What happened to house prices in Spain in 2024 and what can we expect in the year ahead ?

House prices in Spain

By The Spectrum IFA Group Spain

This article is published on: 12th February 2025

First, let’s consider how the residential property market performed last year. The significant increase in average house prices, reaching €2,164 per square metre, represented a 12.5% increase from the historical peak of 2007.

This growth was largely driven by the following factors:

Sustained Demand: Economic recovery and job stability have encouraged more people to invest in property, in turn maintaining steady demand in the housing market.

Limited Supply: The scarcity of developable land along with building restrictions have limited the supply of new homes, particularly in urban areas and coastal regions, contributing to price increases.

Tax & financial planning in Italy 2025

By Gareth Horsfall

This article is published on: 6th February 2025

Hello again and welcome to this E-zine. (Picture from the olive grove last Sunday morning as the sun was rising)

(Just a quick note to those people who are awaiting my promised E-.zine on the new UK IHT rules which came into force in Oct 2024. I have now completed a draft and will be sending it out soon!)

Since my last newsletter, back in December, I have received many emails of congratulations on the new house and equally many tips of how to manage the land we have. Thank you to you all. Please keep the tips and tricks coming: for example, leaving wild areas for the health of the fruit trees and encouraging diverse wildlife – seems logical but then to one who has never had to deal with these things, it is all new. I am learning new things all the time and interested in the land and seeing it develop. My wife is taking on the task of the house and making sure it is furnished as we would eventually like it to be.

Thankfully, the land doesn’t need a lot of money spending on it, it’s more brute labour force which I am maximising to my benefit by staying fit in the early mornings before I throw myself at the computer.

I have also enlisted the help of a local gardener who , in the last week or so, has helped free 3 very old olive trees from years of being covered by ivy and by other much larger pine trees. They are now free to breath again and will get their well earned ‘potatura’ in a few weeks. (See photo below – there is one in the background, if you can see it!).

I have been busy piling the wood cuttings from the various trees to provide me with a varied menu of BBQ wood this summer! Finally, (the last thing about the house in this Ezine, I promise!) the trattorino tagliaerba arrived recently. Thank god for that because the grass is starting to grow again with the warmer weather and I was starting to worry about managing all the grassy areas with just the push mower. It certainly kept me fit, but in the end it was a bit too much. Now, I just have to decide which bits to mow and which to leave to nature….decisions, decisions!

Anyway, enough of my land management problems.

In this E-zine I wanted to tell you about The Spectrum IFA Group Annual Conference which I attended between the 20th and 24th Jan, this year in Casablanca, Morocco.

We had some of the usual asset managers and specialist firms there from Rathbones Asset Managers, Evelyn Partners, New Horizon, LGT Wealth management amongst others. Interestingly the first day of the conference was Donald Trump’s inauguration day and so we were observing live some of his first actions. He was very much a topic of conversation during the conference; so much so, that since his first day in office things have moved so quickly that I was thinking of not writing this E.zine because almost as soon as I wrote something then it either came to pass, or was wiped aside with another executive order. However, in the last few days a number of people have contacted me about what he is doing and if it is going to cause inflation, an economic downturn in the US and across the world and how it will affect your investments. So, with this in mind I decided to provide some of the information that I gleaned from the investment managers’ minds. Those people who are right at the coal face of what is likely to be a profitable period for America, but one with increased investment market volatility.

PRESIDENT TRUMP….again

I will provide an abbreviated version of what his Presidency is likely to entail because by the time I have written this and then edited it, it is highly likely that things will have changed again. So here are some bullet points we learned from the conference:

Whatever your view is on President Trump the consensus is that he is going to be good for the American economy. He is also about trying to bringing business back to the USA, putting the USA first and stimulating business in the US itself.

He can only run for this final term as US President therefore he has 2 years before the mid terms when the situation could all change again. So, the thinking is that he is in it to make a BIG splash and create large improvements for the US economy in a short time frame. What has he to lose?

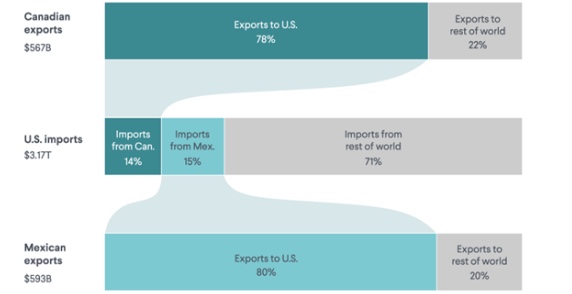

We have already seen that he is going to use tariffs as his weapon of choice, at time of writing Canada and Mexico already seem to have caved in to his demands. The tariff threat is being used merely as at a threat with the idea to create change. And it’s no surprise, re Canada and Mexico, given the figures that we can see below.

** Don’t listen to what he says, watch what he does **

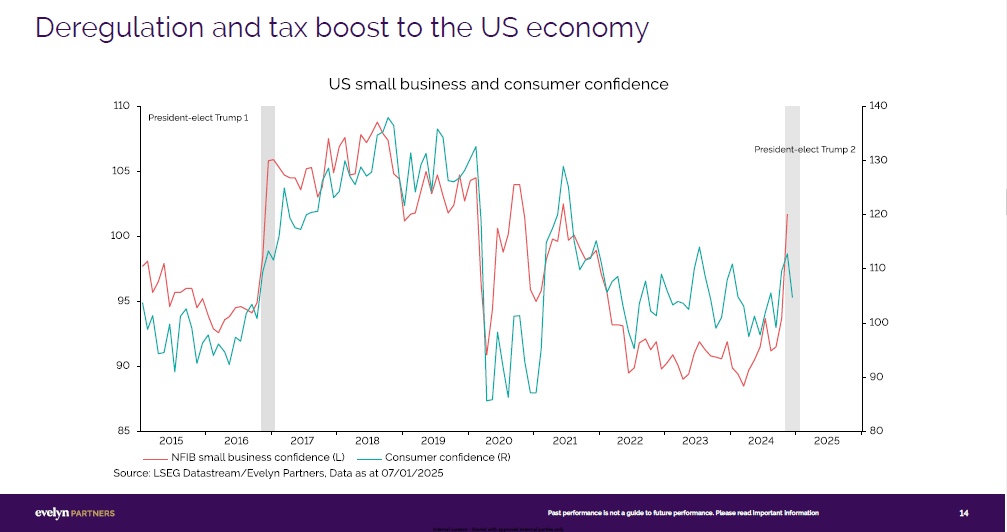

DEREGULATION: Expects big things in this regard: less red tape, cutting the tax code, stimulating business and if you think this is a bad thing, then have a look at the slide below courtesy of Evelyn Partners:

Small business and consumer confidence rose significantly as a result of deregulation during Trump’s first term in office and confidence is rising once again.

