Well, as you might have expected I have decided to write to you at this particularly fragile moment in world politics, and which has now reverberated around world investment markets. As of Friday last week a sell off started in the equity markets which effectively created a bear market situation around the world for fears of global recession based on the Trump tariffs. (as of today we have seena slight rebound, but more volatility is likely)

When markets turn volatile

By Gareth Horsfall

This article is published on: 10th April 2025

Given this, you may be forgiven for wondering why I am leading this E-zine with a picture of one of my apple trees in full blossom on my land?

Last weekend I was away from home, spending time in the North of Italy with friends, to celebrate my wife’s 50th birthday. Seeing what had happened on Friday, starting with the sell off in equity markets, I returned home wondering how to deal with it. I could have thrown myself in front of the computer and sent you a lot of charts about how you need to ‘sit tight and ride it through the rises and falls’ or ‘it’s time in the markets that counts not timing the markets’ and ‘the real threat is inflation, not investment market volatility’, (you won’t get away from these points…….you can find these further down the page!), but instead I took an hour in the morning to get my thoughts together and went out on the land to do some tidying up after the olive pruning and to check out the health of the blooming trees.

This apple tree made me take stock of the situation and I will explain why.

When we bought the house last year, the land and house itself had been left abandoned for quite some years and it needed not just a clearing up, but also some TLC. This apple tree was a case in point. Last summer this tree produced 3 very ugly and unhealthy looking apples. The tree itself looked like it had given up the hope and it entered its winter phase looking like it was on its last legs.

I was in 2 minds to pull up the tree and plant something else. However, I thought I would give it another chance, so, I spent the winter pruning the tree and giving it some nutrients. I cut off the bad old rotten wood and reshaped the tree into a form which would allow it space to breath and allow the light to penetrate deep into the centre, so that flowers and fruit could develop.

I was careful not to over do it so as not to stress it too much!!

This, I am happy to say, is the result. What looks like a pretty healthy tree! It is now in full bloom, the bees are all over it and I expect that it may very well provide some decent fruit this year, albeit still quite a young tree.

Comparisons with markets

You will have guessed by now the point I am trying to make about the apple tree. Sometimes, when all hope seems to be lost there may just be hope around the corner with the right care and attention.

I will caveat the rest of this E-zine by stating that I am not wholly against the Trump’s tariffs. I am 100% against the way he is going about it: his morally dubious behaviour, his manner and potentially corrupt allies but we will leave that for another time! I can also kind of understand what he is trying to do, (bringing business back to the US from overseas), but the way he is going about it is nothing short of ludicrous.

In my opinion, what seems to be happening with the Trump’s administration is that there is a pull back from the last 20/30/40 years ( I am not quite sure of the length of time) of globalisation. We are moving more towards nations becoming more protectionist, rather then more global in nature. Is this a bad thing? It’s difficult for me to tell.

Certainly when we look at tariffs, the US has had a reasonably free and open market for most of this time and yet most other nations around the world have not played by the same rules. Free market capitalism works fine when everyone plays by the same rule book and reduces tariffs respectively, but when one plays by one set of rules and another by a separate set of rules, then imbalances are going to arise. I think this is what we are now seeing a push back against. Pres. Trump is saying that the imbalances have been one sided (true or not, I am not at liberty to say) to the detriment of the USA. To some degree I can see his point, although I understand that it is not as black and white as that.

European cars

This morning I saw that Pres. Trump was referencing the fact that European car manufacturers have always had a relatively easy time importing cars into the USA and that the US has lots of BMW’s and Mercedes and VW etc, but that you don’t see many American cars in Europe. On that point he is right. Now, that might be due to the fact that they are too big and we don’t want them, or that they consume so much fuel that they don’t make sense based on the price we pay at the pump, or it could be that there are restrictive trade measures to prevent US cars from entering into the EU market. I don’t know the details but maybe it’s a combination of them all.

