At the end of January, I joined colleagues and product providers at our annual conference in Monaco. We heard a range of insightful presentations from companies including Evelyn Partners, iPensions, Momentum, New Horizon, VAM Alquity, LGT Wealth Management, Novia Global, Rathbones, Utmost, Prudential and RBC Brewin Dolphin.

French Financial Update February 2026

By Katriona Murray-Platon

This article is published on: 10th February 2026

There is often a difference between what dominates the headlines and what investment managers focus on. While it has become increasingly difficult to ignore what is happening in America, it is important to remember that we maintain a long-term focus for our clients’ investments.

As outlined by the fund managers, markets remain heavily tech-focused. However, although stocks from the companies known as the “Magnificent Seven” dominated markets in 2023 and 2024, there has been some broadening in 2025. Nvidia shares have recently flatlined and Microsoft was down 20%. Even though European stock markets are performing better, fund managers are not yet ready to abandon US equities in favour of European ones.

Unfortunately, the UK economic outlook remains gloomy. For several years now, fund managers have highlighted how little exposure they have to UK stocks within their portfolios. However, the FTSE 100 performed well in 2025, largely because many UK companies generate profits outside the UK.

There was considerable discussion around artificial intelligence.

While some may view AI as potentially similar to the dot-com bubble, our product providers demonstrated how the underlying economic fundamentals are very different.

Many people now use AI, but the key question remains: who is actually making money from it?

AI also requires significant infrastructure, including large data centres and substantial energy supply. Its influence is now extending into emerging markets as well.

Fund managers have reduced their oil exposure as energy prices continue to decline. Sovereign bonds, however, are becoming more attractive, with yields of between 1% and 3%, particularly Norwegian, Australian, New Zealand and Japanese bonds.

Novia announced its new GIA product which, like its SIPP, can hold funds denominated in HKD and Australian dollars, as well as GBP, EUR, CHF and USD. Currently, UK SIPPs sit outside a deceased person’s estate for inheritance tax purposes. However, proposals from the UK Chancellor will bring defined contribution pensions into the inheritance tax net from 6 April 2027.

Evelyn spoke about the digital data boom, describing it not as a fad but as a generational shift (anyone with teenagers will relate). Their aim is to “turn data into dollars” in 2026, and they continue to see opportunities, particularly among companies utilising AI. Stronger earnings and a weaker dollar are also supporting emerging market equities.

In French financial news, from 1 February 2026 the interest rates on French savings accounts have been reduced as follows:

Livret A: 1.50%

Livret de développement durable (LDDS): 1.50%

Livret Jeune: 1.50%

Compte Épargne Logement (CEL): 1.00%

Returns from euro funds in French assurance-vie policies appear to have stabilised. The average rate of return in 2025 was 2.65%, compared with 2.63% in 2024 and 2.60% in 2023.

After social charges taken at source, the average net return is 2.19% — only 1.5 percentage points above inflation.

While these assets are often viewed as safer options, cautious investors may benefit over time from increasing equity exposure to achieve stronger long-term growth.

Local taxes, in particular taxe foncière, are not expected to increase by more than 0.80% in 2026, due to the increase in the rental value of properties.

Other key changes from 1 January 2026 include:

- The annual social security ceiling is set at €48,060 (€4,005 per month).

- The legal interest rate is set at 6.67% for loans between individuals (for example, late custody payments) and 2.62% for loans between professionals.

- The maximum amount that can be withdrawn from a deceased person’s bank account to cover funeral costs is €5,965.

- Medication, treatment or services provided by non-contracted doctors (those who set their own fees) will no longer be covered by social security from January 2027.

- Fees for certain medical specialists have increased (€40 for a gynaecologist, €42 for a geriatrician and €57 for a neurologist).

- Stamp prices have increased, as they do each year, to €1.52 from €1.39. Postal costs for other services have also risen.

- Interest earned on PEL savings accounts is subject to income tax (12.8%) and social charges (18.6%), bringing the flat tax rate to 31.40%. Holding a PEL allows access to a mortgage at 3.2%.

- If you are expecting a baby in 2026, you may be entitled to an additional two months of maternity, paternity or adoption leave.

In January, if you benefited from specified tax credits or reductions (for example, home help), you will have received a payment equal to 60% of the total amount. The remaining balance will be reconciled through your 2025 tax return in September 2026.

After catching up with work following the conference, I will be spending time with my family from 16 to 20 February during the half-term holidays. If you have any questions about the information above, or would like to arrange a time to discuss your financial matters, please do get in touch.