DRILL: Some of the best performing stocks in 2024 were mining and explorations stocks: Chevron, Shell and Schlumberger, to name only 3. President Trump has made executive orders to drill for shale gas and open oil fields in the USA as well as mining for rare earths. He wants the US to be energy and resource independent again and become a net exporter. This has obviously come at the price of withdrawing from the Paris Climate Agreement and he has turned back investment in ethical/sustainable projects which poses the question whether this could mean difficult times for wind and solar?

IMMIGRATION: Regardless of the headline news re: illegals being sent back home, the main point is that he is going to make it harder to get into the USA, but it might be important to remember the following:

- 72% of workers in US agriculture are immigrants

- 40% of which are illegal

- and, of which many are employed in Republican Trump states

- so would he want to alienate too many of his core voting states?

Unlikely.

DOGE: (The Department of Government Efficiency headed up by Elon Musk): One of the first orders from the new department was that all government workers must get back to work in the office 5 days a week. Is this good for productivity?? Elon Musk cut 80% of Twitter staff when he bought it, is he about to do the same at Government agencies? Certainly some of the news coming out of this area already is quite interesting from USAID being involved in funding groups to overthrow foreign governments, to blank cheques being written in government agencies without checking what they are being allocated for. The goal is to cut $2 trillion from the government budget, even Elon Musk said that this was a long shot, but watch this space!

(On a more realistic note, there are real life effects of these cuts. One of our relatives in the US is a dog trainer and Professor in animal training and was applying for a job in a California University, all hirings have now been put on hold in academia and she may be back to living in a camper van again as she goes from job to job!)

JYNA: Did you know that this is how President Trump refers to China? (I had no idea)

Apart from the recent 10% tariff imposed on Chinese goods into the US, there is really only one thing to be concerned about re China and the US: Taiwan.

China holds the greatest stock of rare earths which are required in all the latest technology and chips, so China holds an ace card in its hand.

* In fact 90% of high end chips produced by Nvidia require these rare earths.

* 80% of Japanese trade goes through the Taiwanese Strait.

* Access to technology is the US’s main priority. So if China were to invade Taiwan ( considered unlikely – what could they benefit from it?), then what would be the US’s response?

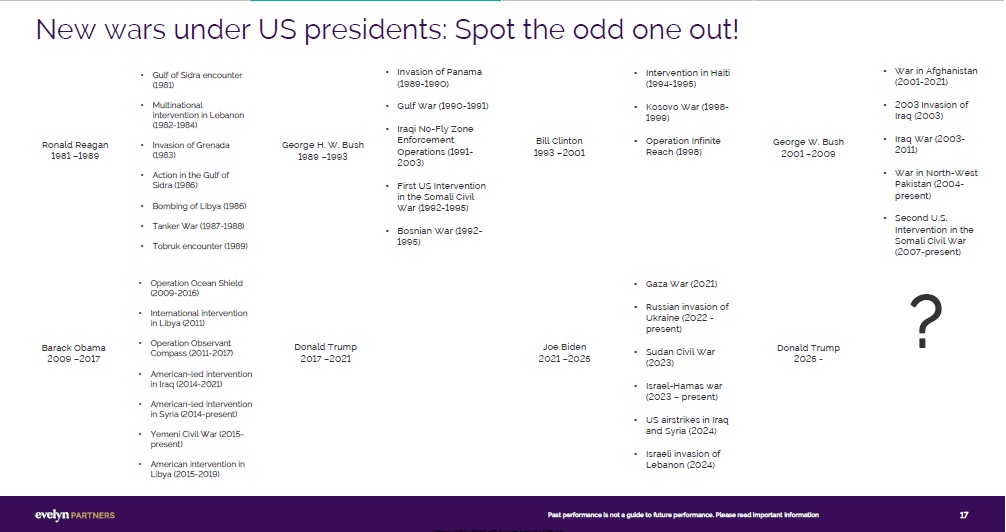

Whilst the US / CHINA spat is the pretext political risk to the world, President Trump is about making deals, not starting wars and compared to other Presidents he has a good track record:

Whilst the US / CHINA spat is the pretext political risk to the world, President Trump is about making deals, not starting wars and compared to other Presidents he has a good track record:

(This slide might be difficult to read, but it’s worth expanding the text to see which US Presidents started the most new wars. A big surprise to me was that Ronald Regan and… Barack Obama! share the record (7 each) – Donald Trump – zero!)

So considering all this, what was the message from the investment managers at the conference?

Trump will be good for America, he will stimulate growth in small to mid sized companies in the US. He will bring jobs and businesses back to the US and he will likely be good for your investments where you have exposure to the US stock market. We may also see a bull market in commodities as well.

But it will come at a price and one which we, as investors, must be mindful of.

INCREASED VOLATILITY: More swings in assets prices based on what I stated above:

** Don’t listen to what he says, watch what he does **

Markets will respond to what he says, but as investors we need to keep our eyes on the actions he takes and cut out the noise. It will certainly be an interesting time but could turn out to be a profitable one for those who ride his Presidency out, and, yes, markets will likely fall at some point and we will all feel some pain for a short period, but remember that investing is mid to long term and most of us have been through something similar, if not a lot worse , before…

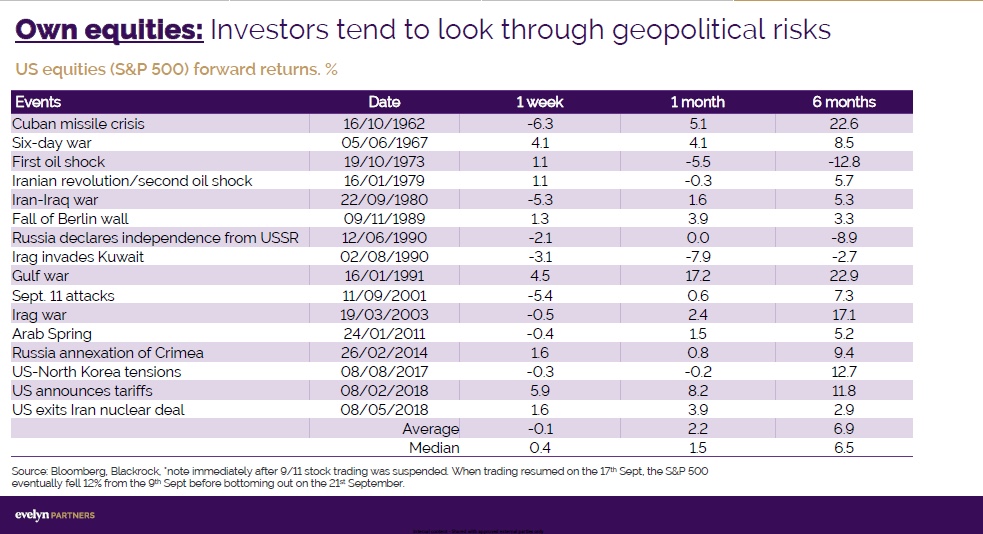

And if you need confirmation of this then check out the following slide:

Equities/stocks are the drivers of growth in most portfolios, what you can see here is that by riding out any invasions/wars, investors in US stocks, in most cases, after just 6 months were experiencing positive returns once again. A good sign for holding your nerve through equity market volatility.

