite sure what the outcome will be—but everyone’s got an opinion.

How Volatility Is Affecting Buyers

- Increased Risk Aversion

When markets get shaky, investors run for the hills—or more precisely, into gold, bonds, or the financial equivalent of curling up under a blanket and binge-watching Netflix: cash. It’s not that they don’t want to invest; it’s just hard to focus on stocks when the economy’s behaving like a budget committee after three espressos.

- Short-Term Focus and Emotional Decisions

High volatility often leads to panic selling and FOMO buying—essentially the investment version of speed-dating your portfolio. One bad news headline and people dump their assets faster than a politician deletes tweets after a scandal.

- Greater Demand for Diversification and Alternatives

With public markets swinging like a metronome at a concert, investors are looking elsewhere: real estate, private equity, and alternatives that don’t fluctuate every time a central banker clears their throat.

Alternative strategies are basically the Switzerland of investing—neutral, quiet, and generally unaffected by the chaos going on next door.

- Hesitation in Major Life Investments

When markets are turbulent, people freeze. Buying a house. Starting a business. Investing in that avocado farm you saw on Instagram?! Better wait until the economy isn’t throwing daily tantrums like it’s on a sugar high.

What’s Causing the Current Volatility?

Geopolitical Tensions

Let’s face it—if the markets had a relationship status, it would be “It’s complicated.” Global tensions (Ukraine, Middle East, China-US trade) have created an environment where investors are just one diplomatic gaffe away from selling everything and moving to the woods.

And with international summits resembling more of a group therapy session than a solutions meeting, it’s no wonder markets are twitchy.

Inflation and Central Bank Policy

Central banks are trying to tame inflation with interest rate hikes—kind of like trying to put out a grease fire by hitting it with a calculator. Every time Jerome Powell or Christine Lagarde so much as raise an eyebrow, markets react like they just heard tax hikes are back on the menu.

Recession Fears

Recessions, Soft landings, Hard landings… No landing? At this point, the economy is basically being piloted by someone reading the instruction manual upside down. With mixed signals and conflicting forecasts, markets are responding like passengers on a turbulent flight—fastening their seatbelts and ordering strong drinks.

Tech and Social Media Hype

Social media has turned investing into part-time entertainment. Between Reddit-fueled pump-and-dumps and influencers recommending crypto in between smoothie recipes, market swings have become more meme than metric. Add algorithmic trading and you’ve got a digital casino with fewer rules and more drama than the House of Commons.

Earnings Uncertainty

Earnings season now feels like a bad date—lots of build-up, dramatic reveals, and someone always ends up disappointed. With rising costs and unpredictable demand, analysts are doing more guesswork than polling firms during a leadership race.

How Investors Can Respond

Here’s what smart investors are doing—besides stress-eating during market dips:

- Keep a long-term perspective: Ignore the noise—just like a seasoned voter during campaign season.

- Diversify: Don’t put all your eggs in one economic basket—especially if that basket is being carried by a toddler on roller skates.

- Use euro-cost averaging: Invest steadily over time, so you’re not stuck trying to time the market like a trying to explain your latest impulse buy to your other half.

- Hedge your bets: Consider options and other protections—because unlike political promises, these can actually reduce risk.

- Stay informed, not alarmed: Headlines sell panic; good decisions are made with data, not doomscrolling.

Conclusion

Volatility might be nerve-wracking, but it’s not the enemy. It’s a changing a nappy—messy, emotional, and always changing—but ultimately navigable if you stay calm, stay smart, and remember that every cycle, no matter how wild, eventually turns.

So hold onto your investments, keep a sense of humour, and remember: if in doubt talk to your adviser.

Financial update May 2025 – France

By Katriona Murray-Platon

This article is published on: 4th May 2025

May is when France comes out to play because the weather is warmer and the days are getting sunnier. However it is also the month when, if you haven’t already begun your tax declaration, you need to at least make a start on it over the next few weeks. The first deadline for filing the tax return is the 20th May for the paper returns which you will need to complete if this is the first year doing a tax return and you don’t have a tax number or login details to do it online.

The other deadlines for submitting both your income tax return and where applicable, your Wealth Tax return, are as follows:

| DEPARTMENT | DEADLINE |

| 0 to 19 | Thursday 22nd May 2025 at 11.59pm |

| 20 to 54 (including 2A and 2B) | Wednesday 28th May 2025 at 11.59pm |

| 55 to 974/976 | Thursday 5th June at 11.59pm |

| Non residents | Thursday 22nd May 2025 at 11.59pm |

If you do not at least attempt to get some sort of declaration submitted by these deadlines a 10% penalty will apply to the amount of taxed owed. Luckily, Spectrum has a free tax guide which you can find HERE. If you have any questions on this guide, please do get in touch.

I know that it may seem daunting and believe me, even though I was a tax adviser and used to do hundreds of declarations for my clients, I still find doing my own quite a challenge! So to help you, here are my ten top tips:

- HAVE YOUR FIGURES READY– Make sure that you know what kinds of income you need to declare and what the total annual figures are, whether they are taken off a bank statement or a tax certificate.

- KNOWING THE EXCHANGE RATE: The Banque de France average exchange rate for 2024 is €1.18 to £1. This is also the rate used by the Connexion newspaper. Make sure you have all your foreign income figures converted into Euros ready to input into the tax form.

- CHECK THE FIGURES ALREADY ENTERED ON THE TAX FORM – French source income (pensions, salaries, French bank income etc) should already be entered on the tax form. Whilst this information is generally correct, it is still worth checking these figures with any tax certificates issued by the relevant body or your December 2024 payslip.

- FOREIGN INCOME ANNEXE – I have noticed this year that whilst some annexe forms such as the 3916 are automatically ticked and carried over from the previous year, the 2047 for foreign income is not. You will therefore have to tick this box in the ANNEXE section of the online form to make this form appear. You must enter all foreign income received in 2024 on this form and then make sure that it is carried over or inputted again into the main 2042 tax form.

- CHECK THAT ALL THE DIFFERENT TYPES OF INCOME ARE TICKED – This applies on both the 2047 form and the main tax form (2042) as when you then click to the next page you will only be shown the boxes and pages that correspond to the income selected on the earlier page. So if you are only declaring pensions and bank interest, only those pages will appear. If you have other income like rental income or business income, you need to tick the relevant box for the page to appear. You can also look at the declaration that you did last year under the “documents” section on the main page and see what boxes you completed last year, then you can use the “search box” option.

- REMEMBER THE BANK ACCOUNTS AND UPDATE THE ASSURANCE VIE AMOUNTS – All non-French accounts must be declared on the 3916 form. This should automatically appear as a form if you declared accounts last year and boxes 8TT and 8UU were ticked. Any accounts you declared last year can be carried forward but if there are any changes, any new accounts or closed accounts, you must provide this information. Your assurance vie information will also be carried forward from last year but you will have to check the letter that was sent to you by the assurance vie provider in order to enter the value of the policy as at 1st January 2025.

- DON’T FORGET YOUR TAX CREDITS – If you have any domestic help or services paid via CESU, the amounts declared will be already entered on the tax form, you just need to check that these are correct. However if you have had any other home help (cleaners; gardeners, child care, after school lessons etc) from private companies or associations, these amounts are not always automatically entered. The company or association should have sent you a tax certificate for last year so you will need to enter that amount in the tax credit section. If you have a child in high school, sixth form or university, don’t forget to tick the box to get the (albeit small) tax reduction.

