I am writing this at the end of another year in which I found myself helping people relocate from the UK to retire to Spain. For many, this was a lifelong dream, for others it was a case of simply having had enough of the UK.

By Jeremy Ferguson

This article is published on: 24th December 2024

I am writing this at the end of another year in which I found myself helping people relocate from the UK to retire to Spain. For many, this was a lifelong dream, for others it was a case of simply having had enough of the UK.

The process is now a lot more involved than it was before Brexit, and my role tends to be focused on making sure all of their finances stack up, and being as tax and investment efficient as possible once they arrive. There are certain things to consider before you leave the UK; an example could be taking your pension lump sum in the tax-free environment of the UK, or making sure your house sale doesn’t create tax implications once you become Spanish resident. This typically revolves around the timing of your move here, which can be critical in relation to effective tax planning.

What has really been obvious to me this year with most of my new clients is the ‘unusual part’ of my job that I had not really come across too much in the past. Most people have been used to making money all of their working lives, be it in the form of receiving a salary each month, or making profits from self-employment. But when retirement comes along, income from working suddenly stops and in the case of people retiring to Spain, they suddenly find themselves in a situation where they no longer receive ‘earned’ income. For many, this is a very difficult situation to deal with psychologically, as they become fearful of spending money.

And this is the unusual part I am referring to, as I find myself spending a lot of time with people running through their finances and expenditure, showing detailed projections of how long their money will last going forward. Of course, it is very difficult as no one knows how long they are going to live, and no one knows what their money will be making going forward, but by making sensible assumptions on both considerations a pretty realistic picture can be painted.

This is the point at which I really emphasise the power of ‘passive income’, and help people to understand its relevance and value. Simply put, even though you have stopped earning money when you retire, it doesn’t mean you have stopped making money. With interest on bank deposits, and growth on investments and pensions, whilst you may be enjoying life relaxing on the beach or playing golf, your hard-earned savings are working away in the background for you. This is why it is so important to keep a close eye on your assets, making sure they are working as hard as possible for you. I always refer to this as passive income.

Over time people become more relaxed about their new situation in retirement, but to start with it can be very difficult to adjust. This is why I spend a lot of time talking with people, explaining that as they ease into retirement this is something that will start to take a back seat in their daily worries, and spending money will become less of a stressful issue. Regular reviews of their financial situation are a great help when it comes to ‘proving’ things will be ok!

If you would like help when it comes to planning your retirement, then please do not hesitate to get in touch.

And let’s hope 2025 is a prosperous year for us all.

By Katriona Murray-Platon

This article is published on: 4th December 2024

The year 2024 is drawing to a close. Financially it has been a rather good year in the markets with a lot of our clients’ portfolios doing much better this year than previous years. Even as you start to prepare for Christmas or wind down at the end of the year, there are still some financial points you should be aware of.

The interest rates on the Livret A and the LDDS savings accounts will reduce from 3% to 2.5% next year (probably in February). Even though the rate has dropped these accounts are still a good place to keep money needed for the short to medium term. Any amounts that you do not foresee needing or you want to get a better return from without paying tax, should be put into an assurance vie.

Christmas is a time for giving whether that is to families or charities. Although gifts to friends and family normally have to be declared, for events such as birthdays or Christmas, you can give money to your loved ones without having to declare these amounts to the tax office. This is known as a “presents d’usage”. If you wish to give money by bank transfer it is advisable to put on the transfer order the words “Présent d’usage pour Noel” so that there is no doubt about the fact that it falls under the exemption.

If you haven’t been giving to charity regularly over the year, now is the time to gift money to any worthy causes. Gifts to charities of general interest or recognised as of public utility in France would allow you to benefit from a tax reduction of 66% of the amount gifted up to a maximum amount of 20% of your taxable income. Gifts to charities who help those in difficulty receive a tax reduction of 75% of the amount gifted for amounts under and including €1000. Any amount over €1000 will get a tax reduction of 66%. In both cases the tax reduction cannot be more than 20% of your taxable income.

You have until 4th December to amend your 2023 tax return online from your online account on the impots website.

After this date you will only be able to submit a paper return with any amendments.

Until 12th December you can change the amount of the 60% advance that you will get for your tax credits and reductions which is normally paid mid January.

