I am back from The Spectrum IFA Group conference 2024 which this year was held in Budapest. I have been to Budapest before but had forgotten just how interesting the city is.

Tax planning in Italy 2024

By Gareth Horsfall

This article is published on: 3rd February 2024

Getting there was relatively easy enough from Rome: Ryanair to Budapest. Getting back was logistically a bit more difficult, needing to re-route through Prague on a Friday afternoon, creating a 4 and 1/2 hr round trip. This I found quite strange. On a Friday there weren’t many flights going from Budapest to Rome. There was one that returned at some ungodly hour, but I preferred to get home earlier so took the alternative route.

Ryanair is always a variable experience for me. The big panic is always how much your bag weighs and if your hand luggage will fit in the container, because you are never sure who is going to ask and if they are going to be pedantic about the rules, or not. In my case I had packed to perfection on the way out so there was no question, but my main bag weight limit was right on the nose of 20kg. My carry on bag, quasi empty.

At these conferences we always come away with some notepads or useful items and inevitably I have to think how to pack these things. I didn’t really want to lug my carry-on full of things and run the gauntlet of the lady at the gate asking me to check the size of my bag. So, I chose to overload my main bag and take the chance.

At the Budapest end all went smoothly as my bag weighed 21.3kgs on their scales and I guess they used some discretion that my main bag was empty and so the extra could go through. Going through Prague airport was a different story. There, interestingly, my bag weigh 23.4 kgs (which was probably more likely!) so I didn’t argue that point. However, I got the Ryanair agent who went by the book. At this point I tried to argue that my carry-on was almost empty and I could just move some things across, but the overall weight would be the same, so what’s the difference? As you might imagine that didn’t work. He did offer to allow me to move to the side and unpack my main luggage and put some things in my hand luggage. I just couldn’t stand it, so I just agreed to pay the extra fee. We were talking 2kgs at the most and I didn’t have the energy to start unpacking and packing again in front of a queue of people. What a pain! Anyway, I guess I should be happy that I managed to at least survive the Budapest side without issue.

So why am I mentioning all of this? Well, one of the main themes of the conference was Artificial Intelligence (AI) and the impact it will have on our lives in the here and now and the not so distant future. The question is will Ryanair become more consistent when they inevitably use AI in their booking procedures, or maybe they will just continue, for some time to come, with their current form of ‘intelligence’ instead of the artificial type? Knowing Ryanair, it won’t take long to find out.

Talking points for 2024 and beyond

Anyway, enough about my travel woes and onto some of the talking points raised and ideas for the future which I learned from The Spectrum IFA Group conference 2024.

A quick look back at the markets – 2023

You may have noticed by now that there was a slight rally in the stock market towards the end of 2023. What you may not have noticed was that it was heavily concentrated in one specific sector: TECH! However throughout the year there were some other more interesting developments which caused market volatility during the year.

AI

The hype around AI started driving up markets early in the year. I am sure you know the hype by now: AI will take over the world, humans will become batteries for electricity generation, we are all going to lose our jobs and be replaced by machines, it will be impossible to speak with a human again etc etc. Well, let me put your mind at rest, none of the above are true….at least for now.

(MIT in the USA think that AI is unlikely to replace as many jobs as we think and even those that it does, it will probably not do the job as well as humans. https://fortune.com/2024/01/22/ai-jobs-humans-cost-mit-study/)

