In most countries, tax-efficient savings and investment schemes exist, with the aim of encouraging people to save for their medium and long-term goals. However, the problem when we become resident in France, is that the tax-efficiency that we enjoyed from our ‘home’ schemes (e.g. in the UK, ISAs and Premium Bonds) is usually lost.

Investing tax efficiently in France

By Occitanie

This article is published on: 24th February 2025

This is because as a French resident, you are liable to French taxes on all your worldwide income and gains, except for anything that might be exempted by the terms of a Double Taxation Treaty between the home country and France.

In our last article we covered tax-free cash deposits available in France for short-term needs and liquidity. For the medium to long-term, there is one product that stands ‘head and shoulders’ above the rest and that is an Assurance Vie.

What is an Assurance Vie?

An Assurance Vie (AV for short) is an insurance-based investment in a tax wrapper. It can be as simple or as complicated as you wish to make it, and it has some rather special properties:

- The investments that you place within your AV are never touched by French income tax or capital gains tax as long as they stay inside the tax wrapper.

- The AV is never locked. You can take your money out whenever you like (although as AVs are designed for longer term investment, withdrawals in the early years will reduce tax efficiency and may incur exit penalties in some circumstances)

- If you keep the AV going for at least 8 years, you then qualify for a special income tax-free band on top of your normal allowances, together with a low withholding tax rate.

Millions of French people use the AV as their standard form of saving and investment and many billions of Euros are invested this way via French banks and insurance companies, which offer their own branded product. However, we work with providers across the European market and favour international providers of an AV typically situated in highly regulated financial centres, such as Dublin and Luxembourg. Some of the advantages of the international AV product compared to the domestic French policy are:

- It is possible to invest in currencies other than Euro, including Sterling and USD.

- There is a larger range of investment possibilities available, providing access to leading investment management companies.

- Documentation is in English, thus helping you to better understand the terms and conditions of the AV policy.

- The AV policy is usually portable, which is of particular benefit if, for example, you moved back the UK.

How do I choose what to invest in inside my Assurance Vie?

You may have strong views on this yourself, or you may have no ideas at all, but in all cases, it helps if you have a good financial adviser at hand. His or her job is to help you understand the whole concept of investment and to help you establish your attitude to investment risk.

Your adviser will show you different types of investment options, explain how they work, and how much risk is involved. You make the final decision, but his or her help can be invaluable, and your adviser will be with you to provide ongoing support and advice.

Does an Assurance Vie have other advantages?

Without doubt, the AV is effective for inheritance planning. AVs are considered to be outside of your estate and you can leave them to your chosen heirs on your death (not just the ones Napoleon thought you should leave them to). You can leave each individual beneficiary a sum completely free of French inheritance tax which is in addition to the standard inheritance tax allowances. To maximise this attractive inheritance benefit, an AV should be established and funded before age 70 since, for sums invested before age 70, your chosen beneficiaries are each entitled to an inheritance tax allowance of up to €152,500. For amounts invested after age 70, inheritance benefits still exist but are much reduced.

Can I take income from an Assurance Vie?

Yes, you can use the funds in your AV to provide income if required and, when the policy is 8 years’ old, it becomes particularly tax efficient since an additional tax-free allowance of €4,600 for an individual or €9,200 for a couple, is available to offset against any taxable gain in relation the amount withdrawn – this is in addition to the usual personal allowances.

Is an Assurance Vie right for me?

An Assurance Vie is a valuable asset, helping you to shelter your capital and income from unnecessary taxation during your lifetime and protection for your loved ones when you are gone. However, everyone’s circumstances are different, and it is essential that you take professional financial advice before investing into this type of product.

If there are any subjects you would like us to cover in one of these articles or if you would like to contact one of our advisers for a financial consultation (no fee), then please get in touch at info@spectrum-ifa.com

Nations Cup Golf – Malta

By Craig Welsh

This article is published on: 18th February 2025

Presented by The Spectrum IFA Group (“Spectrum”)

Taking place at the lovely Royal Malta Golf Club – the 3 matchday competition launching in December 2024 between teams representing Malta, GB & I, Scandinavia and Nordics and The Rest. The teams of 12, across the various club divisions, will be Captained by Nicky Urpani, Patrick Carey, Alex Hillblom and Gernot MacSchmid respectively.

Another blustery, damp and demanding day greeted Round 2.

Malta taking on the Rest and a tie. 3/3. Highlights included young pair Sam Azzorpardi and Mark Ganado decimating OOM leader Danjiel Bogdanovic and Creasy Cup holder Pavel Lunev and an equally big win for Messrs Scudamore and Crittien against the VC and Moses Kiberu. The other matches were closer and the Rest prevailed in 3 to take a tie including the Sanders/ Baltzis axis, the former playing on 2 hours sleep after watching his beloved Eagles lift the Super Bowl.

In the other Match, Scan/Nordics took 3 1/2 points from GBI who lost the overall again. Currently, Patrick Carey the team captain is under more pressure than Ange Postecoglou, the Spurs Manager, after two defeats. Will he face the axe was the question circling the clubhouse…….

Highlights in this match included another birdie barrage from Tore Lindtveit (5).

Standings:

Scandinavia/ Nordics 7

The Rest 6.5

Malta 5.5

GBI 5

SN play The Rest in the final Matchday on another Public Holiday. 31st March. So, it’s set up for a grandstand finish with the two leading teams against each other.

Of more importance, was a thronging clubhouse and matches played with the highest levels of sportsmanship, and the presence of our valued sponsor, Spectrum, represented by Craig and Jozef.

They were there to present the trophy, which will be handed over to the winning team, next month.