The next E-zine will be the update on the new UK IHT rules which came into force in Oct 2024, which could have an impact on any UK person living in Italy.

If you would like to discuss these or any other tax or financial planning related issues in Italy then please don’t hesitate to contact me on gareth.horsfall@spectrum-ifa.com or call / message on +39 3336492356

Always happy to help where I can!

‘Play it again ‘Uncle’ Sam’

By Peter Brooke

This article is published on: 4th February 2025

Looking forward to 2025

Another year and another wonderful Spectrum conference. More on that in a moment.

Last year, in Budapest, was my 20th conference with Spectrum after which I offered a fairly cautious outlook for the year to come. You can review my thoughts in The view from the Danube

I have now just returned from a superb four days in Casablanca, hence the name of this piece, which was our first ever conference outside of Europe. We had another great group of experts who shared their views on the key themes likely to shape 2025. From the future of US markets under Trump 2.0 to opportunities in bonds and the transformative power of AI; here’s a summary of the insights most relevant to your investments and financial goals. Overall I feel cautiously optimistic looking forward to 2025.

Market Highlights & Opportunities

US Exceptionalism: Can the Outperformance Continue?

Even with the slightly pessimistic outlook for 2024, the US stock market had an exceptional year, with the S&P500 delivering one of its strongest performances in history, though much of this was led by a small handful of stocks.

As we look to 2025, several factors suggest US markets could remain a standout:

-

Momentum: The US economy grew by 3.2% in 2023 and is forecasted to grow 2.8% in 2024, showing resilience despite high inflation and interest rates.

-

Earnings Growth: US companies are projected to achieve earnings growth of 13.8% in 2025—significantly higher than the 7.4% forecast for European companies.

-

Profitability: The US has long maintained a profitability edge over other developed economies, and Trump’s deregulation efforts could further enhance competitiveness.

-

Structural Advantages: Energy independence, favourable demographics, and leadership in technology (particularly AI) continue to position the US ahead of its global peers.

Trump 2.0: Pro-Growth Policies and Market Implications

With the Republican Party securing a clean sweep in the 2024 elections, President Trump is expected to have more freedom to implement his policies in his second term. Here’s what investors should consider:

- Focus on Stock Market Performance: Trump views stock market performance as a key indicator of his success, aligning his administration’s priorities with investor interests.

- Trade and Tariffs: ‘America first’ tariff policies aimed at encouraging manufacturing in the US could have a mixed impact—potentially limiting inflationary pressures but altering global supply chains.

- Tax Cuts and Deregulation: Further tax cuts and red tape reductions are likely. While tax policy changes may take time to impact the economy, they could provide immediate support to stock markets.

- Immigration: A crackdown on illegal immigration could weigh on certain sectors like agriculture, but a scaled-back approach may reduce the economic disruption.

- Geopolitical Stability: Trump’s administration is expected to focus on negotiations over conflict, which may support global market stability.While there are risks—such as high valuations in sectors like Artificial Intelligence (AI), the US markets remain supported by strong fundamentals, making increased exposure to this market a prudent strategy.

UK Bonds: A New Era of Opportunity

Bonds are regaining their appeal:

-

Attractive Yields: UK gilts are offering a 5.5% yield, equivalent to a real return of nearly 3%, presenting an appealing alternative to equities, especially in Europe.

-

Diverse Opportunities: Investors are also finding value in international bonds, including those from Portugal, Romania, and Germany.

-

Volatility Awareness: Bonds have become as volatile as equities, underscoring the need for a well-diversified portfolio.

AI: The Next Growth Engine

The AI revolution is driving innovation and creating new opportunities across industries. It is important to consider those companies who will be enabled by AI and who will earn from “enabling the enabled” as well as those companies supporting the infrastructure of AI.

Key investment areas include:

-

Data Ownership and Infrastructure: Companies like RELX (legal and medical data) and Equinix (data centres) are poised to benefit from the AI boom.

-

Efficiency Gains: Firms such as Rentokil and Waste Management are leveraging AI to optimise operations and drive growth.

-

Cloud Infrastructure: AI can’t happen without the Cloud.

Navigating Risk in 2025

Understanding and managing risk is critical to achieving long-term financial success. I will be writing a newsletter in the coming months focussing solely on ‘risk,’ but for now here are key considerations:

-

Inflation remains sticky: The risk of doing nothing could erode your cash’s value over time.

-

Volatility: Short-term market fluctuations are normal but tend to even out over time, emphasising the importance of staying invested.

-

Longevity: For couples, there’s a 50% chance one partner will live to age 90—making a long-term income strategy essential.

-

Sequencing Risk: Timing withdrawals during retirement requires careful planning to avoid depleting your assets prematurely.

What This Means for Your Portfolio

With markets adapting to new norms, a balanced and diversified approach remains crucial:

-

US Market Focus: While US equities remain a core component, avoiding over-concentration in sectors like AI is vital. Just 7 companies make up 33% of the S&P 500 index and contributed 55% of all the returns of the S&P500 in 2024 – the largest concentration in history.

-

Employ Active Managers: Passive investors have had a great run, especially if invested in US equities but as we have already seen this month the AI Titans have sold off on one piece of news from China. Active managers will control these concentration risks.

-

Global Bonds: High yields make bonds an attractive addition to portfolios, particularly for those seeking income and stability.

-

Alternative Investments: Assets like gold can provide a hedge against geopolitical risks and inflation.

I would very much like to thank the investment management teams at RBC Brewin Dolphin, Rathbones Investment Management, Evelyn Partners, New Horizons, Alquity Investments, VAM Funds and Prudential International for their time and expert views for the content in this update.

