Effective Estate Planning for British Expatriates in the Balearic Islands: A Brief Guide

Estate Planning in Spain

By Susan Worthington

This article is published on: 13th July 2025

Estate planning is a critical consideration for British expatriates living in the Balearic Islands. With assets potentially spread across the UK and Spain, and legal frameworks differing between jurisdictions, effective planning ensures that your wealth is passed on efficiently and according to your wishes. Here are the key points to consider:

Planning ahead is essential to safeguard your estate and reduce the likelihood of disputes or unnecessary tax liabilities. British expats in Spain often have assets in both countries, so your plan should address how these will be managed and distributed. Consideration should be given to residence status, the location of assets, and whether your heirs live in the UK, Spain, or elsewhere.

Wills. To streamline the probate process and ensure clarity in both jurisdictions, dual wills can be highly beneficial. This means having one will to cover your UK assets and another for your Spanish holdings. These wills must be carefully drafted to avoid legal conflicts or revocation—coordination between legal professionals in both countries is vital. A Spanish will must comply with local formalities and should reference the UK will, and vice versa.

Assets such as pensions, life insurance policies, and investment accounts may pass outside of a will, depending on the beneficiary nominations made. It’s crucial to regularly review and update these to ensure they align with your broader estate plan. Failing to do so can lead to unintended outcomes, especially if personal circumstances (like marriage or divorce) change.

Spanish Succession Law Spain operates a system of forced heirship, where a significant portion of an estate must go to specific relatives (typically children). However, EU Regulation 650/2012 (Brussels IV) allows foreign nationals residing in Spain to opt for the succession law of their country of nationality. This election must be clearly stated in your Spanish will. Without it, Spanish law may apply by default, potentially overriding your intentions.

UK Inheritance Tax (IHT) Even if you are a long-term resident of Spain, and recognising the recent favourable changes to UK inheritance tax (IHT) rules for many expatriates, you may still face IHT on both UK and non-UK based assets. Careful planning can ensure this exposure is removed entirely. At the same time, Spanish succession tax may also apply based on the location of assets or the residency of beneficiaries. This creates a risk of double taxation. However, tax treaties and relief provisions mitigate these liabilities if utilised effectively.

Solutions. There are several tools and strategies that can enhance estate planning efficiency, including the use of trusts, life insurance policies for tax mitigation, and gifting strategies. Spanish-compliant investment bonds, for instance, may provide tax deferral benefits and simplify succession. The suitability of these solutions depends on personal circumstances and goals.

Professional Advice. Given the complexity of cross-border estate planning, expert guidance is not just helpful—it’s essential. A qualified financial adviser and a solicitor familiar with both UK and Spanish succession laws can ensure your plan is both compliant and effective. Coordinated advice prevents legal conflicts and optimises outcomes for your heirs.

In summary, British expatriates in the Balearics must take a proactive, coordinated approach to estate planning. By understanding the interplay between UK and Spanish law and seeking tailored advice, you can protect your legacy and ensure your wishes are respected.

Financial update – Italy July 2025

By Gareth Horsfall

This article is published on: 3rd July 2025

Pensions, detractions, deductions and more……

I should start this E-zine with an apology that it has taken so long for me to write another one. I would never have left it this long normally, but what with recent global events and the threat of some kind of new world war, I almost felt a bit paralysed with what to write as it all seemed a bit irrelevant.

Thankfully, at least for now, we seem to be over the possibility of global armageddon so whilst we all have some breathing space, I thought I would just put some more financial planning thoughts and experiences down on an E-zine.

But before I start, I am sure you are all eager to know what I have been up to with the new home / land. Well, as many of you already know, spring time brings power to grass! It was quite something to see it grow quite so quickly. Sun and rain, until the start of June, gave it some kind of super power. However, I decided not to try and win the battle because as most people told me I would never win this one, and it would not be long before it all started to dry out with the heat of the summer (which it has now started to do) and besides that it is good for the wildlife

In the end I decided to work with it and mowed ‘sentieri’ into the long grass to allow the birds, butterflies and insects to continue to enjoy their natural habitat. I read that this is a good thing to do for the health of the land, fruit etc and actually it looks quite nice as well. Apart from a few locals who have told me that I need to cut the grass back to the floor because snakes hide in it (which kind of seems an interesting point, because I don’t really want to meet any vipers and if they have somewhere to hide and get away without me noticing them then we should both be happy) others have commented on the nice effect of being able to walk amongst the grass and see the insect life going about its daily business. Not only, but its been fun watching the various flowers that have been popping up at different times. It almost feels like they have been drawing straws. One variety seems to have its moment, then dies back and the next one appears and so on, until I guess at some point it will be so hot and dry that even they will have had enough, but still there are flowers appearing in the shady areas. This all sounds very Laura Ashley and my next step will be to buy a long flowery dress, wide straw hat and wicker basket to collect the fruit! However, land management is interesting and somethng new for me and apart from the grass I have spent time doing the fruit ‘raccolta’ and making jams with the help of my kitchen aid ‘Bimby’! Apricot, Prune, Mulberry, and cherry jams to date. Still got figs, apples and pears to go. I will keep you posted.

Other than that any kind of land clearance and tidying up has come to a stand still because it is just far too hot and so I will have to wait until the autumn to start my early morning (before I start work) workouts on the land…..and then there is the oil as well! Busy busy busy!

