I hope you all had a good summer. We spent ten days in Andernos and then enjoyed a much cooler ten days visiting family in the UK. Whilst I was in the UK I saw an advert in the paper for a bank savings account offering around 5% interest on amounts up to £50,000.

Financial update – France September 2023

By Katriona Murray-Platon

This article is published on: 4th September 2023

However, I noticed that in order to benefit from this rate you would have to commit to leaving the money there for two full years otherwise if you took the money out you would only get around 2% interest. A quick scan of the finance section of the paper showed similar offers. Now, leaving aside the fact that once you are French resident you can’t open a UK bank account, with inflation in July being 6.8% in the UK these rates are still far below inflation. IF you were to have one of these accounts and be a French resident you would need to reduce the interest rate by 30% because that is the French tax that you would have to pay on any gains. Also there is exchange rate risk that needs to be considered.

Some other accounts were brought to my attention in Jersey. However there is no double tax treaty between France and Jersey so any interest earned would be taxable in both countries.

I always advise people to take advantage of the French tax free savings accounts like the LDDS and the Livret A and the LEP if you meet the income threshold BEFORE investing. If you add the CEL account to this list it effectively means you can hold around €50,000 readily available cash earning tax free interest. These rates are reviewed quarterly on 1st of February, May, August and November. You will be pleased to hear that there have been no changes to these rates as at 1st August 2023.

One of the key points about investments is diversification. Not only are the investments we recommend very diversified in terms of geographic location and asset class but if you have invested with us this is usually only a part of your assets.

All investments whether it is your house, your bank accounts, or your other investments, involve some level of risk. You only have to look at the history of the rates on the savings accounts HERE or the current concerns about house prices and mortgage rates in the UK, to see that nothing is guaranteed in the long term. But what we can show you from the past performance of the investments we offer is that over the past three or five years they have performed well. And the longer the investment term, the greater the likelihood of strong, positive returns ahead of the rate of inflation.

Another thing we managed to do at the end of July was to complete our wills and make stipulations about the guardianship of our children. I wrote about guardianship HERE but I admit I never got round to doing anything about it until now. The husband of a French financial adviser that I recently met is the Notaire in an office in our neighbourhood so we were able to make an appointment with him. We hand wrote our wills before the notaire, signed and dated them and then handed them in with a cheque for them to be registered. It was all very easy and I’m glad that it is now sorted.

By now you should have been able to view your tax statements in your online tax account, if you have any questions about the figures please do let me know.

After a long and much needed break, I am excited to be back at work and arrange appointments with my clients and those who have contacted me. If you want to speak to me about something please do let me know.

Looking forward to speaking or hearing from you soon!

Preparing for the inevitable

By Richard McCreery

This article is published on: 4th September 2023

A few tips on how planning ahead, as well as looking back, can make a difficult time much easier on our loved ones. It comes to us all, but we devote relatively little time to thinking about it: death.

Unsurprisingly, most people prefer to avoid thinking about their own mortality, but they are keen to ease the pain for loved ones who are left behind. In this short article I’ll take a look at some tips to make this time a little less hard on your family and I’ll even give you an idea of how you can leave behind a moment of happiness for your closest relatives.

Make ‘The Folder’

My colleague Gareth Horsfall has written about the importance of ensuring your paperwork is in order and stored where your relatives can find everything they’ll need to get through the formalities that inevitably ensue from your passing. The Folder is a central location (digital, physical or both) where you keep a record of all your assets, your bank accounts, your pensions and investments, as well as a copy of all your important documents like birth certificates, marriage certificates, your social security number etc. And, finally, a list of all your internet and device passwords, of which there could be a lot!

Modern life can be extremely complicated whilst we are still alive and it becomes even more so when you have to deal with someone else’s affairs that may not be entirely familiar to you. By collecting all the important paperwork and information in one place, you can ease the inevitable administrative burden and show your loved ones that you were thinking about them. And don’t forget to tell them where they can find The Folder.

Close old overseas accounts and companies

I was once asked to help the wife of a client to deal with some of the inheritance formalities that were required for the settlement of his estate after he died. Wealthy people often have assets in various countries and this can lead to significant extra time and expense when attempting to transfer everything from the deceased’s estate to the beneficiaries.

For example, the ownership of a British Virgin Islands company can’t be transferred to someone else before probate is granted in that jurisdiction, which entails securing the services of a local qualified lawyer. If that company is no longer needed once the deceased is gone then further fees will be incurred in BVI for closing that company. Multiply this scenario across various foreign jurisdictions and it can become quite costly and time consuming in order to settle the full estate.

Conclusion: if you can simplify your affairs by closing underutilized overseas companies or dormant bank accounts, it can save your family a lot of hassle and money later.

Avoid paying more tax than is necessary

Ironically, inheritance tax is a fact of life. It is often only considered when it has to be paid and it can be surprisingly substantial – in France a house can swallow up any allowances you may benefit from, leaving the remainder to be taxed at up to 45% for children and up to 60% for non-family beneficiaries. By using an assurance vie policy as a vehicle for managing some of your wealth you can substantially increase the tax-free sums your loved ones inherit, they may pay a lower tax rate on the amount that is taxed, you can use the beneficiary clause to choose who gets what and the money can grow free of tax during your lifetime if not withdrawn.