Here are some links to other articles supporting this summary if you want to dive deeper into the details:

US Continues to Outperform https://www.evelyn.com/insights-and-events/insights/can-us-outperformance-continue/

A look back on 2024 https://www.evelyn.com/insights-and-events/insights/2024-investment-review-ifa/

Trump 2.0 https://www.lgtwm.com/uk-en/insights/market-views/trump-politics-the-global-order-250934

The excellent monthly Rathbones Sharpe End Podcast https://www.rathbonesam.com/uk/sharpe-end-podcast#podcasts

French financial update February 2025

By Katriona Murray-Platon

This article is published on: 3rd February 2025

In January at our annual conference in Casablanca it was nice to escape the cold, dark mornings of France and get a bit of sunshine. It was an interesting and informative conference thanks to our product providers bringing their various observations and opinions about investment markets and geopolitical events.

On 20th January, just as we were arriving at our conference, Donald Trump was sworn in again as the American president. He wasted no time getting to work with executive orders. On day two of our conference, Rathbones Asset Management presented their views on what we can expect from Trump 2.0. The phrase “Drill, baby, drill” was mentioned more than once – like his first term in office, we can expect (to the extent that Donald Trump’s decisions can be predicted) that he acts to protect American interests and American businesses with tax cuts and less regulation, which in turn is likely to be good for the US economy. This time around it looks like he has his eye on imposing tariffs on everything.

There was much talk about how well the US market had done last year. However, Rathbones also highlighted the following:

- 29% of the global stock-market (as measured by the FTSE All World index) is now in the technology sector, and of this, 19% is concentrated in just seven companies

- 65% of the FTSE World index now comprises US companies

- the top 10 holdings in the FTSE World index account for 23% of the index’s total value

So, whilst markets (and investors’ portfolios) have performed well, the dominance of the “Magnificent Seven” is a concern for some investors.

On the subject of risk, RBC Brewin Dolphin gave us a fascinating presentation on this important aspect of investment management. We often associate risk with the possibility of something bad happening if we take a certain action. Whereas is in practice there is risk in everything we do and everything we don’t do. Over the past few years, the negative impact of inflation on the value of our cash has been significant. For the long-term investor, though, with sensible planning, there is the opportunity to protect capital from erosion by inflation and to achieve strong ‘real’ returns.

It is important to review your appetite for risk regularly. The risk of being too cautious in your investment choices, for example, may lead to disappointment in the years come.

On day three of our conference, which was the second day of Donald Trump’s second term in the White House, he had already introduced executive orders and other measures, which meant that our presenters, Evelyn Partners and LGT Wealth Management, had fresh insights for us. This is likely to be an ongoing theme of Trump 2.0 – there will be lots of change, there will be lots of noise, there may be action that may need to be reversed for not complying with the law and/or the US Constitution, and there may be controversy. However, as controversial as Donald Trump is, and regardless of your personal views on his character, the consensus is that he will be good for the markets.

Prudential International told us about their funds’ positive performance in 2024, how inflation seems to be easing and how property values are showing signs of stability. In 2024 Prudential completed investments in two French forward living projects, notably Clichy Rue du 8 mars, in Paris, and Aurientis, a senior living development in Aix-en-Provence. They now have their sights set on projects on Rue de le République in Lyon, Leadenhall in London and Haymarket in Edinburgh, which are scheduled to complete by the end of 2025.

There were mixed views from our presenters on whether bonds would be a good investment in 2025. New Horizon Asset Management gave us their predictions for 2025 and showed us which of their predictions in 2024 had been accurate.

I have spoken to many people in the past about some UK pension providers requiring them to buy an annuity. Conversely, without a UK address, an annuity is generally unavailable to British expats in France. This however is not an obstacle to successful retirement planning. We work with international pension providers such as Novia Global and iPensions who provide low-cost pension solutions, with a range of investment opportunities, and the option to receive payments in Euros or Sterling. If you or someone you know would like to arrange a free, no obligation, pension review, please get in touch.

In France, there is still no finance bill, which is a cause for concern. Recent issues of Le Particulier magazine (I am a subscriber) have been rather thin. There is some financial news however that may be of interest. New PEL accounts, opened since 1st January 2025, are now paying 1.75% interest as opposed to 2.25% previously. Also, your electricity bill should reduce by around 14%, from 1st February.

If you are heading to Bordeaux, or to any of the other major towns in France, you will need to have a Crit’Air sticker in your car as of 1st January 2025.

Finally, as a reminder, please be vigilant when communicating with financial institutions. You can now look on the impots.gouv.fr website for accounts registered in your name, a worthwhile exercise to check for any that you may have forgotten about, or which may have been opened without your consent (unlikely, but worth checking). You will find this in the “other services” tab on the Impots website.

If you have any questions on any of the points made above, please do get in touch.

10 financial planning tips for Portugal

By Portugal team

This article is published on: 31st January 2025

Good financial planning can protect your family´s future, save money and provide peace of mind. But where do you start?

When it comes to living in Portugal, understanding key tax rules, your financial options and the right questions to ask, can really make the difference.

- Tax residency determines where you pay taxes

You cannot choose where to pay your taxes—your tax residency determines this. If you are a tax resident in Portugal, you must declare and pay tax on your worldwide income and gains in Portugal, even if tax is also due in another country. For instance, if you receive rental income from a UK property, tax is due in the UK, but it must also be reported and potentially taxed in Portugal. You will get a tax credit from the UK so you will not pay tax twice, but tax may still be due in both countries.

- Overseas income must be declared

Some believe that if they do not bring foreign income or assets into Portugal, they do not need to report or pay tax on them. This is incorrect, as Portugal does not operate a remittance-based tax system. All worldwide income and gains are taxable in Portugal, regardless of where they arise.

- Non-UK long term residency rules and inheritance tax (IHT)

In Labour’s budget in October 2024, the government announced that the concept of UK domicile (which currently determines one´s liability to UK inheritance tax on their worldwide estate) will be replaced by a residency based system from 6th April 2025. Therefore, individuals who spend 10 or more years out of the last 20 (before death) will only face UK IHT on UK based assets. Restructuring your asset base outside of the UK can greatly reduce or eliminate any future UK IHT.

- Estate planning for Portuguese residents

Portugal does not have a direct inheritance tax, but stamp duty at 10% applies to Portuguese assets inherited by non-immediate family members (e.g. siblings, nieces, and nephews). Holding assets outside of Portugal and proper estate planning can help minimise future tax burdens for your heirs.

