As of 6th April 2025, several significant changes to inheritance tax (IHT) laws have been implemented in the United Kingdom. For the purposes of this article, I will focus on those people that I deal with in the main, namely UK nationals who are tax resident in Spain.

New UK IHT rules

By John Hayward

This article is published on: 7th April 2025

From a UK perspective, under the new rules, an individual will be classified as a “Long-Term Resident” (LTR) if they have been UK tax resident for at least 10 out of the previous 20 tax years. LTRs will be subject to IHT on their worldwide assets. Conversely, UK nationals who have lived in Spain for 10 out of the previous 20 years will only be liable for IHT on UK-situated assets.

For individuals planning to leave the UK, there will be a “tail” period during which their worldwide assets remain subject to UK IHT. The duration of this tail depends on the number of years the individual was UK resident, ranging from three to ten years.

Inheritance Tax threshold freeze

The IHT threshold, the nil-rate band, which determines the value above which estates are subject to tax, is frozen until 2030. In other words, the value of an estate may increase but the allowance will not. The threshold for the majority of those affected is £325,000. This means that estates valued above this threshold will be taxed at 40%. As there is an inter-spouse exemption in the UK, the surviving spouse will normally inherit the deceased’s allowance creating an allowance of £650,000. There is no such exemption in Spain but, depending on where someone lives in Spain, a beneficiary might be eligible for an allowance to be applied. These (Spanish) tax rules have changed regularly over the two decades that I have lived in Spain and so it is probably wise not to put too much reliance on them for long-term financial planning.

Inclusion of pensions in Inheritance Tax

Beginning in April 2027, pension funds will be considered part of the assets subject to IHT. This means that pension funds outside the UK could be exempt. At the same time, the UK has recently introduced a 25% charge for moving pension funds to overseas schemes (QROPS). Although this might appear to put the final nail in the coffin of the overseas pension transfer market, there could be a Lazarus moment. In simple terms, if a UK based pension fund is valued at £1,000,000 and is moved to QROPS, the fund would reduce to £750,000 after applying the 25% charge. For those who prefer skiing (spending the kids’ inheritance) the same fund left in the UK pension could be subject to a 40% IHT charge, obviously more than if the fund had been transferred with a 25% charge. Growth assumptions and other factors will need to be considered but overseas transfers cannot be ignored.

How UK and Spanish IHT apply to Spanish compliant bonds

As we can see, assets in the UK will be subject to UK IHT. Why not just move cash from the UK to Spain? The problem here is that this opens the Spanish tax door.

As well as bank deposits, there might be ISAs and other UK investment plans which will be subject to UK IHT. UK advice has been restricted since Brexit and, for most tax residents of Spain, holding certain assets in the UK is simply not tax efficient. But moving everything to Spain could also cause problems.

Investment options

We arrange investment bonds, often referred to as Spanish compliant bonds, which are recognised as insurance policies and benefit from the favourable tax treatment in Spain even though they are not situated in Spain. The bonds we recommend are based in Ireland and Luxembourg, both in the EU, satisfying Spain’s conditions. For Spanish IHT, Spain will tax the individual receiving the benefit if either a) the beneficiary is resident in Spain or b) the asset is in Spain. This means that a UK resident beneficiary will not pay Spanish IHT on the bond. Equally, if the deceased is a non-Long Term Resident of the UK under the new rules, the bond will not be part of a UK IHT calculation.

The main aim of a Spanish compliant bond is to increase the value of the underlying investment whilst putting clients in a position to supplement their income. Of course, any investment should reflect the tax regime of the country that the person is resident in. The bonds can move with the individual for these purposes. For example, whilst a resident of Spain, the Spanish tax deferral rules apply. If the person moves back to the UK, the UK rules then apply with the added benefit that tax relief available in respect of time spent outside the UK.

For more information on how we can help you position your money in the most tax efficient manner, contact me at john.hayward@spectrum-ifa.com or (0034) 618 204 731 (WhatsApp).