Despite trailing, Malta/GBI still have it all to play for with a big win for either side potentially upsetting the Apple Cart.

Watch out for the next match on 31st March

What did the Romans ever do for us?

By Tim Yates

This article is published on: 17th February 2025

As John Cleese conceded in Monty Python’s “Life of Brian”, they did provide sanitation, medicine, education, public order, irrigation, roads, a fresh water and a public health system – oh and wine! However, they also came up with – pensions.

In 13BC Emperor Augustus had Roman soldiers stationed across the empire, including some poor souls stuck in Britain disillusioned with the weather and living conditions. To keep morale up, Augustus introduced the first Defined Benefit “Final Salary”, pension scheme. After 20 years’ service soldiers could retire with a lump sum equal to 13 years’ salary. It was initially funded by regular taxes but later by a 5% inheritance tax. Perhaps the UK Chancellor has been studying the Romans recently!

Not much then happened on the pension front until the 17th century when the Germans started the first pension fund in 1645. It was set up to provide benefits for widows of the clergy followed in 1662 by a similar fund for widows of teachers. It took another 200 years for civilian pensions to become widespread, with Germany leading the charge again under Chancellor Otto von Bismarck.

Fast forward to today and global pension funds hold over $55 trillion in assets. The largest 300 account for $22 trillion, with the top 10 holding $7 trillion. Japan and Norway’s government pension funds top the list at around $1.5 trillion each. The problem is that many of these funds (Norway being the exception) are struggling and are unsustainable in their current form.

Back in the 17th century, pensions weren’t costly. People worked until they dropped – literally. The pension age was 60, but the average life expectancy was only 45. Today, life expectancy in the Western world is over 80, and many retire in their mid 60’s, meaning pension funds have to support retirees for 15 years or more. That’s problem number one.

Problem number two is “lifestyle investing”. This affects Defined Contribution (DC) “Money Purchase” schemes. As retirement nears, fund managers gradually move investments from the stock market into government bonds, historically seen as the safest asset.

Bonds are basically IOUs and if issued by the UK government are called gilts (because the original certificates had gold leaf embossed edges). These bonds promise to return the initial investment after 10, 20 or 30 years, paying annual interest in the meantime. Investors typically don’t hold them until maturity but trade them in the open market instead.

Imagine in 2020, I borrowed £10,000 from you on a 10 year, interest only basis at 1% a year. At the time, it seemed a good deal – your bank was paying next to nothing. Now, in 2025, you realise you could lend that money elsewhere and get nearly 5%. But I’m not keen to repay early. Your only option, if you want the higher rate of interest, is to negotiate a lower payout, meaning you get back less than £10,000. That’s how bond markets work.

Before the UK’s 2015 pension freedom reforms, most people took 25% of their pension pot as a tax-free lump sum (tax free in the UK not France) and used the rest to buy an annuity which gave them a guaranteed lifetime income. Since 2015 when everyone was given the flexibility to do basically whatever they liked with their pension, most people have taken their tax-free lump sum and then left the remaining funds in “drawdown” – staying invested and taking an income every year – rather than buying an annuity. This seemed safe after decades of low interest rates. But rising rates in 2022-23, driven by inflation, caused bond yields to soar and bond prices to plummet, hammering lifestyle funds.

Charles Stanley, a leading UK wealth management firm, recently analysed the impact of over- reliance on bonds. If you had invested £150,000 five years ago in a portfolio with 80% shares and 20% bonds, it would now be worth £210,000. But if you had gone all in on bonds, your portfolio would have shrunk by 20% to £120,000. This illustrates the divergence between shares and bonds in recent years.

So, what’s the takeaway? First don’t panic. If you have a final salary (DB) scheme, you are protected – provided your scheme is well funded. If you have a DC pension but don’t monitor it , or don’t have someone reviewing it regularly on your behalf, then you should.

We get regular health checks. Our cars get checked once they reach a certain age. Pensions and other investments are no different. Regular reviews ensure you maximise returns, minimise tax exposure, provide financial security for yourself and your family, and avoid unwelcome surprises. After all, the Romans may have invented pensions, but it is up to you to make sure yours actually works for you.

Top financial tips – Spain February 2025

By Chris Burke

This article is published on: 13th February 2025

Let’s get right into it, the start of the year is a chance to get yourself organised and write down that list of life admin tasks you keep putting off and finally complete, one by one – I am no different to anyone else – and how good does it feel when you tick each one off!

I must admit, I keep a list of ‘tasks’ on my phone, but each day I write these down in front of me which seems much more effective – maybe because I am constantly looking at them? Then I ‘tick’ them off as I go – it’s so satisfying!

Anyway, from a finance perspective this month I remind you of those important admin tasks that you really need to make sure you are on top of and which, if you don’t address, could end up costing you and/or your loved one’s money:

Wills

Make sure, particularly if you have children, that you have a Will and that it is up to date/correct. Many people are astounded to find out that even today there are still archaic rules in place in Spain regarding your children and how inheritance rules apply – make sure you understand this and are comfortable with what could happen.

Mortgages

2025 has a strong forecast for interest rates to continue falling, predicting to around 2% by the end of the year. It could be a good time to review that mortgage and make sure you are not over-paying or to secure a better rate moving forward which, over the lifetime of the mortgage, could save you tens of thousands of euros.

Savings/Investments

With interest rates predicted to continue to fall, although possibly not enough to change inflation, it’s important any savings you have are working hard for you – obtaining a 7% return over 10 years doubles your money. With careful planning and investment advice you can preserve/grow your wealth as per your needs.