- RETIREMENT CONTRIBUTIONS – if you work in France and want to contribute to your pensions, it is a good idea to open a PER account. If you have already made contributions to a PER in 2024, you can deduct a percentage of these payments from your taxable income. The amount that can be deducted or carried over from previous years is shown on your tax statement. However to deduct these amounts from your tax you will need to reenter these amounts in the correct box.

- CHARITABLE DONATIONS – If you have made any charitable donations in 2024 you should have received a tax certificate from the charity with the amount to deduct. This may have been sent by email and fallen into your spam box so it is important to find the email or if it has been sent by post to keep the tax certificate in your tax file. If you still can’t find it you can contact the charity to send you another copy.

- NOBODY IS PERFECT (especially not me ;)) — you can start your declaration and go back to it later. You can do one version and then go back and change it. Once you get to the signature page which shows the tax due (this won’t appear if you have foreign income that will receive a tax credit) if something seems wrong you can go back and amend it. You can do this as many times as you like until the official deadline without it generating separate tax bills and even after the deadline provided you have submitted something before the deadline. If it gets close to the deadline it is better to declare something and sign the tax return and then correct it at a later date rather than incur a fine for late submission.

Property declaration – do you remember last year when you had do declare your properties as a separate declaration? This year you only have to declare whether there have been any changes in 2024. I noted on the online tax form that when you get to the signature page, you must tick a box saying there are no changes otherwise it will not let you sign off and send the tax return.

One of the welcome changes with the 2025 tax declaration is that couples will not be automatically taxed at the same rate but at their individual rates. This is particularly important for those paying tax at source on their pensions and salaries.

Until recently, couples were taxed at the same rate unless they opted for their individual rate which most people didn’t. The result of this was that, because women generally receive less than men when it comes to salaries and pensions, the woman was paying a disproportionate rate of tax. As from 1st September this will change and couples will automatically be taxed at their individual rate unless they opt to pay the same tax rate.

Unfortunately it is too late to contact tax advisers, tax lawyers or anyone else offering help with tax returns as they will be very busy completing the tax returns they already have, so don’t be surprised if they are not returning your calls or emails. However, with a bit of patience and perseverance it is possible to do your own tax return. If you have any questions please do get in touch and I will help as much as I can.

Tax returns in Italy

By Gareth Horsfall

This article is published on: 2nd May 2025

It’s that time of the year again folks!

I am always given warning that tax time is approaching because a number of clients start to ask for valuations of accounts, interpretation of some documents and also help with organising and sharing some documents with commercialisti.

However, regardless of anyone actually alerting me to the upcoming tax declaration in Italy, I always say that Easter time is a good time as any to nudge yourself into getting your financial documents in order for your ‘dichiarazione’ (if you haven’t done it already).

Never leave it too late! Commercialisti are run off their feet in the summer and can be hard to get hold of during their busiest time of the year, just when you or I are thinking about our holidays!

In this E-zine I am going to do an abbreviated version of the taxes that you may be subject to.

Nothing has really changed much from last year, so if you would like a longer explanation of what they are and why they are charged then you can check out my 2024 E-zine on the same subject, HERE.

(More on Italian country life at the end of this E.-zine if you are so inclined to keep reading on!)

TAX ON INCOME

INCOME TAX RATES FOR 2025 (IRPEF)

In a move to simplify the tax regime in Italy the tax bands have now moved from 4 to 3 in 2024.

| On the first € 28000 | 23% |

| € 28001 to € 50000 | 35% |

| € 50000+ | 43% |

PENSIONS

Most of my clients are in, or planning for, retirement to some degree and so understanding how your pension will be taxed as a resident in Italy is of paramount importance.

PRIVATE PENSIONS AND OCCUPATIONAL PENSIONS (Income tax rates – IRPEF)

Private pension provider income: 401K / IRA’s etc / Occupational pensions / Personal pension income / State pension or social security.

All these types of pension incomes fall into the income tax rates ( IRPEF), they are added together and the rates applied to the progressive bands of income.

GOVERNMENT DERIVED PENSIONS

(tax in country of origin unless Italian citizen!)

The definition according to the Italy / UK / USA double taxation convention 1988 is, paid from:

” a political or an administrative subdivision or a local authority”

The pension awarded is generally taxable only in the state in which it originates and tax is generally deducted at source in that country of origin, unless your are an Italian citizen and then it becomes taxable in Italy as well.

(Check the double taxation treaty from the country in which the pension payments originate)

(This income is not taken into account when calculating the tax on your other income sources in Italy, e.g. rental income, and it is not declared on your tax declaration in Italy)

2025: NO TAX AREA (€8500)

The NO TAX AREA applies to anyone receiving a pension, whilst resident in Italy (“pensioner” is defined as someone who is receiving official state benefits i.e., social security or state pension).

No distinction is made between pensions being paid from abroad or within Italy!

The NO TAX AREA is €8500 per annum.

It is important to understand that this is NOT an allowance but a tax credit system.

If your total income (reddito complessivo) is €8500 or less then all the tax payable on your pension will be provided as a tax credit.

HOWEVER, the more your total income, from all sources, increases over €8500, the more of the tax credit you lose.

If your total income is €50000 or above you would not receive any tax credit.

BANK ACCOUNTS AND DEPOSITS

A very simple to understand and acceptable €34.20 per annum is applied to each conto corrente e libretto di risparmio: current account or deposit account. This would typically include fixed deposits, short terms cash deposits, CD’s etc. The charge is the equivalent of the ‘imposta da bollo’ which is applied to all Italian deposit accounts each year.

(Money market accounts, premium Bonds in the UK and other deposit based instruments will not generally fall in this category and would be subject to wealth tax – see below)

Interest income is taxed at 26%.

INVESTMENT INCOME AND CAPITAL GAINS (26%)

A flat tax rate of 26% is payable on interest and income payments from capital and realised capital gains are also taxed at the same rate of 26%.

(Interest from Italian government bonds and government bonds from ‘white list’ countries are still taxed at 12.5% rather than 26%, as detailed above. This is another quirk of Italian tax law as this means that you pay less tax as a holder of government bonds in Pakistan or Kazakhstan, than a holder of corporate bonds from Italian giants ENI or FIAT).

If you are invested in NON-EU harmonised collective investment vehicles i.e. funds which are listed in a place outside the EU, then the gains and income from these assets are NOT taxed at the flat 26% rate in Italy, but would be added to the rest of your income for the year and taxed at your highest marginal rate of income tax! Funds or ETF’s, for example, which re listed in the UK with a GB ISIN code or in the US with an equivalent US number, would fall into this category.

This is particularly important for UK and USA domiciled assets. If you have a brokerage account with a group such as Fidelity or Vanguard or one of the many other asset management firms, or you invest through a platform such as Hargreaves Lansdown in the UK/USA, then depending on which assets you invest in could mean you are pushing yourself into a higher tax bracket on taxable gains and income for the year. Your portfolio may need restructuring for life in Italy!

WEALTH TAX ON ASSETS (0.2% PA)

Any financial assets other than property attract an annual wealth tax of 0.2% on the value of the asset as at the 31st December each year.

Here are examples of a few:

GENERAL INVESTMENT ACCOUNTS, ISAS, BROKERAGE ACCOUNTS, PLATFORMS, DISCRETIONARY MANAGED PORTFOLIO, DIRECT INVESTMENT IN FUNDS, STOCKS AND SHARES, COMMODITIES, ART WORK, CLASSIC CARS, ETC.

If the assets are located in one of tax regimes around the world which are considered fiscally privileged by the Italian authorities, then the rate of tax is 0.4% pa. The list can be found at the end of this article HERE

INCOME FROM OVERSEAS PROPERTY (Income tax rates – IRPEF)

Overseas net property income (after allowable expenses in the country in which is located) is added to your other income for the year and taxed at your highest progressive rate of income tax.