The Spectrum IFA Group annual conference

By Peter Brooke

This article is published on: 9th February 2026

I’ve just returned from the 23rd Spectrum annual conference — my 22nd — which this year was held in Monaco, making it refreshingly easy travel for me.

Each year we bring together Spectrum advisers from across Europe, along with our support and management teams, and a carefully chosen group of investment managers, pension specialists, and tax experts. It’s a chance to step away from the day-to-day detail, compare notes, challenge assumptions, and make sure the advice we give clients continues to stand up in a changing world.

One thing that’s worth sharing, because it underpins everything else in this update, is what Spectrum actually is. We’re a large, international advisory firm — but we’re also owned by the advisers who work in it. We’re currently restructuring the business to widen that ownership further, so more advisers have a direct stake in the firm’s future.

That matters because we’re not building towards a quick exit. We’re building something designed to last, we are proud of the longevity of the business and the strong retention of our advice team. The conversations at the conference reflected that long-term mindset — less about chasing the next headline, and more about understanding the forces that genuinely shape investment outcomes over time.

With that in mind, here are the main themes I took away from the conference, and why they matter for expatriates and internationally mobile families.

1. Artificial intelligence: real change, not just hype

Artificial intelligence was easily the dominant topic of the conference — but not in the “buzzword of the month” sense. The most interesting discussions weren’t about which stock has run the hardest, but about where AI is genuinely changing productivity, margins, and long-term business models.

The key message from managers like Rathbones and Evelyn Partners was that we’re moving into a second phase of the AI story. The early gains were very concentrated — a small group of large US technology companies driving market returns. That phase isn’t necessarily over, but it is evolving.

What’s happening now is a broadening out. AI is starting to affect industrial businesses, healthcare, logistics, energy management, data infrastructure, and even areas like waste management and defence. In other words, it’s moving from “who builds the chips” to “who uses the technology well”.

That distinction matters. History shows that transformative technologies don’t just reward the obvious early winners — they reward companies that apply them intelligently, efficiently, and profitably. For investors, this reinforces the importance of looking beyond the headlines and staying diversified, rather than assuming yesterday’s winners will automatically dominate tomorrow as well.

2. A return to fundamentals and sensible diversification

Another strong theme that came through very clearly was a return to fundamentals.

Markets over the last couple of years have often felt narrow and momentum-driven, with a small number of stocks (mainly AI/Tech) doing most of the work. Several managers made the point that this sort of environment can feel exciting — but it also increases risk if portfolios become too concentrated – at one point just 7 companies made up nearly 35% of the size of the US stock market (S&P 500)!

Rather than trying to predict short-term market moves, the emphasis is now firmly back on:

-

cash flow and balance sheet strength

-

sensible valuations

-

real earnings growth

-

businesses with pricing power and durable demand

For clients, this translates into something reassuringly familiar: diversification still matters. Not just across regions, but across styles, sectors, and asset classes. It’s rarely the most exciting message — but it’s consistently one of the most effective.

3. Looking beyond markets: private assets and the real economy

Several presentations also focused on areas outside traditional listed markets.

There was strong interest in private assets and real assets — things like infrastructure, property, and long-term income-producing investments. These aren’t about quick wins; they’re about accessing different return drivers and reducing reliance on public market volatility alone.

For many expatriate investors, this can be particularly valuable. Income that’s less sensitive to daily market swings, assets linked to real economic activity, and structures designed with long-term planning in mind can all play a role alongside more traditional portfolios.

As always, these areas need careful selection and suitability — but the message was clear: a well-built portfolio doesn’t rely on a single engine to get where it’s going.

4. Scale, governance, and why “size matters”

Another interesting thread was the importance of scale and governance, particularly in uncertain markets.

From an investment perspective, larger, well-capitalised businesses tend to have more resilience: better access to finance, more flexibility in downturns, and greater ability to invest through cycles rather than cut back at the wrong time.

That same principle applies at an advisory level too. Spectrum’s size, international reach, and shared ownership model allow us to invest in systems, compliance, and expertise in a way that simply isn’t possible for smaller, standalone firms.

It’s not about being big for the sake of it — it’s about stability, continuity, and quality of advice over decades, not just years.

5. Who we choose to work with — and why it matters

Another reassuring takeaway from conference was spending time with the firms we work with on clients’ behalf — not just listening to presentations, but understanding how they think, how they’re governed, and how decisions actually get made.

One of the advantages of being part of a group like Spectrum is that we’re able to be selective. We don’t work with managers because they’re fashionable or because they shout the loudest — we work with them because they have depth, longevity, and a track record of navigating change.