Inheritance/Gift planning

Depending on where you live in Spain, it can be very important (and valuable) to know and understand how inheritance tax works versus receiving a gift from someone – in many cases it can be beneficial to do the latter, potentially avoiding much larger, future taxes.

I am here to help you get organised and take those financial worries away. If you would like to discuss any of the above topics in more detail, or you would like to have an initial consultation to explore your personal situation, you can do so here.

Click here to read independent reviews on Chris and his advice.

House prices in Spain

By The Spectrum IFA Group Spain

This article is published on: 12th February 2025

What happened to house prices in Spain in 2024 and what can we expect in the year ahead ?

First, let’s consider how the residential property market performed last year. The significant increase in average house prices, reaching €2,164 per square metre, represented a 12.5% increase from the historical peak of 2007.

This growth was largely driven by the following factors:

Sustained Demand: Economic recovery and job stability have encouraged more people to invest in property, in turn maintaining steady demand in the housing market.

Limited Supply: The scarcity of developable land along with building restrictions have limited the supply of new homes, particularly in urban areas and coastal regions, contributing to price increases.

Tax & financial planning in Italy 2025

By Gareth Horsfall

This article is published on: 6th February 2025

Hello again and welcome to this E-zine. (Picture from the olive grove last Sunday morning as the sun was rising)

(Just a quick note to those people who are awaiting my promised E-.zine on the new UK IHT rules which came into force in Oct 2024. I have now completed a draft and will be sending it out soon!)

Since my last newsletter, back in December, I have received many emails of congratulations on the new house and equally many tips of how to manage the land we have. Thank you to you all. Please keep the tips and tricks coming: for example, leaving wild areas for the health of the fruit trees and encouraging diverse wildlife – seems logical but then to one who has never had to deal with these things, it is all new. I am learning new things all the time and interested in the land and seeing it develop. My wife is taking on the task of the house and making sure it is furnished as we would eventually like it to be.

Thankfully, the land doesn’t need a lot of money spending on it, it’s more brute labour force which I am maximising to my benefit by staying fit in the early mornings before I throw myself at the computer.

I have also enlisted the help of a local gardener who , in the last week or so, has helped free 3 very old olive trees from years of being covered by ivy and by other much larger pine trees. They are now free to breath again and will get their well earned ‘potatura’ in a few weeks. (See photo below – there is one in the background, if you can see it!).

I have been busy piling the wood cuttings from the various trees to provide me with a varied menu of BBQ wood this summer! Finally, (the last thing about the house in this Ezine, I promise!) the trattorino tagliaerba arrived recently. Thank god for that because the grass is starting to grow again with the warmer weather and I was starting to worry about managing all the grassy areas with just the push mower. It certainly kept me fit, but in the end it was a bit too much. Now, I just have to decide which bits to mow and which to leave to nature….decisions, decisions!

Anyway, enough of my land management problems.

In this E-zine I wanted to tell you about The Spectrum IFA Group Annual Conference which I attended between the 20th and 24th Jan, this year in Casablanca, Morocco.

We had some of the usual asset managers and specialist firms there from Rathbones Asset Managers, Evelyn Partners, New Horizon, LGT Wealth management amongst others. Interestingly the first day of the conference was Donald Trump’s inauguration day and so we were observing live some of his first actions. He was very much a topic of conversation during the conference; so much so, that since his first day in office things have moved so quickly that I was thinking of not writing this E.zine because almost as soon as I wrote something then it either came to pass, or was wiped aside with another executive order. However, in the last few days a number of people have contacted me about what he is doing and if it is going to cause inflation, an economic downturn in the US and across the world and how it will affect your investments. So, with this in mind I decided to provide some of the information that I gleaned from the investment managers’ minds. Those people who are right at the coal face of what is likely to be a profitable period for America, but one with increased investment market volatility.

PRESIDENT TRUMP….again

I will provide an abbreviated version of what his Presidency is likely to entail because by the time I have written this and then edited it, it is highly likely that things will have changed again. So here are some bullet points we learned from the conference:

Whatever your view is on President Trump the consensus is that he is going to be good for the American economy. He is also about trying to bringing business back to the USA, putting the USA first and stimulating business in the US itself.

He can only run for this final term as US President therefore he has 2 years before the mid terms when the situation could all change again. So, the thinking is that he is in it to make a BIG splash and create large improvements for the US economy in a short time frame. What has he to lose?

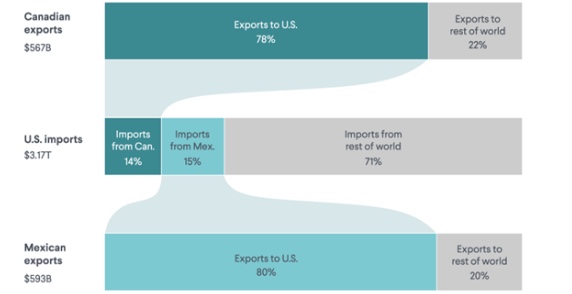

We have already seen that he is going to use tariffs as his weapon of choice, at time of writing Canada and Mexico already seem to have caved in to his demands. The tariff threat is being used merely as at a threat with the idea to create change. And it’s no surprise, re Canada and Mexico, given the figures that we can see below.