December is the last chance to add some money to your PER retirement accounts if you have the money to do so and if you want to reduce your tax liability. You can put as much as you like into the PER but the tax benefits are limited to either up to 10% of your annual income up to a certain amount or 10% of the PASS (see below). You may also use any unused amounts from previous years, these will appear on your 2023 tax statement. This amount is deducted from your taxable income before being assessed at your marginal rate.

The PASS (plafond annual de la sécurité sociale) has increased by 1.6% and is set at €47,100 for 2025 or a monthly amount of €3925 (compared with €3864 in 2024). This has an impact on the maximum amount you can receive from daily sick leave pay for occupational illnesses or maternity pay, disability allowances or French pensions. It is also used to calculate the maximum amount you can pay into a PER retirement account.

There are still a few weeks in December and I will be working until 20th, seeing existing clients and meeting new ones. We are going to spend a few days in London and then travel up to Liverpool to spend Christmas with my family.

I hope you have a lovely holiday season with all your friends and family and I look forward to bringing you more financial news and information next year.

By Gareth Horsfall

This article is published on: 1st December 2024

Before I get into things I thought I would share a picture of my olive oil container (fusto), all 50 ltrs of it! The raccolta, which I did at the start of October with the help of some locals, produced approx 150 ltrs of oil, of which we split 3 ways.

It seemed only fair given I had no equipment and had no idea what I was doing and this will easily cover our annual consumption and maybe some gifts to friends and family. What a great experience though!

Next year I will get more organised and see what I can arrange. The olive oil may be virgin but my virgin olive oil raccolta days are now finally over! I am now starting to really earn that Italian citizenship!

On the property front we are finally getting to the end of the things to be done….at least for now.

After a disastrous first kitchen fitting we had to order another one and will receive that in the coming weeks. We have been cooking and eating in an out house for the last 4 months, but as the colder weather is now settling in it’s becoming more difficult to say the least!!

All the other little bits, which take time and effort, are getting completed meanwhile I am still loving the surroundings, olive trees and watching autumn turn to winter and the changing landscape. I am also finding that on our ‘terreno’ we have a whole load of wild plant foods growing: cicoria, wild finocchio, asparagus, and numerous other edible plants.

I would never have known if it wasn’t for the ex-owner who came around and pointed them all out and advised to do some foraging rather than keeping the grass short everywhere. I will see how that pans out, but it could be interesting and I am keen to try and use the land rather than just curate it (mainly because cutting grass every 2 weeks is hard work) and so I have lots more to learn. A fresh organic larder on the ‘terreno’ might just be the thing; in the areas that I have let grow wild to date the insects and birds seem to be having a ball anyway and some interesting wild orchid type plants have popped up as well.

Anyway, moving swiftly onto financial matters because I imagine you are more interested in that than my explorations of country life…

I refrained from writing an E.zine directly after the US election because everyone seems to have their own opinion of Donald Trump so it matters not what I think. In the end what does matters, for our purposes, are the financial markets and how they react to such events.

If you hadn’t noticed the immediate reaction was very healthy indeed and stock markets rose on the back of the news. Trump is a self confessed businessman after all !!

I saw him doing an interview the other day in which he said that he had spoken to lots of business people since his last time in the Oval Office and had asked what was more beneficial for them: reducing taxes or reducing regulation and bureaucracy. He explained that every one of them said that reducing over-burdensome regulation and bureaucracy was more important by far. So, it might be reasonable to assume that should he be able to follow through with this aim that he can provide a healthy landscape for US companies to flourish.

Certainly the indicators are good! He also has his Department of Government Efficiency head – Mr Elon Musk, rationalising the US government agencies so that should be something interesting to watch if his firing of employees when he took over Twitter is anything to go by.

I myself can confirm that over-burdensome regulation affects our business tremendously these days; there seems to be more and more paperwork than ever before, and much of it could be eliminated or reduced significantly. However, I don’t see that happening any time soon especially from the direction of EU, who set the rules, so we will continue to deal with it. Tech now plays an important part for us in gathering and dealing with client information and it saves you and I a lot of time.