News addiction can damage your wealth

By John Hayward

This article is published on: 3rd March 2025

Basing investment decisions on daily headlines has led to financial loss

We are a couple of months into 2025 and many aspects of life seem to be engulfed in uncertainty which is no great shock because that has always been the standard. Recent headlines have been pretty much the same as these from the 1960s.

- Washington, Moscow establish ‘hot line’ link

- New peace plan for Middle East

- Rail go-slow begins

- Canada plane crash

Not a lot really changes apart from the global population and prices. Yet it seems that very little is learned with all of this experience. People react to headlines and make decisions based on what might well be complete nonsense. The press obviously has to write stories but that does not mean that they are accurate, or even true.

“Watch what we do, not what we say.”

– John Mitchell, Attorney General to Richard Nixon, 1969

All of this has come to the fore with particular focus on Donald Trump and his team. Many people now have a negative outlook because Donald Trump was elected again. Clients have been asking me if their investments have been affected. They have been pleasantly surprised to learn that, far from the investment world imploding, the value of their investments is higher than it was when Donald Trump was elected on 5th November 2024.

Of course, markets can go down as well as up. However, history has shown us that, over time, there have been more ups than downs.

When considering savings and investments, it has often been wiser to ignore the daily headlines and allow things to sort themselves out which, more often than not, they do. We have already seen how the President can appear to regularly change his mind and moving with these political waves could lead to investment nausea.

When he was first President from 2017 to 2020, the S&P 500 index rose by 47% during his term. The message is that the United States of America is the place to have at least some money right now, if not always. The unfortunate fact of life is that stock markets appear to be more important than the well-being of people in general.

In June 2023, clients of mine decided to surrender their investment plan as they felt that they would do better in a deposit account. In 2023, with high inflation leading to high interest rates, 5% interest in a deposit account seemed extremely attractive to them. I am not certain if they are still receiving 5% but, even if they are, they are about 7% down on what they would have had if they hadn’t surrendered their policy and had left the funds intact. Added to that, they will have had to have paid tax each year on the interest whereas tax on the investment gains would have been deferred whilst within the Spanish compliant bond they had. So often, people react to the headlines, make decisions based on short-term market movements, and lose out. And then blame their financial advisers!

I discourage focusing too much on daily headlines. Other than a story about a cat rescued from a tree, headlines are rarely cheery and there is almost always nothing we can do about what has happened. By taking a lot of notice of daily news, one can be led to making decisions that will lead to regret.

For a considered approach to investing, making you aware of taxation in Spain and the UK, contact me today.

Coming to an email box near you:

- Premium Bonds and their value in Spain

- Consolidating UK private pensions

- Claiming state pensions

- Entry/exit system

- Power of attorney

Claiming State Pensions in Spain and the UK

By John Hayward

This article is published on: 13th September 2024

How to benefit from a little extra knowledge

What do the following statements have in common?

1. Fish have no memory.

2. You consume on average 8 spiders in your sleep.

3. Cracking your knuckles causes arthritis.

4. We only use 10% of our brains.

5. You have to pay into the Spanish social security system for 15 years to be eligible for a Spanish state pension.

The answer?

None of them are strictly speaking true. As I am close to clueless when it comes to biology, I will focus on the final point, state pension eligibility.

You will read on numerous websites that, in order to qualify for a Spanish state pension, you have to have paid into the Spanish system for at least 15 years and that two of these years must be within the 15-year period immediately preceding the pension claim. However, what is generally omitted from the text is the fact that years of contributions in other countries, including the UK (despite Brexit), can be added to the years in Spain. In order to pounce on any uncertainty which might be created by my statement, I will illustrate my point with an example:

– Years in the UK system – 22

– Years in the Spanish system – 10

Although 10 is less than 15, the 22 years of UK contributions takes the total number of years over 15, i.e. 32 (10 + 22). This does not mean that one claims 32 years from the UK, or even Spain, but, in this example, there will be an entitlement of 22 years’ worth of state pension from the UK and 10 years of Spanish state pension (as long as contributions were made to the Spanish system in 2 of the 15 years prior to claiming the pension).