But, moving on from my travails, of which many of you share, I wanted to just go through a few clarifications in this Ezine which have come about due to recent discussions with clients and people contacting me and asking questions. I also wanted to share info on the tax deductions and detractions that you/we can take advantage of in Italy to help reduce our taxable burden. As it has been observed many times, unlike many countries which offer non-taxable income allowances (US and UK as examples), Italy does not. Therefore we pay tax from Euro number 1. However, Italy does also have a system of deductions and detractions which can be used to offset against income to try and reduce the tax burden. If I am being honest I can’t say that they are as good as a non-taxable allowance in terms of their effect on income, but they can be help. Lastly, I have posted some short videos on investment themes with the collaboration of one of our investment partners, Chris Saunders at New Horizon Asset Management. A way to get ideas out quickly and easily.

Pensions

Initially I wanted to touch on the subject of UK pension payments.

UK state pension.

I am not sure why but a number of you have contacted me this year to say that your commercialista is now saying that you need to declare your UK state pension on your Italian tax return and pay tax on it. This is, of course, very correct and makes me question why some commercialisti are only now waking up to this fact. It always worries me when I get a surge of the same enquiry. My concern is for those people who have been legitimately taking advice from well meaning professionals who have not been doing the right thing and will now start to file in the correct way. This could mean that the Agenzia delle Entrate will be alerted to the fact and may come asking for back payments, fines and penalties. If this is the case then they have 5 years to do so, and they have a sneaky habit of doing so about 4 years and a few months after the filing.

If you find yourself in such a situation then please remember that your commercialista has to carry insurance in the event of them mis-advising you. As long as you have the proof that they did so (which may be the hardest thing to prove because often they just provided verbal confirmation that something did not need declaring) then you can ask them to carry any costs incurred by you as a result of an error on their part. The hard part is proving it and then having that discussion with them. Check those historical emails discussions!!!

Sign the P85 with HMRC

On a similar note I recently met 2 people in the same Umbrian comune who had received a letter from the AdE which stated that they were no longer able to apply for the double taxation credit for tax paid in the UK on their UK personal / occupational pension payments. Now, this might sound like a contravention of the double taxation treaty, but as the AdE stated in their letter (which I managed to gain sight of), the correct action is that when someone leaves the UK with a pension in payment, they must apply to HMRC for gross income payments by applying through the P85 system on the HMRC website. Failure to do so means that the AdE is not obliged to offer any tax credit for tax paid in the UK and instead can charge full Italian tax. This means that you could pay in Italy and the UK until such time as you have received a gross payment authorisation from the UK: Back payments can be claimed from HMRC (where tax credits have not been awarded already) by completing the P85 form but these can take time.

In my experience, over the last 15 years, Umbria and Tuscany have always been at the leading edge of tax legislation and implementing it to the letter of the law so its not beyond imagination that this may spread out across Italy. However, there are instances in Abruzzo and Marche as well. Therefore, if you are the holder of a UK pension, are still paying tax in the UK and claiming that back through the credito d’imposta option every year, it would be advisable to apply for UK gross pension payments via the P85 claim form on the HMRC website, before the AdE refuses you the option and you end up paying twice. https://www.gov.uk/tax-right-retire-abroad-return-to-uk

So, moving on from pensions, lets take a look at tax deductible and detractable expenditure in Italy. Annoying, as they are due to the adminisitrative issues involved, they can reduce taxable income so are worth looking into..

Firstly, it might help to know the difference between a tax deduction and a detractable expense.

- Deductible expenses (oneri deducibili) reduce your taxable income, meaning you pay tax on a lower income.

- Detractable expenses (oneri detraibili) give you a direct reduction in the tax you owe – usually a 19% tax credit on the value of item you are claiming, unless otherwise specified.

Both are valuable, and knowing the difference helps you understand how the savings work.

Healthcare expenses (19%)

Without a doubt the most common category is healthcare expenses ( detractable at 19%)

What you can claim is as follows:

- Pharmacy receipts (scontrini parlanti) showing the name of the medicine and your tax code (codice fiscale)

- Doctor visits (GPs and specialists)

- Surgeries and hospital stays (private and public)

- Diagnostic tests, X-rays, and blood work

- Dental care (e.g., orthodontics, if medically necessary

- Physiotherapy and rehabilitation

- Medical devices (e.g., glasses, hearing aids, prosthetics)

There is a franchigia related to these expenses, which means that it is only the accumulated expenses over €129.11 which are considered eligible. If your total health expenses are below this amount then you cannot detract from tax. (You cannot claim this credit if the expense is covered by insurance)

To give an example……if my total expenses are €800 during the year, then the calculation is €800 – €129,11 = €670,89, on which I apply the 19% tax credit = €127,47 tax credit.

This example may not seem much but a few years ago I had to have some urgent dental care which cost €10,000. It was not covered by insurance and so I had to pay myself. That year I had a tax credit of €1875,46. Every little helps.

So, for all those trips to the farmacia make sure you present your codice fiscale to the pharamcist and they will normally tell you whether it is an item that qualifies or not.

