The Spectrum IFA Group again co-sponsored an excellent Arts Society de La Frontera lecture on the 15thNovember at the impressive San Roque Golf & Country Club on the Costa del Sol. We were represented by one of our local and long-serving advisers, Charles Hutchinson, who attended along with our co-sponsors Currencies Direct represented by Ignacio Ortega and Carol Schleisman.

Arts Society de La Frontera

By Charles Hutchinson

This article is published on: 23rd November 2023

The Arts Society is a leading global arts charity which opens up the world of the arts through a network of local societies and national events throughout the world. With inspiring monthly lectures given by some of the UK’s top experts, together with days of special interest, educational visits and cultural holidays, the Arts Society is a great way to learn, have fun and make new and lasting friendships.

At this excellent event, over 80 attendees were given a talk on The Real Richard III by Tobias Capwell. Tobias is the curator of Arms and Armour at the Wallace Collection in London and an internationally acknowledged authority on Medieval and Renaissance armour and weapons. He is the author of numerous books on the subject and has been involved in many television programmes on BBC4 and Channel 4. In 2015, Toby had the unusual honour of serving as one of the two fully armoured mounted knights escorting the remains of King Richard III from the battlefield of Bosworth Field to their final resting place in Leicester Cathedral.. It would be no exaggeration to say that his lecture was incredibly gripping and interesting and at times very amusing. His knowledge of his subject was responsible for him being closely involved in the recent feature film “The Lost King” together with all the TV programmes of how they found and identified the king’s remains.

The talk was followed by a drinks reception which included a free raffle for prizes including CH supplied book The Search for Richard III and a large decorative candle. Currency Direct also supplied a Cava presentation case and 2024 diaries.

All in all, it was a very good turnout and a successful event at a wonderful venue. The Spectrum IFA Group was very proud to be involved with such a fantastic organisation and we hope to have the opportunity again at the February 2024 lecture.

UK term deposit rates as a resident of Spain

By Jeremy Ferguson

This article is published on: 1st November 2023

This is something I am being asked a lot at the moment, as so many of my clients have money on deposit in UK banks.

Many of them are offering healthy fixed term deposit rates at the moment to clients, but very often my experience is the bank will only allow customers who live in the UK to place cash into these term deposits. This only tends to come to light after speaking with them for ages on the phone to try and move your cash, after which they will very often ‘reject’ your request due to the fact you live here in Spain. Some banks are OK with that, but the majority are not.

There are also a few ‘downsides’ to these term deposits when you are a Spanish tax resident. To explain; if you were to invest in a 1 year term deposit offering 5%, then this will of course be taxed here in Spain at maturity. The complication comes with the fact that you have to file your tax returns in Euros. Imagine if you placed that one year deposit today, maturing in a year’s time in November 2025, and then assume a scenario where the exchange rate recovered from the 1.14 ‘ish’ we are seeing at the moment to 1.18 by the end of next year, (which is entirely feasible). You would have to declare the 5% yield in euros, which would end up at approximately 8.5% in this example. Tax will then be due on this amount, having the effect of significantly reducing your actual ‘profit’.

Of course it could go the other way but this is an issue, as each year the fluctuations can ‘disturb’ the actual amount you receive. This has only really come to light this year, as people have just not experienced yields on cash deposits for such a long time.

There is also of course the risk of placing your funds with the bank you chose, or institutional risk. The compensation scheme in the UK most people are familiar with will cover a deposit loss up to £85,000 per individual account. To utilize this as best you can it can get messy trying to hold money in many different banks. The reality for most people I deal with here is they tend to have a UK bank account from when they lived there. To try and open a new UK account when you live here is nigh on impossible, so spreading your risk by having a number of different accounts isn’t achievable.

However, a solution which deals with most of these issues is available. Without getting into too much detail, you can invest in a cash ‘fund’ run by one of the World’s biggest Investment Companies. Your money ends up being invested with nearly 200 underlying banks within the fund, so the risk of a bank failure is massively reduced.

Using the right structure to access this fund means you don’t have to pay tax on an annual basis as this will only be due when you cash in your investment, and therefore each year there is no need to consider the complications of the exchange rate issue touched upon earlier.

If rates were to rise further the fund will automatically take benefit from that, and so your ‘cash’ is being actively managed with no need for you to be doing anything.

