Tax season is drawing to a close. However this year there is still something you need to make sure you have done before you can get out there and enjoy the summer weather.

Financial update June 2023

By Katriona Murray-Platon

This article is published on: 19th June 2023

You may still need to do the property declaration that I mentioned in my February edition. The declaration service has been available for several months now and so enough time has passed to be able to address some of the issues that have arisen.

Just as a reminder, if you own a property, and therefore pay taxe foncière, you have to declare the buildings on the land you own if they existed on 1st January. Because the Taxe d’habitation has been scrapped for main residences the French authorities want to find out which buildings are occupied and rented (even if just for holidays) which will allow them to more accurately establish the taxe d’habitation on second homes this autumn.

You must declare anyone who is occupying a property which belongs to you, even if it is a family member living there for free. However if you are only renting a room in your house, you do not need to declare this separately.

If the ownership of the property is divided between the bare owners (nu proprietaries) and the beneficiaries (usufruitiers) it is the latter who should declare the property on their online tax account.

You may have noticed that any outhouses, sheds and garages also appear on the declaration. If these have been converted to be rented or are simply let as parking spaces, they still need to be declared. A garage that is less than 1km from the main house is considered as adjacent to the property and therefore may be included in the surface area calculation for the taxe d’habitation.

The declaration can only be done online. If you do not have access to the internet (or know someone who doesn’t) or if you or they are really having problems completing this form online, you can call the tax office on the number below or make an appointment with your local tax office and they can assist you. Some post offices also have someone there who can help you with administrative matters.

If you have any problems with the declaration you can call the tax office on 0809 401401 or use the messenger service and the drop down menu to select the problem.

If you have an elderly resident who has gone into a home but has kept their former home and it is rented, they still need to declare it. There is an exemption from taxe d’habitation for residents of retirement homes (Ehpads).

If you rent a property you have to declare what kind of rental it is (long term or holiday let) and the identity of your tenants but you don’t need to declare the actual rent received just yet, this will only become mandatory in 2025.

You have until the end of June to complete this declaration so do take your time to make sure that the information is correct.

As always if you have any questions on this or any other matters please do get in touch!

How is France doing?

By Richard McCreery

This article is published on: 17th May 2023

If you live in France, the general impression you might have is of a country that is dragged down by strikes and protests, that the cost of living is soaring and the dream of retiring whilst still young is under threat. But it is not all bad news. If you have investments in France, or are planning to retire here, there are several reasons to be cheerful about the state of the country.

Despite fears of a possible recession, France’s GDP grew 0.2% in the latest quarter and was 0.8% higher than a year earlier – not exactly blowing the lights out but coping reasonably well with Eurozone interest rates that have risen to 3.75%. In fact, you can still get a 20-year mortgage in France and pay less than 3%, so the housing market is not coming under the same pressure as it is in some countries like the US, where a typical mortgage now costs 6.5%, or Sweden, where house prices have fallen sharply.

At 7.2%, France’s unemployment rate is around the lowest level it has been for several decades. The more people in work, the better. Inflation may be historically high at 5.9% but this is lower than the Eurozone average of 7% and considerably less painful than the UK’s 10.1% rate. We were very lucky that the government capped energy price rises at 4% last year and 15% this year.

Where France has more of a problem is its debt levels, partly because of that low retirement age but also because of the government’s generosity during the pandemic, although France is hardly alone in this. France’s government debt-to-GDP ratio has swelled from 97% in 2019 to 111% today. It is because France’s national debt has grown to almost 3 trillion Euros, and because it is so hard for the government to do anything about it without triggering widespread rioting, that the rating agency Fitch recently downgraded the country’s credit rating to AA- (outlook: Stable). This still leaves it slightly better off than the UK, whose outlook is Negative.

But President Macron is making efforts to build on France’s substantial industrial base, asking Elon Musk and other business leaders to invest in the country. In fact, according to accounting firm EY, France is the most attractive country in Europe for foreign investment and has been for four years in a row. It is also the home of LVMH, which recently became the 7th largest company in the world, worth more than half a trillion Dollars, as well as Kering (the owner of Gucci) and Hermès. French luxury goods companies are the European stock market equivalent of Big Tech stocks in the US, they seem to go from strength-to-strength and have powered the CAC 40 to a record high this year. French banks also seem to have come through the recent turmoil in the sector relatively unscathed.

France has a great standard of living, it is the world’s number one tourist destination and the economy is on a fairly sound footing. Taxes are high, but residents also have access to very tax efficient investment vehicles that can reduce exposure to income tax and inheritance tax, with the right planning and advice. There is a lot to be said for investing in the EU’s second largest economy. Despite the burning barricades on the nightly news, France is doing fine right now.

Financial update May 2023

By Katriona Murray-Platon

This article is published on: 10th May 2023

The tax season is fully underway and whilst those who are declaring for the first time by paper have until 22nd May to complete their returns and most other people in most departments have until early June to complete their tax return, many people want to get it done as soon as possible.

Now that all the forms are available (which can be downloaded here) we can have a clearer idea of how to declare.

If you have employed someone to do your tax return, the chances are you have already sent off all your information. However if you want to have a go at doing your own tax return, here are my top tips for this year!

Tips for your taxes

Everything is declarable, not everything will be taxable!

- Get all your information together. If you are using your SATR from the UK, make sure you decide which number you are using (April 22 or April 23) and stick to that method for UK based income. If you suddenly change and start taking the figures from your bank account then you will be double taxed on the first four months of the year. Collect all your statements, payslips, tax certificates together in the one place and note down the figures for all your sources of income and the exchange rate at the date of payment (or the annual average).

- You need to declare all your income on the main tax form (called the 2042), you will also need to put any foreign sourced income on the 2047 and you will need to declare all your non-French bank accounts on the 3916. If you are doing the return for the first time on paper you will need a paper copy of all these forms. You will also need the 2042 C form as that is where you will find boxes 8SH and 8SI that you must tick if you have an S1 so that social charges aren’t charged on your pensions and that the reduced rate of social charges of 7.5% as opposed to 17.2% are charged on any investment income.