As per the statement from La Moncloa, the office of the President of the Government of Spain, “As from 1 January 2021, the UK and Spain will retain their jurisdiction to manage Social Security benefits based on contributions made in their respective territories, under conditions of equality and non-discrimination.”

Furthermore, “The Protocol on Social Security Coordination sets forth the totalisation of contribution periods completed in the other Party for the recognition of retirement pensions”. This is not particularly friendly English but the point is there.

In order to find out more about pension entitlement, it is extremely helpful to be registered on Gateway for UK pensions and have a digital certificate to access information about the Spanish system. The digital certificate is also useful for other legal and tax enquiries, including SUMA and cadastral enquiries. It sits on your computer and allows immediate access to your information.

Although you can access projections as to your future pension entitlement, the story does not end there. Certain assumptions are made with these online facilities and you may not be provided with a completely accurate assessment of your entitlement. In the same way that accumulating years of contributions from different jurisdictions can solve the 15-year minimum term problem in Spain, it might also be the case that you can receive your Spanish state pension earlier than expected. The state retirement age in Spain in 2024 is 66 years and 6 months. This will gradually increase to 67 by 2027. However, if someone is able to show (in 2024) 38 years and 3 months of contributions, the retirement age is 65. This limit is increasing to 38 years and 6 months by 2027 and, presumably, there will be changes after that.

So let us take an example of the person who also paid for 22 years in the UK but, this time, an additional 17 years in Spain. Their default projected state retirement age is 67 in both the UK in Spain. Although the number of years paid overall will have no effect on the UK state pension age, it will do in Spain. As 22 plus 17 is 39, the person expecting to retire at 67 could actually receive their Spanish state pension at 65.

There are other rules and options with this i.e. deferring the receipt of the pension, continuing to work and receive 50% of the pension, etc., and from an income planning perspective, this could be beneficial.

We do not work for the tax office or a social security department but all of this is really important when planning ahead to determine cashflow, income, and even employment, requirements. Using tax efficient investment vehicles, and assessing existing pension arrangements, we can help you work out how much you need in retirement and how you can achieve your long-term financial and life goals.

There is so much information on the internet but not all of it is accurate. We make every effort to filter out the wheat from the chaff as we know how important it is to know the facts before committing to something. People have made bad choices in the past because they did not have all of the relevant information. The decision by the Scots to invade England during the Black Death was not one of the best.

UK Inheritance tax and living in Valencia

By John Hayward

This article is published on: 30th April 2024

Every so often, I write about this cheery subject but it really is worth getting to know the basics if you do not want to suffer from, or leave your beneficiaries exposed to, the slings and arrows of outrageous tax complications. There are proposed changes to UK inheritance tax which I will discuss below.

Inheritance tax in Spain has pretty much disappeared, for some and for the time being. For example, in the Valencian Community, there is an inheritance tax (and gift tax) allowance of €100,000 for spouses, grandparents, parents, children, and grandchildren. For younger beneficiaries, the allowance is higher, as it is for those with qualifying disabilities. Since 28th May 2023, there is also a 99% reduction on the tax bill for spouses, etc. This means that there is little or no tax due for the relevant category. I am not going to write about the different tax bandings but you can contact me if you want to know more.

Taxes in Spain tend not be abolished but rather put on hold or reduced, temporarily. In Valencia, this “new” 99% reduction is the same as the old 99% reduction which was in place up until 2013 when it was reduced to 75% and subsequently 50%. Asset distribution is an important consideration, making certain that, should the thinkable happen, i.e. the reduction is changed again, spreading wealth as tax efficiently as possible is key. (Spending everything is also a way of reducing any inheritance tax liability albeit to the disappointment of those expecting some handy cash.)

When it comes to beneficiaries who do not tick the right boxes, planning is even more important. One of the fairly common situations I have come across is where couples in their second or third marriage have children, from different marriages, who are beneficiaries on the death of their parent and/or step-parent. The inheritance tax allowances above do not apply if the child is not a direct relative.