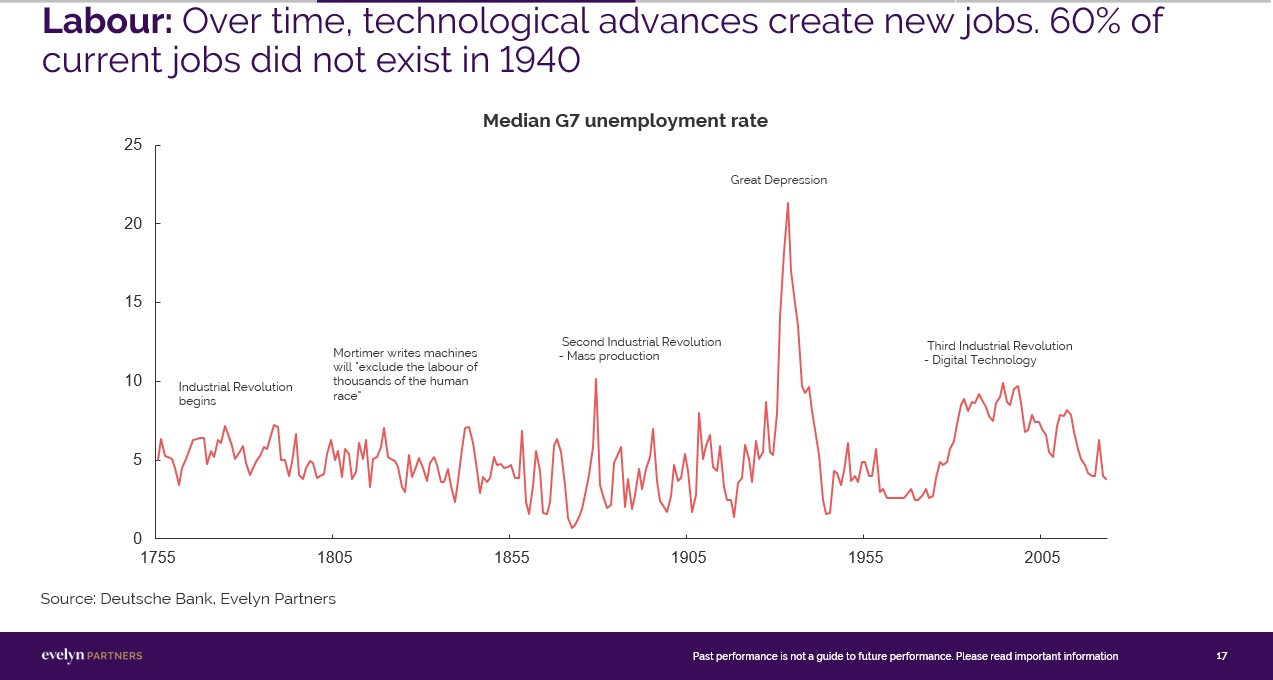

If you don’t believe me then take a look at the following slide, courtesy of Evelyn partners, which shows the G7 median unemployment rate going back to 1755! Whichever jobs are displaced by AI will likely be created in some other field, of which may not even exist yet!

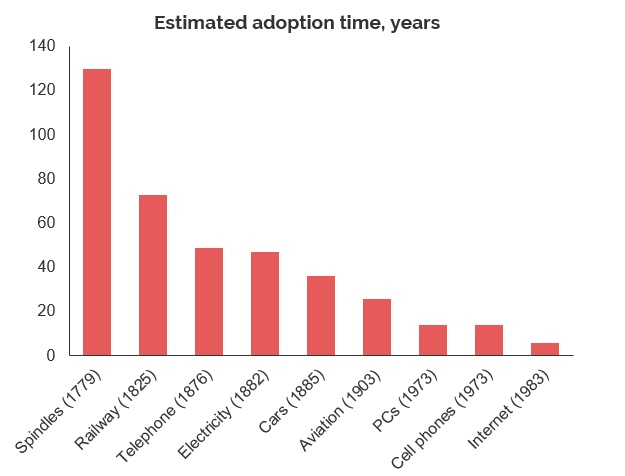

Not only, but AI is in in its infancy (think internet 2000 – if you haven’t used ChatGPT yet I would encourage you to ask it some questions and see what kind of responses you receive, you will likely be under whelmed ), but it will likely develop quicker than any technology we have ever seen in human history!

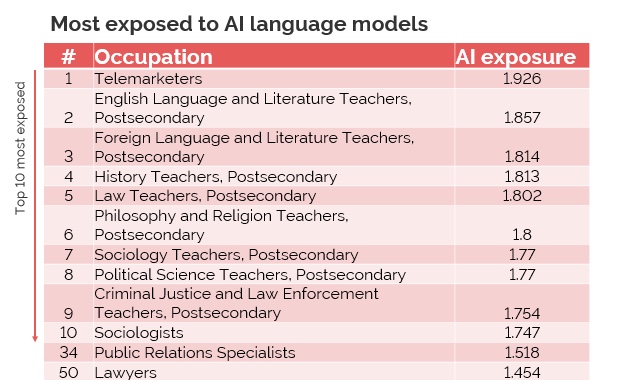

However, here is the list of the top professions which might be affected by AI (Teachers beware!!)

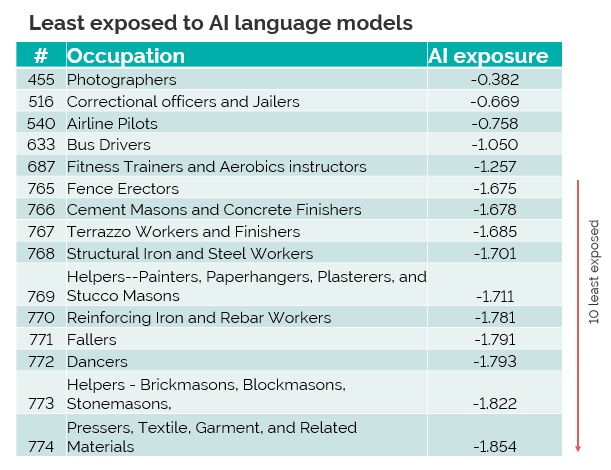

And the least affected:

Here is an interesting fact for you –

In the Federal Reserve in the USA there are approximately 500 employees of which 400 are at PhD level and above, who are all engaged in making economic forecasts. The problem is that they are absolutely terrible at forecasting. In almost every period their forward economic projections turn out to be wrong. As an example in 2021 they anticipated that interest rates in 2023 would be at 1%, when in fact they were 5.25%!