- Healthcare: If you are declaring online you need to tick box 8SH and 8SI to inform the French authorities that you are covered for your healthcare by another system of the EU (including the UK).

- Bank accounts and assurance vies: If you are declaring online you need to tick box 8TT (for assurance vies) and 8UU (for bank accounts) in order to create the 3916 form which needs to be completed with the details of these accounts. If you are declaring on the paper form, these boxes are at the bottom of the main 2042 form. If you are declaring an assurance vie you will need to have the value (in euros) of the account as at 1st January 2022.

- Foreign sourced income must go on the 2047 form (the pink one). Most foreign pensions and salaries go in section 1 of this form but UK salaries, UK rental income, UK Government pensions, which are all declared in France but given a tax credit equivalent to the tax that would have been paid in France all have to go into Section 6 of this form in order to get the tax credit (box 8TK on the 2042 form).

- Don’t forget any charitable donations that you made in 2022. French based charities send you a tax certificate, so you can use this to enter the correct amount.

- Don’t forget the kids! The tax credit for child care costs for children under 6 (born after 1st January 2016) have increased from €2300 to €3500 per child and you get 50% of this amount. This is for expenses for a nanny (nounou), nursery, after school care and holiday club. If however your child is now over 6 but you still have someone to collect them from school, this is counted as a home help tax credit (see below).

- Tax credits for home help. If you have a gardener or cleaner or have had some other home help in 2022, and you haven’t already received the tax credit automatically, you can declare these amounts on the 2042 RICI form here You are allowed at tax credit of 50% of any expenses up to a maximum of €12,000.

Not everything has to be 100% accurate. If you get close to the deadline, just submit your tax return as it is, you can amend the tax return, without penalties, through the correction service which will open at the beginning of August.

If you have any questions please let me know by email but if you would rather speak to me about something, please do give me a call.

Tax time in France

By Peter Brooke

This article is published on: 9th May 2023

Its that time of year again….

The tax season is underway and whilst those who are declaring for the first time by paper have until 22nd May to complete their returns, most other people in most departments have until early June. Of course many people want to get it done as soon as possible. Now that all the forms are available, which can be downloaded here from the French Government website, you can have a clearer idea of how to declare.

If you have employed someone to do your tax return, the chances are you have already sent off all your information. However if you want to have a go at doing your own tax return, then here are some tips for this year!

First tip – I would highly recommend investing in the Income Tax Return guide from the Connexion magazine – which can be bought online here.

Please note that we, at Spectrum, are not accountants and do not complete tax returns for our clients, in fact I personally find the process as complicated as I am sure you do.

Hopefully some of these tips will help – of course if you do need help then I would recommend speaking to the team at French Tax Online who have a lot of information and experience with French Tax returns: https://www.frenchtaxonline.com/

Tips for your taxes

Everything is declarable, not everything will be taxable!

1. Get organised first – have all your information together before you start. If you are using your Self Assessment Tax Return from the UK, make sure you decide which number you are using (April 22 or April 23) and stick to that method for UK based income. If you suddenly change and start taking the figures from your bank account then you will be double taxed on the first four months of the year. Collect all your statements, payslips, tax certificates together in the one place and note down the figures for all your sources of income and the exchange rate at the date of payment (or the annual average)

2.You must declare ALL of your worldwide income. French income is declared on the main tax form (called the 2042) and put any foreign sourced income on the 2047 form. You need to declare all of your non-French bank accounts on the 3916 form. If you are doing the return for the first time on paper you will need a paper copy of all these forms

You will also need the 2042 C form as that is where you will find boxes 8SH and 8SI that you must tick if you have an S1 certificate so that social charges aren’t charged on your pensions and that the reduced rate of social charges of 7.5% as opposed to 17.2% are charged on any investment income

All of the forms can be downloaded here from the French Government website

3. Healthcare: If you are declaring online you need to tick box 8SH and 8SI to inform the French authorities that you are covered for your healthcare by another system of the EU (including the UK)

4. Foreign Bank accounts and Assurance Vie (AV): If you are declaring online you need to tick box 8TT (for Dublin or Luxembourg AV) and 8UU (for non French bank accounts) in order to create the 3916 form which needs to be completed with the details of these accounts. If you are declaring on the paper form, these boxes are at the bottom of the main 2042 form. If you are declaring an assurance vie you will need to have the value (in euros) of the account as at 1st January 2022, you should receive statements from your AV provider with this information during April and May each year

5. Foreign sourced income must go on the 2047 form (the pink one). Most foreign pensions and salaries go in section 1 of this form but UK salaries, UK rental income, UK Government pensions, which are all declared in France but given a tax credit equivalent to the tax that would have been paid in France all have to go into Section 6 of this form in order to get the tax credit (box 8TK on the 2042 form)

6. Don’t forget any charitable donations that you made in 2022. French based charities send you a tax certificate, so you can use this to enter the correct amount

7. Don’t forget the kids! The tax credit for child care costs for children under 6 (born after 1st January 2016) have increased from €2300 to €3500 per child and you get 50% of this amount. This is for expenses for a nanny (nounou), nursery, after school care and holiday club. If however your child is now over 6 but you still have someone to collect them from school, this is counted as a home help tax credit (see next point)

8. Tax credits for home help. If you have a gardener or cleaner or have had some other home help in 2022, and you haven’t already received the tax credit automatically, you can declare these amounts on the 2042 RICI form here You are allowed at tax credit of 50% of any expenses up to a maximum of €12,000

IMPORTANT

Not everything has to be 100% accurate.

If you get close to the deadline, just submit your tax return as it is, you can amend the tax return, without penalties, through the correction service which will open at the beginning of August.

Currency… all hail to the Euro

If you are receiving income in any currency other than Euros you need to convert it to Euros for your declaration.

You should use the exchange rate on the day the you received the income into your account and daily rates are available here:

If you don’t have access to the accurate data it is possible to use an average rate for the year which is shown in the Connexion guide as £1 = €1.158

French financial updates April 2023

By Katriona Murray-Platon

This article is published on: 12th April 2023

April hails the beginning of tax season. For those eager bunnies who want to get on with it as soon as possible please note that the tax season will begin on 13th April with the online service being available and the new 2022 income tax forms available to be printed online or found at the tax offices from this date.