Allocating assets through a will could alleviate this problem. Spain will apply inheritance tax to an asset in Spain or an individual resident in Spain. A UK asset inherited by a UK resident will not be subject to Spanish tax.

Therefore, planning is necessary to decide which child receives which asset. (See below for proposed UK inheritance tax change).

Although you might read that the double taxation agreement between Spain and the UK does not cover inheritance tax, tax paid on the UK estate can be deducted proportionately from the individual’s tax liability in Spain.

Proposed changes to UK inheritance tax

The UK government is looking to move from a domicile basis to a residence basis. To determine where one is domiciled can be a complicated exercise.

The UK government website states: HMRC will treat you as being domiciled in the UK if you either:

- lived in the UK for 15 of the last 20 years

- had your permanent home in the UK at any time in the last 3 years of your life

The proposed change, effective from 6th April 2025, will be to charge individuals who have been UK resident for 10 years and keep them on the radar for 10 years after leaving the UK. This would mean that after 10 years in, say, Spain, only UK assets would be subject to UK inheritance tax. This leads us back to my point about asset distribution. Where possible and necessary, assets should be allocated to beneficiaries based on their residence to maximise the tax allowances in both the UK and Spain.

We specialise in arranging savings and investments in a tax efficient manner and have saved clients and their families thousands in taxes on the death of a spouse, partner, or parent, or even an unknown uncle in one case. I am certain that we can help you too.

Interest in deposit accounts

By John Hayward

This article is published on: 11th January 2024

Timing when to invest for long term needs is trickier than solving a Rubik’s Cube wearing boxing gloves

As we enter a new year, we face another year of known and, so far, unknown global problems which could impact our finances. Many “experts” will guess and then advise us what will happen but, as so often in the past, be wrong, or lucky if the guess works out to be true. The world is governed by a handful of people. Therefore, there are very few who really know what is happening.

Fortunately, in the Western world at least, we are allowed to get on with our lives with an element of freedom. As financial advisers, especially as old as me, we can make some judgement based on how people react to global events. Some people over react, fed by questionable journalism. In the investment world, this leads to the wealthy becoming wealthier aided by panic selling by the less wealthy enabling the wealthier to buy into the market at a lower cost.

2022 was a rotten year overall for investments. 2020 was not great but people then were more concerned about living with Covid-19 than what was going on with their money. Stock and bond markets both had a torrid time, mainly as a consequence of Covid-19 which introduced high inflation once we had a chance to spend money again. A consequence of this was a reluctance in 2023 to commit to investing at a time where inflation was rampant. History has shown us that investing in traditional markets can overcome inflation. With high inflation came attractive interest on cash, something that we had not seen in decades. Back to the history book and we see that interest rates on deposit accounts have not outpaced inflation over the long term. However, the expression “long-term” seems to disappear from the vocabulary of some investors and short-term problems become the index to follow. Many have caught the interest rate bug over the last few months feeling that doing this would be sensible in the short term and then switch into investment markets when the time is right(?). Paraphrasing Jim Bowen of Bullseye fame, “Let’s look at what they could have won” had they not taken this approach.

Let us look at two different examples of investors. One who was invested on 1st January 2022 with 50% in the Rathbone Strategic Growth fund and 50% in Aegon High Yield Bond fund who decided to sell on 31st December 2022 due to the downturn in 2022 and another who was thinking about investing on 1st January 2023 but decided not to. In both cases, they eventually put their cash into a deposit account with a fixed rate of 5% (for 12 months) in July 2023.

| 1/1/22 to 31/12/222 | 1/1/23 to 31/12/23 | |

| Rathbone and Aegon | -9.10% | 11.45% |

The person who sold from the two funds at the end of 2022 was 9.10% down for the year and only recouped 2.50% (6 months at 5% p.a.) by the end of 2023 instead of 11.45%.

In a similar way, the potential investor, who was holding off until things improved, missed that particular bus. Again 2.50% versus 11.45%. I appreciate that there are underlying charges with our products but nowhere near 9% a year and there are also tax considerations with the deposit account being taxed annually whereas the Spanish compliant bonds that we promote have tax deferred, if not completely negated.