They use historical economic data to predict the future rather than forward looking models which are now readily available from many different companies. Is this an AI opportunity?

But enough of AI, some other strange hype happened during 2023….

Weight reduction drugs

A buzz started around new drugs that would help you to lose weight. Apparently, it will be as easy as taking a pill before long. Long gone will be the days of dieting and exercise!

The publicity from various celebs touting the benefits of weight loss drugs started a hype around the fact that we would no longer have diabetes, no more knee surgery would be required, nor hip surgeries and all our eye problems would be resolved. Who knew that it was all down to weight loss and a pill could cure all?

Airline company stocks rose

And if you couldn’t believe that all that was true, then airlines stock prices started to rise because it was believed that bigger seats would no longer be required as larger people would be no more, and so with more space they could fill the plane with more seats and earn more profits.

So, you might be forgiven for wondering why the markets didn’t really climb during the year when all these actors were at play. Well, the truth is that markets did climb, but they also fell back around November. The hype died. Every 3 or 4 months in 2023 there was a new theme which came to life and then quickly died away. It was almost like everyone was searching for some sign of good news in a year, which otherwise was once again occupied by concerns about global war. Thankfully the year finished on a positive note mainly because of the rise in stock prices of the Magnificent 7 – as they are now known – (Meta, Amazon, Alphabet (Google), Apple, Microsoft, Nvidia and Tesla).

To 2024 and beyond

So looking forward, what is awaiting us?

US elections

Probably the single most important event of the year will be the US elections in November, and the likelihood that our friend Donald Trump could very well become the President of the United States once again. However, as I mentioned in my previous E-zine the third candidate Robert. F :Kennedy Jr is striving to get his Independent party on the ballot and could be a contender. From what I learned, it seems unlikely that Joe Biden will be voted in again mainly due to growing concerns about his health and mental condition.

The USA is faced with multiple issues that need fixing, none more so than the illegal immigration problem, bringing manufacturing back to the US, fixing the rural rust belt crisis and the fentanyl crisis, and there is a possibility that under Trump they may also leave NATO. The USA is retreating from the rest of the world and becoming more protectionist. Globalisation is unwinding. In some ways it is starting to look very much like the period of the 60’s and 70’s: wars, geopolitical risk, and perhaps the end of the centre left and not just in the US, but also around the world. So all eyes are on the USA this year. US general election years can be good for investment markets (there are no guarantees), but often the government in power will do its utmost to stimulate the economy, consequently stimulating the markets which may help with the voters. It’s all to play for in a world which is changing very quickly.

Elections around the world

Let us not forget that there are also going to be a further 64 elections around the world in 2024, plus the European Union. This will cover 49% of the world’s population. We might see some interesting results as the year progresses.

Bonds versus Equities

For years leading up to the start of the current inflationary cycle (2022) there has been debate over whether one would have more Bonds or equities in a portfolio to drive growth. Almost always, over the last 20 years, equities has won outright with interest rates at low to zero and sometimes even negative there seemed to be little value in the bond sector (I am talking mainly sovereign bonds).

However, a number of our speakers made the case that perhaps the tide has turned. Not since the 1980’s and 1990’s have they seen such value in the bond sector. Prices are looking attractive, particularly US treasuries and sovereign bonds over a 1, 2 and 5 year periods. Not only do sovereign bonds now have some potential to provide reasonable yields (interest), but also capital growth and capital protection of your portfolio as well.

Portfolio diversification in the1990’s, when I first started investing, very much looked like a 60/40 portfolio. 60% equities and 40% Bonds or vice versa depending on the way of the economy. These days we have many more asset classes to help diversify our portfolio, but it might be that your portfolio starts to resemble those portfolios of the past moving forward.

Healthcare

As I stated above healthcare was very much a hyped theme in 2023, but it will continue to play a much more important role for growth in coming years. I am not just talking about over publicised weight loss drugs but the developments in medical technology. The world is aging. Almost all developed countries in the world now have a falling or negative replacement rate (the birth to death ratio to sustain population). The Far East: China, S. Korea, Japan, for example have dangerously low replacement rates. This means that their populations are aging at a fast rate and with the benefit of better medical care they are living longer. Italy included!

