I wrote an article back in 2021 which you can read here. I just wanted to offer a reminder of the 10 most important reasons why you should consider having an Assurance Vie whilst living in France:

Why Should I have an Assurance Vie?

By Michael Doyle

This article is published on: 20th May 2025

- Tax Efficiency: Assurance vie allows for tax-deferred growth on income and gains while the funds remain within the policy.

- Flexible Investment Options: With my help and planning you can choose from a variety of funds, including equity, bond, and special products, allowing for a diversified investment strategy.

- Access to Capital: You have full access to your capital at all times, with the option to take regular income withdrawals (possibly subject to an early exit penalty in the early years).

- Inheritance Planning: Assurance vie is highly effective for inheritance planning, allowing policyholders to designate beneficiaries and providing significant tax-free allowances.

- Long-Term Savings: It serves as a viable alternative to traditional pension plans, offering flexibility in saving for retirement.

- Potential for Higher Returns: By investing in unit-linked funds, there is potential for higher returns compared to traditional savings accounts.

- Social Charges on Gains: Only the gain element of withdrawals is subject to social charges, which can be advantageous compared to other investment vehicles.

- International Options: International assurance vie policies offer additional benefits, such as investment in multiple currencies and broader investment choices. We offer these at Spectrum meaning if you move country your Assurance Vie is often portable.

- Adaptability to Risk Tolerance: We offer regular reviews so can switch funds as your circumstances or attitudes toward investment risk change.

- Tax-Free Allowance After Eight Years: After eight years, gains can be offset against a tax-free allowance of €9,200 for couples or €4,600 for singles, enhancing tax efficiency.

You can now book a 30 minute zoom meeting with me (at your convenience) by clicking here.

Financial update May 2025 – France

By Katriona Murray-Platon

This article is published on: 4th May 2025

May is when France comes out to play because the weather is warmer and the days are getting sunnier. However it is also the month when, if you haven’t already begun your tax declaration, you need to at least make a start on it over the next few weeks. The first deadline for filing the tax return is the 20th May for the paper returns which you will need to complete if this is the first year doing a tax return and you don’t have a tax number or login details to do it online.

The other deadlines for submitting both your income tax return and where applicable, your Wealth Tax return, are as follows:

| DEPARTMENT | DEADLINE |

| 0 to 19 | Thursday 22nd May 2025 at 11.59pm |

| 20 to 54 (including 2A and 2B) | Wednesday 28th May 2025 at 11.59pm |

| 55 to 974/976 | Thursday 5th June at 11.59pm |

| Non residents | Thursday 22nd May 2025 at 11.59pm |

If you do not at least attempt to get some sort of declaration submitted by these deadlines a 10% penalty will apply to the amount of taxed owed. Luckily, Spectrum has a free tax guide which you can find HERE. If you have any questions on this guide, please do get in touch.

I know that it may seem daunting and believe me, even though I was a tax adviser and used to do hundreds of declarations for my clients, I still find doing my own quite a challenge! So to help you, here are my ten top tips:

- HAVE YOUR FIGURES READY– Make sure that you know what kinds of income you need to declare and what the total annual figures are, whether they are taken off a bank statement or a tax certificate.

- KNOWING THE EXCHANGE RATE: The Banque de France average exchange rate for 2024 is €1.18 to £1. This is also the rate used by the Connexion newspaper. Make sure you have all your foreign income figures converted into Euros ready to input into the tax form.

- CHECK THE FIGURES ALREADY ENTERED ON THE TAX FORM – French source income (pensions, salaries, French bank income etc) should already be entered on the tax form. Whilst this information is generally correct, it is still worth checking these figures with any tax certificates issued by the relevant body or your December 2024 payslip.

- FOREIGN INCOME ANNEXE – I have noticed this year that whilst some annexe forms such as the 3916 are automatically ticked and carried over from the previous year, the 2047 for foreign income is not. You will therefore have to tick this box in the ANNEXE section of the online form to make this form appear. You must enter all foreign income received in 2024 on this form and then make sure that it is carried over or inputted again into the main 2042 tax form.

- CHECK THAT ALL THE DIFFERENT TYPES OF INCOME ARE TICKED – This applies on both the 2047 form and the main tax form (2042) as when you then click to the next page you will only be shown the boxes and pages that correspond to the income selected on the earlier page. So if you are only declaring pensions and bank interest, only those pages will appear. If you have other income like rental income or business income, you need to tick the relevant box for the page to appear. You can also look at the declaration that you did last year under the “documents” section on the main page and see what boxes you completed last year, then you can use the “search box” option.

- REMEMBER THE BANK ACCOUNTS AND UPDATE THE ASSURANCE VIE AMOUNTS – All non-French accounts must be declared on the 3916 form. This should automatically appear as a form if you declared accounts last year and boxes 8TT and 8UU were ticked. Any accounts you declared last year can be carried forward but if there are any changes, any new accounts or closed accounts, you must provide this information. Your assurance vie information will also be carried forward from last year but you will have to check the letter that was sent to you by the assurance vie provider in order to enter the value of the policy as at 1st January 2025.

- DON’T FORGET YOUR TAX CREDITS – If you have any domestic help or services paid via CESU, the amounts declared will be already entered on the tax form, you just need to check that these are correct. However if you have had any other home help (cleaners; gardeners, child care, after school lessons etc) from private companies or associations, these amounts are not always automatically entered. The company or association should have sent you a tax certificate for last year so you will need to enter that amount in the tax credit section. If you have a child in high school, sixth form or university, don’t forget to tick the box to get the (albeit small) tax reduction.