- UK pension transfers are not mandatory

If you are living in Portugal, you do not have to transfer your UK pension overseas. Whether an overseas transfer is right for you depends on multiple factors, including how you plan to use your pension. For example, if you intend to withdraw your pension in full, a transfer may be unnecessary and could incur fees without added benefits. However, if you do not intend to use your pension during your lifetime and meet the UK non-long-term residency rules, a transfer could remove your pension from the UK Inheritance Tax net.

- Plan pension taxation beyond Non-Habitual Residency (NHR)

Foreign pensions, including UK pensions, are generally taxable in Portugal. While NHR offers a temporary reduced tax rate (currently 0% or 10%), this benefit does not last indefinitely. Planning ahead and restructuring during your NHR period could significantly reduce future taxation.

- Choosing between QNUPS and investment bonds

Investing in a Qualifying Non-UK Pension Scheme (QNUPS) or an investment bond depends on your personal circumstances. However, a key difference is that QNUPS income is always taxable, meaning you may pay tax even if no gain is made or you have made a loss! With an investment bond, only the gain element is taxable, which may be a more tax-efficient option.

- Investment income is taxable, even if not withdrawn

A common misconception is that if you do not take income from your investments, you will not be taxed. In Portugal, tax is due on an arising basis, meaning income, dividends, and capital gains are taxable when they are paid or realised (sale or switch of any fund/holding), unless held in a tax-efficient structure such as a pension, company, trust, or investment bond.

- Capital gains tax applies when selling a home

When selling a property in Portugal, 50% of the capital gain is taxed at scale rates. However, main residence relief is available if 100the full proceeds are reinvested into a new primary residence, a pension, or a long-term investment. The latter options allow flexibility to release capital while securing future income.

- Consider the impact of exchange rates on your income

If you receive income or pensions in a currency other than euros, fluctuations in exchange rates can impact your finances. Using a currency exchange service or planning ahead with fixed-rate transfers can help stabilise your income and reduce the risk of unfavourable rate changes.

With over 35 years’ experience, Debrah Broadfield and Mark Quinn are Chartered Financial Planners and UK Tax Advisers specialising in cross-border advice for expatriates. For a complimentary initial consultation please contact +351 289 355 316 or portugal@spectrum-ifa.com. Alternatively, visit www.spectrum-ifa.com.

Why a Financial Adviser is Essential for Expats Living in Spain

By Barry Davys

This article is published on: 18th January 2025

Change is inevitable, and for many, it can be unsettling—especially when moving to a new country like Spain. Navigating the complexities of a new tax system, managing investments in unfamiliar markets, and ensuring your financial future aligns with both your personal goals and local regulations can be daunting.

Fortunately, in the 19 years I have been in Spain, many of my clients have placed their trust in me, allowing me to guide them through these challenges on their financial journeys. While seeking professional advice might involve a cost, the peace of mind it provides – and the assurance that your wishes are carried out efficiently and effectively – makes it an invaluable investment.

For expats living in Spain, the need for a financial adviser becomes even more apparent. The financial landscape here is unique, with specific regulations, tax implications, and cultural nuances that can easily trip up even the savviest individuals. An experienced adviser ensures that every decision you make is informed, compliant, and tailored to your needs.

The Value of an Adviser in Spain

When you choose to work with a financial adviser in Spain, you gain far more than someone to manage your investments. Here’s what we bring to the table:

- Navigating Spanish Tax Systems: Spain’s tax system is complex, particularly for expats. From wealth taxes to inheritance taxes and the rules around double taxation treaties, an adviser can guide you through the maze and help optimise your arrangements.

- Structuring Tax-Efficient Investments: An adviser ensures your assets are structured to maximise tax efficiency during your lifetime and, importantly, for your family after you’re gone.

- Providing Stability During Market Turbulence: When stock markets fluctuate, it’s easy to panic. An adviser helps you maintain perspective, adapt strategies if necessary, and keep focused on your long-term goals.

- Liaising with Local Experts: In Spain, financial planning often requires collaboration with tax lawyers, notaries, and other local experts. A good adviser coordinates these relationships to safeguard your interests.

- Accessing Expert Investment Insights: Advisers have access to fund managers and global investment opportunities that may outperform self-managed options. This expertise ensures your investments are aligned with your risk tolerance and financial goals.

- Supporting Life Transitions: Whether you’re buying property in Spain, starting or selling a business, or preparing for retirement, an adviser provides a steady hand to guide you through every major change.

Preparing for Life’s Uncertainties

As an adviser with decades of experience, I’ve walked with my clients through every stage of life. For expats, ensuring your financial affairs are in order is crucial—not just for you, but for your loved ones. If your next of kin are unfamiliar with Spanish legal and financial requirements, settling your affairs can become an overwhelming burden.

A good financial adviser ensures everything is prepared ahead of time, reducing stress for those left behind. This includes organising inheritance planning to minimise tax liabilities and ensuring your wishes are carried out exactly as intended.

Planning for Continuity

Even as I consider the future of my own practice, I reflect on the importance of continuity. For my clients, this means having a trusted team in place to manage their affairs should I no longer be available. Similarly, expats need to consider how their financial arrangements will be managed over the long term, especially in a foreign country.

Why You Shouldn’t Go It Alone

While it’s possible to manage your finances independently, the risks of missing out on key opportunities or making costly mistakes are significantly higher. This is especially true in Spain, where the rules and regulations are often different from those in your home country.

Working with a financial adviser ensures that every aspect of your financial life is optimised and aligned with your goals. It’s not just about avoiding pitfalls, it’s about unlocking opportunities that you might not even know exist.

Take Control of Your Financial Future

Whether you’re new to Spain or have lived here for years, the value of professional financial advice cannot be overstated. By partnering with a knowledgeable adviser, you gain more than financial stability, you gain peace of mind, knowing that every decision you make is informed, strategic, and designed to protect your future.

Don’t leave your financial future to chance. Take the first step today. Send me a summary of your situation at barry.davys@spectrum-ifa.com and discover how tailored financial advice can help you achieve your goals while navigating the unique challenges of living in Spain.

Contact me now to begin your journey toward financial clarity, security, and success. Your future self, and your family, will thank you.

AI in financial planning

By Barry Davys

This article is published on: 8th January 2025

Enhancing Your Financial Strategy with Trusted AI Tools

The buzz around Artificial Intelligence (AI) is hard to ignore, with tools like ChatGPT becoming increasingly accessible. While AI offers exciting possibilities, my approach remains measured and focused on one goal: enhancing your financial planning experience.

How AI Enhances Your Financial Planning

AI is a powerful tool, but it’s not a replacement for personalized advice.