Medical technology will help to relieve the stress on already over-burdened health care systems. A great example of this is my mother in law, who had polio when younger, now has difficulty walking and more importantly a fear of falling. She recently told me that she had bought an iPhone and iWatch because the iWatch will call for an ambulance if your heart rate drops and it suspects that you are unconscious and need medical help.

We might even see more of these things become mandatory if we want to receive access to our health care systems. Imagine your doctor being able to get real time access to your heart rate data if you are suffering from cardiovascular problems.

This will be a huge growth area, but identifying the tech winners might be harder than you might think.

Defence

It seems that we ‘humans’ don’t have a great capacity for living in peace with one another. We could now have about 5 – 10 years of retreating from globalisation. The retreat probably started in 2022 with the Russia/Ukraine war, if not before with China/US trade wars. If Trump pulls away from NATO then the EU is going to have to find a way to defend itself and to do that it has to re-stock its weaponry. This has already started. The US needs to do the same and almost all other countries around the world are starting to see national sovereignty as more important than globalisation.

Defence stocks will almost certainly benefit from a multi-year period of growth as armoury, weaponry and military logistical hardware be required for re-stocking purposes by nations across the world. Who will buy from who will very much depend on military and economic interests.

AI Hardware – not software

With all the hype over AI software, the real winners could be the companies who provide the hardware to build the AI infrastructure. Think nano computing chips: Nvidia, AMSL, Taiwan Semiconductor Manufacturing Company etc.

Nvidia is just one of these companies. It was valued at 50 times its earnings at the start of 2023 (average price to earnings is about 17 times across a broad range of companies), but this grew a further 3 times over the course of 2023…is this justified? Probably not. Is it likely to be a bubble? More than likely. Or is their hardware so needed for an AI powered world that it can keep on growing? Do, therefore, traditional valuation metrics still mean anything? Only time will tell!

I read the other day that to power the AI universe that the utopian thinkers would have us believe is our future, we would need so much energy that we would effectively need to cover the earth with solar panel and wind turbines, if we were to try and support it with green sustainable energy sources. To what degree that is true, I don’t know, but we are going to need an incredible amount of energy to power the tech needs of the future and it does beckon the question, where is all that energy going to come from? We need a revolution in the storage of energy and no-one is talking about that…yet.

Rewarding Loyalty

As a shopper we all like to think that we are loyal customers. A lot of our favourite places to shop and eat are digging deep to discover just how loyal we really are.

McDonalds is a great example, you can now sign up to their loyalty scheme and receive offers for free burgers and other deals. They are seeing the customer return rate increase as a result of their loyalty schemes. (Interestingly, they are, at the same time pulling away from healthy food options because they were a resounding failure because who wants to go to McDonalds for a salad and a vegan burger… right?!)

Costco is another success in the USA. They are a membership driven business. Their prices and quality of goods are second to none (I have visited one in the UK and can confirm it’s true!) but it’s not that which pulls clients in. They actually have the cheapest gas prices in the USA and this drives people to become members which then allows them to market to each and every customer according to their specific needs.

Customer focused businesses will survive in the modern world.

And finally….boring old infrastructure

(For any non-UK person reading this, HS2 is the high speed railway which the UK has been planning and building for years and is turning into a national farce. But why am I mentioning this? )

Did you know that the USA is in the process of building 50-100 equivalent high speed rail networks?

Infrastructure companies, those building tunnels, roads, railways, electricity grids, toll roads, inter-connected cities, schooling, healthcare facilities etc, leading up to 2023, were considered to be solid businesses in which to invest that would provide long lasting portfolio stability and a decent return. However like most other sectors they were also burdened with debt. In 2022/2023 the interest rate spike suddenly meant they had to contend with significantly increased debt repayments and therefore started restructuring their businesses. The markets didn’t like that and most stocks in this area were down 30-40% in 2023, that created a buying opportunity, because in the end some boring old businesses are worth investing in.

The USA is undergoing significant infrastructure build. A southern border wall is almost assured to be erected following the US election, whoever comes ino power, and besides that we need to update, modify and prepare our economies for the future. Infrastructure spend is going to continue unabated.

So on that note I will leave it there. I just wanted to add a note about some of my activities planned for 2024.

I would like to thank everyone who enjoys reading this E-zine, those who support me by forwarding it on to others and to those of you who email me to let me know. I often wonder how many people it is reaching and if you actually enjoy what I write. To hear back gives me some solace that I am doing the right thing. They take a bit of time to think about and write but are enjoyable to do. If you do find them useful then please do forward them onto others as it is one of the best ways to widen my audience and is a great help.

In 2024 I will be expanding my short video content on topics that come up during the year, and I can do a quick video about them. I will, of course expand on these subjects in my E-zine. If you are interested then you can see the videos, to date, on my page on The Spectrum IFA Group website. Just click our logo to the right to take you to the page.