** Don’t listen to what he says, watch what he does **

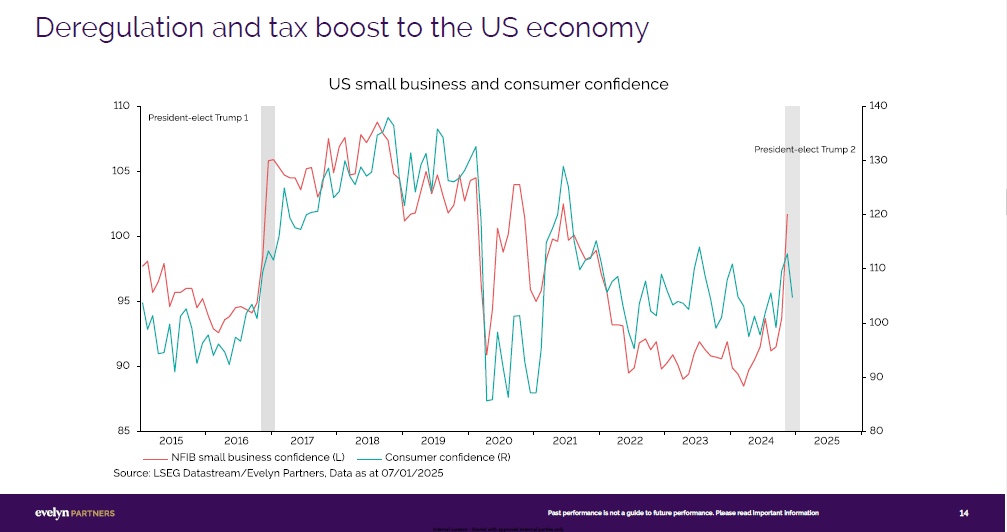

DEREGULATION: Expects big things in this regard: less red tape, cutting the tax code, stimulating business and if you think this is a bad thing, then have a look at the slide below courtesy of Evelyn Partners:

Small business and consumer confidence rose significantly as a result of deregulation during Trump’s first term in office and confidence is rising once again.

DRILL: Some of the best performing stocks in 2024 were mining and explorations stocks: Chevron, Shell and Schlumberger, to name only 3. President Trump has made executive orders to drill for shale gas and open oil fields in the USA as well as mining for rare earths. He wants the US to be energy and resource independent again and become a net exporter. This has obviously come at the price of withdrawing from the Paris Climate Agreement and he has turned back investment in ethical/sustainable projects which poses the question whether this could mean difficult times for wind and solar?

IMMIGRATION: Regardless of the headline news re: illegals being sent back home, the main point is that he is going to make it harder to get into the USA, but it might be important to remember the following:

- 72% of workers in US agriculture are immigrants

- 40% of which are illegal

- and, of which many are employed in Republican Trump states

- so would he want to alienate too many of his core voting states?

Unlikely.

DOGE: (The Department of Government Efficiency headed up by Elon Musk): One of the first orders from the new department was that all government workers must get back to work in the office 5 days a week. Is this good for productivity?? Elon Musk cut 80% of Twitter staff when he bought it, is he about to do the same at Government agencies? Certainly some of the news coming out of this area already is quite interesting from USAID being involved in funding groups to overthrow foreign governments, to blank cheques being written in government agencies without checking what they are being allocated for. The goal is to cut $2 trillion from the government budget, even Elon Musk said that this was a long shot, but watch this space!

(On a more realistic note, there are real life effects of these cuts. One of our relatives in the US is a dog trainer and Professor in animal training and was applying for a job in a California University, all hirings have now been put on hold in academia and she may be back to living in a camper van again as she goes from job to job!)

JYNA: Did you know that this is how President Trump refers to China? (I had no idea)

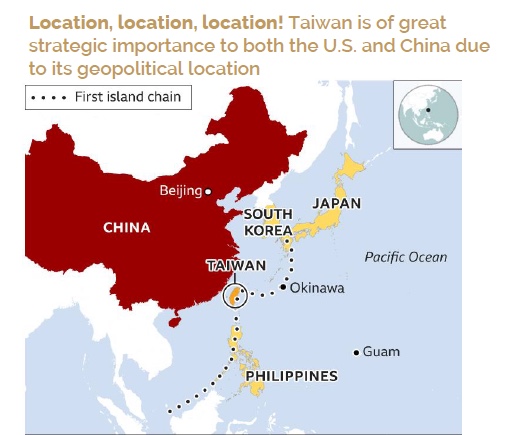

Apart from the recent 10% tariff imposed on Chinese goods into the US, there is really only one thing to be concerned about re China and the US: Taiwan.

China holds the greatest stock of rare earths which are required in all the latest technology and chips, so China holds an ace card in its hand.

* In fact 90% of high end chips produced by Nvidia require these rare earths.

* 80% of Japanese trade goes through the Taiwanese Strait.

* Access to technology is the US’s main priority. So if China were to invade Taiwan ( considered unlikely – what could they benefit from it?), then what would be the US’s response?