- RETIREMENT CONTRIBUTIONS – if you work in France and want to contribute to your pensions, it is a good idea to open a PER account. If you have already made contributions to a PER in 2024, you can deduct a percentage of these payments from your taxable income. The amount that can be deducted or carried over from previous years is shown on your tax statement. However to deduct these amounts from your tax you will need to reenter these amounts in the correct box.

- CHARITABLE DONATIONS – If you have made any charitable donations in 2024 you should have received a tax certificate from the charity with the amount to deduct. This may have been sent by email and fallen into your spam box so it is important to find the email or if it has been sent by post to keep the tax certificate in your tax file. If you still can’t find it you can contact the charity to send you another copy.

- NOBODY IS PERFECT (especially not me ;)) — you can start your declaration and go back to it later. You can do one version and then go back and change it. Once you get to the signature page which shows the tax due (this won’t appear if you have foreign income that will receive a tax credit) if something seems wrong you can go back and amend it. You can do this as many times as you like until the official deadline without it generating separate tax bills and even after the deadline provided you have submitted something before the deadline. If it gets close to the deadline it is better to declare something and sign the tax return and then correct it at a later date rather than incur a fine for late submission.

Property declaration – do you remember last year when you had do declare your properties as a separate declaration? This year you only have to declare whether there have been any changes in 2024. I noted on the online tax form that when you get to the signature page, you must tick a box saying there are no changes otherwise it will not let you sign off and send the tax return.

One of the welcome changes with the 2025 tax declaration is that couples will not be automatically taxed at the same rate but at their individual rates. This is particularly important for those paying tax at source on their pensions and salaries.

Until recently, couples were taxed at the same rate unless they opted for their individual rate which most people didn’t. The result of this was that, because women generally receive less than men when it comes to salaries and pensions, the woman was paying a disproportionate rate of tax. As from 1st September this will change and couples will automatically be taxed at their individual rate unless they opt to pay the same tax rate.

Unfortunately it is too late to contact tax advisers, tax lawyers or anyone else offering help with tax returns as they will be very busy completing the tax returns they already have, so don’t be surprised if they are not returning your calls or emails. However, with a bit of patience and perseverance it is possible to do your own tax return. If you have any questions please do get in touch and I will help as much as I can.

Financial Market Update April 2025

By Peter Brooke

This article is published on: 8th April 2025

Uncertainty leads to Volatility

Quite understandably my inbox has been full of messages from concerned clients and musings from commentators and investment managers about how to respond to the current market reaction to President Trump’s raft of tariffs.

The uncertainty around how these tariffs will play out has led to large falls in stock markets, especially the US.

As discussed in my last newsletter Lets Talk About Risk, volatility is an important and unavoidable part of investing and will be negated by time in the market and can provide great opportunities. The key is to ‘stay the course’ and try and ‘see through the noise’.

However, I did want to get something out to you with some current thoughts about what is happening, what might happen in the near future and why ‘staying the course’ is the best option.

We’ve Been Here Before

When markets turn volatile, perspective is everything.

The past week feels pretty tumultuous but, of course, we’ve been here before.

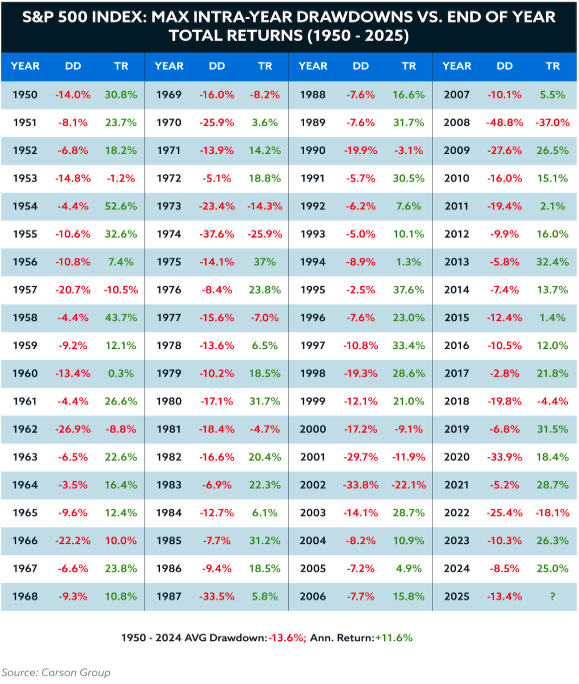

The table below shows the maximum intra-year drawdowns (DD) and end-of-year total returns (TR) for the S&P 500 from 1950 to 2025.

It reveals that after severe drawdowns, the market has often recovered the full decline and finished the year strongly positive.

Years to Note:

- 1970: Market fell -26% from peak to trough… yet ended +3.6%

- 1975: Dropped -14.1%, but closed the year up +37%

- 1987 (Black Monday): Down -33.5% mid-year, still finished +5.8%

- 2009: Deep in the Global Financial Crisis, dropped -27.6%, yet ended +26.5%

- 2020: COVID crash brought a -33.9% drawdown… ended +18.4%

On each occasion, the best course of action would have been to avoid the noise and stay invested.

“History doesn’t repeat itself, but it often rhymes.”

I hope that the above shows that though periods of volatility will always happen and always be temporary it is best to stay the course and try and avoid the noise;

I do appreciate that it is difficult with today’s ‘news’ channels adding to the feeling of panic on an hourly basis so I have shared below some links from firms much closer to the markets to share more detail about what is happening and what investors should consider in these temporarily volatile times.