If you do want to get it over and done with, that is understandable, but actually this year you have a bit more time to get it done as most of the submission deadlines are either towards the end of May or even beginning of June.

Those submitting their first paper returns have until Monday 22nd May 2023 at 11.59pm, as attested by the postal stamp. The other dates for the online submissions are as follows:

- Zone 1 or departments numbered 1 to 19 have until Thursday 25th May 2023 until 11.59pm

- Zone 2 or departments numbered 20 to 54 have until Thursday 1st June 2023 until 11.59pm

- And Zone 3 or departments numbered 55 to 974/976 have until Thursday 8th June until 11.59pm

At the time of writing and until the 13th April, I can’t comment on any changes in the tax forms but in my next Ezine I will give more information about any specific aspects of the 2022 declarations. You can always download our free tax guide HERE and please also look at my adviser page for previous articles on tax matters.

As tax residents in France, you have to declare your worldwide income irrespective of where it comes from. Not everything is taxable, depending on the provisions of the double tax treaty, but everything is declarable. One of the things you do not need to worry about is any French sourced income like salaries, French pensions, French bank interest. This information is generally already completed on your tax return so you just need to check that it is correct. You only need to declare your foreign bank accounts on the 3916 form and not any French accounts or investments.

Tax offices often get confused about what foreign income gets a tax credit under the double tax treaty and what gets a tax credit because it was actually taxed in the country in question whereas, very often, because the income falls under the tax threshold the income wasn’t actually taxed. Well the French Administrative court, the Conseil d’Etat has just confirmed in a decision dated 20th March 2023 (https://www.legifrance.gouv.fr/) that where a double tax treaty grants a tax credit on this income, this is not subject to whether or not the income has in fact been taxed in the country from which it originated.

Finally, an additional energy cheque of an amount of between €48 and €277 depending on income, will be sent out and can be used until 31st March 2024 to pay gas or electricity bills. This is in addition to the exceptional energy cheque and the wood and fuel cheque that have been sent out already.

I will be available for meetings except for the week commencing 17th April as I will be away with my family. But there are still plenty of slots for meetings in the second and last week of April. Please do get in touch with any tax or financial questions.

Finance Update Q1 2023

By Peter Brooke

This article is published on: 27th March 2023

The Great Moderation & The Next Decade.

Is it really different this time?

The finance industry is often guilty of a very short term view. I read at least two emails every day that focus solely on the last 24 hours, which is probably not particularly healthy. It is also ironic that my industry then tells all its clients to only judge performance over the medium to long term … whatever that means.

Of course, understanding how daily events can affect performance is important, but from time to time we really must put this into the context of the long term, and sometimes the VERY long term.

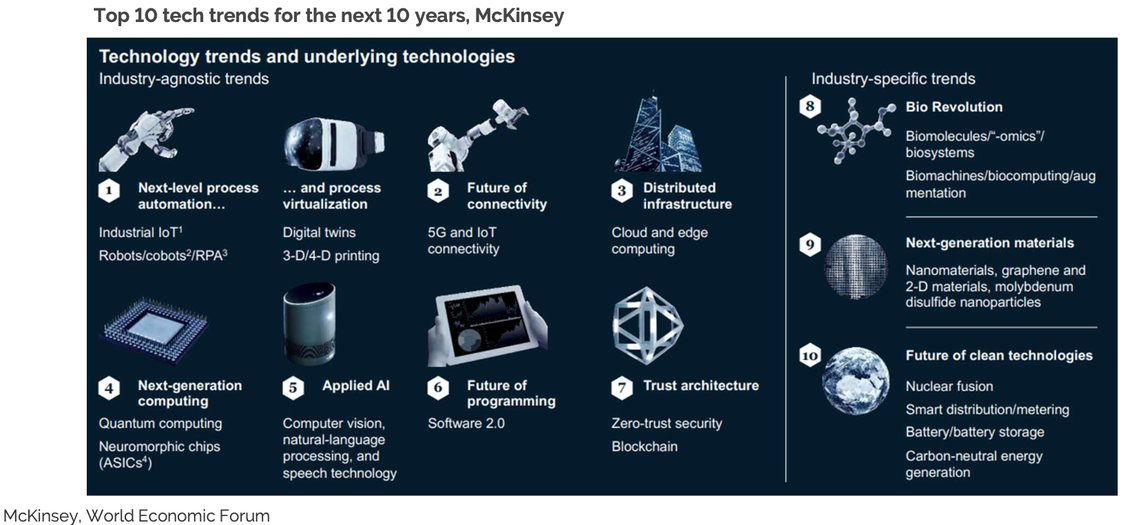

Our friends at Evelyn Partners have created a terrific piece of research considering the last 40 years (yes, 40) and then looking forward at the next decade, where they feel there really is something different happening. Here I will summarise their musings – I hope you find it interesting.