THE WEALTH TAX OF 1.06% ON THE VALUE OF THE PROPERY (IVIE)

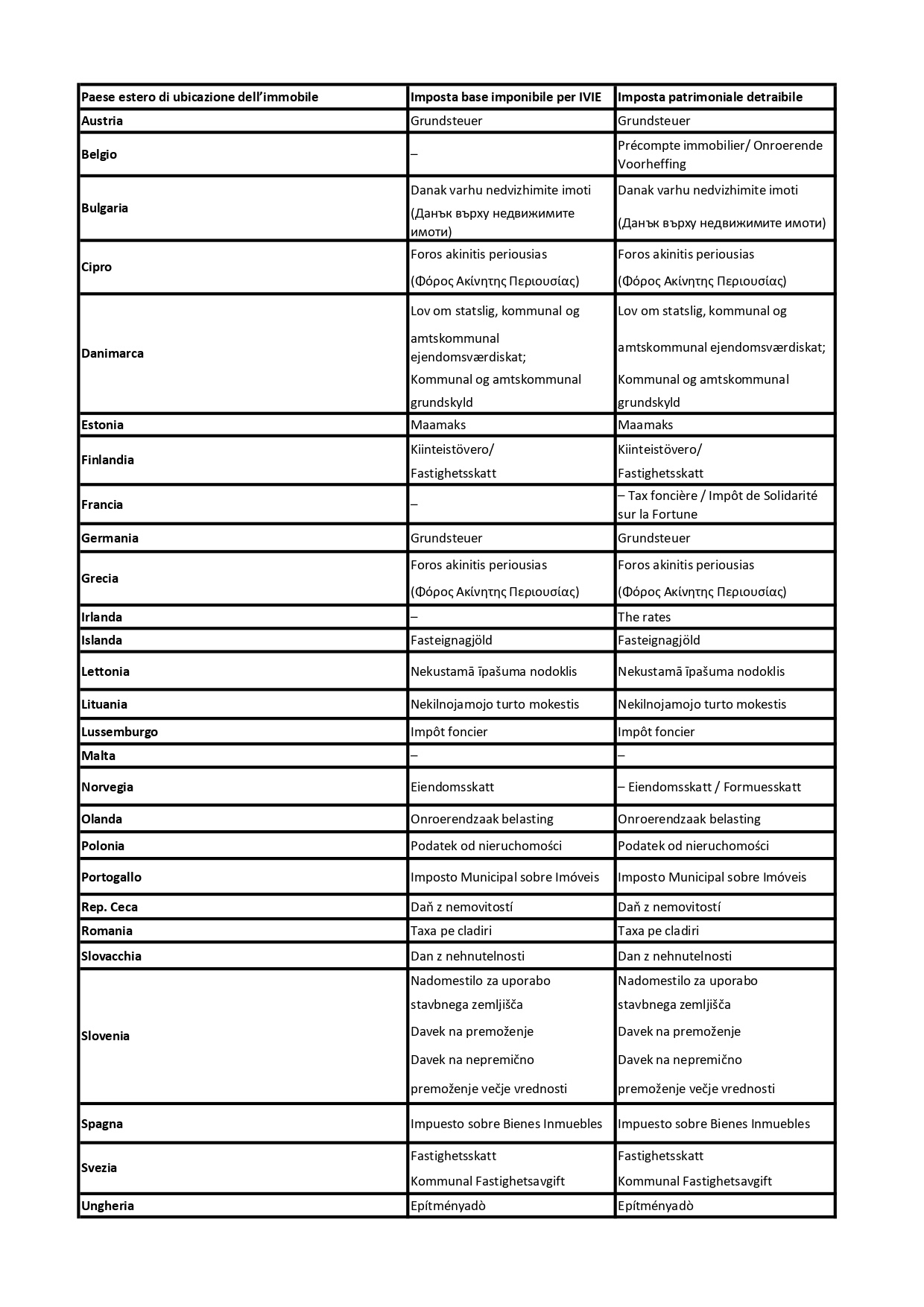

For properties based in the EU, the value on which this tax is based is the Italian cadastral equivalent. You will find that the market value will, in most cases, to be significantly more than the cadastral equivalent value. For a list of the different tax values across Europe see the table below.

For properties located outside the EU (inc the UK/USA/Canada/Australia/NZ etc) the value for tax purposes is defined as the acquisition value (purchase /inherited/acquired) where this can be evidenced, otherwise it is the current market value of the property.

DISPOSAL OF PROPERTY

Disposal of properties both abroad and in Italy (exc prima casa) are not deemed speculative if you have owned the property for more than 5 full tax years and therefore are not capital gains tax liable on the disposal, in Italy.

NOTE: If you gain residency in Italy then by default your previous ‘first home’ or ‘family home’ for the purposes of the Italian tax authorities is now classified as an investment property. By definition, if you have a home in Italy and a property in another country, even if you consider this property your family home, it can no longer be considered your ‘Prima Casa’ for Italian tax purposes.

If you have any questions about any of these taxes and how they might apply to you and your individual financial situation, or if you think that you might be paying more than need to, then do get in touch and I will be happy to see if I can help you with your plans.

I can be contacted on email: gareth.horsfall@spectrum-ifa.com or on cell: +39 333 6492356

A QUICK UPDATE ON COUNTRY LIFE

The country life update seems to be garnering more interest than the financial talk, given the lovely feedback I have from many of you. I know many of you have already trodden this well worn path of moving to Italian rural homes and are involved in differing degrees with your properties and land management.

I am now slowing down a little bit as the spring has arrived and I see that the plants are literally exploding before my eyes. It seems futile to try and manage it too much when its all growing so quickly. However, it is hard to let go and I do find myself getting up in the morning and just having an hour or 2 on the land before work, or even on the weekend, where it rolls easily into 4 or 5 hours to the extent that my wife finally shouts from the window “Are we ever going to see you this weekend?”. At which point I know my day on the land is over, at least for that day.

Anyway, I know I have been telling many of you that I have refrained from cutting the grass under the olive trees to date. There is now good reason to be careful because as you will see below in the pictures, there are some new occupants of the land and I am a little reluctant to start mowing them down. (I have recently staked around them so I can get on with the grass cutting but without destroying the wild orchids).

I did however want to share a funny story. I bought a trattorino ( ride on lawn mower) in the January sales online, and got quite a good deal on it. However, given the weather had been quite cold up until about a month ago, the grass hadn’t really grown that much and so I put it in storage. I decided to start it up about a week ago, just to see how it went and as you might imagine, it didn’t start.

I was left with my trusty motorized lawnmower. ‘Che fatica!‘ as they say !! The trattorino ride on mower has now been fixed, under guarantee, (it was a broken fuse) and what a difference !!! A HUGE labour savings device.

On another note, I am finally starting, after the winter clean up of the land, to start looking at the border areas and wondering how I can tidy them up as well. A lot of trees and woodland needs to be at least trimmed back and will leave me with lots of material to deal with as always, given I need to do some fencing I was thinking about using this material in some way.

Facebook and social media, almost as soon as I started thinking about it, started pumping out lots of ideas from dead hedges, to woven fences and lots more. I am undecided, but might try my hand at some fence building at some point. It should be fun.

Interestingly, on our annual work and investment conference for The Spectrum IFA Group there has been lots of talk about the impact of Artificial Intelligence, on our lives, in the last few years.

In 2024 we were presented with a list of the jobs most at risk of AI, and those least at risk. At the bottom of the list was fence builder! They didn’t mention that this job might be at risk from Gareth, although the likelihood is that I will give it a try and make a mess and need to call a fence builder in the end, but at least I am guaranteed a nice human conversation instead of wondering if I am talking to an AI application.