The suitability of this solution of course depends on each person’s individual circumstances, but if you would like some more information, please do not hesitate to get in touch on the form below.

Top tips for expat finances | Spain

By Chris Burke

This article is published on: 10th October 2023

The clocks go back in a few weeks, so enjoy the last of the summer evenings before its time to get the winter wardrobe out and get cosy!

This month’s Top Tips are as follows:

- Wills – Why almost everyone should have one

- How to build a pension in Spain, quick example

- Why have your investment in a tax ‘Wrapper’ rather than an investment platform?

Wills – why almost everyone should have one

If you die whilst living in Spain or owning property/assets here, the expression is known as dying ‘intestate’. To quote why you should not want this to happen (apart from the obvious!) the Law societies words are as follows:

“Dying intestate not only means your final wishes will probably go unheeded, but the financial and emotional mess is left for your loved ones to sort out. This need not be your final legacy.”

So, if are not bothered about the administration you leave behind, the only circumstances under which I would suggest you might not want a Will (I still think you should, but it’s your choice) are if you are single or married with no children.

If you have children under the age of adulthood, in my professional opinion there are no excuses for not having a Will for the following reason: God forbid something should happen to both parents, how would the law know who you would want them to be raised by and how? Those left behind (grandparents for example) may not agree with your wishes but they should respect them. Imagine if you didn’t stipulate and the state decided against your families wishes………………….

Building a pension in Spain, quick example

“Chris, I want to save for retirement but I note the annual amount you can save into a private pension in Spain is €1,500, what options do I have?”

Well, some people tell me they could overpay into the state pension to obtain more, I say good luck with that. One of the ways they now calculate this is the average of the last 25 years of your salary/income, so the days of a great Spanish state pension for most are over.

I could go into great depth here but for ease’s sake, the following saving / investing example could give you an income of approximately €25,000 per year, so along with a full UK state pension that would give you a total income of approximately €38,000 per year and hardly any tax to pay:

- Initial investment of €50,000

- €2,000 per month contribution for 20 years

- Total investment value at the end: €926,247.78

I did say it was quick! This is of course is in tomorrows money (inflation roughly doubles every 24 years). With my clients we go into much more depth and analysis, but it gives you an idea.

Why have your investment in a tax ‘Wrapper’ rather than a platform?

Because of Tax, Tax, Tax!!!!!

Need I say anymore, THE most important aspect to consider as a Spanish tax resident.

When you withdraw money from an investment platform you are taxed on the ‘profit’ you take out. So, for example you start/invest €100,000, it grows to €120,000, you withdraw €10,000, tax is payable on the €10,000 as that is profit.

However, with a ‘tax wrapper’ you pay a different tax, Spanish Proportional tax, which is calculated by the following formula:

Initial investment amount, divided by current investment value, multiplied by the amount you are withdrawing.

So, to copy the above example, you start/invest €100,000, it grows to €120,000, you withdraw €10,000, tax is payable on the gain proportionally which is calculated the following way:

€100,000 divided by 120,000 multiplied by €10,000 = €8,333.

This €8,333 is the amount tax exempt, so you are ONLY taxable for €1,666 as opposed to €10,000 for an investment platform gain.

You can also add Children over the age of 14 to Tax Wrappers who benefit from this in the future, as well as partners/spouses. So, the additional cost of the Tax Wrapper can more than outweigh the tax savings over time.

Some of today’s Tips can be quite complex, if you are not sure don’t hesitate to get in touch.

1980’s advert

For those of you who don’t know me that well, I am a bit of an 1980’s fan. I was brought up on prawn cocktail, roast beef with all the trimmings and trifle for pudding. I still even now listen to 1980’s music channels………anyway, I am going to share each month some of my favourite TV commercials from back then until you tell me to stop OR I get inspired with something else!

Looks like we’ve overdone it on the…………

Click here to read independent reviews on Chris and his advice.

If you would like any more information regarding any of the above, or to talk through your situation initially and receive expert, factual based advice, don’t hesitate to get in touch with Chris.

Let’s deal with the facts

By Paul Roberts

This article is published on: 9th October 2023

Over the summer I read a fascinating book called ‘Checklist Manifesto’ by Atul Gawande. It’s a book about how the systematic use of checklists can help improve outcomes in a wide range of activities.