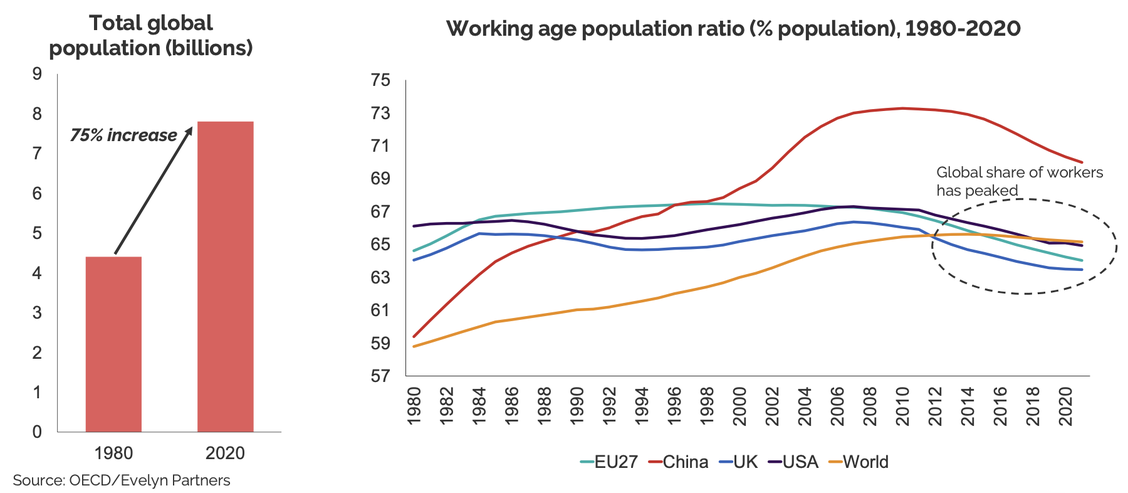

The Great Moderation 1980 to 2020

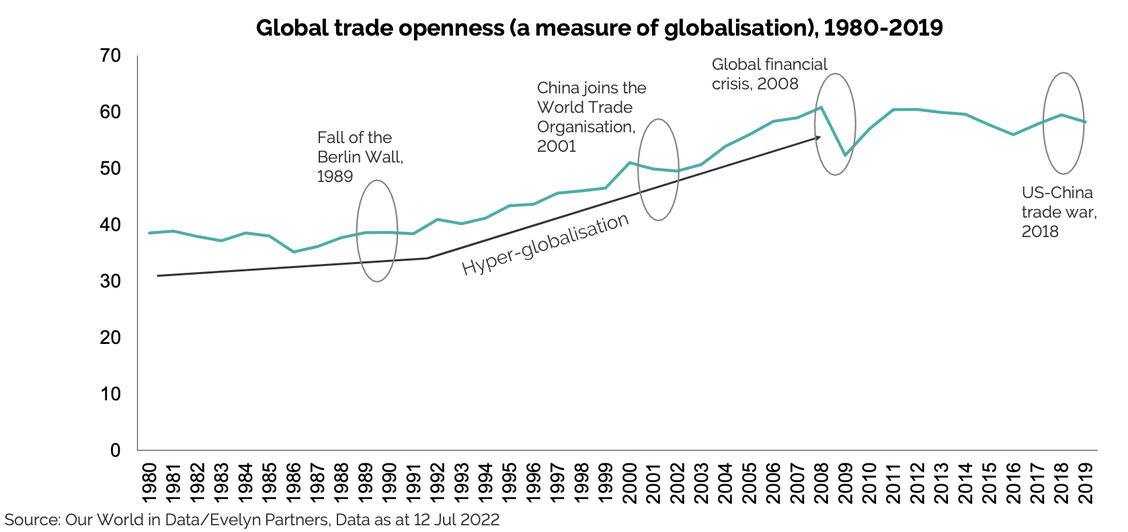

The economic impact of China’s emergence over the last 40 years has contributed to lower inflation and lower interest rates this impact is particularly characterised by

- Favourable Demographics

- Movement of workers

- Globalisation

1. Favourable Demographics – massive growth in global population AND in the numbers of ‘working age people.

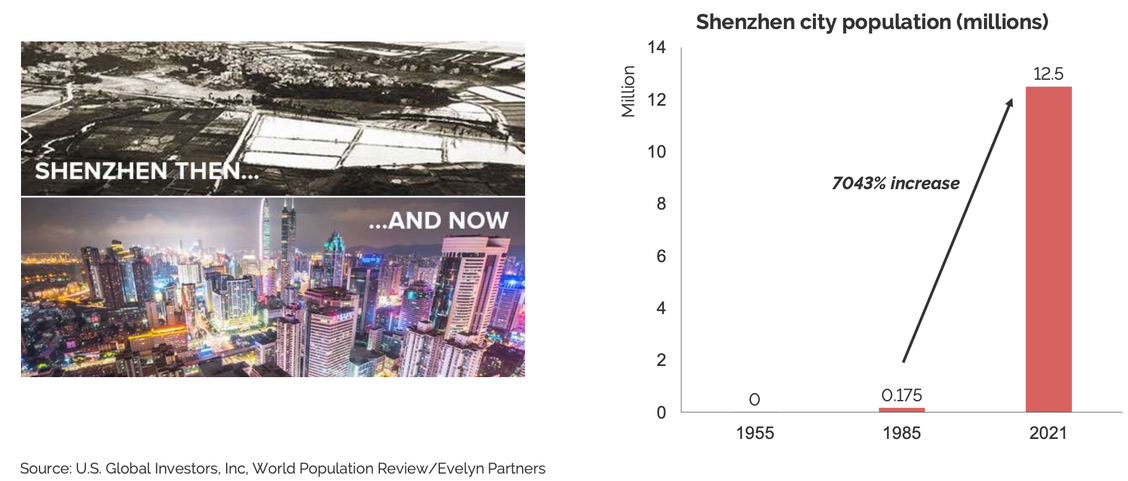

2. Massive movement of workers from rural regions into new cities facilitated rapid growth in manufacturing and economic output.

3. Globalisation enabled advanced economies to tap into this pool of cheap labour. But it now seems to be slowing…

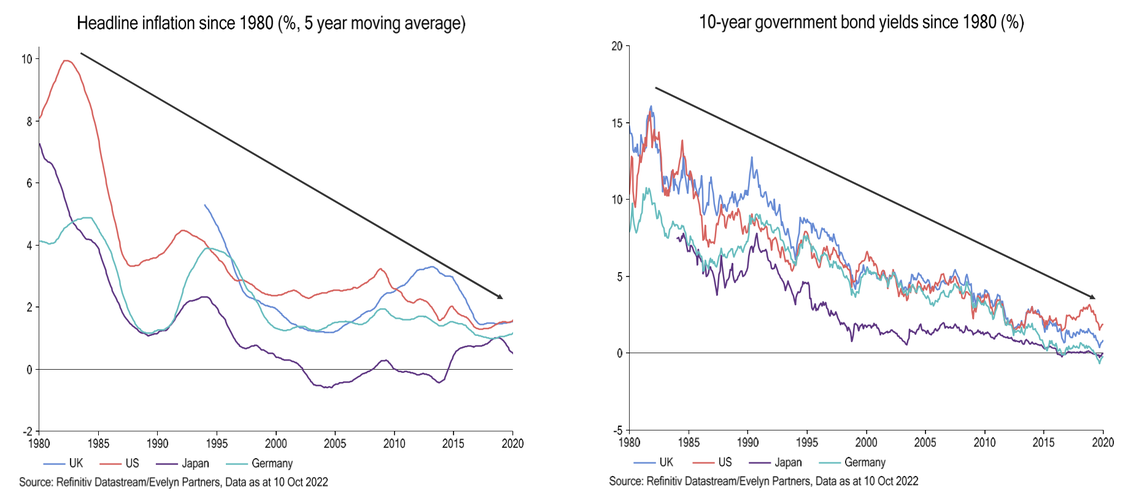

The economic impact has been significant: 40 years of falling inflation and interest rates!!