Everyone hates paying inheritance tax, so when you know that your children can inherit an extra 152,500€ each tax-free if the money is coming from an assurance vie policy, it quickly becomes apparent how much you can save them (don’t forget: in order to get the maximum benefit, you should start your policy before you turn 70). They say there are only two things that are certain in life: death and taxes. Whilst you can’t avoid the first, your family might avoid the second with a bit of foresight and planning.

Finally, leave them something really personal

You’ve finished tidying up the loose ends of your life, you’ve done all you can to minimize the tax your family will pay and your affairs have been put ‘in order’. You have made every effort to ensure your passing will be as little of a burden on your beneficiaries as is possible, you have made a difficult time less difficult by thinking ahead. There is also a way to use this moment to bring some joy into the lives of those who love you: by thinking back on your life.

A memory journal is a little treasure that helps you to record some of the most precious moments of your life, to be passed on to your children or grandchildren. It is a guided book that contains prompts and questions such as ‘How did you meet my mother?’, ‘What was your favourite subject at school?’, ‘Tell me about the happiest or greatest memories of your life’ or ‘What did you feel when you first saw me after I was born?’ It gives you the opportunity to leave your family the story of your life, your most intimate thoughts and feelings, perhaps alongside a few photos.

Money and paperwork are important, they have to be dealt with. Put everything in order, in advance, and you will be doing your family a big favour. Leave them as much money as you can tax-free and you’ll ensure they will be better off. And finally, a few of your own words left alongside the admin makes this difficult time more bearable. These things are easily put off, you may not even want to think about them, but if you take action sooner rather than later, I promise you will never regret it.

If you would like to speak me about planning ahead and putting your family affairs in order, please get in touch. I’m here to help and happy to answer any questions with no obligation.

Expatriate life in Malta

By Jozef Spiteri

This article is published on: 31st August 2023

When expats think about possible destinations for settling down and retiring, several factors come into play. Apart from Malta’s attractive Mediterranean climate, English-speaking locals and great connections to other European cities, the financial advantages associated with living here should also be considered.

When looking at Malta, apart from the obvious desirable features of the island, there are various visa programs available, offering a range of tax-efficient solutions specifically aimed at expats.

The following are just some of the options available:

Malta Retirement Programme (MRP)

This program is available to EU and non-EU nationals (including EEA and Swiss nationals) who are not employed and receiving a pension as regular income.

Beneficiaries of the MRP will be granted a special tax status with pension income remitted to Malta taxed at a flat rate of 15%, whilst other income arising in Malta will be taxed at a flat rate of 35%.

This can be very attractive for expat retirees who are paying significantly higher tax rates on their pension incomes in other countries.

Although they cannot be employed as such, those retirees on the MRP can hold non-executive roles on boards of companies based in Malta, and they can also engage in activities related to any institution, foundation or trust of a public nature (for example educational, philanthropic, or research and development work in Malta)

Professional advice should always be sought on suitability to personal circumstances.

Digital Nomad Visa

Many professionals are now working remotely – why not do so from a sunny island in the Mediterranean? This visa is valid for ‘third country’ individuals (non-EU, non-EEA, non-Swiss) who are either partners or employed with a company located outside the country. Consultants advising entities outside Malta are also eligible to apply.

The main requirement is that applicants must be earning a minimum of €2,700 per month.

Applicants who are accepted will also be allowed to bring over spouses and dependent children to live in Malta. These individuals will be able to take advantage of all that Malta has to offer, including hassle free travel to other Schengen countries.

A key advantage of this program is that no tax is payable within its first year. Again, professional advice is recommended.

Citizenship by Investment

This program is targeted at ultra-high net worth individuals who are willing to make a minimum contribution of €600,000 to the national development fund set up by the local government and who have been Maltese resident for 36 months. Another option is also available, requiring a contribution of €750,000 but with a lower residency condition of 12 months. Additionally, applicants must contribute a further €50,000 for each dependent included in their application.

€700,000 will also have to be invested into residential real estate or a rental contract of €16,000 per year will have to be established and maintained for five years. A donation of €10,000 will also have to be made to a registered philanthropic, cultural, sporting, scientific, animal welfare or artistic non-governmental approved organisation/society.

This will lead to citizenship and a Maltese passport after one to three years of residency, which by default also brings European citizenship, enabling these individuals to live, work and study anywhere in the EU.

Malta Permanent Resident Scheme

This program is a straightforward residency by investment program. The processing time for applications is four to six months from the submission of a correct and complete application form. The program is particularly valuable for prospects intending to make Malta their second home.

To be eligible for the MPRP, applicants should:

• be a third country national (non-EU, non-EEA, non-Swiss)

• not hail from sanctioned countries, as announced from time to time by the Community Malta Agency

• not benefit under other pertinent regulations and schemes

• have sufficient financial resources to maintain themselves and their dependants without recourse to the social assistance system of Malta

• show they have capital assets of not less than €500,000, out of which a minimum of €150,000 must be financial assets

• be fit-and-proper individuals and have a clean criminal record

• not pose any potential threat to national security, public policy, public health or public interest

Global Residency Program

The GRP is designed for non-EU, non-EEA or non-Swiss nationals who are not long-term Maltese residents. Individuals applying for the program can work in Malta if they satisfy the necessary conditions to obtain a work permit.