** FARMACIA AND HEALTH EXPENSES ARE NOW REGISTERED AUTOMATICALLY ON THE AGENZIA DELLE ENETRATE WEBSITE (YOU CAN ACCESS THE WEBSITE AND CHECK THEM YOURSELF) HOWEVER THERE ARE OCCASIONS WHEN THEY DON’T APPEAR SO MAKE SURE YOU KEEP YOUR RECEIPTS AND GIVE THEM TO YOUR COMMERCIALISTA / FISCALISTA WHEN YOU FILE YOUR RETURNS **

Home renovations and energy efficiency (various rates from 36% to 50%)

This is by far and away the next biggest category for gaining tax credits. I know myself because in 2024 we spent alot of our savings on the new home and this year we will be applying for almost all of these bonuses as tax credits.

The key incentives for home improvements are as follows:

- Bonus Ristrutturazioni (Renovation Bonus) – 50% for general home upgrades

- Ecobonus – 50–65% for energy-saving improvements (e.g., insulation, windows, solar panels)

On your ‘Prima Casa’ you can claim a 50% tax credit up to a maximum spend of €96000, spread over 10 years.

On your second home or property (other than Prima Casa) it is a 36% on a maxi psend of €96000 spread over 10 years.

(excluding boilers which burn fossil fuels, such as caldaia gas)

- Sismabonus – 50% on Prima Casa for 2025 then 36% for 2026/27 for work related to protection against sismic risks

36% on non-Prima Casa in 2025, falling to 30% from 2026/27. - Bonus mobili (e grande elettrodomestici) – tax credit of 50% on spend of up to €5000 on electrical appliances and furniture that are linked to renovations.

- Nuovo contributo per elettrodomestici ad alta efficienza – 30% up to €100 discount on electrical domestic appliance purchases, outside renovation works

- Green Bonus – 36% on garden and green area improvements.

A FEW THINGS I LEARNED BY GOING THROUGH WORKS LAST YEAR:

- All payments must be made by traceable means i.e bonifico or credit card payment. No trace, no bonus!

- If paying by bonifico then you need to use the bonifico per agevolazione fiscale option with your bank NOT the bonifico ordinario option. It asks for more info, such as the partitia IVA of the company / person you have worked with and this is needed for the bonus.

- If you employ single workmen working alone then you don’t need an authorisation (SCIA or CIA) from the local authority but if they are a ‘dita edilizia’ (this can include even 2 people working together as a construction company) then you need to have a ‘piano di sicurezza’ from an architect who will need to draw that up and provide you with the necessary numbers/reference codes. No ‘piano di sicurezza’ no bonus! (Our’s cost about €1000)

- Your workmen can apply for 10% IVA (VAT) on purchased items, but this is not necessarily a given. Our commercialista recommended that we signed a document ‘richiesta di applicazione dell’IVA ad aliquota ridotta’ for each workman / company so they would be authorised to apply for it as the materials would fall under the approved renovation works.

Insurance premiums

This is a category which people often fail to utilise because there are some questions over whether foreign insurance premiums paid can be deducted in an Italian tax return.

The policies which qualify are Life insurance, accident ( both max €530) and long-term care insurance (LTC) – (€1291)

They must qualify ( even if issued outside Italy) under the following conditions:

- Policy must be with an EU or EEA-authorized insurer (i.e. the company must be licensed to operate in the EU/EEA under EU regulations).

- The policy must cover eligible risks: life, accidents, disability, or LTC.

- The beneficiary must be the taxpayer or close family (not a third party like a bank).

- The contract must not be speculative (e.g., pure investment policies are excluded unless they include real coverage of life or disability).

I myself still insist on entering my life policies issued in the UK years ago, before Brexit, and which cover me throughout the EU and were issued whilst the UK was still in the EU. I principally have life insurance contracts with Legal and General and they provide cover across the EU. The other alternative is to take out Italian equivalent policies especially for things like health insurance. It’s worth getting a quote from one of the bigger insurance providers such as Generali (or Genertel, their online offering) Allianz, Zurich, Groupama, Unipol Sai, Banca Intesa, Reale etc

Other categories include:

Donations (19-30%)

donations to recognised NGO’s, religious institutions or universities.

Mortgage interest (19%)

You can deduct interest on mortgages for your first home (prima casa) up to a cap of €4,000 per year.

Education expenses (19%)

- Kindergarten through university tuition (both public and private, up to limits)

- School meals and after-school program

- University housing (if located outside the student’s home province)

Max annual deduction for private schools may vary by level and region, with a cap around €800 per child.

Rental deductions

If you rent your main home, you may claim a tax credit based on your income and contract type.

For example: Ordinary rental contracts (contratto 4+4), Student housing and transfers for work (if you’ve moved for employment reasons)

The credit varies depending on income, age, and contract type (e.g., up to €495.80 or more).

Family related deductions and credits

Dependent children and other family members, alimony and maintenance payments (deductible), Nursery/kindergarten costs (detraction up to €632 per child)

Disabled persons (LEGGE 104/1992 BENEFITS)

Special deductions and detractions for people with disabilities or their caregivers, including: 19% for adapted vehicles (with limits), full deduction of medical devices, assistance costs, etc.

Sport and Youth activities (19%)

Up to €210 per child under 18 for gym, swimming, dance classes, etc. Applies to recognized sports facilities and clubs.