Traversing Trump tariffs by Daniel Casali, Chief Investment Strategist at Evelyn Partners

Trump’s tariffs: how should investors respond? From Rathbones Investment Management

I would like, once again, to thank these expert commentators and the team at New Horizon Asset Management for their quick and important updates to a challenging situation.

Talk to me

As always, please remember that financial decisions should be made with careful consideration of individual circumstances and professional advice, I am here to support you.

If you have missed any previous news and updates these can all be found on the archive page here.

If you have any questions please use the the below channels, or the booking system – always drop me a quick message if you need a time slot outside of those available.

Mobile & Whatsapp: +33 6 87 13 68 71

Email: peter.brooke@spectrum-ifa.com

Facebook: Peter Brooke – Financial Advice

Calendly: https://calendly.com/peterbrooke/30min

Financial update April 2025

By Katriona Murray-Platon

This article is published on: 4th April 2025

The clocks have gone forward, winter is officially over and the lovely sunny weather seems finally to have arrived. Spring has sprung but of course April also hails the beginning of tax season in France and the start of the new tax year in the UK, bringing with it new financial laws and measures.

The costs of buying a house in France are usually bourne by the purchaser. Most of these costs are taxes which are paid to the state, the department and the town/village (commune) but there is also the Notaire’s fee which needs to be taken into consideration. The amount taken by the department is usually around 3.8% of the purchase price but the department councils can decide to amend this rate every year and increase it by between 1.2% and 4.5% maximum. This maximum amount can then be increased by a further 0.5% to make it 5% as from 1st April 2025 and 31st March 2028 (Article 116 of the finances law for 2025, no2025-127 of 14.02.2025).Paris has already decided that this 5% rate will apply to deeds of sale signed as from 1st April. The date upon which these rates come into effect will depend on when the council notifies its decision to the tax authorities.

Some departments may decide to reduce or even not apply this rate. However first time buyers are exempt from this rate and will pay no more than 4.5%.

The measure introducing the lower VAT threshold of €25,000 has been postponed until 1st June 2025. VAT will apply to auto entrepreneurs as soon as their turnover exceeds €27,500 (if their turnover was less than €25,000 in 2024). If their turnover is less than €27,500 in 2025, the VAT will be due from 1st January 2026.

As from 2nd April, those people with EU, EEA or Swiss citizenship, must have an Electronic Travel Authorization (ETA). This will cost approximately €12 and can be obtained from the UK ETA app or the GOV.UK website.

If you need to take a taxi or ambulance to go to the hospital or return home you may have to share your journey with another patient. The aim of this measure is to reduce costs for the health care service. Two patients may be required to share a taxi or ambulance for part or all of the journey if the prescription specifies that the health of the patient would not be jeopardized by sharing the transport with someone else. However this can only apply if the detour to collect the other patient is no more than 10 km per patient and up to 30km maximum. Also the waiting time for the taxi/ambulance before or after the appointment cannot be longer than 45 minutes. This only applies for medical visits to treat certain kinds of conditions such as cancer, chronic liver failure etc. The patient can refuse to share their taxi or ambulance but will not be covered by their mutuelle and will not be fully reimbursed.

The online tax declaration service will begin from 10th April 2025. Although the tax form doesn’t change dramatically from one year to the next, there can still be small changes which will not be known until the declaration service starts after 10th April.

Also, if this is your first time doing your tax return, you will need to submit a paper return.

The downloadable versions of the forms will also be available after 10th April.

After a busy March, I am set for an even busier April with plenty of appointments in my diary. I am looking forward to driving through the beautiful French countryside and catching up with my clients. If you have any questions and would like to make an appointment with me to discuss your financial situation, please do get in touch.

Understanding Investment Risk

By Peter Brooke

This article is published on: 30th March 2025

“Risk” is an unavoidable, and sometimes welcome, part of investing so having a better understanding of the different forms of risk can help investors make informed decisions that align with their financial goals. In this (quite long) article, we explore key types of “risks” and how they impact financial planning.

What is RISK?

Definition: The possibility of something bad happening!!

What is INVESTMENT RISK?

Definition: The degree of uncertainty and/or potential financial loss inherent in an investment decision.

So we need to frame our conversations about “RISK” by trying to understand the ‘something bad’ in every decision we make.

Inflation Risk: The risk of doing nothing!

A.K.A. – The Erosion of Purchasing Power

Inflation risk occurs when the value of money declines over time, reducing its purchasing power.

For example, if inflation averages 2.5% per year, €100 will only buy €53.10 of goods in 25 years’ time.

To counteract inflation risk, investors should turn to non-cash assets like shares and bonds, which have historically always outpaced inflation over the long term.

What’s the something bad? – The risk of doing nothing and leaving money in a bank account will guarantee a financial loss over the long term.

Permanent and Total Loss of Capital

Companies can and do ‘go bust’ and for an investor in those company’s shares this would mean a total and permanent loss of capital – the share price falling to zero.

Therefore understanding how a company is managed and investing across a diversified group of high quality companies will minimise this risk.

Outsourcing to a fund manager to diversify this risk is a great way to ‘avoid the losers’ even if you don’t always ‘own all the winners’.

What’s the something bad? – Investing in just one or a few companies and not understanding the ‘fundamentals’ of each investment.

Volatility: Fluctuations in Values

Volatility is often ‘defined’ as RISK with respect to investments.

Volatility refers to short-term fluctuations in the price of an investment; for example a share price.

While dramatic drops can be unsettling, history shows that volatility is entirely normal and markets always recover over time.