Gawande, a surgeon, explored the use of checklists in medical procedures and found that developing and complying with detailed checklists has an extraordinarily positive effect on medical outcomes. His book is well worth a read – some of the sections that describe how problems arise and are dealt with when things go wrong in an operating theatre or a cockpit on a passenger flight are truly incredible.

It is an unlikely page-turner, with a lot of practical examples of how adopting good working practices can have a hugely positive effect on outcomes. Here is one example;

In 2001, Peter Pronovost, an intensive care specialist at John Hopkins Hospital, was frustrated with the incidence of central line infection in intensive care. He created a simple checklist of the steps that needed to be taken to prevent infection.

As simple as the steps look, the ICU nurses noted that doctors were often in such a hurry that they ignored a step or two. With this information, Pronovost persuaded the hospital administration to allow nurses to prevent doctors from putting in central lines if they ignored a checklist step.

The nurses were also encouraged to ask doctors every day if they could remove the patients’ lines so they would not stay longer than necessary.

This step reduced the likelihood of untreated pain from 41% to 3%. Pronovost was described as a “genius” by his colleagues because he had the idea of integrating a task list or a checklist into the daily routine of everyone working in the ICU.

It has been interesting to reflect on the power of checklists and very reassuring to note that at Spectrum we have our own set of checklists that ensure we are disciplined and methodical about how we work. This approach, which we apply as part of our standard business practice, helps to secure positive financial outcomes for our clients.

Let me explain how this works with a couple of simple examples;

All potential clients do a fact-find with us as a first step in our financial planning process. The fact find is our checklist of questions that allow us to see where the person is, financially of course, but also in terms of life-stage, planning priorities, tax situation, etc. We build up a comprehensive picture of individual circumstances, what assets they have and what they are looking to do, well BEFORE we offer any advice.

With Client A, we had spoken at length about what he wanted to do and had agreed on a plan of action. When we got together some time later, I followed our Spectrum checklist and asked him if anything had changed with his situation since we had last spoken and the conversation that ensued filled me with concern. He had been contacted by a boiler room operation that had targeted him and who were in the process of getting him to transfer a high five figure sum into an offshore bank account. It was a scam. I was able to stop this before it went any further. He never made the transfer and he still has the money. I was so pleased that I’d followed the checklist and had done my job properly.

Client B is a young family member who is saving up to buy a house. He and his girlfriend have around 85000€ saved up. I asked him what return he was getting on that money. Answer – zilch. I was able to encourage him to explore the options at their bank on the basis that 2-3% was probably there for the taking, explaining that spending a few hours looking into it and taking some action will be the easiest couple of thousand euros they will earn this year.

These are two simple examples of the value that can be created in my business by following a reliable and clearly defined advice process. At Spectrum we are of course appropriately experienced and authorised for the financial planning services on offer. Beyond that, we care about doing a good job. We always offer a no fee, no obligation, face-to-face fact find meeting to anyone who is prepared to invest a couple of hours in finding out more about the planning opportunities available to them. If prospects go on to become clients, we also arrange at least annual review meetings (again at no cost), to revisit the fact finding exercise and to ensure that our original advice recommendations remain suitable, or where necessary to revise arrangements in response to changes in your circumstances.

As an aside, we know that banks generally don’t call their customer to suggest that surplus cash be placed in interest bearing deposit accounts. They just don’t do this sort of thing, because bank employees work for the bank. At Spectrum we work for our clients.

Please feel free to book an introductory appointment with a financial planner at Spectrum and see where it takes you.

Do I need a financial adviser?

By Susan Worthington

This article is published on: 1st October 2023

Just recently I returned “home” to continue my work under the wing of The Spectrum IFA Group. Two years ago I moved away thinking I could expand the range of services to offer my clients, but sometimes the grass isn’t greener. However, leaving one base for another also creates time for reflection and, sometimes, realisation that where you were was rather good.

Change is always happening around us, but for some it can be unsettling. I am fortunate in that all my clients and contacts have been happy to stay with me on my journey.

It made me appreciate that a client’s commitment to one adviser for the duration of their financial arrangements is fundamental to developing a strong relationship and achieving successful outcomes. It’s what an adviser can help them with that matters, and supporting those requirements over the long-term creates a unique bond. Matching the actual advice and arrangements to a client’s needs should be the highest priority for any adviser.