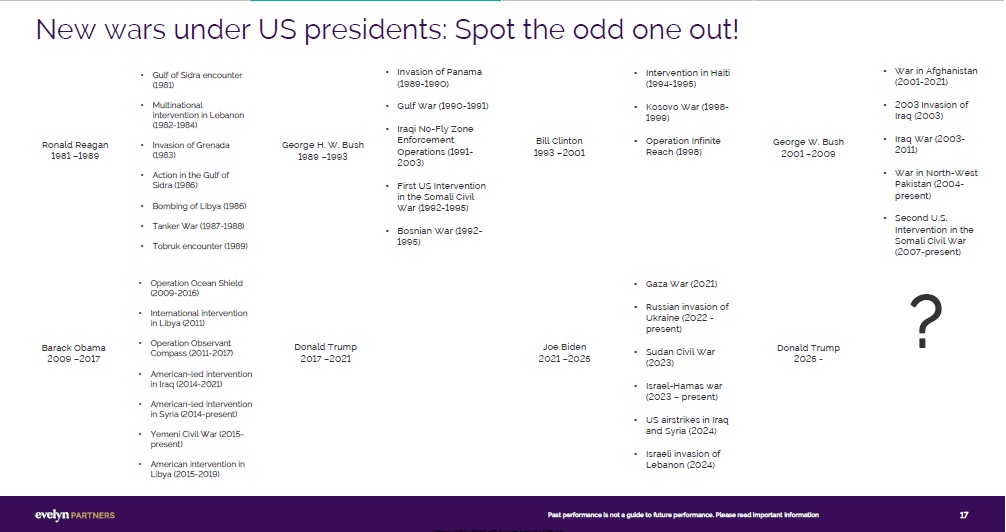

Whilst the US / CHINA spat is the pretext political risk to the world, President Trump is about making deals, not starting wars and compared to other Presidents he has a good track record:

Whilst the US / CHINA spat is the pretext political risk to the world, President Trump is about making deals, not starting wars and compared to other Presidents he has a good track record:

(This slide might be difficult to read, but it’s worth expanding the text to see which US Presidents started the most new wars. A big surprise to me was that Ronald Regan and… Barack Obama! share the record (7 each) – Donald Trump – zero!)

So considering all this, what was the message from the investment managers at the conference?

Trump will be good for America, he will stimulate growth in small to mid sized companies in the US. He will bring jobs and businesses back to the US and he will likely be good for your investments where you have exposure to the US stock market. We may also see a bull market in commodities as well.

But it will come at a price and one which we, as investors, must be mindful of.

INCREASED VOLATILITY: More swings in assets prices based on what I stated above:

** Don’t listen to what he says, watch what he does **

Markets will respond to what he says, but as investors we need to keep our eyes on the actions he takes and cut out the noise. It will certainly be an interesting time but could turn out to be a profitable one for those who ride his Presidency out, and, yes, markets will likely fall at some point and we will all feel some pain for a short period, but remember that investing is mid to long term and most of us have been through something similar, if not a lot worse , before…

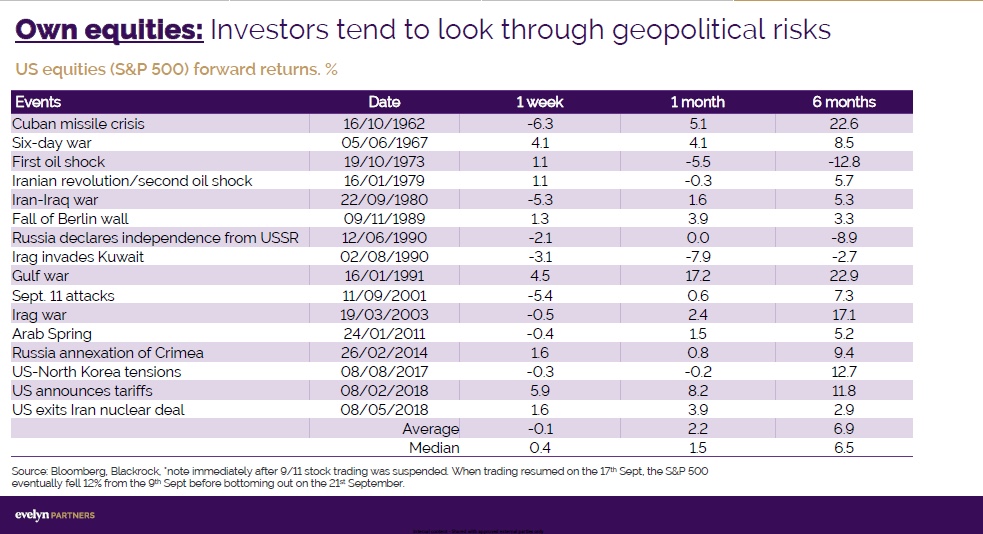

And if you need confirmation of this then check out the following slide:

Equities/stocks are the drivers of growth in most portfolios, what you can see here is that by riding out any invasions/wars, investors in US stocks, in most cases, after just 6 months were experiencing positive returns once again. A good sign for holding your nerve through equity market volatility.

The next E-zine will be the update on the new UK IHT rules which came into force in Oct 2024, which could have an impact on any UK person living in Italy.

If you would like to discuss these or any other tax or financial planning related issues in Italy then please don’t hesitate to contact me on gareth.horsfall@spectrum-ifa.com or call / message on +39 3336492356

Always happy to help where I can!

‘Play it again ‘Uncle’ Sam’

By Peter Brooke

This article is published on: 4th February 2025

Looking forward to 2025

Another year and another wonderful Spectrum conference. More on that in a moment.

Last year, in Budapest, was my 20th conference with Spectrum after which I offered a fairly cautious outlook for the year to come. You can review my thoughts in The view from the Danube

I have now just returned from a superb four days in Casablanca, hence the name of this piece, which was our first ever conference outside of Europe. We had another great group of experts who shared their views on the key themes likely to shape 2025. From the future of US markets under Trump 2.0 to opportunities in bonds and the transformative power of AI; here’s a summary of the insights most relevant to your investments and financial goals. Overall I feel cautiously optimistic looking forward to 2025.

Market Highlights & Opportunities

US Exceptionalism: Can the Outperformance Continue?

Even with the slightly pessimistic outlook for 2024, the US stock market had an exceptional year, with the S&P500 delivering one of its strongest performances in history, though much of this was led by a small handful of stocks.

As we look to 2025, several factors suggest US markets could remain a standout:

-

Momentum: The US economy grew by 3.2% in 2023 and is forecasted to grow 2.8% in 2024, showing resilience despite high inflation and interest rates.