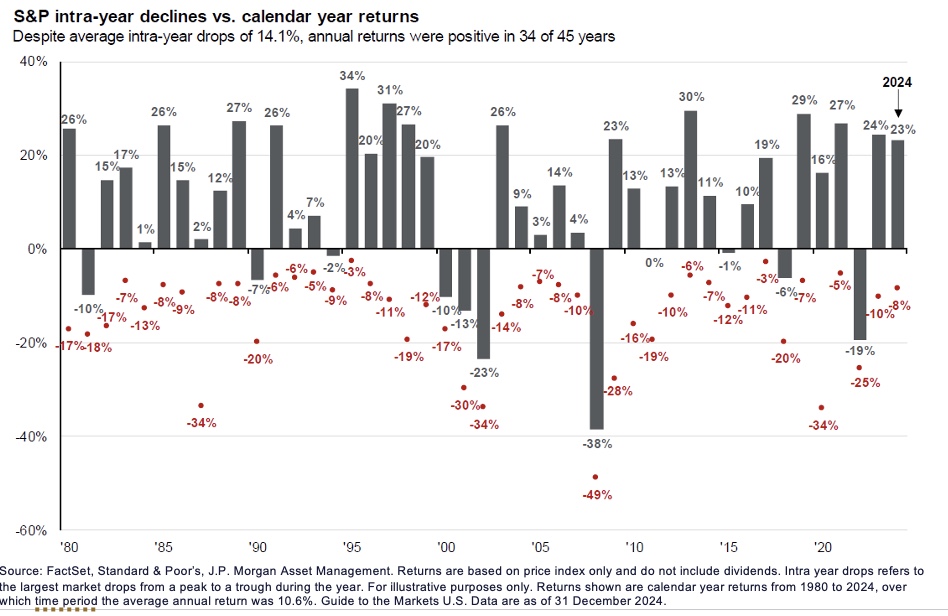

For example, look at the chart below; since 1980, the US stock market (S&P 500) has experienced declines averaging 14.1% during each year, yet annual returns were positive in 34 of those 45 years (75%).

The red figures show the largest market drop in value for each year and the grey bars show the total return for that same year… for example 2024 shows a drawdown of 8% but the S&P 500 finished the year 23% up.

Volatility is NORMAL and does NOT mean a capital loss for the long term investor.

Volatility risk is mitigated by TIME in the market

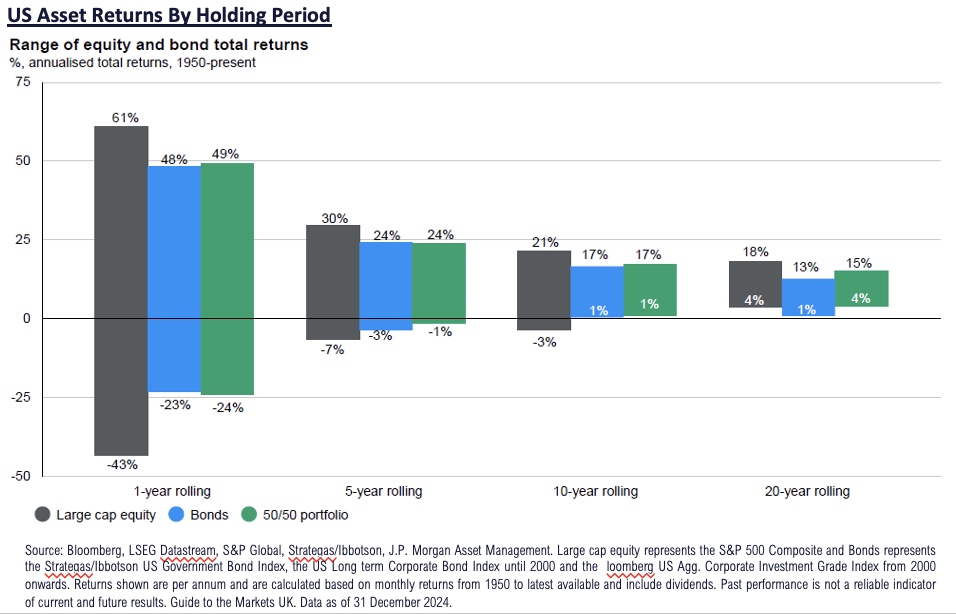

Volatility is part and parcel of investing, and your investment time horizon almost without exception determines the likelihood of investment success. This chart shows the annualised returns over four different time frames (1, 5, 10 and 20 years) using data from 1950 to today.

A 50/50 portfolio of shares and bonds (the green bar) shows that in the last 75 years you could lose up to 24% or gain up to 49% in any given one year period.

However, over every 10 year rolling period in that same 75 years, your worst possible return would be 1% p.a, (ie. no loss) and the best would be 17% p.a.

The longer the investment term, the less relevant volatility becomes, and crucially, the longer the investment term, the greater the likelihood of investment success.

What’s the something bad? – Not maintaining a long-term perspective and reacting impulsively to market swings.