So what can an adviser provide:

• Helps maintain perspective (and calm) during stock market turbulence. This is particularly relevant at the time of writing!

• Able to explain and problem solve when something goes wrong.

• They provide more accurate news and updates from the real experts, steering clear of the media hype and scaremongering that is everywhere.

• Recommend tax efficient arrangements geared to your lifetime and also very importantly, after it, for your family.

• Have access to investment fund experts who often fare better than self-selected choices.

• Keep you on track as your circumstances change. Nothing ever stays the same, part of life’s rich pattern, so having a hand to hold you through that change can be comforting and supportive.

• Liaise with your tax or legal advisers to ensure your overall interests are protected.

Not everyone chooses to work with a financial adviser. Some people can’t find one they can work with or trust or just simply prefer to manage their own affairs. Many don’t do anything at all.

It made me check some UK statistics. Did you know that:

• 39% of adults (20.3 million) don’t feel confident managing their own money.

• 11.5 million have less than £100 in savings.

• nearly nine million people are in serious debt, and only around a third receive help.

• Brits who took professional financial advice between 2001 and 2006 enjoyed an average increase in their assets of nearly £48,000 after 10 years, compared to those who took no advice.

• Most millionaires likely use some type of financial adviser to grow and protect their wealth.

According to a recent report from Prudential, more than half – 53% – of UK adults say that financial problems and changed circumstances over the last 12 months have caused them to seek financial advice. Of this figure, 33% have already sought financial advice, whilst the remaining 20% are planning to do so.

Most people will benefit from the knowledge and experience of a professional financial adviser, especially if they have a variety of assets. When deciding between working with a financial adviser or doing it yourself, you just need to weigh the benefits against what you could be missing out on. Just a thought…….!

Top tips for expat finances – Spain

By Chris Burke

This article is published on: 18th September 2023

Well, thank goodness that heatwave is over and I can venture out during daylight hours again! September and October for me are the absolute best times of the year here in Spain, great comfortable temperatures, less people (tourists) around and the sea has been warmed up over the summer.

This month’s Top Tips are as follows:

- 7P tax exemption rule – do you travel outside of Spain at least two weeks a month?

- Property price forecast UK & Spain for the end of 2023/2024

- Why should I speak to a Financial Adviser (a good one, that is 😊) in one sentence?

- 90’s nostalgia advert

7P Tax Rule

One of the most common questions people ask me is ‘As I am not on the Beckham Law, how can I reduce my taxes?’ One of the first questions I ask them is ‘how much time do you travel for work outside of Spain?’ If you travel for 2 weeks or more every month, in simple terms you might not to have to pay tax for those days you are away – a significant saving and you may have a tax exemption of up to €60,100 per year.

The key qualification factors are as follows:

- You must be a Spanish tax resident

- The company you are performing the work for must not be Spanish, must be based abroad and not a Spanish entity (but you can be employed by a Spanish company and have been instructed to carry out this work outside of Spain)

- You must physically be outside of Spain when conducting this work

- The country you are working in must have a similar tax system to Spain/have a double tax treaty

If you adhere to all these points then this tax exemption could be applicable for you – please ensure you take professional advice.

Property price forecast for the UK & Spain, for the end of 2023/2024

Property is, in my opinion, a great asset to hold and one that every investment portfolio should have. Just like ‘non-property’ investments, the value can go up and down. It can be more ‘hassle’ to manage taking into account tenants, taxes, issues with the property etc. but long term it has usually been a good investment. Governments are starting to make being a landlord a more expensive venture in the UK now – let’s see if Spain follows suit.

Since covid we have seen that property prices have generally boomed. However, the last 12 months or so things have started to change. New Zealand is in the midst of a property crash, down approximately 18% in a year. Canada is also in a property ‘recession’, down by approximately 15% year on year (most of you probably won’t have heard about these – the news outlets tell you what they want you to hear). Property, just like investment portfolios, does not only go one way, as in up. This year, for the first time in a long time (probably 15 years), I have been advising some clients to sell their UK property investments if they don’t think they will go back there, and it makes sense from a tax perspective. If you are living outside of the UK, at some point you are going to have a decent sized taxable gain/event on that property, (more so in Spain) and even if it is inherited by someone else, it’s unlikely that even then the tax will be avoided/mitigated.