Successful applicants may also have household staff providing services in their qualifying property if all requisite conditions are met.

If you would like to know more about these programs feel free to contact our team in Malta. We can outline the various options and determine suitability to your circumstances. All initial meetings and discussions are free of charge and carry no obligation to proceed.

Investments in Spain

By Chris Burke

This article is published on: 16th August 2023

Savings accounts or investing in Spain – what is right for you?

This is one of the most common questions I am asked, and with interest rates creeping up I thought it prudent to run through how you should decide what’s right for you.

To help with this, firstly we need an explanation of the important differences between the two:

Why would you put money into a savings account?

Saving is putting money aside in a deposit account for the next few years. When interest rates are low, the return you’ll get on your money will be very modest. The risk is that it won’t beat inflation, which is the rate at which the prices of goods and services increase. So, whilst your money is safe (covered up to £85,000 in the UK and €100,000 in Europe), its purchasing power will be eroded over time, meaning you will be able to buy less with your money in the future. When interest rates are high you will get more return on your money, but generally in this type of economic climate it will still be less than inflation. Because of this, money you keep in cash savings accounts should be for short term savings of less than about 5 years.

Why would you invest your money?

Investing is another way of setting aside money for the future, where you invest your money into something with the aim of making a profit in the long run. When you invest, you’re generally exposed to the risk of stock market volatility (although some investments don’t invest entirely or solely in these markets). Your expected returns can fluctuate and you may not get back what you put in, especially in the short term.

You should aim for a minimum of 5 years when investing and start planning ahead with your investment strategy to manage this risk a few years before you want to access your money.

“Save for what’s around the corner and invest for the future”.

Why take any risk with your money?

Firstly, as explained above, inflation will eat into the power of your money over time. This is a problem while you are working, but is particularly important to manage when you are retired and you cannot replace lost buying power with income from your job. Secondly, not all investment risk is equal. The benefit of taking a calculated amount of risk over the long term is that it gives you the potential to make much more money than you would from a savings account, helping to pay for future large expenses and a more comfortable retirement.

What is the trend when interest rates are high compared to investing in the stock markets?

Over a short timeframe, holding cash in a savings account is usually a safe and appropriate option. It is less risky in the short term as it is readily accessible and interest rates are currently attractive relative to the past few years.

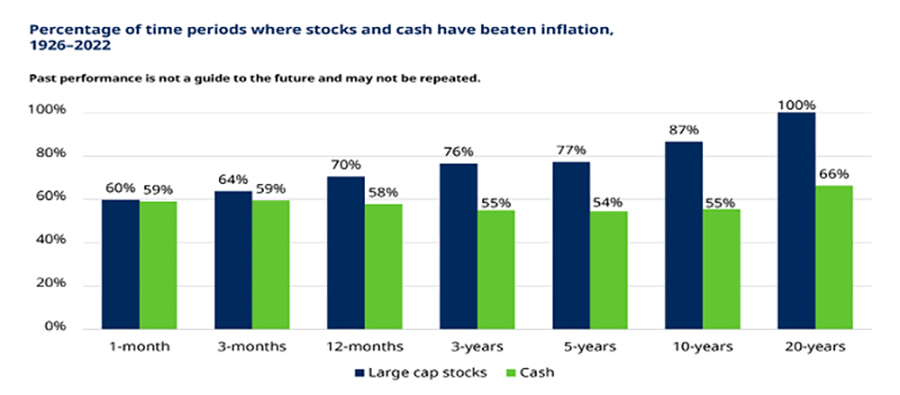

However, time is the critical factor to consider here, as over the longer term cash won’t beat inflation but investing should, as can be seen in the chart below:

Over long periods of time there is a big difference in the returns achieved from saving and investing. In the short-term, investing is riskier than an interest-bearing cash account, however when compared to inflation investing has offered far more certainty and success in the long run.

Prudential 90’s advert

Do you remember this timeless, funny classic: We want to be together!

The principles remain the same even today……

Click here to read independent reviews on Chris and his advice.

If you would like any more information, or to talk through your situation initially and receive expert, factual advice, don’t hesitate to get in touch with Chris.

Refused Italian residency

By Gareth Horsfall

This article is published on: 8th August 2023

Living in Italy always feels like a great privilege for me. I never expected that a ‘lad’ from Yorkshire would be having the opportunity to live the life I now do. Of course, it comes with it’s issues and there are many people who, every year, also make the decision to want to come and live in ‘Il bel paese‘.

However, as I have found out this year, there are those who also get refused this opportunity when they have applied for ‘residenza elettiva’. (elective residence in which you demonstrate to the Italian ‘Consolato Generale d’Italia’, that you have the financial resources, now and in the future, to be able to live your life in Italy without becoming a burden on the Italian state). There are certain criteria which you must meet, such as minimum income levels and financial independence.

Since Brexit, of course, many UK citizens who previously only had to trot off to their local comune and register as residents in Italy, under their EU citizen rights, are now subject to much stricter assessment of their financial affiars before a visa will be granted to enter the country and life begin in Italy.