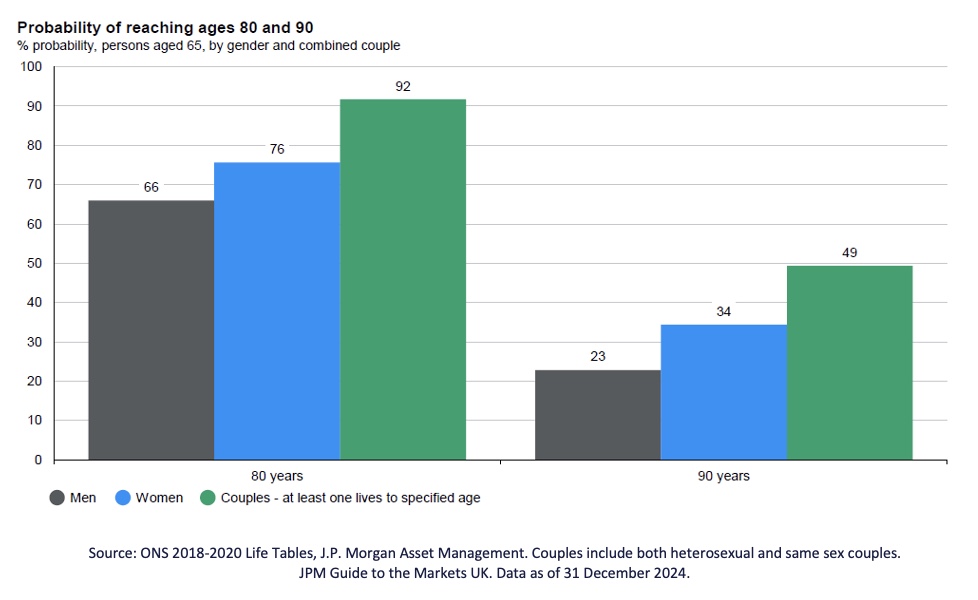

Longevity Risk: Outliving Your Wealth

With increasing life expectancy, investors must consider the risk of outliving their assets.

For a couple aged 65 today there is a 92% chance that one of them will live to 80 and a 49% chance one will live to 90.

Planning for a longer retirement by investing must now include more exposure to growth-oriented assets.

Sequencing Risk/ The Timing of Returns Matters

For retirees or those drawing an income from investments, sequencing risk— the order in which returns occur— can significantly impact portfolio longevity.

A market downturn early in retirement can lead to a faster depletion of funds compared to a downturn later in retirement.

Strategies like maintaining a cash reserve, actively managing portfolio risk as you approach retirement and diversifying investment assets will help.

What’s the something bad? – A market correction just at the point of retirement can significantly impact the quality of that retirement.

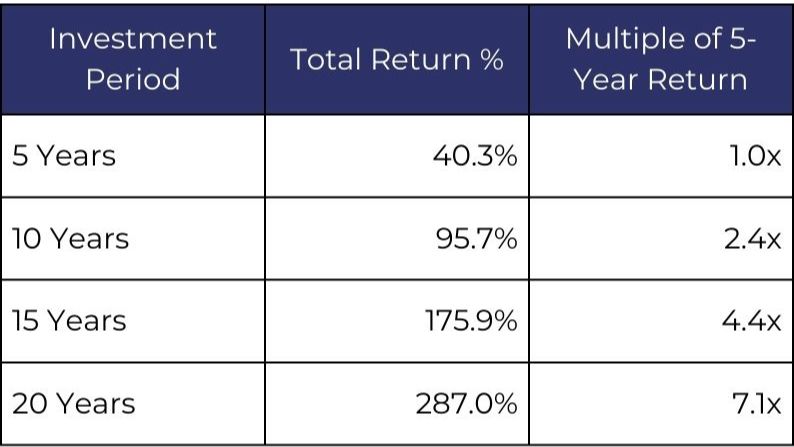

ROMO – The Risk Of Missing Out: The Cost of Not Investing

As well as the risk of not keeping up with inflation, there is also a significant risk (and great financial cost) in staying out of the market.

The ‘magic of compounding’ delivers substantial rewards for the patient, long term investor.

The 8 – 4 – 3 Rule

- The first 8 years is a period where money grows steadily

- The next 4 years is where it accelerates

- The next 3 years is where the snowball effect takes place

Here is a table showing the compounding effect of a 7% annual return:

What’s the something bad? – The risk of doing nothing and not benefiting from compounding returns.

Currency Risk

Expatriates often have assets in one currency but expenditure in another; for example a Pension in British Pounds and outgoings in Euros.

As global investors there will always be some form of underlying currency risk but mitigating the practicalities of moving money around from one currency to another is possible with careful planning.

Options could be:

- Take all the currency risk at the start – ie transfer the whole ‘pot’ today to your expenditure currency – a one off risk.

- Take all the currency risk at the end – exchange the money to your expenditure currency when you draw the money out; this might be better as it may spread the risk over time.

- Manage the currency – you could set up your account in your expenditure currency (e.g. Euros) but keep the underlying investments in their original currency (e.g. GBP) and then create a strategy to move the money over time to match the outgoings.

What’s the something bad? – The risk of not correctly matching your assets with your liabilities – a large fluctuation affects your lifestyle.

Assessing Your Attitude to Risk:

All of the above is to help our conversation about ‘RISK’ but in order to best set up and review your investment portfolio we have a 3 part process to determine exactly how much investment risk you can tolerate:

1. Your ATTITUDE to risk – this is a psychometric test, via a questionnaire, to assess your in-built view on risks, volatility and returns.

2. Your CAPACITY to take risk – this is a deeper understanding of your overall situation and therefore your ability to weather ups and downs in portfolio values… i.e. do you have other assets, a large pension or property income; how reliant are you on your portfolio at any given time?

3. Your TIME HORIZON for investing – when do you need to access to this money? Will the access be to draw an income or large lump sums or even, all of the fund in one go? Or is this money just to be invested to pass on to beneficiaries?

The answers to these 3 questions provide us with a ‘score’ and ‘understanding’ of how you will use the money being invested… this allows us to assign a ‘Risk Benchmark’ to your portfolio, from which we will determine its asset allocation and then monitor its performance and volatility for the duration of the investment.