In the UK, properties valued at up to around £600,000 are ‘still moving’, estate agents tell me. Many people over the next year or two will be coming off fixed rate mortgages they took out during covid (when interest rates were low) and their new mortgage repayments will at least double under current rates. They will have the choice to either swallow this extra monthly cost or sell (some will have no choice). Taking all of this into account, forecasters are predicting the UK property market will decline – it is already stumbling at best, with a slow down in sales and asking prices not being achieved generally.

In Spain things are slightly different, and one of the driving factors is that you can fix your mortgage rate for life, meaning you have much more stability of payments moving forward – they can only reduce (if you re-mortgage when rates come down…if and when they do). Research says that the property market is booming in Spain. However, with approximately 15% of the property bought in Spain last year acquired by foreign buyers, taking into account what’s happening elsewhere an economist might say this impact will inevitably have a ripple effect at some point.

Some professions will always be able to be performed from home, however many companies are also starting to ask employees to return to the office. This could put an end to ‘we can work from anywhere, let’s go and live on an island/in the countryside’.

In summary I would say the Spanish property market is at best coming to a slow down, at worst a decline of some proportion. Of course, if you are holding this property for the long term then this will be of less importance. But considering the prices are the highest now they have ever been, and mortgage rates are much higher than they were, taking on a property now might mean you ‘have’ to hold it for a long time to realise its value.

Why should I speak to a Financial Adviser, in one sentence!?

A good adviser will make you more knowledgeable, financially organised, take the strain away from your finances, make your money work hard for you and always be there for you with sound advice whenever you need it (even if they don’t know all the answers, they will do their best to get them for you), always putting your needs first.

Prudential 90’s advert number 2

Do you remember this timeless, funny classic:

Now you can Identify as a Tree……who would have known back then!

If you would like any more information, or to talk through your situation initially and receive expert, factual advice, don’t hesitate to get in touch with Chris.

The end of succession tax in Valencia

By John Hayward

This article is published on: 6th September 2023

On 28th May 2023, Carlos Mazón was elected president of the regional government of Valencia as leader of the Partido Popular. On 21st July 2023 he announced that his government had approved the initiation of a bill to reduce succession and gift tax (ISD – Impuesto de sucesiones y donaciones – Inheritance Tax to the UK reader).

The draft bill was placed on the urgent pile with Les Corts on 3rd August 2023 and it awaits absolute approval.

Mazón’s reasoning was that the income from ISD represents around 1% of the region’s total revenue and that charging tax on money that has been taxed before was not fair. He wants to reduce the tax burden to prevent an inheritance from becoming a “serious economic loss for many families, who have to face its payment, without the inheritance entailing any economic benefit or real increase in their assets.” This seems a very refreshing attitude although his opposition have argued that the wealthy will avoid tax that would generate around €400 million a year. This assumes that the timing of deaths and gifts matches their statistics.

There are conditions to this bonificación in that only close family members and spouses will benefit but that is the same with the existing reduction. The improvement is that, for the majority of spouses and close family members, they will receive a reduction of 99% on the tax bill. Currently it is only 50%.

All this being said, there is still room for inheritance tax, and gift tax, planning. We experience many complicated situations where, for example, couples are not married or there are children from different marriages. Keeping assets away from the inheritance and gift tax net in Spain, in a legal way, is key, especially for beneficiaries who do not live in Spain.

We await absolute approval of the bill but, and although this may sound a little insensitive, any deaths, and gifts made, since 28th May 2023 will be eligible for this new law.

And like buses… Abolition of Wealth Tax in Valencia?

One at a time, please!

More to follow…

To find out how Spanish inheritance and gift tax will affect you and your beneficiaries, as well how we can help you with your existing investments and tax planning, and provide you with ideas for the future, contact me today at john.hayward@spectrum-ifa.com or on +34 618 204 731 (WhatsApp)

Investments in Spain

By Chris Burke

This article is published on: 16th August 2023

Savings accounts or investing in Spain – what is right for you?

This is one of the most common questions I am asked, and with interest rates creeping up I thought it prudent to run through how you should decide what’s right for you.