Over the years I have met many people (US citizens mainly) who have been through the elective residence process and managed to get the necessary visa to come and live in Italy. I also learned that many managed to do so without meeting the strictest financial requirements. Instead with some help and understanding of the types of accounts they held in the US they were able to assist the consulate in assessing their application, at which point the elective residency was granted.

The people I have met this year (all Brits) who have been refused the elective residency visa were refused due to failure to strictly adhere to the rules. (Strict adherence to rules not being something that Italians are famous for).

This is quite sad to see because, firstly it could be said that the British citizen might be treated unfairly due to Brexit. There is no evidence to suggest this. It is merely a hunch, but one which is shared with a few other professionals with whom I have been in touch about this. Secondly, there are certainly the rules, but interpretation is everything and as you will see from reply from the Consolato below, certain assumptions have been made by the assessor regarding this specific application which could be argued to be true and fair, but would still not affect this persons ability to live comfortably in Italy without being a burden on the state. (I can attest to this as I conducted an initial financial planning exercise with them) It would seem the absolute letter of the law is being applied here when in fact merely the extracted statement below from the legislation itself gives a significant amount of discretion to the assessor.

‘Il visto per residenza elettiva potrà essere esteso anche al coniuge convivente, ai figli minori o maggiorenni se conviventi e a carico e ai propri genitori, qualora le condizioni finanziarie suddette siano sufficienti a garantire il mantenimento di tutti i soggetti interessati.’

The point to this E-zine is to say that this application was likely refused because the application was not prepared with the help of an Italian professional (lawyer and commercialista) who could a) interpret the foreign held accounts for the assessor/s and explain how they function and b) provide a signed and certified overview that would be seen by the Italian authorities as more credible than merely statements from the applicant themselves.

I hope that if you, or someone you know is going through or about to go through the elective residence process then you can pass this E-zine and message to them. Take professional advice (lawyer and /or a commercialista) before submitting the application. Once granted then financial planning is also critical.

The applicant mentioned in the letter text below is being contested directly with the Consolato Generale d’Italia, now with legal help, but this could take up to 2 years. It might have been avoided ( possibly not) if professional help had been sought at the start.

Please feel free to pass the E-zine onto anyone you may know who this affect or of whom it might be interest to. The more we spread the word the less likely mishaps and refusals will occur in the future.

Harp House,

83-86 Farringdon St,

London EC4A 4BL,

United Kingdom

VISA SECTION

“As per Art. ,comma 2 of T.U. 286 modified by Law 30 July 2OO2 n.l-89, and Art. 6-bis of D.P.R. l-8 October 2004 n. 334 regarding visa denials, we regret to inform you that your recent application for an Elective Residence visa has been denied because unfortunately, at this point in time, it does not comply with the minimum conditions required for the issuance of such a visa.

To date, all the documentation provided with your applications do not currentlv illustrate that vou have immediate access to the minimum required economical and financial resources necessary lo guarantee continuity through time from a proven, steady & substantial income stream/s deriving from pensions, annuities, properties or other types of regular income declared in the UK ( with the “Tabello A’ Direttivo Ministero dell’lnterno dated March 7’t, 2000 ond as per D.l. 850/2077, i.e. startinq from a net amount of 37,000 euro per person), meaning not cash in the bank, savings, unrealised profits from investments subject to volatility and/or private income deriving from employment. It is worth highlighting that this office has carefully examined your recent applications, by comparing them with your previous ones; i.e. denials ref: XXXXXXXX prot n. XXXXX issued on the XXXXXX.2022 respectively, with the view to gauge if there have been any new and/or substantial changes in both your economic and financial circumstances to be considered when granting the issuance of such visa.

Unfortunately, when taking into consideration both your eligible proven and steady income streams guaranteeing continuity through time that you have provided to date i.e. combined net full pensionable entitlements from both state and private pensions (including future increases in net state pension and the potential volatility in exchange rates), we regret to inform you that,at this point in time, you do not meet the minimum conditions required for such a visa.

ln fact in particular, it appears that in the case of Mrs.XXXXX, she is yet still to reach State pensionable age (XXXX); with her only current source of income, coming from a yearly drawdown payments of circa £XXXXX per annum (subject to tax, effective from the XXXXX). These appear to be generated from a portfolio of pension investments that are in turn subject to volatility. and which unlike an annuity, do not offer a guaranteed, steady & substantial income stream that guarantees continuity through time.

As for Mr. XXXXXXX even in consideration of potential annual gross increases of 5% in line with RPl to his private and state pensions, his total net income, is unlikely to reach, at this point in time, the minimum levels required when granting the issuance of such visa.

Furthermore, in response to the letter dated XXXXXX from your legal representatives, we would like to clarify lhat, “the annual passive income requirement of €31,000 plus 20% for the dependent spouse” they have made reference to, is NOT applicable for this type of visa (i.e. elective residency), but rather to other types.

For clarification purposes, the minimum nef amount, for elective residency visas applications, starts from a guaranteed minimum of €31,000 per applicant. We appreciate that since BREXIT, you may have experienced limitations towards visa free travel arrangements previously enjoyed, but would like to remind you that, as British citizens you may still travel to the Schengen area visa free up to 90 out of 180 days. You have the right to appeal this decision by filing a formal appeal with the assistance of an attorney to the “Tribunale Amministrativo Regionale del Lazio” in Rome within 60 days from receipt of this Notice. To be valid, the appeal must be notified to the Avvocatura dello Stato (General Attorney) according to the Article !44 of the Code of Civil Procedure and Article LL of the Royal Decree no 1,61,1/1933.”