Very few are smart enough or knowledgeable enough or lucky enough to time markets correctly. In the last year we have seen this proven once again.

When I tell people that they should be prepared to leave their money invested for at least 5 years, I often get the response that they are not young and that they may not survive 5 years. In a region such as the Costa Blanca where I live, with 300 plus days of sunshine a year and plenty of olive oil, the risk people face is living too long! In the “good old days” when the life expectancy was 65 or less, long term care and dementia were not a consideration. Making money work over the long term is not only a good idea but possibly essential.

We have products that can work with you and your family throughout your life, and beyond. Following the scaremongering headlines is not a great idea and can be very harmful to your wealth, and your health.

I know that it is possible to solve a Rubik’s Cube wearing boxing gloves but try it.

Reduction of Succession and Gift Tax in Valencia

By John Hayward

This article is published on: 29th November 2023

Making gifts to spouses is no longer a tax worry.

In September, the Valencian government approved the draft bill reducing succession tax (Inheritance tax) and gift tax for certain beneficiaries

The reasons were that the taxes formed a very small part of the region’s revenue and many people were refusing inheritances as the tax worked out to be more than the overall benefit. Does the son or daughter in the UK really want to inherit the casita in the campo housing pigs and chickens?

We have had to wait for the bill to become law and this occurred on 24th November 2023 taking effect from 28th May 2023, the date that Carlos Mazón was elected president of the regional government of Valencia as leader of the Partido Popular. The backdating of this law is significant for beneficiaries who are dealing with deaths and inheritances since 28th May.

It is important to understand that the taxes for certain beneficiaries have been reduced but not abolished. The reduction in the tax has increased from 50% to 99% of the tax bill. This reduction applies to Class 1 and Class 2 beneficiaries and includes the proceeds of life insurance. These classes cover children, grandchildren, adoptees, parents, grandparents, adopters, and spouses. The €100,000 allowance per qualifying individual beneficiary (up to €156,000 for children under 21) will remain.

Suggesting that it is a better time to die now may sound a little crass but it would appear to be a very good time to make gifts, taking advantage of the gift tax reduction and mitigate future succession tax. Another important aspect to gifts is that they need to be formally documented.

Over the last 10 years, Valencia has changed the basis of succession and gift tax on a number of occasions. There was a 99% reduction before. This fell to 75%, then 50%, and is now back up to 99%. Therefore, it is reasonable to suggest that there could be changes to the law again.

Strangely, before these revisions, spouses in the Valencian Community did not receive an allowance on gifts and this caused a problem when planning financial structures. Spouses in the Valencian Community are now eligible for the allowance of €100,000 on gifts along with the 99% reduction on the tax on any excess. In my case, the “What’s hers is hers and what’s mine is hers” principle still applies.

Contact me to discuss ways of reducing the tax liability for those you care about no matter what the law is at the time.

The end of succession tax in Valencia

By John Hayward

This article is published on: 6th September 2023

On 28th May 2023, Carlos Mazón was elected president of the regional government of Valencia as leader of the Partido Popular. On 21st July 2023 he announced that his government had approved the initiation of a bill to reduce succession and gift tax (ISD – Impuesto de sucesiones y donaciones – Inheritance Tax to the UK reader).

The draft bill was placed on the urgent pile with Les Corts on 3rd August 2023 and it awaits absolute approval.

Mazón’s reasoning was that the income from ISD represents around 1% of the region’s total revenue and that charging tax on money that has been taxed before was not fair. He wants to reduce the tax burden to prevent an inheritance from becoming a “serious economic loss for many families, who have to face its payment, without the inheritance entailing any economic benefit or real increase in their assets.” This seems a very refreshing attitude although his opposition have argued that the wealthy will avoid tax that would generate around €400 million a year. This assumes that the timing of deaths and gifts matches their statistics.

There are conditions to this bonificación in that only close family members and spouses will benefit but that is the same with the existing reduction. The improvement is that, for the majority of spouses and close family members, they will receive a reduction of 99% on the tax bill. Currently it is only 50%.