To help with this, firstly we need an explanation of the important differences between the two:

Why would you put money into a savings account?

Saving is putting money aside in a deposit account for the next few years. When interest rates are low, the return you’ll get on your money will be very modest. The risk is that it won’t beat inflation, which is the rate at which the prices of goods and services increase. So, whilst your money is safe (covered up to £85,000 in the UK and €100,000 in Europe), its purchasing power will be eroded over time, meaning you will be able to buy less with your money in the future. When interest rates are high you will get more return on your money, but generally in this type of economic climate it will still be less than inflation. Because of this, money you keep in cash savings accounts should be for short term savings of less than about 5 years.

Why would you invest your money?

Investing is another way of setting aside money for the future, where you invest your money into something with the aim of making a profit in the long run. When you invest, you’re generally exposed to the risk of stock market volatility (although some investments don’t invest entirely or solely in these markets). Your expected returns can fluctuate and you may not get back what you put in, especially in the short term.

You should aim for a minimum of 5 years when investing and start planning ahead with your investment strategy to manage this risk a few years before you want to access your money.

“Save for what’s around the corner and invest for the future”.

Why take any risk with your money?

Firstly, as explained above, inflation will eat into the power of your money over time. This is a problem while you are working, but is particularly important to manage when you are retired and you cannot replace lost buying power with income from your job. Secondly, not all investment risk is equal. The benefit of taking a calculated amount of risk over the long term is that it gives you the potential to make much more money than you would from a savings account, helping to pay for future large expenses and a more comfortable retirement.

What is the trend when interest rates are high compared to investing in the stock markets?

Over a short timeframe, holding cash in a savings account is usually a safe and appropriate option. It is less risky in the short term as it is readily accessible and interest rates are currently attractive relative to the past few years.

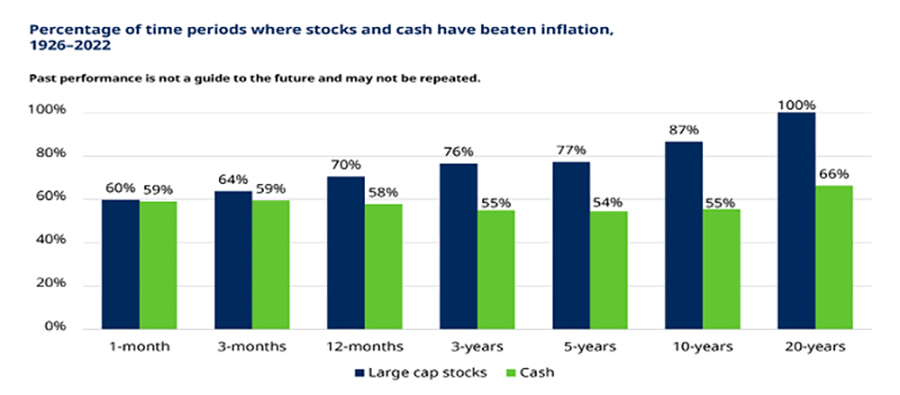

However, time is the critical factor to consider here, as over the longer term cash won’t beat inflation but investing should, as can be seen in the chart below:

Over long periods of time there is a big difference in the returns achieved from saving and investing. In the short-term, investing is riskier than an interest-bearing cash account, however when compared to inflation investing has offered far more certainty and success in the long run.

Prudential 90’s advert

Do you remember this timeless, funny classic: We want to be together!

The principles remain the same even today……

Click here to read independent reviews on Chris and his advice.

If you would like any more information, or to talk through your situation initially and receive expert, factual advice, don’t hesitate to get in touch with Chris.

Top tips for moving to Spain in 2023

By Charles Hutchinson

This article is published on: 1st August 2023

Spain is an interesting and beautiful country with a fantastic lifestyle and very hospitable people. I have been in business here with my family for nearly 30 years and have learnt to identify the pitfalls. Here’s how to avoid some of them so you don’t spoil your early days here:

1. Visa and residency permits. It is important to seek advice from a lawyer, gestor or financial adviser specialising in assisting expatriates in Spain as to which visa or permit you need. Since Brexit this has become essential, especially for UK nationals who no longer have the right of abode in the EU.