The Next Decade

So is it really different this time?

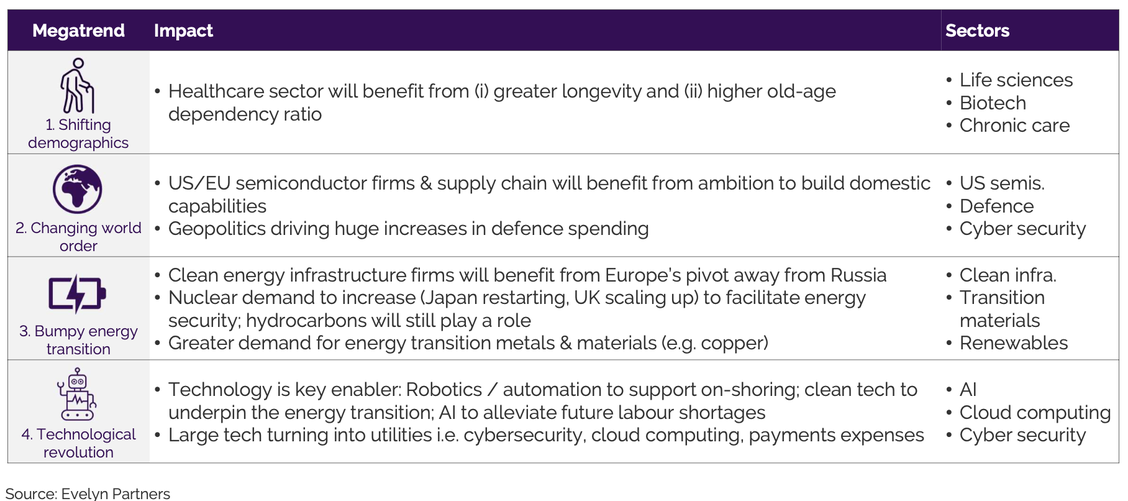

YES – We are at an inflexion point. 4 “Megatrends” will shape markets over the next 10 years – and beyond!

