In this E-zine I am going to provide a brief summary of the taxes which mostly affect you and your lives in Italy. It is not an exhaustive list, but you can use this for reference or discussion tool with your commercialista if you need to.

Taxes in Italy 2024

By Gareth Horsfall

This article is published on: 21st January 2024

There may be specific elements regarding your personal situation, but I shall discuss the most important ones hat might affect you. Throughout this article, I shall also describe the latest changes from the Legge di Bilancio which have now been introduced in 2024.

Summary of the main taxes that affect your life as a ‘straniero/a living in Italy

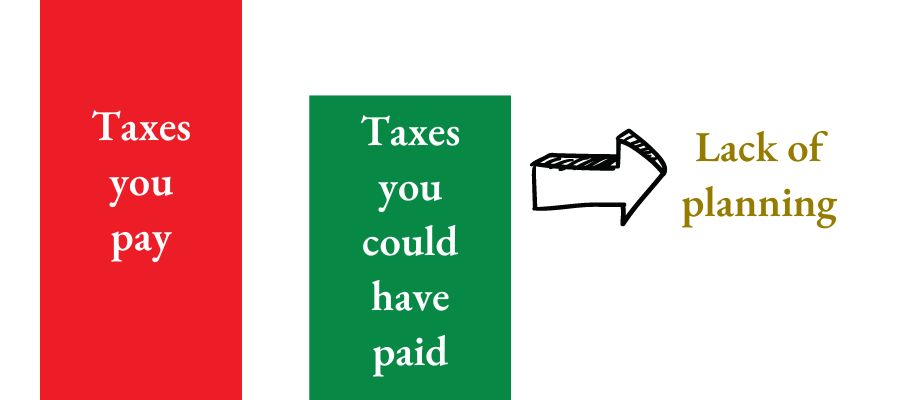

The first thing you need to remember, as a fiscally resident individual of Italy, is that you are subject to taxation on your worldwide earned and non-earned income: capital gains and assets (including property). It is your job to make sure that you report these to your commercialista each year to complete your tax return. But before you do it for the first time, a financial planning exercise can come always come in useful.

Fiscal residency generally means that you qualify under ‘1’ of the following criteria:

- You are registered as a resident on the anagrafe

- You spend more than 183 days a fiscal year ( calendar year) in Italy

- You have your main business, social or family interests in the country

TAX ON INCOME

NEW INCOME TAX RATES FOR 2024 (IRPEF)

In a move to simplify the tax regime in Italy the tax bands have now moved from 4 to 3 in 2024.

| € 0 – 28,000 | 23% |

| € 28,000 – 55,000 | 35% |

| € 55,000+ | 43% |

EMPLOYMENT

If you are employed or self employed then there are multiple options available, from partita iva, partita iva, regime forfettario, rientro di cervello, amongst others. I won’t go into details here as these really need to be looked at on a case by case basis, but needless to say that there are financial planning opportunities. If you are working, or intending to work, in Italy or if you have any questions in this area you can contact me on gareth.horsfall@spectrum-ifa.com

2024 Change: INBOUND WORKERS TAX REGIME

Regarding the inbound workers tax incentive. The previous tax regime was a 70 – 90% income tax (and social security contributions) deduction for a period of 5 years. This has been reduced to 50%, capped at an annual gross income of €600,000. The time spent as non-resident of Italy prior to applying has been increased to 3 years, (or 6 – 7 years if there is continuity in the employment relationship). However, Italian residency must now be retained for 4 years in Italy, whereas it was previously 2. They have also introduced a requirement for a high level of specialisation (degrees, masters etc) in the qualifications necessary for the job in question.

PENSIONS

Most of my clients are in, or planning for, retirement to some degree and so understanding how your pension will be taxed as a resident in Italy is of paramount importance.

PRIVATE PENSIONS AND OCCUPATIONAL PENSIONS

If you are in receipt of a pension income and it is being paid from a private pension provider / 401K provider / occupational pension provider or you are in receipt of a state pension / social security, then that income has to be declared on your Italian tax return and tax will be due on it.

If you have paid tax already on that income, then a tax credit will be given for the tax paid in the country of origin (assuming that the country has a double taxation agreement with Italy). Any difference between the tax rates in the country of origin and Italy will have to be paid.

I often hear stories of people who are told by their commercialista that their state pension / social security pension is not taxable in Italy, and, more recently I have seen numerous videos on Youtube of individuals who also make this claim. This is absolutely NOT the case!! The UK state pension and US social security are 100% taxable in Italy. It is not excluded from the double taxation treaties and therefore must be declared in Italy. Failure to declare could mean fines and penalties.

2024 Change: NO TAX AREA

For some time now there has been what is know as a NO TAX AREA for someone receiving a pension in Italy (“pensioner” is defined as someone who is receiving official state benefits i.e., social security or state pension). No distinction is made between pensions being paid from abroad or within Italy.

From 2024 the NO TAX AREA has been increased to €8500 per annum.

It is important to understand that this is NOT an allowance i.e., an exclusion of income tax on the first €8500 for ALL pensioners. It is a tax credit system. If your total income (reddito complessivo) is €8500 or less then all the tax payable on your pension will be provided as a tax credit. HOWEVER, the more your total income, from all sources, increases over €8500, the more of the tax credit you lose. If your total income is €55000 or above you would not receive any tax credit.