Kind Regards,

Visa Office Consulate Generale of ltaly in London

If you would like to discuss this or any other content I have posted online, or merely to discuss your financial situation for life in Italy, then please do not hesitate to get in touch:

Tel: +393336492356 or gareth.horsfall@spectrum-ifa.com

I would be happy to try and help where I can.

Finance update Q2 2023

By Peter Brooke

This article is published on: 4th August 2023

This update is a look back at 2022 and the year so far in 2023! I believe that 2022 was one of the toughest years of the 25 of my career in terms of the very difficult conversations I had with many of my clients. Those 25 years included the DotCom Bubble, 9:11, the invasion of Afghanistan, the second Iraq war and the Global Financial Crisis.

2022 was different for one main reason… it seriously affected Cautious and Balanced investors and as most of my clients are retired and therefore dependent on their capital for income, it means they need to take a more cautious or balanced approach to managing their money.

So what happened?

At the start of 2022 markets were pricing in a low to moderate increase in interest rates for the whole year, how wrong they were … in fact, the US Federal Reserve raised rates by 4% in 2022 and have carried on into 2023 and many other central banks followed suit.

When interest rates rise, the values of government and corporate bonds fall but long-standing portfolio theory states that bonds must always make up a large part of cautious portfolios, hence the very difficult year for cautious investors. Equities (shares) didn’t fare much better but have shown a faster recovery towards the end of 2022 and into 2023.

This chart shows four different typical risk profiles over the last 2 ½ years taking in the recovery from Covid to the inflation spike, invasion of Ukraine and the year so far. Highlighting the tough times that cautious (green line) and balanced (orange line) investors have had over the past few years.

So why did this happen?

Inflationary pressures had started to build up as economies reopened after the Covid pandemic. Supply chain disruption during the pandemic created shortages, which collided with a sudden increase in demand. An under-investment in energy, particularly fossil fuels also contributed to inflation through higher oil and gas prices.

The war in Ukraine shifted this inflation problem to a full-blown cost-of-living crisis. Central banks were slow to act initially, thinking it was all linked to the pandemic, but it soon became clear that rising prices would be more persistent than expected. Central banks had no alternative but to raise interest rates.

Financial Markets in 2022

Equities

2022 was a year most investors would rather forget, with bond and equity markets seeing significant falls and uncomfortable volatility. Importantly, holding a portfolio of bonds and equities provided little protection, as both asset classes proved correlated to high inflation.

The year also saw a considerable rotation from “growth” to “value”, ending the long dominance by the technology sector. In particular, many of the stock market darlings of the previous decade saw weakness – Meta Platforms, Amazon, Alphabet and Netflix. At the same time, investors had assumed the strong performance of areas such as e-commerce during the pandemic would persist in a normal environment. It didn’t, earnings fell and share prices were hit hard.

Energy was the only obvious victor at a time when commodity prices were high, though share price rises slowed in the second half of the year as governments demanded a share of their windfall profits. Nevertheless, the sector remained the best performing of 2022.

The UK stock market outpaced most of its international peers due to a bias in the year’s most popular sectors such as mining, commodities, oil and gas, and the shift away from growth sectors such as technology, which are only lightly represented in UK equity markets.

Bonds

It was a grim year for bond markets, which had to contend with rising inflation and interest rates. Where the US led, other bond markets followed. The UK has its own idiosyncratic problems, when an ill-judged ‘mini-budget’ under new Prime Minister Liz Truss in September 2022 crashed the pound and caused a spike in UK borrowing costs.

As discussed above, rising yields meant significant losses for investors. Most bond investors saw double-digit falls in their bond investments over the year. It may be little reassurance, but bond prices have recovered from those lows and yields are now at more reasonable levels reflecting the interest rate environment more accurately. They may once again be able to fulfil their traditional role in portfolios – as a source of income and a diversifier from equities.

Financial Markets so far in 2023

So, with this backdrop and a difficult year behind us how have things fared so far in 2023?

Firstly, the gloomy scenario envisaged by many economists at the start of the year has not come to pass. The much-anticipated US recession has been deferred, while financial markets have remained resilient.

The IMF is now predicting a rise in global growth for 2023 though much of this growth won’t becoming from developed economies while emerging markets economies are expected to expand led by China and India.

Inflation has come down but has proved far stickier than many expected, with labour markets remaining healthy across most major economies. This has forced central bankers to continue raising interest rates. While the US Federal Reserve appears to have paused with central bank rates of 5.25%, the UK and eurozone central banks are still raising rates and have indicated further rises may lie ahead.

Financial markets have been resilient. The disruption created by the collapse of several banks proved short-lived, with swift action from policymakers and regulators preventing wider problems.

The US stock market has seen a surprising surge from the technology sector. After a grim year in 2022, against expectations, they roared back in 2023. The galvanising force has been generative artificial intelligence, with excitement around Chat GPT creating interest in semiconductor companies such as Nvidia as businesses look to invest in this new technology.

The US economy continues to deliver mixed messages. A buoyant labour market has continued to reduce expectations of a deep recession.The Fed has remained resolute on interest rates, although it paused rate rises in June, it has made it clear that it is willing to raise them again should inflation continue to rise.