Instead, I use AI to complement my expertise, freeing up more time to focus on your unique needs and objectives. Below, I’ve outlined how AI is being integrated into our processes and the benefits it brings to you.

Common Questions About AI in Financial Planning

Will AI take over jobs?

AI is ideal for repetitive tasks, such as sorting recyclable materials in factories. In financial planning, it’s a supportive tool, not a replacement for human judgment and empathy.

Will my financial planning be fully automated?

Absolutely not. Financial planning is deeply personal and requires understanding your goals, values, and circumstances. While AI can assist with specific tasks, I remain at the heart of your financial strategy, ensuring your plan reflects your needs.

Where and How AI is Being Used

I take an incremental approach to adopting AI, focusing on areas that directly enhance your experience and outcomes:

1. Cash Flow Modeling

AI helps generate clearer, more timely reports, allowing us to review and adjust your plan efficiently. Future developments will include portfolio research and implementation improvements, currently in the testing phase.

2. Tax-Efficient Savings

Calculating taxes on investments with complex withdrawal patterns has traditionally been time-consuming. AI now streamlines this process, reducing calculation times from weeks to days, ensuring more accurate and timely tax planning.

3. Investment Research

AI aids in analyzing market trends and investment options, giving us deeper insights to recommend strategies aligned with your goals.

4. Communication

AI enhances how I communicate updates on your financial plan, changes in tax laws, or regulatory developments. You’ll receive information faster and in more digestible formats, keeping you informed every step of the way.

A Human-Centered Approach

AI is an augmentation tool, not a replacement. It allows me to dedicate more time to addressing life events and complex planning needs, including:

- Managing inheritances and inheritance tax (in Spain and the UK)

- Retirement planning tailored to your lifestyle goals

- Tax-efficient strategies whether you stay in Spain or return to the UK

While AI supports behind the scenes, you can trust that I remain your adviser – a person you can rely on for clarity, guidance, and answers to all your financial questions.

A Commitment to Your Success

AI is being introduced thoughtfully, with the sole aim of improving outcomes for you. Rest assured, I’m not becoming a robot or avatar. I will always be here to provide personalized, human-centric advice tailored to your unique circumstances.

If you have any questions about how AI is being used or how it benefits your financial plan, please don’t hesitate to reach out.

To start a conversation book a call with Barry Davys using his online system. This allows you to choose a time that is convenient for you for the call which can be either a phone or video call.

Finance in Italy 2025

By Gareth Horsfall

This article is published on: 5th January 2025

Buon Anno 2025

Happy New Year to everyone! I hope that you are reading this feeling relaxed and rested. Who knows what 2025 will throw at us from a political and financial point of view, but the most important thing is our health (physical and mental) and making sure we all keep communicating with one another.

So, in this January 2025 Ezine I just wanted to just follow up on my year with you. After sending out my last few Ezines, and writing about our new house and move away from Rome in 2024, many of you have written back to congratulate us and offered many words of support and also wisdom because I know that many of you have also been through, or are continuing to go through a similar experience. I have to say that I wake every morning now feeling fresher and more mentally alert than before. I even started my year this morning (2nd Jan) with some early morning outdoor exercise (no need for the closed gym anymore) to get back into the normal health and fitness regime that I follow (after all the panettone and other goodies during this period).

I wanted to thank you all for your words and thoughts of support in 2024 and thought this E-zine might be a good opportunity to send you some fotos and afterwards to provide some of my own thoughts about the year ahead from a financial and economic point of view (my own thoughts, I must add!)

Below are some pictures from my house adventures in 2024.

The house as it is now – day and night.

The living room, then and now:

My wife has got quite handy at sunrise and sunset shots as well:

Then I am sure you will all be happy to see me doing some hard manual labour for a change:

*From left to right:

My first decespugliatore experience (in 38 degs!), picking pears, excavating a random pipe which led to nowhere, re-laying the same pipe which now goes somewhere!

And my famous ‘trinchea’ for laying the new pipes, which is now filled in and working like a dream!

And finally, our famous kitchen which was finally installed 100% on the ‘Virgilia di Natale’ and we were able to make Xmas dinner in it. (Thankfully, as I didn’t fancy trying it on the camp stove in the outhouse).

My job over the next few months, apart from ongoing work, will be to get all the necessary papers together to present to my commercialista and take advantage of the Bonus Edilizia for 2024. In the end we probably maxxed them all out, playing with the main one of 50% on most works, bonus eletrodomestici and then the other detractions such as the cost of the estate agent. The paperwork will be a mission in itself but I have been quite good at documenting and filing everything as we went along so its just a case of putting it altogether for the commercialista. (I can’t advocate enough for keeping good and regular records if you embark on this kind of journey as the paperwork requirements to take advantage of the bonuses are quite something).

THE YEAR AHEAD

And so, as my thoughts now move away from building to ongoing maintanence, I thought I would share some of my thoughts for what I see from 2025 and to touch on some of the things which are probably in everyone’s mind. (I should add that, as usual, I will be attending the Spectrum IFA Group annual conference again around the 22nd January and will be reporting back on the opinions of the people at the investment coal face, as they see it).

As far as I see things, I think we are in for a volatile ride. This is not to say that I see things turning out negatively for use in 2025, far from it. It could actually turn out to be positive for investment returns, but it will likely come with some periods of volatility during the year, certainly more so than 2024, I suspect this will be driven primarily by President elect Donald Trump. He has been voted for a second term and knows he cannot be voted for a third so he really has nothing to lose. His rhetoric already has been quite interesting, from wanting Canada to become the 51st State of the USA to purchasing Greenland.

It is easy to write him off as a lunatic, and certainly I suspect the Canada comment was really a way to wind up Justin Trudeau, but Greenland would be a much more strategic and important asset for the USA, because of the Arctic shipping corridor which Russia is already utilising to it’s advantage. Rising arctic temparatures now mean that it is open for the whole of the year. (Goods shipped from East Asia to the UK could save up to 10-12 days in shipping time over the traditional Suez Canal route and save over 40% in costs!). Donald Trump is probably very aware of this and would prefer that Russia does not get power and control of this route.

Apart from that he is going to come out of the gate on the 20th January with the tariff gun, is my thinking. I imagine he is going to hit everyone and everything with tariffs, where it is not in the interests of the USA. (The EU needs to prepare itself) I would think that his biggest target will be China to try and balance trade between the 2, but even more so to encourage businesses to return to the USA rather than offshoring production in China. He has also fired off a comment about imposing 100% tariffs on any country that joins a currency union in the newly formed BRICS economic community, so as to preserve the dominance of the US dollar.