This country life certainly has its challenges! I recently was sharing these experiences with someone and finished my emails by saying ‘1st world problems, I guess’. It was only on reflection that I thought that it’s probably one of the types of work that we actually have in common with people wherever they are from on the planet.

I won’t bore you with any more country life tales for this E-zine, but if you have any fence building ideas or want to talk about finances / tax, then please do get in touch!

Trump’s 100 days

Lastly, I thought I would leave you with a piece on Pres. Trump given that he is occupying a significant amount of time with conversations with you, at the moment ( and rightly so)

On April 29th he completed his first 100 days in office and his tone has softened, just slightly, in the last few days.

The article below was sent by one of our collaborative fund manager partners, VAM Funds and I thought I would share it as it’s a succinct article which explains what Trump is trying to do and his potential for success and possible hurdles along the way.

This is not one of my opinion piece’s but instead direct from the financial market people.

As Donald Trump approaches his first 100 days in office, a complex economic narrative emerges – challenging traditional approaches while attempting to address long-standing structural challenges. His presidency has introduced uncertainty and volatility, yet the broader economic context remains one of relative strength. This dynamic sets the current period apart from prior episodes of market turmoil.

Economic Context

The US faces critical economic pressures: a $2 trillion annual deficit, $36 trillion in national debt, and a declining manufacturing base. Trump’s approach represents an unconventional attempt to reimagine America’s economic positioning – neither entirely destructive nor completely transformative.

Yet, unlike previous periods of market unease, the economy today shows notable resilience. US unemployment remains near historic lows, corporate earnings continue to post positive growth, and balance sheets are broadly solid. Credit markets, while reflecting some spread widening, remain stable and not excessively leveraged. In many ways, the economy itself is not the root of the current turbulence.

The singular variable creating uncertainty is Trump himself. Markets are reacting less to economic fundamentals and more to political risk.

Against this backdrop, Trump’s strategy can be broken down into three core themes that shape his economic agenda:

| Trade Recalibration | Structural Economic Challenges | Economic Repositioning |

| Challenging existing global supply chain dependencies | Addressing long-term fiscal sustainability | Reviving domestic manufacturing |

| Seeking "fair trade" rather than pure free trade | Acknowledging the limits of current economic models | Reducing over-reliance on specific global partners |

| Attempting to redirect, not eliminate, global economic relationships | Proposing radical, and sometimes necessary, interventions | Balancing potential opportunity with heightened geopolitical risk |

Market Dynamics

Investors are navigating a landscape marked by uncertainty, but underpinned by strength. Unlike past episodes where systemic weakness drove market corrections, this time, economic indicators remain broadly constructive.

The real concern is political instability. Trump’s unpredictable tactics have jolted investor confidence, even though the macroeconomic foundations remain intact. However, his motivations are clear: he is ultimately driven to prove that he can build a robust U.S. economy, contain inflation, and secure strategic wins in the global trade arena.

With the 2026 mid-term election cycle beginning as early as Q1/Q2 next year, Trump cannot afford to alienate voters or lose his party’s slim Congressional majority. This political imperative may lead to quick policy “off ramps,” efforts to de-escalate tensions, and the search for visible wins – moves that could rapidly calm markets.

Indeed, any signs of stabilising rhetoric or resolution to current crises may spark an equally swift rebound in both equity and fixed income markets.

Structure in Chaos

Trump’s economic policy is neither pure economic nationalism nor traditional globalism. It is a hybrid approach – an improvised balancing act between disruption and adaptation characterised by:

· Challenging existing economic orthodoxy

· Acknowledging global economic interdependence

· Pursuing strategic economic repositioning

with the following potential outcomes:

· Possible supply chain diversification

· Increased domestic economic resilience

· Risk of short-term market volatility

· Long-term structural economic recalibration

Conclusion

Trump’s first 100 days signal a high stakes experiment in economic leadership. The market’s turmoil is not a reflection of economic collapse but of political unpredictability. Yet, the core economy remains resilient.

Should Trump pivot towards pragmatism – seeking quick wins, stabilising policy narratives, and presenting a clearer economic roadmap – the same markets that reacted sharply to uncertainty may respond just as swiftly to renewed clarity.

Are You Leaving 40% of Your Assets to the Taxman?

By Jett Parker-Holland

This article is published on: 22nd April 2025

Most people try to do the right thing. They work hard, save diligently, contribute to their pensions, and even invest in property to secure a comfortable retirement and leave something behind for their loved ones. It’s the responsible thing to do, but recent changes to the UK tax system have turned that logic on its head, especially for British expats living abroad or planning to retire in Spain.

As of April 2025, a new inheritance tax test will be introduced, replacing the ambiguous concept of domicile with a more definitive measure: residency. If you are living—or planning to live—in Spain for the long term, this change affects you directly. Under the new rules, if you have lived outside the UK for at least 10 of the last 20 years, you’ll be classified as a non-UK Long-Term Resident. This is important because it means your overseas assets will no longer be subject to UK Inheritance Tax (IHT); however, UK-based assets such as pensions, property, and bank accounts will still be taxed at 40%.

For many clients, much of their estate remains tied up in the UK. This includes UK property, bank accounts, and—most notably—UK pensions. Although yields on UK assets like rental property or fixed-term bank deposits can appear attractive, the long-term benefit may be diminished if 40% of the value is lost to IHT on death. Because of this, those planning to live in Spain for the long term may want to consider moving certain assets out of the UK tax system. It’s an area where careful financial planning can make a real difference.

The same applies to pensions. Under the old regime, UK pensions were exempt from IHT. Now, pensions are included as part of your estate. If you pass away after age 75, your beneficiaries could face a 40% IHT charge, and potentially up to another 45% in income tax when they take money out of the pension. It’s a harsh reality and fundamentally changes how we should value UK pensions. If your beneficiaries can’t access the full pot, it’s simply not as valuable as it once was. Under these conditions, a £400,000 pension could lose £160,000 to IHT alone.

At Spectrum, we specialise in cross-border financial planning. We can help you review your UK assets and explore options to reduce your exposure to unnecessary taxes, ensuring more of your hard-earned wealth stays with your family, not the taxman.

If you’re living in Spain, or planning to, and you’re unsure how these changes affect you, this may be a good time to review your plans. A short conversation could help secure your legacy.

If you would like to discuss your situation in more detail and explore your options, please feel free to contact me directly for a no-obligation consultation.

Navigating Offshore Banking: What Superyacht Crew Need to Know

By Tom Worthington

This article is published on: 18th April 2025

For those working aboard superyachts, managing finances across multiple countries is part of the job. Offshore banking is a common topic in the industry, but what does it actually mean? More importantly, how can superyacht crew members ensure they use offshore accounts legally and effectively?

What is an Offshore Account?

An offshore account is a bank account held outside the account holder’s country of residence. These accounts are often established in jurisdictions known for financial privacy, currency flexibility, and, in some cases, tax efficiency. Common offshore banking hubs include Switzerland, the Cayman Islands, Singapore, and Luxembourg.

Key Features of Offshore Accounts

• Multi-Currency Access – Useful for those paid in different currencies or working in international waters.

• Privacy & Confidentiality – Some jurisdictions have strict banking secrecy laws.

• Tax Efficiency – Depending on residency status, offshore accounts may offer tax advantages.

• Asset Protection – Offshore banking can safeguard funds from political instability or legal claims.

Are Offshore Accounts Legal?