-

Earnings Growth: US companies are projected to achieve earnings growth of 13.8% in 2025—significantly higher than the 7.4% forecast for European companies.

-

Profitability: The US has long maintained a profitability edge over other developed economies, and Trump’s deregulation efforts could further enhance competitiveness.

-

Structural Advantages: Energy independence, favourable demographics, and leadership in technology (particularly AI) continue to position the US ahead of its global peers.

Trump 2.0: Pro-Growth Policies and Market Implications

With the Republican Party securing a clean sweep in the 2024 elections, President Trump is expected to have more freedom to implement his policies in his second term. Here’s what investors should consider:

- Focus on Stock Market Performance: Trump views stock market performance as a key indicator of his success, aligning his administration’s priorities with investor interests.

- Trade and Tariffs: ‘America first’ tariff policies aimed at encouraging manufacturing in the US could have a mixed impact—potentially limiting inflationary pressures but altering global supply chains.

- Tax Cuts and Deregulation: Further tax cuts and red tape reductions are likely. While tax policy changes may take time to impact the economy, they could provide immediate support to stock markets.

- Immigration: A crackdown on illegal immigration could weigh on certain sectors like agriculture, but a scaled-back approach may reduce the economic disruption.

- Geopolitical Stability: Trump’s administration is expected to focus on negotiations over conflict, which may support global market stability.While there are risks—such as high valuations in sectors like Artificial Intelligence (AI), the US markets remain supported by strong fundamentals, making increased exposure to this market a prudent strategy.

UK Bonds: A New Era of Opportunity

Bonds are regaining their appeal:

-

Attractive Yields: UK gilts are offering a 5.5% yield, equivalent to a real return of nearly 3%, presenting an appealing alternative to equities, especially in Europe.

-

Diverse Opportunities: Investors are also finding value in international bonds, including those from Portugal, Romania, and Germany.

-

Volatility Awareness: Bonds have become as volatile as equities, underscoring the need for a well-diversified portfolio.

AI: The Next Growth Engine

The AI revolution is driving innovation and creating new opportunities across industries. It is important to consider those companies who will be enabled by AI and who will earn from “enabling the enabled” as well as those companies supporting the infrastructure of AI.

Key investment areas include:

-

Data Ownership and Infrastructure: Companies like RELX (legal and medical data) and Equinix (data centres) are poised to benefit from the AI boom.

-

Efficiency Gains: Firms such as Rentokil and Waste Management are leveraging AI to optimise operations and drive growth.

-

Cloud Infrastructure: AI can’t happen without the Cloud.

Navigating Risk in 2025

Understanding and managing risk is critical to achieving long-term financial success. I will be writing a newsletter in the coming months focussing solely on ‘risk,’ but for now here are key considerations:

-

Inflation remains sticky: The risk of doing nothing could erode your cash’s value over time.

-

Volatility: Short-term market fluctuations are normal but tend to even out over time, emphasising the importance of staying invested.

-

Longevity: For couples, there’s a 50% chance one partner will live to age 90—making a long-term income strategy essential.

-

Sequencing Risk: Timing withdrawals during retirement requires careful planning to avoid depleting your assets prematurely.

What This Means for Your Portfolio

With markets adapting to new norms, a balanced and diversified approach remains crucial:

-

US Market Focus: While US equities remain a core component, avoiding over-concentration in sectors like AI is vital. Just 7 companies make up 33% of the S&P 500 index and contributed 55% of all the returns of the S&P500 in 2024 – the largest concentration in history.

-

Employ Active Managers: Passive investors have had a great run, especially if invested in US equities but as we have already seen this month the AI Titans have sold off on one piece of news from China. Active managers will control these concentration risks.

-

Global Bonds: High yields make bonds an attractive addition to portfolios, particularly for those seeking income and stability.

-

Alternative Investments: Assets like gold can provide a hedge against geopolitical risks and inflation.

I would very much like to thank the investment management teams at RBC Brewin Dolphin, Rathbones Investment Management, Evelyn Partners, New Horizons, Alquity Investments, VAM Funds and Prudential International for their time and expert views for the content in this update.

Here are some links to other articles supporting this summary if you want to dive deeper into the details:

US Continues to Outperform https://www.evelyn.com/insights-and-events/insights/can-us-outperformance-continue/

A look back on 2024 https://www.evelyn.com/insights-and-events/insights/2024-investment-review-ifa/

Trump 2.0 https://www.lgtwm.com/uk-en/insights/market-views/trump-politics-the-global-order-250934

The excellent monthly Rathbones Sharpe End Podcast https://www.rathbonesam.com/uk/sharpe-end-podcast#podcasts

French financial update February 2025

By Katriona Murray-Platon

This article is published on: 3rd February 2025

In January at our annual conference in Casablanca it was nice to escape the cold, dark mornings of France and get a bit of sunshine. It was an interesting and informative conference thanks to our product providers bringing their various observations and opinions about investment markets and geopolitical events.

On 20th January, just as we were arriving at our conference, Donald Trump was sworn in again as the American president. He wasted no time getting to work with executive orders. On day two of our conference, Rathbones Asset Management presented their views on what we can expect from Trump 2.0. The phrase “Drill, baby, drill” was mentioned more than once – like his first term in office, we can expect (to the extent that Donald Trump’s decisions can be predicted) that he acts to protect American interests and American businesses with tax cuts and less regulation, which in turn is likely to be good for the US economy. This time around it looks like he has his eye on imposing tariffs on everything.