You may or may not have noticed by now that the effects of war often have very little effect on financial markets, in fact we could even argue that they actually have a slight positive effect in the main, where the wars are contained in their various regions of the world.

(I will refrain from any personal thoughts on this because there is a human element here which is indescribable).

A month or so ago I decided with one of our investment management partners, Chris Saunders at New Horizon Asset management, to do some trial question and answer short videos which I thought might be a good way to quickly get some investment manager thought out into the internet-sphere and from which you/we could all benefit from. Our initial video was on the possibility of a tariff on European goods, imposed by the USA, and which is a topic which is still on the table and so I will share it here.

The second was a video on the Iran / Israel escalations which have, for the meantime, now subsided but which included some historical information from Chris about the duration of war and effect on financial markets in general. Quite interesting if you are akin to listening.

I feel like these are still relevant given that we don’t know yet where things are going. If you find them useful then please let me know, I would welcome the feedback. They are meant to be quick fire short videos which we can get out to you and on social media to react to events, rather than waiting to write about it on an Ezine which takes time and by the time that I can get round to it Pres. Trump has already changed his mind another 50 times. It’s proving to be a challenging year to keep on top of the political minefield. Thankfully as we have seen from the markets dull reaction to recent events, the politics is largely treated as short term noise and so we can focus our minds on our long-term personal financial planning instead.

If you are interested in the questions and answer short videos then click on the links below.

If you would like to discuss these or any other tax or financial planning related issues for your life in Italy then please don’t hesitate to contact me on gareth.horsfall@spectrum-ifa.comor call / message on +39 3336492356

Always happy to help where I can!

If you want to know more about me or the things I do then just click here.

Why do your fellow affluent expats become clients of The Spectrum IFA Group in Spain?

By Barry Davys

This article is published on: 30th June 2025

It is all about the planning, solutions, implementation and continuing support (PSIC).

We take as long as is necessary to understand your situation and listen to your hopes and plans for the future. It is time well spent because to be effective for you, we work to understand first, which then guides the process for your planning. In fact it governs how you and your adviser approach each step in our PSIC process..

So, why do wealthy expatriates become clients of The Spectrum IFA Group in Spain?

- Secure document exchange and secure email

- We take into account your views, especially in your approach to risk

- We look forward, not just backwards at past performance

- Cashflow modelling allows you to see what your financial future could look like and includes a “What if” function to allow you to see potential outcomes before you commit to a decision

- Investment portfolios are built according to your individual objectives, using a discretionary fund manager if appropriate. Historic performance data from 1990 to 2023 is used for reliable and realistic cashflow forecasting

- When you become a client of The Spectrum IFA Group in Spain, we take into account the impact of the following in our planning and investment recommendations: Wealth tax, Income tax, Capital gains tax, Inheritance tax, Gift tax, Property tax and how to mitigate the impact of these taxes

- We plan across generations

- We understand both UK and Spanish taxes, how they work together and where they conflict, to help with cross-border tax planning

- Our assistance has included planning leading up to and post business sales, structuring share option vesting, managing property sale proceeds, investment of lottery/premium bond wins and gifts and advice for adult children of clients.

- Ongoing service which follows a clear process to ensure long-term planning remains fully aligned with your circumstances

- The Spectrum IFA Group has been advising in Spain for 23 years. We currently have 17 advisers across the group who have been with us continuously for 20 years or more

- Additional tax guidance and reporting – in Catalonia I work with only two firms of tax lawyers after vetting dozens.

- I call on the support of a specialist Visa lawyer to advise on and apply for visas

- We have a specialist mortgage service within the group – Spectrum International Mortgages is a mortgage broker in Spain with extensive experience handling high value transactions. A search of one estate agent’s offering in the area around S’Agaro, Costa Brava, shows the following available properties:

– 31 over €1M

– 13 over €2M

– 7 over €3M

– 3 over €4M

– 1 over €5M

– 1 over €6M

– 2 over €7M

– 1 over €8M

– 6 with Price by Request

- Our mortgage solutions are available as a stand alone service or as part of our PSIC process – the PSIC process itself is best suited to clients with €500,000 or more to invest

If this is how you want your planning to be managed, book an initial call directly with Barry Davys, at a time that is convenient for you, using his online service. You will be offered the choice of a phone call or a video call when choosing your time.

Relocating to Spain

By Barry Davys

This article is published on: 27th June 2025

Are you planning to relocate to Spain and don’t know where to start? Are you a Spanish national thinking of coming back to Spain after more than 5 years in the UK?

Barry Davys was a guest with the Spanish Chamber of Commerce alongside Kle&Vera – the international law firm, in the UK for a recent webinar on Relocating to Spain & the Financial Insights.

You can watch part of this webinar below:

If you have any questions after watching the video or would like to talk to Barry, please use the online calendar booking system to choose a time that suits you.

French financial update June 2025

By Katriona Murray-Platon

This article is published on: 7th June 2025

Although the official beginning of Summer is not for a few weeks, these last few weeks of lovely sunny weather already makes it feel like summer is here.

Tax season is almost at a close. Those in departments numbered over 55 have until Thursday 5th June to finalise their tax declarations. I hope you managed to submit your returns in time.