- Shifting Demographics

- Changing World Order

- Bumpy Energy Transition

- Technological Revolution

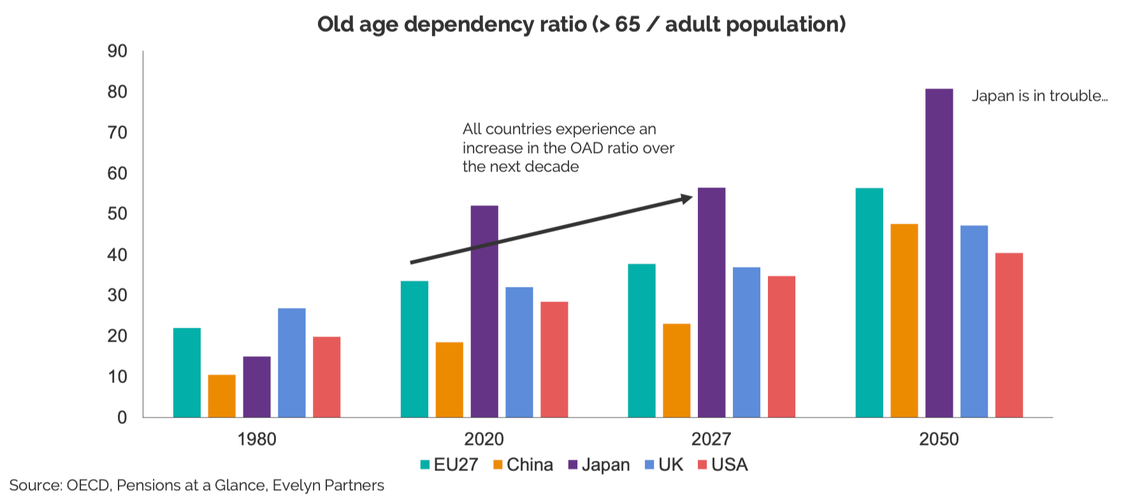

1. Shifting Demographics: The old-age dependency ratio is set to increase sharply & population growth will slow

2. Changing World order: US-China decoupling and the war in Ukraine will result in ‘slowbalisation’.

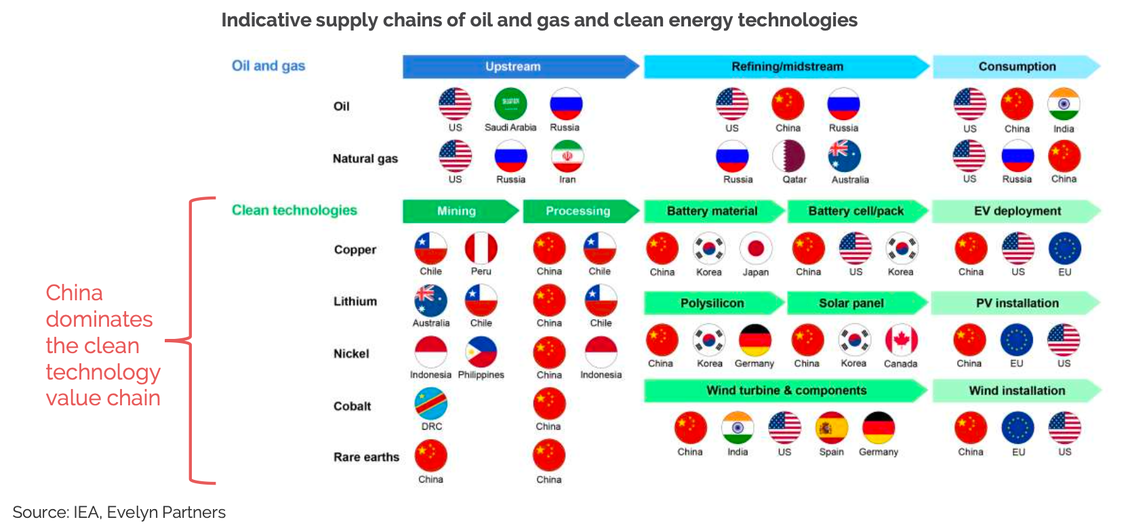

3. Bumpy Energy Transition: The war has undermined energy security & accelerated the energy transition… But the transition is likely to be bumpy. It will bring new energy trade patterns and geopolitical considerations into play…

Who really owns the infrastructure which will help our Energy transition?

4. Technological Revolution: New technologies will underpin the future of business and most areas of our lives… for example Artificial Intelligence and Automation

So if we really are entering a genuinely different world, how do we manage our money over the next decade and beyond?

All of these factors will present challenges AND opportunities and so it is important to align our approach to benefit as much as possible from these opportunities and minimise the risks of being on the wrong side of the challenges.

Is it time to review your investments?

I hope this ‘longer term’ view has helped you put your existing investment choices into perspective or helped you when choosing new investments.

If you want help with reviewing existing or choosing new funds then don’t hesitate to get in touch.

I want to sincerely thank the team at Evelyn Partners, one of the investment management firms we work closely with, for this excellent piece of research and its refreshingly long term approach.

For more information on this please visit Evelyns Megatrends Hub here www.evelyn.com/good-advice/megatrends/

Make a time to call – it’s good to talk

If we haven’t spoken recently and you want to get in touch via my new booking system then please click on the link to book a quick call.

I have linked my diary to the excellent ‘Calendly app’ which allows us to arrange our next call, zoom or face to face meeting more easily – feel free to forward to family or friends who might need my services.

Tax efficient savings and investments in France

By Amanda Johnson

This article is published on: 21st March 2023

Assurance Vie in France – In most countries, tax-efficient savings and investment schemes exist with the aim of encouraging people to save for the medium and long-term so they don’t become a burden on the state.

However, when we become resident in France the tax-efficiency that we enjoyed from our home schemes is usually lost. This is because, as a French resident, you are liable to French taxes on all your worldwide income and gains, except for anything that might be exempted by the terms of a Double Taxation Treaty.

Even if certain income is exempt from French taxes, it is usually the case that this exempt income must still be declared in France and will be included with your other income when calculating your French income tax liability. The fundamental point to note is that including such exempt income has the effect of increasing the rate at which other sources of income are taxed in France, including investment income.

In France, there are several tax-free accounts available for short-term savings such as:

- the Livret A, available to both residents and non-residents, in which you can deposit up to €22,950 and earn interest of 3%. No tax or social charges are applied

- the Livret Développement Durable, eligible to French resident taxpayers only for deposits up to €12,000, also earning interest of 3%

- the Livret Epargne Populaire, eligible to French resident taxpayers only, paying an extra 6.10% interest for deposits up to €7,700 if your income doesn’t exceed a certain threshold..

For medium to long-term investments (as opposed to savings), there is one product that stands head and shoulders above the rest and that is an Assurance Vie

What is an Assurance Vie?

An Assurance Vie (AV) is an insurance-based investment product. It can be as simple or as complicated as you wish to make it. Think of it as that old shoe-box that you keep your documents in, or maybe that fireproof metal cabinet for certificates and the like. Old and battered it may be, but an AV has some rather special properties:

- The investments that you place within your AV are never touched by French income tax or capital gains tax whilst they stay inside the AV

- The majority of investments are never subject to social charges whilst inside the AV. Be aware that this does not apply to Fonds en Euros, from which social charges are deducted annually

- The AV is never locked. You can take your money out whenever you like, unlike a pension which has age restrictions

- If you keep the AV going for at least eight years, you then qualify for a special income tax-free band on top of your normal allowances, together with low withholding tax rates

- If your aim is to leave your financial assets to your chosen heirs (not just the ones Napoleon thought you should leave them to), you can leave each individual beneficiary a large sum completely free of French inheritance tax

Millions of French people use the AV as their standard form of savings and investments and many billions of Euros are invested this way via French banks and insurance companies. In addition, there is a much smaller group of companies that are not French, but have designed French compliant AV products aimed specifically at the expatriate market in France. These companies are typically situated in well-regulated EU financial centres, such as Dublin and Luxembourg. Before choosing such a company, however, it is important to establish that the company has a French fiscal representative, to ensure that you receive the same tax and inheritance advantages as a French equivalent product.

Some of the advantages of an international AV policy compared to French policies are:

- It is possible to invest in currencies other than Euro, including Sterling and USD

- There is a larger range of investment possibilities available, providing access to leading investment management companies as well as capital guaranteed products and funds

- Documentation is in English, thus helping you to understand better the terms and conditions of the AV policy

- The AV policy is usually portable which is of benefit if moving around the EU since in many cases the policy can be endorsed for tax-efficiency in other EU countries

How does an Assurance Vie work?

Your single lump sum investment or regular premiums are paid to an insurance company, which then places the money with the investment manager(s) of your choice. These are usually unit- linked types of investments, for example in equity or bond funds, but can also be in deposits or special products on offer from various financial institutions. You can invest in any number of different funds or products and these are all collated together by the insurance company to form a collective bond, which is your AV policy.

If you have chosen your investments wisely (with the help of your financial adviser), over the long-term the value of units you hold in the funds is likely to increase and so too is the value of your AV policy. However, you must be fully aware of and comfortable with the amount of risk that you are taking, since with any type of unit linked investment your fund value can go down as well as up, as a reflection of what is happening in investment markets. Over the long-term, however, the effect of short-term market volatility will usually be reduced.

Can my capital be guaranteed through an Assurance Vie?