Yesterday, I also went to our local Chinese store to get a few bits and pieces and was reflecting on the low prices of goods in these Chinese stores and on the new Chinese online store Temu. Again, I am not an economics expert or even know anything about tariffs between the EU and China, but, just by observation I ask myself why these Chinese goods are so cheap in Europe and yet we have a lack of Italian businesses manufacturing similar goods. Is it that the Chinese are willing to work harder and be paid less to produce the same goods? Have we really sold out EU manufacturing to lower cost countries? Is it tariffs are lower in the EU for Chinese goods than reciprocal tariffs in China, I have no idea but this particular moment in global politics does get me wondering.

If anyone knows please do feel free to let me know!

My point is, what if Trump is right? What if there are imbalances in world trade that need to be corrected and this is the way to do it? What if it can reindustrialise the USA?

(I very much doubt this by the way as I saw a list of companies who have announced significant investment and manufacturing in the USA since this trade war started and they are mainly AI firms and manufacturers of high level semiconductors etc. These firms are very unlikely to need rust belt workers to work in factories where they are more reliant on robotics and highly sophisticated machinery. That being said, bringing back the production of essential computer components for industry and defence also has some merit).

However, to give him the benefit of the doubt, what if there is some merit in taking short term pain to try and achieve long term gain?

If Pres. Trump can pull even a small % of manufacturing from China to the USA and create more national independence on its goods and services, and improve national security , may he have achieved his goal? It does feel like an end of empire last grasp at power, scenario, but maybe this will mean that the USA can retain it’s No 1 global economic powerhouse status for some time to come.

Markets speak in the US

So moving away from my random hypotheses, let’s dwell on markets and the horrible news that our portfolios have fallen in value once again but, before I do, if you have been an investor for years, I would ask you to reflect on just the last 5 years for a moment.

What did you think when a global pandemic hit? Businesses were shut, schools too, everyone was told to stay at home and not interact with each other without a mask on and to stay 6 metres away from others? The markets tanked as a result.

What was your reaction? Maybe we were too distracted by the pandemic to really pay much attention – and rightly so! but what about when Russian invaded Ukraine and it sent global markets into a panic and a global inflation spike, sending us from years of disinflation and near zero interest rates, to an overnight significant rise in prices which to date continues. Did you panic sell off your portfolio?

Probably the answer is no and you did the right thing because markets rebounded (albeit more slowly after the Russia Ukraine war) but they did and the same happened after 2008 Financial Crisis and 2010 Euro crisis: hanging on and riding through the panic was the best thing to do… and it is now!

You might argue ‘It’s different this time’ ; the whole world is changing and markets will never recover. If you think this then I would coach you to read the book, ‘It’s different this time -Eight Centuries of Financial Folly’ by Reinhart and Rogoff. Largely financial markets are governed by human behaviour and that has not changed since time began, or at least over the last 8 centuries according to the data they present.

Please also bear in mind that success for every US President is judged on the US stock market. Most, if not all Americans, have significant assets invested in the US stock market and so it is a sign of health of the US economy and more importantly a measure of the US Presidents success at home ( interestingly, Pres. Trump’s favourability ratings have increased from 48% at election time to 53% now. clearly, he is increasingly approved of in the USA).

After reading so much on this topic and trying to syphon through the almost hourly noise, my view is that he is front loading all the bad news now to get it out of the way. He knows that come the mid-terms in 2026 he needs to have made significant inroads into making good on his promises to the American people and for that reason he is getting the worst out of the way now, whilst he can, after which a flurry of good news will likely follow.

Trump’s strategy

So, moving away from the media hype and screaming economists for a moment, let’s take a look at what Pres. Trump is really trying to achieve.

Pres. Trump watches consumer confidence closer than anything and in order to keep it high he has to achieve 3 goals:

1. Get oil prices lower

Gas at the pump is the beating heart of the America middle class and the Trump administration will go to any lengths to reduce the price of oil at the pumps. (When I was in New York in February the gas at the pump, I calculated, cost €1 a litre!!!!!!! – compare that to the the €1.59 a litre, this morning, that I just paid for diesel. Petrol was €0.20 higher still). So, if this administration can reduce gas prices further that could stimulate a mini economic boom in the US.