If you now realise that you missed out some income or misdeclared income, you can still amend your tax return on the online webpage. Please note however that as the return has been filed by the deadline, this will generate a tax statement and any tax due on this first statement must be paid promptly. If you amend your return on the website now, this will generate a second statement which may request more tax from you and therefore adjust your monthly payments or will result in a tax rebate. Whichever the case, you must pay the first tax statement first and wait until the second statement is issued.

In June there is still one more declaration to complete if you are a trustee of a trust for which one of the beneficiaries, settlors or trustees are French resident. A trust must also be declared if it contains French based assets.

Although Trusts do not exist under French law, the French courts have accepted that Trusts set up in other countries can have effects in France (Paris Court of Appeal decision, dated 10 January 1970, Epoux Courtois and others of Ganay) provided that they have been set up in compliance with the laws of the country in which it was set up and that they don’t contain any provisions that go against French public policy (ordre public) especially as regards the réserve heriditaire (mandatory heirs rights).

Although generally, if it says Trust in the document, then it needs to be declared, there are some exceptions such as Unit Trusts, a company trust, or an investment trust. Also pension trusts do not need to be declared in the annual trust declaration provided the trustees of these pension trusts are subject to the law of a State which has signed an agreement with the French state to provide administrative assistance in the prevention of fraud and tax evasion (https://bofip.impots.gouv.fr/bofip/7886-PGP.html/identifiant=BOI-DJC-TRUST-20220330). This includes pension trusts in Malta.

There are two declarations that need to be done, TRUST 1 (https://www.impots.gouv.fr/formulaire/2181-trust1/declaration-de-constitution-de-modification-ou-dextinction-dun-trust), if you have never declared the trust before or it is a new trust and TRUST 2 (https://www.impots.gouv.fr/formulaire/2181-trust2/declaration-annuelle-de-la-valeur-venale-au-1er-janvier-des-biens-droits-et- ) which is the annual trust declaration which must be done every year. Unfortunately, you cannot submit these forms online like you can when you do your income tax return, they must be submitted in paper form and sent to the Non-Residents tax office in Noissy-le-Grand before 15th June every year.

For those with Pru Assurance Vies or those thinking of investing in a Pru Assurance Vie there is news as, on Tuesday 27th May 2025, the Prudential Assurance Company (PAC) board reviewed the Prufund Expected Growth Rates (EGR) as part of the quarterly review process. The Expected Growth Rate (EGR) is the forward looking element of the Prufund smoothing process. Pru announced that the EGRs for all the offshore versions of Prufund remain unchanged. The Unit Price Adjustment (UPA) part of the smoothing process, which is a backward looking element, and which is formulaic and non-discretionary are also reviewed quarterly. This quarter there is a negative UPA for the Prufund Cautious fund in GBP of – 2.3%.

At the beginning of June, I shall join some of my colleagues and some of our product providers for our adviser meeting in Paris. It will be interesting catching up with my colleagues and also hearing our providers views on the markets in what has been a very interesting first part of the year!

After all the May bank holidays, I am looking forward to having some normal working weeks and getting lots of work done before the summer holidays. If you have any questions or would like to organise a meeting to discuss your finances, please do get in touch.

FEIFA Annual Adviser Conference

By Peter Brooke

This article is published on: 30th May 2025

I recently attended the FEIFA Annual Adviser Conference in London and wanted to share a brief summary of the latest market insights, along with how advisers are continuing to evolve their approach to best serve clients in today’s environment.

The Federation of European Independent Financial Advisers (FEIFA) – not to be confused with the football governing body! – was founded 16 years ago by a group of experienced IFA firms across Europe. They saw the need for an organisation that could uphold professional standards and represent the interests of advisers and their clients with both industry bodies and regulators across the continent. Spectrum is proud to be one of the original founding members, and we continue to support and build on those standards through our ongoing involvement.

The annual conference brings together FEIFA members and leading industry voices to discuss the unique challenges of advising cross-border clients. As Head of the Spectrum Investment Committee, it remains a valuable and important event in my calendar.

Staying the Course Through Market Volatility

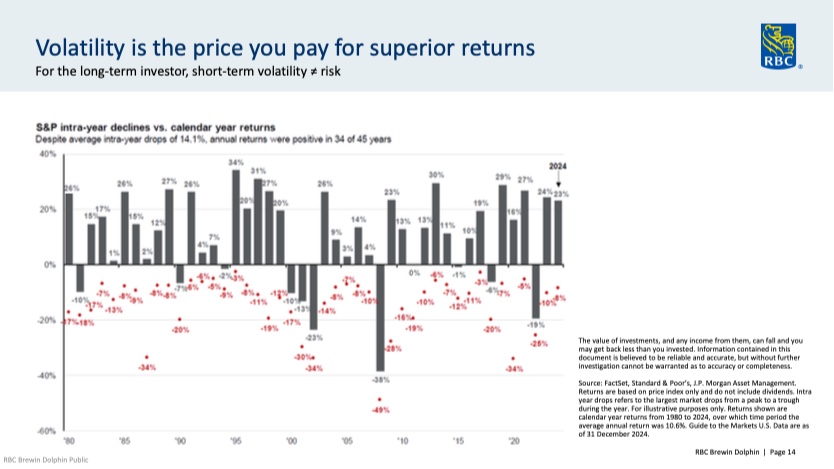

Richard Flood (RBC Brewin Dolphin) reminded us that global events—whether pandemics, wars, or political wrangling —are a constant. Despite this, markets rise over time. The key is to focus on long-term fundamentals rather than react to short-term noise.

