HOWEVER, the more your total income, from all sources, increases over €8500, the more of the tax credit you lose.

If your total income is €50000 or above you would not receive any tax credit.

BANK ACCOUNTS AND DEPOSITS

A very simple to understand and acceptable €34.20 per annum is applied to each conto corrente e libretto di risparmio: current account or deposit account. This would typically include fixed deposits, short terms cash deposits, CD’s etc. The charge is the equivalent of the ‘imposta da bollo’ which is applied to all Italian deposit accounts each year.

(Money market accounts, premium Bonds in the UK and other deposit based instruments will not generally fall in this category and would be subject to wealth tax – see below)

Interest income is taxed at 26%.

INVESTMENT INCOME AND CAPITAL GAINS (26%)

A flat tax rate of 26% is payable on interest and income payments from capital and realised capital gains are also taxed at the same rate of 26%.

(Interest from Italian government bonds and government bonds from ‘white list’ countries are still taxed at 12.5% rather than 26%, as detailed above. This is another quirk of Italian tax law as this means that you pay less tax as a holder of government bonds in Pakistan or Kazakhstan, than a holder of corporate bonds from Italian giants ENI or FIAT).

If you are invested in NON-EU harmonised collective investment vehicles i.e. funds which are listed in a place outside the EU, then the gains and income from these assets are NOT taxed at the flat 26% rate in Italy, but would be added to the rest of your income for the year and taxed at your highest marginal rate of income tax! Funds or ETF’s, for example, which re listed in the UK with a GB ISIN code or in the US with an equivalent US number, would fall into this category.

This is particularly important for UK and USA domiciled assets. If you have a brokerage account with a group such as Fidelity or Vanguard or one of the many other asset management firms, or you invest through a platform such as Hargreaves Lansdown in the UK/USA, then depending on which assets you invest in could mean you are pushing yourself into a higher tax bracket on taxable gains and income for the year. Your portfolio may need restructuring for life in Italy!

WEALTH TAX ON ASSETS (0.2% PA)

Any financial assets other than property attract an annual wealth tax of 0.2% on the value of the asset as at the 31st December each year.

Here are examples of a few:

GENERAL INVESTMENT ACCOUNTS, ISAS, BROKERAGE ACCOUNTS, PLATFORMS, DISCRETIONARY MANAGED PORTFOLIO, DIRECT INVESTMENT IN FUNDS, STOCKS AND SHARES, COMMODITIES, ART WORK, CLASSIC CARS, ETC.

If the assets are located in one of tax regimes around the world which are considered fiscally privileged by the Italian authorities, then the rate of tax is 0.4% pa. The list can be found at the end of this article HERE

INCOME FROM OVERSEAS PROPERTY (Income tax rates – IRPEF)

Overseas net property income (after allowable expenses in the country in which is located) is added to your other income for the year and taxed at your highest progressive rate of income tax.

THE WEALTH TAX OF 1.06% ON THE VALUE OF THE PROPERY (IVIE)

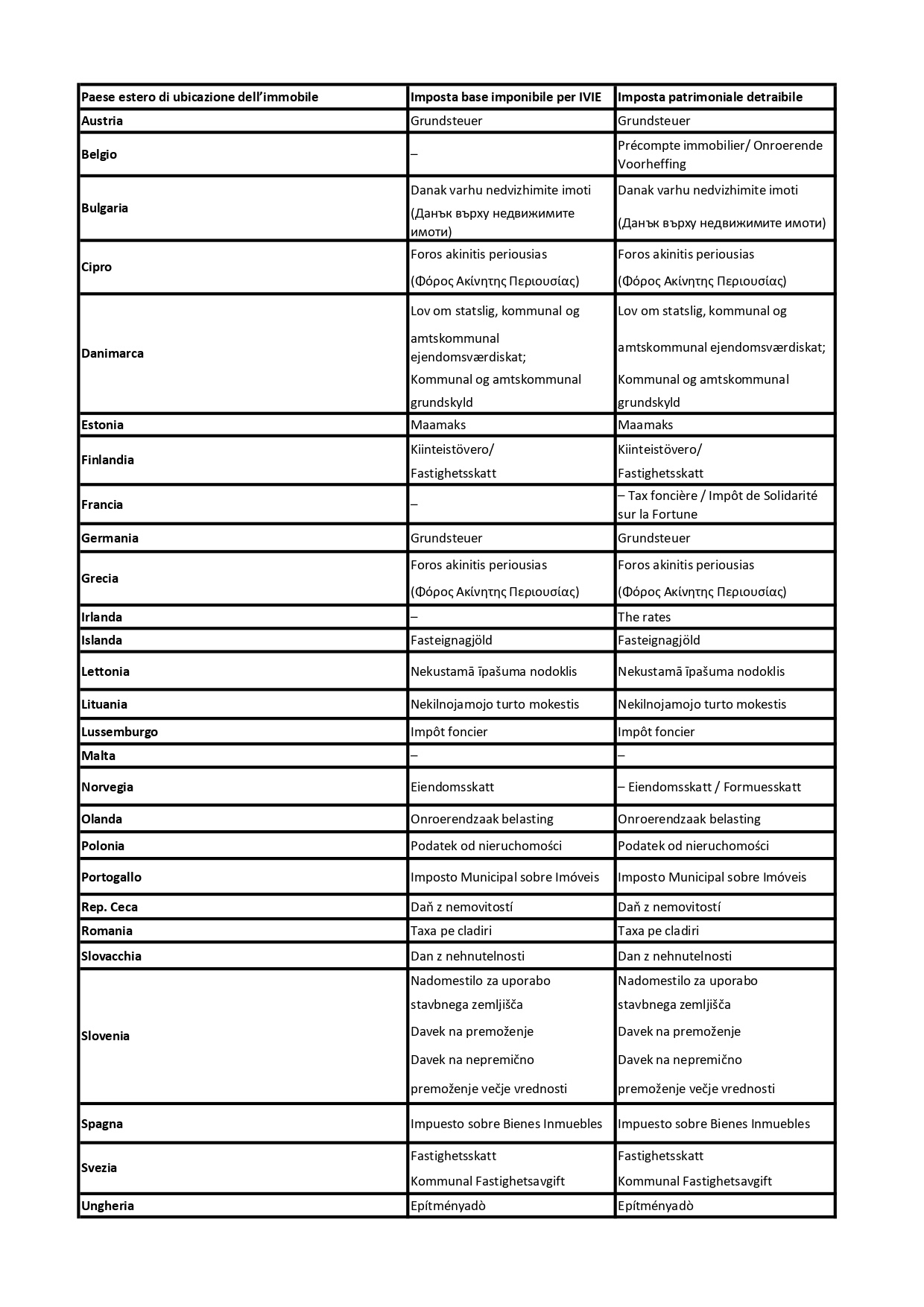

For properties based in the EU, the value on which this tax is based is the Italian cadastral equivalent. You will find that the market value will, in most cases, to be significantly more than the cadastral equivalent value. For a list of the different tax values across Europe see the table below.