One of the best, short articles I have read in relation to the risks of keeping most or all your assets in cash is on Trustnet and quotes from Lindsay James, Investment Strategist at Quilter Investors. I enclose the link to the article below.

Sitting in cash ‘isn’t as risk free as investors think,’ warns Quilter | Trustnet

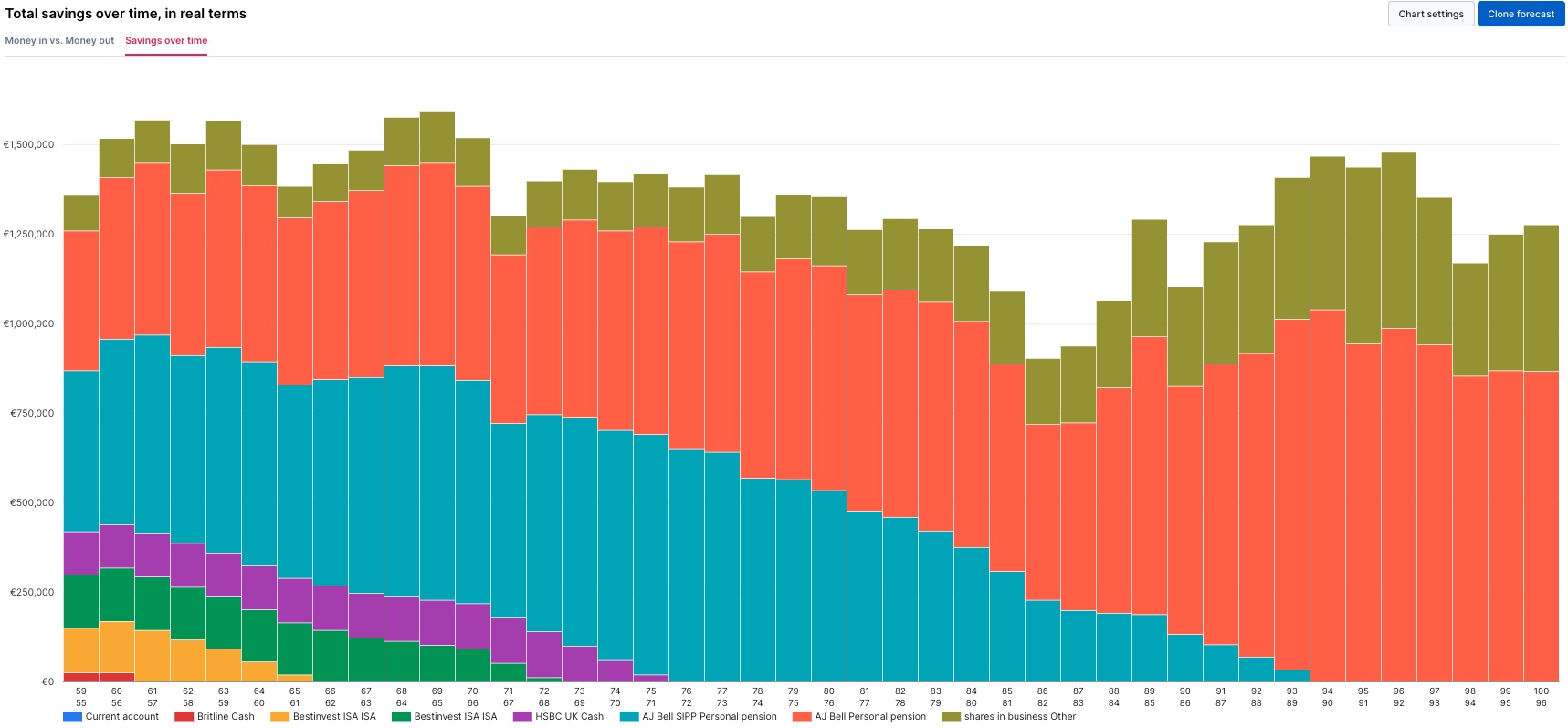

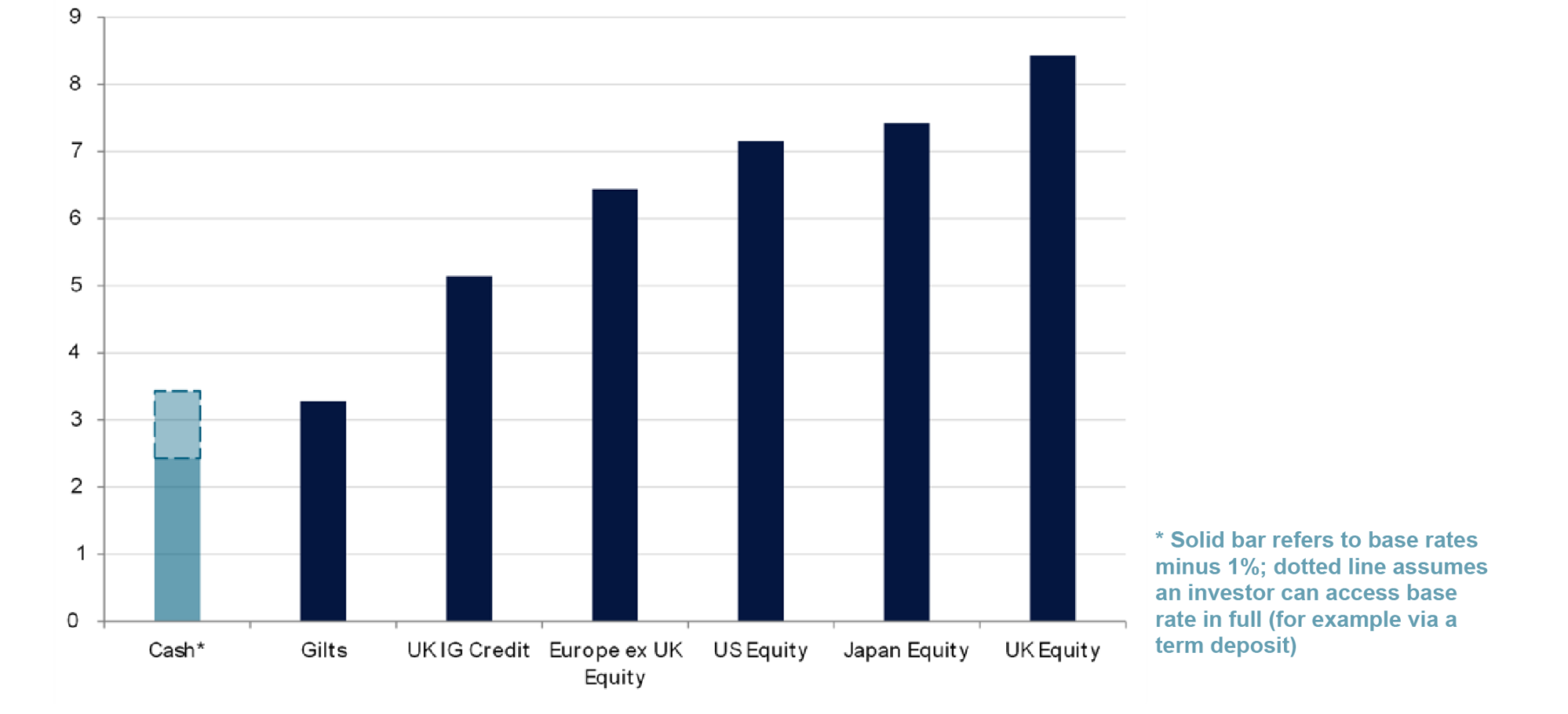

If you only look at the two graphs, this will illustrate the point clearly:

a) Graph No. 1: The first graph shows what happened to global financial markets in the year following the first interest rate cut (i.e. at the beginning of a rate cutting cycle). There are a few exceptions (most notably during the Global Financial Crisis in 2008/9), but in most cases the financial markets rose strongly. It is too late to wait until this happens and then move funds into the markets, as often the biggest returns can occur over the duration of just a few days, and this leads to the second graph.

b) Graph No. 2: This graph is even more stark, showing the investment returns over a 30-year period of an initial investment of £10,000. Staying invested throughout this period resulted in growth of 1020%. Being absent from the markets for just ten of the best days in the financial markets during this 30-year period, result in a return of half this amount, 469%!

This is why within the world of investing the following saying is so popular – “it’s not about timing the market, but about time in the market” or to put it another way, research has shown that those who remain invested in the markets through the troughs as well as the peaks, generally outperform those who try and time their buy and sell decisions to exit the markets as they fall and buy into the markets as they rise.

The reasons for this are that inevitably, people sell too late (i.e. the markets have already fallen which triggers their decision to exit), and then are too late with their entry back into the markets and miss out on significant gains. Even amongst professionals, it is usually luck not skill (or the benefit of hindsight!) which allows people to call the top or the bottom of the market or get remotely close.

In Summary

Those with limited savings and assets, who cannot afford to lock funds away for several years, should utilise the French interest-paying bank accounts I referred to earlier. Those who are very risk averse and find the prospect of seeing their investments fall in value, stressful and anxiety inducing, should also find the best return they can using risk-free savings accounts, but should also be aware that over the longer term, their savings will inevitably underperform market returns.

However, for everyone else, the evidence clearly demonstrates that investing in the financial markets, irrespective of potential economic or geo-political challenges and even with the current appeal of interest on cash deposits, will, almost without exception, deliver positive long-term financial rewards.

At the risk of oversimplifying – my advice to most people is to set aside sufficient cash for short term needs and unexpected contingencies and invest the rest in a portfolio that is appropriate to your risk profile.

Where should you consider investing any funds? That is for my next article where I will review the best options in France for tax efficient investing.