Volatility, he stressed, is a normal part of investing and “the price you pay for superior returns.”

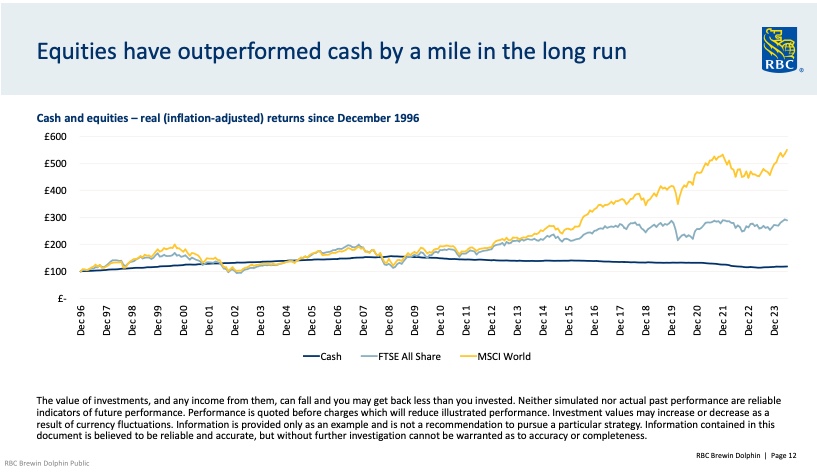

Avoiding volatility by sitting in cash is not a good idea either as Inflation diminishes the purchasing power of cash – as illustrated in this Equities v’s Cash ‘inflation adjusted’ performance chart.

Navigating an Uncertain 2025

David Coombs (Rathbones) highlighted the ongoing impact of geopolitical events like Trump’s executive orders and Tariffs on trade and compared them to other countries ‘protectionist policies’ like unbalanced tax rates (eg Ireland), agricultural subsidies (eg France).

He also stressed the unconsidered challenges that passive investments (eg ETFs) pose to market stability due to being “forced sellers & and forced buyers” therefore adding to volatility.

Active management, in his view, remains vital, especially in 2025, and he shared a wonderful example of how active he has been in the last year:

The below chart is the Shopify share price, a share he has held for some time, the red dots are where he sold some shares (trimmed) and the yellow dots are where he added money – this shows that active management is much more than strategically choosing which companies to own or not own, but how to add value through tactical decisions.

The Passive Investing Paradox

Henry Wilson (LGT Wealth Management) discussed the risks of over-reliance on passive funds, including the concentration risk in a few large companies (eg MAG 7). Because of this concentration of returns (and risk) to fewer, larger companies he believes that true diversification is under threat, valuations are higher, future returns are compromised…

… BUT as Harry Markowitz, the architect of Modern Portfolio Theory & Efficient Frontier said “Diversification is the only free lunch to investing”.

Therefore while passive investing remains a useful tool, LGT and Spectrum advocate for highly diversified, actively managed portfolios to help manage risk and improve long-term returns.

If you are going to own passive investments you have to be active with them.

Model Portfolios & Adviser Alpha

Matthew Lamb (Pacific Asset Management) explored the evolution of model portfolios and the increasing role of technology. With many portfolios becoming similar, the real value lies in the advice given—not just the investments chosen.

This fits strongly with my recent newsletter about risk (click here) – If most ‘Balanced’ portfolios are similar to each other and most ‘Growth’ portfolios are similar to each other then the outcome for you, as my client, is not in picking between two balanced funds or two growth funds… it’s ensuring we choose correctly between Balanced or Growth in the first place!!

Good risk profiling conversations make sure we start in the right place.

Planning for the Summer

After almost 13 years, we’re finally heading to Australia for a long-overdue family holiday. We’ll be visiting my wife’s side of the family, who all live in Queensland. She’s been able to make a few trips in that time, but between school schedules, travel costs and a global pandemic, the children and I haven’t been back since 2013. We’ll be away for five weeks from the end of June and are really looking forward to the trip.

I’ll still be checking emails and messages periodically, but if you’d like to catch up — whether by phone, Zoom or in person before we go — please do get in touch or book something in the calendar before Friday 27th June.

All being well, I’ll be back at my desk (with a fair dose of jet lag) on Wednesday 6th August.

Lions V’s Australia

Of course, seeing family and friends is the main priority — but I’d be lying if I said there wasn’t something else I’m particularly excited about.

As a lifelong rugby fan, getting the chance to see the British & Irish Lions take on Australia in both the 1st and 3rd Test Matches — plus the Queensland Reds in early July — is nothing short of a bucket list experience for me.

As always, if there’s anything you’d like to go over before I head off, just let me know. And if anything comes up while I’m away, I’ll do my best to ensure it’s handled smoothly.

Contact me if you have any questions via the below channels, or the booking system – always drop me a quick message if you need a time slot outside of those available.