Recession appeared an inevitability for the UK economy at the start of the year. As it is, it has not materialised, with falling energy prices, government support and a resilient consumer all acting to shore up growth. Inflation has remained stubbornly high and so the Bank of England has been forced to keep raising interest rates, which are now expected to peak at around 6%.

The UK stock market had a weak start to the year as commodity prices fell and the banking sector was hit by the failures of Credit Suisse in Europe and Silicon Valley Bank in the US. The resurgence of US technology stocks also impacted the UK market as investors swapped from “value” back to “growth” companies.

It was a stronger period for stock markets in Europe as company earnings improved and outstripped the US early in the year. A mild winter and prompt action by governments across the region saw an energy crisis averted. The region was also lifted by the resurgence of China, which is an important export market, particularly for Germany and Spain.

The European Central Bank raised interest rates to 3.5% in June, their highest level in 22 years. Eurozone Consumer price inflation declined steadily from over 10% in October 2022.

The outlook for Asia has been dominated by China. The country’s reopening in October 2022 led hopes of galvanising global economic growth at the start of the year. However, the initial stock market rally petered out as growth has not bounced as many had hoped. Confidence has not yet returned to pre-pandemic levels.

Asian markets have continued to lag their global counterparts as expectations of a swift return to economic growth in China have receded. Nevertheless, there remain plenty of reasons to be optimistic as Chinese stimulus for infrastructure projects is beginning to feed through to the economy.

Japan has been rediscovered by investors in 2023, with veteran investor Warren Buffet making a high-profile investment in the country’s stock markets. The Japanese economy is also starting to improve as reopening gathers pace and wage growth drives consumer spending. As a net importer, it is also benefiting from lower oil prices, which is helping to improve the Government’s fiscal position.

Bonds

The yield (interest paid) on US ten-year government bonds dipped in April, but moved back up as investors started to anticipate more rate rises ahead. Short-dated bonds now have higher yields than longer-dated bonds. This situation is known as an inverted yield curve and means investors expect rates to be cut over the longer term.

This “inversion” is currently common place, with 37 countries now trading with inverted yield curves, including the UK,Germany, France and Canada.

Conclusion

Financial markets seem to be in a holding pattern, waiting to see how much impact higher interest rates will have on economic activity and looking for clear signs that the interest rate cycle has peaked, and the next rate move is downwards. From the strength of China’s recovery to a potential recession in the US to the resilience of the corporate sector, there are major questions going into the second half of this year.

I am, once again, very grateful to the team at Evelyn Partners for their help in putting this summary together and hope it is useful in framing where we are today and how we got here.

They have some excellent articles on the impact of AI and the basics of how Bonds work.

https://www.evelyn.com/insights-and-events/insights/the-basics-of-bonds

Top tips for moving to Spain in 2023

By Charles Hutchinson

This article is published on: 1st August 2023

Spain is an interesting and beautiful country with a fantastic lifestyle and very hospitable people. I have been in business here with my family for nearly 30 years and have learnt to identify the pitfalls. Here’s how to avoid some of them so you don’t spoil your early days here:

1. Visa and residency permits. It is important to seek advice from a lawyer, gestor or financial adviser specialising in assisting expatriates in Spain as to which visa or permit you need. Since Brexit this has become essential, especially for UK nationals who no longer have the right of abode in the EU.

2. Residency. Again, it is important to consult on the various ramifications of residency, particularly the timing of physically moving from your previous jurisdiction (such as the UK) to Spain. For example, the UK has the 90 day rule whereby if you spend more than 3 months there in any 12 months, you are deemed to be tax resident. In Spain, it is the 183 day rule. However, should your “centre of vital interests” be deemed to be here (if you have children in school here or you are running a business from here), then despite being physically here less than 183 days, you may well be deemed to be a fiscal resident.

3. Foreign pensions and tax efficient investments. While they may be tax efficient in your country of origin, they may not be here. For example, if you are about to draw down on your pension where there is a 25% PCLS (cash lump sum) available tax free, it may not be so here and could be taxed at full income tax rates. Likewise, UK ISAs and some UK National Savings products will probably not be tax free here. You should consider encashing these while UK resident and switching into tax efficient alternatives here (more on that later).

4. Choice of new country of residence. For me this is a no brainer. Over the years I have met many potential and future clients who let taxation rule their lives and dictate where they should live. I genuinely feel that if you and your partner (and children) want to be happy, choose the place that offers what you and yours need for a happy life. There are still too many people who choose their new home on the basis that there is less or no taxation. A frequent typical example would be a couple who spend 180 days in Spain, then 90 days in the UK, one month on a cruise and one month in Florida. While the husband might be rubbing his hands in “Fiscal Nomad” glee, his poor wife is just fed up wandering the world as Mrs Nomad and not being able to call anywhere “home” (please also remember my earlier reference to “centre of vital interests”).

5. Taxation. There are certain taxes in Spain which are foreign to many from other jurisdictions. Typically this might be wealth tax or inheritance tax (IHT) between spouses or common law partners. Please see an earlier article I wrote about how Andalucia might currently be considered a tax haven. The threshold on wealth tax has now been raised here (and in Madrid) so that most couples can avoid it. In Andalucia, there is effectively no more inheritance tax – if you plan carefully. By selecting the correct structure in which to hold your investments, IHT no longer applies between partners (more on this later).