Bear in mind that the US is already the worlds largest producer of oil at 40% higher than its nearest competitor ( Saudi Arabia). Pres. Trump has stated clearly that he wants to aim for 100% energy independence and I think they will not just aim for it but do it at any cost.

(It should be noted that I paid €1.59 a litre for diesel this morning. 1 week ago it was €1.67. – Is his strategy working?)

2. Mortgages are the second lever to pull

If he wants the American public to gain confidence in his policies then he needs to give them breathing room economically (i.e. more money in their pockets) and he can then continue to go about reshaping the US economy . (At time of writing, with pressure building on a possible recession, pressure is equally being heaved on Jerome Powell – head of the Federal Reserve, to reduce interest rates). Was the market correction manufactured to some degree, or at least expected, to pressure the Fed to reduce interest rates?

This administration has also openly stated that they will also look to deregulate the banking industry, to release them from overly administrative and bureaucratic procedures and to allow them to get back to banking. This will also assist in bringing interest rates down. (This point I can fully agree with :banking regulation, anti money laundering legislation, source of wealth and origin of wealth obligatory requirements have become, quite frankly , out of control and any simplification in this regard, in my opinion, is warranted).

3. Lastly – the Trump administration will focus on food price inflation

Remember to watch out for the first 100 days of the Pres. Trump term which is often linked to his early successes; the 100th day lands on April the 29th!

So, there you have it, a few thoughts of my own on the Trump administration and why it might not be as bad as it seems.

So, let me turn to the technical for a moment: some data about market volatility.

The data below courtesy of one of our investment management partners, New Horizon Investment Management.

When markets turn volatile, perspective is everything

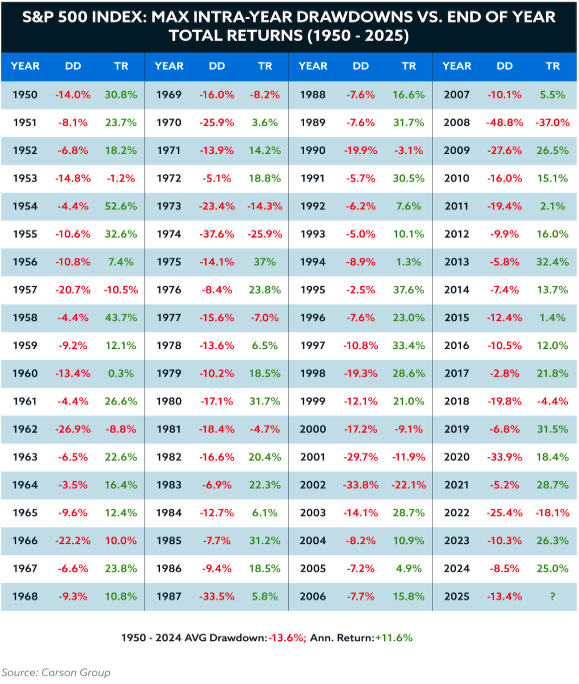

This market volatility feels tumultuous but, of course, we’ve been here before. The table below reveals that after severe drawdowns, the market has often recovered the full decline and finished the year strongly positive.

Years to Note:

- 1970: Market fell -26% from peak to trough… yet ended +3.6%

- 1975: Dropped -14.1%, but closed the year up +37%

- 1987 (Black Monday): Down -33.5% mid-year, still finished +5.8%

- 2009: Deep in the Global Financial Crisis, dropped -27.6%, yet ended +26.5%

- 2020: COVID crash brought a -33.9% drawdown… ended +18.4%

On each occasion, the best course of action would have been to avoid the noise and stay invested.

“History doesn’t repeat itself, but it often rhymes.” – Mark Twain

Whatever happens in the market we have bigger things to worry about!

Besides, when markets sell off, why on earth would you not buy into them at these prices? They are at bargain basement prices and as the saying goes ‘fill your boots!’ I had a measly amount of cash available to invest and have taken advantage of these prices.