- A few examples give a flavour of this:

LGT Wealth Management is owned by the Princely House of Liechtenstein and has been for several generations. That sort of long-term, family ownership creates a very different mindset — one focused on wealth preservation, discipline, and thinking in decades rather than quarters. - Prudential International is part of a wider group that manages around £350 billion of assets. That scale brings financial strength, deep governance, and the ability to invest heavily in systems, risk management, and long-term product development.

- Rathbones, one of the UK’s largest private asset managers, looks after approximately £115 billion of assets and has been in existence for over 250 years. Very few firms survive that long without adapting repeatedly to political change, market cycles, and economic upheaval.

None of this guarantees outcomes — nothing ever does — but it does give us confidence. These are organisations built to endure, with governance structures and cultures that align closely with how we think about long-term planning for clients.

For me, this is a crucial but often invisible part of the job: doing the work behind the scenes so that clients don’t need to worry about whether the foundations are solid. The conference reinforced that the partners we choose, and the effort that goes into maintaining those relationships, genuinely matters.

6. What this all means in practice

Stepping back, the conference reinforced something I see year after year: successful long-term investing is rarely about prediction.

It’s about:

- understanding structural change (like AI) without overreacting to hype

- staying diversified when markets feel narrow

- focusing on quality and fundamentals

- using scale, governance, and expertise to manage risk properly

- ignoring the inevitable noise of geopolitics and political posturing, it rarely has long term impact.

- and keeping plans aligned with real lives, not just market cycles

That’s particularly important for expatriates, where cross-border rules, currencies, tax systems, and future uncertainty add extra layers to every decision.

If you’d like to talk through how these themes relate to your own situation — or simply want a sense-check that your plans still reflect what matters most to you — that’s exactly what I’m here for.

If you want to dive a little deeper into any of this detail, there are some great articles at these links.

Evelyn Partners Turning data into dollars in 2026

Rathbones Video Market broadening and Geopolitical noise

If you feel this would be helpful to friends, family or colleagues, please do feel free to forward this on to them.

As always, I’ll keep translating what we hear from conferences like this into practical, real-world advice that fits your life, not just the markets.

With thanks

Finally, I’d like to say a genuine thank you to the firms who took the time to join us in Monaco, share their thinking so openly, and engage in thoughtful, sometimes challenging discussion.

In particular, my thanks go to the teams from Rathbones Asset Management, Evelyn Partners, LGT Wealth Management, Alquity VAM Investment Management, New Horizon Asset Management and Prudential International, and the other investment, pension, and tax specialists who contributed to the conference.

These events only work because people are willing to go beyond polished presentations and talk honestly about risks, opportunities, and uncertainties. That openness is exactly what helps us refine our thinking and, ultimately, improve the advice we give to clients.

It was a privilege to spend time with such high-quality partners — and it left me confident not only in the ideas discussed, but in the people and organisations helping us put those ideas into practice.

Financial update January 2026 – France

By Katriona Murray-Platon

This article is published on: 7th January 2026

Happy New Year!! I wish you all the very best for 2026. I hope that you had an enjoyable festive season. We spent Christmas at home, which was very nice and relaxing, so now I am well rested, ready for the new year and looking forward to seeing all my clients.

On 9th December the Law for the Financing of the Social Security was adopted by the National Assembly and, pending any issues with the Constitutional Court, it is now enacted into law. Under this law, the official retirement age is now 62 years and 9 months, with a required contribution of at least 170 semesters set until 1st January 2028 for pensions taking effect from 1st September 2026. As a result, anyone born between 1964 and 1968 may retire 3 months earlier than previously expected. Furthermore, as from 1st January 2026, the French state pension increased by 0.9%.

This law also increased the CSG social charges on interest, dividends and capital gains from 9.2% to 10.6%. The flat tax (PFU) on this income has therefore risen from 30% to 31.4%. However, withdrawals from assurance vie policies, PEL and PEP (plan épargne populaires) accounts, rental income and capital gains on property are not affected. So for people with money in UK saving accounts, the interest will now be taxed more heavily in France. It is worth considering whether it remains appropriate to keep such accounts, or whether it would be more tax-efficient to move funds into French savings vehicles such as a Livret A or LDDS, or into an assurance vie for longer-term planning.

If you have up to €61,200 that you need to put away for a year or two, a PEL account opened from 1st January 2026 now offers an interest rate of 2% compared with 1.75% for PELs opened after 1st January 2025. The interest rate for a PEL is determined at the time the account is opened.