Yes. Offshore banking is entirely legal, provided account holders comply with tax reporting obligations in their country of residence. Many governments enforce strict regulations requiring individuals to disclose offshore accounts.

Key compliance measures include:

• Common Reporting Standard (CRS) – Over 120 countries automatically share offshore account data with tax authorities.

• Foreign Account Tax Compliance Act (FATCA) – A U.S. law requiring Americans to report foreign financial accounts.

Failure to disclose offshore accounts can result in heavy fines, tax penalties, or even legal action. However, when used correctly, offshore accounts serve legitimate purposes such as international transactions, estate planning, and investment diversification.

How Offshore Banking is Enforced

The days of absolute banking secrecy are over. Since the introduction of CRS in 2018, tax authorities worldwide have cracked down on undisclosed offshore assets. Here are a few key examples:

Switzerland’s Secrecy Crumbles

• Over 3.1 million accounts worth €1.3 trillion were reported in the first year of CRS.

• Countries like France, Germany, and Italy used this data to launch tax audits on individuals with undeclared Swiss accounts.

• Many account holders voluntarily disclosed assets to avoid penalties.

Spain’s Offshore Crackdown

• Over 11,000 undisclosed offshore accounts were uncovered from 2020-2023.

• Tax authorities recovered millions in unpaid taxes and issued heavy fines.

• High-profile cases, including football stars like Cristiano Ronaldo and Lionel Messi, highlighted the risks of offshore tax evasion.

UK’s HMRC Recovers £570 Million

• The UK’s tax authority identified over 150,000 residents with hidden offshore accounts.

• £570 million was recovered in unpaid taxes.

• Stricter penalties were introduced for failure to declare offshore wealth.

What This Means for Superyacht Crew

Superyacht crew frequently work across jurisdictions, earning salaries in different currencies and often living outside their home country.

This can make offshore banking an attractive option, but it’s crucial to remain compliant with tax laws.

Key Considerations:

• Know Your Tax Residency – Your tax obligations depend on where you are officially resident, not just where you work.

• Report Your Offshore Accounts – Avoid penalties by declaring foreign accounts where required.

• Seek Professional Advice – Offshore banking and tax laws are complex. Consulting a financial adviser who understands the yachting industry can help navigate the rules effectively.

Final Thoughts

Offshore banking is a useful financial tool when used correctly. However, with increasing transparency and global information-sharing agreements like CRS, hiding offshore assets is no longer an option.

Superyacht crew should approach offshore banking with full awareness of their legal responsibilities to ensure financial security without unnecessary risks.

To make sure you are doing it properly, feel free to contact Tom

When markets turn volatile

By Gareth Horsfall

This article is published on: 10th April 2025

Well, as you might have expected I have decided to write to you at this particularly fragile moment in world politics, and which has now reverberated around world investment markets. As of Friday last week a sell off started in the equity markets which effectively created a bear market situation around the world for fears of global recession based on the Trump tariffs. (as of today we have seena slight rebound, but more volatility is likely)

Given this, you may be forgiven for wondering why I am leading this E-zine with a picture of one of my apple trees in full blossom on my land?

Last weekend I was away from home, spending time in the North of Italy with friends, to celebrate my wife’s 50th birthday. Seeing what had happened on Friday, starting with the sell off in equity markets, I returned home wondering how to deal with it. I could have thrown myself in front of the computer and sent you a lot of charts about how you need to ‘sit tight and ride it through the rises and falls’ or ‘it’s time in the markets that counts not timing the markets’ and ‘the real threat is inflation, not investment market volatility’, (you won’t get away from these points…….you can find these further down the page!), but instead I took an hour in the morning to get my thoughts together and went out on the land to do some tidying up after the olive pruning and to check out the health of the blooming trees.

This apple tree made me take stock of the situation and I will explain why.

When we bought the house last year, the land and house itself had been left abandoned for quite some years and it needed not just a clearing up, but also some TLC. This apple tree was a case in point. Last summer this tree produced 3 very ugly and unhealthy looking apples. The tree itself looked like it had given up the hope and it entered its winter phase looking like it was on its last legs.

I was in 2 minds to pull up the tree and plant something else. However, I thought I would give it another chance, so, I spent the winter pruning the tree and giving it some nutrients. I cut off the bad old rotten wood and reshaped the tree into a form which would allow it space to breath and allow the light to penetrate deep into the centre, so that flowers and fruit could develop.

I was careful not to over do it so as not to stress it too much!!

This, I am happy to say, is the result. What looks like a pretty healthy tree! It is now in full bloom, the bees are all over it and I expect that it may very well provide some decent fruit this year, albeit still quite a young tree.

Comparisons with markets

You will have guessed by now the point I am trying to make about the apple tree. Sometimes, when all hope seems to be lost there may just be hope around the corner with the right care and attention.

I will caveat the rest of this E-zine by stating that I am not wholly against the Trump’s tariffs. I am 100% against the way he is going about it: his morally dubious behaviour, his manner and potentially corrupt allies but we will leave that for another time! I can also kind of understand what he is trying to do, (bringing business back to the US from overseas), but the way he is going about it is nothing short of ludicrous.

In my opinion, what seems to be happening with the Trump’s administration is that there is a pull back from the last 20/30/40 years ( I am not quite sure of the length of time) of globalisation. We are moving more towards nations becoming more protectionist, rather then more global in nature. Is this a bad thing? It’s difficult for me to tell.

Certainly when we look at tariffs, the US has had a reasonably free and open market for most of this time and yet most other nations around the world have not played by the same rules. Free market capitalism works fine when everyone plays by the same rule book and reduces tariffs respectively, but when one plays by one set of rules and another by a separate set of rules, then imbalances are going to arise. I think this is what we are now seeing a push back against. Pres. Trump is saying that the imbalances have been one sided (true or not, I am not at liberty to say) to the detriment of the USA. To some degree I can see his point, although I understand that it is not as black and white as that.

European cars

This morning I saw that Pres. Trump was referencing the fact that European car manufacturers have always had a relatively easy time importing cars into the USA and that the US has lots of BMW’s and Mercedes and VW etc, but that you don’t see many American cars in Europe. On that point he is right. Now, that might be due to the fact that they are too big and we don’t want them, or that they consume so much fuel that they don’t make sense based on the price we pay at the pump, or it could be that there are restrictive trade measures to prevent US cars from entering into the EU market. I don’t know the details but maybe it’s a combination of them all.

Yesterday, I also went to our local Chinese store to get a few bits and pieces and was reflecting on the low prices of goods in these Chinese stores and on the new Chinese online store Temu. Again, I am not an economics expert or even know anything about tariffs between the EU and China, but, just by observation I ask myself why these Chinese goods are so cheap in Europe and yet we have a lack of Italian businesses manufacturing similar goods. Is it that the Chinese are willing to work harder and be paid less to produce the same goods? Have we really sold out EU manufacturing to lower cost countries? Is it tariffs are lower in the EU for Chinese goods than reciprocal tariffs in China, I have no idea but this particular moment in global politics does get me wondering.

If anyone knows please do feel free to let me know!

My point is, what if Trump is right? What if there are imbalances in world trade that need to be corrected and this is the way to do it? What if it can reindustrialise the USA?

(I very much doubt this by the way as I saw a list of companies who have announced significant investment and manufacturing in the USA since this trade war started and they are mainly AI firms and manufacturers of high level semiconductors etc. These firms are very unlikely to need rust belt workers to work in factories where they are more reliant on robotics and highly sophisticated machinery. That being said, bringing back the production of essential computer components for industry and defence also has some merit).

However, to give him the benefit of the doubt, what if there is some merit in taking short term pain to try and achieve long term gain?