All this being said, there is still room for inheritance tax, and gift tax, planning. We experience many complicated situations where, for example, couples are not married or there are children from different marriages. Keeping assets away from the inheritance and gift tax net in Spain, in a legal way, is key, especially for beneficiaries who do not live in Spain.

We await absolute approval of the bill but, and although this may sound a little insensitive, any deaths, and gifts made, since 28th May 2023 will be eligible for this new law.

And like buses… Abolition of Wealth Tax in Valencia?

One at a time, please!

More to follow…

To find out how Spanish inheritance and gift tax will affect you and your beneficiaries, as well how we can help you with your existing investments and tax planning, and provide you with ideas for the future, contact me today at john.hayward@spectrum-ifa.com or on +34 618 204 731 (WhatsApp)

Reducing Spanish tax

By John Hayward

This article is published on: 27th June 2023

Use a beneficial savings structure

Investing money is often seen as a risky thing to do even though it is generally understood to be necessary. For example, those receiving pension income would not be in the same position if the companies paying the income had left all of the pension contributions in a current account or in a box under the bed.

Financial markets can be volatile (always, I hear you shout). We fully appreciate this. We also acknowledge that inflation has created higher interest rates. Better news if you are a saver but not so pleasant for mortgage payers, or parents having to help their children pay off increased debt.

Let us imagine that, for the foreseeable future, we have high inflation accompanied by higher interest rates. Using an amount of £500,000, I have compared depositing in a savings account with investing in a Spanish compliant investment bond and I have used an interest/growth rate of 4%. I have based my comparison on the bond paying growth to the bondholder’s bank account and using GBP as I cannot see any Euro accounts paying 4%.

– £500,000 at 4% = £20,000

– Using an exchange rate of 1.16 £/€,

– £20,000 = €23,200

The deposit account interest is taxed in full and, at current 2023 rates, is €4,752 each year. This has to be declared in the annual tax return.

The Spanish compliant bond attracts tax on the gain within the withdrawal. I have based the calculation on the same amount being withdrawn i.e., €23,200. In the first year, the taxable gain within this is only €892 and the corresponding tax is €170. The taxable amount within the bond income increases over time but, over 10 years, the tax is:

– €47,520* on the deposit account interest

– €8,381* on the bond income

This gives a tax saving of over €39,000 over 10 years by using the Spanish compliant bond.

If no money is withdrawn from the bond, no tax is payable whereas the interest on the deposit account will continue to be taxed.

If the bondholder moved back to the UK, and nothing had been withdrawn whilst living in Spain, any growth on the bond whilst resident in Spain would be ignored by the UK tax office.

As an added benefit of reducing taxable income, wealth tax can be reduced. See this Wealth Tax in Spain article.

There can also be inheritance tax benefits with the bond when compared to the deposit account.

Well managed portfolios have consistently outstripped inflation. Conversely, deposit interest rates offered to savers have consistently under-performed inflation over the years.

To find out how we can help you with your existing investments and tax planning, and provide you with ideas for the future, contact me today at john.hayward@spectrum-ifa.com or on +34 618 204 731 (WhatsApp)

* E&OE. The above is a simplified example for illustrative purposes and general guidance only.

How to reduce Wealth Tax in Spain

By John Hayward

This article is published on: 21st June 2023

Earlier this year, I wrote an article about the introduction of solidarity tax in Spain. This is a “temporary” (we shall see) tax on wealth for those with more than €3,000,000 in assets. This is in addition to wealth tax although any wealth tax due can be deducted from the solidarity tax bill. (This is not the case for residents of the Madrid or Andalusia regions as there is no Wealth Tax currently).

I have been working with clients who are affected by these taxes, trying to find ways of reducing the tax liability. Reducing wealth by gifting to, say, children is an option but that can create additional immediate tax problems. Also, for a number of different reasons, some clients are not willing to gift anything in their lifetime.

The amount of wealth Tax that has to be paid can be governed by income. Your income tax and wealth tax cannot exceed 60% of your total taxable income.