GOVERNMENT DERIVED PENSIONS

It is a good idea to define what is meant by government paid pensions. The definition according to the Italy / UK / USA double taxation convention 1988 is, paid from:

” a political or an administrative subdivision or a local authority”

This generally means civil servants of any kind and foreign office employees but would generally include teachers who have worked in a public school, health care workers, military personnel, police fire service etc. In these cases, the pension awarded is taxable only in the state in which it originates, and tax is generally deducted at source in that country of origin.

But there are some tax idiosyncrasies to look out for here. On the positive side, this income is not taken into account when calculating the tax on your other income sources in Italy, e.g. rental income, and it is not declared on your tax declaration in Italy.

On the negative side, for those of you who are thinking of becoming citizens of Italy, these pensions are only taxed in the state of origin UNLESS you become a citizen of Italy, or are one already, in which case it becomes taxable. So for anyone thinking about cittadinanza, plan before you leap!

My final note on pensions is to say that ensuring that they are filed correctly on your tax return in Italy is essential. There are only various shades of grey when it comes to how to declare overseas pensions correctly. Speaking to the right experts might mean the difference between paying more tax than you need to.

INVESTMENT INCOME AND CAPITAL GAINS

As of 1st January 2017, interest from savings, income from investments in the form of dividends and other non-earned income payments stands unchanged at a flat tax rate of 26%. Realised capital gains are also taxed at the same rate of 26%.

(Interest from Italian government bonds and government bonds from ‘white list’ countries are still taxed at 12.5% rather than 26%, as detailed above. This is another quirk of Italian tax law as this means that you pay less tax as a holder of government bonds in Pakistan or Kazakhstan, than a holder of corporate bonds from Italian giants ENI or FIAT).

Property which is located overseas is taxed in two ways. Firstly, there is the tax on the income and, secondly, a tax on the value of the property itself.

THE INCOME FROM OVERSEAS PROPERTY

Overseas net property income (after allowable expenses in the country in which is located) is added to your other income for the year and taxed at your highest marginal rate of income tax.

Where many properties are generating all your income, this can prove to be a tax INEFFICIENT income-stream for residents in Italy. It is better to have a diversified income stream, pensions, investments and property, to maximise tax planning opportunities and allow you to redirect income from the most tax efficient source at any one time.

Relying solely on one type of asset for income in Italy can mean paying more tax and you getting less in your pocket.

* Value must be defined here. For properties based in the EU, the value is the Italian cadastral equivalent. You will find that the market value will, in most cases, be significantly more than the cadastral equivalent value.

For properties located outside the EU (inc the UK/USA) the value for tax purposes is defined as the purchase price or acquisition value where this can be evidenced, otherwise its the current market value of the property.

Disposal of investment properties both abroad and in Italy (except prima casa) are not deemed speculative if you have owned the property for more than 5 full tax years and therefore are not capital gains tax liable on the disposal, in Italy.

However, you would need to see if you would still be liable for capital gains tax on the disposal of the property in the country in which it is located and if any tax breaks are available there. You might be able to tax advantage of any tax breaks in both countries with careful preparation and planning.

NOTE: If you gain residency in Italy then by default your previous ‘first home’ or ‘family home’ for the purposes of the Italian tax authorities, becomes now an investment property. By definition, if you have a home in Italy and a property in another country, even if you consider this property your family home, it can no longer be considered your ‘Prima Casa‘.

BANK ACCOUNTS AND DEPOSITS

Here are examples of a few:

GENERAL INVESTMENT ACCOUNTS, ISA’S, BROKERAGE ACCOUNTS, PLATFORMS, DISCRETIONARY MANAGED PORTFOLIO, DIRECT INVESTMENT IN FUNDS, STOCKS AND SHARES, COMMODITIES, ART WORK, CLASSIC CARS, ETC.

For all other financial assets we have the foreign-owned assets tax (IVAFE). The tax on these is 0.2% per annum based on the valuation as of 31st December each year.

2024 CHANGE: If the assets are located in one of tax regimes around the world which are considered fiscally privileged by the Italian authorities, then the rate of tax is 0.4%pa. The list can be found at the end of this article HERE

** Also worth mentioning is that if you are invested in NON-EU harmonised collective investment vehicles i.e. funds which are listed in a place outside the EU, then the gains and income from these assets is not taxed at the flat 26% rate in Italy, but would be added to the rest of your income for the year and taxed at your highest marginal rate of income tax. This is particularly important for UK and USA domiciled assets. If you have a brokerage account with a group such as Fidelity or Vanguard or one of the many other asset management firms, or you invest through a platform such as Hargreaves Lansdown in the UK/USA, then depending on which assets you invest in could mean you are pushing yourself into a higher tax bracket on taxable gains and income for the year. Your portfolio may need restructuring for life in Italy! **

If you have any questions about any of these taxes and how they apply to you and your financial situation, or if you think that you might be paying more than need to, then do get in touch and I will be happy to see if I can help you with your plans.

I can be contacted on email: gareth.horsfall@spectrum-ifa.com or on cell: +39 333 6492356