If Pres. Trump can pull even a small % of manufacturing from China to the USA and create more national independence on its goods and services, and improve national security , may he have achieved his goal? It does feel like an end of empire last grasp at power, scenario, but maybe this will mean that the USA can retain it’s No 1 global economic powerhouse status for some time to come.

Markets speak in the US

So moving away from my random hypotheses, let’s dwell on markets and the horrible news that our portfolios have fallen in value once again but, before I do, if you have been an investor for years, I would ask you to reflect on just the last 5 years for a moment.

What did you think when a global pandemic hit? Businesses were shut, schools too, everyone was told to stay at home and not interact with each other without a mask on and to stay 6 metres away from others? The markets tanked as a result.

What was your reaction? Maybe we were too distracted by the pandemic to really pay much attention – and rightly so! but what about when Russian invaded Ukraine and it sent global markets into a panic and a global inflation spike, sending us from years of disinflation and near zero interest rates, to an overnight significant rise in prices which to date continues. Did you panic sell off your portfolio?

Probably the answer is no and you did the right thing because markets rebounded (albeit more slowly after the Russia Ukraine war) but they did and the same happened after 2008 Financial Crisis and 2010 Euro crisis: hanging on and riding through the panic was the best thing to do… and it is now!

You might argue ‘It’s different this time’ ; the whole world is changing and markets will never recover. If you think this then I would coach you to read the book, ‘It’s different this time -Eight Centuries of Financial Folly’ by Reinhart and Rogoff. Largely financial markets are governed by human behaviour and that has not changed since time began, or at least over the last 8 centuries according to the data they present.

Please also bear in mind that success for every US President is judged on the US stock market. Most, if not all Americans, have significant assets invested in the US stock market and so it is a sign of health of the US economy and more importantly a measure of the US Presidents success at home ( interestingly, Pres. Trump’s favourability ratings have increased from 48% at election time to 53% now. clearly, he is increasingly approved of in the USA).

After reading so much on this topic and trying to syphon through the almost hourly noise, my view is that he is front loading all the bad news now to get it out of the way. He knows that come the mid-terms in 2026 he needs to have made significant inroads into making good on his promises to the American people and for that reason he is getting the worst out of the way now, whilst he can, after which a flurry of good news will likely follow.

Trump’s strategy

So, moving away from the media hype and screaming economists for a moment, let’s take a look at what Pres. Trump is really trying to achieve.

Pres. Trump watches consumer confidence closer than anything and in order to keep it high he has to achieve 3 goals:

1. Get oil prices lower

Gas at the pump is the beating heart of the America middle class and the Trump administration will go to any lengths to reduce the price of oil at the pumps. (When I was in New York in February the gas at the pump, I calculated, cost €1 a litre!!!!!!! – compare that to the the €1.59 a litre, this morning, that I just paid for diesel. Petrol was €0.20 higher still). So, if this administration can reduce gas prices further that could stimulate a mini economic boom in the US.

Bear in mind that the US is already the worlds largest producer of oil at 40% higher than its nearest competitor ( Saudi Arabia). Pres. Trump has stated clearly that he wants to aim for 100% energy independence and I think they will not just aim for it but do it at any cost.

(It should be noted that I paid €1.59 a litre for diesel this morning. 1 week ago it was €1.67. – Is his strategy working?)

2. Mortgages are the second lever to pull

If he wants the American public to gain confidence in his policies then he needs to give them breathing room economically (i.e. more money in their pockets) and he can then continue to go about reshaping the US economy . (At time of writing, with pressure building on a possible recession, pressure is equally being heaved on Jerome Powell – head of the Federal Reserve, to reduce interest rates). Was the market correction manufactured to some degree, or at least expected, to pressure the Fed to reduce interest rates?

This administration has also openly stated that they will also look to deregulate the banking industry, to release them from overly administrative and bureaucratic procedures and to allow them to get back to banking. This will also assist in bringing interest rates down. (This point I can fully agree with :banking regulation, anti money laundering legislation, source of wealth and origin of wealth obligatory requirements have become, quite frankly , out of control and any simplification in this regard, in my opinion, is warranted).

3. Lastly – the Trump administration will focus on food price inflation

Remember to watch out for the first 100 days of the Pres. Trump term which is often linked to his early successes; the 100th day lands on April the 29th!

So, there you have it, a few thoughts of my own on the Trump administration and why it might not be as bad as it seems.

So, let me turn to the technical for a moment: some data about market volatility.

The data below courtesy of one of our investment management partners, New Horizon Investment Management.

When markets turn volatile, perspective is everything

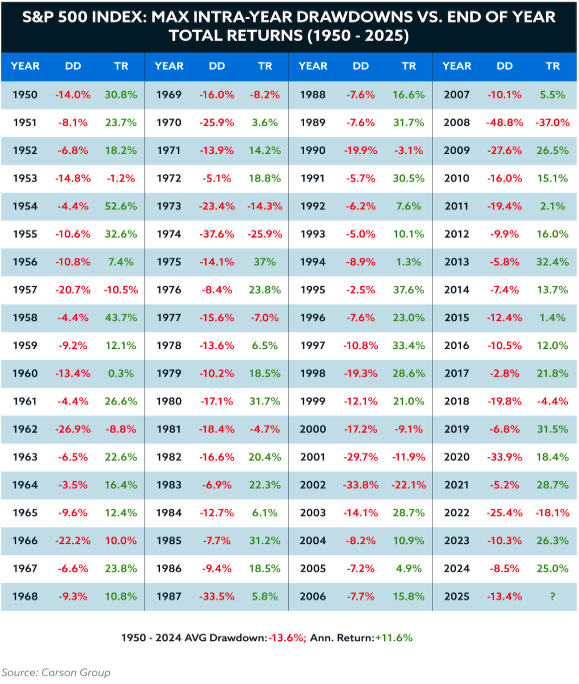

This market volatility feels tumultuous but, of course, we’ve been here before. The table below reveals that after severe drawdowns, the market has often recovered the full decline and finished the year strongly positive.

Years to Note:

- 1970: Market fell -26% from peak to trough… yet ended +3.6%

- 1975: Dropped -14.1%, but closed the year up +37%

- 1987 (Black Monday): Down -33.5% mid-year, still finished +5.8%

- 2009: Deep in the Global Financial Crisis, dropped -27.6%, yet ended +26.5%

- 2020: COVID crash brought a -33.9% drawdown… ended +18.4%

On each occasion, the best course of action would have been to avoid the noise and stay invested.

“History doesn’t repeat itself, but it often rhymes.” – Mark Twain

Whatever happens in the market we have bigger things to worry about!

Besides, when markets sell off, why on earth would you not buy into them at these prices? They are at bargain basement prices and as the saying goes ‘fill your boots!’ I had a measly amount of cash available to invest and have taken advantage of these prices.

Let me tell you a couple of my own investment tales:

My first tale which I have written about before was during the financial crisis of 2008 ( which by the way was a many times worse than what we are going through today) and my wife had just sold a house in the UK and we had some cash to invest. I knew I had to invest but I was very nervous because, working at the coal face of what was happening at that time, I knew that things were very serious. However, I also knew the theory of markets and that the best time to buy was in the height of the chaos. I went for it and the next 3 months were tragic and I lost 20% in value on the portfolio. (I never told me wife!) 6 months later the portfolio was up 45% ! It should be noted that I am an adventurous investor profile and so was invested 100% in equity ; it was a wild ride I can tell you but I knew the logic and I just had to be patient. Later we needed that money for something else and had to sell a sizeable portion of it, but it did its job.