Let me tell you a couple of my own investment tales:

My first tale which I have written about before was during the financial crisis of 2008 ( which by the way was a many times worse than what we are going through today) and my wife had just sold a house in the UK and we had some cash to invest. I knew I had to invest but I was very nervous because, working at the coal face of what was happening at that time, I knew that things were very serious. However, I also knew the theory of markets and that the best time to buy was in the height of the chaos. I went for it and the next 3 months were tragic and I lost 20% in value on the portfolio. (I never told me wife!) 6 months later the portfolio was up 45% ! It should be noted that I am an adventurous investor profile and so was invested 100% in equity ; it was a wild ride I can tell you but I knew the logic and I just had to be patient. Later we needed that money for something else and had to sell a sizeable portion of it, but it did its job.

My other tale is that at the start of my career as a financial planner I thought I was smarter than the market itself and that I could time my way in. I waited and waited and…. waited for the right entry point, waiting for a decent correction to buy in at the price I deemed to be right. I arrogantly waited 6 years before buying in! (What an idiot!) I can’t even bring myself to calculate the gains that I missed in those 6 years even with the correction that happened.

Lesson: It’s time in the markets, not timing the markets, that counts…

As I said to someone recently “I have made all the mistakes in the books, so you don’t have to!”

Inflation

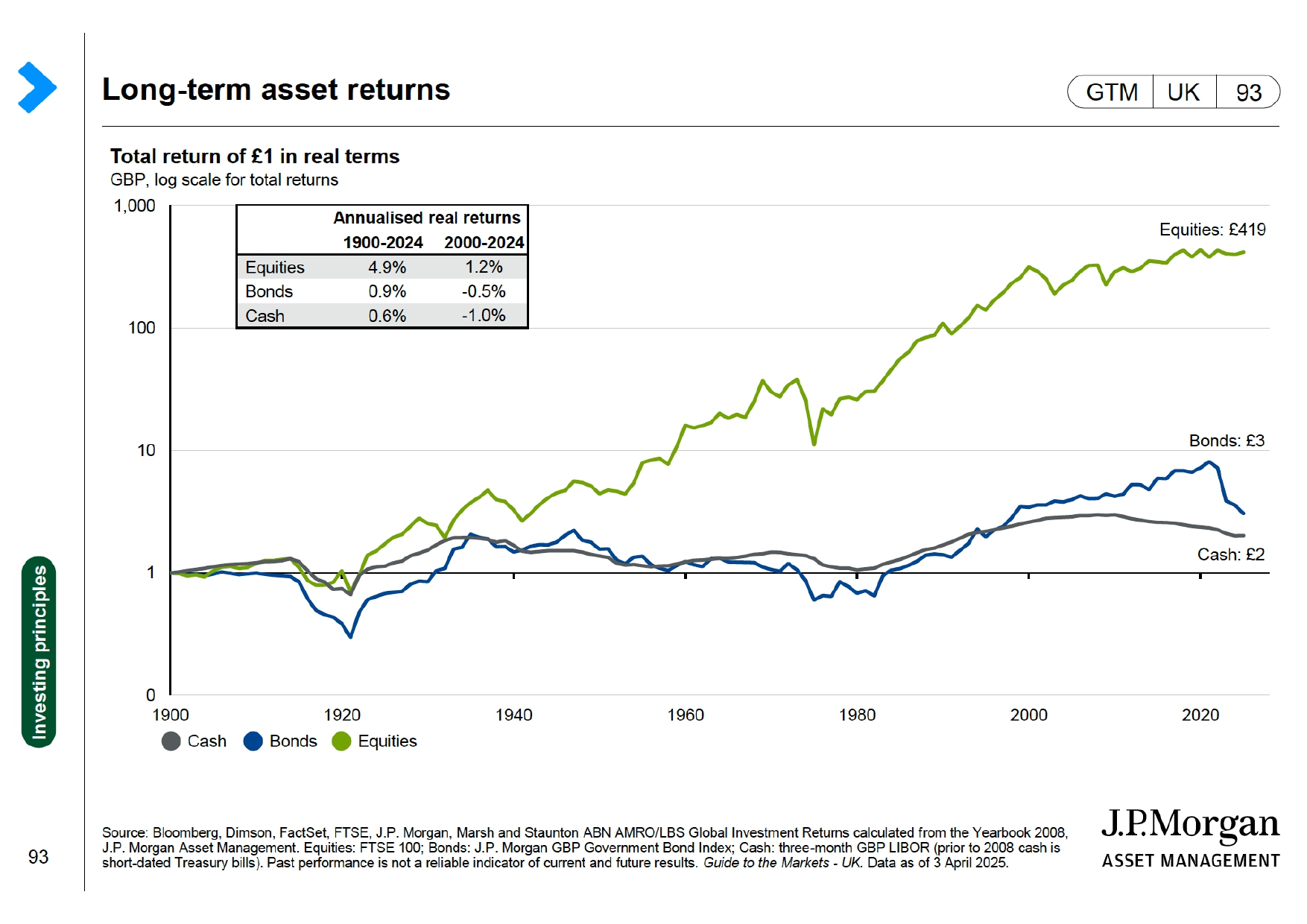

Finally, let’s talk about inflation. Here I take the words of Charles D Ellis who wrote the book ‘Winning the Losers Game – Timeless strategies for successful investing’.