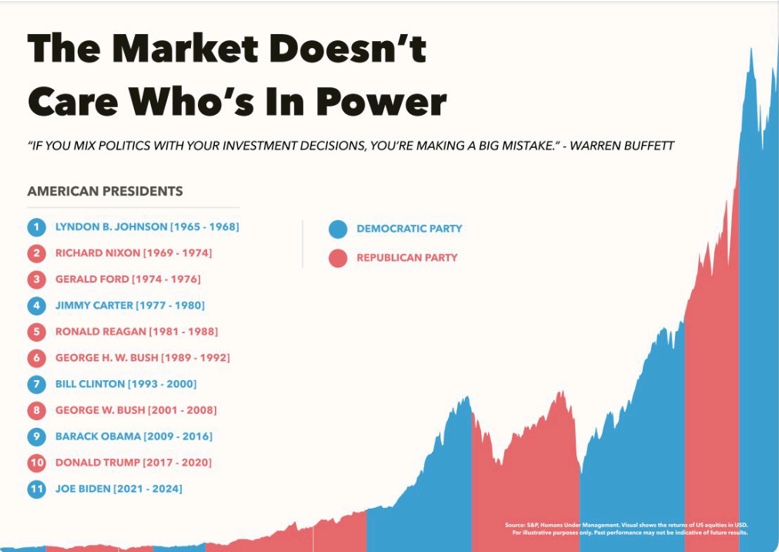

But regardless of all of this, we have to consider how financial markets will continue to react and, at the time of the election someone shared on LinkedIn a graph which I will share with you below:

As you can see, the stock market doesn’t care who is in power, we can all have our own views on Donald Trump and his effect on the world, but in the end it doesn’t matter one tiny bit; but there are 2 takeaways from this graph:

1. The market rises over time

2. In every period there is market volatility and there will be moving forward.

The stock market may have risen since the election and Bitcoin is equally flying, but be under no illusion, at some point markets will correct.

The best thing to do is be invested in solid companies and diversify your portfolio. Match it to your risk profile and decide how much of those ups and downs you can stomach. Patience will take care of the rest for you.

Your financial enemy is not Donald Trump nor anyone who will come after it is simply inflation! The rise in the cost of goods and services over time. Keep your eye on that and not on the daily swings in markets.

On the subject of inflation, it continues its rise – I can’t believe how much things cost in relation to the new house we bought. I asked for a quote from a local gardening firm to cut a long hedge, which is quite overgrown, and when I got it back my eyes started to water. So, like a good Yorkshire man I went out and bought a chainsaw for €180 and thought I would just do it myself, piano piano. In the process I saved myself a whole load of money! Equally, the daily rate for builders, electricians, plumbers etc is now so high! Obviously their cost of work has increased and that is being passed onto us.

Are you an investor in crypto currencies? Well there is some rather alarming news for you moving into 2025, if you are an Italian resident for tax purposes.

From 1st Jan 2025, the capital gains tax rate on crypto currency speculation will increase from the flat standard CGT rate of 26% to a whopping 42%! Not great news for you if you have been investing in crypto and are sat on healthy gains, certainly given the fact that Bitcoin has risen significantly over the last few months, effectively doubling in price.

One way to mitigate the higher tax rate on your historic gains might be to cash out before the end of the year and pay your 26% on historic gains in next years tax return. At the same time you can buy back in and in that way you reset the clock on the purchase price, to the new amount. Clearly this means paying 26% CGT on your gains to date, but if significant then it could be worth it. From there on in it will be 42% on realised gains.

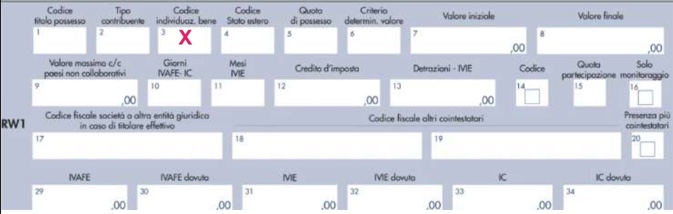

One of the things I help my clients with these days is taking a look at their tax returns and making sure that the section Quadro RW ( declaration of overseas assets) is prepared correctly.

This year I found a number of incorrect entries from commercialisti and got them corrected, saving some clients thousands in tax. However, to be fair to commercialisti they are often bombarded with information which is in English and on statements which they don’t know how to interpret. It is no wonder they sometimes get it wrong and we can’t expect them to understand non-Italian portfolio or cash transaction statements. However, that’s no excuse and either we or they have to be more attentive.

So, here’s one tip for checking your own Quadro RW.

You will find in that section that there are lots of little boxes, in which various values need to go. In box No.3 you will find the title.