A common feature of the French AV is the possibility of investing in Fonds en Euros. This is a special type of fund designed to form a very cautious base to your total investment, since your capital, as well as any interest and year-end bonus added to it, is guaranteed. The fund invests mostly in government and corporate bonds, although there can also be a little exposure to equities and properties with the aim of enhancing returns. During the year, your capital will earn interest and by law the insurance company must allocate most of your share of the return of the fund to your account, in the form of a year-end bonus. The balance of the return of the fund is kept in the insurance company’s reserves, to smooth out future investment returns, for example in times of poor market investment performance.

Due to the nature of the guarantees with Fonds en Euros, the rate of return is typically low, but is usually better than the interest that you might earn from a bank deposit with immediate access. However, this type of fund is regarded by the tax authorities as being so secure that social charges are levied annually on the gain (rather than only at the time that you take a withdrawal as would be the case with other investments within the AV). This effectively reduces the rate of return over the long term. Through some international AV policies there is the possibility to invest in structured bank deposit offerings, where the investment return is linked to the stock market, but with the security of a capital guarantee.

How do I choose what to invest in inside my Assurance Vie?

You may have strong views on this yourself, or you may have no ideas at all, but in all cases it helps if you have a good financial adviser at hand. His or her job is to help you understand the whole concept of investment and to help you establish your attitude to investment risk. Sadly, there is no realistic chance of a meaningful return on your savings without accepting some degree of risk. We have also seen in recent years that even leaving your savings in a bank can be risky, whether this is because you do not earn a real rate of return or because the bank fails due to poor management.

Your adviser will show you different types of investment options, explain how they work, what their track records are and how much risk is involved. You make the final decision, but his or her help can be invaluable. When the investments have been made, there should be follow-up meetings to review the performance of your investments. Your adviser may well recommend some changes depending upon the evolution of your own circumstances, or perhaps because of fund performance, or may have interesting new funds to introduce to you.

It is also possible to use the services of a Discretionary Fund Manager, with whom you agree an investment mandate (based on your specific investment objectives and risk profile), who then manages your money on a discretionary basis to achieve your financial goals.

How is Assurance Vie taxed?

Only the gain element of any amount that you withdraw is liable to income tax and the rate of tax is determined by the date on which premiums are paid.

Premiums paid before 27th September 2017:

For premiums paid before 27th September 2017, the taxpayer has the option to be taxed at the progressive rates of the barème scale or the Prélèvement Forfaitaire Libératoire (PFL) rates, as follows:

- during the first 4 years at 35%

- between 4 years and 8 years at 15%

- post 8 years at 7.5%

- social charges at the rate of 17.2%* are payable in addition

Premiums paid from 27th September 2017:

The Prélèvement Forfaitaire Unique (PFU) – also known as the Flat Tax – was introduced in the Project de Loi de Finances 2018, published on 27th September 2017. From this date the PFU applies to the total amount of interest, dividends and capital gains on the sales of shares received by the taxpayer. It also applies to certain gains on withdrawals from assurance vie contracts.

The Flat Tax rate is 30%, made up as follows:

- a fixed rate of income tax of 12.8%; plus

- social charges at the rate of 17.2%*

For premiums to assurance vie contracts paid from 27th September 2017, the tax rate will vary according to the age of the contract, and for contracts older than eight years according to the ‘threshold’ amount of capital remaining in the contract as at 31st December of the year prior to the withdrawal being taken.

The threshold amount is €150,000 per individual person (across all assurance vie policies), which is determined by reference to the amount of the premiums invested, reduced by any capital already withdrawn, and not the value of the contract.

The threshold is not cumulative between persons and therefore couples who are taxed as a household cannot share in each other’s thresholds. Thus, one spouse may reach the threshold level whilst the other does not, for example where one has say €200,000 capital invested and the other only has €80,000 invested.

The PFU applies to assurance vie contracts of less than eight years regardless of the amount of the outstanding capital. Thus, the PFU rate of 30% replaces the pre-27th September 2017 rates detailed above.

Therefore, according to the age of the contract, the following tax rates apply:

- during the first eight years, the Flat Tax rate of 12.8%

- over eight years, 7.5% up to the threshold, plus 12.8% above the threshold

* A lower rate of social charges at 7.5% applies if you are resident in France and hold the EU S1 certificate, whereby you are covered by the health system of another EU or EEA country.

Insurers are obliged to deduct the tax of 12.8% or 7.5% (depending on the duration of the contract) plus the social charges. Subsequently, for contracts older than eight years where the taxpayer has exceeded the threshold, any additional tax due is charged through the taxpayer’s annual declaration.

Tax-free allowance on all policies after the eight year holding period:

In addition to this, and in all cases regardless of the ‘premium paid’ date, after holding a policy for eight years a single taxpayer receives an income tax allowance of €4,600 per annum against the gain element of any withdrawals during the tax year. For a couple who are subject to joint taxation, this is increased to €9,200. Hence, providing that the gain element of total withdrawals made during the year does not exceed the allowance, then there is no income tax to pay. This might not sound a lot, but it is a very useful allowance, as can be seen in the following simple example.

Peter and Pam have an AV policy, which they start in January 2018 with an investment of €100,000. They do not make any withdrawals on this investment for the next eight years, and it is then worth €160,000 (hypothetical). A new car is then needed, and they need some cash to help pay for it, so they withdraw €20,000 from their AV. In this case €60,000 of their AV worth €160,000 is profit, and that is 37.5% of the total, so it is logical that the gain element of their withdrawal is €7,500 and €12,500 is their original capital.

The insurance company (assurance vie provider) will deduct income tax and social charges on the gain element when they pay out the withdrawal. Since the policy is over eight years old however, and they are subject to joint taxation, Peter and Pam have a tax-free allowance of €9,200. The gain will then be declared on their next tax return and they will receive a rebate of the income tax charged.

Does an Assurance Vie have other advantages?

Without doubt, the AV is effective for inheritance planning. There are age restrictions, but via an AV policy you can leave up to €152,500 to any number of beneficiaries, each of whom will pay no succession tax. In addition, AV policies are exempt from the strict French succession rules. You can leave your money to whomever you wish. Should you wish to leave more than this amount to any one beneficiary, they will pay tax at a rate of 20% on the next €700,000, and then at 31.25% above that.