Example:

– Total taxable income is €40,000

– Tax payable €8,000

– Assets subject to wealth tax €3,000,000

– Wealth tax due €39,000

– The maximum that can be paid when adding income tax and wealth tax together is 60% of the total taxable income (€40,000).

– €40,000 x 60% = €24,000

Therefore, the maximum wealth tax that can be paid is €16,000 (€24,000 less €8,000 income tax).

However, having to pay €16,000 a year in wealth tax is still not particularly nice. What we can do is look at the income in order to see if this can be restructured. Notable targets for this type of planning are savings interest (more relevant at the moment) and income/dividends from shares and investment funds. By careful planning, we can provide the same level of income yet reduce the tax. Please visit this Tax Benefits of a Bond page which illustrates one of the major benefits of a correctly structured investment bond which not only reduces income tax but also helps to reduce wealth tax.

To find out how we can help you with your existing investments, pensions, and tax planning, and provide you with ideas for the future, contact me today at john.hayward@spectrum-ifa.com or on +34 618 204 731 (WhatsApp)

History: How it can save you money

By John Hayward

This article is published on: 31st May 2023

“If you think you have it tough, read history books.” Bill Maher

I was not particularly interested in history at school, mainly because the history masters (I went to a grammar school where we were taught by masters in moth-eaten gowns and who wore their ties outside their jumpers) would want to teach us about aspects that I had absolutely no interest in.

The Dark Ages, for example. They are called dark ages for a reason. These days I will happily surf the web (can we still say that?) going off-piste (no holding me now) and finding out brilliant historical facts that I am interested in and not what I am told to be interested in. Or maybe I am being told, in this Artificial Intelligence world that we now live in. Having said that, I have not felt any pressure to learn any more about the dark ages.

What is my point here? History is important because it can help us to make decisions. The problem is that, although we have plenty of information to refer to, and perhaps have taken on board, we all too often forget, or even choose to ignore, the “lesson”. In the investment world, it appears that everything that is happening now never occurred before. Or maybe it did but in a dark age when nobody was literate enough to write down what was going on.

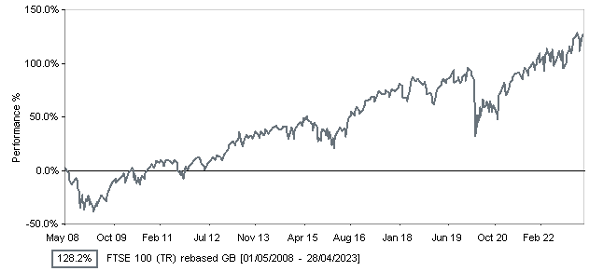

Sell low, buy high. Isn’t that a ridiculous investment strategy? It seems not, to some. I have been in the company of many people over the years who believe that they know when to sell and when to buy back in when “things are better/markets have settled/it is less rainy/the dog has been to the vet”. This strategy has consistently proven itself to be flawed. Although past performance is no guarantee of future performance, history can give us an idea of what could happen in the investment world after different global events. In more recent years, the financial crisis of 2008 and Covid-19 in 2020 have been big tests. After both “incidents”, those who stuck with it have been better off.

Source: Financial Express

Focusing on a stock market index that many British people are familiar with, the FTSE100, in the last 15 years to 1st May 2023, there have been 4 years that have been negative. I apologise for spelling this out but that means 11 years have been positive. 11-4. I like that score. The average annual gain of the index over that period has been almost 13%. Even more interesting is the tendency that a bad year is followed by an outstanding one. This is why, when people sell, they crystallise a loss and then possibly miss the best part of any recovery.

I understand that not everybody is comfortable with sitting out large falls (2008 and 2020). To cater for this, we have solutions within our armoury which limit the downside whilst still providing long-term growth.

To find out how we can help you with your existing investments, and/or provide you with ideas for the future, contact me today at john.hayward@spectrum-ifa.com or on +34 618 204 731 (WhatsApp)

If you are feeling down, pick up a history book. It is certain to take your mind off your woes.