This is nothing other than the number which you (or your commercialista) must select to identify the type of asset that you hold abroad, but clearly it’s not much good if you don’t have the list of identifier numbers. So, here, below, I have included a list of all the different codes:

| CONTI CORRENTI E DEPOSITI ESTERI | 1 |

| PARTECIPAZIONI AL CAPITALE O AL PATRIMONIO DI SOCIETA NON RESIDENTI | 2 |

| OBBLIGAZIONI ESTERE E TITOLI SIMILARI | 3 |

| TITOLI NON RAPPRESENTATIVI DI MERCE E CERTIFICATI DI MASSA EMESSI DA NON RESIDENTI | 4 |

| VALUTE ESTERE DA DEPOSITI E CONTI CORRENTI | 5 |

| TITOLI PUBBLICI ITALIANI EMESSI ALL'ESTERO | 6 |

| CONTRATTI DI NATURA FINANZIARIA STIPULATI CON CONTROPARTI NON RESIDENTI | 7 |

| POLIZZE DI ASSICURAZIONE SULLA VITA E DI CAPITALIZZAZIONE | 8 |

| CONTRATTI DERIVATI E ALTRI RAPPORTI FINANZIARI CONCLUSI AL DI FUORI DEL TERRITORIO DELLO STATO | 9 |

| METALLI PREZIOSI ALLO STATO GREZZO O MONETATO DETENUTI ALL'ESTERO | 10 |

| PARTECIPAZIONI PATRIMONIO DI TRUST, FONDAZIONI O ALIRE ENTITA GIURIDICHE DIVERSE DALLE SOCIETA | 11 |

| FORME DI PREVIDENZA GESTITE DA SOGGETTI ESTERI | 12 |

| ALTRI STRUMENTI FINANZIARI ANCHE DI NATURA NON PARTECIPATIVA | 13 |

| ALIRE ATTIVITA ESTERE DI NATURA FINANZIARIA E VALUTE VIRTUALI | 14 |

| BENI IMMOBILI | 15 |

| BENI MOBILI REGISTRATI (es. yacht e auto di lusso) | 16 |

| OPERE D'ARTE E GIOIELLI | 17 |

| ALTRI BENI PATRIMONIALI | 18 |

| IMMOBILE ESTERO ADIBITO AD ABITAZIONE PRINCIPALE | 19 |

| CONTO DEPOSITO TITOLI ALL’ESTERO | 20 |

Each number relates to the different type of assets you may hold. No 1 being conto correnti e depositi, which is current accounts and deposit accounts. However, be aware that there are different interpretations because National Savings Certificates or money market accounts, for example, will not fall into this category in Italy even though they may seem as though they should based on our interpretation.

A good start is to get a copy of your Unico tax return and check that the numbers are inserted correctly. You can work the figures out as well, but an asset declared incorrectly i.e bank account instead of stock portfolio, could end up costing you!

Remember, that you can down load a copy of your tax return now on the Agenzia delle Entrate website if you have a SPID or the carta d’identità elettronica which you have linked to the app. We have all the tools, so let’s use them or alternatively, just ask me!

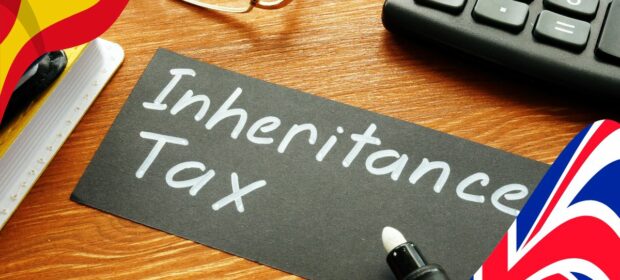

On that note, I will leave you with this shorter E-zine. I will be writing about UK Inheritance tax and the very important changes that have occurred in the 30th October budget in my next E-zine. For once some tax changes could be a huge bonus for anyone looking to live in Italy for the rest of their lives and then pass on as much as possible to their heirs. The rules have been changed to make it much more clear on how you can now escape UK inheritance tax. For the likes of us who live in Italy, where from an inheritance tax point of view the country is like a fiscal paradise, we have a clearer path to taking advantage of Italy’s rules rather than the UK, but like almost everything it will require carefully planning and a full understanding of the changes.

I will certainly get that Ezine to you before Xmas !!