Mobile & Whatsapp: +33 6 87 13 68 71

Email: peter.brooke@spectrum-ifa.com

Calendly booking system: https://calendly.com/peterbrooke/30min

Behavioural Confirmation: The Sneaky Culprit Behind Your Wallet’s Woes

By Tom Worthington

This article is published on: 27th May 2025

Ever feel like your wallet has a mind of its own? You set out to save, but somehow end up splurging on that fancy coffee machine or the latest gadget. Let’s delve into the psychological phenomenon known as behavioural confirmation and see how it might be influencing your financial decisions.

What Is Behavioural Confirmation?

Behavioural confirmation is a type of self-fulfilling prophecy where our expectations about others lead them to behave in ways that confirm those expectations. In the realm of personal finance, this can manifest when we project our beliefs onto our spending habits, leading to outcomes that align with those beliefs—even if they’re detrimental.

Spending Habits: The Self-Fulfilling Cycle

Imagine believing you’re terrible at budgeting. This belief might cause you to avoid tracking expenses, leading to overspending, which then reinforces your initial belief. It’s a vicious cycle where your expectations shape your behavior, confirming your original assumption.

Similarly, if you think you’re a savvy investor, you might take on riskier investments without proper research, leading to potential losses that challenge your self-perception.

Investments: Confidence vs. Overconfidence

Believing in your investment prowess is great, but overconfidence can be costly. You might ignore warning signs or dismiss advice, thinking you know best. This can lead to poor investment choices, reinforcing the belief that the market is unpredictable, rather than acknowledging personal missteps.

Imagine believing you’re the next Warren Buffett after a couple of successful trades. This mindset, while empowering, can sometimes lead investors astray. Overconfidence bias is a well-documented phenomenon in Behavioural finance, where individuals overestimate their knowledge, underestimate risks, and exaggerate their ability to create returns.

Initial Success: An investor experiences early gains, attributing success solely to personal skill.

- Increased Risk-Taking: Buoyed by confidence, the investor undertakes riskier investments without thorough analysis.

- Neglecting Diversification: Believing in their ability to pick winners, the investor concentrates holdings, ignoring the benefits of a diversified portfolio.

- Ignoring Contradictory Information: The investor dismisses data or advice that challenges their beliefs, leading to potential blind spots.

- Potential Losses: Without proper risk assessment and diversification, the investor becomes vulnerable to market downturns, leading to significant losses.

Real-World Implications

- Excessive Trading: Overconfident investors often trade more frequently, incurring higher transaction costs and taxes, which can erode returns.

- Underestimating Risks: Believing they can predict market movements, these investors may overlook potential pitfalls, leading to investments in volatile or unsuitable assets.

- Confirmation Bias: Overconfident individuals tend to seek information that supports their views, ignoring evidence to the contrary, which can reinforce poor investment choices.

Mitigating Overconfidence

- Seek Diverse Perspectives: Engage with financial advisors or peers to gain different viewpoints and challenge personal assumptions.

- Implement Checklists: Before making investment decisions, use a checklist to ensure all factors, including risks and alternatives, are considered.

- Embrace Humility: Recognize the limits of personal knowledge and remain open to learning and adapting strategies.

Breaking the Cycle

To combat Behavioural confirmation:

- Self-awareness: Regularly assess your financial beliefs and challenge negative assumptions. Don’t start saving tomorrow, start saving today.

- Seek feedback: Discuss financial decisions with trusted individuals to gain different perspectives. This is exactly what a financial adviser can help you with.

- Stay open to options presented to you.

- Set realistic goals: Establish achievable financial objectives to build positive reinforcement loops.

Think of your financial beliefs as that friend who insists they’re bad at directions. Every time they get lost, they say, “See? I told you!” But maybe, just maybe, if they used a map or GPS, they’d find their way. Similarly, by challenging our financial self-perceptions and seeking guidance, we can navigate towards better financial health.

At the Spectrum IFA Group we can help you by being your GPS through the financial world and design your bespoke road map to make sure we you get to where you want to go.

Why Now Is a Surprisingly Good Time to Invest (Yes, Really!)

By Michael Doyle

This article is published on: 25th May 2025

I Do Love a Bargain

I know it’s almost summer, but is there anything better than the hope and expectation that builds around Christmas. It’s the best time of the year for me.

Not only do we get to enjoy all the trappings that come with the festive time of year but on Boxing Day the madness begins!!!!

The trainers that were €130 have been reduced to €60, the jacket that was out of reach at €400 is now €240, the sports T-shirts that just 2 days ago were €40 are now €20. What a time to buy.

There’s something similar happening in the markets right now and I just wanted to take a few minutes to explain why I think now could be a great time to invest.

Volatility is a Discount in Disguise

The markets have been bumpy — and that’s a gift in plain wrapping. Volatility creates opportunities. Quality companies with strong fundamentals often get marked down along with the rest of the market, offering savvy investors the chance to buy value at a discount. If you’ve read my other articles, you’ll know I’m partial to the odd quote from Warren Buffett: “Be fearful when others are greedy and greedy when others are fearful.” Right now? There’s more caution than confidence. That’s your opening.

Inflation Is Cooling. Rates May Follow

While central banks have taken us on a wild ride with interest rates, there are early signs of stabilization. Inflation is cooling in many regions. As economic data settles, interest rates may begin to ease, restoring more predictable conditions for both equities and bonds. Those who position themselves before the pivot are typically the ones who benefit most.

