“As per Art. ,comma 2 of T.U. 286 modified by Law 30 July 2OO2 n.l-89, and Art. 6-bis of D.P.R. l-8 October 2004 n. 334 regarding visa denials, we regret to inform you that your recent application for an Elective Residence visa has been denied because unfortunately, at this point in time, it does not comply with the minimum conditions required for the issuance of such a visa.

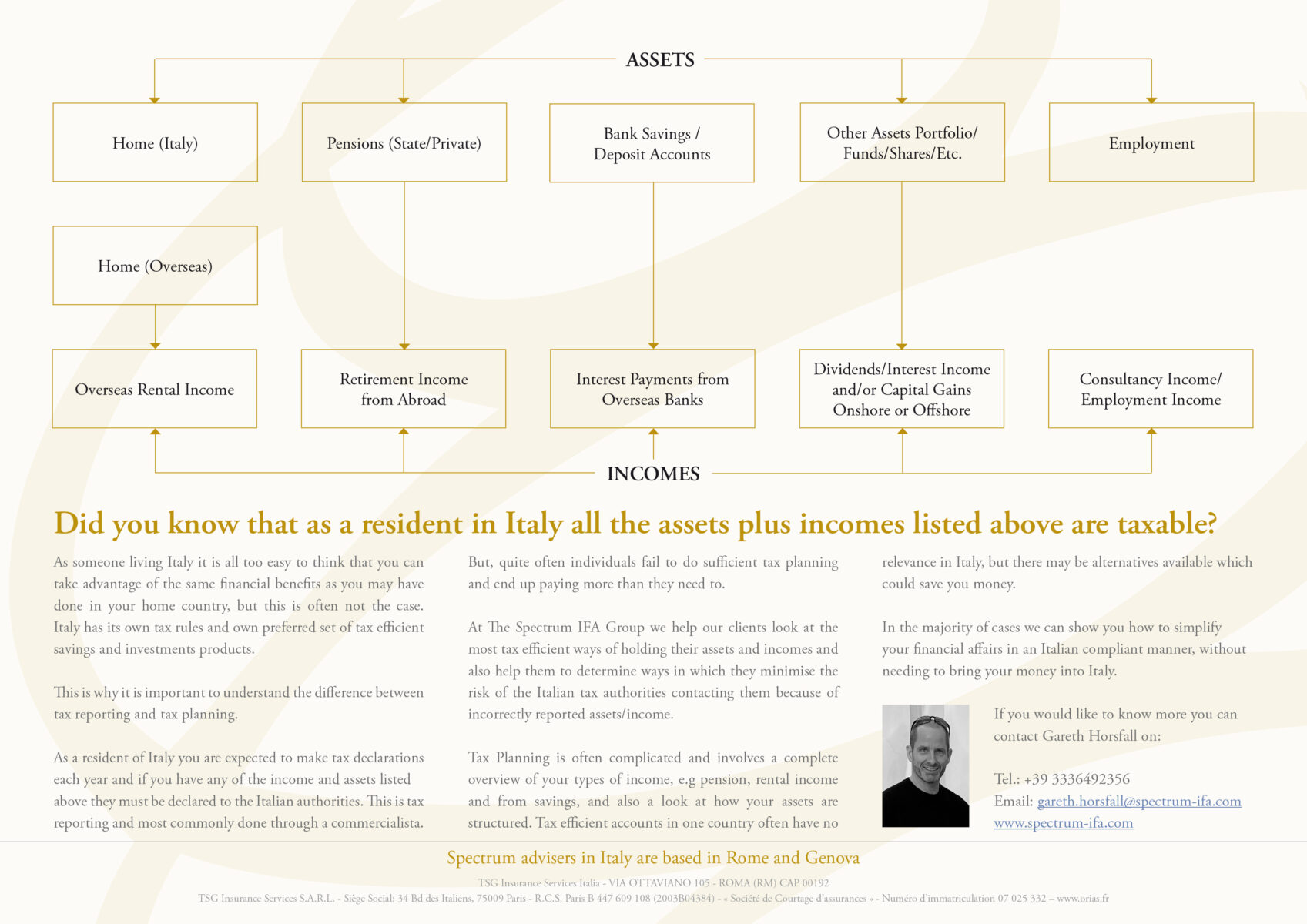

To date, all the documentation provided with your applications do not currentlv illustrate that vou have immediate access to the minimum required economical and financial resources necessary lo guarantee continuity through time from a proven, steady & substantial income stream/s deriving from pensions, annuities, properties or other types of regular income declared in the UK ( with the “Tabello A’ Direttivo Ministero dell’lnterno dated March 7’t, 2000 ond as per D.l. 850/2077, i.e. startinq from a net amount of 37,000 euro per person), meaning not cash in the bank, savings, unrealised profits from investments subject to volatility and/or private income deriving from employment. It is worth highlighting that this office has carefully examined your recent applications, by comparing them with your previous ones; i.e. denials ref: XXXXXXXX prot n. XXXXX issued on the XXXXXX.2022 respectively, with the view to gauge if there have been any new and/or substantial changes in both your economic and financial circumstances to be considered when granting the issuance of such visa.

Unfortunately, when taking into consideration both your eligible proven and steady income streams guaranteeing continuity through time that you have provided to date i.e. combined net full pensionable entitlements from both state and private pensions (including future increases in net state pension and the potential volatility in exchange rates), we regret to inform you that,at this point in time, you do not meet the minimum conditions required for such a visa.

ln fact in particular, it appears that in the case of Mrs.XXXXX, she is yet still to reach State pensionable age (XXXX); with her only current source of income, coming from a yearly drawdown payments of circa £XXXXX per annum (subject to tax, effective from the XXXXX). These appear to be generated from a portfolio of pension investments that are in turn subject to volatility. and which unlike an annuity, do not offer a guaranteed, steady & substantial income stream that guarantees continuity through time.

As for Mr. XXXXXXX even in consideration of potential annual gross increases of 5% in line with RPl to his private and state pensions, his total net income, is unlikely to reach, at this point in time, the minimum levels required when granting the issuance of such visa.

Furthermore, in response to the letter dated XXXXXX from your legal representatives, we would like to clarify lhat, “the annual passive income requirement of €31,000 plus 20% for the dependent spouse” they have made reference to, is NOT applicable for this type of visa (i.e. elective residency), but rather to other types.

For clarification purposes, the minimum nef amount, for elective residency visas applications, starts from a guaranteed minimum of €31,000 per applicant. We appreciate that since BREXIT, you may have experienced limitations towards visa free travel arrangements previously enjoyed, but would like to remind you that, as British citizens you may still travel to the Schengen area visa free up to 90 out of 180 days. You have the right to appeal this decision by filing a formal appeal with the assistance of an attorney to the “Tribunale Amministrativo Regionale del Lazio” in Rome within 60 days from receipt of this Notice. To be valid, the appeal must be notified to the Avvocatura dello Stato (General Attorney) according to the Article !44 of the Code of Civil Procedure and Article LL of the Royal Decree no 1,61,1/1933.”

Kind Regards,

Visa Office Consulate Generale of ltaly in London