6. Tax returns and declaration of foreign assets. Timing is all important. When you arrive here, it is important to seek advice as to when you should make your first tax return. As usual in Spain, there is the official rule and the unofficial version. As long as there is a provable intent to make one’s first return, one is not breaking the law. It is always easier to make a return for the tax year beginning after you arrive. This often coincides with the fact you have not been here for more than 183 days prior to the beginning of the tax year (1st January). Returns are made by end of June of the following year, so there is plenty of time to decide when to start. You can of course make a return for a period beginning part way through the tax year. This is sometimes done to coincide with date you left your country of previous tax residence but it is not essential. Modelo 720 (Declaration of Foreign Assets) is always made in March of the following year, with regard to the previous tax year. Note that certificates of tax residency here are only issued after you have made your first return.

7. Capital gains tax (CGT) timing. Whenever possible, dispose of any assets which are either CGT free in your previous country or attract a lower tax rate than here while still tax resident in your previous country. For example, your main residence in the UK is free of CGT when disposed of as a UK tax resident, but when you are tax resident here it would be regarded as a second home, even if you are only renting here. Your Spanish home in turn has special tax privileges as a Spanish resident when you come to eventually dispose of it (as an owner).

8. Health insurance. It is important to remember that since Brexit, UK nationals no longer have the privilege of cross border health care. It is however the rule that to obtain a resident permit or visa you must have Spanish recognised health insurance. To avoid stress, investigate options as early as possible.

9. Spanish compliant investment bonds. These are not only recognised here, but also across many EU countries and the UK (where they were pioneered). They are an incredibly effective tax efficient structure provided by several major insurance companies outside of Spain and with offices within the EU. Here in Spain, they are a flexible, 100% secure (under EU law) means of holding investment funds and cash almost without tax exposure. Only when making regular (income) or lump sum withdrawals is there a withholding tax on the growth element of the withdrawal. Even then, the tax rate is far lower than normal income tax. IHT can also be avoided and you can retain your previous investment manager to manage your portfolio. You should consult your new financial adviser in Spain for details.

10. Happiness is where the heart is. Observe these steps and you will begin with less stress and hopefully continue to happily live your lives here for the rest of your days. There is no place like Spain to have a satisfying and rewarding life (just beware when grandchildren heart strings begin to tug if they live somewhere else!)

I have received an inheritance. What now?

By Barry Davys

This article is published on: 31st July 2023

I acknowledge the feelings that come with the death of a relative, but this article is not about the grieving process.

The article describes how to deal with an inheritance and so will start from the point when you learn how much your inheritance (bequest) is going to be.

Oh wow, that will be helpful/very nice! I didn’t expect that much! What a lovely surprise!

These very common responses on finding you are about to benefit in a Will are shortly followed by “What should we do with it?” or “Let’s buy a holiday home/new car/go on a cruise/ give money to the kids etc.” It is unusual for me to find a reaction in between these two different approaches to receiving a bequest.

My experience of working with people who have received inheritances gives me insight into what things are important to consider. Some of these people have worked with me on inheritance tax planning before the death of the relative. This does not mean planning immediately before the death but sometimes years in advance. This type of planning is the subject of another article.

Typically though, as recipients we focus on the amount that we are getting in isolation and make our decisions based simply upon the amount we receive.

This approach often leads to buyers’ regret, defined in the dictionary as:

‘A sense of regret or uneasiness often after having purchased a house, car, or other major item, especially when the acquisition involves an ongoing financial burden.’

A new car comes with ongoing expenses: insurance premiums for a newer or bigger car can be higher, maintenance costs greater. Similar issues occur for a holiday home. Here is an analysis of the true cost of buying a house

Here are some very important steps to ensure you avoid the buyers’ regret syndrome and form a process on how to make the best of your good fortune.

Check your answers to these questions:

- Am I thinking “What would Dad/Mum have wanted me to do with the money, what can I spend it on?” Or am I thinking “What would be the best use of the money for my family”?

- The money is now mine. Have I accepted yet that I am now responsible for looking after it?

- Can I write a list of how to improve my family situation with my money?

- What type of an investor am I?

- If I want to be cautious, what does that really mean in practical terms? How would I choose savings that are “safe”?

- Will I be glad when it is all over, put away somewhere safe and I don’t have to worry about it anymore?

- Will I be able to leave an inheritance to my family?

These questions help us take the focus away from how much you have received to how it will benefit your family and improve your quality of life. Why is this important? Unlike an annual bonus or a job with a higher salary, receiving an inheritance from the deceased relative will happen just once from that relative. Often the relative, when deciding to leave you something, will have been thinking “I hope this will benefit the family and make their life a little easier”.

How to deal with an inheritance – a step by step process

How you approach the issue of what to do with an inheritance should depend on your financial position before the inheritance.

How can you fit the inheritance into your finances so it gives ongoing benefit?