My other tale is that at the start of my career as a financial planner I thought I was smarter than the market itself and that I could time my way in. I waited and waited and…. waited for the right entry point, waiting for a decent correction to buy in at the price I deemed to be right. I arrogantly waited 6 years before buying in! (What an idiot!) I can’t even bring myself to calculate the gains that I missed in those 6 years even with the correction that happened.

Lesson: It’s time in the markets, not timing the markets, that counts…

As I said to someone recently “I have made all the mistakes in the books, so you don’t have to!”

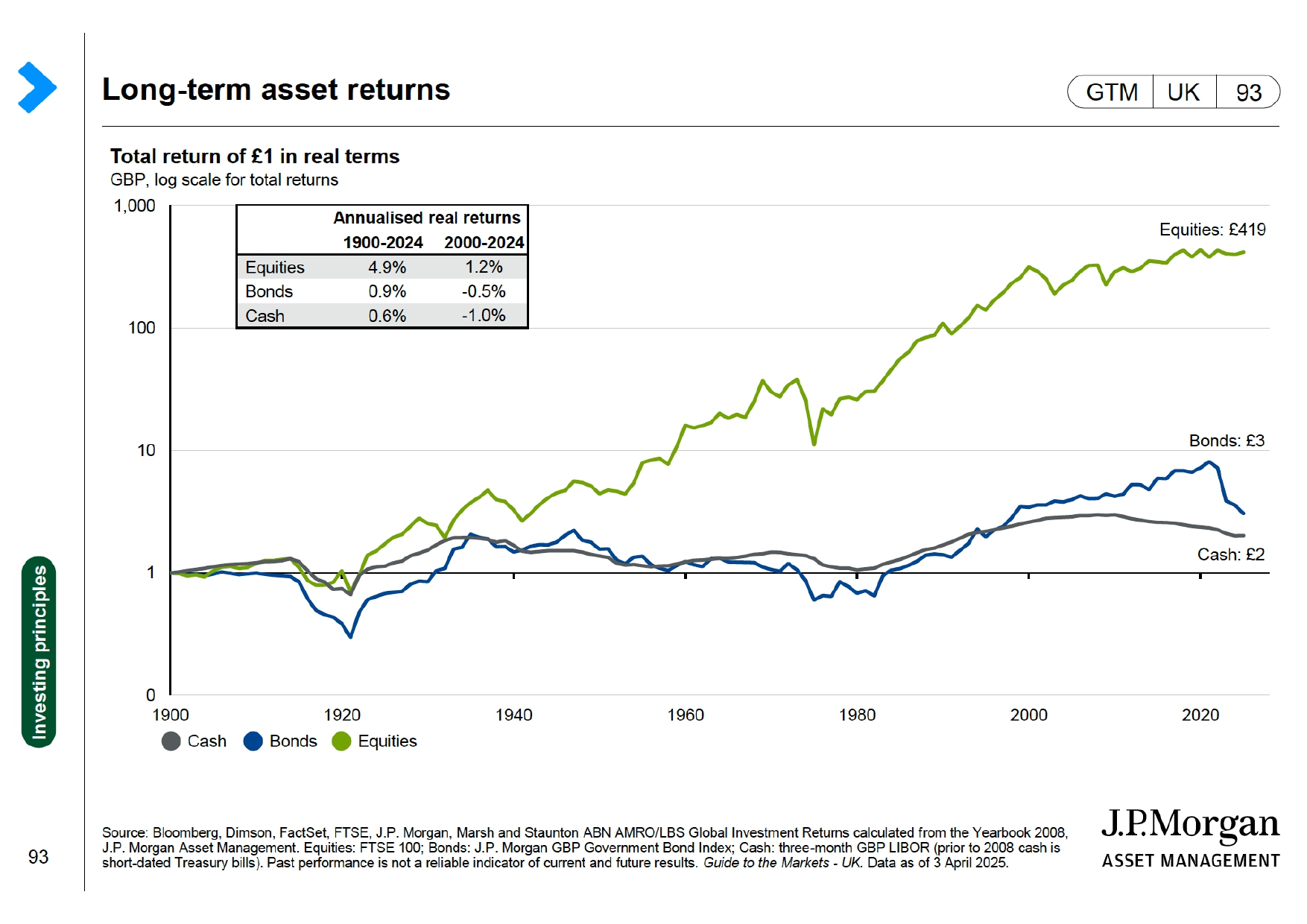

Inflation

Finally, let’s talk about inflation. Here I take the words of Charles D Ellis who wrote the book ‘Winning the Losers Game – Timeless strategies for successful investing’.

“For individual investors, inflation has usually been the major problem – not the attention getting daily or cyclical changes in security prices that most investors fret about. The corrosive power of inflation is truly daunting. At 5% inflation the purchasing power of your money is cut in half in less than 15 years and cut in half again in the next 15. At 7% your purchasing power drops to 25 % of its present level in just 21 years- the elapsed time between early retirement at age 61 and age 82, an increasingly normal life expectancy“.

Again, it might be useful to provide some perspective here because the all so surreptitious march of inflation is often upon us when we notice it, by which time it is far too late to do anything about it.

1. The price of my journey to Rome on the autostrada from Orte has increased from €4.50 in 2024 to €4.80 in 2025. That’s a 6.6% increase. I track this price and it has never, in my 20 years in Italy, increased at inflation levels or under. Always above!

2. The water machine in central Amelia, where I go to fill our drinking water bottles was 5 cents for a litre and half, they have just changed the machine and it’s now 5 cents a litre. That’s a 33.3% increase. (It’s hardly breaking the bank but a great example)

3. The news on RAI announced a few nights ago that the price of Colomba Easter cake is up 31% year on year and Easter eggs up 26%.

4. I took my son to KFC 2 weeks ago, reluctantly, and asked for the 4 large pieces of chicken. The last time I went to KFC was about 15 years ago and I remember these 4 huge pieces of chicken. Now, the 4 pieces resembled the size of 4 larger nuggets. Shrink inflation in practice so if you can’t increase your prices, reduce the amount of product. It has the same effect !

OK, I hear you say ‘These are not everyday items’ but they do reflect the general trend of the stealthy march of inflation.

Be under no illusion that this is your main financial enemy and investing is your only tool to protect yourself from it!

Investing requires patience and courage…or a financial adviser who you can ring and let off some steam. Make sure you can tap into any of these things if you get concerned about world events and market volatility!