2. Residency. Again, it is important to consult on the various ramifications of residency, particularly the timing of physically moving from your previous jurisdiction (such as the UK) to Spain. For example, the UK has the 90 day rule whereby if you spend more than 3 months there in any 12 months, you are deemed to be tax resident. In Spain, it is the 183 day rule. However, should your “centre of vital interests” be deemed to be here (if you have children in school here or you are running a business from here), then despite being physically here less than 183 days, you may well be deemed to be a fiscal resident.

3. Foreign pensions and tax efficient investments. While they may be tax efficient in your country of origin, they may not be here. For example, if you are about to draw down on your pension where there is a 25% PCLS (cash lump sum) available tax free, it may not be so here and could be taxed at full income tax rates. Likewise, UK ISAs and some UK National Savings products will probably not be tax free here. You should consider encashing these while UK resident and switching into tax efficient alternatives here (more on that later).

4. Choice of new country of residence. For me this is a no brainer. Over the years I have met many potential and future clients who let taxation rule their lives and dictate where they should live. I genuinely feel that if you and your partner (and children) want to be happy, choose the place that offers what you and yours need for a happy life. There are still too many people who choose their new home on the basis that there is less or no taxation. A frequent typical example would be a couple who spend 180 days in Spain, then 90 days in the UK, one month on a cruise and one month in Florida. While the husband might be rubbing his hands in “Fiscal Nomad” glee, his poor wife is just fed up wandering the world as Mrs Nomad and not being able to call anywhere “home” (please also remember my earlier reference to “centre of vital interests”).

5. Taxation. There are certain taxes in Spain which are foreign to many from other jurisdictions. Typically this might be wealth tax or inheritance tax (IHT) between spouses or common law partners. Please see an earlier article I wrote about how Andalucia might currently be considered a tax haven. The threshold on wealth tax has now been raised here (and in Madrid) so that most couples can avoid it. In Andalucia, there is effectively no more inheritance tax – if you plan carefully. By selecting the correct structure in which to hold your investments, IHT no longer applies between partners (more on this later).

6. Tax returns and declaration of foreign assets. Timing is all important. When you arrive here, it is important to seek advice as to when you should make your first tax return. As usual in Spain, there is the official rule and the unofficial version. As long as there is a provable intent to make one’s first return, one is not breaking the law. It is always easier to make a return for the tax year beginning after you arrive. This often coincides with the fact you have not been here for more than 183 days prior to the beginning of the tax year (1st January). Returns are made by end of June of the following year, so there is plenty of time to decide when to start. You can of course make a return for a period beginning part way through the tax year. This is sometimes done to coincide with date you left your country of previous tax residence but it is not essential. Modelo 720 (Declaration of Foreign Assets) is always made in March of the following year, with regard to the previous tax year. Note that certificates of tax residency here are only issued after you have made your first return.

7. Capital gains tax (CGT) timing. Whenever possible, dispose of any assets which are either CGT free in your previous country or attract a lower tax rate than here while still tax resident in your previous country. For example, your main residence in the UK is free of CGT when disposed of as a UK tax resident, but when you are tax resident here it would be regarded as a second home, even if you are only renting here. Your Spanish home in turn has special tax privileges as a Spanish resident when you come to eventually dispose of it (as an owner).

8. Health insurance. It is important to remember that since Brexit, UK nationals no longer have the privilege of cross border health care. It is however the rule that to obtain a resident permit or visa you must have Spanish recognised health insurance. To avoid stress, investigate options as early as possible.

9. Spanish compliant investment bonds. These are not only recognised here, but also across many EU countries and the UK (where they were pioneered). They are an incredibly effective tax efficient structure provided by several major insurance companies outside of Spain and with offices within the EU. Here in Spain, they are a flexible, 100% secure (under EU law) means of holding investment funds and cash almost without tax exposure. Only when making regular (income) or lump sum withdrawals is there a withholding tax on the growth element of the withdrawal. Even then, the tax rate is far lower than normal income tax. IHT can also be avoided and you can retain your previous investment manager to manage your portfolio. You should consult your new financial adviser in Spain for details.

10. Happiness is where the heart is. Observe these steps and you will begin with less stress and hopefully continue to happily live your lives here for the rest of your days. There is no place like Spain to have a satisfying and rewarding life (just beware when grandchildren heart strings begin to tug if they live somewhere else!)