By Barry Davys

This article is published on: 26th November 2024

It is highly unusual for a UK budget to give us an opportunity to significantly reduce our tax liabilities. The budget of the 30th October 2024 has done exactly this, and by following a few basic steps it is easy, for those of us who have lived outside the UK for more than 10 consecutive years, to benefit greatly.

The UK currently has an Inheritance Tax system where the estate of the deceased is assessed based on worldwide assets if they were considered domiciled in the UK at the time of death. The term domicile and its meaning has been the important factor to consider up to now, and in the UK has a different meaning to “resident” or “residency”.

There is no need for us to go into the definition of domicile here, as the budget has changed the basis for Inheritance Tax (IHT) assessment to a “residency” test, which has also simplified the tax system.

If you have lived outside the UK for more than 10 consecutive years, your non UK assets will not be liable to UK IHT. The rule is as follows –

From 6 April 2025, the test to determine whether non-UK assets are within the scope of IHT will be whether an individual has been resident in the UK for at least 10 out of the last 20 tax years immediately preceding the tax year in which the chargeable event (including death) occurs.

(Editorial Note. Some other press and advisers are stating it is 10 years, not more than 10 years, outside the UK. This applies to a different tax in the Budget, not IHT).

To meet the rule it is necessary to have been out of the UK for more than 10 years, because of a Split Year rule for taxation that will also apply. Again, there is no need to go into detail here, suffice to know that we need to be out of the UK for more than 10 years in the last 20.

The benefit will depend on our personal circumstances, where our assets are based and the value of our assets.

I have used a case study to illustrate –

Mr & Mrs Ingles

– More than 10 consecutive years out of the UK in the last 20 years

– Assets outside the UK include Spanish compliant bonds, bank accounts, QROPS pension and property, all jointly owned, as follows:

Spanish bank accounts €98,000

Spanish compliant bonds €290,000

House (mortgage free) €525,000

QROPS pension €178,000

Total €1,091,000

– UK assets £325,000 jointly owned

Mr and Mrs Ingles can return to the UK and if death occurs within 10 years of the return the following will apply.

– UK assets assessed for UK IHT fall within the UK nil rate band. Tax due £0

– Assets outside the UK not assessed under the residency basis €1,091,000

At the time of writing the exchange rate would give a value to the non UK assets as £865,814. The savings from not having these assets taxed in the UK would be £346,325.60. (£865,814 * 40%)

Complete more than 10 consecutive years outside the UK, return to the UK and be unfortunate enough to pass away in the next 10 years, and your estate will get the additional benefits (on top of being IHT exempt on non UK assets):

If you pass away outside of the UK and your beneficiaries are in the UK, they will pay no UK IHT if you have met the long term non resident criteria. This is because your non UK assets will not be taxed in the UK. As the UK government taxes your estate, not the beneficiary receiving the bequest, no IHT will be payable.

And because you live in Spain, your UK based beneficiaries will be assessed on residency and as they are outside Spain they will not have to pay Spanish IHT on non-Spanish assets.

The changes to UK IHT rules are hugely important for those of us living outside the UK. It may be possible to leave anything from tens of thousands pounds (or euros) to hundreds of thousands to our family and/or worthy causes.

There is a great deal of planning that can be completed to get the best outcome for you. It will depend on your personal circumstances. However, as a principle, it is better to start this planning sooner rather than later.

To start a conversation book a call with Barry Davys using his online system. This allows you to choose a time that is convenient for you for the call which can be either a phone or video call.

Source: HMRC, UK Gov 30th October 2024

Notes

This article is for general information purposes only. Professional tax advice must be taken before undertaking planning to benefit from changes to the UK IHT system.

The content is based on our understanding of legislation at 25th November 2024

The policy paper issued by HMRC as part of the Budget becomes law when the Act of Parliament has been passed.

You can find out more about Barry Davys of The Spectrum IFA Group and his clients by clicking Barry Davys IFA

By Portugal team

This article is published on: 22nd November 2024

The UK’s latest budget announcement has ushered in significant reforms that could transform how British expats manage their pensions and inheritance tax (IHT) liabilities.

These changes, particularly impactful for long-term expatriates, redefine key aspects of domicile, residency, and asset protection. Here’s what you need to know that will affect British expats and why understanding the changes is critical.

From Domicile to Long-Term Residency: a seismic shift

Historically, the concept of “domicile” has been central to determining UK IHT obligations for British citizens. Many expats found that, despite decades abroad, they were still deemed UK domiciled, exposing their global estates to IHT.