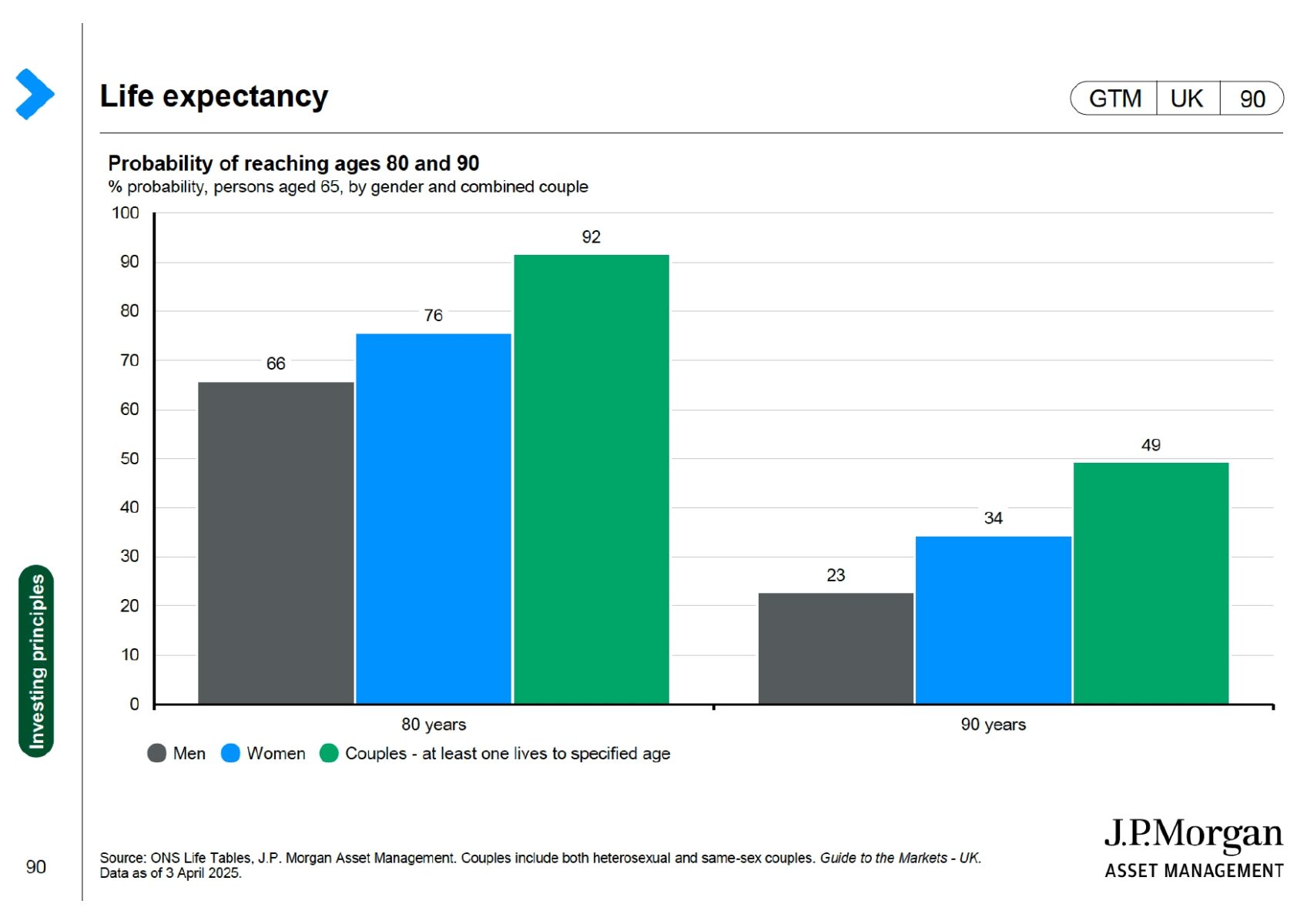

So, on this happy point let me leave you with this information about the life ahead of you.

Life Expectancy

More people needing to finance live beyond 90th birthday

- Ratio of women over age 90 to men was about 2:1 in 2023

- The number of people aged 90+ has doubled over the last 30 years

- The ratio of women over age 90 to men was 2:1 in 2023 compared to 4:1 in the 1980’s. About one in every 100 people is now aged at least 90.

- The odds of living to beyond 90 are high enough that people shouldn’t assume it can’t happen to them. Historically, this has been mainly women but the numbers of men are catching up fast.

- For those who are age 66 this year there is about a one in 3 chance (33%) for men and nearly an evens chance (46%) for women of making it to at least age 90 and if they do get to age 90 there is nearly an even chance they will survive to beyond 9%

The message: Think long term and not Donald Trump term!

If you would like to let off some steam with me or discuss any of what is going on in the world, tax or financial planning related issues in Italy then please don’t hesitate to contact me on: gareth.horsfall@spectrum-ifa.com or call / message on +39 3336492356

Always happy to help where I can!

Financial Market Update April 2025

By Peter Brooke

This article is published on: 8th April 2025

Uncertainty leads to Volatility

Quite understandably my inbox has been full of messages from concerned clients and musings from commentators and investment managers about how to respond to the current market reaction to President Trump’s raft of tariffs.

The uncertainty around how these tariffs will play out has led to large falls in stock markets, especially the US.

As discussed in my last newsletter Lets Talk About Risk, volatility is an important and unavoidable part of investing and will be negated by time in the market and can provide great opportunities. The key is to ‘stay the course’ and try and ‘see through the noise’.

However, I did want to get something out to you with some current thoughts about what is happening, what might happen in the near future and why ‘staying the course’ is the best option.

We’ve Been Here Before

When markets turn volatile, perspective is everything.

The past week feels pretty tumultuous but, of course, we’ve been here before.

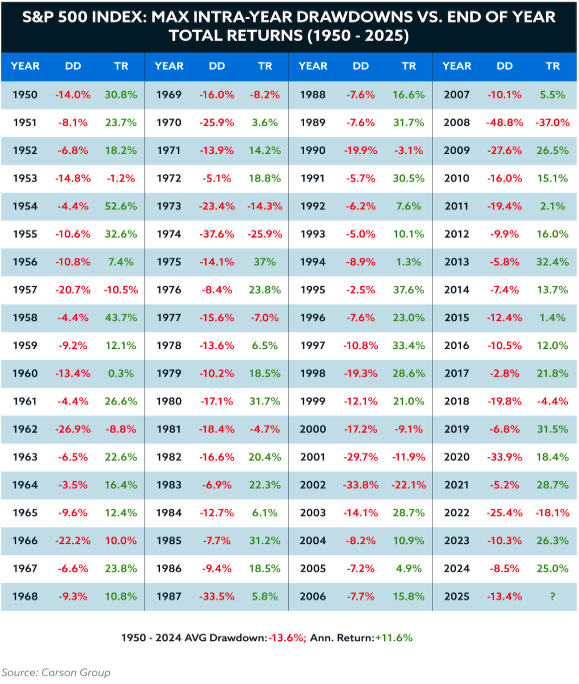

The table below shows the maximum intra-year drawdowns (DD) and end-of-year total returns (TR) for the S&P 500 from 1950 to 2025.

It reveals that after severe drawdowns, the market has often recovered the full decline and finished the year strongly positive.

Years to Note:

- 1970: Market fell -26% from peak to trough… yet ended +3.6%

- 1975: Dropped -14.1%, but closed the year up +37%

- 1987 (Black Monday): Down -33.5% mid-year, still finished +5.8%

- 2009: Deep in the Global Financial Crisis, dropped -27.6%, yet ended +26.5%

- 2020: COVID crash brought a -33.9% drawdown… ended +18.4%

On each occasion, the best course of action would have been to avoid the noise and stay invested.

“History doesn’t repeat itself, but it often rhymes.”

I hope that the above shows that though periods of volatility will always happen and always be temporary it is best to stay the course and try and avoid the noise;

I do appreciate that it is difficult with today’s ‘news’ channels adding to the feeling of panic on an hourly basis so I have shared below some links from firms much closer to the markets to share more detail about what is happening and what investors should consider in these temporarily volatile times.

Traversing Trump tariffs by Daniel Casali, Chief Investment Strategist at Evelyn Partners

Trump’s tariffs: how should investors respond? From Rathbones Investment Management

I would like, once again, to thank these expert commentators and the team at New Horizon Asset Management for their quick and important updates to a challenging situation.

Talk to me

As always, please remember that financial decisions should be made with careful consideration of individual circumstances and professional advice, I am here to support you.

If you have missed any previous news and updates these can all be found on the archive page here.

If you have any questions please use the the below channels, or the booking system – always drop me a quick message if you need a time slot outside of those available.

Mobile & Whatsapp: +33 6 87 13 68 71

Email: peter.brooke@spectrum-ifa.com

Facebook: Peter Brooke – Financial Advice

Calendly: https://calendly.com/peterbrooke/30min