Empowering People, Ensuring Continuity, and Deepening Commitment to Clients

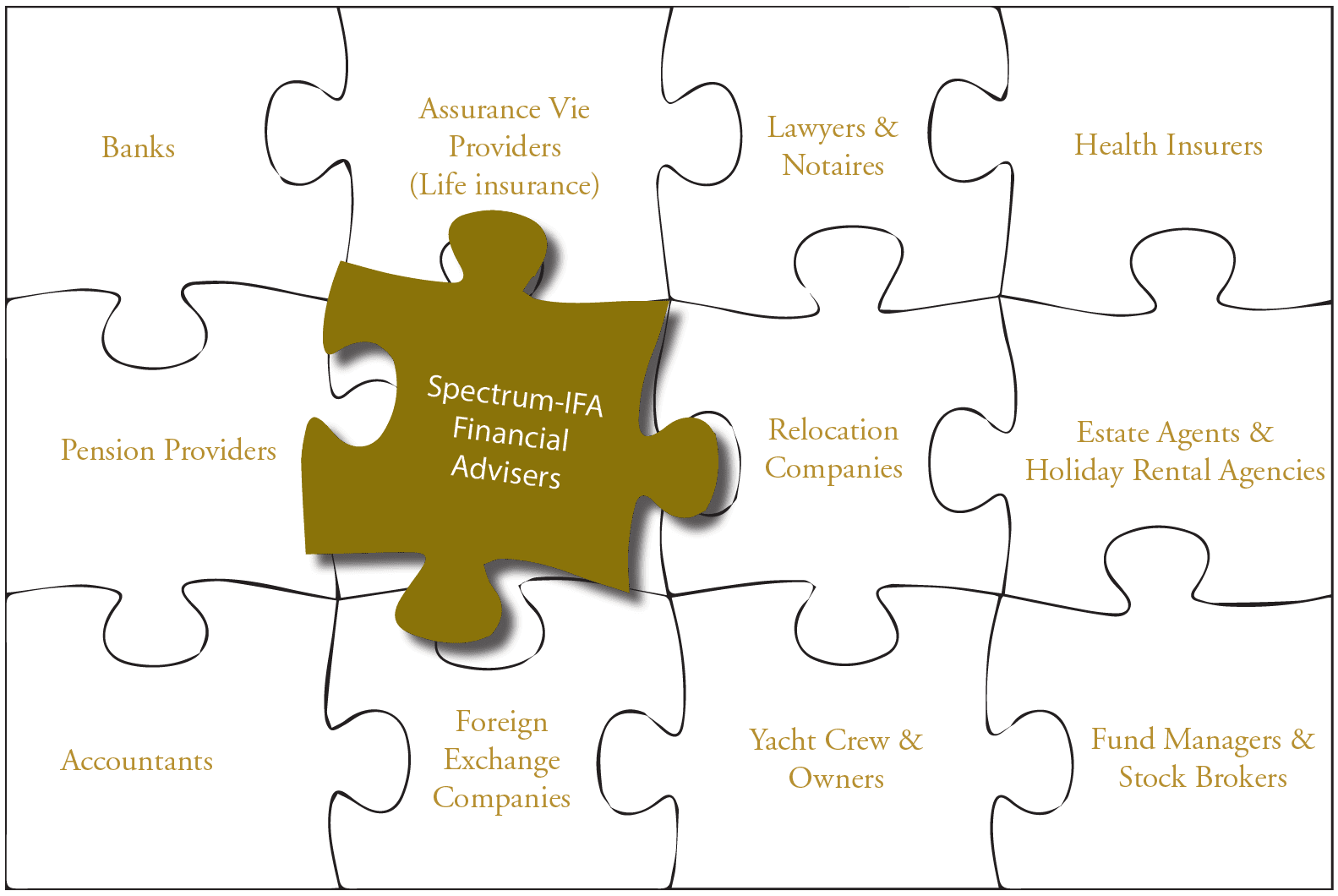

At The Spectrum IFA Group, our success has always relied on our people, their expertise, dedication, and a shared belief in doing what is best for our clients. As a firm founded on trust, transparency and building long-term relationships, we recognise that sustainable growth depends not only on sound financial advice but also a solid grounding in joint ownership and responsibility.

Since its inception, Spectrum has aspired to share company ownership with its advisers and staff. Establishing a clear succession plan is essential, not only to ensure business continuity but also to provide long-term security for our advisers, employees, and most importantly, our clients.

Today, Spectrum’s advisers and staff collectively hold over 15% of the company’s share capital. This initiative reflects our belief that those who contribute daily to looking after our clients’ interests should also participate in the company’s growth. In 2026, Spectrum plans to increase employee and adviser equity participation to approximately 30%. Our longer-term intention is for advisers and employees to own 48% of the business, with the remaining 52% retained by the founders.

This approach demonstrates our commitment to creating a resilient, people-focused organisation where everyone has a vested interest in delivering exceptional advice and service. By aligning ownership with those who directly support our clients, we are securing our longevity whilst embedding the long-term continuity of relationships that help define our unrivalled service standards.

At Spectrum, we view this as more than simply an exercise in restructuring company ownership – it reflects of our core values. We are building an organisation that empowers people, rewards dedication, and safeguards the future security of our clients, advisers, and employees alike. Together, we are shaping a stronger, more sustainable Spectrum team for generations to come.