The new rules mark a major shift, particularly impacting British expatriates who have been living overseas for extended periods, replacing the concept of domicile with new long-term residence (LTR) rules. Under these new rules, the test for liability to UK IHT will be based on residency.

Those who have lived outside of the UK for at least 10 of the last 20 years will now be classified as non-UK long-term residents. This change means their global assets (except UK based holdings such as pensions, property, investments) will be exempt from UK IHT.

Therefore, expats intending to remain out of the UK for extended periods of time should seriously consider moving assets outside of the UK.

If an individual does not meet the non-residency criteria at death, their entire estate remains subject to UK IHT and the usual rules, exemptions, and tax rates apply.

New incentives: tax breaks on return to the UK

The budget introduced two noteworthy provisions for British expats considering a return to the UK:

1. Four Years of Tax-Free Foreign Income and Gains: The Foreign Income & Gains (FIG) rules allow non-UK LTRs returning to the UK to enjoy tax-free treatment on income and gains from overseas assets for up to four years.

2. 10-Year IHT Exemption: Returning expats can benefit from a 10-year IHT exemption on non-UK assets, provided they are are still classified as non-UK LTRs at the date of death. After this 10 year period, full UK LTR status applies, reinstating IHT liability on worldwide estates.

Pensions, QROPS & QNUPS – what has changed?

Under the revised rules, expats who have previously relied on UK pensions and offshore pension schemes such as Qualifying Recognized Overseas Pension Schemes (QROPS) and Qualifying Non-UK Pension Schemes (QNUPS) to protect their wealth will no longer be sheltered from UK IHT if deemed UK LTR at death.

Moreover, those who are non-UK LTR at death, but still hold UK based pensions will still suffer UK IHT on the pension as it is a UK situ asset.

An added element is how pensions interact with the Portuguese Non-Habitual Residence (NHR) regime and how, once the scheme ends, pension are generally taxed at scale rate of income tax (up to 53% with solidarity taxes).

Therefore, Portuguese residents with or without NHR who are holding UK, QROPS and QNUPS pension holders should revisit their pension planning.

Double whammy tax – 85%

Where death of the pensioner occurs before age 75, beneficiaries receive UK and overseas pension income tax free and post age 75, the beneficiary is taxed at their marginal rates of income tax. There have been no changes to these rules.

However, with the introduction of IHT to pensions, where death occurs after age 75, beneficiaries could be hit with a “double whammy” of 40% IHT and then income tax up to 45% on any drawdown.

Expats holding pensions should therefore be aware of this potential for double taxation and consider restructuring options for their intended beneficiaries.

Other benefits for expats

Most Brits will be aware of the “7 year rule” when making gifts during their lifetime, whereby there is the potential for the gift to be brought back into the UK IHT net if death occurs within 7 years.

An interesting outcome of the budget is, where a non-UK LTR gifts a non-UK asset, the gift is immediately exempt from UK IHT. There is no 7 year waiting period. Moreover, if the donor subsequently returns to the UK this gift will remain outside of the scope of UK IHT, even if death then occurs within the 7 years or the donor becomes a UK LTR again.

Final word

The sweeping changes underscore the importance of careful financial planning for British expats.

Restructuring assets and revisiting long-term strategies are crucial steps to minimise IHT, income and capital gains tax exposure, and to optimise tax efficiency, and those who are intending to be long-term, or permanent expats should certainly revisit their affairs in light of the new changes.

If you would like to discuss your position in detail, please contact us for a confidential and complimentary meeting.

By Craig Welsh

This article is published on: 12th November 2024

Some big news coming from our Malta office.

The Spectrum IFA Group, thanks to the efforts of our branch manager, Craig Welsh, will be the main sponsor of the Nations Cup.

The Nations Cup will be organised by the Royal Malta Golf Club, teeing off in December 2024. This will be a 3 matchday competition between teams representing Malta, GB & Ireland, Scandinavia and Nordics, and The Rest of the World.

This year’s innagural event will feature Spectrum IFA Group as the title sponsor, bringing a new level of excitement and international flair to the club. Known for delivering tailored financial planning services to expatriates across Europe, The Spectrum IFA Group is a fitting partner for an event that celebrates global connections and international sportsmanship.

