As an expat, do you make the most out of your finances?

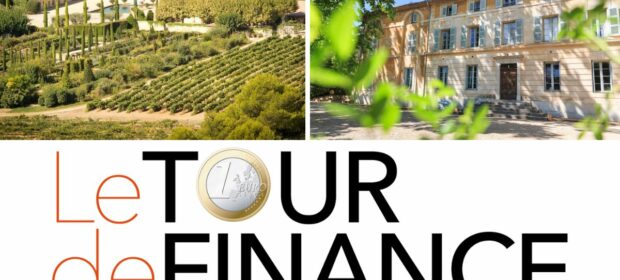

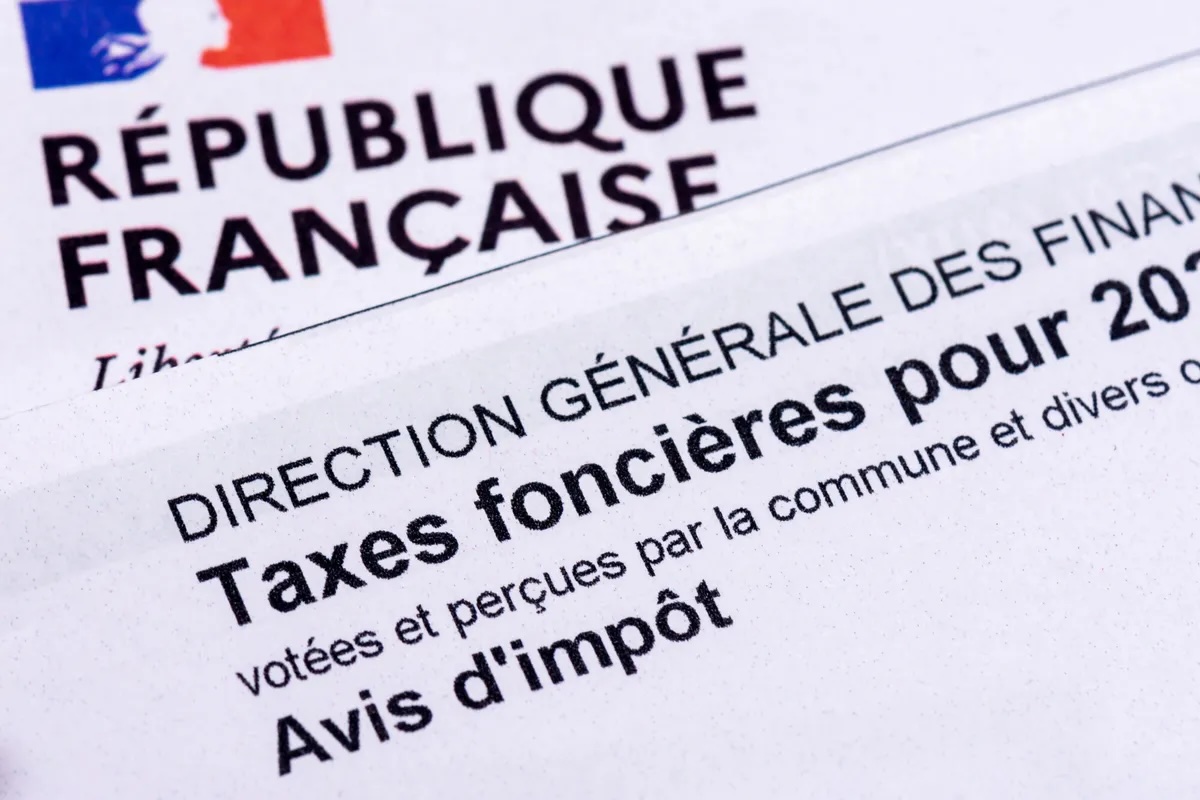

Are you an expat living in France, or considering the move? Managing your finances across borders can feel daunting – tax rules, inheritance laws, pensions, investment accounts… there’s a lot to get right. That’s exactly why we’re inviting you to Le Tour de Finance – two dynamic, expert-led seminars designed to guide expats like you through the ins and outs of financial planning in France.

Each event features a panel of financial specialists who will break down complex topics like Assurance Vie, cross-border tax obligations, pensions / QROPS, investment opportunities, estate planning, and more. Whether you’re already in France, or planning to relocate, these sessions will help you safeguard your wealth, optimise your tax strategy, and make confident decisions for the future.

When:

- Chateau Val Joanis, Pertius, 84120 — 21st October 2025

- Chateau de la Begude, Valbonne, 06560 — 22nd October 2025

Two convenient locations, same powerful content. The format combines expert presentations with opportunities to ask questions, network with other expats, and hear real-world insight from people navigating similar paths.

Why attend?

Because doing your financial planning well as an expat isn’t just about avoiding mistakes—it’s about gaining advantages. With the right advice, you can reduce your tax burden, ensure your investments are legal and efficient on both sides of the border, and protect your family’s future.

Space is limited. If you’re serious about making the most of your finances in France, these seminars are not to be missed.

Register today via Le Tour de Finance, and give yourself peace of mind – so your money works as hard as you do.