However, the BRICS economic community are not going to be phased by this because they are unlikely to be ready to launch any common currency for quite some time and can always wait 4 years until Donald Trump is no longer in power. (Countries and economic unions have a much longer time outlook than a US Presidential term).

One thing which I hope he will achieve is his desire to put an end to the Ukraine Russia war. I am not sure what form this will take, but will likely mean Ukraine ceding already lost territory to Russia in exchange for calling a ceasefire to the war. Whilst I may not agree with the outcome, it will stop a war which seems more like a killing ground than anything else and has only demonstrated that Russia is significanlty more advanced militarily than we may have thought. The recent dropping of their ballistic Oreshnik bomb, as a warning to NATO, was a bit of an eye opener given that reports seem to confirm that it travels so fast that Western/NATO allies have no system to effectively intercept such a weapon. On that basis it’s better that Russia never has a reason to use it, in my opinion.

I suspect the situation in the Middle East, Israel and Gaza and Syria will not get any better in 2025. I can’t see any reason why anything will change there, sadly. More of the horrific images coming from Gaza and human rights abuses on both sides. I was taken a bit by suprise by the falling of the Assad regime in Syria, not more so than by an ex-Al Qaeda second in command, who is now a western ally. Somehow I don’t see that ending well.

And lastly, I will touch on the EU because it warrants some mention given Donald Trumps re-election.

It has become evident that EU nations have been riding on the coat tails of the USA for defence, through NATO since World War 2. I remember when Donald Trump was President first time around that he started demanding that NATO allies contribute their fair share of the defense budget to NATO and ‘requested’ that they increase their expenditure to 3% of GDP. I don’t remember the facts but I don’t think many EU countries did, apart from Estonia if memory serves me correctly.

This time I have seen reports of Donald Trump requesting 5% of GDP or he may withdraw the USA from NATO. This would seem to be a significant worry for the EU, and rightly so because ultimately any defense/borders/war with Russia are going to have to be funded/managed by the EU and no longer by the USA. Additionally, USA Tariffs on goods and increased defense expenditure are going to have a significant impact on EU member states. Already with the increased gas prices that we are paying (DT will also de-regulate energy exploration and production in the USA so they can start drilling and mining and become more resource independent again) many businesses are moving to the US or to places like Dubai to benefit from lower costs and /or lower taxation. This is a long-term serious problem for the EU and the bureaucrats in Brussels are going to have to step up to the plate. In the very short term I see this as having a serious economic impact but could lead to an economic boom time in the EU, especially in defense, as it relies less on the USA for support in the medium term.

There is so much more to say here and I could make some more predictions. The fun thing is that none of this will not define your investment returns in 2025. Would you have predicted that in 2024, whilst Russia was at war with Ukraine, Israel/Gaza were was committing their deeds, the fall of Syria and the re-election of Donald Trump, would produce of return on the US stock market of over 20%? The analysts predict a return of around 14% on the US stock market in 2025.

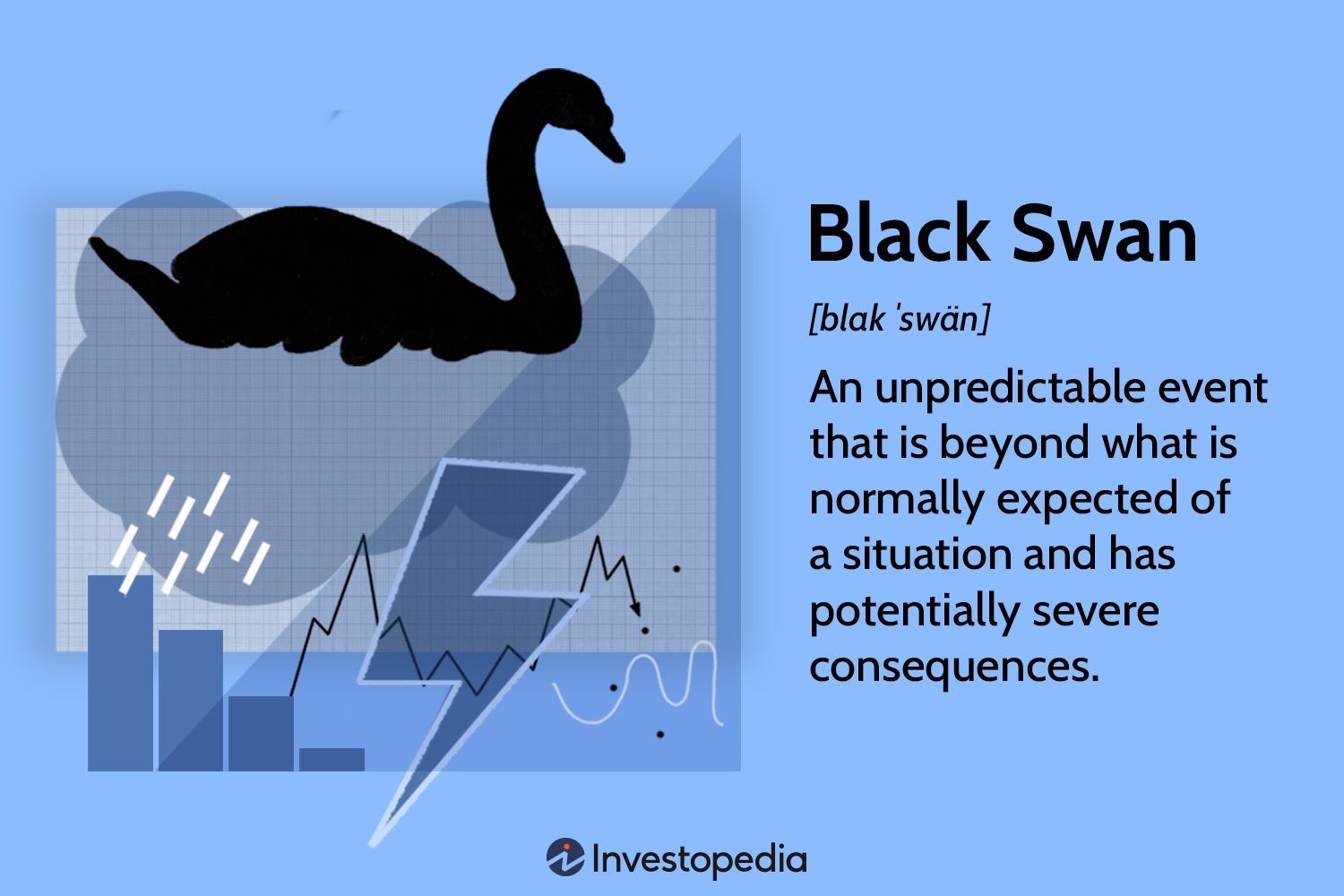

I will finish this E-zine just by saying that I am a great believer in the Black Swan event. For anyone who is not familiar with this theory it was coined by Nassim Nicholas Taleb in his book The Black Swan. The theory goes that until Western colonial powers discovered and colonised Australia it was believed that all swans were white. N0-one had ever seen a black swan. Therefore to see such a creature was a moment of shaking belief and requiring a re-thinking of ideas and plans.