From 1st January 2026, cash gifts now need to be declared online via your account on the impots.gouv.fr website. This applies to gifts of money, shares or valuable items such as a car. You will be asked to declare any money or gifts of value and state whether they fall under the €100,000 allowance between parents and children or the €31,865 made by a relative under 80 years old to a recipient who is over 18 years old. If the recipient is a minor, their parents should do the declaration for them on their online account. Christmas gifts remain exempt and do not need to be declared.

Since 1st December 2025, parents who are divorced or separated, will now both receive childcare benefit (complement de libre choix de garde) provided the child is cared for by a registered childminder either at the childminder’s home or at the child’s home.

For those looking for a bargain or waiting to buy something special, the sales in France will begin on Wednesday 7th January at 8am and will continue until Tuesday 3rd February.

If you are considering choosing an electric vehicle for your next car, the good news is that government incentives will continue in 2026.

Low-income households may receive a bonus of €5,700, middle-income households €4,700, and all other buyers €3,500, when purchasing a brand-new electric car.

An additional bonus of between €1200 and €2000 may also be granted if the battery of the car was manufactured in Europe.

Furthermore the thresholds for what is considered a low income and middle income households have been increased.

Later this month, I will be attending our annual conference in Monaco with colleagues and meeting with our product providers to review the past year and discuss the factors likely to influence investment strategies in 2026. I will share key insights from our conference in the next Ezine.

In the meantime, if you have any questions about the topics above or would like to discuss your personal financial situation, please do not hesitate to get in touch to arrange a free phone call or meeting.

It’s been another unusual year

By Peter Brooke

This article is published on: 25th December 2025

As we come to the end of the year, we wanted to share a brief reflection on what has been a challenging but ultimately rewarding period for investors.

It’s been another unusual year (I think I wrote that in my last Christmas newsletter!!). We began 2025 with talk of a Trump tariff driven recession, interest rate cuts and the end of US dollar dominance. Instead, growth has slowed but not collapsed, interest rates have stayed higher for longer, and after weakening early in the year, the US dollar has strengthened again in the second half of 2025.

Equities experienced volatility along the way, driven by geopolitics, policy changes and concerns around inflation. Despite this, strong company earnings — particularly in technology and AI — helped global markets finish the year close to record highs. This was a reminder of the value of staying invested through short-term uncertainty.

Bonds quietly did their job. While yields rose earlier in the year, they provided attractive income and stability, reinforcing their role as a key diversifier within portfolios.

Gold stood out as a strong performer, offering effective protection against geopolitical and economic uncertainty while contributing positively to returns.

Overall, 2025 reinforced an important lesson: diversified, multi-asset portfolios can help investors navigate uncertainty and capture long-term opportunities — even in unsettled markets.