There was much talk about how well the US market had done last year. However, Rathbones also highlighted the following:

- 29% of the global stock-market (as measured by the FTSE All World index) is now in the technology sector, and of this, 19% is concentrated in just seven companies

- 65% of the FTSE World index now comprises US companies

- the top 10 holdings in the FTSE World index account for 23% of the index’s total value

So, whilst markets (and investors’ portfolios) have performed well, the dominance of the “Magnificent Seven” is a concern for some investors.

On the subject of risk, RBC Brewin Dolphin gave us a fascinating presentation on this important aspect of investment management. We often associate risk with the possibility of something bad happening if we take a certain action. Whereas is in practice there is risk in everything we do and everything we don’t do. Over the past few years, the negative impact of inflation on the value of our cash has been significant. For the long-term investor, though, with sensible planning, there is the opportunity to protect capital from erosion by inflation and to achieve strong ‘real’ returns.

It is important to review your appetite for risk regularly. The risk of being too cautious in your investment choices, for example, may lead to disappointment in the years come.

On day three of our conference, which was the second day of Donald Trump’s second term in the White House, he had already introduced executive orders and other measures, which meant that our presenters, Evelyn Partners and LGT Wealth Management, had fresh insights for us. This is likely to be an ongoing theme of Trump 2.0 – there will be lots of change, there will be lots of noise, there may be action that may need to be reversed for not complying with the law and/or the US Constitution, and there may be controversy. However, as controversial as Donald Trump is, and regardless of your personal views on his character, the consensus is that he will be good for the markets.

Prudential International told us about their funds’ positive performance in 2024, how inflation seems to be easing and how property values are showing signs of stability. In 2024 Prudential completed investments in two French forward living projects, notably Clichy Rue du 8 mars, in Paris, and Aurientis, a senior living development in Aix-en-Provence. They now have their sights set on projects on Rue de le République in Lyon, Leadenhall in London and Haymarket in Edinburgh, which are scheduled to complete by the end of 2025.

There were mixed views from our presenters on whether bonds would be a good investment in 2025. New Horizon Asset Management gave us their predictions for 2025 and showed us which of their predictions in 2024 had been accurate.

I have spoken to many people in the past about some UK pension providers requiring them to buy an annuity. Conversely, without a UK address, an annuity is generally unavailable to British expats in France. This however is not an obstacle to successful retirement planning. We work with international pension providers such as Novia Global and iPensions who provide low-cost pension solutions, with a range of investment opportunities, and the option to receive payments in Euros or Sterling. If you or someone you know would like to arrange a free, no obligation, pension review, please get in touch.

In France, there is still no finance bill, which is a cause for concern. Recent issues of Le Particulier magazine (I am a subscriber) have been rather thin. There is some financial news however that may be of interest. New PEL accounts, opened since 1st January 2025, are now paying 1.75% interest as opposed to 2.25% previously. Also, your electricity bill should reduce by around 14%, from 1st February.

If you are heading to Bordeaux, or to any of the other major towns in France, you will need to have a Crit’Air sticker in your car as of 1st January 2025.

Finally, as a reminder, please be vigilant when communicating with financial institutions. You can now look on the impots.gouv.fr website for accounts registered in your name, a worthwhile exercise to check for any that you may have forgotten about, or which may have been opened without your consent (unlikely, but worth checking). You will find this in the “other services” tab on the Impots website.

If you have any questions on any of the points made above, please do get in touch.

10 financial planning tips for Portugal

By Portugal team

This article is published on: 31st January 2025

Good financial planning can protect your family´s future, save money and provide peace of mind. But where do you start?

When it comes to living in Portugal, understanding key tax rules, your financial options and the right questions to ask, can really make the difference.

- Tax residency determines where you pay taxes

You cannot choose where to pay your taxes—your tax residency determines this. If you are a tax resident in Portugal, you must declare and pay tax on your worldwide income and gains in Portugal, even if tax is also due in another country. For instance, if you receive rental income from a UK property, tax is due in the UK, but it must also be reported and potentially taxed in Portugal. You will get a tax credit from the UK so you will not pay tax twice, but tax may still be due in both countries.

- Overseas income must be declared

Some believe that if they do not bring foreign income or assets into Portugal, they do not need to report or pay tax on them. This is incorrect, as Portugal does not operate a remittance-based tax system. All worldwide income and gains are taxable in Portugal, regardless of where they arise.

- Non-UK long term residency rules and inheritance tax (IHT)

In Labour’s budget in October 2024, the government announced that the concept of UK domicile (which currently determines one´s liability to UK inheritance tax on their worldwide estate) will be replaced by a residency based system from 6th April 2025. Therefore, individuals who spend 10 or more years out of the last 20 (before death) will only face UK IHT on UK based assets. Restructuring your asset base outside of the UK can greatly reduce or eliminate any future UK IHT.

- Estate planning for Portuguese residents

Portugal does not have a direct inheritance tax, but stamp duty at 10% applies to Portuguese assets inherited by non-immediate family members (e.g. siblings, nieces, and nephews). Holding assets outside of Portugal and proper estate planning can help minimise future tax burdens for your heirs.

- UK pension transfers are not mandatory

If you are living in Portugal, you do not have to transfer your UK pension overseas. Whether an overseas transfer is right for you depends on multiple factors, including how you plan to use your pension. For example, if you intend to withdraw your pension in full, a transfer may be unnecessary and could incur fees without added benefits. However, if you do not intend to use your pension during your lifetime and meet the UK non-long-term residency rules, a transfer could remove your pension from the UK Inheritance Tax net.