He overlaid this onto the investment markets explaining that there are events of which we are ignorant, even to go as far as saying we have no knowledge whatsoever, until such time as they become evident, normally because of problems occuring in their respect markets: think mortgage backed securities (2008/9), Long Term Capital Management (Russian debt crisis 1998) The point is that we can never measure, prepare or be cognisant of these things before they happen, but they inevitably have significant consequences and create more stress for investors. The good thing is that they come along rarely and they pass, and we move on.

As always we need to remain diversified, manage costs where we can and have the right people managing our money to get us through such events.

In this E-zine I have shared some thoughts about what will happen politically and economically in 2025, but I remain postive for the year ahead from an investment focus. Good luck to all of us for the year ahead.

From the new house in Amelia….. Auguri alla Befana !!!!

An unusual part of the job

By Jeremy Ferguson

This article is published on: 24th December 2024

I am writing this at the end of another year in which I found myself helping people relocate from the UK to retire to Spain. For many, this was a lifelong dream, for others it was a case of simply having had enough of the UK.

The process is now a lot more involved than it was before Brexit, and my role tends to be focused on making sure all of their finances stack up, and being as tax and investment efficient as possible once they arrive. There are certain things to consider before you leave the UK; an example could be taking your pension lump sum in the tax-free environment of the UK, or making sure your house sale doesn’t create tax implications once you become Spanish resident. This typically revolves around the timing of your move here, which can be critical in relation to effective tax planning.

What has really been obvious to me this year with most of my new clients is the ‘unusual part’ of my job that I had not really come across too much in the past. Most people have been used to making money all of their working lives, be it in the form of receiving a salary each month, or making profits from self-employment. But when retirement comes along, income from working suddenly stops and in the case of people retiring to Spain, they suddenly find themselves in a situation where they no longer receive ‘earned’ income. For many, this is a very difficult situation to deal with psychologically, as they become fearful of spending money.

And this is the unusual part I am referring to, as I find myself spending a lot of time with people running through their finances and expenditure, showing detailed projections of how long their money will last going forward. Of course, it is very difficult as no one knows how long they are going to live, and no one knows what their money will be making going forward, but by making sensible assumptions on both considerations a pretty realistic picture can be painted.

This is the point at which I really emphasise the power of ‘passive income’, and help people to understand its relevance and value. Simply put, even though you have stopped earning money when you retire, it doesn’t mean you have stopped making money. With interest on bank deposits, and growth on investments and pensions, whilst you may be enjoying life relaxing on the beach or playing golf, your hard-earned savings are working away in the background for you. This is why it is so important to keep a close eye on your assets, making sure they are working as hard as possible for you. I always refer to this as passive income.

Over time people become more relaxed about their new situation in retirement, but to start with it can be very difficult to adjust. This is why I spend a lot of time talking with people, explaining that as they ease into retirement this is something that will start to take a back seat in their daily worries, and spending money will become less of a stressful issue. Regular reviews of their financial situation are a great help when it comes to ‘proving’ things will be ok!

If you would like help when it comes to planning your retirement, then please do not hesitate to get in touch.

And let’s hope 2025 is a prosperous year for us all.

Financial update December 2024

By Katriona Murray-Platon

This article is published on: 4th December 2024

The year 2024 is drawing to a close. Financially it has been a rather good year in the markets with a lot of our clients’ portfolios doing much better this year than previous years. Even as you start to prepare for Christmas or wind down at the end of the year, there are still some financial points you should be aware of.

The interest rates on the Livret A and the LDDS savings accounts will reduce from 3% to 2.5% next year (probably in February). Even though the rate has dropped these accounts are still a good place to keep money needed for the short to medium term. Any amounts that you do not foresee needing or you want to get a better return from without paying tax, should be put into an assurance vie.

Christmas is a time for giving whether that is to families or charities. Although gifts to friends and family normally have to be declared, for events such as birthdays or Christmas, you can give money to your loved ones without having to declare these amounts to the tax office. This is known as a “presents d’usage”. If you wish to give money by bank transfer it is advisable to put on the transfer order the words “Présent d’usage pour Noel” so that there is no doubt about the fact that it falls under the exemption.

If you haven’t been giving to charity regularly over the year, now is the time to gift money to any worthy causes. Gifts to charities of general interest or recognised as of public utility in France would allow you to benefit from a tax reduction of 66% of the amount gifted up to a maximum amount of 20% of your taxable income. Gifts to charities who help those in difficulty receive a tax reduction of 75% of the amount gifted for amounts under and including €1000. Any amount over €1000 will get a tax reduction of 66%. In both cases the tax reduction cannot be more than 20% of your taxable income.

You have until 4th December to amend your 2023 tax return online from your online account on the impots website.

After this date you will only be able to submit a paper return with any amendments.

Until 12th December you can change the amount of the 60% advance that you will get for your tax credits and reductions which is normally paid mid January.

December is the last chance to add some money to your PER retirement accounts if you have the money to do so and if you want to reduce your tax liability. You can put as much as you like into the PER but the tax benefits are limited to either up to 10% of your annual income up to a certain amount or 10% of the PASS (see below). You may also use any unused amounts from previous years, these will appear on your 2023 tax statement. This amount is deducted from your taxable income before being assessed at your marginal rate.

The PASS (plafond annual de la sécurité sociale) has increased by 1.6% and is set at €47,100 for 2025 or a monthly amount of €3925 (compared with €3864 in 2024). This has an impact on the maximum amount you can receive from daily sick leave pay for occupational illnesses or maternity pay, disability allowances or French pensions. It is also used to calculate the maximum amount you can pay into a PER retirement account.

There are still a few weeks in December and I will be working until 20th, seeing existing clients and meeting new ones. We are going to spend a few days in London and then travel up to Liverpool to spend Christmas with my family.

I hope you have a lovely holiday season with all your friends and family and I look forward to bringing you more financial news and information next year.