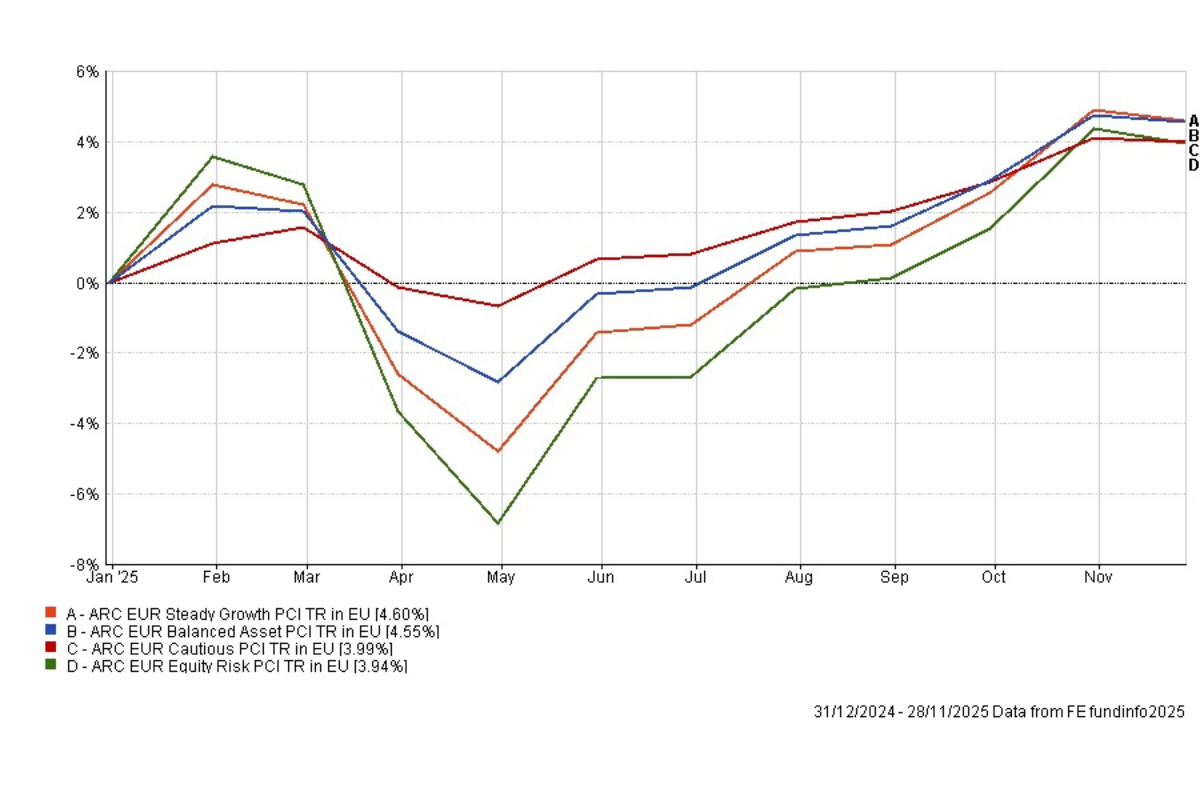

You’ll see below a chart showing the ARC Euro Indices for this year; the movements reflect the periods of volatility investors experienced, especially post ‘Liberation Day’ followed by a recovery as confidence improved.

It’s a helpful visual reminder that while markets rarely move in a straight line, staying invested through the ups and downs has historically been key to achieving long-term outcomes.

As we head into the festive season, I’d like to thank you for your continued trust and wish you and your family a very happy Christmas and a healthy, prosperous New Year.

I will be back in touch in January with a financial outlook for 2026 following our next annual Spectrum conference and, of course, I plan to continue to provide you with updates, developments and new support tools over the year ahead…

What is a présent d’usage and how can it be used?

By Victoria Lewis

This article is published on: 27th November 2025

A présent d’usage is a customary gift given on a special occasion and of modest value, in proportion to the donor’s wealth and income.

In plain terms, it’s a gift made for a particular event – like a birthday, wedding, graduation, Christmas, or another significant celebration – and it must not be large enough to affect the donor’s financial situation.

If those two conditions are met, the gift is not subject to gift tax and does not need to be declared.

Legal definition and principles:

French law doesn’t specify a fixed euro amount. Instead, courts and tax authorities judge “modest value” relative to the donor’s means.

Key references:

- Article 852 of the Code civil

- Article 784 of the Code général des impôts (CGI)

- Various rulings of the Cour de cassation (French Supreme Court)

- The tax administration (BOFiP-ENR-DMTG-20-10-20-10 § 10) says that the assessment depends on: “la fortune du donateur et les usages” — the donor’s wealth and customary practice.

Common examples of “présents d’usage”

Event + Typical acceptable gifts (if proportionate)

Birthday or Christmas: A few hundred euros, watch, jewelry, small artwork

Wedding: A few thousand euros if donor is wealthy, smaller if not

Graduation / birth of a child: A symbolic sum or piece of jewelry

Religious events: Usually modest cash or gift

When it stops being a “présent d’usage”:

The gift ceases to qualify and becomes a taxable donation if:

- The value is disproportionate to the donor’s income or assets.

- It’s not linked to a special occasion.

- It’s intended to transfer wealth permanently (not symbolic).

- The donor gives multiple large “presents” that together look like a disguised donation.

If the tax administration audits and decides it’s really a “donation déguisée,” they can requalify it and apply the 60% gift tax (if between non-relatives).

Practical rule of thumb.

French notaires often say:

A gift of no more than 1–2% of the donor’s net worth or a few weeks’ income will usually be accepted as a présent d’usage, provided it’s tied to a genuine occasion.

There’s no official threshold — it’s all about proportion and context.

- Principle

As noted earlier, there’s no fixed ceiling — it depends on whether the gift is modest relative to the donor’s wealth and income and is tied to a special occasion (birthday, wedding, graduation, etc.).

For guidance, notaires and tax authorities often use informal rules of thumb when advising clients.

- Typical “reasonable” range (for €500,000 income)

If the donor earns about €500,000/year and has assets consistent with that income, a gift of roughly 1–2% of annual income would often be viewed as proportionate for a major occasion.