The Power of Time Is on Your Side

Time in the market beats timing the market — every time. The longer your money is invested, the more it compounds. Trying to wait for the “perfect” moment often leads to missed gains. Historically, the market’s best days tend to cluster near its worst days — miss those, and you risk missing most of the upside.

I wrote an article on this a few years back which still holds true today. You can read it here.

Innovation Hasn’t Slowed Down — It’s Accelerating

From AI and biotech to clean energy and space tech, we’re witnessing a new industrial revolution. These aren’t just exciting ideas; they’re multi-trillion-euro transformations already reshaping global economies. Investing now means getting in before the wave crests — not after.

Diversification Is More Powerful Than Ever

The global landscape is broader than ever. While some markets face headwinds, others are thriving. A well-diversified portfolio — across sectors, regions, and asset classes — isn’t just a shield, it’s a springboard. With the right structure, you can grow your wealth through both sunny and stormy weather.

So, Why Now?

Because uncertainty is the soil where opportunity grows. Because prices reflect fear, not fundamentals. Because the future isn’t waiting — it’s happening now.

As your financial adviser, my job is to help you see the forest through the trees, and to guide you with strategies that match your goals, timeline, and comfort level — especially when others are sitting on the sidelines.

Let’s have a conversation. Your future wealth might just thank you for acting today.

The best time to invest? Yesterday. The second-best time? Right now.

You can now book a 30 minute zoom meeting with me (at your convenience) by clicking here

Basic Investment Terms Explained

By Michael Doyle

This article is published on: 22nd May 2025

I’m Scottish and I live between France and Luxembourg. I moved to Luxembourg in 2008 and then France around 2015 and have commuted between both for a lot of my time with Spectrum. Needless to say my French has improved over time (as long as people speak to me as if I’m 6 year old child).

One of the things though that I still struggle with is some of the terms they use, eg Pédaler dans la semoule which seemingly means going around in circles. I always wondered why people were pedalling around in semolina.

It got me to thinking that I often assume people know all of the terms we use in financial planning, so here I’ve decided to try and break down the barriers.

What is a stock?

A stock represents partial ownership in a company. When you own a stock, you own a slice of that business — known as a “share” — and have a claim on its assets and earnings. Stocks are traded on public exchanges, and their value fluctuates based on the company’s performance, investor sentiment, and broader market conditions. Investors often buy stocks to participate in a company’s growth and, potentially, receive dividends.

What is a share?

A share is a single unit of ownership in a company, essentially your piece of the total stock issued. If a company issues 1 million shares and you own 10,000 of them, you own 1% of the company. Shares entitle the holder to a portion of the company’s profits (via dividends) and voting rights in some corporate decisions. Shares can rise or fall in value depending on market demand and the underlying company’s performance.

What is a bond?

A bond is a type of loan that investors give to governments, municipalities, or corporations. In return, the issuer agrees to pay back the principal amount on a set date and provide regular interest payments over the life of the bond. Bonds are considered fixed-income investments and are often used to provide portfolio stability and predictable income, especially in contrast to more volatile assets like stocks.

What is an ETF?

An ETF, or Exchange-Traded Fund, is a pooled investment vehicle that holds a diversified basket of assets — such as stocks, bonds, or commodities — and trades on a stock exchange like a regular share. ETFs allow investors to gain broad market exposure, often at a lower cost and with greater flexibility than mutual funds. They are popular for their diversification, transparency, and ease of access for both beginners and seasoned investors.

Let’s have a conversation. Your future wealth might just thank you for acting today.

You can now book a 30 minute zoom meeting with me (at your convenience) by clicking here.

Why Should I have an Assurance Vie?

By Michael Doyle

This article is published on: 20th May 2025

I wrote an article back in 2021 which you can read here. I just wanted to offer a reminder of the 10 most important reasons why you should consider having an Assurance Vie whilst living in France:

- Tax Efficiency: Assurance vie allows for tax-deferred growth on income and gains while the funds remain within the policy.

- Flexible Investment Options: With my help and planning you can choose from a variety of funds, including equity, bond, and special products, allowing for a diversified investment strategy.

- Access to Capital: You have full access to your capital at all times, with the option to take regular income withdrawals (possibly subject to an early exit penalty in the early years).

- Inheritance Planning: Assurance vie is highly effective for inheritance planning, allowing policyholders to designate beneficiaries and providing significant tax-free allowances.

- Long-Term Savings: It serves as a viable alternative to traditional pension plans, offering flexibility in saving for retirement.

- Potential for Higher Returns: By investing in unit-linked funds, there is potential for higher returns compared to traditional savings accounts.

- Social Charges on Gains: Only the gain element of withdrawals is subject to social charges, which can be advantageous compared to other investment vehicles.

- International Options: International assurance vie policies offer additional benefits, such as investment in multiple currencies and broader investment choices. We offer these at Spectrum meaning if you move country your Assurance Vie is often portable.

- Adaptability to Risk Tolerance: We offer regular reviews so can switch funds as your circumstances or attitudes toward investment risk change.

- Tax-Free Allowance After Eight Years: After eight years, gains can be offset against a tax-free allowance of €9,200 for couples or €4,600 for singles, enhancing tax efficiency.

You can now book a 30 minute zoom meeting with me (at your convenience) by clicking here.