Obviously, your TIMESCALE changes over time and your CAPACITY can change as your life situation changes; even if you maintain the same inherent ATTITUDE to risk we must always review and monitor the overall position of your portfolio and potentially change your benchmark as time passes.

Final Thoughts

Investing always carries ‘risks’, but knowledge and strategy can help manage them effectively. Whether it’s inflation, market fluctuations, or longevity concerns, working with a financial adviser ensures that risk is considered within a well-thought-out plan. Overall doing nothing is the largest risk.

Staying focused on long-term goals, and avoiding emotional reactions to short-term market movements, usually leads to successful financial outcomes.

I would very much like to thank the team at RBC Brewin Dolphin for their kind input and help with this article, I truly hope you found it useful.

If you’d like to discuss your investment strategy and how to manage these risks, feel free to get in touch!

Live Webinar – Buying your dream home in France

By Alan Watson

This article is published on: 25th March 2025

ONLINE LIVE WEBINAR

Join our expert panel on Thursday 27th March

18.00 (GMT), 19.00 (CET)

An informative webinar where our panel of experts will address topics such as relocating to France, mortgage, visas, buying and living in France, and currency transfers. We will also provide insights into the buying process in France.

10 Golden Financial Planning Rules For Expats in France

By Richard McCreery

This article is published on: 19th March 2025

France is a great place to live and I’ve enjoyed every minute of my 25 years here. It’s not always easy living in a foreign country, especially in light of the Anglo-Franco relationship through the centuries (I had never realised that the French were so upset about what the English did to Jean of Arc until I joined the events committee in my village), but there are things we can do to make it is a little easier.

I always recommend expats learn to speak at least a little French and tell them not to worry about making mistakes. An attempt to communicate is always appreciated even if your grammar isn’t perfect. Always say ‘Bonjour’ upon entering a shop or a lift, ‘Au revoir’ when leaving. We might not always do it in the UK but some French people get really annoyed if you forget. And always look both ways when crossing the street, even if it is one way. French drivers often treat the rules of the road more like guidelines.

Expats coming to live in France should also not assume that the French approach to finances and taxes are similar to where you’ve come from. If we think about how complicated these subjects are even in our home country, then you won’t be surprised to hear that they may not be entirely straightforward in France either. Often there are differences that you might never have considered, some are small but some are so substantial that they could add up to hundreds of thousands of Euros.

That is why I’m going to share a few tips for managing your finances and making life in France smoother and less stressful.

- Use a Livret A or LDDS for your emergency fund – these are government-regulated bank accounts with a fixed rate of interest that is tax-free. As part of your financial planning, I always recommend you have an easily-accessible emergency fund in case you need it at short notice. These accounts currently pay 2.4% – not much, but better than nothing and always available.

- Consider transferring UK assets to France – Some Brits living in France may have left savings and investments back in the UK and therefore would be liable for tax on income and capital gains. By holding this money in French-compliant products instead, you could save yourself from paying tax unnecessarily, and still enjoy a very wide range of investment options (with paperwork in English).

- Ensure your French investments are tax efficient – Assuming you have brought investments or savings to France, are they now in the most tax-efficient vehicles? Some popular investment accounts are subject to taxes that could easily be avoided. Tax-efficient savings and investment vehicles may have limits on how much you can put in, but make sure you maximise the use of these as far as possible to reduce your French tax bill.

- Think about planning your inheritance as early as possible – France’s inheritance taxes can be onerous and the basic allowances can be swallowed up quickly if you own property or other substantial assets. However, by using the correct structure and planning techniques as early as possible, families can smoothly pass assets to their loved ones and potentially save hundreds of thousands of Euros that would otherwise go in tax.

- Don’t forget to declare foreign accounts, income and trusts – Foreign bank accounts should be declared with your income tax declaration each year, regardless of whether they are empty or pay much interest. Failure to do so can result in big fines and they are far more common than you might think. Equally, if you have any links to a trust, there are strict reporting requirements in France.

- Shop around for general insurance – Over the years it has become increasingly simple to cancel your existing car, home, scooter or health insurance in order to switch to another provider. By using the major comparison websites, I’ve found that you can save hundreds, if not thousands, of Euros by regularly checking what the insurance market is offering.

- Speak to an expert before taking pension benefits – Whilst you can take a tax-free lump sum at retirement in the UK, the situation is different if you are resident in France. Before accessing your pensions or making a transfer, you should speak to someone who can explain the consequences relevant to your personal situation or it could be costly.

- Understand how your marriage regime is treated – France recognises several different types of marriage regime and they can be treated differently for tax purposes. Before making investments, gifts or any other significant financial transactions between spouses, you should speak to an expert in order to avoid potential tax liabilities down the road.

- Own your own home if you can – I always include this because for many people the 100% capital gains tax allowance you get on the sale of your main residence could be the biggest tax break you ever get. French house prices have risen 27% during the past decade. In fact, the French stock market has risen even more, 61%, hence why it is important to ensure your financial investments are also rolling up tax-free.

- Take advice from a regulated professional with cross-border experience – Financial planning can make you money and it can save you money. But understanding the implications of assets and taxes in more than one country is extremely complicated and requires professional assistance. Give yourself an advantage and get in touch! I am here to help.