Is an Assurance Vie right for me?

An Assurance Vie is a valuable asset, helping you to shelter your capital and income from unnecessary taxation. It can provide protection for you during your lifetime and protection for your loved ones when you are gone. However, everyone’s circumstances are different and it is essential that you take professional financial advice before investing into this type of product.

Why is now a good time to invest?

By Michael Doyle

This article is published on: 9th March 2023

I have been working with a few clients over the past couple of years who were very nervous about investing for the longer term as the markets had been volatile. Recently they decided to ‘push the button’ after we reviewed their situation together.

So, here are ten reasons why now could be a good time to invest:

1. Economic recovery: The global economy is recovering from the impact of the COVID-19 pandemic, and this presents opportunities for investors to take advantage of growth opportunities in various sectors.

2. Low-interest rates: Interest rates are currently low, which can make borrowing cheaper and provide investors with a chance to invest in assets that are likely to yield higher returns.

3. Inflation protection: Investing in stocks, bonds, and other assets can provide protection against inflation, which can erode the purchasing power of your money over time.

4. Increased savings: Many people have saved more money during the pandemic due to reduced spending on things like travel and entertainment. This has led to an increase in the amount of money available for investment.

5. Technological innovation: The pandemic has accelerated the adoption of new technologies in many industries, and investors can potentially benefit from investing in companies that are at the forefront of innovation.

6. Diversification: A well-diversified portfolio can help investors spread their risk and potentially minimize losses if one sector or asset class underperforms.

7. Long-term focus: Investing is a long-term strategy, and the current market volatility should not deter investors from thinking about the long-term potential of their investments.

8. Behavioural finance: Understanding how emotions and biases can impact investment decisions can help investors avoid making costly mistakes.

9. Education and access: There are many resources available to investors to help them learn about different investment opportunities and strategies, and technology has made it easier than ever to invest from the comfort of your own home.

10. Social responsibility: More investors are looking to make investments that align with their personal values and beliefs, and there are now many options for socially responsible investing that can potentially provide both financial returns and social impact.

Now would be a great time to review your own situation. Either speak with your financial consultant or feel free to contact me for a no obligation review.

Financial updates March 2023

By Katriona Murray-Platon

This article is published on: 8th March 2023

March is always a busy month for me and this month is already looking to be the same thing. Whilst all is quiet on the tax front, for now, I am enjoying the calm before the tax storm to do client reviews and meet new people.

One of the questions that came up this month was to do with wills and power of attorney. I have already written about wills in previous articles and whilst I do not undertake to help people write their will many people find it helpful to have a conversation with me before speaking to a notaire just to fully understand the implications for expats in France. So if you haven’t written a will and have any questions please do get in touch.

When you have assets in the UK and in France it is important to have a UK will and a French will and these should refer to and not repeal or revoke each other. Equally, if you have money paid into a UK account, over which you would need someone to have power of attorney, it is a good idea to have a UK power of attorney for your UK accounts and a French power of attorney for French accounts. Whilst a UK power of attorney is, under The Hague Convention, valid in France, and a French power of attorney is, if properly drafted, legalised and translated, valid in the UK, it would be easier for those close to you, whom you have appointed as your attorney, to have a registered power of attorney in France and in the UK. This will avoid lengthy administration and translation costs. It is best to consult a notaire to make sure that your French power of attorney is properly drafted and will, come the day, be accepted by French banks.

Hopefully you have already had a look at your tax page and declared your property, if not you have until 1st July 2023 to do this. Just to add to the information in last month’s Ezine, if you rent a property you will have to declare the amount of rent. This information will be used to calculate the rental value of the properties in your area and therefore the Taxe Foncière. However you don’t have to declare the rent just yet, you have until July 30 June 2025 until this becomes mandatory.

Finally, as 8th March is International Women’s Day, I wanted to share with you a photo of the lovely ladies who work for or with The Spectrum IFA Group. This photo was taken at our Gala event in Gleneagles. Before officially joining Spectrum I was encouraged to speak to some of the female advisers to find out their experience and it is because of their experience working in Spectrum that I decided to become a financial adviser.

Today I have the great privilege to work with this amazing group of women! In addition to this I have a large and growing number of female clients who I am pleased and proud to advise. Happy Women’s Day to all my female clients! If no one else is spoiling you, please do take the time to do something nice for yourself to celebrate International Women’s Day.

French Tax Returns

By Michael Doyle

This article is published on: 7th March 2023

It’s that time of year again where we all must start thinking about submitting our French tax returns.

Here are my 5 top tips for completing your tax return.

1. Gather all necessary documents: Before you start preparing your tax return, make sure you have all the necessary documents, such as your income statements, receipts for deductible expenses, and proof of any tax credits you may be eligible for, the figures taken from your bank account(s) and the relevant exchange rate(s).

2. Choose the right form: France has different tax forms for different types of taxpayers, so make sure you choose the right one. In general most people will need to declare their income on the main form (2042) and its related forms (2042C and 2042 pro), the 2047 for all foreign income and the 3916 for foreign bank accounts and investments.

3. Fill out the form accurately: Take your time to fill out the form accurately and completely. Make sure you provide all the required information, including your income, expenses, and any tax credits or deductions you may be eligible for. Remember to declare all bank and investment accounts as any omissions can lead to high penalties.

4. Submit the form on time: The deadline for submitting your tax return in France typically falls in May each year. Make sure you submit your form before the deadline to avoid any penalties.

5. Consider getting professional help: If you are unsure about how to fill out your tax return, consider getting help from a tax professional. This can help ensure that your return is accurate and that you are not missing out on any tax benefits.

This is also a great time to review your own financial planning needs.

Due to recent uncertainty in the markets many people are keeping their money in the banks.

Purely for illustrative purposes (as inflationary pressures are currently decreasing), if inflation did persist at say 7% for 10 years your spending power would halve over this period. Inflation across Europe has been higher than this throughout 2022.

Now is a good time to speak with your financial advisor.