- Plan pension taxation beyond Non-Habitual Residency (NHR)

Foreign pensions, including UK pensions, are generally taxable in Portugal. While NHR offers a temporary reduced tax rate (currently 0% or 10%), this benefit does not last indefinitely. Planning ahead and restructuring during your NHR period could significantly reduce future taxation.

- Choosing between QNUPS and investment bonds

Investing in a Qualifying Non-UK Pension Scheme (QNUPS) or an investment bond depends on your personal circumstances. However, a key difference is that QNUPS income is always taxable, meaning you may pay tax even if no gain is made or you have made a loss! With an investment bond, only the gain element is taxable, which may be a more tax-efficient option.

- Investment income is taxable, even if not withdrawn

A common misconception is that if you do not take income from your investments, you will not be taxed. In Portugal, tax is due on an arising basis, meaning income, dividends, and capital gains are taxable when they are paid or realised (sale or switch of any fund/holding), unless held in a tax-efficient structure such as a pension, company, trust, or investment bond.

- Capital gains tax applies when selling a home

When selling a property in Portugal, 50% of the capital gain is taxed at scale rates. However, main residence relief is available if 100the full proceeds are reinvested into a new primary residence, a pension, or a long-term investment. The latter options allow flexibility to release capital while securing future income.

- Consider the impact of exchange rates on your income

If you receive income or pensions in a currency other than euros, fluctuations in exchange rates can impact your finances. Using a currency exchange service or planning ahead with fixed-rate transfers can help stabilise your income and reduce the risk of unfavourable rate changes.

With over 35 years’ experience, Debrah Broadfield and Mark Quinn are Chartered Financial Planners and UK Tax Advisers specialising in cross-border advice for expatriates. For a complimentary initial consultation please contact +351 289 355 316 or portugal@spectrum-ifa.com. Alternatively, visit www.spectrum-ifa.com.

Why a Financial Adviser is Essential for Expats Living in Spain

By Barry Davys

This article is published on: 18th January 2025

Change is inevitable, and for many, it can be unsettling—especially when moving to a new country like Spain. Navigating the complexities of a new tax system, managing investments in unfamiliar markets, and ensuring your financial future aligns with both your personal goals and local regulations can be daunting.

Fortunately, in the 19 years I have been in Spain, many of my clients have placed their trust in me, allowing me to guide them through these challenges on their financial journeys. While seeking professional advice might involve a cost, the peace of mind it provides – and the assurance that your wishes are carried out efficiently and effectively – makes it an invaluable investment.

For expats living in Spain, the need for a financial adviser becomes even more apparent. The financial landscape here is unique, with specific regulations, tax implications, and cultural nuances that can easily trip up even the savviest individuals. An experienced adviser ensures that every decision you make is informed, compliant, and tailored to your needs.

The Value of an Adviser in Spain

When you choose to work with a financial adviser in Spain, you gain far more than someone to manage your investments. Here’s what we bring to the table:

- Navigating Spanish Tax Systems: Spain’s tax system is complex, particularly for expats. From wealth taxes to inheritance taxes and the rules around double taxation treaties, an adviser can guide you through the maze and help optimise your arrangements.

- Structuring Tax-Efficient Investments: An adviser ensures your assets are structured to maximise tax efficiency during your lifetime and, importantly, for your family after you’re gone.

- Providing Stability During Market Turbulence: When stock markets fluctuate, it’s easy to panic. An adviser helps you maintain perspective, adapt strategies if necessary, and keep focused on your long-term goals.

- Liaising with Local Experts: In Spain, financial planning often requires collaboration with tax lawyers, notaries, and other local experts. A good adviser coordinates these relationships to safeguard your interests.

- Accessing Expert Investment Insights: Advisers have access to fund managers and global investment opportunities that may outperform self-managed options. This expertise ensures your investments are aligned with your risk tolerance and financial goals.

- Supporting Life Transitions: Whether you’re buying property in Spain, starting or selling a business, or preparing for retirement, an adviser provides a steady hand to guide you through every major change.

Preparing for Life’s Uncertainties

As an adviser with decades of experience, I’ve walked with my clients through every stage of life. For expats, ensuring your financial affairs are in order is crucial—not just for you, but for your loved ones. If your next of kin are unfamiliar with Spanish legal and financial requirements, settling your affairs can become an overwhelming burden.

A good financial adviser ensures everything is prepared ahead of time, reducing stress for those left behind. This includes organising inheritance planning to minimise tax liabilities and ensuring your wishes are carried out exactly as intended.

Planning for Continuity

Even as I consider the future of my own practice, I reflect on the importance of continuity. For my clients, this means having a trusted team in place to manage their affairs should I no longer be available. Similarly, expats need to consider how their financial arrangements will be managed over the long term, especially in a foreign country.

Why You Shouldn’t Go It Alone

While it’s possible to manage your finances independently, the risks of missing out on key opportunities or making costly mistakes are significantly higher. This is especially true in Spain, where the rules and regulations are often different from those in your home country.

Working with a financial adviser ensures that every aspect of your financial life is optimised and aligned with your goals. It’s not just about avoiding pitfalls, it’s about unlocking opportunities that you might not even know exist.

Take Control of Your Financial Future

Whether you’re new to Spain or have lived here for years, the value of professional financial advice cannot be overstated. By partnering with a knowledgeable adviser, you gain more than financial stability, you gain peace of mind, knowing that every decision you make is informed, strategic, and designed to protect your future.

Don’t leave your financial future to chance. Take the first step today. Send me a summary of your situation at barry.davys@spectrum-ifa.com and discover how tailored financial advice can help you achieve your goals while navigating the unique challenges of living in Spain.

Contact me now to begin your journey toward financial clarity, security, and success. Your future self, and your family, will thank you.