That works out to:

€5,000 to €10,000 for a standard event (birthday, graduation, wedding present, etc.)

Possibly up to €20,000 or so for a very special event (e.g. child’s wedding, milestone anniversary) — but that’s at the high end and should clearly match the occasion.

- Key conditions to stay within “présent d’usage”

To keep it safely tax-free:

Occasion-based: The gift is clearly tied to a socially recognized event (wedding, birthday, graduation, etc.).

Proportionate: It doesn’t change the donor’s lifestyle or deplete assets.

Customary: It’s the kind of thing people of similar means might reasonably give.

Documentation: It’s helpful to note (privately) what the occasion was and the donor’s income level, in case of audit. There’s no need to declare it if it’s truly a présent d’usage.

- When to get advice

If the amount goes well above 2–3% of income (say, >€15,000–€20,000 on €500,000 income) or there’s no special occasion, a notaire or fiscaliste should review it. The tax office could otherwise requalify it as a donation taxable at 60% (for non-relatives).

UK bank & savings protection

By Victoria Lewis

This article is published on: 21st November 2025

Deposit limit protection increase

From 1 December 2025 the Financial Services Compensation Scheme (FSCS) deposit protection limit will rise to £120,000. This means that if you hold deposits or savings with a UK-authorised bank, building society or credit union and it goes out of business, FSCS will compensate you up to the new limit of £120,000 per eligible person, per authorised firm.

The FSCS also covers temporary high balances, which will also rise from December, of up to £1.4 million. These may occur from major life events, such as selling a home or receiving an inheritance. Temporary high balances are protected for up to six months.

There are some details to be aware of:

- The additional compensation limit is per person, per qualifying life event. For joint accounts with a temporary high balance, each named person benefits from FSCS protection of up to £1.4m.

- The protection begins on the date the money becomes legally transferable to you, or from when it is first credited to your account (or to a solicitor’s client account for onward payment to you). You can move the funds to another account in your name and maintain the protection, but the six-month period would not begin again.

- Proceeds from the sale of second homes or buy-to-let properties are not covered. If your temporary high balance exists because of a real estate transaction, it must relate to your main residence for FSCS protection to apply.

- Compensation is unlimited for temporary high balances that relate to personal injury, disability or incapacity claims.

- FSCS will pay compensation when certain requirements set out by the UK’s financial regulators are met.

Qualifying life events and evidence required

A range of life events could create a temporary high balance in your bank account, including:

- Real estate transactions (property purchase, sale proceeds, equity release – this doesn’t have to be a UK property but must relate to your main residence).

- Benefits payable under an insurance policy.

- Personal injury compensation.

- Disability or incapacity (state benefits).

- Claim for compensation for wrongful conviction.

- Claim for compensation for unfair dismissal.

- Redundancy (voluntary or compulsory).

- Marriage or civil partnership.

- Divorce or dissolution of a civil partnership.

- Benefits payable on retirement.

- Benefits payable on death.

- A claim for compensation in respect of a person’s death.

- Inheritance.

- Proceeds of a deceased’s estate held by a personal representative.

To verify the source of funds for a temporary high balance, the FSCS may ask for evidence which could include (but not be limited to) the following:

- A property sale receipt or agreement.

- A court judgement.

- A will.

- A letter from an insurer regarding an insurance payout.

- A letter from a lawyer, conveyancer, mortgage provider, former employer, or pension trustees.

- Court orders.

- Social security statements.

- Probate / letters of administration.

- Death / marriage certificate.

- Land registry and HMRC records.

This list isn’t exhaustive, and the evidence needed will depend on your individual circumstances. If you provide the relevant supporting evidence and your claim is eligible under FSCS rules, compensation is payable within three months.

Why are the limits being increased now?

The previous protection limit was established in 2017, when the UK was a member of the EU. Following Brexit, regulatory control has returned to the UK, whilst inflation since 2017 has reduced the real value of the original limit. As a result, the FSCS has increased the protection level to ensure it remains equivalent in value to that provided in 2017.

While this increase is welcome, maintaining substantial cash balances in a bank account is generally not advisable over the medium to long term. We would be pleased to advise you on tax-efficient investment options for any surplus deposits you may hold.

Financial update November 2025 | France

By Katriona Murray-Platon

This article is published on: 9th November 2025

Autumn has officially arrived in France. The clocks have gone back, the air is cooler, and whilst grey, rainy days have set in, we can still look forward to the occasional burst of sunshine. November may be one of the shorter months, but before preparations for the end-of-year festivities begin, there are several important matters to keep in mind

Although the taxe d’habitation has become a thing of the past for most French residents, it still applies to owners of second homes in France. Over four million households are liable for either the Taxe d’Habitation sur les Résidences Secondaires (THRS), the Taxe sur les Logements Vacants (TLV), or the Taxe d’Habitation sur les Logements Vacants(THLV).