“For individual investors, inflation has usually been the major problem – not the attention getting daily or cyclical changes in security prices that most investors fret about. The corrosive power of inflation is truly daunting. At 5% inflation the purchasing power of your money is cut in half in less than 15 years and cut in half again in the next 15. At 7% your purchasing power drops to 25 % of its present level in just 21 years- the elapsed time between early retirement at age 61 and age 82, an increasingly normal life expectancy“.

Again, it might be useful to provide some perspective here because the all so surreptitious march of inflation is often upon us when we notice it, by which time it is far too late to do anything about it.

1. The price of my journey to Rome on the autostrada from Orte has increased from €4.50 in 2024 to €4.80 in 2025. That’s a 6.6% increase. I track this price and it has never, in my 20 years in Italy, increased at inflation levels or under. Always above!

2. The water machine in central Amelia, where I go to fill our drinking water bottles was 5 cents for a litre and half, they have just changed the machine and it’s now 5 cents a litre. That’s a 33.3% increase. (It’s hardly breaking the bank but a great example)

3. The news on RAI announced a few nights ago that the price of Colomba Easter cake is up 31% year on year and Easter eggs up 26%.

4. I took my son to KFC 2 weeks ago, reluctantly, and asked for the 4 large pieces of chicken. The last time I went to KFC was about 15 years ago and I remember these 4 huge pieces of chicken. Now, the 4 pieces resembled the size of 4 larger nuggets. Shrink inflation in practice so if you can’t increase your prices, reduce the amount of product. It has the same effect !

OK, I hear you say ‘These are not everyday items’ but they do reflect the general trend of the stealthy march of inflation.

Be under no illusion that this is your main financial enemy and investing is your only tool to protect yourself from it!

Investing requires patience and courage…or a financial adviser who you can ring and let off some steam. Make sure you can tap into any of these things if you get concerned about world events and market volatility!