The Nations Cup is set to become a highlight in the RMGC golf calendar, featuring teams from Malta, Great Britain and Ireland, Scandinavia and the Nordics, and a collective team from “The Rest” regions. This competition will foster camaraderie and regional pride as these diverse teams vie for victory.

We feel that Spectrum IFA Group is a fitting partner for an event that celebrates global connections and international sportsmanship. We look forward to the camaraderie and regional pride, as these diverse teams vie for victory on Malta’s greens!

We are looking forward to a successful event.

By Portugal team

This article is published on: 4th November 2024

Are you interested in learning more about Succession and Domicile Planning? Join us at our free to attend educational workshop on 7th November, where our speakers will be discussing the 2024 tax landscape, retirement planning options, investment solutions and tax strategies for expatriates living in Portugal.

The workshop will cover:

Succession and Domicile Planning Workshop

7th November 2024

Date: 7th November

Time: 10am-1pm

Venue: Wyndham Grand Algarve

Quinta do Lago, Av. André Jordan 39, 8135-024 Almancil

Pension Planning and Income Generation Workshop

27th November 2024

Date: 27th November

Time: 10am-1pm

Venue: Wyndham Grand Algarve

Quinta do Lago, Av. André Jordan 39, 8135-024 Almancil

The workshop will cover:

By Barry Davys

This article is published on: 4th November 2024

During the Brexit negotiations, many of us Brits living abroad were concerned about our fate following March 2019. Thankfully, Britain and the EU reached a solid agreement about the rumoured ‘freezing’ of the state pension after Brexit, and the result is very positive indeed – state pensions will continue to increase for those of us living in the EU.

To read the full article please click here www.telegraph.co.uk/pensions-retirement/news/britain-eu-reach-agreement-expats-state-pension-brexit/

Further to the post above about the UK State pension. Here is how helpful this agreement to increase pensions has been. All figures per week

At a time that is convenient for you

By Peter Brooke

This article is published on: 2nd November 2024

On November 3rd, Peter Brooke from The Spectrum IFA Group will proudly run with The Run for Hope Team in the Nice-Cannes Relay Marathon. For years, Peter and Spectrum have embraced this challenge, raising awareness and funds for a cause that deeply resonates with them.

The Run for Hope team, is a partnership between Mimosa and Cancer Support Group 06, brings together a community of runners from beginners to experts, inspiring teamwork and fun to raise funds for cancer support by running in the Nice-Cannes Relay Marathon. Participants enjoy comprehensive training, support and a festive after-party, all contributing to a great cause, the support of cancer patients on the French Riviera.

As experts in financial planning for English speaking expatriates living in Europe, The Spectrum IFA Group provides comprehensive and personalised financial advice, and planning. Peter, who has been with Spectrum for 20 years on the French Riviera understands the complex financial and tax issues his clients face and he and Spectrum are dedicated to helping you navigate these challenges.

By participating in the relay marathon, Peter and Spectrum demonstrate their commitment to the broader community on the Côte d’Azur. Supporting The Run for Hope Team allows them to blend their professional expertise with their passion for making a difference. Cheer on Peter and the whole Mimosa team as they run for hope, showcasing the same dedication they bring to managing your finances.

Together, we can achieve great things—both on the marathon route and in your financial journey!

The Spectrum IFA Group: Running for Hope, Running for You!

By Michael Doyle

This article is published on: 1st November 2024

I was travelling back to Brittany by train from Luxembourg on Friday 26 July. A day that may have been remembered for it being the opening ceremony of the Olympics in Paris. I expected some disruption due to the sheer number of people visiting Paris, but I’d no idea what would happen next.

If you don’t know by now the rail network was attacked by vandals who set fire to the fibre optics on the tracks and in doing so put almost 800,000 train services “off the rails”.

What I was impressed by was the network’s response. They had police at most if not all stations affected, they increased the labour rate and what could have been a disaster was handled swiftly and efficiently, with trains back running within two days.

As financial planners, we sometimes have to deal with unforeseen and disruptive events. What happened on the rail network was totally unexpected. As a financial planner, I’ve had to guide my clients through the following over recent years:

The main thing my clients were happy with was that I provided reliable guidance on investment repercussions and how to address the events.

This was through either:

So if you had a nervous time with your own financial planning during those uncertain times, or indeed at any time, give me a call and we can work together to ensure you remain “on track” to achieve your financial goals.