The Taxe d’Habiation statements should now be available in your online account on impots.gouv.fr, where you will also find the payment details and deadlines.

On 25th October, the French deputies voted to amend the draft finance bill that was proposing to freeze the income tax rates, instead voting in favour of re-establishing indexation in line with inflation which increases current tax bands by 1.1%. Below is a table showing the 2025 thresholds compared with the proposed thresholds for 2026.

| 2025 income tax thresholds | Proposed tax thresholds (increased by 1.1%) for 2026 | Income tax rate |

| Under €11,497 | Under €11,623 | 0% |

| Between €11,498 and €29,315 | Between €11,624 and €29,637 | 11% |

| Between €29,316 and €83,823 | Between €29,638 and €84,745 | 30% |

| Between €83,824 and €180,294 | Between €83,746 and €182,277 | 41% |

| Over €180,295 | Over €182,278 | 45% |

Once the finance law is officially adopted at the end of the year, I will confirm these thresholds.

If you are subject to Wealth Tax on Property (IFI) and the amount due is €300 or less, this must be paid by 17th November by cheque, cash or bank card or by the 22nd November if you pay online. If the amount is more than €300, it must be paid online via the impots.gouv.fr website.

By now, you should have received your income tax statement and paid tax due. If you have discovered any errors or miscalculations, please correct them as soon as possible as after 3rd December 2025 you will no longer be able to submit an amended tax return on the impots.gouv.fr website; any corrections after this date must be submitted in paper form.

If you have a PEL account which was opened between 2011 and 2015, your bank will automatically close it and transfer the funds to another savings account. PELs opened since 1st March 2011 can be held for a maximum of 15 years, whereas the PELs opened before this date can remain open indefinitely. According to the Banque de France, the average balance of a PEL account is €25,017, with around 12% of such accounts exceeding the maximum capital limit of €61,200. These accounts are not term accounts and should only be used if you plan to purchase a property or carry out renovations to your property.

If you do seasonal lettings, you will have received an email from the tax office reminding you that the tax rules have changed in 2025. For “meubles de tourisme non classés” if your income in 2023 and 2024 was more than €15,000 you can no longer stay as micro-BIC. The income that you received will be under the “régime réel” and will require the assistance of an accountant. You should contact your tax office for more information.

Urssaf also sent an email to remind those who earned over €23,000 from their season lettings that they have to pay social security contributions on this income and not social charges like other landlords. Depending on your turnover, you can opt for the micro-social regime at either 21.2% (for meublés de tourisme non classés) or 6% (for meublés de tourisme classés). From 2027, website-based business as Airbnb and Arbitel will take the social contributions directly at source.

If you have any questions on the above or any other matters, please do get in touch. I am available for online meetings or face to face meetings throughout November, so if you have any questions about your finances, please do contact me to arrange a free, no obligation, meeting.

Le Tour de Finance in France

By Spectrum IFA

This article is published on: 23rd October 2025

Thinking of moving to Europe… or already living the expat life in France?

Welcome to Where Money Talks.

Le Tour de Finance brings together expats, advisers and finance professionals for relaxed, practical and interactive sessions on tax and financial planning in France. The event is designed for people who want to live well, feel secure and plan smartly while navigating French-resident tax regimes, Assurance Vie, pensions, investment markets and estate planning.

Two exceptional venues, two great days of connection

Over the course of our recent tour we gathered over 70 participants across two beautifully located events. Day one took place at Château Val Joanis near Pertuis (Vaucluse) — nestled in the Luberon region, a scenic estate of vines, olive trees and renowned terraced gardens.

Day two followed at Château de la Bégude in Valbonne on the Côte d’Azur, a 17th-century manor within a peaceful golf-estate setting between Valbonne and Opio.

The atmosphere throughout was warm and interactive: in both venues attendees were able to enjoy breakout conversations, mingle in the gardens, and engage in meaningful Q&A with the presenters. More than just formal lectures, the days offered an opportunity to ask real-life questions, share experience with fellow expats, and take away actionable next-steps in a friendly setting.