The process:

- List your debts

Whether you should you pay off your debts depends on the interest rate of each debt. One certainty is that if you have a Spanish mortgage with a fixed rate of interest at 1% for 10, 20 or 30 years you should not pay off this debt. Please contact me for an explanation of the returns on your savings and how this mortgage fights against inflation to your benefit, along with a full description of how this works. - List your future expenditure e.g. school or university fees

If you have a use for the money at a set date, savings should be designed to meet that need. Bitcoin etc is not going to give you the certainty that the money is there when you need it. - How much emergency fund do you already have in the bank?

An emergency fund should typically be enough for six months of expenditure. Top up your emergency fund if necessary. - Do I need the money to grow or do I need it to provide an income?

If you wish to bolster your pension when you get to retirement, it may need to grow now and provide an income at retirement. If you wish to leave money to your family, you may wish take the income or profit from your savings and to leave the capital ready to pass on. - Where are my existing savings and investments?

Often I see people doubling up on a particular investment, often by accident. One fund may, for example, hold lots of Tesla shares already. If so, you might not want to buy lots of Tesla shares with your inheritance. Why not? By concentrating your investments like this you increase your exposure to risk. - Look to pay for gifts or toys such as new golf clubs from the income not the capital

I have helped many clients over the years preserve their inheritance with this approach. In addition to the toys, I have structured donations to charity too. - Analyse your options

What type of savings match my risk profile and how do I make them tax efficient? - Then do what you have decided to do

It is surprisingly common for people to still have an inheritance some years after they have received it. Not being an expert or experienced in savings and investments and tax they end up doing nothing out of fear of doing something wrong. Whilst this is understandable, the real value of the inheritance is eaten away by inflation with a “do nothing” approach.

Thoughtful, considered planning is how I approach a request to help with an inheritance. A step by step approach is best using the process above. By using cashflow modelling software I can show you what your financial future looks like now you have the new money. The software also allows you to explore different options and compare the possible outcomes. This “what if“ analysis is one of the most useful parts of the planning process. Assessing the best planning for Spanish and/or UK tax is a speciality of my advice.

Special Spanish tax items

There are specific reporting requirements about your inheritance in Spain, even if you have paid inheritance tax in the UK or Ireland.

This report must be made within six months from the date of death.

If you receive an inheritance in your name and then decide to do something with the money in joint names, there is gift tax to pay in Spain. A typical trap is buying a property in joint names with the inheritance only to find out there is gift tax on half the value of the house.

What next and how to make the best of having received the money?

You can book a call with Barry Davys of The Spectrum IFA Group who specialises in advising on how to manage the inheritance. Please choose a time that is convenient for you on his online system

He has dealt with many such situations in both the UK and in Spain. He brings understanding of the circumstances and respect of your wishes inside a framework of professional advice.

He often acts with lawyers who are settling an estate. The lawyer works on the process of settling the estate whilst Barry is forward looking and works on the planning for the future.

Barry will personally get in touch with you within the next five days. Any call or communication will be in confidence.

Use your inheritance you have received for your future

By Barry Davys

This article is published on: 30th July 2023

Travel broadens the mind, and the investment portfolio

Have you ever been to India for work or to travel?

I haven’t but my partner went for work and my daughter for travel. Some seven other friends have also travelled and all have reported the same way. It is a great place, still lots of improvements to be made, but the people work hard and are generally friendly.

With a current population estimated at 1.46 billion (now larger than China’s), India accounts for around 18% of the world’s total population.

If you were running a business with:

- 18% of the world’s population in your home market

- English being spoken well by a good proportion of the population and with English language ability providing valuable access to international markets

- skilled and hard working employees

Would you be mildly optimistic about your outlook? Of course, you would have to deal with the day to day issues of logistics, marketing, financing etc but even so, you might still be mildly optimistic.

The story is only just beginning. Yours and my parts of this story come at the end of this article. Read on.

The IMF, World Bank and Goldman Sachs are all optimistic about the country’s outlook. India is currently the fifth largest country by size of economy. However, by 2050 Goldman estimates it will be the third largest in the world. Sounds good but when you examine the numbers it really is impressive.

In 2022 the Indian economy was valued at $3.385 trillion. Goldman expects the economy to be $22.2 trillion by 2050. By 2075 it is anticipated it will be $52.5 trillion, making it the second largest economy in the World.

To give some context, the economic output (GDP) of some other countries in 2075 are estimated to be:

- USA $51.5 trillion

- Japan $7.5 trillion

- UK $7.6 trillion

- Germany $8.1 trillion

Your involvement in the story

Sounds good but what has this got to do with me?

If you are about to receive or have received an inheritance at, as an example, age 50, it is likely that you will live around 40 years. This change in India to 2050 will take place in your lifetime.

If you have children, and especially with grandchildren, this change in India to 2075 will take place in their lifetimes.

I am not an investment manager but am able to arrange for discretionary fund managers (DFMs) to run investment portfolios on behalf of my clients. I direct the DFM to invest in a manner that fits both with your attitude to risk and your longer-term planning objectives. This includes your requirements for income and inheritance tax planning for your family.

I am forward looking. This story of India is not a recommendation to invest in India. It does illustrate however that if this economic expansion is expected to develop over your lifetime, we could ask the DFM to consider including at least some Indian exposure in your portfolio.

If you wish to look to the future, book an appointment for an initial call with Barry Davys at a time that is convenient for you, using his online system at Receiving an Inheritance – What Now