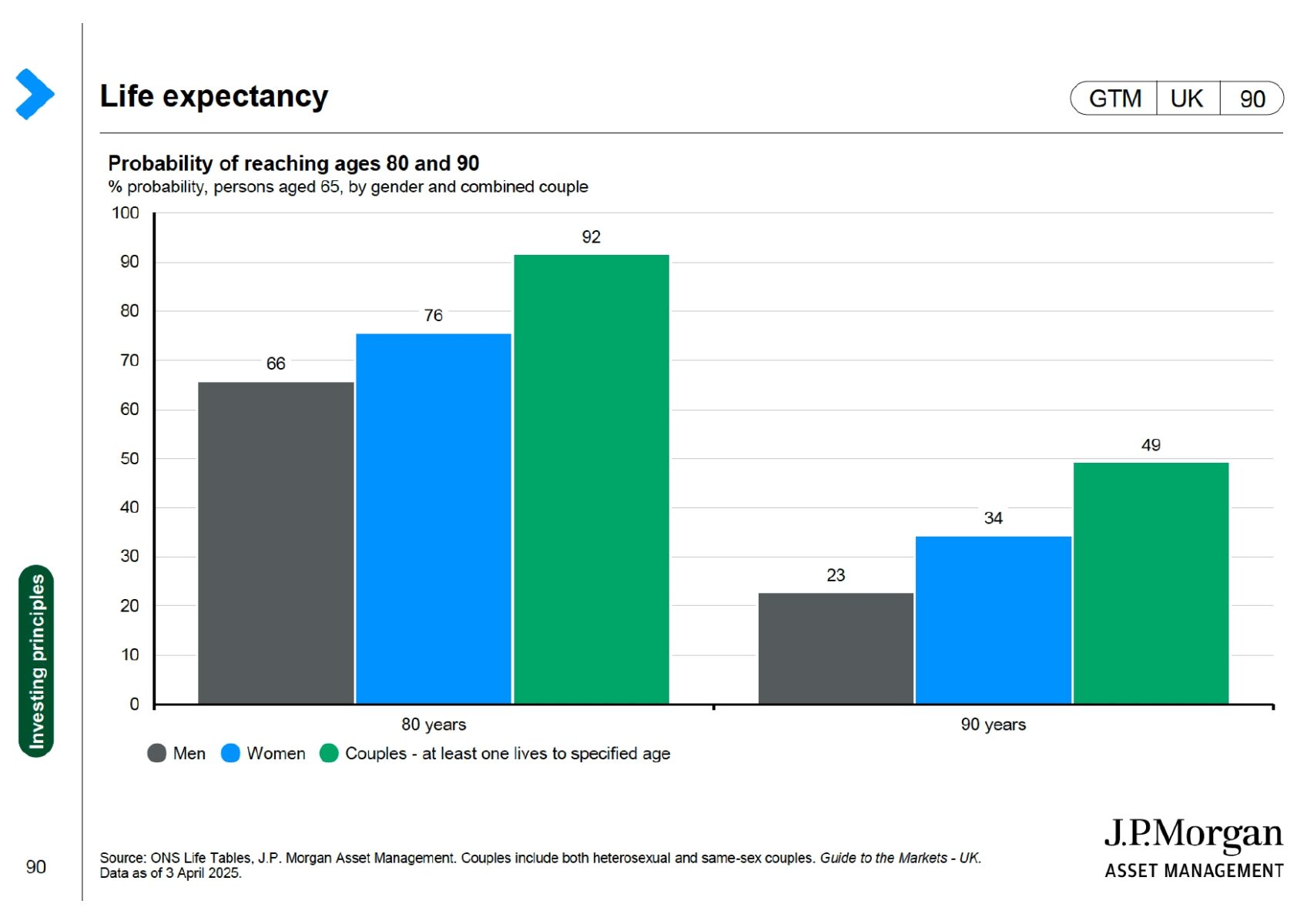

So, on this happy point let me leave you with this information about the life ahead of you.

Life Expectancy

More people needing to finance live beyond 90th birthday

- Ratio of women over age 90 to men was about 2:1 in 2023

- The number of people aged 90+ has doubled over the last 30 years

- The ratio of women over age 90 to men was 2:1 in 2023 compared to 4:1 in the 1980’s. About one in every 100 people is now aged at least 90.

- The odds of living to beyond 90 are high enough that people shouldn’t assume it can’t happen to them. Historically, this has been mainly women but the numbers of men are catching up fast.

- For those who are age 66 this year there is about a one in 3 chance (33%) for men and nearly an evens chance (46%) for women of making it to at least age 90 and if they do get to age 90 there is nearly an even chance they will survive to beyond 9%

The message: Think long term and not Donald Trump term!

If you would like to let off some steam with me or discuss any of what is going on in the world, tax or financial planning related issues in Italy then please don’t hesitate to contact me on: gareth.horsfall@spectrum-ifa.com or call / message on +39 3336492356

Always happy to help where I can!