Speakers & professional insight

Speakers & professional insight

We were pleased to host a strong panel of trusted advisers and finance practitioners including representatives from The Pru, The Spectrum IFA Group, Currencies Direct, Brewin Dolphin and Novia Global. These experts guided discussions through key issues such as tax-efficiency for French-resident expats, UK/France pension interfaces, the role of Assurance Vie, foreign exchange and currency strategies, investment markets and legacy/estate planning. Having all these viewpoints in one place meant attendees could begin to build a rounded understanding – rather than piecemeal advice.

Living in France as an expat — why planning matters

Living abroad in France brings many rewards – lifestyle, weather, culture, international community, but also distinct financial and tax responsibilities. Becoming tax-resident in France triggers a range of rules on income, inheritance, assets and investments. Without careful planning, the complexity can lead to missed opportunities or unintended liabilities. Time and again during the event we heard how proactive planning with professionals makes the difference: understanding the French tax treaty framework, choosing the right investment wrapper (such as Assurance Vie), considering currency exposure, and aligning UK/France pensions and inheritance.

Equally important is the personal dimension: being able to relax, knowing your financial affairs are in order, and being part of a network of like-minded expats. That sense of community and shared experience was very evident across both days of Le Tour de Finance.

Thank you & next steps

A heartfelt thank-you to everyone who attended and to our presenters for their clarity and engagement. If you couldn’t join this round, keep an eye on our website for future events, and feel free to get in touch to explore how tailored advice might support your personal expat financial journey. Because when you’re living abroad, planning ahead matters – and getting the right help makes all the difference.

Spectrum IFA begins Employee Ownership for a Sustainable Future

By Spectrum IFA

This article is published on: 14th October 2025

Empowering People, Ensuring Continuity, and Deepening Commitment to Clients

At The Spectrum IFA Group, our success has always relied on our people, their expertise, dedication, and a shared belief in doing what is best for our clients. As a firm founded on trust, transparency and building long-term relationships, we recognise that sustainable growth depends not only on sound financial advice but also a solid grounding in joint ownership and responsibility.

Since its inception, Spectrum has aspired to share company ownership with its advisers and staff. Establishing a clear succession plan is essential, not only to ensure business continuity but also to provide long-term security for our advisers, employees, and most importantly, our clients.

Today, Spectrum’s advisers and staff collectively hold over 15% of the company’s share capital. This initiative reflects our belief that those who contribute daily to looking after our clients’ interests should also participate in the company’s growth. In 2026, Spectrum plans to increase employee and adviser equity participation to approximately 30%. Our longer-term intention is for advisers and employees to own 48% of the business, with the remaining 52% retained by the founders.

This approach demonstrates our commitment to creating a resilient, people-focused organisation where everyone has a vested interest in delivering exceptional advice and service. By aligning ownership with those who directly support our clients, we are securing our longevity whilst embedding the long-term continuity of relationships that help define our unrivalled service standards.

At Spectrum, we view this as more than simply an exercise in restructuring company ownership – it reflects of our core values. We are building an organisation that empowers people, rewards dedication, and safeguards the future security of our clients, advisers, and employees alike. Together, we are shaping a stronger, more sustainable Spectrum team for generations to come.

Le Tour de Finance France October 2025

By Spectrum IFA

This article is published on: 8th October 2025

As an expat, do you make the most out of your finances?

Are you an expat living in France, or considering the move? Managing your finances across borders can feel daunting – tax rules, inheritance laws, pensions, investment accounts… there’s a lot to get right. That’s exactly why we’re inviting you to Le Tour de Finance – two dynamic, expert-led seminars designed to guide expats like you through the ins and outs of financial planning in France.

Each event features a panel of financial specialists who will break down complex topics like Assurance Vie, cross-border tax obligations, pensions / QROPS, investment opportunities, estate planning, and more. Whether you’re already in France, or planning to relocate, these sessions will help you safeguard your wealth, optimise your tax strategy, and make confident decisions for the future.

When:

- Chateau Val Joanis, Pertius, 84120 — 21st October 2025

- Chateau de la Begude, Valbonne, 06560 — 22nd October 2025

Two convenient locations, same powerful content. The format combines expert presentations with opportunities to ask questions, network with other expats, and hear real-world insight from people navigating similar paths.

Why attend?

Because doing your financial planning well as an expat isn’t just about avoiding mistakes—it’s about gaining advantages. With the right advice, you can reduce your tax burden, ensure your investments are legal and efficient on both sides of the border, and protect your family’s future.

Space is limited. If you’re serious about making the most of your finances in France, these seminars are not to be missed.

Register today via Le Tour de Finance, and give yourself peace of mind – so your money works as hard as you do.