Example 1

A premium of €30,500 is invested at the age of 70, the insured person dies at the age of 87.

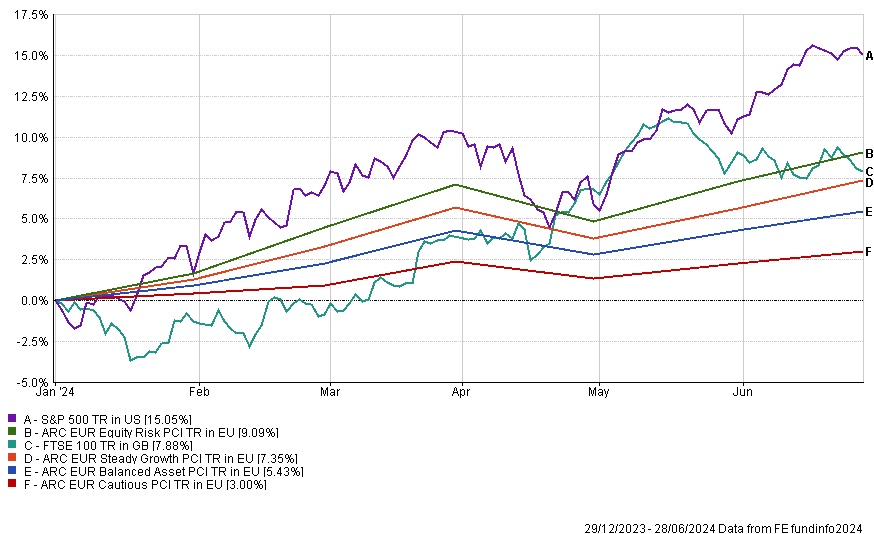

For 17 years, the policy grows at an average rate of 2% per year, net of fees. At the end of 17 years the gain in value is €12,339, thus a total of €42,839 is passed tax-free to the beneficiaries. At 3% per year, the amount of gain after 17 years represents €20,259 meaning a total of €50,759 passes free of IHT. If the €30,500 had been left on deposit with interest added at a similar rate the capital and interest would fall into the estate and be subject to the standard IHT rules.

Example 2

A premium of €100,000 is invested at age 70 and the life assured dies at the age of 90, i.e. 20 years later. The beneficiaries are the life assured’s two children in equal shares.

Taking an average growth rate of 4% per year, the €100,000 becomes €222,258 after 20 years. Each child receives €111,129. This is in addition to anything they may receive from a pre-age 70 policy. €30,500 of the capital and all gains are exempt, therefore the only taxable element for each child is €34,750 (€69,500 / 2). This can be offset against the standard IHT allowance of €100,000 per parent per child if this is not used up elsewhere.

Example 3

A nephew receives €55,000 from an assurance vie policy taken out by his uncle when he was over 70 years old.

The premiums paid amounted to €40,000, the gain was €15,000. €30,500 of the premiums paid and the gain of €15,000 are exempt.

Therefore, the potentially taxable element is €9,500 (€40,000 – €30,500). However, this can be offset against the inheritance allowance between uncle and nephew of €7,967. Assuming the allowance is fully available the taxable element is €1,033 (i.e. €9,000 – €7,967) at the rate of 55%. IHT of €568 is payable (i.e. €1,033 X 55%).

The outcome, €55,000 was transferred via an assurance vie opened after the age of 70 to a nephew who pays only €568 in IHT instead of €25,868 if the legacy had not been wrapped in assurance vie (i.e. €55,000 – €7,967 = €47,033 x 55%).

In summary, if your situation allows, it is definitely worthwhile considering investing in assurance vie after the age of 70 in order to take advantage of the additional €30,500 allowance and exemption on the total gains on investment which, in some cases, could be higher than the capital invested. Not forgetting, of course, that you retain control of the policy and can spend it or change the beneficiaries whenever you wish.

If you would welcome a chat about whether investing in assurance vie is right for you or would simply like a review of your financial situation you can contact me at sue.regan@spectrum-ifa.com or call me on +33 6 89 20 32 47