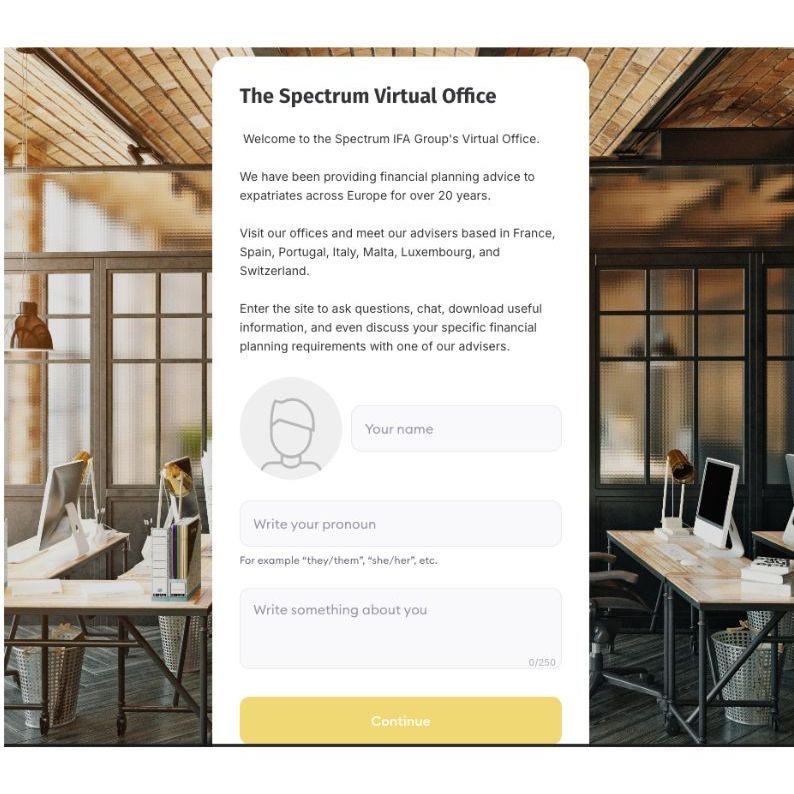

Enhance Your Financial Planning Experience

By Peter Brooke

This article is published on: 7th March 2025

I’m always looking for ways to improve how we can work together, ensuring that your financial planning experience is seamless, efficient, and tailored to your needs. To that end, I am excited to share some recent technology updates that will enhance our communication and collaboration.

These two new enhancements add to the suite of tech tools I am already using to save time, improve communication, improve my efficiency in dealing with follow up tasks and provide you with the best financial planning service possible.

Introducing Our Virtual Office Via Spatial.chat

Spectrum advisers and our clients are spread across Europe and so we have invested into an innovative virtual office via App.Spatial.chat to offer a more interactive and engaging way to meet remotely. This platform allows for an easy to use virtual face-to-face experience, making it easier for us to discuss your financial plans in a comfortable, secure setting – whether you’re at home or on the go.

This tech does not replace face-to-face meetings but offers us another way of meeting. I will be offering this as an invite option via my Calendly Booking system as well as zoom, teams, telephone calls and, of course, face to face meetings.

When you enter the Spectrum Virtual office, as a guest, you will see a brief introduction as to how it works, you can then enter the main office or any of our ‘country’ offices, via the list on the right hand side of the screen.

Our meetings will be conducted in my own personal office which is password protected so we have complete privacy from anyone else who might be online at the time.

I look forward to seeing some of you there over the coming months.

Secure Meeting Documentation with Otter.ai

To ensure I capture every important detail during our discussions, I will now be using Otter.ai to record virtual and even live face to face meetings, with the agreement of my clients.

This tool allows me to create accurate transcripts of our conversations, helping me stay fully aligned with your financial goals and ensuring that nothing is overlooked.

Rest assured, all recordings and transcriptions will be handled securely, I permanently delete each one as soon as I have downloaded the transcribed notes and follow up to task lists, maintaining strict confidentiality in accordance with data protection standards.

Why These Changes Matter to You

- More convenience: Join virtual meetings effortlessly, without the hassle of traditional video conferencing setups.

- Better accuracy: Transcribed notes ensure that no key point is missed.

- Improved collaboration: We can refer back to meeting summaries for clarity and progress tracking.

Successfully Introduced over the last few years

Cash Calc Secure Client Portal for data gathering, expense tracking, document sharing and even secure messaging: https://the-spectrum-ifa-group-1002.cashcalc.co.uk/register?ref=MTIzMTU=

Calendly booking system for easy call and meeting booking linked straight to my diary https://calendly.com/peterbrooke/30min

DocuSign and Adobe Sign – these allow me to send you paperwork to sign digitally and securely to save us all time and the requirement to print and post documents.

The future of finance is undeniably tech-enabled. By embracing AI and support tools like these, we plan to remain competitive, agile, and customer-focused.

Feel free to get in touch if you have any questions via the below channels, or the booking system – always drop me a quick message if you need a time slot outside of those available.

If you have missed any previous emails, click here to access the Archive.

For now, have a great day, speak soon…

Financial update in France – March 2025

By Katriona Murray-Platon

This article is published on: 6th March 2025

Even though Spring is officially a few weeks away, it certainly feels like it is in the air with the sunnier weather and flowers popping out. We have a large Mimosa tree in our garden which is full of bright yellow, fragrant flowers.

Although it’s ‘better late than never’, we now have a finance law and a budget as of 6th February. The income tax bands have been increased by 1.8% rather than the originally announced 2% as inflation is lower than anticipated.

