If you follow Italian media reports, you may have picked up on the idea that a one-off wealth tax may be on the way to help lower the levels of government debt.

Wealth taxes in Italy

By Andrew Lawford

This article is published on: 15th October 2024

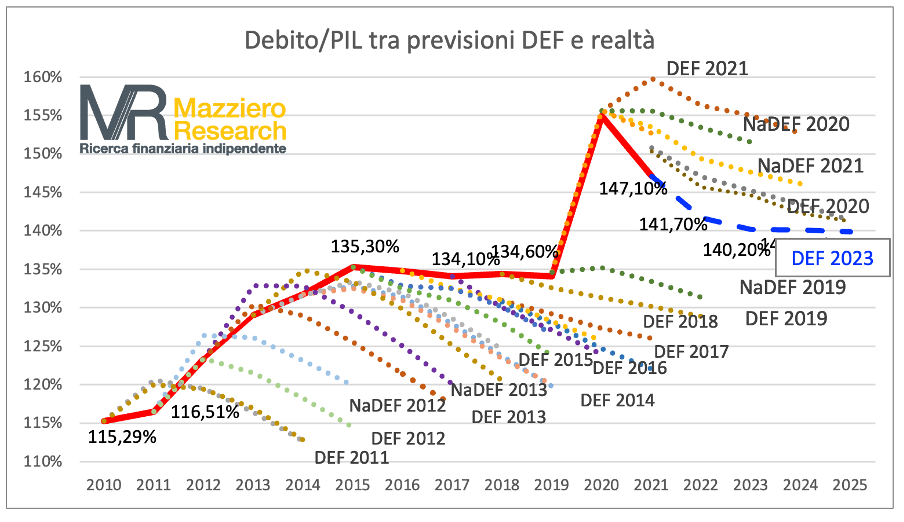

It probably comes as no surprise that Italy has a long history of over-promising and under-delivering when it comes to reducing its debt levels. If a picture is worth a thousand words, then the graph below shows how each budget forecast (dotted lines) promised a reduction in the ratio of Debt/GDP, whilst the actual level (solid red line) generally heads in one direction only.

Of course, the Debt/GDP ratio is one thing, the absolute level of indebtedness is quite another. I note with some uneasiness that over the last 20 years Italian Government debt levels have increased by almost 100% whilst nominal GDP has only increased by around 60%. Soon I fear that Italy will cross the threshold of €3 trillion in debt. That’s €3,000,000,000,000 for those who like lots of zeros.

Is a wealth tax a likely route to try and bring the public finances back into line? Italy has seen this sort of thing before, and the mention of a wealth tax (una patrimoniale) is enough to provoke any Italian who had a bank account at the time to start grumbling about the “patrimoniale del ‘92”, when Giuliano Amato, the recently appointed prime minister, did an overnight raid on Italian bank accounts, withdrawing 0.6% of the value to try and bolster the parlous state finances. Interestingly, Mario Draghi was Director General of the Italian Treasury at the time, apparently willing to do whatever it took even back then.

In considering the likelihood of new wealth taxes, it must be noted that Italian residents already suffer an annual 0.2% tax on the value of their financial holdings (either through stamp duties or the foreign assets wealth tax known as IVAFE). A one-off wealth tax of 0.6% would be preferable to 0.2% per annum in my opinion, but getting both would be a bit rough.

One must also consider the current political landscape compared with 1992. Back then, the system was beginning to crumble as the tangentopoli bribing scandal was getting started. This eventually led former prime minister Bettino Craxi to flee to Tunisia and brought about a supposed cleansing of the political classes dominant in the post-war period. The new system, known as the Second Republic, continues to this day and is currently dominated by Giorgia Meloni. Notwithstanding her somewhat inauspicious background and the fact she is surrounded by a cast of more or less unsavoury individuals, she has managed to convince the world that she is a force for good. My own view is that she is an able political operator and figured out fairly quickly that, if you play by the rules of modern conservatives, you get invited to far better parties – have a look at this video from the Atlantic Council who recently gave her the Global Citizen Award. From minute 1.30 you can hear what Elon Musk has to say about her.

As far as Meloni’s attitude towards raising taxes, she has recently declared them to be una cosa di sinistra (a left-wing thing), presumably meaning that any dirty work of raising extra taxes will be left to a technocrat like Mario Monti or Mario Draghi at some point in the future.

Whatever the case, it is always prudent to maintain a solid asset base outside of one’s country of residence and it should be clear that any overnight raid on financial assets could not include those deposited outside the Italian financial system.

Foreign assets may well be dragged into the tax net in other ways, of course, but at least you won’t wake up one morning suddenly poorer than when you went to bed. In extreme circumstances, which admittedly are almost unimaginable for the moment, capital controls and the like could severely reduce your financial flexibility in the event that all your assets were held in Italian financial institutions. This may seem like scare-mongering, but remember that the unthinkable has happened in the EU in recent memory, so it pays to be prepared. If the weather is uncertain (and when is it not?) then it’s always a good idea to have an umbrella with you. If you end up not needing it, all the better.

If you feel like discussing your own financial set-up to see if it can be improved, then do get in touch. I’m happy to provide a no-obligation consultation to discuss any concerns you might have and the options you have available.