The new tax bands are as follows:

Tax thresholds applicable in 2025 for income earned in 2024

| Under €11,497 | 0% |

| From €11,498 to €29,315 | 11% |

| From €29,316 to €83,823 | 30% |

| From €83,824 to €180,294 | 41% |

| From €180,294 | 45% |

A new tax; called the “contribution differentielle sur les hauts revenus” (CDHR), has been introduced, and will come into effect next year, for those who earn over €250,000 as an individual or €500,000 pa for couples. This is to guarantee a minimum tax of 20% on their income earned in 2025. Those tax payers who are subject to this tax (i.e. those whose income is largely exempt or subject to the flat tax of 12.8%) have to make an advanced payment of 95% between 1st and 15th December 2025. The exact amount of tax will be calculated in Summer 2026.

A parent, grandparent or great-grandparent can give €100,000 to a descendant without paying tax up until 31st December 2026, subject to certain conditions. The beneficiaries of this gift must use this money in the six months following the gift to buy a new property, or a property soon to be completed or for energy efficient renovation costs to an existing property. If the person does not have children, the money can be given to a niece or nephew. This is in addition to the usual gift allowances. The property purchased or renovated must become and remain their primary residence for the next five years. Since the gift would need to be declared through a notaire, it is important to ask them whether in your situation this allowance can be used.

You can give up to €1000 to charities which provide food, aid, or housing for people in need and get a tax reduction of 75%. Any amounts over this threshold are subject to a tax reduction of 66% up to 20% of the taxable income. The same allowance is granted for donations to charities that protect victims of domestic violence.

There has been much concern from small businesses about the lowering of the VAT threshold to €25,000. This has now been suspended whilst the tax authorities consult with professionals and the minister for the economy has said that for now micro entrepreneurs do not have to make any additional declarations. However the VAT thresholds have already been lowered in the 2024 finance law. In 2025 if your turnover exceeds €85,000 for sales/puchases or lettings or €37,500 for services, you have to charge VAT in 2026 or even in 2025 if you have gone over the threshold of €93,500 or €41,250 respectively.

If you have any questions on any of the matters mentioned above or would like to discuss your own financial situation please do get in touch.

Investing tax efficiently in France

By Occitanie

This article is published on: 24th February 2025

In most countries, tax-efficient savings and investment schemes exist, with the aim of encouraging people to save for their medium and long-term goals. However, the problem when we become resident in France, is that the tax-efficiency that we enjoyed from our ‘home’ schemes (e.g. in the UK, ISAs and Premium Bonds) is usually lost.

This is because as a French resident, you are liable to French taxes on all your worldwide income and gains, except for anything that might be exempted by the terms of a Double Taxation Treaty between the home country and France.

In our last article we covered tax-free cash deposits available in France for short-term needs and liquidity. For the medium to long-term, there is one product that stands ‘head and shoulders’ above the rest and that is an Assurance Vie.

What is an Assurance Vie?

An Assurance Vie (AV for short) is an insurance-based investment in a tax wrapper. It can be as simple or as complicated as you wish to make it, and it has some rather special properties:

- The investments that you place within your AV are never touched by French income tax or capital gains tax as long as they stay inside the tax wrapper.

- The AV is never locked. You can take your money out whenever you like (although as AVs are designed for longer term investment, withdrawals in the early years will reduce tax efficiency and may incur exit penalties in some circumstances)

- If you keep the AV going for at least 8 years, you then qualify for a special income tax-free band on top of your normal allowances, together with a low withholding tax rate.

Millions of French people use the AV as their standard form of saving and investment and many billions of Euros are invested this way via French banks and insurance companies, which offer their own branded product. However, we work with providers across the European market and favour international providers of an AV typically situated in highly regulated financial centres, such as Dublin and Luxembourg. Some of the advantages of the international AV product compared to the domestic French policy are:

- It is possible to invest in currencies other than Euro, including Sterling and USD.

- There is a larger range of investment possibilities available, providing access to leading investment management companies.

- Documentation is in English, thus helping you to better understand the terms and conditions of the AV policy.

- The AV policy is usually portable, which is of particular benefit if, for example, you moved back the UK.

How do I choose what to invest in inside my Assurance Vie?

You may have strong views on this yourself, or you may have no ideas at all, but in all cases, it helps if you have a good financial adviser at hand. His or her job is to help you understand the whole concept of investment and to help you establish your attitude to investment risk.

Your adviser will show you different types of investment options, explain how they work, and how much risk is involved. You make the final decision, but his or her help can be invaluable, and your adviser will be with you to provide ongoing support and advice.

Does an Assurance Vie have other advantages?

Without doubt, the AV is effective for inheritance planning. AVs are considered to be outside of your estate and you can leave them to your chosen heirs on your death (not just the ones Napoleon thought you should leave them to). You can leave each individual beneficiary a sum completely free of French inheritance tax which is in addition to the standard inheritance tax allowances. To maximise this attractive inheritance benefit, an AV should be established and funded before age 70 since, for sums invested before age 70, your chosen beneficiaries are each entitled to an inheritance tax allowance of up to €152,500. For amounts invested after age 70, inheritance benefits still exist but are much reduced.

Can I take income from an Assurance Vie?

Yes, you can use the funds in your AV to provide income if required and, when the policy is 8 years’ old, it becomes particularly tax efficient since an additional tax-free allowance of €4,600 for an individual or €9,200 for a couple, is available to offset against any taxable gain in relation the amount withdrawn – this is in addition to the usual personal allowances.

Is an Assurance Vie right for me?

An Assurance Vie is a valuable asset, helping you to shelter your capital and income from unnecessary taxation during your lifetime and protection for your loved ones when you are gone. However, everyone’s circumstances are different, and it is essential that you take professional financial advice before investing into this type of product.

If there are any subjects you would like us to cover in one of these articles or if you would like to contact one of our advisers for a financial consultation (no fee), then please get in touch at info@spectrum-ifa.com